| Kaiser Watch May 19, 2023: When losers are winners everybody losers |

| Jim (0:00:00): How is the debt ceiling affecting resource juniors and what might we expect if a default happens? |

The resource juniors, which had a strong start during the first couple months of 2023, already faltered in March as it became apparent that China's post zero-covid rebound was not happening as vigorously as predicted, in contrast to the rebound in the United States during 2021 when the vaccine rollout began. The Chinese government target is 5% GDP growth while the IMF in its April 2023 World Economic Outlook optimistically projects 7.0% growth for China. The Federal Reserve's effort to subdue persistent inflation through interest rate hikes, even at the risk of destabilizing regional banks and triggering bank runs as depositors seek the safety of "too big to fail banks" or short term money market funds offering 4% plus yields that haven't been seen since the 2008 financial crisis, has had a dampening effect on metal prices as if a hard economic landing was inevitable in 2023. In some cases like lithium carbonate the steep decline was a consequence of the unsustainable level in 2022 courtesy of a severe supply-demand imbalance. But commodity prices, both metals and energy, have seen the gains of Q4 2022 reversed. General equity markets which on average lost 20% in 2022 when the interest rate hikes began mid year, have held their 2023 gains remarkably well, ignoring the debt ceiling crisis even as the projected June 1 date looms when the United States can no longer print new money to pay its bills. Even the US economy has ignored the approaching debt limit, continuing to add lots of jobs each month despite widespread layoffs in the technology sector. The resource juniors, however, have witnessed a distinct loss of market appetite during the past two months, despite gold spending a couple weeks above $2,000, poised to benefit on the upside if a default is actually allowed to happen.

The debt ceiling was created in 1939 as a compromise to give the United States greater flexibility in issuing new debt to pay for the war effort. It represents an arbitrary limit which Congress must increase when the national debt approaches this limit. Historically this has been a rubber stamp event with both parties agreeing to periodic increases because the growing debt represents obligations already created by legislation passed by Congress. In 2011 after the Republicans gained control of the House in the 2010 mid-terms this ritual debt ceiling was politicized when the Republican Party threatened to withhold approval of a debt ceiling increase. Failure to increase the debt ceiling would trigger a default which is predicted to have catastrophic consequences. Ostensibly the Republican Party was concerned about America's rising debt, and wanted the Obama administration to curtail spending plans. The timing was in the years following the 2008 financial crisis which unfolded under the watch of a two-term Republican administration.

Obama wanted to rebuild the American economy through fiscal stimulus aimed at infrastructure renewal with a climate change twist which today is called the "energy transition". Since the losers of the 2008 election really had nothing to lose since the president gets blamed for anything bad that happens on his or her watch, Obama decided not to call their bluff and capitulated to an agreement that limited fiscal stimulus. The task to rebuilding the American economy defaulted to the Federal Reserve which engaged in "quantitative easing" to restore liquidity to America's paper assets. Demand growth for raw materials ended up depending on China which embarked on an infrastructure building binge which ran out of steam in 2017. The result was an extraordinary bull market for bonds and equities which the resource sector sat out.

The Republicans lost the 2020 election and the Democrats managed to get razor thin majorities in the House and Senate which enabled Biden to pass the Chips and IRA bill which are focused on reshoring or friend-shoring manufacturing in the case of the Chips bill and promoting the energy transition in the case of the poorly named Inflation Reduction Act. I say "poorly named" because shifting from cheap fossil fuel sourced energy to renewables and rewiring the electricity transmission grid was never going to reduce inflation during the transition. If the measures encouraged by IRA work they significantly reduce the inflation risk that unmitigated global warming will cause down the road. But in 2022 the inflation that started to show up in 2021 during the American post-Covid rebound, which was partly caused by supply-chain bottlenecks in China where Xi Jinping had turned a zero-covid policy into a symbol of the superiority of Communist style autocracy over democracy, not only proved persistent but accelerated. Most people have a hard time imagining the value of current pain justified by the future pain that will never happen thanks to the current pain. But everybody who looks at a grocery store shelf and sees an $8 box of sugary cereal or $5 bag of potato chips that used to cost $2-$3 will know exactly what that means to them. They will probably not see the inflation caused by energy transition policies but they cannot help thinking that something called the "Inflation Reduction Act" is clearly not working for them.

