| | Sprott-Stansberry 2015 Symposium Index

Publisher: Kaiser Research Online

Author: Copyright 2015 John A. Kaiser

|

| |

KRO Theme Index: Sprott-Stansberry 2015 Symposium Exhibitors

| Index Criteria: The Sprott-Stansberry 2015 Symposium was a collaboration between the Sprott-Global brokerage complex of which Rick Rule and Eric Sprott are the principals, and Stansberry Research, a publisher of financial information services and newsletters headed by Porter Stansberry. Held in Vancouver from July 28-31, 2015, the conference attracted about 500 paying delegates and featured a group of public companies that were invited because at one time or another they were financed or recommended by the entities related to the conference principals, and presumably still regarded as worthy of attention despite the carnage in the resource sector since 2011. The index, consisting of the TSX/TSXV listed exhibitors, was created to document the past performance of the Canadian listed exhibitors and track how they perform going forward. |

| Index Method: Each member of a KRO Index is assigned a value of $1,000 when added to the index, which is divided by the closing stock price on the inclusion date to arrive at a quantity of shares which remains constant during the life of the index. In the event of a split or consolidation, the quantity is adjusted by that ratio. If a company is divided into separate entities, the surviving entity that meets the index criteria has its quantity recalculated by dividing the prior day value by the subsequent closing price of the surviving entity. If a company is delisted pursuant to a takeover bid or merger, the value on the delisting day remains part of the index and the total members will include that company. The same applies to companies which have lost their eligibility. The value of the index is the total value divided by the number of members, which will be 1000 at the official start date. The value of the TSXV Index on the offcial start date is normalized to 1000, and the resulting factor is used to adjust the TSXV Index for comparison purposes. |

| Index Start Date | July 28, 2015 | Current Date | May 8, 2018 |

| Index End Date |

| Current Value | 2377.4 |

| Index backdated to | January 3, 2012 | Total Members | 51 |

| Sprott-Stansberry 2015 Symposium Exhibitors - Members as of May 8, 2018 |

|---|

| Ceased to be index members due to delisting or ineligibility - their value is frozen as of the end date and included in the daily index calculation. |

|---|

| Underwent a rollback or split which resulted in an adjustment to the share quantity used in the member's index value calculation. |

