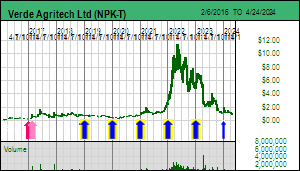

| Kaiser Watch April 6, 2023: Verde Agritech spooks Retail Investors |

| Jim (0:00:00): Verde Agritech sold off sharply after reporting 2022 results last week. Was the market reaction justified? |

Verde Agritech Ltd reported 2022 results on March 30, 2022 which revealed that revenues had increased 190% to CAD $27.7 million, physical sales of K Forte and the nutrient enhanced BAKS version had increased 57% to 628,000 tonnes, EBITDA had increased 271% to $23.9 million, and bottom-line earnings had increased 386% to $0.34 per share. What is there not to like about that? There was the disappointing confirmation that 2022 Q4 sales declined 7% to 125,000 tonnes of K Forte compared to 2021 Q4, but the company had already signaled late last year that the rest of the year was going to be dismal. The two key fertilizer shipping windows in Brazil are Q2 and Q3. In mid 2021 NPK got permits to mine 2.5 million tonnes from a second location and started building Plant 2 which with Plant 1 gives the company the capacity to produce 3 million tonnes of K Forte annually. Brazilian port potash prices (KCl) began rising in mid 2021 as the world rebounded from the covid pandemic, and reached record highs during H1 of 2022 after Russia invaded Ukraine. NPK engages in delivered KCl parity pricing with what now looks like a 10% discount. What this means is NPK negotiates a price that will be 10% lower for delivered K Forte than what it will cost the farmer for KCl delivered to his doorstep, with an adjustment for the fact that six times as much K Forte needs to be applied to the farmer's field to achieve the equivalent K2O content.

Potash underwent two supply shocks in early 2022. The first was when Lithuania acted on EU sanctions against Belarus by no longer allowing Belarusian potash to transit through Lithuania to a port from where it could be shipped to customers anywhere in the world. This meant Belarus had to transport its potash north through Russia to a port near St Petersburg, which created logistics and capacity problems. In late February Russia invaded Ukraine, and although no sanctions were imposed on Russian potash, a transportation bottleneck emerged as insurance companies refused to insure ships carrying Russian cargo. Brazilian farmers, realizing that the disruption of Ukrainian grain supply would boost global crop prices, panicked and srcambled to secure potash for their 2022 planting season. This was a boon for NPK which was able to book orders above and beyond the 600,000 tpa capacity of Plant 1. The key was to have Plant 2 operational by July. The reality was that Plant 2 was not operational until the end of August, and then NPK encountered a water problem with the Plant 2 access road which caused it to spend September building a new bridge and upgrading the road. By October Plant 2 was fully operational at 2.5 million tpa capacity, but the orders NPK needed to deliver in Q3 vanished. This forced NPK to change its 2022 guidance back to what it had set in January 2022 before an upward revision in May that accounted for orders whose fulfillment required Plant 2 to be operational for the Q3 fertilizer application and planting season. Construction delays and the unforeseen water problem that killed K Forte delivery rendered Plant 2, which cost $42 million to build, useless for K Forte sales in 2022. To top that off, coffee plantation orders that normally are delivered in Q4 were scaled back because the coffee growing regions have suffered a cycle of drought and unusual frost that has disrupted the biennial cycle of coffee trees (fruit productivity alternates between high and low in sucessive years). Anticipating poor yields coffee farmers opted not to bother with potash application (potash is the most expendable of the three key fertilizer inputs - the other two are nitrogen which makes photosynthesis possible, and phosphorous which affects the plant's plumbing system while potash boosts pest resilience). While the market would not have known about the coffee problem, which is only a portion of the crops K Forte fertilizes, the market knew about the other problem, and as far as I could tell, was focused on the 2023 selling season. So why the negative market reaction that dropped the stock price nearly 50%?

A minor contributing factor is that in H2 of 2022 the CEO Cris Veloso instituted a selling program whereby a third party sells stock during periods when the company is not in possession of potentially negative material information. Veloso sold $1.4 million worth of stock in two batches, the first in late August, and the second in late December. He continues to hold 9,807,934 shares which is 18.6% of the 52.6 million issued shares, and he is the largest shareholder of NPK. He is the founder of the company and has spent nearly 15 years turning this junior into a remarkable success story, dealing with a couple major setbacks along the way. At one point last year he was worth $100 million on paper. He has a family with two young children. I don't begrudge him selling some stock to enhance his lifestyle beyond what his salary makes affordable. But retail investors, goaded by short sellers, are always up in arms when they see insider selling, especially when the stock subsequently goes down. Where the market and myself have a problem is when the insider "forgets" to file insider trading reports within a couple days of the transaction. Veloso did not report the bulk of a sale done on December 29, 2022 until March 14, 2023, almost 3 months after the fact. I doubt there is any sinister reason for the delayed filing, but it reflects poorly on his attention to details that are a big deal for shareholders. I guess he has grown a beard as a form of atonement, like wearing a sack cloth; I look forward to him losing it.