The Republicans should have gained control of both the House and Senate during the 2022 mid-terms just on the back of voter unhappiness over visible inflation but because the Supreme Court tossed precedent out the window to reverse Roe and allow Republican controlled states to ban abortion, plus the party nominated Trump poodles as candidates, they failed to regain the Senate and just barely won control of the House. With the debt ceiling approaching in 2023 the Republican Party decided it was time to worry about the national debt. That worry is an absolute lie because no Republican president has ever failed to increase the national debt by a greater amount than any predecessor's term, regardless the party. The bill the House passed strives to undo the Inflation Reduction Act, in effect put the brakes on energy transition policies. This is tantamount to the loser declaring itself the winner and using a suicide vest to bully the winner into granting the loser policy making rights.

The House Bill has zero chance of being passed by the Democrat controlled Senate but serves as a starting point for negotiating the surrender of the Biden administration to the losers of the 2020 election. Whatever concession Biden makes will only hurt his party's election chances in 2024. The federal revenues for 2023 are projected by the Office of Management & Budget to be $4.8 trillion while outlays are estimated at $6.5 trillion, meaning about $1.7 trillion must be issued as new debt to cover the deficit. The debt at the end of 2022 was $30.9 trillion and is projected to be $32.7 trillion by the end of 2023. The current statutory debt ceiling is $31.4 trillion. The 2024 federal outlays are projected at $6.9 trillion while revenues are projected at $5.0 trillion, implying another $1.9 trillion deficit. The OMB projects the national debt to stand at $34.8 trillion by the end of 2024. The current Republican strategy is to approve a debt ceiling increase that does not shift the need to raise the ceiling again into 2025 after the 2024 election outcome is known. A half dozen Republican House members could decide to join the Democrats in approving a debt ceiling increase, but that would be political suicide for them, so not likely to happen. At the same time if the Democrats make concessions that allow the debt ceiling extortion to be launched again during an election year, that would be political suicide for the entire party.

The problem the Republican Party faces if it does boost the debt ceiling so that it potentially becomes its problem in 2025, assuming the Democrats retain control of the House or Senate, is that they will have to explain to voters where it will cut spending if put in charge of America's destiny. During Trump's term they cut revenues with the bogus claim that a trickle down effect will generate overall more tax revenues. Covid came along in 2020 as a major cause of new government spending, leaving Donald Trump with a record $5.1 trillion national debt expansion for his term. Biden is on track for scoring a new record with a $9.8 trillion expansion during his term.

The elephant in the room is the money spent on American retirees. Social Security and Medicare represent 33.4% of federal spending or $2.2 trillion compared to the $1.7 trillion that workers cough up through social security and Medicare deductions from their pay checks. By 2030 the entire Boomer generation will be 65 or older. The categories of "health" and "income security" which presumably is spent on non-retirees and will include welfare, food stamps and Medicaid is 25.8% of federal spending in 2023 or $1.7 trillion. The Republicans would like less money to be spent on people under the age of 65. But when you look at the chart showing the growth of the different spending categories it is Social Security and Medicare that are the national debt growth engine. The other key categories ate national defense which represents 12.5% or $815 billion, and interest on the national debt, which is 10.1% or $661 billion in 2023. Spending in these categories will rise if a default is allowed to happen because it will allow China and its autocratic allies to become more aggressive on the global stage.

Currently the United States enjoys an unusual advantage because the US dollar is the world's reserve currency. This allows the United States to use sanctions to squeeze nations it feels are misbehaving, such as Iran, North Korea and Russia. China would like its renminbi to become a reserve currency but nations are reluctant to embrace it because of China's capital controls. Since coming to power China's Xi Jinping has reversed China's drift into a more open society and returned China to a full blown autocracy exploiting hyper-surveillance technology that would turn Hitler's Nazis green with envy. Vladimir Putin has done the same with Russia. The difference between the two is that China claims to be a communist society striving for prosperity for all whereas Russia is focused on enriching an oligarchic elite while peddling nationalist fantasies to the rest of Russia. China is the second largest economy today and the gap between it and the United States is shrinking. When Russia invaded Ukraine in February 2022 as an explicit assault on democracy, China chose to declare its allegiance with Russia. The expectation was that Ukraine would be a pushover for Russia, the United States and Europe would huff and puff for a while, but then shrug their shoulders and get on with life. This would set the stage for China annexing Taiwan, a democracy in its backyard which is economically unimportant to China but stands as a refutation of China's autocratic political structure.

