| Kaiser Watch November 18, 2022: Why is Twitter good for Resource Juniors? |

| Jim (0:00:00): Will Elon Musk's ownership of Twitter change how you use Twitter? |

The Twitter controversy is mainly about how it is used to spread mis-information and hate, and to what extent Twitter should try to moderate the worst abuses. It is possible that under Elon Musk Twitter could become a free for all that channels online and physical harm at people. But Twitter is also used by dissidents to push information into the public domain which has made abusive governments like Iran very unhappy and eager for access to the actual identities of such people. Elon's quest for cash flow may require accommodating the demands of thug governments. Twitter could see a big drop in membership usage. But none of that affects me because I only use Twitter Kaiser Research as a notification system. The public can choose to follow or unfollow me at its leisure.

When I publish a Kaiser Watch Episode I also create an unrestricted blog comment on my KaiserResearch.com web site which includes links to its location on YouTube. I include written comments and graphics with the blog comment to illustrate the audio version on YouTube. It is also set up so that if somebody is just interested in the Bell Copper question they can click on the YouTube link and start the audio at Bell Copper. I then tweet a link to the latest KW Blog comment which alerts my followers that the latest KW is available. This brings them to my web site which does not require blue check verification. I use Twitter as a one way broadcast system.

I also include the Twitter handles of companies that I mention so that people can go to their profiles and find out more. I am busy collecting corporate Twitter handles and adding them to the KRO profiles so that members who use the KRO Search Engine to research the juniors can easily follow those companies that interest them. I myself follow the Twitter accounts of companies that interest me because I expect these companies to tweet whenever they have a press release or new presentation on their web site. The tweet should include the headline and a link so that I can go to their web site and review the new content. I also like it when they tweet a link to third party web site hosted content relevant to their story. Public companies should not engage in Twitter conversations with their followers. Like me they should just use it as an alternative to email.

Email is dead as a notification system. Spam filters, opt-in requirements and blacklisting have made email unreliable as a one to many broadcast tool. The fact that my Twitter feed is polluted by sponsored tweets sucks, but anything that is truly free won't survive. There is always a price.

I encourage resource juniors to set up a Twitter account and use it as a notification system, not just because it dispenses with the headaches of email, but because it also allows organic audience growth. Kaiser Research is a membership fee based information portal for whose content I alone am responsible. But I also run a Slack Forum. New KRO members are sent a slack invite that allows them to register for KaiserResearchOnline at Slack. I've created 30 theme based channels into which I post off the cuff comments and links to anything new I have posted on KRO. Members can also post links, ask questions, engage in conversations. If anybody becomes uncivil or uses it to pump some garbage I can deactivate their membership. Most KRO members just lurk and read. A small percentage are active posters. This is where I engage in conversations.

There are no advertisements. It is like a private forum on CEO.ca, except nobody is running analytics to extract knowledge from our private activity. Slack is not free. It is now owned by Sales Force and its target market are businesses whom it wants to charge $10 or so per month for every employee that is a member. Because Slack facilitates collaboration and direct messaging this $120 annual cost per employee is a good deal. But it would be a quarter of the annual $450 membership fee which is not a good deal for me. Slack is free to me and my members because there is a price. It used to be that only the last 10,000 posts were visible, which, based on the level of activity in my Slack space, meant that only the last year's posts were visible. In September Slack switched to a new policy where it displays only the last 90 days of posts. This means KRO Slack will be mainly useful to KRO members for current conversations. That still is hugely useful to me and my members.

I mention Slack because the real value of Twitter for myself and resource juniors is that Slack is an example of the millions of social media clubs out there whose members engage in conversations. Slack is ideal for an investment club run by a moderator who also controls who has access. Public forums like Stockhouse and Hot Copper in Australia inhibit thoughtful posting because there is an army of anonymous pumpers and bashers ready to trash the poster or pollute the thread. Twitter is the place where influencers hang out to market products and ideas. Some of these influencers follow the resource juniors and develop their own following. When they receive a tweet they like they can publicly like or retweet it to their followers, who in turn can do likewise. Or, when they are members of a social media club such as KRO Slack, they can post the tweet link or the tweet's embedded link in the channel where appropriate.