The main reason for the sharp sell-off is the guidance for 2023 which shows a sales range of 800,000 to 1,200,000 tonnes which is 27% to 40% of current capacity. This range represents year over year product growth ranging from 27% to 91%, which may represent NPK choosing to err on the side of caution. To me the big question heading into 2023 is to what extent Brazilian farmers are willing to adopt K Forte as an alternative to potassium chloride (KCl). In 2022 NPK released a PFS showing a staged growth strategy that could see NPK delivering 50 million tonnes of K Forte annually to Brazilian farmers which is 17 times more than current installed capacity, and 42 times the best case guidance for 2023. While the market may shrug and say to itself, sales growth does not happen overnight, it is less happy with the revenue and earnings guidance provided by NPK for 2023. At the lower product sales end NPK estimates revenues of $78.1 million, down 2.6% from 2022, with EBITDA at $9.3 million, down 61% from 2022, and EPS at $0.04, down 88% from 2022. At the upper end revenues grow 44% to $115 million, EBITA grows 3% to $24.6 million, barely better than 2022, and EPS ends up 15% lower at $0.29 per share. In other words 2023 will fall short of the 2022 accomplishment.

A further reason for the sell-off is the gloomy assessment NPK has provided about the current potash demand situation in Brazil. The USGS has reported that Belarus potash supply declined 61% in 2022 to 3 million tonnes K2O equivalent. Russia's supply declined 45% to 5 million tonnes. Global supply shrank from 46.3 million tonnes in 2021 to 40 million tonnes in 2022, with expanded supply coming mainly from Canada. Brazil cfr KCl prices rose from $256/t in January 2021 to a peak of $1,183/t in April 2023 but have since fallen to $473/t in March. The lower revenue and earnings guidance is based on NPK assuming a $450/t average price for 2023, which, after deducting a 10% discount, will result in $405/t before port to farm transport costs. Although the world lost 8.7 million tonnes of K2O equivalent supply from Russia and Belarus (USGS figures published in January are preliminary) in 2022, it appears that that quite a lot of potash found its way to Brazil thanks to the high price in H1 of 2022. At the same time the central bank war on inflation which resulted in the fastest interest rate increases in decades cooled demand for agricultural products, which hit farmers with a double whammy of abnormally high fertilizer prices and declining crop revenues. Since August monthly KCl imports dropped two-thirds as farmers decided to wait out the Brazilian election and wait for a sudden potash glut to result in lower prices for 2023. NPK's muted sales growth projections reflect the uncertainty of the outlook for 2023. Last year Brazilian farmers were motivated to give K Forte a chance as an alternative potash; this receptivity will be lacking in 2023. The market's negative reaction reflects this uncertainty?

But is the stock price decline justified? If one was counting on the windfall potash prices of 2021-2022 to be permanent then the answer would be yes. But just as thermal coal had a bumper year in 2023, created by the scramble to deal with the natural gas supply shock that came with the Russian invasion of Ukraine, so did oil. Lithium carbonate had a windfall year that has come to an end. Lithium needs a long term price range of $10-$15/lb lithium carbonate to justify mobilizing the supply required to meet energy transition EV goals for 2030. Naturally this has hit the price of lithium producers, though battery and car makers are celebrating. Whether NPK's stock price decline is justified is a question that only makes sense if you treat NPK like a mine that is in production at an optimum rate with defined mine life. NPK is in fact a product sales growth story from a near infinite reservoir of product. With 3 million tpa capacity operational NPK can respond very quickly to rising demand if Brazil experiences another potash supply shock, or the global economy avoids a recession and agricultural product demand rises. I confirmed Verde Agritech Ltd at $4.95 as a KRO 2023 Favorite with a Good Speculative Value rating at the start of the year and confirm it at the current price range of $2.50-$2.60 based on the idea that NPK will be successful growing its sales to 50 million tpa, replacing half of Brazil's potash import dependency.

