Kaiser Blog: Is McFauld's Lake Shaping up as a Great Canadian Area Play?

Kaiser Blog: Is McFauld's Lake Shaping up as a Great Canadian Area Play?

October 19, 2007

The TSXV set a new volume trading record on October 17, 2007 at 411,550,319 shares thanks to a dozen juniors which have land in the McFauld's Lake region of the James Bay Lowlands in northern Ontario. Although the resource sector in general has rebounded smartly from the fallout it suffered during August when the subprime problem created a liquidity freeze, I continue to believe we are trapped in a "Slow Motion Train Wreck" as described in Express 2007-04. It will be another 6-12 months before we can shed anxiety that a recession in the United States will drag down the global economy and with it metal prices. While I believe any such downturn will be temporary, and not severe enough to create a base metals price bust, this period of heightened anxiety will encourage greater market interest in exploration plays that generate new discoveries. The exploration bear that has cowered in the shadows of the "race to production" commodity bull will find itself in a bullish spotlight while the commodity bull sulks in the barn. Great Canadian Area Plays flourish when bearish moods prevail.

Driving the market action is an old junior called Noront Resources Ltd (NOT-V: $5.78) which has made an unusually high grade nickel-copper-PGM discovery. The first assays reported on September 13, 2007 yielded decent grades which at current metal prices represented a rock value in excess of $700 per tonne. The fifth hole yielded 68.2 metres with a spectacular rock value in excess of $2,300 per tonne. No assays have been published for the additional holes, which now total 12. At this stage the geometry of this irregular, southerly plunging pipe-like peridotite body is poorly understood, as is the grade distribution. Until recently Noront has provided weak descriptions of the hole locations and angles which has created considerable confusion, particularly in light of a number of holes which surprised management when they missed the peridotite hosted mineralization. The diagram below which has been circulating on the internet and which was apparently created by a university professor offers a good guess at the geometry of this discovery as it currently stands.

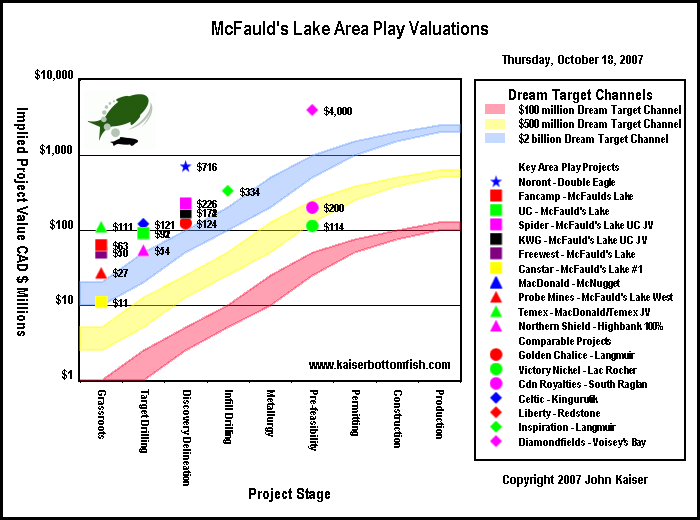

At the moment a debate is raging as to whether the results so far indicate a discovery of 1-2 million tonnes with a rock value of about $1,000 per tonne, or if it perhaps represents 2-5 million tonnes. Until we get additional assays and more drill holes that properly define this deposit it is anybody's guess as to how much tonnage at what grade it represents. In any case, Noront has made a discovery that would be the envy of any small junior and which has propelled the stock to a market capitalization of $716 million.

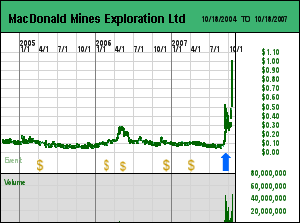

On September 14, 2007 I published a KBFO Theme Report on the McFauld's Lake Area Play in which I described what appeared to be a major new discovery with implications for a Great Canadian Area Play. KBFO Theme Reports are a new product which contains information about companies and projects related to a common theme, in this case, owning land in the McFauld's Lake region. A KBFO Theme Report is always restricted to KBFO members. However, on September 18, 2007 I published Express 2007-06: Can McFaulds Lake flourish in the Eye of the Hurricane? in which I explained why it is premature to make comparisons to Voisey's Bay, and recommended McDonald Mines Exploration Ltd (BMK-V: $0.83) as a Good Relative Spec Value Buy at $0.38 based on its strategic land position, and Probe Mines Ltd (PRB-V: $0.86) as a Good Relative Spec Value Buy at $0.90 based on the closeology of its McFauld's Lake West claims. (Express 2007-06 is now available for unrestricted viewing.) The general basis for my recommendation was my rational speculation model and the speculative assumption that Noront's discovery would scale to world class status.

|

|

Noront has not yet done this, but following a very aggressive article in the Financial Post on Saturday October 13, 2007 in which reporter Peter Koven provided a platform for Noront management's opinion that it has a discovery in the making comparable to Voisey's Bay, Noront's stock along with that of the key satellites has achieved new price levels. Rumors are now flying that majors such as Xstrata have come knocking on Noront's door, and influential market players such as Eric Sprott and Sheldon Inwentash of Pinetree Capital have placed heavy bets on Noront and are now exploring the area play possibilities. In fact, on October 16 Pinetree disclosed that open market purchases of McDonald had boosted its stake to 10.5 million shares or about 11%.

