Home / Companies / KRO Profile

KRO Profile

|

| Price: | $1.110 | Open Rec: | See Strategy |  |

| Market Cap: | $64,296,186 | WC % of Mkt Cap: | 7% |

| Working Cap: | $4,672,840 | As of: | 9/30/2023 |

| Issued: | 57,924,492 | Insider %: | 63.4% | | Diluted: | 59,535,492 | Story Type: | Resource: Feasibility Demonstration |

| Key People: | Sandy McVey (CEO), Peter F. Palmedo (Chair), Frank R. Hallam (CFO), |

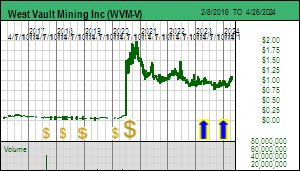

SV Rating: Good Spec Value - Favorite - as of December 29, 2023: West Vault Mining Inc is a 2023 KRO Favorite effective April 13, 2023 at $1.02 with a Good Speculative Value rating based on it positioning itself as a buyout target for a mid tier gold producer interested in developing the Hasbrouck project located just outside Tonopah in Nevada's Walker Lane. The target is a rapid repricing into the $1.50-$2.00 range to reflect fair speculative value, followed by leveraged tracking of higher real price gains (ie a 25% move by gold to $2,500 translates into a 600%-800% move to $7-$9 ahead of a buyout offer involving inflated but liquid paper from a mid tier producer). West Vault is headed by CEO Sandy McVey and Chairman Peter Palmedo whose Sun Valley Gold LLC owns 46% of the stock. Ruffer LLP and Eric Sprott own another 22%. The junior has about $4 million working capital which at the current overhead burn rate and no plans to do additional work at Hasbrouck would allow the company to operate for 4-5 years without any further equity dilution. The board includes highly experienced people like Stephen Quin and Pierre Lebel. The stated goal is to minimize dilution by spending only necessary overhead and foregoing additional feasibility related work or exploring those parts of the property with untested potential. This "gold vault strategy" is designed to maximize the upside when a major gold bull market based on a rising and sticky real gold price emerges and unleashes a scramble among mid-tier producers to expand their mining portfolio. Hasbrouck consists of three low sulphidation epithermal gold systems: Hasbrouck with a proven and probable reserve of 34,370,000 tons of 0.017 opt gold and 0.306 opt silver, Three Hills with a probable reserve of 9,653,000 tons of 0.018 opt gold, and Hill of Gold which has no resource. The reserves are ba...(see Profile for full Overview) SV Rating: Good Spec Value - Favorite - as of December 29, 2023: West Vault Mining Inc is a 2023 KRO Favorite effective April 13, 2023 at $1.02 with a Good Speculative Value rating based on it positioning itself as a buyout target for a mid tier gold producer interested in developing the Hasbrouck project located just outside Tonopah in Nevada's Walker Lane. The target is a rapid repricing into the $1.50-$2.00 range to reflect fair speculative value, followed by leveraged tracking of higher real price gains (ie a 25% move by gold to $2,500 translates into a 600%-800% move to $7-$9 ahead of a buyout offer involving inflated but liquid paper from a mid tier producer). West Vault is headed by CEO Sandy McVey and Chairman Peter Palmedo whose Sun Valley Gold LLC owns 46% of the stock. Ruffer LLP and Eric Sprott own another 22%. The junior has about $4 million working capital which at the current overhead burn rate and no plans to do additional work at Hasbrouck would allow the company to operate for 4-5 years without any further equity dilution. The board includes highly experienced people like Stephen Quin and Pierre Lebel. The stated goal is to minimize dilution by spending only necessary overhead and foregoing additional feasibility related work or exploring those parts of the property with untested potential. This "gold vault strategy" is designed to maximize the upside when a major gold bull market based on a rising and sticky real gold price emerges and unleashes a scramble among mid-tier producers to expand their mining portfolio. Hasbrouck consists of three low sulphidation epithermal gold systems: Hasbrouck with a proven and probable reserve of 34,370,000 tons of 0.017 opt gold and 0.306 opt silver, Three Hills with a probable reserve of 9,653,000 tons of 0.018 opt gold, and Hill of Gold which has no resource. The reserves are ba...(see Profile for full Overview) |

| Last Corporate Change - Jul 2, 2020: 10:1 Name Change from West Kirkland Mining Inc (WKM-V) |

| Last KRO Comment - Mar 29, 2024: KW Excerpt: Kaiser Watch March 29, 2024: West Vault Mining Inc (WVM-V) |

| Recent News - Oct 12, 2023: Granted 1% Royalty on Prospective Property Adjacent to Hasbrouck, Nevada |

|

| |

Project |

Interest |

|

Country |

Region |

Stage |

IPV

($mm) |

Target |

Deposit

Model |

|

Hasbrouck |

100% WI |

|

United States |

Esmeralda County |

7-Permitting & Feasibility |

$66 |

Gold Silver |

Low Sulphidation Epithermal  |

![]() |

|