Home / Companies / KRO Profile

KRO Profile

|

| Price: | $0.060 | Open Rec: | No |  |

| Market Cap: | $4,744,111 | WC % of Mkt Cap: | 75% |

| Working Cap: | $3,577,751 | As of: | 9/30/2023 |

| Issued: | 79,068,523 | Insider %: | 19.1% | | Diluted: | 92,039,477 | Story Type: | Resource: Feasibility Demonstration |

| Key People: | Jean-Sebastian David (CEO), Serge Savard (Chair), Anthony Glavac (CFO), |

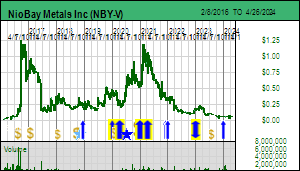

SV Rating: Bottom-Fish Spec Value - as of December 29, 2023: NioBay Metals Inc was made a Fair Spec Value rated 2023 Favorite at $0.18 on December 30, 2022 based on early evidence a major new niobium bearing carbonatite has been discovered under a lake a few km to the west of the existing low grade Crevier syenite dyke hosted niobium-tantalum deposit located in southern Quebec about 150 km northwest of the Niobec Mine now owned by a private group called Magris which owns 27.5% of Crevier. The stock was rated a Good Spec Value Favorite in 2020 and 2021 based on the PEA completed in late 2020 for the James Bay carbonatite hosted niobium deposit in northern Ontario near the town of Moosonee. This deposit was discovered in the 1960s but never developed because of its remote location and the superior Niobec deposit in southern Quebec. NioBay acquired the James Bay project in early 2016 but could not start work because the chief of the Moose Cree First Nation, who represented an anti-mining stance with an emphasis on traditional Indigenous activities such as hunting, fishing and trapping, refused to engage in consultations with NioBay as required by Ontario's drill permitting process. She was ousted in mid 2019 tribal council elections and replaced by a new chief who engaged with NioBay in a manner that would protect community interests. This allowed NioBay to conduct a drill program in 2020 to support an updated resource and delivery of a PEA in October 2020 for a 6,600 tpd open pit mining scenario. Open pit mining was chosen over underground mining because the Moosonee community members preferred jobs operating equipment above ground rather than underground. At the base case price of $45/kg ferro-niobium James Bay has an after-tax NPV ranging from USD $638 million at 10% to $1.25 billion at 5% discount rates with an IRR of 30.4%. Wit...(see Profile for full Overview) SV Rating: Bottom-Fish Spec Value - as of December 29, 2023: NioBay Metals Inc was made a Fair Spec Value rated 2023 Favorite at $0.18 on December 30, 2022 based on early evidence a major new niobium bearing carbonatite has been discovered under a lake a few km to the west of the existing low grade Crevier syenite dyke hosted niobium-tantalum deposit located in southern Quebec about 150 km northwest of the Niobec Mine now owned by a private group called Magris which owns 27.5% of Crevier. The stock was rated a Good Spec Value Favorite in 2020 and 2021 based on the PEA completed in late 2020 for the James Bay carbonatite hosted niobium deposit in northern Ontario near the town of Moosonee. This deposit was discovered in the 1960s but never developed because of its remote location and the superior Niobec deposit in southern Quebec. NioBay acquired the James Bay project in early 2016 but could not start work because the chief of the Moose Cree First Nation, who represented an anti-mining stance with an emphasis on traditional Indigenous activities such as hunting, fishing and trapping, refused to engage in consultations with NioBay as required by Ontario's drill permitting process. She was ousted in mid 2019 tribal council elections and replaced by a new chief who engaged with NioBay in a manner that would protect community interests. This allowed NioBay to conduct a drill program in 2020 to support an updated resource and delivery of a PEA in October 2020 for a 6,600 tpd open pit mining scenario. Open pit mining was chosen over underground mining because the Moosonee community members preferred jobs operating equipment above ground rather than underground. At the base case price of $45/kg ferro-niobium James Bay has an after-tax NPV ranging from USD $638 million at 10% to $1.25 billion at 5% discount rates with an IRR of 30.4%. Wit...(see Profile for full Overview) |

| Last Corporate Change - Sep 21, 2016: 5:1 Name Change from MDN Inc (MDN-V) |

| Last KRO Comment - Apr 21, 2023: KW Excerpt: Kaiser Watch April 21, 2023: NioBay Metals Inc (NBY-V) |

