Home / Companies / KRO Focus

KRO Focus

| Outcome Visualization Project as of Feb 15, 2024: Vanstar Mining Res Inc: Nelligan |

| Project: | Nelligan | Location: | Canada | Stage: | 4-Infill Drilling |

| Net Interest: | 20% FC | Uncapped NSR: | 0.0% | Target Metals: | Gold |

| OV Project ID: | 1000031 | OVP Posted: | 7/9/2021 | OVP Retired: |

|

| Current OV ID: | 1000084 | Current OV Confirmed: | 1/12/2023 | Visualizer: | JK |

Issued

57,650,458 |

Price

$0.670 |

Working Capital

$2,825,170 |

Key People: Jean-Claude (JC) St. Amour (CEO), Martin Nicoletti (CFO), |

Diluted

67,740,458 |

Insiders

6.9% |

As of

9/30/2023 |

|  |

| Visualized Outcome: Vanstar: Nelligan 30,000 tpd OP Scenario |

| The initial purpose of this OV was to visualize what the Nelligan deposit is worth if it never grows beyond the 43-101 resource estimate of inferred 96,990,000 tonnes at 1.02 g/t gold published on Oct 22, 2019 by IAMGOLD and is put into production as an open pit mine at 30,000 tpd. On Jan 12, 2023 IMG updated the resource as 72.2 million tonnes of 0.85 g/t indicated and 114.1 million tonnes of 0.88 g/t inferred using 0.35 g/t cutoff compared to 0.5 g/t but still using $1,500 gold. On Jan 12, 2023 this OV was adapted to use the I+I resource with existing parameters. Using the same parameters (except increasing sustaining capital from $75 million to $143 million to reflect the mine life increase from 9 to 17 years) and gold price as the day before, the new OV increased AT NPV 20% to USD $1.118 billion, decreased AT IRR 20% from 41.4% to 33.3%, and extended mine life from 9 years to 17 years. IAMGOLD is now vested for 75% and has the right to earn 80% by funding all costs through feasibility, at which point it has the right to purchase Vanstar's 20% interest based on an independent valuation which presumably will rely on the feasibility study IMG delivers. Vanstar would retain a 1.5% NSR if IMG purchases the asset. If IMG does not exercise this purchase option, it will carry Vanstar through production, and Vanstar must repay its share of CapEx with 80% of its share of cash flow. A likelier outcome is that IMG will make a friendly takeover bid for Vanstar that will include a spinout of other assets Vanstar has meanwhile acquired. An alternative scenario is that a diversified gold producer buys out IMG which has been selliing off other assets to fund completion of its Cote Mine. In such a scenario Nelligan, for which IMG plans 10,000 m drilling in 2023, could be put on a fast development track. Due to the carried to production feature Vanstarcould become a buyout target for a royalty company which would get a cash payout for the 20% stake and retain a 1.5% NSR. |

| Source Note: Deposit parameters are based on the 43-101 updated resource estimate produced by operator IAMGOLD on Jan 12, 2023. Mining scenario is based on Springpole PFS published by First Mining Gold on Jan 20, 2021 and cut off grade assumptions by IMG for Nelligan. |

| Visualized Outcome Summary: Vanstar: Nelligan 30,000 tpd OP Scenario |

| Deposit Scenario: 186,300,000 t @ 0.87 g/t Gold |

| Mining Scenario: Open Pit 30,000 tpd 17.0 yrs, CapEx $720.0 million, SustCapEx $143.0 million, OpEx $19.21/t (USD) |

| LOM Payable: 4.7 million oz gold |

| Economic Outcome (USD): Revenue Model at OV designated Metal Prices |

| Annual Average | Life of Mine (LOM) | LOM Stats |

| Recoverable Revenue: | $646,538,338 | $11,000,008,441 | $59/t ore Recoverable Value: |

| Smelter/Transport Costs: | ($12,930,767) | ($220,000,169) | 2.0% of Recoverable Revenue |

| Gross Payable Revenue: | $633,607,572 | $10,780,008,272 | 98.0% of Recoverable Revenue |

| Royalties: | $0 | $0 | 0.0% of Gross Payable Revenue |

| Net Payable Revenue: | $633,607,572 | $10,780,008,272 | 98.0% of Recoverable Revenue |

| Mining Cost: | ($78,949,500) | ($1,343,223,000) | 36% of OpEx - $7.21/t ore |

| Processing Cost: | ($120,450,000) | ($2,049,300,000) | 55% of OpEx - $11.00/t ore |