|---|

| Company | Active | Start | End | Quantity | Weight | Value | Chg |

|---|

| Africa Oil Corp (AOI-T) | Yes | 7/28/2015 |

| 533 | 0.5% | 640 | (36.0%) |

| Alexco Resource Corp (AXR-T) | Yes | 7/28/2015 |

| 2,469 | 3.9% | 4,740 | 374.0% |

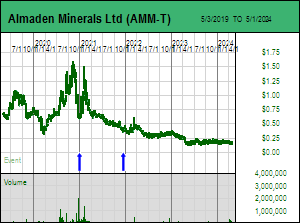

| Almaden Minerals Ltd (AMM-T) | Yes | 7/28/2015 |

| 1,266 | 1.1% | 1,329 | 32.9% |

| Altius Minerals Corp (ALS-T) | Yes | 7/28/2015 |

| 73 | 0.9% | 1,031 | 3.1% |

| Amerigo Resources Ltd (ARG-T) | Yes | 7/28/2015 |

| 3,636 | 3.1% | 3,745 | 274.5% |

| Atlantic Gold Corp (AGB-V) | Yes | 7/28/2015 |

| 3,571 | 5.5% | 6,713 | 571.3% |

| Auryn Resources Inc (AUG-T) | Yes | 7/28/2015 |

| 820 | 1.1% | 1,394 | 39.4% |

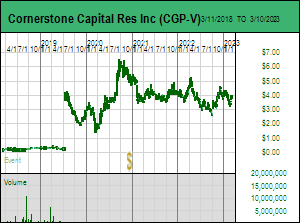

| Cornerstone Capital Res Inc (CGP-V) | Yes | 7/28/2015 |

| 50,000 | 10.5% | 12,750 | 1,175.0% |

| Crops Inc (COPS-V) | Yes | 7/28/2015 |

| 4,651 | 0.3% | 372 | (62.8%) |

| Denison Mines Corp (DML-T) | Yes | 7/28/2015 |

| 1,695 | 0.8% | 1,017 | 1.7% |

| EMX Royalty Corp (EMX-V) | Yes | 7/28/2015 |

| 1,667 | 1.5% | 1,800 | 80.0% |

| Endeavour Silver Corp (EDR-T) | Yes | 7/28/2015 |

| 581 | 1.8% | 2,150 | 115.0% |

| Evrim Resources Corp (EVM-V) | Yes | 7/28/2015 |

| 9,091 | 9.0% | 10,909 | 990.9% |

| First Majestic Silver Corp (FR-T) | Yes | 7/28/2015 |

| 243 | 1.8% | 2,153 | 115.3% |

| First Mining Gold Corp (FF-T) | Yes | 7/28/2015 |

| 2,667 | 1.2% | 1,414 | 41.4% |

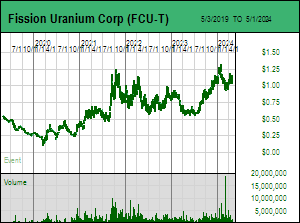

| Fission Uranium Corp (FCU-T) | Yes | 7/28/2015 |

| 1,408 | 0.8% | 915 | (8.5%) |

| Gold Standard Ventures Corp (GSV-T) | Yes | 7/28/2015 |

| 2,000 | 3.4% | 4,120 | 312.0% |

| Golden Arrow Resources Corp (GRG-V) | Yes | 7/28/2015 |

| 3,333 | 1.3% | 1,583 | 58.3% |

| Goldmining Inc (GOLD-V) | Yes | 7/28/2015 |

| 1,724 | 1.6% | 1,983 | 98.3% |

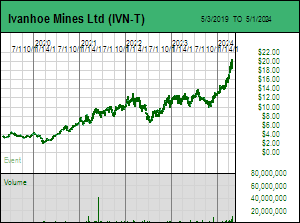

| Ivanhoe Mines Ltd (IVN-T) | Yes | 7/28/2015 |

| 1,515 | 3.6% | 4,378 | 337.8% |

| Kaizen Discovery Inc (KZD-V) | Yes | 7/28/2015 |

| 4,878 | 0.3% | 366 | (63.4%) |

| Kaminak Gold Corp (KAM-V) | Yes | 7/28/2015 | 7/20/2016 | 1,538 | 3.4% | 4,137 | 313.7% |

| Lara Exploration Ltd (LRA-V) | Yes | 7/28/2015 |

| 4,000 | 2.2% | 2,680 | 168.0% |

| Liberty Gold Corp (LGD-T) | Yes | 7/28/2015 |

| 2,597 | 0.9% | 1,065 | 6.5% |

| Lucara Diamond Corp (LUC-T) | Yes | 7/28/2015 |

| 503 | 0.8% | 1,016 | 1.6% |

| Lundin Gold Inc (LUG-T) | Yes | 7/28/2015 |

| 273 | 1.2% | 1,411 | 41.1% |

| Lydian International Ltd (LYD-T) | Yes | 7/28/2015 |

| 2,564 | 0.8% | 974 | (2.6%) |

| Medgold Resources Corp (MED-V) | Yes | 7/28/2015 |

| 11,765 | 1.9% | 2,353 | 135.3% |

| Midas Gold Corp (MAX-T) | Yes | 7/28/2015 |

| 2,899 | 2.3% | 2,812 | 181.2% |

| Midland Exploration Inc (MD-V) | Yes | 7/28/2015 |

| 1,538 | 1.3% | 1,600 | 60.0% |

| Millrock Resources Inc (MRO-V) | Yes | 7/28/2015 |

| 5,000 | 1.0% | 1,225 | 22.5% |

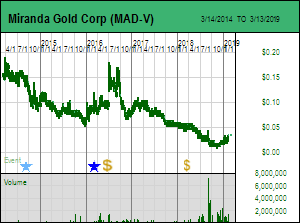

| Miranda Gold Corp (MAD-V) | Yes | 7/28/2015 |

| 12,500 | 0.5% | 563 | (43.8%) |

| Mirasol Resources Ltd (MRZ-V) | Yes | 7/28/2015 |

| 1,176 | 1.8% | 2,234 | 123.4% |

| Nevsun Resources Ltd (NSU-T) | Yes | 7/28/2015 |

| 228 | 0.8% | 1,017 | 1.7% |

| NGEx Resources Inc (NGQ-T) | Yes | 7/28/2015 |

| 1,333 | 1.2% | 1,400 | 40.0% |

| Northair Silver Corp (INM-V) | Yes | 7/28/2015 | 4/21/2016 | 25,000 | 3.3% | 4,000 | 300.0% |

| Novagold Resources Inc (NG-T) | Yes | 7/28/2015 |

| 249 | 1.3% | 1,571 | 57.1% |

| Platinum Group Metals Ltd (PTM-T) | Yes | 7/28/2015 |

| 2,532 | 0.4% | 519 | (48.1%) |

| Premier Gold Mines Ltd (PG-T) | Yes | 7/28/2015 |

| 526 | 1.3% | 1,552 | 55.2% |

| Pretium Resources Inc (PVG-T) | Yes | 7/28/2015 |

| 163 | 1.2% | 1,410 | 41.0% |

| Pure Gold Mining Inc (PGM-V) | Yes | 7/28/2015 |

| 8,696 | 4.9% | 6,000 | 500.0% |

| Radius Gold Inc (RDU-V) | Yes | 7/28/2015 |

| 13,333 | 1.2% | 1,467 | 46.7% |

| Reservoir Capital Corp (REO-V) | Yes | 7/28/2015 |

| 2,564 | 0.1% | 128 | (87.2%) |

| Reservoir Minerals Inc (RMC-V) | Yes | 7/28/2015 | 6/24/2016 | 241 | 1.8% | 2,224 | 122.4% |