Russia and China were blind-sided by two developments. First, the Ukrainian president Volodomyr Zelensky, whose prior career was that of a comedian, proved to be anything but a pushover clown. Secondly, the United States and Europe rallied to support Ukraine against Putin's invasion. More than a year later the siege of Ukraine continues with no clear end in sight, which is a problem for the United States, a segment of whose voting population favors autocracies which promote religion, homophobia, and a subordinate role for women. Allocating part of America's defense budget to support Ukraine as a way of supporting democracy and freedom does not sit well with Putin Poodles.

The world has divided into three groups over the Russian invasion. The full-blown autocracies all support Russia for self-preservation reasons. Democracies such as the countries of Europe, Australia, United States, Canada, parts of South America and southern Africa have supported Ukraine and the sanction regime imposed on Russia. But another third which includes India have declined to support the sanction regime. The Biden administration has packaged the geopolitical conflict as a showdown between democracy and autocracy, but there is an excluded middle that is thinking hard about its economic goals, is watching America as a terrible example of a democracy where the losers claim they are the winners and are able and willing to push the United States into a default that likely has immediate negative repercussions for all nations. Such abdication of responsibility becomes a Humpty Dumpty event where it will be difficult to restore the credibility of the United States.

I've created a number of graphics to illustrate the geopolitical problem looming for the United States if there is an outright revolt against the United States where countries like India, Brazil and South Africa align themselves with China, which in turn is exploiting Russia's weakened hand to pull central Asia, former involuntary members of the Soviet Union, into its fold, and will likely out-compete Russia's Wagner mercenary group in Africa. I have created several heat map graphics to show the balance between the China-America great power conflict now underway. One is a population heat map which shows the concentration of people in Asia, primarily India and China. Others include heat maps of GDP and defense spending, which shows the geographical balance between China and the United States. There is also an official gold reserve heat map, but I believe it understates China's true gold holdings which need not be inside its central bank. I've created a graphic to show that if Chinese state owned entities have been buying gold, the actual holdings at Xi Jinping's disposal nearly match of those of the United States.

I've also created two heat map versions of political and civil freedom data compiled by Freedom House. Freedom House has a political rights and civil liberties scoring system that generates two scores which are added to create a "total freedom" score where 100 is the top freedom score. That graphic shows darker colors in areas with more freedom. Freedom House also has a matrix which allows it to combine the separate scores for civil and political liberty into three groups of "free", partly free", and "not free" to which I have assigned numbers 1, 2 and 3 so that the heat map color is darkest where least free. I've also provided the graphic which shows what percentage of each metal comes from China and Russia combined to illustrate what I see as a major looming problem if this widening geopolitical split demolishes globalized trade.

Whether or not the United States lets the debt ceiling problem cause it to default on its obligations, this over-arching geopolitical conflict can only worsen. It is just a matter of how quickly the actions of American politics accelerate the division of the world's economies into China aligned or America aligned. While the United States can inflict serious wounds upon itself, it will take a long time for it to become just one of many high GDP countries with little influence on affairs elsewhere in a world which currently is itching to migrate away from reliance on the US dollar as a trade currency vulnerable. The immediate affect of this trend should be higher demand for gold, which would benefit Canadian resource juniors. Despite gold trying to establish $2,000 as a new base for future upside price moves rather than a ceiling it cannot definitively break through, investors have not shown much interest in accumulating ETF gold such as the World Gold Council backed GLD. So who is buying physical gold that kept it above $2,000 for much of May until the past week? One explanation has been that central banks from the partly free and not free nations have been buying gold as a way to diversify away from the US dollar as a reserve currency. In terms of total official sector gold holding the gain in 2022 was actually smaller than for much of the past decade which shows consistent central bank accumulation of gold. The lower net growth is due to some nations being forced to sell gold to deal with their financial problems which offset a demand surge by other nations. If the United States defaults on its debt and yields for US treasuries soar, we can likely expect more central banks to increase their gold holdings. Once that becomes a visible and sustained trend we can expect broader audiences to buy gold and create a real price uptrend.

