| Kaiser Watch August 2, 2023: James Bay a new world class lithium district |

| Jim (0:00:00): What did you think about Patriot Battery Metal's maiden resource estimate? |

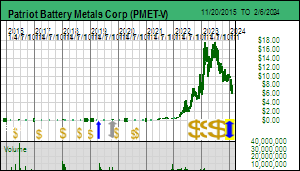

Patriot Battery Metals Inc delivered a world class lithium inferred resource on July 31, 2023 in the form of 109.2 million tonnes of 1.42% Li2O at a 0.4% cut-off grade. This contains 3,835,000 tonnes of lithium carbonate, which is roughly what the IEA projects will be needed annually by 2030 to meet EV deployment goals as part of the net zero emission target for 2050 which limits global temperature change to 1.5 degrees Celsius. It is roughly equal to Rio Tinto's stalled Jadar deposit in Serbia of which Rio Tinto has predicted the world will need 60 by 2035. The resource confirms that the James Bay region of Quebec is a world class lithium district. And the CV5 deposit occupies less than a tenth of the 50 km trend of the Corvette property on which we know there are multiple additional LCT type pegmatite outcrops. By the time PMET is finished exploring the rest of the property there may be four more such open-pittable deposits. But even that does not come close to guaranteeing the supply the world will need as electric vehicles gradually replace internal combustion engine cars. And that doesn't even take into account the possibility that Toyota has indeed solved the problem of a cost effective solid state electrolyte that allows lithium metal to substitute for graphite in the anode of the lithium ion battery.

This news should kickstart Lithium Mania 2.0, in particular in the James Bay region where there is evidence that a much bigger area is fertile for similar pegmatites. Investors should be buying juniors like Brunswick Exploration Inc and Dios Exploration Inc as speculative bets on similar discoveries, which would deliver a ten-fold price gain for Brunswick and a hundred-fold gain for Dios. Almost everybody missed the PMET boat, but there are plenty of boats still idling at the dock, and unlike for metals such as rare earths for which there is room only for a couple more world class deposits, there is room for dozens more such discoveries. Canada has the potential to rival Australia as a supplier of hardrock sourced lithium. But Canadian investors are asleep at the switch. They blew their brains out on bitcoin and cannabis, and what money they have left is now parked in 4%+ yielding bank deposits. In fact, a Financial Times article on August 2 pointed out that American investors have USD $3.5 trillion parked in money market accounts yielding 5%+.

At the moment the junior resource sector looks hopelessly stuck in a rut, and people like myself are starting to be overwhelmed by dark thoughts that the resource junior eco-system may finally be down for the count, as it started to feel in 2015. Back then it was not clear what would trigger a major inflow of risk capital; the old apocalyptic standby of gold going to the moon thanks to fiat currency debasement and hyper-inflation was not getting much traction. And it still is not today even though gold bumbles between $1,900 and its apparent $2,000 ceiling. But this time around the trigger is staring us right in the face, and the apocalyptic theme is that if we do not roll up our sleeves on all fronts to move the energy transition along, we are toast. It isn't despair that it is going to revive the resource juniors; it will be an awakening of determination that, yes, we can do this!

So far, however, Canadian investors were not impressed by the maiden resource estimate. But one of the world's biggest lithium producers, Albemarle Corp, which earlier this year made a conditional offer for Liontown at AUD $2.50 which valued Kathleen Valley at AUD $5 billion (see KW Episode March 29, 2023), and is in a position to understand very deeply what is going on with the energy transition, was very impressed. Kathleen Valley has a M+I+I resource of 156 million tonnes at 1.4% Li2O, which makes it comparable to Corvette whose CV5 zone itself has room for expansion, not to mention multiple repetition within the 50 km Corvette trend which near surface potential Liontown does not have at Kathleen Valley. Four months after Liontown rejected Albemarle's offer the company has a market cap of AUD $6 billion.

