| Kaiser Watch November 3, 2022: Death by Perpetual Permitting & Inflation |

| Jim (0:00:00): What does the world of resource juniors look like at the start of November? |

Based on the latest quarterly filings which are now up to date as far as June 30, 32% of the 1,175 TSXV listed resource juniors have negative working capital, 15% have between zero to $500,000, and 51% have betweern $500,000 to $50 million. In terms of bottom-fishing strategy this latter group will be the target at the end of 2022. When you separate the companies into those with postive and negative working capital, those with negative working capital owe about $3 billion which is unlikely to ever be repaid and will probably be converted into stock. Of that amount $2.4 billion is owed by companies trading below $0.10. If you assume a $0.05 conversion price that translates into 48 billion new shares for which there is no market, and consequently will be dealt with by 10:1 or higher rollbacks after parties connected with the company have bought the debt at a deep discount to the paper settlement price. On the plus side there is still $893 million positive working capital lurking inside the treasuries of companies trading below a dime. There are 560 companies or 48% of 1,1175 trading below a dime, so the trick is to find those below a dime that have a meaningful amount of working capital. About 30% of the TSXV resource listings trade in the $0.10-$-0.29 range of which those with money are sitting on $1.25 billion in positive working capital while the rest owe $310 million.

The chart which shows how traded value is split between TSXV resource and non-resource listings indicates that since mid December 2021 the resource listings have consistently represented over 50% of traded value. The occasional exceptions, such as on October 11 and November 3, 2022, are due to an oddball listing called Topicus.com which trades at abput $70, has 82 million shares issued, has software-related revenues approaching 1 billion euro on an annulaized basis, and is profitable. It usually trades less than 50,000 shares a day but on bigger volume days it single-handedly drags up the traded value of TSXV non-resource listings. Without this company that doesn't belong on the TSXV exchange the relative performance of non-resource listings is truly dismal. But that doesn't mean things arw wonderful for resource juniors.

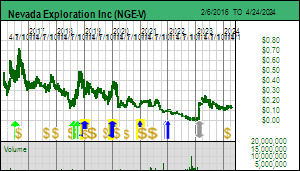

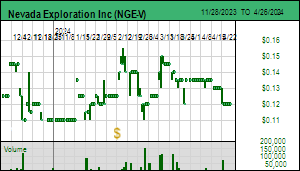

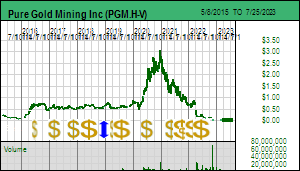

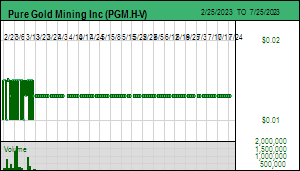

During the past week there has been a spike in traded volume by TSXV resource listings, but that was not for positive reasons because this was due to capitulation selling involving two juniors from opposite ends of the exploration-development spectrum. One was Nevada Exploration Inc which suffered a market blowout at the bid that took it to a half penny after announcing it would be pursuing a reorganization. NGE has been a long running KRO bottom-fish recommendation based on its innovative gold-in-groundwater based strategy of generating targets under Nevada's basin gravels where there are no clues in the ranges that might suggest a Carlin type gold system may be lurking under the gravel as proved to be the case with Twin Creeks, Pipeline, Cortez Hills and Goldrush. These world class gold deposits, however, had modest gold mineralization in the nearby ranges to arouse curiosity about the adjacent shallow gravel covered pediments. NGE did succeed in finding a highly altered Carlin-style Lower Plate window at the southern end of Grass Valley where there is no gold whatsoever in the nearby hills, but whatever Carlin-style gold is present it is deep beneath the gravel and layers of unpermissive stratigraphy the junior has had a difficult time testing. The story is not definitively dead, but existing shareholders will be wiped out by whatever rollback is coming, and, if gold is ever found at SGV, the reward will go to the newcomers. Such is the tragedy of innovative resource junior exploration. The other is Pure Gold Mining Inc which put the Madsen gold deposit west of Red Lake into production and filed for bankruptcy protection on Monday. On Wednesday the TSXV shoveled Pure Gold into the garbage can it calls the NEX. As I have mentioned before, we are in a bear market so severe shareholders have no patience left for a comeback from failure.