The benefit for resource juniors is that their audience can grow virally with only the effort of tweeting the latest news release, corporate presentation, or third party web site link relevant to their story. And it doesn't cost them a penny. |

Example of Interactive/Collaborative Activity in KRO Slack |

| Jim (0:09:30): Is Bell Copper any closer to resuming work at its Big Sandy emerging copper discovery? |

Kaiser Watch October 6, 2022: Cheering for Bell Tower Endurance has graphics and a good description of Bell Copper's Big Sandy story so I include only a couple here. The question then was financing needed to resume drilling at Big Sandy. On November 15 BCU bit the bullet and announced a private placement to raise up to $3 million by offering 25 million units at $0.12 with a full 2 year warrant at $0.20 whose expiry will be accelerated to 30 days if the stock's VWAP price is $0.40 or higher for 20 consecutive trading days. If it closes in its entirety this would push fully diluted to 204 million shares. This is not an automatic trigger because BCU will have 20 days after it is hit to make it effective.

The potential 50 million share dilution is a disappointment in light of the stock trading in the $0.30-$0.70 range in February through March after announcing that hole BS-3 encountered 287 m of chalcocite mineralization at a hole depth of 1,302 m in the Big Sandy target. The stock had jumped from the $0.20 level because the market interpreted this intersection as confirmation that the truncated top of the Diamond Joe porphyry root 13 km to the southwest across a basin had finally been discovered. Explorers have searched in vain for decades for the missing top because the width of the root and the remnant mineralization indicated a world class scale porphyry deposit. Arizona's basin and range faulting assumed that the top had slid to the east and was lurking somewhere under the gravels of the 13 km wide basin valley through which the Big Sandy River flows. Even Bell Copper under Tim Marsh took a crack at it a decade ago but gave up when the bedrock proved a couple thousand metres deep. The conclusion was that wherever it ended up, it was too deep and expensive to find, and perhaps too deep to mine, even though it had the potential for a copper rich supergene enrichment blanket above the primary copper zone.

Marsh shifted BCU's attention to finding the missing top of the Wheeler Wash porphyry stock farther north which used to be called Kaaba but is now called Perseverance. Robert Friedland's Cordoba Minerals optioned it in 2018 and has yet to find the missing top. Bored with waiting for Cordoba to find the prize and meditating on what the effort was revealing, Marsh decided in 2020 to revisit Diamond Joe. This time he went all the way across the basin, much farther east than he had ever imagined the truncated top could have wandered, and started exploring the range front east of the Big Sandy River. There he observed exotic copper of the kind that forms when groundwater dissolves copper, carries it towards the surface, and precipitates the copper in rocks unrelated to the original porphyry system. This is different from a supergene enrichment blanket which forms when circulating groundwater leaches primary chalcopyrite and drops its copper payload as another sulphide called chalcocite father down. This repetition leaves the upper part of the zone barren but enriches the copper grade of the deeper chalcopyrite zone.

Since there wasn't any room for the Diamond Joe top in the eastern range, Tim Marsh came to the stunning realization that it must be buried east of the Big Sandy River near the eastern edge of the basin, over 13 km from the source. So he staked the Big Sandy claim, whose outlines he has never revealed in any corporate graphics, conducted an MT survey which indicated a major conductive body at 400 m depth, and started a drill vectoring strategy. The conductor turned out to be fake, probably caused by clays in the basin, and bedrock proved 1,000 m deep. This first hole hit the edge of a porphyry system, confirming the truncated Diamond Joe had traveled this far east. The second hole hit older country rock that the Diamond Joe had intruded and would have traveled with the porphyry zone when it faulted off the root. The third hole excited the market because the presence of a leach cap followed by supergene mineralization confirmed that the missing Diamond Joe head had finally been found.

Tim, however, knew, with the help of his XRF gun, that the grade was not going to be the 0.6% plus copper needed to support an underground block-caving operation and he made no secret about that. But as the hole passed into the underlying primary chalcopyrite zone it was too low grade to have been the source from which the chalcocite grade was enriched. It resembled the pyritic shell which flanks the richer primary copper shell that is draped around the low grade core of a porphyry stock. This led him to conclude that the chalcocite enrichment was partly created by lateral flow from the center of the stock. He had also observed that the Diamond Joe top was tilted, with the unfortunate result that hole BS-3 hit bedrock deeper than where the fully enriched blanket would be located. But because of the tilt angle it was possible that if he pushed BS-3 deeper it might hit the edge of the primary copper shell, delivering definitive confirmation of Diamond Joe's location. He pushed the hole another 524 m to a depth of 2,026 m, but the copper mineralization never improved and he finally quit the hole. After surveying the hole he understood why, namely that the angled hole had straightened and was in effect coring parallel to the primary copper shell if it was where he expected it to be. The key benefit was that he now knew exactly where to spot the fourth hole to hit the supergene blanket above the primary copper shell.