PMET's maiden resource still has 3-5 years of feasibility demonstration, permitting and construction to go before it is at the stage of Kathleen Valley, so it cannot command a similar valuation. But Albemarle did not flinch at the current CAD $2 billion valuation (fully diluted). The same day the maiden resource came out it agreed to invest CAD $109 million by purchasing 7,128,341 shares at $15.29, a 7% premium to Monday's close. This gives it a 4.9% fully diluted stake (142,043,367 shares), which is below the US 5% insider reporting threshold. It comes with a 12 month standstill agreement whereby Albemarle cannot increase its fully diluted stake nor sell stock, but it can participate in any financings to maintain its 4.9% stake. There is also a 9 month exclusive period to explore a partnership for developing a lithium hydroxide refinery in Quebec or the United States linked to concentrate supply from Corvette. With the $50 million working capital as of March 31, PMET now has over $150 million to take Corvette through the next stages of additional exploration and feasibility demonstration. There is no need to rely on Bay Street or Wall Street for bought deal financings at deep discounts to the market, nor does this dual listed Canadian company have to rely on Australian brokerage firms. This Albemarle financing takes Patriot Battery Metals back from the Australians and makes it a North American lithium hardrock play.

Does this mean the stock can't go down? Night Market Research's short attack (see KW Episode July 14, 2023) predicted a resource of 73 million tonnes at 1.28% Li2O, which I thought would be quite an accomplishment, but this number was chosen to make all the analyst predictions look excessive when the actual resource came out. In fact, the base case resource is superior to any of the other estimates. PMET published resources at different cutoff grades. At 1% the resource is 77.6 million tonnes at 1.69% and at 1.1% it is 69.3 million tonnes at 1.77% Li2O. NMR's prediction falls within this tonnage range, but the PMET resource grade is 30%-40% higher. The resource is open-pit constrained and only included spodumene mineralization. The size of the resource is definitely not a reason for the stock to decline.

To put the base case resource into a gold context, at $10/lb lithium carbonate the rock value is $763/t which is the same as 0.38 opt gold or 11.9 g/t. At the current $17/lb price it is 0.65 opt or 20.2 g/t. The latter is the same as a 71 million oz gold deposit at $2,000/oz gold. At the more conservative $10/lb lithium carbonate price it is equivalent to 41 million ounces gold in situ. Open-pittable! Are Canadian investors ignoring this outcome because they are having a bad flashback to 1997 when John Felderhof waved his arms to describe a fake 80 million ounce Busang deposit? Are they thinking of Rare Earth Mania 2.0 when China's export controls sent rare earth prices to the moon and on paper deposits like Quest's Strange Lake had a similar gold equivalent in situ value? These are bad comparisons. When the IEA predicts a 600% lithium supply expansion by 2030 as necessary for the energy transition, it implies a future annual value of $100-$200 billion for global lithium supply, in the same league as gold and copper. Canadian investors need to wake up to this unprecedented opportunity in their own backyard.

Where NMR may still have a point about interim downside is that there are 24.3 million warrants between $0.35-$0.75 that are heavily in the money which would raise about $17.4 million if exercised but require $355 million worth of stock sales at the Albemarle private placement price. This overhang is still present, but no longer as a big a threat as last week. By validating the valuation through its $109 million investment and sparing PMET the headache of dealing with the brokerage sector to continue advancing Corvette, Albemarle has significantly reduced the anxiety of those warrant holders which otherwise could translate into a cascade of panic selling.

Ironically, the biggest threat now is that these warrant holders will short the stock in the hope of buying back in the market a few dollars lower while keeping their warrants alive, stripping out incoming capital while they wait for a major liquidity event such as another major lithium producer making a hostile bid for the entire company. But with about 73% of those warrants expiring at the end of 2023, this sort of market abuse will be short-lived. In the absence of a pre-emptive buyout offer there is not much left to expect on the upside for PMET during the rest of the year, but it will start to serve as an ATM machine for risk capital deployed into other lithium exploration juniors, especially ones active in the James Bay region, assuming forest fires subside and the access closures are lifted. |

Patriot Battery Metals Corp (PMET-V)

Unrated Spec Value |

|

|

| Corvette |

Canada - Quebec |

3-Discovery Delineation |

Li |

Patriot Battery Metal Maiden Resource Estimate for CV5 Zone at Corvette |

Comparison of Corvette with other North and South American lithium deposits |

Comparison of Corvette with major global lithium deposits |

Corvette Geology and Lithium Pegmatite Trend |

Lithium Rock Value Matrix and Price Chart |

| Jim (0:12:53): Why did Solitario do a private placement with Newmont? |

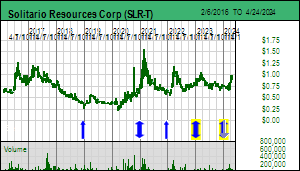

Solitario Zinc Corp, which seems to have changed its name to Solitario Resources Corp though I have not yet seen a formal notice from the TSX, perhaps because the junior also trades on the NYSE, announced a USD $2.5 million financing at USD $0.60 on August 2, 2023 which boosts Newmont's existing stake to 9.95% of issued stock. Solitario now has about USD $6.1 million working capital. This financing done at a modest premium to the market gives Newmont certain pre-emptive rights with regard to the sale, financing and operation of the Golden Crest project in South Dakota. The financing makes Newmont the largest single Solitario shareholder, but it has not been granted a board seat. Why did Solitario do this financing now when the company may be drilling Golden Crest this fall for the first time ever in the property's history?

