| |

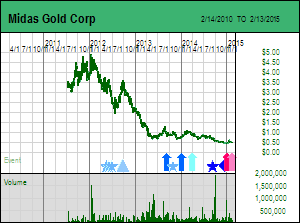

Midas Gold Corp offers better optionality on higher gold prices because its $1 billion CAPEX for a 12 year mine producing 300,000 plus ounces gold annually is manageable for a bigger group of gold producers. Furthermore, I think the stock price is suffering from a perception that the Stibnite Mine in Idaho will never be permitted. After publishing a PFS in December 2014 Midas Gold is now entering the dreaded trough of permitting and feasibility study, a process expected to take at least three years. While Idaho's beauty makes any mine development plan in that state a target for NGOs, the Stibnite deposit is not located in a pristine wilderness. It is located in an environmental disaster zone created to supply the American military with tungsten and antimony during World War II. The subsequent gold mining conducted until the end of the fifties long before modern environmental standards were created only made it worse. As CEO Stephen Quin aptly puts it, Stibnite is a reclamation project with a gold-antimony mine attached to it as the funding engine. Midas Gold Corp offers better optionality on higher gold prices because its $1 billion CAPEX for a 12 year mine producing 300,000 plus ounces gold annually is manageable for a bigger group of gold producers. Furthermore, I think the stock price is suffering from a perception that the Stibnite Mine in Idaho will never be permitted. After publishing a PFS in December 2014 Midas Gold is now entering the dreaded trough of permitting and feasibility study, a process expected to take at least three years. While Idaho's beauty makes any mine development plan in that state a target for NGOs, the Stibnite deposit is not located in a pristine wilderness. It is located in an environmental disaster zone created to supply the American military with tungsten and antimony during World War II. The subsequent gold mining conducted until the end of the fifties long before modern environmental standards were created only made it worse. As CEO Stephen Quin aptly puts it, Stibnite is a reclamation project with a gold-antimony mine attached to it as the funding engine.

While the PEA published in 2012 was focused on demonstrating the economic merit of developing Stibnite (formerly called Golden Meadows), the PFS is much more reclamation conscious and includes revisions that fast-track restoration of fish migration to an upstream valley that has been stranded for more than 70 years. There will always be NGOs determined to block any mine, but Stibnite offers NGOs the opportunity to participate constructively in a mine development that is a win-win for all stakeholders. But there is also a security of supply spin to this story. The United States does not have any domestic production of antimony, whose main use is as a fire retardant but for which there are some potential innovation driven uses on the horizon. China supplies 85% of the world's antimony, with much of the rest coming from Russia, Tajikistan, Bolivia and South Africa. Long term reliance on these geographical sources is not prudent, especially if the trend of reshoring manufacturing from China to the United States continues and China's central command regression leads to open hostility with the United States. The PFS indicates Stibnite will produce 100 million lbs of antimony. That is worth only $400 million at the current antimony price, but if a supply crunch happens, it would be of great strategic benefit to the United States to have Stibnite in operation.

One boost for Midas shareholders over the next year could thus come from a switch in the market's glass half-empty perception of the permitting risk. In IRR terms the Stibnite project can be developed at $1,200 gold, but in terms of the relationship between CAPEX and NPV it needs gold above $1,400. However, that is based on the 43-101 numbers in the PFS, which for reporting reasons was forced to exclude about 900,000 oz gold and half the antimony output projected by the PEA. There is a strong probability that infill drilling will bring those excluded resources back into the mining plan, and because they would be mined during the early part of the mine life, their inclusion would have a notable impact on NPV. This is not obvious to the casual observer but it will be part of the internal calculations done by potential suitors.

|