During the 2022 Earnings Conference Call briefly talked about several potential developments in 2023. One was that the application for building an 85 km railway to connect Plant 2 to the farther agricultural states is moving along, and seems to have the support of the Lula government. NPK cannot build a railway on its own, but once it has a greenlight it can partner with a much bigger company. Another was the R&D into converting K Forte, currently sold as a powder, into a granulated form which would open up Brazil's blender network as a product sales gateway. Veloso indicated the company is still working on this, which at least leaves hope for a breakthrough. He also talked briefly about carbon sequestration. Although K Forte is a silicate which does not dissolve in water the way a salt like potassium chloride does, its K2O payload is liberated through a complex interaction between microbes and plant root secretions. Enhanced rock weathering is a concept whereby the natural weathering of rock into particles that absorb carbon dioxide to form carbonate minerals that permanently pack away CO2 is accelerated through geo-engineering processes. FPX Nickel Corp through CO2 Lock is pursuing accelerated carbon sequestration with the help of brucite dominated ultramafic rocks. There are geo-engineering solutions being contemplated which involved grinding up rock and dispersing it in the ocean, atmosphere and on the ground as a way of pulling carbon dioxide out of the atmosphere. That seems rather energy intensive.

In the case of NPK's glauconite material the main cost excluding transportation is the energy spent grinding up the silicate. The cost is offset by the value K Forte delivers as a source of potash fertilizer for crops. What if the amount of CO2 that a tonne of K Forte applied to a field packs away as a carbonate can be measured and certified so that a carbon credit could be attached to every tonne sold. While Jair Bolsonaro and Brazilian farmers have no interest in doing anything about global warming, the Lula government is more open-minded about climate change mitigation. Although Veloso did not spell out details, what if it could sell carbon credits for every tonne of K Forte applied as fertilizer? I wouldn't look at this as an extra revenue stream, but more as a way to reduce the delivered cost of K Forte, undercutting delivered KCl by more than a 10% discount. The greater good does not hold much sway with farmers, but show the farmer a significantly cheaper alternative form of potash that also doesn't harm his soil, adoption of K Forte could happen a lot faster than the market is currently thinking. On March 20, 2023 the Financial Times had a very interesting Big Read article: . It doesn't mention Verde Agritech and the climate change potential of K Forte, or the BioRevolution product which seeds K Forte with specific microbes. NPK has the potential to become very topical. |

Verde Agritech Ltd (NPK-T)

Favorite

Good Spec Value |

|

|

| Cerrado Verde |

Brazil - Other |

9-Production |

K |

Late Insider Trade Reporting Blunder angered Market |

2022 was a Fantastic Year but 2023 Guidance a Lame Sequel |

NPK benefited from a windfall potash cycle that has for now ended |

Brazilian Potash Imports and port KCl Price harts |

Top 4 Potash Producers - only Canada had big supply increase |

Potash Supply Evolution Chart |

2022 Potash Supply Distribution Chart |

Oil, Natural Gas, Coal & Lithium had a Windfall Year |

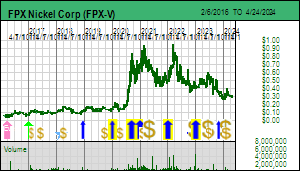

| Jim (0:19:34): Why did Jogmec and FPX Nickel form a generative alliance? |

The generative exploration alliance with Jogmec announced by FPX Nickel Corp on April 3 seems trivial on the surface, but not when you hear that Jogmec's interest in awaruite systems, natural stainless steel, is based on the potential to make battery grade nickel sulphate from Decar's 63% nickel concentrate that is otherwise intended as a direct feedstock for stainless mills. The value for FPX Nickel resides in a government body validating these low grade natural stainless steel deposits as a source of nickel sulphate for the battery sector. In a Kerry Lutz Financial Survival Network Interview CEO Martin Turenne states that Jogmec and a number of Japanese corporations have been following the Decar story for the past year. Jogmec is a government agency which does farm-in deals and exploration alliances with juniors, and when a project achieves critical mass, auctions the Jogmec stake to Japanese corporate giants with a strategic need for the target metal. Most of the Jogmec option deals simply fade away, but some reach the auction stage.