For the resource juniors an even more important benefit than a gold price rising well beyond $2,000 will be the collective realization that Canada is well endowed with many of the critical minerals needed for energy transition related technologies (as well as metals with more mundane applications) of which lithium is the most pressing metal today. While the focus is generally on how Canadian mine production can supply America's future needs, one should not forget that Europe, in so far that it resists alignment with the China-Russia axis, could be an important source of demand for responsibly mined metals. By Q3 of 2023 we should know the outcome of the debt ceiling debacle. Either a default has happened and we see what damage to the economy and markets it has caused, or it will have resolved itself without a catastrophic outcome. In either case the dread of what might happen will be gone and markets can adapt to a new reality. |

TSXV listed resource junior traded value has declined since April |

Metal and Energy Prices have declined thanks to weak China post zero-covid rebound |

Interest rates still rising as inflation rate slowly eases |

US Non-Farm Jobs at Record High |

IMF projected distribution of 2023 Global GDP |

General Equity Market seems unconcerned by Debt Ceiling Problem |

A Visual History of National Debt Growth |

Federal Revenue Estimate for 2023 |

Federal Spending Estimate for 2023 |

2023 Spending Amounts for each Federal Category |

Federal Spending Projection through 2028 |

The Global Geographical Balance between United States and China |

Global Distribution of Freedom |

The China-United States Collision Trajectories |

The Metal Supply Problem facing Democracies if Globalized Trade Collapses |

China is the world's biggest gold producer: where did its domestic gold supply end up? |

A History of Annual Official Sector Gold Holdings Changes |

Daily Changes in the GLD Gold Holdings |

| Jim (0:11:23): What are the implications of the recent Mexican mining law changes for juniors like Sonoro Gold? |

On April 29 the Mexican Senate jammed through a couple constitutional changes unrelated to the mining sector and a new mining law. This was accomplished by members of the ruling Morena party secretly gathering in another chamber to put the proposals to a vote while the opposition was gathered in the main chamber to protest the proposed rule changes. Last year Mexico's president nationalized the mining of lithium, effectively stripping owners of mining concessions with lithium potential from having the right to develop and mine lithium. The result has been that exploration for lithium in the form of claystones, brines or pegmatites simply stopped. Now the government is trying to come up with a system that will attract exploration and development capital of the sort juniors typically bring to the table. Chile's leader Gabriel Boric recently proposed a change which would give Chile a major stake in all new brine projects. The Chilean system was already messed up due to the government's excessive role in granting production leases. Some juniors have claimed that greater clarity will get things moving for the Chilean portion of the Lithium Triangle, but for now Chile's state copper mining entity has been instructed to study how to best take a higher stake in existing brine operations and figure out what the investment and title regime will be for undeveloped lithium projects. However, because the proposed Chilean change must get approval from another government branch, it may be quite some time before anything is formalized. In the meantime, all Chilean brine projects not already in production are in limbo. This has helped spotlight why Argentina is a better jurisdiction for developing brine projects and it has given brine producers like Albemarle, SQM and Wesfarmers extra reason to look at supply expansion through pegmatite lithium projects. Chile's foolishness may turn out to be of great benefit to Canadian juniors engaged in Lithium Mania 2.0 exploration in Canada. The Mexican mining law change may also boost the fortunes of resource juniors with a focus on Canadian projects.

The first implication of this Mexican mining law change is to create a period of limbo. Because of the manner in which the laws were passed it will be challenged to the Mexican Supreme Court which has resisted Andres Manuel Lopez Obrador's efforts to undermine Mexico's democratic institutions. Amlo is a populist like Trump but chases left wing goals such as more state control of everything. His term ends in 2024 so he will not be in a position to claim the election was stolen. But like Vladimir Putin and Xi Jinping he will do his best to get the rules changed so that he can stay in power beyond the current 6 year term limit. Because of the urgency of the matter a court decision could be in hand within a couple months.

Amlo has been pushing for mining law reform for some time, arguing that the existing mining concession system is too generous. In countries like Canada mineral title is established by staking open claims, online in most provinces through map-staking. There are staking fees and assessment work reporting requirements to keep the claims alive. Countries like Mexico have a claim application system where a company or individual must file a request for a land package. Once the application has been made nobody else can apply for those claims which are either confirmed as a mining concession or not. These mining concessions have a 50 year term. As a result Mexico is checkered with existing concessions covering most prospective geology. Canadian companies have typically done deals on these claims so that they can explore and develop them if an orebody is outlined.

