Home / Research Tools

Research Tools

| | Corporate Profile: Copper Canyon Resources Ltd

Publisher: Kaiser Research Online

Author: Copyright 2013 John A Kaiser

|

| |

Copper Canyon Resources Ltd (CPY-V)

| Copper Canyon is a June 2006 spin-out from Eagle Plains Resources that has as its primary asset the Copper Canyon project that adjoins Novagold's Galore Creek project. The project has an inferred resource of 152 million tonnes grading 0.31% Cu, 0.52 g/t Au, and 6.32 g/t Ag (1.04 billion copper pounds, 2.5 million gold ounces, and 31 million silver ounces.) Novagold is earning an 80% interest in the Copper Canyon project, and in December 2010 announced a takeover offer for Copper Canyon on the basis of 0.0425 Novagold shares per CPY share, roughly $0.60 per share, for a transaction value of approximately $34.1 million shares. In March 2011 a revised offer was agreed upon, with Novagold offering 0.735 Novagold share, plus one share of a spin-out company for every four Copper Canyon shares held. |

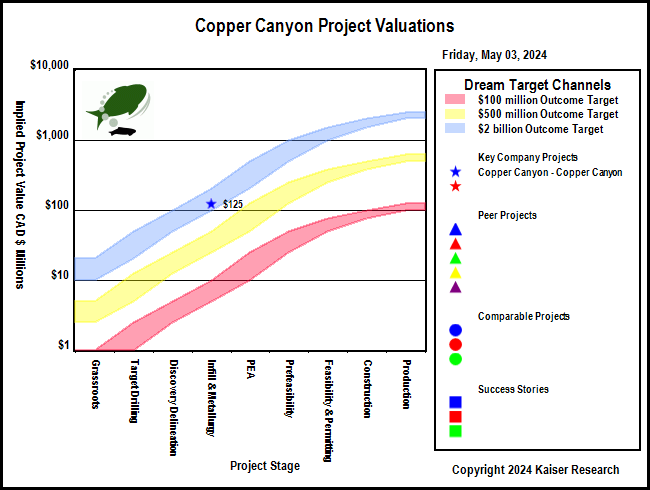

Key to Understanding IPV Charts and Spec Value Hunter Tables

| An IPV Chart is a graphical presentation of a Spec Value Hunter table that has been constructed according to the Rational Speculation Model developed by John Kaiser. The IPV Chart allows speculators to identify which projects offer poor, fair or good speculative value in both absolute and relative terms. The speculative value depends on the project stage, the project's implied value as calculated by the company's fully diluted capitalization, stock price and net project interest, and the dream target deemed appropriate for the project. A dream target is what a project would be worth in discounted cash flow terms once in production. |

| Green background indicates the dream target judged appropriate for this play by John Kaiser - otherwise unranked. |

Poor Speculative Value -   |

Fair Speculative Value -  |

Good Speculative Value -   |

Note:   narrow arrows indicate IPV is outside the fair value channel but within 25% of the fair value limits narrow arrows indicate IPV is outside the fair value channel but within 25% of the fair value limits |

| Click on the company name to view the company profile, the project name to view project details. |

| Click on the project icon if its background is shaded to get the IPV Chart for that company. |

Copper Canyon Project Valuations

| Company | Project | Country | Stage | IPV $

MM |

$100 | UPV

$500 |

$2000 | Target Metals | Deposit Style |

| Key Company Projects |

|

Copper Canyon Resources Ltd (CPY-V) | Copper Canyon |  | Canada | Infill & Metallurgy |

$125 |  |  |

| Copper Gold | Porphyry |

|

|

| Peer Projects |

|

|

|

|

|

|

| Comparable Projects |

|

|

|

|

| Success Stories |

|

|

|

|

| |

| | You can return to the Top of this page

|

|