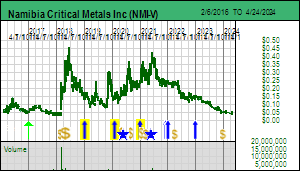

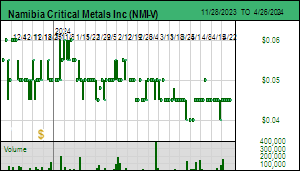

For example, last November Jogmec put its stake in the Lofdal heavy rare earth project of Namibia Critical Metals Inc out for tender, with a decision expected in March, though we have heard nothing yet. Jogmec will have spent CAD $10,075,000 by May to vest for 40%, and will have an option to go to 50% by spending another $10 million by 2028. The Jogmec deal was done January 2020, prior to which NMI had invested CAD $24 million into Lofdal between 2008-2019, most of it during Rare Earth Mania 1.0 which ran from 2009-2012. Jogmec also has an option to pay $5 million to go to 51%, after which NMI can contribute 49% or dilute to 26% which includes not contributing to CapEx which the October 2022 PEA estimated at USD $207 million. In either case NMI retains pro rata offtake rights which would be of serious interest to non-Japanese magnet makers if NMI gets a solid Japanese development partner. China is exploring a technology export ban related to the production of rare earth magnets, which is seen as a tit for tat response to US restrictions on the export of semi-conductor technology to China. This is not the same as a magnet export ban which would seriously harm the non-Chinese EV sector; it is more a threat against Chinese citizens transferring their know-how outside of China. In an autocracy conformity is achieved by threatening the innocent relatives of anybody who acts contrary to the agenda of the thugs in charge. It is a bit too late for China to keep magnet making know-how in-house because Japan already has domestic rare earth production capacity so doesn't need to poach Chinese workers to learn how to make these high powered permanent magnets which Elon Musk claims Tesla no longer needs. Whether or not Elon is faking till he makes it, other EV makers might very well prefer to partner with a Japanese rare earth magnet maker, perhaps by acquiring NMI to control part of the dysprosium and terbium supply from Lofdal. A strong Japanese partner replacing Jogmec would be a major development for NMI.

While it is unlikely we will see China impose a export ban on the primary magnet rare earths, neodymium and praseodymium, the heavy rare earths dysprosium and terbium come from a different, rapidly depleting source, ion adsorption clay deposits. There are similar deposits in places like Brazil and Chile, but they are all very low grade (less than 0.1% TREO) and face local opposition, which, of course, does not exist in a country like China where the interests of local downstream victims are subordinated to the greater good. Bedrock sources of the heavy rare earths do exist, but they are either tiny percentages of the total rare earth content of big or rich light rare earth deposits (Mt Weld, Mountain Pass, Bayan Obo) and typically not worth recovering, or they exist in major deposits like Strange Lake in northern Quebec which are hampered by remote locations and complex mineralogy, or like Norra Karr in Sweden blocked by NIMBY opposition. Lofdal does not have world class scale, but its grade resides within xenotime, an HREO dominated cousin of LREO dominated monazite often found with it as a minor component of heavy mineral deposits and whose extraction technology was figured out in the days when monazite concentrates were separated from heavy mineral sands operations targeting titanium and zircon. Monazite has less than 1% HREO, but a small portion of the monazite concentrate would include xenotime grains. The problem with monazite and xenotime is that thorium occurs within the crystals. New rules created many decades ago for the handling of radioactive materials shut down monazite sands as a a source of light and heavy rare earths, though groups like Energy Fuels are using their uranium related certification to revive rare earth recovery form heavy mineral feedstock.

The only other advanced stage deposit like Lofdal is Browns Range in Australia controlled by Northern Minerals Ltd. Browns Range has a higher grade and has been running a pilot plant for several years. In October 2022 NTU did an offtake deal with heavy mineral sands producer Iluka Resources Ltd which will process a xenotime concentrate from Browns Range. NTU is currently updating its DFS with the help of funding provided by Iluka. The offtake deal does allow NTU some participation in higher rare earth prices, but Iluka has a right of first refusal on Browns Range output. A 25:1 rollback proposed in December was rejected by shareholders; the 5 billion plus issued stock limps along with ex Lynas head Nick Curtis now leading the company on behalf of its largely Chinese shareholder base. Namibia Critical Minerals is thus really the only pure bet on near term heavy rare earth supply with unconstrained upside, but for the moment the junior waits to see which partner, if any, emerges from the Jogmec auction of its Lofdal stake. For this reason NMI only has a Bottom-Fish Spec Value rating, though it is a candidate to become a KRO Favorite if a strong Japanese partner replaces Jopgmec.

Jogmec's pursuit of exploration deals should be seen as a geopolitical security of supply strategy for Japanese industry. The Jogmec deal with FPX Nickel is a much weaker deal than the NMI deal because Jogmec will spend only $1.3 million over two years on a project to identify acquisition targets. Since the value of low grade awaruite style nickel deposits is not widely understood, as is evident in the very low valuation the market assigns to FPX, acquisition costs will likely be low. But when a project is identified and acquired Jogmec and FPX will immediately form a 60:40 joint venture to which FPX must contribute 40%. That really is not something FPX shareholders want to see happen while they await a PFS in September or early Q4 and the response by an institutional audience that still seems to be missing from the shareholder base.