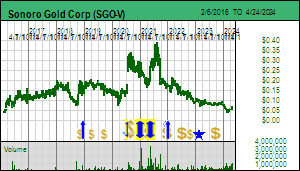

Sonoro Gold is an example of such a junior which has done deals with the mining concession title holders in the area of the Cerro Caliche project in Sonora State. These deals require Sonoro to pay USD $4.9 million by March 2024 of which $3.5 million has already been paid since 2018. Over 57,000 m have been drilled to delineate an indicated and inferred resource of 30,450,000 tonnes of 0.43 g/t gold which at $2,007 gold represents a rock value of $31 per tonne. That's just over 400,000 ounces gold. Sonoro delivered a PEA in September 2021 for a 15,000 tpd open-pit heap leach operation which it updated in May 2022. The mining plan involves several shallow open pits which represent only a portion of the known mineralized zones on the property. The resource supports only a 6-7 year mine life, which is normally a deal-breaker because nearby communities, when they support a mine in their backyard, want a longer mine life to sustain the local economy. However, Cerro Caliche is within an established mining district, there are no nearby communities, and the mineral title has been secured from the local surface rights holders. This has allowed Sonoro to adopt a strategy of designing for a larger scale operation with the goal of using cash flow to fund delineation drilling of additional zones to extend the mine life. For example, I've done an outcome visualization for 75 million tonnes of ore that would yield about 700,000 ounces over 14 years.

This is a low sulphidation epithermal system with gold smoke all over the place, and which, while it has yielded some high grade ore shoots, has not yet yielded deeper higher grade veins such as the Mercedes vein being mined next door by Bear Creek Mining after acquiring it from I-80 Gold. The problem for a junior is that it cannot afford to drill off a 20 year mine life backed by a feasibility study, especially during a bear market and with a gold system whose average grade is at the lower end of what is generally put into production. Sonoro has chosen to seek debt financing supported by a PEA with the argument that at current gold prices not only will lenders be paid back, but there will be sufficient cash flow for reinvestment in expansion drilling and scaling up production down the road with a 1-2 million ounce scenario a plausible outcome. With that goal in mind Sonoro submitted a mine permit application in May 2022.

Since 2018 when Amlo was elected no new mining concessions have been granted. Back in late 2021 Sonoro was confident it could have a mining permit in hand within 6-8 months of application. It is 18 months later and there still is no indication when a mining permit will be granted. Sonoro cannot secure project financing until mine approval is in hand. The COO Jorge Diaz who has put numerous Mexican mines into production has observed a distinct slowdown in the approval process from what he was accustomed to. Part of the problem is that during the covid pandemic bureaucracies such as Semarnat (Scretaria de Medio Ambiente y Recursos Naturales) slowed down activities substantially and lost competent personnel.

At the other end of the regulatory system no new mining concessions have been granted because Amlo wanted to reduce the concession term from 50 years to 15 years. That was a non-starter for the mining industry because any new concession application will be of a grassroots, generative nature where you can spend at least 5 years to be in a position to make a production decision, if you are lucky with exploration early on, at least another year to get mine approval, and then a couple years to build and commission the mine assuming you don't have to sit out a metal price bear market before you can secure CapEx funding. Nobody is going to bother with grassroots exploration if the best outcome is a 7 year mine life. As a result of industry feedback Amlo agreed to a 30 year concession term with a 15 year renewal.

Since Sonoro is paying to acquire existing concessions whose terms are grandfathered, the new concession rules are irrelevant to this Canadian junior with an advanced project in Mexico. But they are deadly to the type of junior that styles itself as a prospect-generator-farmout type. An important change to the concession granting process is the first come first serve principle has been abolished. Any concession application submitted by a party will be made available for anybody under an auction system where the highest bidder is awarded the concession. This makes sense when a land package within a government mineral reserve is being offered for exploration and development to third parties, but not when somebody has applied geological creativity to identify an area as prospective. An earlier version of the mining law reform included a requirement to describe what metals one hoped to find and how much. There was even a plan for the concessions to be metal specific. So if you have an idea for a carbonate replacement type deposit, which would be rich in silver, lead and zinc, you would need 3 concessions to be able to profit from mining all three. Common sense prevailed and these requirements were scrapped. But if this new mineral concession system is adopted, grassroots exploration will be limited to existing mineral concessions.