When BCU reported 200 m of 0.42% copper for the chalcocite zone and 524 m of 0.16% copper for the chalcopyrite zone the market reacted very negatively because together they seemed to suggest a low grade copper system that could only be mined underground and thus had zero economic potential. Part of this reaction was due to the resource sector having finally also gotten caught up in the 2022 equity market decline, but also because the market did not understand the geological context. For that Tim Marsh was partly to blame, because although his written descriptions made sense to competent geologists, who realized Marsh had landed a major emerging copper discovery, lay people need cartoons to understand geological word salads. Later in the summer he capitulated by creating graphics for the presentations he was giving to geology societies whose members like retail do actually prefer staring at cartoons rather than converting words into mental graphics. But by then the market perception damage had been done, and the cost of pushing the hole to 2,026 m had left the junior with a near empty treasury. By the time he secured a permit and a special rig to pre-collar hole BS-4 through the gravel, which should reduce the prior hole's 3 month gravel drilling ordeal to 1 month, the market was no longer interested, and majors which had signed NDA's were distracted by the declining copper price. And so in mid November Tim Marsh bit the bullet so that he could drill what could be a make or break hole.

The financing, while appearing hideously dilutionary, is well thought out. First of all, the press release says up to $3 million. Closing is not conditional on all $3 million being raised. Bell Copper will close it in tranches. If it all comes in at once, so be it. But if $1 million comes in the door quickly, Bell will close that tranche and start hole BS-4. The hope is to start BS-4 in early December so that it is poised to intersect bedrock in early January. Once that milestone is reached BCU will close the financing because the visuals will reveal lots about how the hypothesis is playing out. The private placement has a four month hold, so it won't be free trading until April, and even if the trigger is reached in Q1, BCU is unlikely to pull the trigger until the four month hold is over. By March BCU would be in a position to report visuals, setting the stage for assays by June.

BCU has 9,648,922 warrants at $0.25-$0.26 from earlier financings that expire in March through June of 2023 (mostly in early June) which could raise about $2.4 million. If the results are good enough to allow the stock to trade above $0.40 and generate the trigger, it would be wise for BCU to pull the trigger, because clip and flippers will be tempted to dump their $0.12 stock. A discovery hole that inflects Big Sandy from emerging discovery to confirmed discovery, unleashing S-Curve speculation, would bring in new buyers that can absorb the selling created by placees being forced to exercise their $0.20 warrants. If the older and accelerated warrants end up exercised, BCU would start H2 2023 with an extra $7.4 million in the bank, and no warrant overhang left. With 204 million fully diluted and 100% ownership of Big Sandy confirmed as a major new copper discovery in Arizona, the stock, carrying an implied value of only $100 million at $0.50, would have upside room to deliver a 5-10 bagger as BCU gets to work delineation drilling the new discovery. |

Bell Copper Corp (BCU-V)

Bottom-Fish Spec Value |

|

|

| Big Sandy |

United States - Arizona |

3-Discovery Delineation |

Cu Mo |

Aerial View of the Diamond Joe Displacement Hypothesis at Big Sandy |

Geological Cartoon of Big Sandy Target |

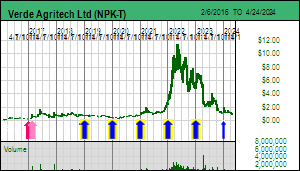

| Jim (0:24:13): Can you give us a summary of Verde Agritech's third quarter conference call? |