During 2010-2014 while Cliffs was advancing Decar FPX engaged in a global research project which identified and, where possible, visited similar ultramafic bodies, typically ophiolites which are slabs of oceanic basalt that instead of being subducted got obducted onto the continental crust, often ending up perched high in mountain chains like the Swiss Alps and the Himalayas. Under the right metamorphic conditions the nickel tied up in the olivine crystals of the peridotite gets squeezed out and melds with iron to form the awaruite mineral, a natural stainless steel. At the time this was a novel discovery and FPX was concerned there would be a super-abundance of such deposits around the world. This turned out not to be the case. In British Columbia they investigated many such ultramafic bodies but in the end retained only the Mich in Yukon, and Wale and Klow in British Columbia. The key to a Decar-like deposit is a uniform coarse awaruite grain distribution leading to a DTR grade of 0.09% nickel or better, and the absence of sulphides. Most of the low grade nickel deposits promoted by Canadian juniors have a significant nickel sulphide component which requires downstream smelting and results in acid generating tailings; both represent additional costs.

One of the interesting aspects of Decar is that it contains a magnesium mineral called brucite which is very effective at absorbing carbon dioxide when exposed to water to form a carbonate mineral similar to limestone that packs away CO2 permanently. FPX Nickel's research program discovered a number of ultramafic deposits that underwent the same serpentinization as Decar but failed to develop awaruite grains though brucite was created. FPX has formed a subsidiary called CO2 Lock which has started acquiring these rock bodies which are worthless in terms of metallic content but are in locations where they could be developed as carbon sinks for delivered carbon dioxide. This carbon sequestration strategy, which gets zero value from the market, would be spun out at some point, especially in the event of a takeover bid by a producer who wishes to develop Decar.

Although FPX Nickel's 2010-2014 research program established that ultramafic bodies dominated by awaruite were rather rare rather than abundant, it did identify promising bodies in other parts of the world. But the company decided not to acquire such systems outside of Canada because some were in difficult jurisdictions, and the PEA Cliffs delivered was not greeted as a proof of concept by the market, so funding a similar grassroots project was a bridge too far. But in September 2020 FPX delivered a PEA with an enhanced flow-sheet that produces a 63% nickel concentrate compared to Cliffs' 12% concentrate, which in turn opened the potential for an additional processing stage that deploys hydrometallurgy to produce battery grade nickel and cobalt sulphate. Some time in Q2 of 2023 we expect to see the results of Sherritt's study, and while the market will yawn at a 20 page press release filled with metallurgical details, Jogmec and its corporate Japanese friends will be paying close attention. There has been much speculation about the identity of the strategic investor who invested $12 million at $0.50 last year, and all we can glean from Martin Turenne's comments is that it is a public company and not a traditional mining company. Panasonic is Japan's leading battery maker, but Toshiba also makes the list. We know Toshiba is collaborating with CBMM to come up with a niobium-titanium based anode substitute for graphite, and that battery would require nickel in the cathode. With Jogmec teaming up with FPX Nickel to identify awaruite deposits elsewhere in the world and perhaps develop them, it is not a stretch to speculate that a Japanese battery maker is the strategic investor.

There is the puzzling question of why Jogmec optioned Klow to earn 60% by spending a mere $1 million over 2 years. The answer is purely technical. In order to create a generative alliance with a junior like FPX Jogmec needs to have a touchstone property. FPX regards Mich (Yukon) and Wale (northern BC) as important awaruite projects that emerged from the 2010-2014 research period, with Klow as the least prospective. So this easy $1 million deal for 60% over 2 years really is just to accommodate Jogmec's need for a specific option to anchor the alliance. FPX is willing to do the generative alliance with Jogmec because this is an opportunity for FPX to get a piece of those awaruite potential projects with the help of a strong partner. The current corporate presentation has a Jogmec slide and it includes a global map of ultramafic rock belts (the purple dots). FPX has a database from the research period with which Peter Bradshaw was very much involved. They are recruiting a VP of exploration to be in charge of this alliance. The alliance is not going to generate any acquisitions overnight, and you can probably guess which regions are no-fly zones. But because these ultramafic bodies with a low nickel grade due to an obscure mineral called awaruite are not really recognized as having commercial potential, acquisition costs will be low, though possibly time consuming in jurisdictions such as Zimbabwe where it can take years to get an exploration license application approved.