The big mining companies like Gruppo Mexico, Penoles and Fresnillo have indicated there are no implications for their existing mines, and their landholdings are large enough to offer plenty of greenfields and brownfields exploration potential. Furthermore, when Canadian resource juniors lose interest in Mexico the existing mineral concession holders with grandfathered rights will be easier to deal with. The new mining law does include tougher water usage scrutiny. Until now if a mining company secured water rights from an existing holder it would simply start using them. Now the plan to use water for a mining operation must undergo a study in terms of its impact on the basin from which it will be drawn. Since most mines use a relatively small portion of the water available in a basin the thresholds that would trigger a denial are unlikely to be hit. But the permitting cycle now has an additional study and approval layer. In the case of Sonoro it has secured water rights so this simply means extra studies. The main negative implication of this mining law reform for Sonoro is the uncertainty about when it will become law. The permitting department is not going to speed up processing until clarity has been achieved. If the Supreme Court strikes the mining law down on procedural grounds, Amlo will simply try to change the mining law in another manner. That means further sluggishness in the permitting department.

Sonoro Gold Corp is dealing with the situation by doing a private placement of 30 million units at $0.10 with a full 2 year warrant at $0.15. Insiders will take down a third of the financing to help pay loans Sonoro secured to make property payments due earlier this year and accumulated exploration expenses. Enough money will be set aside to take care of remaining payments this year, though more will have to be raised for the final Q1 2024 payments that secure title, something project lenders will insist on. A portion of the financing will be spent on drilling the western trend defined by the Cabeza Blanca, Guadalupe and El Colorado Zones where more recent drilling has intersected high grade shoots whose grades SRK Consulting capped at 3 g/t gold. The goal is to better flesh out these zones so that the resource grade can be boosted for the starter pits in the proposed mine life. So even if the mining law uncertainty drags on in Mexico Sonoro will be in a position to improve the Cerro Caliche project from the perspective of the project lenders waiting in the wings.

The financing does add 60 million shares of dilution, boosting fully diluted from 232 million shares to 292 million shares. However, 55.6 million warrants at $0.30 expire by the end of 2023, 38.6 million on August 12 and 16.9 million on Dec 20. The first batch was done in September 2020 when the covid response launched gold above $2,000 for the first time. A major participant was Pallisades which embraced a strategy of clipping the warrant and flipping the stock as soon as it became free trading. It did this with most of the juniors it bankrolled during that frenzied financing period. In another 7 months the free-lunchers will have no stake left in Sonoro and the overhang that remains will be in the hands of shareholders who invested in 2021 when the gold market had cooled and who were investing in the Sonoro team's plan to fast-track develop a gold mine that would benefit from a rising gold price. Sonoro will have 236 million shares fully diluted with the dilution held mainly by parties who understand the development dynamics of this story which will become much easier to appreciate when $2,000 becomes the base for gold's future price rather than its ceiling. |

Sonoro Gold Corp (SGO-V)

Bottom-Fish Spec Value |

|

|

| Cerro Caliche |

Mexico - Other |

7-Permitting & Feasibility |

Au Ag |

Chart showing what percentage of each metal's global supply Mexico provides |

Chart showing what percentage of each metal's global supply Chile provides |

Sonoro Gold's Cerro Caliche Resource |

Sonoro is led by a very tenacious, experienced team |

Current grade expansion focus and future expansion target area |

Sections showing the high grade potential of the western trend |

Sonoro's Cerro Caliche Timeline plus warrant and property payment details |

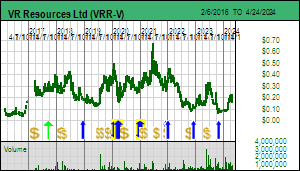

| Jim (0:28:03): How important is the latest news from the Northway diamond project of VR Resources? |

VR Resources Ltd announced on May 18 2023 that the second hole drilled at its Northway project encountered 117 m of diatreme breccia between 240 and 357 metres. The hole had to be stopped because of excessive caving at the unconformity between the kimberlite and the mudstones that filled the hole excavated when the kimberlite erupted 400-450 million years ago. Hole #2 was spotted dead center of a 1.2 km wide magnetic low anomaly 450 m to the northwest of hole #1 drilled last year and reported on February 22, 2023. KW Episode March 10, 2023 provides background about the potential implications of this discovery. Northway was a large untested magnetic low anomaly in the James Bay Lowlands of Ontario where a 400 million year old limestone platform covers the 2 billion plus year old basement rocks. Hole #1 yielded only 40 m of what has been described as kimberlitic material and was spotted near the edge of the circular anomaly because the initial model was that this was a carbonatite like Hecla-Kilmer or some other alkaline intrusive complex with IOCG potential such as Roanoke that was prospective for copper and gold. Typically the outer ring of such intrusions has the best chance for copper mineralization.