In KW Episode May 12, 2023 I explained why the USFS plan of operations permit the company expected by April in order to start drilling in May was delayed by an unrelated USFS distraction. There was hope that a permit would be in hand to allow a September drill program to begin, possibly with two rigs, because between November and April the project has too much snow to justify winter drilling a property that does not yet have a discovery. Unfortunately, the US Forest Service does not seem to have any sense of urgency and has yet to issue a "Finding of No Significant Impact" notice, FONSI for short. It may be only a couple weeks away, but once a FONSI is issued it is at least another two months before a drill permit is approved because first the FONSI must be exposed to a public comment period during which every anti-mining crank can lodge an objection, followed by administrative steps to deal with the comments. CEO Chris Herald sees August 20 as the date beyond which if no FONSI has been issued there will be no time to mount a drill program before the snow flies.

I made Solitario a KRO Favorite for 2023 based on the sleeper 30% carried interest in the Florida Canyon zinc-lead project in Peru and its grassroots generated Golden Crest project which I think is perhaps the last major frontier in the United States where it is possible to make a world class gold discovery based on surface indications. Tracker December 20, 2022 explains the story which has not really hit the radar of the investing public but has received intense scrutiny from Newmont and other major gold producers who have signed non-disclosure agreements. Golden Crest is west of the Black Hills that host the former Homestake Mine which yielded about 70 million ounces gold from shear structures within banded iron formation folds in the Precambrian basement. The Wharf system operated by Coeur Mining to the northwest had about 10 million ounces hosted by younger carbonates wholse mineralizing event was about 60 million years ago. Coeur only owns the right to mine the younger sediments above the Precambrian basement, with Barrick, via its acquisition of Homestake, owning the deeper rights. The basement rocks have thus never been explored. One of the theories is that 1.72 billion years ago was a major gold mineralizing event that created the Homestake deposit, which was buried by Paleozoic carbonates similar to the Wharf area, but thanks to uplift of the Black Hills those carbonates eroded away a long time ago. The suspicion is that the mineralizing event during the Tertiary period harvested Precambrian gold and redeposited it in the overlying Paleozoic carbonates. But with the split ownership the basement at Wharf has never been explored.

Golden Crest is extremely interesting because it has carbonates at surface which are younger than the Wharf carbonates, and yet gold mineralization is present at surface which past prospectors failed to recognize. The company has refrained from sharing a big picture view of everything that has emerged because it is not sure that it owns everything that might be part of a giant gold system whose roots potentially are in the Precambrian basement that starts below 400 m depth. So the public just gets to see the results of surface sampling here and there. But this summer Solitario has a 20 man crew at Golden Crest conducting a major soil sampling program which the company sees as key to seeing the gold structures beneath a 2 ft deep veneer of soil cover with lots of vegetation. In fact, Solitario has had such success identifying new gold in soil anomalies that it has already started a separate plan of operations application to allow future drilling of these areas. But until the market sees how the gold is distributed in the third dimension it just sees a gold geochemical anomaly with higher grade structures here and there. As Chris Herald started to realize the USFS permit might not come through in time to allow even a late season 2023 drill program, he became nervous about Solitario's treasury and general market apathy towards the resource sector. So he accepted the financing offer from Newmont so that he does not have to worry about getting properly funded when he finally has a drill permit. The reason I have assigned only a Fair Speculative Value is the uncertainty about the timing of a drill program that can turn this prospect into a major gold discovery.