Most resource juniors this year have a downhill ski slope chart pattern which usually bottoms in December as shareholders collect their tax losses by selling stock which bottom-fishers accumulate at rock bottom prices. But this year bottom-fishing may be far more dangerous than usual because of the macro-economic backdrop of rising interest rates and concern that inflation will not ease without a harsh global recession. So when looking for bottom-fishing candidates one must look very hard for an underlying story that can still inspire fundamental optimism. If fundamental success hinges on higher metal prices, such as is the case with ounce or pound in the ground plays, one has to make sure that there are some big shareholders in place who will not let the asset be raided by predators with a long time horizon.

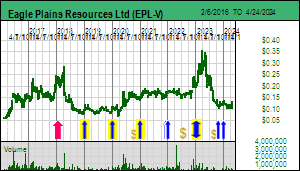

In this regard I will be looking for a chart pattern different from the usual bottoming washout. 2022 was a year when the market tended not to reward fundamental progress in the form of a higher stock price. What I will be monitoring for when I use the KRO Search Engine to screen for other parameters such as working capital is a chart pattern that has largely gone sideways in 2022. Two companies that are part of the KRO 2022 Bottom-Fish Collection are Endurance Gold Corp and Eagle Plains Resources Ltd. Check last week's KW episode for my discussion of EDG which this week not only confirmed closing of its $1.5 million private placement but confirmed that it had been increased to $2 million with just over half taken down by insiders.

Eagle Plains was a KRO Favorite in 2021 but I did not include it in the much shorter 2022 KRO Favorites because I did not think the prospect-generator-farmout model would interest the market in 2022 though in retrospect I should have had only Verde Agritech on the list given that the rest except FPX Nickel are down at least 50%. At the start of 2022 Eagle Plains was waiting for SSR to complete its acquisition of Taiga for cash which did occur, turning EPL's Taiga "marketable securities" into hard cash and making its $10 million working capital position very real. Not surprisingly none of its farmed out prospects have delivered any upside joy for EPL, but the junior did spend money drilling its 100% owned Vulcan project. Sullivan 2 was not delivered but the results have yielded a much better understanding of why Sullivan 2 was not found by previous campaigns, plus peripheral evidence that a big zinc-lead-silver system is present at not unreasonable depths. The market shrugged, perhaps because it now expects EPL to farm the project out to somebody else. But with such a rich treasury, and a bear market lingering into 2023 likely to hinder farmout activity, some shareholders such as myself are urging Tim Termuende to spend another $1-$2 million on Vulcan in 2023.

Many of EPL's farmouts involve a combination of staged cash, share issuances and exploration expenditure that allow the other junior to earn a majority interest. But in a lot of cases EPL lets the other junior earn 100% and keeps a royalty. The market is assigning no value to this portfolio of royalties which includes one covering part of Banyan's gold project in Yukon. So EPL is trying to figure out a way to monetize this royalty portfolio which could include a spinout to shareholders. In late 2021 EPL also staked the Adamant project in southeastern BC which Critical Elements had explored during Rare Earth Mania 1.0. It covers a trend of nepheline syenite intrusions that includes meaningful heavy rare earth values whose local distribution is not understood. This year EPL did its own prospecting survey over the project while compiling historical work. While a gold or base metals prospect might be hard to farm out in 2023, the rarity of REO prospects could attract a good deal in 2023 for Adamant. All these developments help explain why Eagle Plains, like Endurance Gold, has flat-lined all year within a narrow range despite fundamental progress. Such examples typically indicate a supportive and knowledgeable shareholder base engaged in fundamental outcome slow gambling rather than short term momentum chasing. 2022 has harshly and deservedly punished momentum gamblers. So if you see a flat-lining resource junior, use that as an excuse to look a little closer, not under the surface, but what is there in plain view that only solid long term shareholders can see. |

Nevada Exploration Inc (NGE-V)

Bottom-Fish Spec Value |

|

|

| South Grass Valley |

United States - Nevada |

2-Target Drilling |

Au |

Pure Gold Mining Inc (PGM.H-V)

Fair Spec Value |

|

|

| Madsen |

Canada - Ontario |

7-Permitting & Feasibility |

Au |

Eagle Plains Resources Ltd (EPL-V)

Bottom-Fish Spec Value |

|

|

| Vulcan |

Canada - British Columbia |

2-Target Drilling |

Zn Pb Ag |

Price Range Breakdown for TSXV listed Resource Juniors |

Working Capital Range Breakdown for TSXV listed Resource Juniors |

Positive & Negative Working Capital for TSXV listed Resource Juniors based on Price Range |