| Recent News - Feb 29, 2024: Property Asset or Share Purchase Agreement |

|

| |

Project |

Interest |

|

Country |

Region |

Stage |

IPV

($mm) |

Target |

Deposit

Model |

|

James Bay |

100% WI |

|

Canada |

James Bay Lowlands |

6-Prefeasibility |

$6 |

Niobium |

Carbonatite  |

|

Crevier |

72.5% WI |

|

Canada |

Central Quebec |

7-Permitting & Feasibility |

$8 |

Tantalum Niobium |

Carbonatite  |

|

Foothills |

80% WI |

|

Canada |

Quebec |

2-Target Drilling |

$7 |

Titanium |

Magmatic Intrusive  |

|

Valentine |

100% WI |

|

Canada |

James Bay Lowlands |

2-Target Drilling |

$6 |

Niobium |

Carbonatite  |

|

Gouin |

100% WI |

|

Canada |

Southern Quebec |

2-Target Drilling |

$6 |

Niobium |

Carbonatite  |

![]() |

|

| Price: | $0.135 | Open Rec: | See Strategy |  |

| Market Cap: | $25,745,933 | WC % of Mkt Cap: | 2% |

| Working Cap: | $435,859 | As of: | 9/30/2023 |

| Issued: | 190,710,613 | Insider %: | 0.0% | | Diluted: | 214,245,711 | Story Type: | Resource: Feasibility Demonstration |

| Key People: | Lauren McDougall (CFO), Tyler Caswell (VP EX), Pamela White (Sec), |

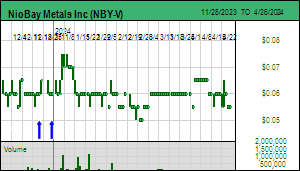

SV Rating: Bottom-Fish Spec Value - as of December 30, 2022: Northwest Copper Corp is the combination of two former KRO Favorites, Serengeti Resources Inc and Sun Metals Corp, which merged on March 5, 2021 on terms where Serengeti undertook a 2:1 rollback and Sun Metals merged with the resulting company on a 0.215 NWST share for 1 Sun Metals share. Sun Metals was a Bottom-Fish Spec Value rated 2020 Favorite at $0.23 but it was downgraded to Poor Spec Value on Oct 2, 2020 when it became apparent that the Stardust project was not delivering anything new. Serengeti, in contrast, which was started as a Bottom-Fish Spec Value rated 2020 Favorite at $0.185 was upgraded on October 8, 2020 to a Fair Spec Value rated Favorite at $0.355 based on news that the East Niv copper-gold prospect had turned into a compelling porphyry target that would be drilled for the first time in 2021 (see Tracker October 8, 2020). The merger deal was announced on November 30, 2020. Serengeti was continued as a Fair Spec Value rated 2021 Favorite at $0.39 on December 31, 2020 which adjusted to a $0.78 cost base when Serengeti and Sun Metals merged. The merger created synergies in several areas which effective May 17, 2021 justify upgrading Northwest Copper Corp to a Good Spec Value rated 2021 Favorite at $0.80. The first issue was that neither Sun Metals' Stardust nor Serengeti's Kwanika projects in central British Columbia had sufficient critical mass to be developed as standalone mines, Stardust as an underground only high grade copper-gold-silver CRD style mine, and Kwanika as a combination open-pit/underground mine most of whose output would be underground mined. Stardust, which started off with the Canyon Creek resource of 2,970,000 tonnes at 1.27% copper, 1.68 g/t gold and 32.6 g/t silver, spurred excitement in 2018 with the late season discovery of the ...(see Profile for full Overview) SV Rating: Bottom-Fish Spec Value - as of December 30, 2022: Northwest Copper Corp is the combination of two former KRO Favorites, Serengeti Resources Inc and Sun Metals Corp, which merged on March 5, 2021 on terms where Serengeti undertook a 2:1 rollback and Sun Metals merged with the resulting company on a 0.215 NWST share for 1 Sun Metals share. Sun Metals was a Bottom-Fish Spec Value rated 2020 Favorite at $0.23 but it was downgraded to Poor Spec Value on Oct 2, 2020 when it became apparent that the Stardust project was not delivering anything new. Serengeti, in contrast, which was started as a Bottom-Fish Spec Value rated 2020 Favorite at $0.185 was upgraded on October 8, 2020 to a Fair Spec Value rated Favorite at $0.355 based on news that the East Niv copper-gold prospect had turned into a compelling porphyry target that would be drilled for the first time in 2021 (see Tracker October 8, 2020). The merger deal was announced on November 30, 2020. Serengeti was continued as a Fair Spec Value rated 2021 Favorite at $0.39 on December 31, 2020 which adjusted to a $0.78 cost base when Serengeti and Sun Metals merged. The merger created synergies in several areas which effective May 17, 2021 justify upgrading Northwest Copper Corp to a Good Spec Value rated 2021 Favorite at $0.80. The first issue was that neither Sun Metals' Stardust nor Serengeti's Kwanika projects in central British Columbia had sufficient critical mass to be developed as standalone mines, Stardust as an underground only high grade copper-gold-silver CRD style mine, and Kwanika as a combination open-pit/underground mine most of whose output would be underground mined. Stardust, which started off with the Canyon Creek resource of 2,970,000 tonnes at 1.27% copper, 1.68 g/t gold and 32.6 g/t silver, spurred excitement in 2018 with the late season discovery of the ...(see Profile for full Overview) |