Looking at the map some obviously hopeless regions stand out: Turkey, Russia, the Himalayas, India, China, Venezuela, Saudi Arabia, southern Europe's mountain chain including the Swiss Alps, and most of mainland southeast Asia. Interesting areas are New Zealand, the eastern part of Australia, Brazil, Zimbabwe, Norway, and Spain. Japan also stands out, but Japan is outside of Jogmec's jurisdiction. What strikes me as interesting is that Alaska and the west coast of the United States, as well as its eastern coast host these type of ultramafic bodies. It will be interesting where the focus of Jogmec's generative alliance with FPX lands.

Indonesia stands out but it has become the world's dominant nickel producer based on its nickel laterite deposits. Indonesia and the Philippines emerged as major nickel producers in the past decade thanks to an innovation created by steelmaker Tsingshan which figured out how to make China quality stainless steel from nickel pig iron, which itself was created by feeding raw laterite ore into obsolete blast furnaces in China. Around 2015 Indonesia banned the export of raw nickel ore and forced Chinese companies like Tsingshan to build nickel processing capacity in Indonesia. The Indonesian nickel product does not qualify for delivery to LME warehouses, but it can be upgraded to produce battery grade nickel sulphate. Tsingshan, which knew how much new nickel supply was coming on stream in 2022 from Indonesia, went short LME nickel to capture the inevitable price decline. Tsingshan either did not know about Russia's planned invasion of Ukraine, or believed it would be a cakewalk about which the rest of the world would shrug and carry on business as usual. The disruption of Russian nickel supply created a short squeeze which the LME bobbled because it threatened some of its members who were also short. The situation was stabilized when Beijing bailed out Tsingshan by loaning it nickel from its stockpile that was deliverable against its short position while Tsingshan's own nickel stocks were not. The Chinese are now agitating for an Asian benchmark price for nickel that is separate from the LME benchmark which suffers from the supply type fragmentation and its bailout of Tsingshan last year.

If nickel prices are going to be weak because of over-supply from Indonesia, why would Jogmec bother looking for Decar-style awaruite deposits elsewhere in the world? The problem is that 65% of global nickel supply now comes from Indonesia, Philippines and Russia. While the Philippines are now edging away from former president Duterte's embrace of China, if the autocracy-democracy conflict escalates to a hot conflict, triggered by China annexing Taiwan or Putin resorting to tactical nuclear weapons, southeast Asian nickel supply will cease to flow around the world to whoever wants it. Furthermore, Philippines is still shipping raw ore to China, the only such market for it. After what Japan did to China during World War II it knows it cannot leave itself at the mercy of China. Jogmec's generative alliance with FPX Nickel for a source of nickel that may yield cheaper nickel sulphate than is possible from refined LME nickel which comes largely from smelted nickel sulphide concentrates makes strategic sense. It also bolsters the speculation that FPX Nickel's strategic investor is a Japanese entity.

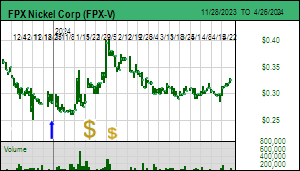

I've updated charts for my DCF analysis based on the PEA with CapEx and OpEx escalated 20% which I first presented last year. At the current $10.39/lb LME nickel price Decar is well in the money. I do think the market is anxious about what has happened to costs, which usually increase more for the mining sector than general inflation. The PFS will be a very important milestone because it will reset the cost structure for the market. The PFS outcome, even with higher costs, may be better than the PEA because it will include flow-sheet optimization, and, if the upcoming nickel sulphate study is positive, expands Decar from just another stainless steel feedstock to one that can also provide a clean nickel supply for the battery market. |

FPX Nickel Corp (FPX-V)

Favorite

Good Spec Value |

|

|

| Decar |

Canada - British Columbia |

6-Prefeasibility |

Ni |

Namibia Critical Metals Inc (NMI-V)

Bottom-Fish Spec Value |

|

|

| Lofdal |

Namibia - Other |

5-PEA |

REM U |

Rare Earth Supply Evolution Chart |

2022 Distribution of Rare Earth Supply |

Price History of Magnet Rare Earths |

Nickel Supply Evolution Chart |

2022 Distirbution of Nickel Supply |

Long Term Nickel Price and Warehouse Stocks Chart |

Global Map of Friendly, Nimby and Unfriendly Awaruite Nickel Potential |

Cost Escalated DCF NPV Sensitivity Chart for Decar |

Cost Escalated DCF NPV/share Sensitivity Chart for Decar |

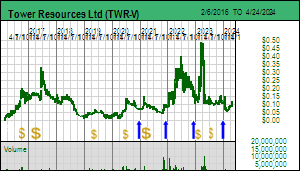

| Jim (0:29:35): Tower Resources has assays for some of the Rabbit North holes drilled this year. What are we learning? |

Tower Resources Ltd has twice during the past week released results for the first 3 of 4 holes drilled into the new Thunder Zone at the 100% owned Rabbit North project in southern British. The first 2 holes (#39 & #40) released March 30 delivered decent gold intervals in both holes but the market was not overly disappointed because these had been drilled in a NW-SE direction to intersect a structure interpreted to be oriented NE-SW as was the original assumption for the Lightning Zone in early 2022. The second hole drilled 50 M to the NE of the first hole forced Stu Averill to rethink this interpretation of the structure's orientation which he had assumed tracked the trend of a valley that itself would have reflected a zone of structural weakness.