Relative Daily Value Traded for Resource & Non-Resource TSXV Listings |

The Price of Failure in 2022 - A Wipeout |

The Reward for Progress in 2022 - Go Nowhere |

| Jim (0:08:25): Are there any positive trends in the junior resource sector? |

The only sector whose members are registering uptrends is lithium whose demand thanks to the EV sector is outstripping supply, which has enabled lithium carbonate to undergo a ten-fold price increase since the 2020 nadir and remain strong throughout 2022 even while all other metals are undergoing price declines as the world braces for a serious economic slowdown. Backstopping this uptrend is the realization that if policy goals of replacing new ICE car sales entirely with EV sales by 2035, as now mandated by California and in Europe, lithium supply will have to undergo a ten-fold expansion from the 100,000 tonnes of elemental lithium produced in 2021. Last year's output at the average lithium carbonate price of $15.33/lb indicated a value of $18 billion for 2021. This year supply is likely higher, but at an average price double that of 2021 at a minimum the lithium supply market will have been worth $36 billion in 2022. At a ten-fold supply expansion this would be a $360 billion market by 2035, which is so outlandish it is prudent to assume the long term price will be $10/lb which is still a staggering market worth more than $100 billion annually. Why pick $10/lb? Because that is the minimum needed to mobilize the second half of that future supply from pegmatite sources outside Australia which, along with the Lithium Triangle in South America, will deliver the first half of the projected demand expansion. The rest will have to come from pegmatite deposits in eastern Canada, Brazil, Scandinavia and Africa. Lithium Mania 1.0 which ran in 2015-2017 put in motion the Australian pegmatite and Lithium Triangle brine supply, and those juniors that persisted despite the brutal lithium carbonate price decline below $3/lb in 2018-2020 are reaping big rewards for their shareholders as the EV sector scrambles to secure the lithium supply needed to feed the gigafactories on which it is spending hundreds of billion dollars as the multi-trillion dollar car industry shifts from oil to electricity powered cars over the next decade. Lithium Mania 2.0, which is just waking up, represents the scramble to secure the second half of the future demand. It has to happen now because everybody is starting to understand that it takes 5-8 years to bring brand new supply into production. So the great pegmatite hunt beyond Australia needs to ramp up now. None of this matters if we end up in a global depression that leads to war and destruction, because humanity will have accepted the End Timer mentality. Greta Thunberg's generation will end up inhabiting the Planet of the Apes. But this doesn't have to happen, and embracing Lithium Mania 2.0 is the mark of an optimist.

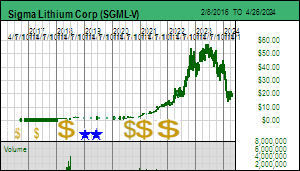

Last week the market capitalization of Sigma Lithium Corp briefly exceeded CAD $5 billion when the stock hit $54.33. Sigma is in the final stages of putting into production phase 1 of the Grota do Cirilo lithium project in Minas Gerais state of Brazil. The project was assembled by a private group in 2012 and vended into a CPC in late 2017. A bankable feasibility study for the Xuxa deposit completed in 2019 generated an after tax NPV of USD $249 million based on a LOM China cif price of $733/t spodumene concentrate (6% Li2O). The mining plan has since been expanded to include the Barreiro deposit as phase 2 which together represent an open-pit mining rate of 9,200 tpd. Together these 2 deposits are 33.6 million tonnes proven and probable at 1.43% Li2O (diluted grade) which at $34.65/lb lithium carbonate represents an in situ rock value of $2,700/t or about $91 billion total of which 60% is recoverable. When you include 3 additional deposits the M+I+I resource is 85.7 million tonnes of about 1.43% Li2O. Clearly there is production expansion potential. When the RTO was completed in early 2018 the lithium carbonate price had already cratered. SGML plans to ship its spodumene concentrate to China. The updated 2022 numbers indicate a starting price of $2,840/t concentrate, 4 times higher than in 2019. The economic analysis uses Benchmark lithium hydroxide price forecasts which Sigma converts into concentrate prices, as shown in its cirrent corporate presentation slide 68 for the Phase 1&2 mining plan through 2035. It shows the concentrate price peaking at $3,606/t in 2024 and settling back into a $1,600-$1,800/t range. The pricing scenario generates an after tax NPV of USD $4 billion at 8%. Concentrate prices are currently above $7,000/t. The CAD valuation of Sigma Lithium is fair and may represent good value to a major company seeking to develop tthe additional resources. Blackrock funds came on board in January 2022 as part of a $137 million financing at $11.75. Sigma Lithium is a real company that by the start of 2023 will be producing lithium concentrates from pegmatites in Brazil. The race is now on to repeat this success elsewhere in Brazil and in other parts of the world that have LCT type pegmatites grading 1%+ Li2O.