| Last Corporate Change - Mar 5, 2021: 2:1 Name Change from Serengeti Resources Inc (SIR-V) |

| Last KRO Comment - Sep 2, 2022: KW Excerpt: Kaiser Watch September 2, 2022: Northwest Copper Corp (NWST-V) |

| Recent News - Apr 1, 2024: Grant Sawiak Has Submitted His Resignation Together With Reasons |

|

| |

Project |

Interest |

|

Country |

Region |

Stage |

IPV

($mm) |

Target |

Deposit

Model |

|

Kwanika |

100% WI |

|

Canada |

Central BC |

5-PEA |

$29 |

Gold Copper Silver Molybdenum |

Porphyry  |

|

East Niv |

100% WI |

|

Canada |

Northern BC |

2-Target Drilling |

$29 |

Copper Gold Silver |

Porphyry  |

|

Stardust |

100% WI |

|

Canada |

Northern BC |

4-Infill & Metallurgy |

$29 |

Gold Copper Silver Zinc |

Carbonate Replacement  |

|

Lorraine-Top Cat |

100% WI |

|

Canada |

|

4-Infill & Metallurgy |

$29 |

Copper Gold Silver |

Porphyry  |

|

Jewel |

100% WI |

|

Canada |

Central BC |

2-Target Drilling |

$29 |

Copper Gold |

Skarn  |

|

Arjay |

100% WI |

|

Canada |

Northern BC |

2-Target Drilling |

$29 |

Copper |

Porphyry  |

|

East Copper King |

100% WI |

|

Canada |

Northern BC |

1-Grassroots |

$29 |

Copper |

Porphyry  |

|

ET West |

100% WI |

|

Canada |

Northern BC |

1-Grassroots |

$29 |

Copper |

Porphyry  |

|

Far East - LaForce |

100% WI |

|

Canada |

Northern BC |

1-Grassroots |

$29 |

Copper Silver |

|

|

Notch |

100% WI |

|

Canada |

Northern BC |

1-Grassroots |

$29 |

Copper |

|

|

TrUM |

100% WI |

|

Canada |

Northern BC |

1-Grassroots |

$29 |

Nickel Cobalt |

Ultramafic Complex  |

|

West Goldway |

100% WI |

|

Canada |

Northern BC |

2-Target Drilling |

$29 |

Copper |

Porphyry  |

|

UDS |

100% WI |

|

Canada |

British Columbia |

2-Target Drilling |

$29 |

Gold Copper |

Porphyry  |

|

Croy Bloom |

100% WI |

|

Canada |

Quesnal Trough |

2-Target Drilling |

$29 |

Copper Gold Cobalt |

Porphyry  |

|

Milligan West |

56.3% WI |

|

Canada |

Quesnal Trough |

2-Target Drilling |

$51 |

Copper Gold |

Porphyry  |

|

OK |

100% WI |

|

Canada |

Southwest BC |

4-Infill & Metallurgy |

$29 |

Copper Molybdenum |

Porphyry |

![]() |

|

| Price: | $0.150 | Open Rec: | See Strategy |  |

| Market Cap: | $16,030,787 | WC % of Mkt Cap: | -2% |

| Working Cap: | ($395,207) | As of: | 9/30/2023 |

| Issued: | 106,871,913 | Insider %: | 37.5% | | Diluted: | 150,451,971 | Story Type: | Resource: Feasibility Demonstration |

| Key People: | Joseph J. Ovsenek (CEO), Grant Bond (CFO), Tom S.Q. Yip (CFO), Kenneth C. McNaughton (VP EX), |