The third quarter financials were released on Monday Nov 14 and the conference call was held Thursday Nov 17. The entire call was 1 hour 17 minutes. The first 21 minutes has the CFO going through the results. In summary for the first 9 months of 2022 NPK has generated CAD $63 million in revenues, almost 3 times that for last year, and generated $23 million in cash flow, almost 5 times last year. In terms of volume they have sold 503,000 tonnes of K Forte compared to 266,000 tonnes last year. The stock, which almost hit $8 on Monday, has since retreated below $6. The best explanation is that the market has realized that NPK may not make its revised 2022 guidance of $87 million revenue and $31 million cash flow. Plant 2 is now fully operational at its 2.4 M tpa capacity, bringing total capacity to 3M tpa, but the road access problem that emerged in early September and was not fixed until late October cost the company over 100,000 tonnes of K Forte in cancelled orders because it could not be delivered from Plant 2. Q4 and Q1 are low demand quarters because it is the rainy season and if the farmers don't have the fertilizer in time they won't need it until the next planting season which starts in Q2. Cris Veloso made it very clear that the company is working very hard to meet its 2022 guidance of 700,000 tonnes which is a warning to the market that when the full year results are announced in mid April they may fall short of guidance. As far as I am concerned it doesn't matter to me because it was always optimistic that Plant 2 would be operational in time to ship K Forte during the third quarter. The company is now positioned to expand sales and revenues four-fold in 2023 and by the time we get the annual results the market will be focused on the extent that orders have been booked for delivery in Q2-Q3.

The interesting part of the conference call was the nearly hour long Q&A. Here are a few themes that caught my attention.

The first batch of questions were of a technical accounting nature. I am not a financial analyst so these sorts of questions are boring. But they are an important sign that Verde Agritech has graduated into the league of an operating company and is attracting analysts who care about revenues and costs.

Verde Agritech attracted a lot of market attention earlier this year after Russia invaded Ukraine and concern arose about Russian and Belarusian potash supply which is about 37% of global output. Potash, however, was never put on the sanctions list, and Belarus managed to figure out an alternative route to market when Lithuania stopped being a transportation corridor. The Brazilian ports are now bulging with potash and some of it is being diverted to other countries. The price, however, is still $740/t KCl, well above the $360/t the company uses in its feasibility study. NPK's pricing strategy allowed Plant 1 to operate at capacity, and in May NPK boosted its guidance on the expectation that Plant 2 would be operational by July, but it didn't happen until late August, and then came the water problem that prevented them from operating Plant 2 while they built a new bridge and upgraded the access road. Apparently NPK has only 15,000 tonnes of storage capacity, so its plants operate only to fulfill orders that can be immediately trucked to farmers.

There were several questions about providing K Forte in a granular form which is the form preferred by the bigger farms. Apparently there is a limit to how much powdered K Forte NPK can sell to farmers, but apparently that limit will not be hit by the current 3M tpa capacity. The problem with converting K Forte powder into a granular form is that it requires adding water and a binder to the powder and then drying the result to remove the moisture. Drying is a significant cost and the company has been researching a method to create granular K Forte that avoids the drying step. Their bigger concern right now is boosting sales to 3M tpa and they are planning to use discounted prices for Q4-Q1 deliveries which is shaping up to be a difficult period for all fertilizer companies.

There was a question about BioRevolution being sold at a 90% discount from its list price which CV explained was necessary to persuade farmers to try out the microbe loaded K Forte as a soil rehabilitation strategy. That makes sense because this is a brand new concept and farmers will want to see it work before committing to use it.

There was a question about carbon credits which the company is exploring and which is a benefit of Lula's election and Brazil's pivot back to caring about climate change.

There were also questions about the US listing with no definitive timing offered though they are still working on it. They are also close to unveiling a brand new web site which will include translations of the 100 Portuguese testimonials about the efficacy of K Forte. That in itself could help investors overcome concern about how quickly sales grow in 2023. |

Verde Agritech Ltd (NPK-T)

Favorite

Good Spec Value |

|

|

| Cerrado Verde |

Brazil - Other |

9-Production |

K |

Verde Agritech Q3 & YTD Income |

Verde Agritech Q3 & YTD Operational Summary |

Verde Agritech Quarterly History 2018-2022 |

Verde Agritech Yearly Product and Revenue History |

Verde Agritech Yearly Cash Flow History 2018-2022 |

Potash and Diesel Price History |

| Disclosure: JK owns Verde Agritech; Verde Agritech is a Good Spec Value rated KRO Favorite; Bell Copper is Bottom-Fish Spec Value rated |