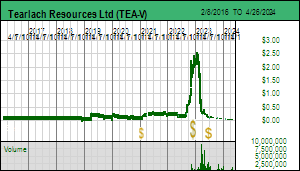

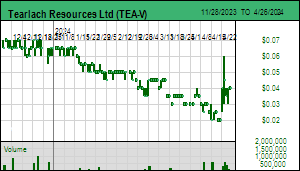

The other example, Tearlach Resources Ltd, is a shell whose disclosed insiders own less than 1% of the 63 million shares created since a 20:1 rollback in 2011. Nothing of value was created during the past decade of cheap financings. In July former Teck exploration boss Lindsay Bottomer helped Tearlach acquire 3 lithium prospects in northwestern Ontario that seem to have no virtue other than being near properties already staked by lithium explorers. The web site has the look and feel of lifestyle battery metal juniors: rotating background images, EV charging photos, ESG blather, pages that fade in and out - and very little useful information. And yet when this $0.10 shell announced the acquisition of lithium pegmatite pasture and had 2 people from the cannabis world join the board, it popped to $0.50 for a $30 million valuation. When it announced a $5 million unit private placement at $0.50 the stock shot past $2 to represent a fully diluted implied value of $136 million. On Thursday somebody broke rank and dumped a pile of stock on the bid, but by Friday the stock was recovering. The only reason I mention Tearlach is to use it to illustrate that the promoter crowd smells Lithium Mania 2.0 and is positioning itself. Most likely, similar to Li-Ft Power, a recent CSE listing with grassroots James Bay properties optioned 100% from Kenoraland that sports a $200 million plus valuation, Tearlach will acquire a more substantial lithium asset with the help of a puffed up valuation. No point complaining by those of us who accumulate Lithium Mania 2.0 pegmatite hunters such as Bob Wares' Brunswick Exploration which has a coherent and fully deployed strategy for assembling a truly prospective portfolio of grassroots lithium prospects in eastern Canada. We should welcome the likes of TEA and LIFT as validation of our belief that Lithium Mania 2.0 will become the biggest exploration game ever in Canada, much bigger than the diamond rush kicked off by Dia Met in late 1991. |

Sigma Lithium Corp (SGML-V)

Unrated Spec Value |

|

|

| Grota do Cirilo |

Brazil - Other |

7-Permitting & Feasibility |

Li |

Tearlach Resources Ltd (TEA-V)

Unrated Spec Value |

|

|

| Wesley |

Canada - Ontario |

2-Target Drilling |

Li |

Lithium Price and Supply Trends |

Sigma Lithium and Tearlach: A contrast between Lithium Mania 1.0 and 2.0 |

Sigma's Grota do Cirilo Reserve and Resource Estimates |

Economic Analysis of Sigma's Phase 1&2 Mining Plan |

Sigma Lithium's Spodumene Concentrate Prices based on Benchmark Hydroxide Forecast |

| Jim (0:16:02): Is the perpetual permitting cycle of Perpetua Gold Corp potentially coming to an end? |

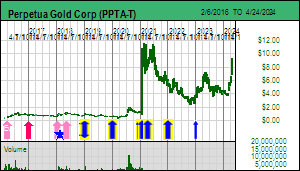

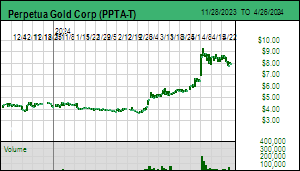

The USFS has finally released a Supplemental Draft Environmental Impact Statement that reflects the modifications Perpetua Gold Corp made in response to the comments generated when the USFS released the original Draft EIS in August 2020. In Q1 of 2021 PPTA's largest shareholder John Paulson fired the Canadian team led by Stephen Quin and replaced them with Idahoes and his pals. Two years later we are where we were two years ago: waiting for a 75 day comment period to end on January 10, 2023 that finally results in a Final EIS in mid 2023 that kicks off application for dozens of other permits needed to begin mine construction. But it no longer matters.