Although it looks like we may have to wait until May 2024 to see drilling get underway at Golden Crest, Solitario did announce last week that Nexa plans a 4,000 m drill program at the Florida Canyon zinc-lead silver project in Peru where Solitario has a 30% carried through production interest. The property was last drilled in 2019 and has since been bogged down by Peru's covid complications. Nexa has secured a community agreement that will allow it to drill through 2025. It is permitting numerous targets in the valley well beyond the existing deposit and appears to have the goal of assessing what is this area's global potential before starting a feasibility study on the main deposit. The purpose would be to allow it choose a bigger processing scale that would deplete the existing resource faster than community stakeholders would like. But this would be justified if they have evidence of additional CRD style deposits in the area that could be developed at a later date to feed the mill. The current program involves holes that step out 500 m or more from the existing drilling footprint, so there is potential for news later this year that Florida Canyon is scaling bigger. Solitario does not plan to consider a spinout to facilitate a future buyout by Nexa until it is confident that Golden Crest is turning into a major gold discovery. At the current valuation speculators can choose to allocate the market cap to Florida Canyon or Golden Crest. |

Solitario Zinc Corp (SLR-T)

Favorite

Fair Spec Value |

|

|

| Golden Crest |

United States - South Dakota |

2-Target Drilling |

Au |

Hypothetical Geological Section for Golden Crest screamining to be drilled |

Florida Canyon Map showing additional targets Nexa is permitting |

| Jim (0:19:32): What do you think of the new SEDAR Plus filing system unveiled last week by the Canadian Securities Administrators? |

The Canadian Securities Administrators apparently threw the switch from the old SEDAR system to the new one called SEDAR Plus on July 25, 2023, though I didn't notice until July 28 when I clicked on one of my company SEDAR bookmarks to retrieve the latest financials and annual meeting circular and got a page not found browser error. Years ago I heard they planned to upgrade the system that has reliably served me for the past two decades, and I cringed that it would become something like the Canadian insider reporting system called SEDI but which everybody calls SHITTY because it has such an awkward multi-click interface and presentation format (it was designed by the Canadian software house that delivered the disastrous Obamacare online system). But it wasn't happening and so I had developed a false sense of security. My initial instinct to be afraid was correct.

They say if it isn't broken don't fix it. SEDAR was created in 1999 as a repository for regulatory filings Canadian listed companies are required to make. These include news releases, financial statements, meeting circulars and technical reports. It also includes a bunch of clutter of interest only to lawyers, not investors. It replaced the old physical file system where you had to visit a securities commission or stock exchange and request a file which wasn't guaranteed to be intact. My only complaint was that the documents in the company listing had generic names; news releases did not have titles and technical reports did not have a project name. Normally I rely on a fee based service like Stockwatch to retrieve fresh news, but that service is text based, and many news releases have complex tables and graphics that help explain the story. When that mattered I would go directly to a company's list of SEDAR filings to retrieve a pdf version of the news release because generally the news release was not yet up on the company's web site, and, more often than not, when it was available it was as a printer unfriendly html page. Kudos to those companies who would have the news release up on their web site when it was released with an additional link to a printer friendly pdf version.

With the help of the Internet SEDAR democratized investor access to information about publicly listed Canadian companies. It was better than the EDGAR system of the United States because the documents were pdfs with printer friendly formatting whereas the US filings are in an awful html form that wastes a lot of paper when printed. But like EDGAR, once you knew the company's profile ID, you could save a bookmark (they call them favorites today), and any time you clicked it you could get a direct listing of all the filings in chronological descending order. One more click and you would have the document you needed.

The CSA did not like this design because it also allowed web crawler robots to scrape the site and download documents, though the pdfs served by SEDAR all had the same generic name so you needed a smart web crawler to remember what it "clicked" on and match that name to the file. To stymie the web crawlers SEDAR presented an alphanumeric captcha which took 5 seconds to enter and allowed you to poke around for 20 minutes or so before it expired. But if you proved too efficient at retrieving documents, SEDAR would suspect you were violating its terms of service and ask you to click on all the photos in a set with, for example, cars in it before allowing you to resume. It seems making efficient use of SEDAR was what they didn't want investors to do, and with the launch of SEDAR Plus they have finally entrenched inefficiency and delivered what should properly called SEDAR Plus ClickAlot.

They accomplished this inefficiency goal by adopting the design of SEDI which requires you to click through a series of forms that serve pages with a unique, time stamped and temporary url. Don't bother bookmarking any of these URLs to use again later to bypass the ClickAthon because it will not work. It's as if regardless what letter of the alphabet you need, you must first recite all your ABCs like a three year old until you get to the letter you need.