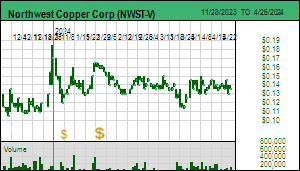

SV Rating: Bottom-Fish Spec Value - as of December 22, 2023: P2 Gold Inc was made a Bottom-Fish Spec Value rated 2021 Favorite at $0.40 on December 31, 2020 based on its new role as the post-Pretium exploration vehicle for Joe Ovsenek and Ken MacNaughton, the former CEO and Exploration VP for Pretium and its high grade Brucejack gold project in the Golden Triangle. On February 23, 2021 P2 Gold expanded the focus with the acquisition of an all-season advanced project in Nevada's Walker Lane called Gabbs which hosts several copper-gold porphry style deposits. This is an expensive acquisition whose closing is contingent on P2 Gold completing a $16 million private placement consisting of 32 million shares at $0.50. Gabbs will become the new flagship project for P2 Gold which in the worst case will function as a copper-gold optionality story with the existing resource, but will initially be the focus of a major system rethink by the Ovsenek/MacNaughton team which will assess the deeper potential of what they believe is a gold dominated alkaline porphyry system different from the copper porphyries at Yerington. The Golden Triangle projects optioned during the summer of 2020 have heavy vesting obligations that kick in after the second year, so these will be subjected to make or break exploration programs over the next year. P2 Gold remains Bottom-Fish Spec Value rated while we wait for the $16 million financing to close, of which USD $5 million will go to close the Gabbs acquisition, and the rest will fund 2021 exploration programs. Along with several associates Joe Ovsenek and Ken MacNaughton purchased founder stakes through a 10 million share private placement at $0.10 (no warrants) in April 2020 following a 6:1 rollback of Central Timmins Exploration Corp, a mediocre junior which went public by IPO through PI Financial on Oct 16, 201...(see Profile for full Overview) SV Rating: Bottom-Fish Spec Value - as of December 22, 2023: P2 Gold Inc was made a Bottom-Fish Spec Value rated 2021 Favorite at $0.40 on December 31, 2020 based on its new role as the post-Pretium exploration vehicle for Joe Ovsenek and Ken MacNaughton, the former CEO and Exploration VP for Pretium and its high grade Brucejack gold project in the Golden Triangle. On February 23, 2021 P2 Gold expanded the focus with the acquisition of an all-season advanced project in Nevada's Walker Lane called Gabbs which hosts several copper-gold porphry style deposits. This is an expensive acquisition whose closing is contingent on P2 Gold completing a $16 million private placement consisting of 32 million shares at $0.50. Gabbs will become the new flagship project for P2 Gold which in the worst case will function as a copper-gold optionality story with the existing resource, but will initially be the focus of a major system rethink by the Ovsenek/MacNaughton team which will assess the deeper potential of what they believe is a gold dominated alkaline porphyry system different from the copper porphyries at Yerington. The Golden Triangle projects optioned during the summer of 2020 have heavy vesting obligations that kick in after the second year, so these will be subjected to make or break exploration programs over the next year. P2 Gold remains Bottom-Fish Spec Value rated while we wait for the $16 million financing to close, of which USD $5 million will go to close the Gabbs acquisition, and the rest will fund 2021 exploration programs. Along with several associates Joe Ovsenek and Ken MacNaughton purchased founder stakes through a 10 million share private placement at $0.10 (no warrants) in April 2020 following a 6:1 rollback of Central Timmins Exploration Corp, a mediocre junior which went public by IPO through PI Financial on Oct 16, 201...(see Profile for full Overview) |

| Last Corporate Change - Aug 31, 2020: 1:1 Name Change from Central Timmins Expl Corp (CTEC-V) |

| Last KRO Comment - Oct 21, 2022: KW Excerpt: Kaiser Watch October 21, 2022: P2 Gold Inc (PGLD-V) |

| Recent News - Mar 28, 2024: Option Grants |

|

| |

Project |

Interest |

|

Country |

Region |

Stage |

IPV

($mm) |

Target |

Deposit

Model |

|

Gabbs |

100% WI |

|

United States |

Nye County |

4-Infill & Metallurgy |

$23 |

Gold Copper |

Porphyry  |

|

BAM |

100% WI |

|

Canada |

Golden Triangle |

4-Infill & Metallurgy |

$23 |

Gold Silver Copper |

Intermediate Sulphidation Epithermal  |

|

Todd Creek |

70% WI |

|

Canada |

Golden Triangle |

2-Target Drilling |

$32 |

Copper Gold |

Porphyry  |

|

Natlan |

100% WI |

|

Canada |

Northern BC |

1-Grassroots |

$23 |

Silver Lead Zinc Gold |

Carbonate Replacement  |

|

Silver Reef |

100% WI |

|

Canada |

Northern BC |

2-Target Drilling |

$23 |

Silver Lead Zinc Gold |

Carbonate Replacement  |

|

Lost Cabin |

100% WI |

|

United States |

Oregon |

2-Target Drilling |

$23 |

Gold |

Epithermal  |

![]() |

|