When the Stibnite feasibility study was filed in late 2020 it used $1,600 gold as a base case price. Stibnite cleared the IRR hurdle and made the hurdle of after-tax NPV matching CapEx provided you used a 5% discount rate. But during the past year we have seen two bad things unfold: inflation has reached 3 decade highs and gold has retreated from the $2,000 level almost back to the base case level of $1,600. Perpetua was made a Good Spec Value rated KRO Favorite based on the feasibility study and the expectation that $1,600 gold was likely the low end of the gold price range going forward. I still believe that.

To understand the upside of Stibnite I created a DCF model that closely follows all the assumptions in the feasibility study. This allows me to see the impact on after tax NPV at both 5% and 10% discount rates as well as IRR at different gold prices. It also allows me to convert those absolute figures into per share figures in CAD using the latest exchange rate and fully diluted. The first two charts below illustrate this in NPV/share and aboslute NPV terms. The NPVsh chart shows that PPTA has a target range of $16-$26 at $1,600 gold, soaring to $31-$46 at $2,000 gold.

But gold has sunk back close to $1,600 as the Federal Reserve cranks up interest rate to fight inflation. So I did what I did the other week with FPX Nickel and its Decar PEA: I escalated all costs by 20% which is not unreasonable to do for a mining project whose costs were figured out for the 2020 FS. The result in the second set of charts is horrific. The NPV at $1,600 gold collapses to USD $377 million at 10% and $715 million at 5%, well below the new $1.6 billion CapEx. The per share target of CAD $8-$15 looks good for a current stock price below $3, but it is fictitious because the NPV is far below the CapEx, and with only a 15 year mine life this is not going to be built, which is different in a scenario like Decar with a 40 year mine life producing a metal the world can never do without (keep in mind that BitCoin is the new gold as pumped by the libertarian crowd which will continue to rely on stainless steel until Ray Kurzweil shows them how to migrate into quantum space as disembodied Q like beings). At $2,000 gold the hurdle gets cleared with a $1 billion NPV at 10% and $1.6 billion at 5%, though again only with the 5% discount rate just as was the case with the original FS assumption. The price target range would be $22-$34.

If the Stibnite permit is ever granted Perpetua will have to redo its feasibility study with current numbers. And if gold is not $2,000 plus by the end of next year, Stibnite will be just another gold optionality play. The juiciest rony would be if the government is forced to step in to bankroll CapEx so that Stibnite is not just a reclamation project funded by a gold mine, but antimony supply security funded by a gold mine. But I'm not sure what that triumph will be worth on a per share basis. To stay enthusiastic about Perpetua you have to be optimistic that the perpertual permitting cycle is coming to an end, that my cost inflation assumptions are excessive, and that gold will charge through $2,000 while inflation succumbs to a high interest rate induced recession. |

Perpetua Gold Corp (PPTA-T)

Favorite

Good Spec Value |

|

|

| Stibnite |

United States - Idaho |

7-Permitting & Feasibility |

Au Sb |

Feasibility Study based NPV Sensitivity of Stibnite to Gold Price on Per Share Basis |

Feasibility Study based NPV Sensitivity of Stibnite |

20% Cost Escalation applied to 2020 Feasibility Study presented as NPV per share |

20% Cost Escalation applied to 2020 Feasibility Study presented as NPV |

| Jim (0:21:15): Your 2022 KRO Favorites Index finished October down about 25% but that is up from being down 39% in mid October. Is the worst over for your KRO Favorites? |

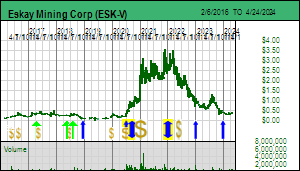

The KRO 2022 Favorites Index is down 28.1% as of November 3, 2022, up from its October low of being down 39.4%. The only stock that is up is Verde Agritech which is up 163.6% after a good week during which it announced that the full 2.4 million tpa K Forte capacity of Plant 2 is now operational. So far it looks like Jair Bolsonaro will accept his narrow defeat but I think he is just waiting to see what happens with the American mid-terms on November 8. FPX Nickel is the next best performer down 20% at $0.40. It seems that the RBC selling has dried up, but the market remains nervous. All the rest are down 50% or more and probably are close to the bottom if not already off the bottom like FPX Nickel. The one exception that makes me nervous is Eskay Mining Corp which is a Favorite because of its potential to deliver an Eskay Creek clone discovery at its Eskay project in the Golden Triangle. The company announced on October 7, 2022 that it had completed 29,500 m of drilling that started late May in the TV-Jeff area and then moved on to the more exciting Scarlet Ridge target in the northern part of the property not that far from Eskay Creek 1 but within the east anticline of this former marine rift basin. This area has never been properly explored so it held the greatest hope for a discovery in 2022. ESK has reported sulphide visuals which support the VMS model but no assays yet for any of the holes.

