| |

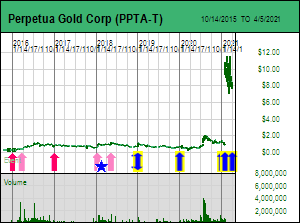

Tracker - April 6, 2021: Spec Value Rating for Perpetua Gold Corp (PPTA-T)

Perpetua Gold Corp, the new name for Midas Gold Corp effective Feb 18, 2021 following a 10:1 rollback on Jan 29, 2021 to allow a NASDAQ listing where it now trades with the symbol PPTA, has been a KRO Fair or Good Spec Value rated recommendation since September 6, 2013 based on its 100% owned gold-antimony Stibnite project in Idaho. On December 31, 2020 Perpetua was continued as a 2021 Favorite at $1.22 ($12.22 after adjusting for the 10:1 rollback) following the filing of a Draft Environmental Impact Statement by the USFS on Aug 14, 2020 and the company's delivery of a positive feasibility study on December 22, 2020. We are now waiting for the USFS to release a Final EIS in Q2 of 2021 followed by a draft Record of Decision in Q3 and a Final Record of Decision in Q4 which becomes the basis for ROD dependent permits and a construction decision in 2022 with production beginning in 2026 if CapEx of $1.3 billion can be raised. Perpetua Gold Corp, the new name for Midas Gold Corp effective Feb 18, 2021 following a 10:1 rollback on Jan 29, 2021 to allow a NASDAQ listing where it now trades with the symbol PPTA, has been a KRO Fair or Good Spec Value rated recommendation since September 6, 2013 based on its 100% owned gold-antimony Stibnite project in Idaho. On December 31, 2020 Perpetua was continued as a 2021 Favorite at $1.22 ($12.22 after adjusting for the 10:1 rollback) following the filing of a Draft Environmental Impact Statement by the USFS on Aug 14, 2020 and the company's delivery of a positive feasibility study on December 22, 2020. We are now waiting for the USFS to release a Final EIS in Q2 of 2021 followed by a draft Record of Decision in Q3 and a Final Record of Decision in Q4 which becomes the basis for ROD dependent permits and a construction decision in 2022 with production beginning in 2026 if CapEx of $1.3 billion can be raised.

On April 5, 2021 Perpetua Gold Corp was confirmed as a Good Spec Value rated Favorite at $7.97 in Tracker Apr 5, 2021 which includes NPV and NPV/share based graphics for the Stibnite project using a close approximation of the parameters in the feasibility study's technical report and showing sensitivity to a gold price as high as $2,500. The feasibility study envisions a 15 year 20,000 tpd open-pit operation that mines three deposits whose refractory ore will be processed through a milling and pressure-oxidation complex that would yield 4,284,000 oz gold and 118 million lbs of antimony with a minor silver by-product. CapEx and Sustaining Capital were USD $1.292 billion and $295 million with OpEx at $26.45 per tonne. At base case prices of $1,600/oz gold, $20/oz silver and $3.50/lb antimony the after tax NPV was $1.347 billion at a 5% discount rate and IRR was 22.3%. At 54.9 million fully diluted that translates into a price target of USD $24.54 or CAD $30.91 at an exchange rate of 1.26 CAD:USD (earning: on April 1 Perpetua filed a short form base shelf prospectus to raise up to USD $100 million through a variety of instrument so fully diluted will rise if any financings are done - as of Dec 31, 2020 Perpetua had USD $22 million working capital).

On these assumptions we should expect the stock to be in the CAD $20-$30 range by the end of 2021 if a Record of Decision is achieved. The current market pricing is signaling a thumbs down on that outcome, so in effect Perpetua is a bet on a permitting outcome. But it is a potentially lucrative bet that science rather than politics will dictate the outcome. I have constructed a cash flow model based on the ore schedule in the FS technical report which at the base case prices yields an after-tax NPV of USD $1.13 billion which is 16% lower than Perpetua's nameplate outcome mainly because I cannot emulate the complex depreciation-depletion treatment utilized in the FS. However, the DCF model is close enough that I can justify running it at spot prices as well as at much higher gold prices than allowed by 43-101 sensitivity range rules.