The third hole (#41) was a 45° 300 m stepout to the southeast drilled in a NE direction to a length of 303.5 m which had extensive pyrite mineralization that confirmed the new interpretation of a NW-SE orientation that lined up with the Central Train of till sample gold grains. This prompted a fourth hole (#42) from the same location and in the same direction but at a steeper 65° angle to undercut the third hole. It was pushed to 480.5 m, effectively reaching the eastern limit of hole 3 except at a vertical depth of 435 m. Although the 2 sets of holes were 300 m apart, the mineralized strike they tested was 200 m. Averill's published comments about how exceptional the pyritization and veining complexity looked for an initial drill campaign helped spawn market speculation that the Thunder Zone is a major emerging gold discovery after last year's disappointment with the Lightning Zone which saw the gold vanish from its northern extent and saw the southern extent interrupted by a diorite plug related to the Durand stock which was not a good deposition host for the younger orogenic fluid flow. The strike of the Thunder Zone was declared open to the north and south while down dip remained open.

The results for hole #41 were released on April 5 and perplexed the market because both the grades and discussion muddied expectations about the Thunder Zone as a wide north-south oriented, structure highly pyritized by an orogenic hydrothermal system also carrying gold whose exposure at the bedrock surface fed a Central Train of fairly coarse gold grains. The Thunder Zone contained two intervals of 13.25 m at 3.28 g/t Au at 124.5 m and 10.12 m of 2.19 g/t Au at 148 m. The 10.6 m gap between ran 0.345 g/t Au. The market was perhaps hoping for grades in the 5-10 g/t range as Endurance Gold has delivered for its Reliance orogenic gold play, and some shareholders scaled back their expectations.

The remaining 145.4 m of the hole was not described, though Averill grudgingly admitted that while it contained sulphides the gold content was anomalous in the 0.1-0.3 g/t range like it is for much of the Rabbit North project and probably related to the older porphyry mineralizing event. The Thunder Zone is characterized as a younger 149 million year old shear controlled orogenic system like the Lightning Zone to the east which fed the Dominic Lake Train, related to some deeper unidentified intrusion, in contrast to the copper-gold porphyry mineralization related to the 215 million year old Durand stock and which is responsible for most of the copper-gold mineralization intersected by decades of exploration at Rabbit North.

Although Tower never disclosed which hole had 130 m of mineralization, the description in the March 1 news release that kicked off market interest pretty much fingered hole #42 which is the only basis for the observation that the Thunder Zone appears to be blossoming at depth. The initial news release mentioned evidence of increasing chalcopyrite. When I talked to Stu Averill several weeks ago he was of the view that any copper mineralization is from the earlier porphyry event and at best a side story peripheral to the structures carrying orogenic gold mineralization. The big surprise in the April 5 release was the discussion of the Rainbow Zone which occurs updip from the Thunder Zone gold intervals and ran 36.0 m of 0.19% copper, 0.34 g/t gold and 0.004% molybdenum. The press release invoked both the Highland Valley deposit to the west which is a Cu-Mo porphyry system of similar copper grade, and the Afton system to the east which is a Cu-Au calc-alkaline porphyry system with a better grade.

I have modified the #41 hole section Tower provided with its news release today to highlight the uncertainty now haunting the market. There are several surprises in the #41 results. The first is why the hole was pushed to 303.5 m when the two Thunder Zone gold intervals show up between 125-157 m. Similarly, why was hole #42 pushed to a similar eastward extent at 480.5 m? The answer seems to be that the drillers chased the sulphides, but it is now clear that the correlation between pyrite and gold does not hold everywhere, which is the disappointment we experienced last year with the northern stepout on the Lightning Zone. It's a reminder that with sulphides one really must wait for assays to find out the gold grade. The second surprise is that the Rainbow Zone, which has a low copper, gold and moly grade occurred in the upper part of hole #41 west of the inferred NS strike of the Thunder Zone, rather than in the bottom part east of the Thunder Zone.