The similarity of the McFauld's Lake discovery play with past area plays such as Lac de Gras, Voisey's Bay and the ill-fated Lac Rocher play of 1999 has prompted me to dig up my past material on the Great Canadian Area Play. If you share my view that McFauld's Lake is shaping up to be a Great Canadian Area Play, and want a good refresher on what makes such area plays tick, I recommend you read From the Archives: Bear Markets and the Great Canadian Area Play from January-February 1995 and Express 99-02: Lac Rocher - Another Great Canadian Area Play?.

The Eagle One zone on Noront's 100% owned Double Eagle claims certainly fulfills the criteria of a surprise. The discovery hole was drilled on an EM conductor to fulfill assessment requirements on a small claim Noront acquired for a pittance this year from a private company that had originally staked it to cover a potential kimberlite target. The play had been generated in 2003 after De Beers failed to find kimberlite on ground optioned from Spider Resources Inc (SPQ-V: $0.17) ), but did find VMS style polymetallic mineralization. De Beers walked away, but Spider began to explore for high grade copper-zinc-lead-gold-silver VMS style deposits within the felsic volcanics of the greenstone belt at McFauld's Lake. Spider's initial success, which never grew into an orebody, attracted a handful of other juniors that also tried their hand at finding VMS deposits without notable success. When Noront drilled the EM conductor at Eagle One management was rather surprised to encounter magmatic nickel-copper sulphide mineralization within a mafic host rock.

The serendipity of the discovery leaves open the possibility that there can be any number of similar mineralized zones within the McFauld's Lake region. In fact, much of the ground that was thought to have been sterilized for orebody potential has in fact been sterilized only in terms of EM conductors coinciding with magnetic lows interpreted to represent the Archean aged felsic volcanics associated with VMS deposits. The EM conductors associated with magnetic highs were ignored as probable graphite within unprospective mafic rocks. All those juniors with "tired" land positions in McFauld's Lake are now scrambling to reinterpret those low priority conductors coinciding with magnetic highs. In effect, all the past drilling was conducted on targets within a geological setting that was unlikely to yield a magmatic nickel-copper sulphide deposit of the sort Noront has found. With a new geological model being applied the entire region is back in play. Furthermore, there are suspicions that the Eagle One peridotite is of a Proterozoic age, which means that these prospective units may have intruded the Archean country rock just about anywhere, a key reason why post-discovery staking has gone well beyond the original staking strategy that tracked the banana shaped belt of greenstones. The map below shows some of the staking Noront has done adjacent to its existing Double Eagle claims, and some of the staking McDonald and Temex have done.

A big concern with every new discovery is that the junior who makes the discovery has plenty of time to recognize the significance of results and will stake or acquire all the ground it perceives as geologically relevant to its new discovery. However, the probability that Noront "got it all" is very low because very nearby ground was already held by Probe, Fancamp and Freewest from the VMS exploration play, the location is remote and Noront was not in a position to mobilize staking crews on a large scale, and MacDonald Mines, whose management immediately recognized the significance of the "visuals" reported in late August, already had a fully fledged program underway on its property and was in a position to mobilize staking crews.

As a result a fair number of juniors have strategic land positions either because they were already present by virtue of the earlier VMS play, or because they have been quick to stake claims. As the above modified GSC map indicates, this region is devoid of any known nickel deposits, which is largely because of the remote location and the lack of outcrop in the swampy James Bay Lowlands. Logistics has hampered the staking rush, which in Ontario still has to be done through traditional post staking whereas just about everywhere else online map staking is the norm. The Eagle One discovery does not yet have world class scale, but if speculations prove true that the discovery zone is similar to the original Reid Brook feeder dyke at Voisey's Bay that was eventually linked to the Ovoid Zone which at today's metal prices has an in situ value in excess of $30 billion, Great Canadian Area Play staking will encompass a vast part of northern Ontario.

To provide a sense of geographical scale I have superimposed the McFauld's Lake map on the Slave Craton area play map of 1996 four years after the diamond staking rush began. I have also superimposed the Voisey's Bay claim block that Diamondfields controlled when it made its nickel-copper discovery in 1994. At the peak of the Voisey's Bay area play in 1996 about 140 juniors had checkerboarded a 300 km by 200 km region in Labrador surrounding the Voisey's Bay discovery.

The juniors all represent potential "rags to riches" stories, companies who have been through a number of speculation cycles and who have widely held bloated capitalizations. The people base is in place to provide massive networking of the McFauld's Lake story. In addition, the various management groups already plugged into McFauld's Lake know each other well and have been sharing information about the discovery. There seem to be very few secrets, with the result that the rumor mill can be an effective driver of market sentiments.

Those of you who are in Toronto this weekend may want to catch the Cambridge Conference on October 21-22. You can find registration, exhibitor and agenda details at the following link: Cambridge Toronto 2007 Show. At 11:00 AM Monday I will be in Speaker Workshop 1 giving a presentation with the title: "Is McFauld's Lake shaping up into a Great Canadian Area Play?". In this workshop I will be covering what I know so far about Noront's discovery, what it takes to become a Great Canadian Area Play, and how to use the rational speculation model to profit from an area play. At 2:00 PM Monday I will give a keynote speech with the theme "The Race to Production and the Revival of Exploration Plays".

If you are attending the conference, I suggest you go to Exhibitor Research and print out a listing of all the exhibitors and their projects to help you focus your research activity at this conference.

*JK does not own any of the securities mentioned herein