Warning: the following is very tedious to read. To use SEDAR Plus ClickAlot you must go to the Landing Page. Click on "Search SEDAR+ documents" which sgets you the Search Documents or Search Profiles page which has a field to enter a company's profile number or a partial spelling of the company's name. Since the profile # is a 10 digit number which you as an investor won't know unless you are an idiot savant, you pretty much have to type in the company's name, or at least part of it.

Type in the first part of the company name - 5-10 key strokes - and then click Search again. This will give you a list of names that begin with what you typed or have it as part of the name. Only 10 are displayed at a time. If you are lucky your company will be in the first batch. Click the name and it will serve you the company details page which under old SEDAR used to fit on your browser screen but now stretches down multiple scrolled pages. Click on the "Documents search and download documents for this profile" link. Scroll past the resulting form to the documents list below.

You will get a randomly ordered list. Click "submitted date" and you will get a list of documents starting with the oldest filing at the top. Since it displays only 10 of hundreds of documents at a time this is useless. Click "submitted date" again. (Common sense says the default order should be chronological descending - why it starts with a useless random order and then sorts oldest ascending before finally providing a most recent descending order is mind-boggling. Not only are the software designers inmates running an asylum, but, given that the asylum's orderlies had plenty of time to use the system, notice how stupidly inefficient this was, and raise the alarm, why was this not fixed before launching it? Is it because nobody within the Canadian regulatory system gives a damn about their purpose?)

Now the list is in chronological descending order like the old SEDAR listing used to be, except in batches of 10. If you are lucky you will have your document with the next mouse click. If you are unlucky there are a couple dozen useless certification documents to get past.

Assuming you typed 10 characters of the company's name and didn't mistype, you have just done 20 key strokes starting with the SEDAR Plus ClickAlot bookmark in your browser just to get one document. Half of these are link clicks so you will have to wait for the SEDAR Plus server to retrieve and serve the document. Are the documents any different than under the old SEDAR? No, they are the same. What is Plus about the new SEDAR other than it takes an absolutely unavoidable lot of clicks for an investor to retrieve a useful document?

The other day there was a warning the site will be indefinitely unavailable due to "maintenance" during the evening and on weekends, which is when investors might have time to research Canadian listed companies. Now it says "the CSA Service Desk is currently experiencing high call volumes". Everybody I have spoken to from retail investors to industry professionals is horrified by what the Canadian regulatory system has turned the good old reliable SEDAR into: a time wasting, user unfriendly monstrosity that is supposed to be a free public service paid for by the filing fees of listed companies.

The Canadian Stock Exchange's head Richard Carleton must have anticipated the investor hostility of the people in charge of Canada's regulatory filing system. The CSE has a Listings page where you can enter the symbol or name of a company which generates a list from which you can select your target company. This delivers a page dedicated to that company with a URL that is permanent and which you can bookmark so that one click gives you access to everything available about that company. This includes a chart, links to all the news releases, capitalization data which doesn't just have issued but the dilution total and which is remarkably up to date, market trading data including depth by order and price, and, best of all, a slider box that lists in chronological descending order all the SEDAR filings done by the company, and not in batches of 10. This is a tremendous resource!

The TMX Group which owns the TSX and TSXV exchanges also offers a Listed Company Directory which allows you to get to a company page with a permanent URL that has several sections of information which are not behind a paywall. But don't waste your time; there are no SEDAR filings and the web pages are sluggish, inefficiently laid out, and cluttered with random advertisements of stuff like weird hats and T-shirts with dog faces. It feels like you have landed on the web site of a defunct junior whose domain name was grabbed by a Chinese company after it lapsed and now uses it to market trash. If you are willing to pay a monthly fee to get access to all the Canadian listed companies, Stockwatch is the best option, because its company pages include links to all the SEDAR filings. The only problem with the Stockwatch system is that its company data is based on the symbol rather than an identifier that stays constant while a company goes through endless name and symbol changes. When old symbols get recycled by different companies the chain to old data gets broken. The only gratitude I feel towards the CSA is that it took them so long to wreck a good thing thoughI do appreciate the humor behind the Sedar+ logo which looks like it has been splattered by rotten tomatoes. Farewell SEDAR, you served us well. |

Out with the old SEDAR in the new SEDAR Plus |

Demonstration of how the new SEDAR Plus ClickAlot works |

| Disclosure: JK owns Brunswick and Dios; Solitario and Brunswick are Fair Spec Value rated Favorites; Dios is Bottom-Fish Spec Value rated; Patriot Battery is unrated |