| Other Cost: | ($10,950,000) | ($186,300,000) | 5% of OpEx - $1.00/t ore |

| Sustaining Cost: | ($7,944,444) | ($143,000,000) | 4% of OpEx - $0.77/t ore |

| Total Operating Cost: | ($218,293,944) | ($3,721,823,000) | 35% of Net Payable Revenue - OpEx - $19.98/t ore |

| Pre-Tax Cash Flow: | $415,313,627 | $7,058,185,272 | 65% of Net Payable Revenue - $37.89/t ore |

| Taxes: | ($141,725,061) | ($2,408,510,403) | 34% of Pre-Tax Cash Flow - $12.93/t ore

|

| After-Tax Cash Flow: | $273,588,566 | $4,649,674,869 | 43% of Net Payable Revenue - $24.96/t ore |

| Note: Concentrate transport costs, smelter treatment costs and retention are subtracted from recoverable revenue to get gross payable revenue to which the uncapped royalty rate for the project is applied. The annual average of LOM sustaining cost is expensed as an annual operating cost. Annual average figures reflect full production years. |

| Economic Outcome (USD): Royalty Model for 1% NSR at OV designated Metal Prices |

| Mine Life: | 18 years | Startup | NPV 5% | NPV 10% | NPV 15% |

| Annual Avg NSR: | $6,336,076 | Now | $68,066,098 | $46,218,891 | $33,323,723 |

| LOM NSR: | $107,800,083 | 2024 | $68,066,098 | $46,218,891 | $33,323,723 |

| Economic Outcome - Discount Rate: 8.0% - CAD AT NPV: $2.4 billion - Fair Speculative Value |

| Gross Rock Value (USD/t): | $64 | Recoverable Rock Value: | $59 | Payable Rock Value: | $58 |

| LOM Net Payable Revenue (USD): | $10,780,008,272 | LOM PT Cash Flow (USD): | $7,058,185,272 | LOM AT Cash Flow (USD): | $4,649,674,869 |

| USD Pre-Tax NPV: | $2,840,558,774 | Pre-Tax IRR: | 57.7% | Pre-Tax Payback: | 1.7 |

| USD After-Tax NPV: | $1,735,028,164 | After-Tax IRR: | 46.1% | After-Tax Payback: | 1.8 |

| CAD Fair Spec Value Low: | $118,606,525 | CAD Fair Spec Value High: | $237,213,051 | CAD Implied Project Value: | $226,930,534 |

| Price Target if Visualized Outcome delivered by Expl-Dev Cycle without dilution: CAD $7.00 |

|

| Fair Speculative Value Stock Price Range: CAD $0.35 - $0.70 |

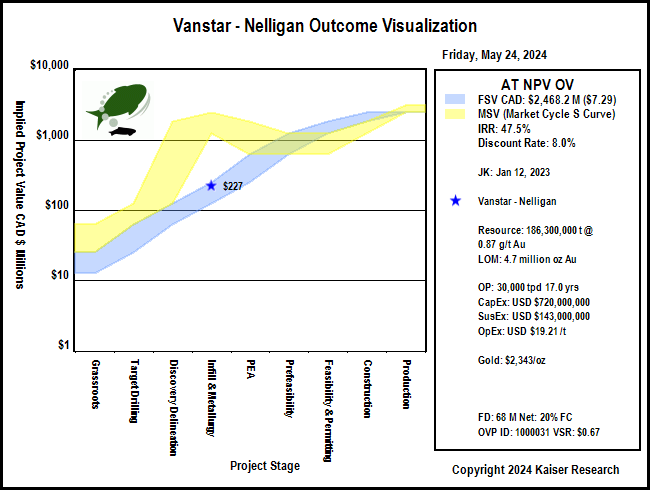

| MSV (Market Cycle S Curve): Market Speculative Value represents the typical market pricing pattern of a new discovery as it moves through its exploration-development cycle. The irrational pricing behavior of the yellow channel contrasts with the fair speculative value of the blue channel as defined by the rational speculation model because during the pre-economic study stages there is great uncertainty about how big the discovery will turn out. |

Fair Speculative Value Ladder

| USD OV NPV | CAD OV NPV | Exch Rate | Diluted | Net Interest |

|---|

| $1,735,028,164 | $2,372,130,505 | 1.3672 | 67,740,458 | 20.00% |

|---|

| Project Stage | Uncertainty Range | CAD FSV Range | CAD FSV per Share Range | CAD MSV per Share Range |