VR's Mike Gunning and Justin Daley were quite surprised by what they intersected last year and eventually decided it was a kimberlite though petrographic studies confirming the origin depth of the magma were not done, nor was any of the initial hole submitted for caustic fusion to recover micro diamonds because the sample was so small. VR quietly staked a couple dozen other untested magnetic low anomalies within a 30 km radius management realized that the Northway diatreme was a magnetic low because during its emplacement the earths magnetic poles were reversed relative to the Precambrian basement rocks (when a magma cools the magnetite crystals will align according to the polarity of the poles at the time, which doesn't mean they are more magnetic than the country rock, but simply end up a reversed polarity that shows up as circular anomalies in a magnetic survey). The exciting hypothesis was that after the limestone was laid down about 450 million years ago something triggered a wave of magmatic intrusions which burst through the limestone creating a cluster of kimberlite pipes. All those other magnetic lows could be a cluster of kimberlite pipes which avoided detection because they erupted into a marine environment. The craters were subsequently filled with marine sediments. As a result no kimberlite outcropped anywhere and was exposed to glacial activity which gouges out the softer kimberlite and creates the indicator mineral trains explorers track back to their origin through till sampling.

VR was able to raise $1.9 million through a private placement that closed in April, attracting some investors intrigued by the potential for a new diamond field in Canada. The market reacted strongly to the news despite an overall lacklustre market because the intersection confirmed that the geophysical interpretation was not an illusion, that the anomaly represented a 1.2 km wide intrusive body with a footprint of 500 million to 1 billion tonnes to a depth of 300 metres. It is unlikely that this is a single kimberlite intrusion, but rather multiple intrusions such as is the case with the world class Jwaneng pipe in Botswana. It is disappointing the hole could not be drilled deeper, but it is very positive that it obtained fresh rock beneath the altered crater facies material at the unconformity. VR has published core photos which certainly support the interpretation that this is a kimberlite. The sample is also large enough to allow a characterization study to be done that establishes the origin depth of the magma and the garnet bearing xenolith entrained during the ascent. The next important step is confirmation that the magma originated beneath the diamond stability field between 150-200 km where diamonds would have formed.

The sample is also large enough to allow part of it to be submitted to SRC for caustic fusion to recover micro-diamonds. The diamond bearing potential remains a critical obstacle because Northway occurs within the Kapuskasing Structural Zone which developed between 2-1 billion years ago. The resulting thermal event spawned the carbonatite and IOCG style intrusions in the James Bay Lowlands, but it would also have wiped out the diamond stability field, converting any diamonds that formed during the older Archean period into graphite. For the Northway cluster to be diamondiferous conditions would have had to be right to allow diamond populations to form after the thermal event subsided. The diamond population of the depleted Victor Pipe to the northwest several hundred kilometres is an example that is less than 1 billion years old. Micro diamond results with a coarse distribution supporting prediction of a macro grade will be an important next step, though not necessarily a death blow for Northway because the Victor pipe almost never became a mine because the micro diamond portion of the population was not observed in early drill core. Furthermore, with such a large intrusive complex there may be multiple phases representing a broad range of diamond content. VR will need to test a lot more than one drill hole pin-prick into Northway before it can conclude that it is a diamond bust. But if we get early confirmation that Northway is a true kimberlite, that the xenoliths contain garnets exclusively associated with the pressure-temperature regime of the diamond stability field, and ideally that a coarse micro diamond distribution is present, it would create the basis for testing all the other blind magnetic low anomalies. We will likely have to wait 2-4 months to get the petrography and micro diamond results. Meanwhile VR is moving the drill back to Hecla-Kilmer to delineate more of the rare earth zone, and in the fall it hopes to be in a position to drill the New Boston copper-molybdenum prospect in Nevada. |

VR Resources Ltd (VRR-V)

Bottom-Fish Spec Value |

|

|

| Northway |

Canada - Ontario |

3-Discovery Delineation |

D |

Northway regional map and geological section |

North plan and section showing location of drill holes into geophysical anomaly |

Photos of core from Northway holes #1 and #2 |

Northway Claim Map showing claims covering magnetic low anomalies |

| Disclosure: JK does not own any of the companies mentioned; Sonoro Gold and VR Resources are Bottom-Fish Spec Value rated |