This raises the question of where the 130 m "mineralized" zone mentioned in the March 1 news release begins. I've plotted where the 65 degree hole #42 is relative to #41 which it undercut it in the same eastward direction. In the Mar 1 news release Stu said the Thunder Zone appears to be sub-vertical and that it blossoms at depth. I have created 3 segments of 130 m to illustrate the quandary we now face, one made worse because Stu won't say where within hole #42 that 130 m interval begins ("The mineralized core sections vary in length from approximately 30 m to 130 m; most importantly, the longest intercept is also the deepest and most strongly mineralized" and "Pyritization is most intense in the long, deep intersection of Hole 042 and the pyrite is increasingly accompanied by chalcopyrite, potentially indicating a significant Cu bonus").

When I originally read that I assumed the chalcopyrite was showing up in the bottom part of hole #42 east of the NS oriented Thunder Zone, possibly similar to the diorite plug that got in the way of the Lightning Zone. Reading between the lines from talking to Stu, I think his expectations have been scrambled by the latest results and he is waiting for #42 assays before offering any comments. So to reset our expectations I've colored the 3 segments to represent 3 outcome scenarios.

The black segment symbolizes the elevated copper grade Rainbow Zone and assumes it starts at the same vertical depth as with #41 (plausible since the cover rock beneath the till is a shallow much younger flood basalt that blankets a good part of the property, followed by a short saprolite later that is part of the Rainbow Zone and reflects tropical weathering probably within the Cretaceous period. The black segment ends about where the "sub-vertical" gold enriched Thunder Zone is supposed to begin.

The green segment is a blend of the Rainbow and Thunder Zones positioned on hole #42 to end at the eastern limit of the Thunder gold zone in #41, projected vertically. The red segment assumes that the 130 m interval starts at the western limit of the "sub-vertical" Thunder gold zone. This is the best outcome for an orogenic gold discovery which implies a 50-60 m wide structural zone. The open question is why hole #42 was pushed an extra 118 m deeper so that its horizontal limit lines up with that of #41, and what does the above quote from the March 1 release mean?. For now we are at the mercy of hole #42 results which, despite weaker gold grades in #41 than hoped for, could still be stunning.

Although the market is now looking at the Thunder Zone with a glass half empty perspective, we do appear to have two distinct discovery plays emerging at Rabbit North. The gold based Thunder Zone is the market's priority at the moment, but the unexpected Rainbow Zone has Averill wondering if there is a major copper-gold system to the west which has never seen any drill holes. The geology map shows that holes 41-42 were spotted in Nicola andesitic volcaniclastics which Stu says are contemporaneous with the Durand stock and existing porphyry mineralization. But the area to the west is largely till covered, and the first bedrock encountered in hole #41 was the much younger Chilcotin basalt which is mapped as bedrock 200 m to the north. The area to the west has no drill holes, apparently because there was never a geochemical or geological reason to do so. But if the andesites are mis-mapped, and the reality is a laterally extensive veneer of young basalts, who knows what is lurking to be discovered to the west "under cover".

Averill said he would like to turn that drill around on the same pad and drill west, though they won't do that until after spring thaw. In terms of the geometry of a blind porphyry system, Stu says it is unlikely the porphyry systems are intact in their traditional form; he suspects the Durand stock is tilted west. The presence of moly in the Rainbow zone tells Stu that area is part of the inner core which has lower copper, with the copper shell still to be found. In my annotated section the black 130 m segment begins where hole #42 can be expected to hit the Rainbow Zone beneath the till, basalt, and saprolite sequence. I've presented these three 130 m segments as exclusive alternatives, but in light of Averill's recent reluctance to talk about a "130 m segment", instead of pessimistically wondering where it occurred and what it will assay, one can also optimistically wonder if we will get multiple lengthy mineralized segments representing the copper Rainbow Zone to the west, the gold Thunder Zone in the middle, and perhaps another copper zone to the east. It may be that the Thunder gold zone is a younger system cutting through an older laterally extensive copper system that has eluded discovery due to an extensive cover of till and much younger basalt in this little explored area west of the Durand stock. This lengthy discussion may come across as tedious, but it also represents the entertainment aspect of emerging discovery plays as investors try to decode what a junior has been willing to disclose. |

Tower Resources Ltd (TWR-V)

Bottom-Fish Spec Value |

|

|

| Rabbit North |

Canada - British Columbia |

3-Discovery Delineation |

Au Cu |

Enhanced Section for Hole #41 into the Thunder Zone at Rabbit North |

| Disclosure: JK owns shares of FPX Nickel, Namibia Critical Metals and Verde Agritech; FPX Nickel and Verde Agritech are Good Spec Value rated; Namibia Critical Metals and Tower Resources are Bottom-Fish Spec Value rated |