|---|

| Grassroots |

0.5% - 1.0% |

$11,860,653 - $23,721,305 |

$0.04 - $0.07 |

$0.07 - $0.18 |

| Target Drilling |

1.0% - 2.5% |

$23,721,305 - $59,303,263 |

$0.07 - $0.18 |

$0.18 - $0.35 |

| Discovery Delineation |

2.5% - 5.0% |

$59,303,263 - $118,606,525 |

$0.18 - $0.35 |

$0.35 - $5.25 |

| Infill & Metallurgy |

5% - 10% |

$118,606,525 - $237,213,051 |

$0.35 - $0.70 |

$3.50 - $7.00 |

| PEA |

10% - 25% |

$237,213,051 - $593,032,626 |

$0.70 - $1.75 |

$1.75 - $5.25 |

| Prefeasibility |

25% - 50% |

$593,032,626 - $1,186,065,253 |

$1.75 - $3.50 |

$1.75 - $3.50 |

| Permitting & Feasibility |

50% - 75% |

$1,186,065,253 - $1,779,097,879 |

$3.50 - $5.25 |

$1.75 - $3.50 |

| Construction |

75% - 100% |

$1,779,097,879 - $2,372,130,505 |

$5.25 - $7.00 |

$3.50 - $5.25 |

| Production |

100% |

$2,372,130,505 |

$7.00 |

$7.00 - $8.75 |

|

| Market Speculative Value Stock Price Range: CAD $3.50 - $7.00 |

| Warning: while the market spec value (S-Curve) and fair spec value channels presented in project value terms track the evolving expected ultimate outcome value, when presented in stock price terms the expected stock prices are subject to dilution through future equity financings or project interest farmouts. |

| Alternative Metal Price Scenarios |

| Metal 1 | Metal 2 | Metal 3 | Metal 4 |

| Gold |

|

|

|

| Spot: | $2,294 /oz |

|

|

| | OV Assigned: | $2,294 /oz |

|

|

| | Pessimistic: | $1,300 /oz |

|

|

| | Optimistic: | $2,300 /oz |

|

|

| | Fantasy: | $3,000 /oz |

|

|

| | Note: for Metal 1 pessimistic, optimistic and fantasy price scenarios, OV assigned prices are used for Metals 2-4 |

| Economic Outcomes with Alternative Metal Price Scenarios |

| USD PT NPV | USD PT IRR | USD AT NPV | USD AT IRR | AT Payback yrs |

| Spot: | $2,840,558,774 | 57.7% | $1,735,028,164 | 46.1% | 1.8 |

| OV Assigned: | $2,840,558,774 | 57.7% | $1,735,028,164 | 46.1% | 1.8 |

| Pessimistic: | $520,297,029 | 18.4% | $270,570,146 | 14.7% | 5.2 |

| Optimistic: | $2,853,508,095 | 57.9% | $1,743,093,729 | 46.3% | 1.8 |

| Fantasy: | $4,486,755,841 | 84.7% | $2,760,372,229 | 66.8% | 1.3 |

| Fair Speculative Value for Alternative Metal Price Scenarios |

| Stage: Infill & Metallurgy - 5.0% - 10.0% |

| CAD AT NPV | CAD Target Price | CAD FSV Range | CAD FSV per Share Range | CAD MSV per Share Range |

| Spot: | $2,372,130,505 | $7.00 | $118,606,525 - $237,213,051 | $0.35 - $0.70 | $3.50 - $7.00 |

| OV Assigned: | $2,372,130,505 | $7.00 | $118,606,525 - $237,213,051 | $0.35 - $0.70 | $3.50 - $7.00 |

| Pessimistic: | $369,923,504 | $1.09 | $18,496,175 - $36,992,350 | $0.05 - $0.11 | $0.55 - $1.09 |

| Optimistic: | $2,383,157,746 | $7.04 | $119,157,887 - $238,315,775 | $0.35 - $0.70 | $3.52 - $7.04 |

| Fantasy: | $3,773,980,911 | $11.14 | $188,699,046 - $377,398,091 | $0.56 - $1.11 | $5.57 - $11.14 |

| Disclaimer: A visualized outcome is one of many possible outcomes for an exploration project as it moves through the 9 stages of the exploration-development cycle from grassroots to a producing mine with failure as an outcome at any point along the way. The range of possible outcomes for the physical nature of a deposit shrinks after delivery of an initial 43-101 resource estimate. While the nature of the deposit constrains the range of mining scenarios, the cost assumptions will vary as the project moves through the feasibility demonstration stages of the cycle, which affects the economic value of the final outcome. This economic value will also vary according to the prices of the metals targeted for extraction which may change during the years it takes for a project to become a mine. An outcome visualization is thus a compilation of best guess assumptions for the key variables that drive the discounted cash flow model, the basis for assigning an economic value to a mine. An OV is not intended as a prediction, but rather as a framework that allows the incorporation of new information generated by the exploration-development cycle for the project into a valuation model on an ongoing, dynamic basis. |

.

|