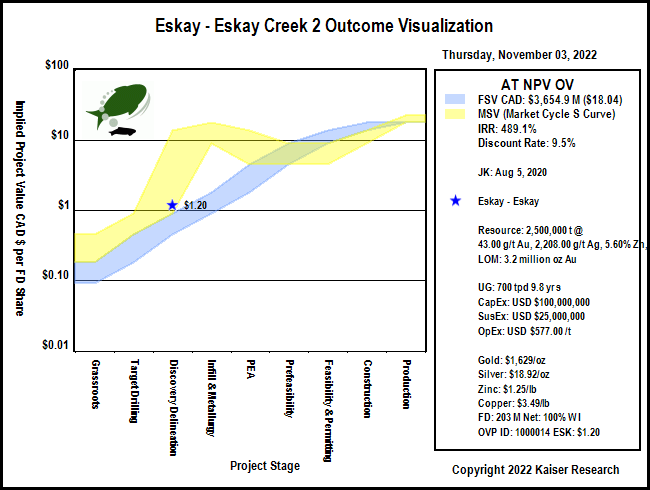

I am not expecting anything significantly new for the TV-Jeff area based on the visual descriptions published, and the market will not care about short isolated high grade silver-gold intervals. It wants to hear that enough of a zone has come into view to allow a resource estimate. If a resource estimate is not in the cards we know it is no longer a real discovery in the sense of something with mine potential. As far as I am concerned everything now hinges on what Scarlet Ridge assays. And therein lies my problem. The two IPV charts below show the fair value and S-Curve channels for an Eskay Creek equivalent outcome which would be worth CAD $3.7 billion at today's metal prices, or $18.04 per share assuming no further dilution. At a $1.20 stock price the project has an IPV of CAD $241 million based on 203 million fully diluted. That pricing represents poor speculative value in terms of the rational speculation model, but it is within the lower end of the S-Curve range for a project at the discovery delineation stage. However, given that TV-Jeff assays are still pending, one has to conclude that this target is no longer at the discovery delineation stage, and should be dropped back to target testing stage where Scarlet Ridge is currently at. Scarlet Ridge needs to replace TV-Jeff as the new discovery focus.

ESK is already down 56% from its $2.77 starting price, but if assays lead the market to conclude that Scarlet Ridge has not yet reached discovery stage, or if it has, with a much more modest outcome than Eskay Creek 1, the stock will be vulernable to another 50%-80% drop. The stock has held up remarkably well, in part because it has developed a cult style shareholder base, but even cultists are not stupid when it comes to financing. At the current price none of the warrants are in the money, including the 1.6 million at $1.30 that expire in early December. And even these won't solve ESK's working capital problem. As of August 31 it had only $5.3 million working capital, much of which will be gone by the time the final assays are paid for. There is a $2.7 million debenture due to Seabridge at the end of the year which Mac Balkam can maybe persuade Rudy Fronk to defer for another year. But if ESK is to follow up next year with a similar scale work program, it will need to finance with flow-through in December or hard dollars in Q1 of 2023. Unless Scarlet Ridge delivers spectacular results that turn it into the new Eskay Creek 2 discovery delineation play, such future financing will happen at much lower prices. Even if the faithful hold steady, the algos will tank the stock. Eskay Mining Corp poses the greatest risk for dragging the KRO 2022 Favorites Index lower. May John Dedecker's enthusiasm prove prophetic. |

Eskay Mining Corp (ESK-V)

Favorite

Fair Spec Value |

|

|

| Eskay |

Canada - British Columbia |

3-Discovery Delineation |

Au Ag Cu Pb Zn |

KRO 2022 Favorites Index |

KRO 2022 Favorites Performance Table |

IPV per Share Chart for Eskay Creek 2 Outcome Visualization |

IPV Chart for Eskay Creek 2 Outcome Visualization |

| Disclosure: JK owns shares of Brunwsick, Eagle Plains and Endurance Gold; Eskay Mining is a Fair Spec Value rated Favorite and Perpetua Gold is a Good Spec Value rated Favorite; Brunswick, Eagle Plains Endurance are Bottom-Fish Spec Value rated; Sigma Lithium and Tearlach Resources area unrated |