The result at $1,728/oz gold, $25/oz silver and $5/lb antimony spot prices as of April 5, 2021 is USD $1.491 billion NPV at 5% with 31.1% IRR and $988 million at 10%. This translates into a mine approval contingent target of USD $27 at 5% and $18 at 10% which is CAD $34 and $23 at prevailing exchange rates. At $2,500 gold the after tax NPV jumps to USD $3.2 billion at 5% and $2.3 billion at 10%, or roughly USD $54 and $42 compared to the NASDAQ price of $6.46, or CAD $68 and $53 compared to the TSX price of $7.97. So if gold stays where it is and Stibnite secures mine approval, we can expect an approximate gain range of 200% to 300% reflecting the difference between 10% and 5% discount rates.

On the other hand, if gold makes a 45% move to $2,500 which is a real price move reflecting global uncertainty that does not change the cost structure outlined in the FS, the equivalent gain range is 550% to 736%, more than double the price move in gold. Perpetua thus offers a double to triple if mine approval is achieved, and a five to seven fold gain if at the same time gold goes to $2,500. Perpetua is the best single advanced project leveraged gold bet among the juniors, but this has been made possible by the management discount created by the company's largest shareholder.

John Paulson launched Midas Gold (Perpetua) into its permitting trajectory when he agreed in 2016 to fund most of a $55 million financing in the form of a zero coupon $55 million note convertible at about $0.35 ($3.50 post rollback). Getting mine approval will have cost USD $70 million on top of $125 million on feasibility demonstration. Shortly after the DEIS was filed in August 2020 John Paulson converted his note into a 20,935,732 share equity stake representing 44% of Perpetua's 47.6 million issued (54.9 million fully diluted). After the extended DEIS comment period ended in late October 2020 Paulson initiated a purge of the Midas management team, which he achieved on Dec 4, 2020 when Stephen Quin was replaced as CEO by Laurel Sayer whose job had been goodwill marketing while Quin's team did the engineering and technical work to support the DEIS and feasibility study. The independent board was replaced by Paulson's people who are either local politically connected people or connected to Paulson's other gold investments. Their skin in the game amounts to 10,500 shares plus lots of zero-risk stock options.

John Paulson's political support for Donald Trump has become a liability, which Perpetua is trying to overcome by pitching the reclamation strategy underpinning the FS and the fact that antimony by-product supply from Stibnite would not only make the United States self-sufficient in terms of antimony rather than reliant on China and other unfriendly nations, but would even be able to help out other democracies which have aligned against autocracy. Furthermore, not included in the mining plan is a high grade antimony zone outside the pit shell which can be quickly accessed by adit via the pit by-pass tunnel that restores waterway access to the upstream watershed and which hosts at least as much by-product antimony as Stibnite would produce during its 15 year life. Antimony isn't overly important to emerging technologies, but if a molten salt technology being investigated as a storage system for renewable energy became viable, the Stibnite Mine would be the place to call.

In a sense Perpetua Gold Corp is a short term bet that the politics of its major shareholder will not get in the way of mine approval, and, if that bet fails, a longer term bet that Trump or a clone regains the presidency in 2024. The alternative is a buyout by a major gold producer among whom Barrick Gold which already owns 11.3% is a primary contender because it may have at its disposal an alternative scenario where concentrate gets trucked to Nevada for roasting at one of its facilities with spare capacity. However, since the formation of the Nevada Gold JV with Newmont in 2019 whose purpose was to rationalize the infrastructure of their respective operations this opportunity may no longer be available. So Perpetua should be looked at as a future standalone mine open to all bidders which currently offers Good Speculative Value because of market skepticism about mine approval and the competence of the management team installed by John Paulson, a vocal Trump supporter, after forcing out in late 2020 Stephen Quin's team which had led Stibnite through the permitting cycle and delivered a feasibility study.

|