| Revelo Resources Corp (RVL-V) | Yes | 7/28/2015 |

| 8,000 | 0.2% | 200 | (80.0%) |

| Riverside Resources Inc (RRI-V) | Yes | 7/28/2015 |

| 6,061 | 1.3% | 1,546 | 54.6% |

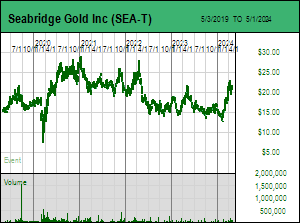

| Seabridge Gold Inc (SEA-T) | Yes | 7/28/2015 |

| 189 | 2.1% | 2,597 | 159.7% |

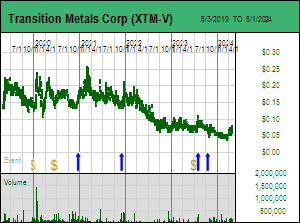

| Transition Metals Corp (XTM-V) | Yes | 7/28/2015 |

| 11,111 | 1.2% | 1,500 | 50.0% |

| True Gold Mining Inc (TGM-V) | Yes | 7/28/2015 | 4/27/2016 | 5,556 | 3.1% | 3,723 | 272.3% |

| Uranium Energy Corp (UEC-A) | Yes | 7/28/2015 |

| 758 | 1.0% | 1,182 | 18.2% |

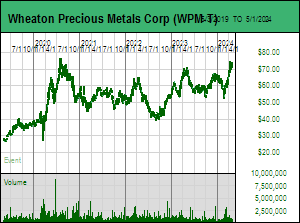

| Wheaton Precious Metals Corp (WPM-T) | Yes | 7/28/2015 |

| 59 | 1.4% | 1,640 | 64.0% |

Sprott-Stansberry 2015 Symposium Exhibitors - Market Activity for May 8, 2018

Open Bottom-Fish or Spec Value Hunter Recommendation - Click for Recommendation Status Open Bottom-Fish or Spec Value Hunter Recommendation - Click for Recommendation Status |

| Company |

|

Volume |

High |

Low |

Close |

Chg |

MI% |

RS% |

W% |

| Africa Oil Corp (AOI-T) |

|

50,900 |

$1.200 |

$1.160 |

$1.200 |

$0.030 |

2.6% |

3.1% |

1% |

| Alexco Resource Corp (AXR-T) |

|

62,300 |

$1.980 |

$1.900 |

$1.920 |

($0.040) |

-2.0% |

-1.5% |

4% |

| Almaden Minerals Ltd (AMM-T) |

|

800 |

$1.060 |

$1.020 |

$1.050 |

$0.000 |

0.0% |

0.5% |

1% |

| Altius Minerals Corp (ALS-T) |

|

15,300 |

$14.600 |

$14.130 |

$14.130 |

($0.170) |

-1.2% |

-0.7% |

1% |

| Amerigo Resources Ltd (ARG-T) |

|

8,600 |

$1.060 |

$1.030 |

$1.030 |

($0.020) |

-1.9% |

-1.4% |

3% |

| Atlantic Gold Corp (AGB-V) |

|

1,160,900 |

$1.900 |

$1.830 |

$1.880 |

$0.010 |

0.5% |

1.1% |

6% |

| Auryn Resources Inc (AUG-T) |

|

44,600 |

$1.725 |

$1.670 |

$1.700 |

$0.030 |

1.8% |

2.3% |

1% |

| Cornerstone Capital Res Inc (CGP-V) |

|

145,200 |

$0.260 |

$0.250 |

$0.255 |

($0.005) |

-1.9% |

-1.4% |

11% |

| Crops Inc (COPS-V) |

|

0 |

$0.000 |

$0.000 |

$0.080 |

$0.000 |

0.0% |

0.0% |

0% |

| Denison Mines Corp (DML-T) |

|

83,100 |

$0.610 |

$0.600 |

$0.600 |

$0.000 |

0.0% |

0.5% |

1% |

| EMX Royalty Corp (EMX-V) |

|

6,900 |

$1.110 |

$1.080 |

$1.080 |

($0.040) |

-3.6% |

-3.0% |

1% |

| Endeavour Silver Corp (EDR-T) |

|

318,200 |

$3.720 |

$3.550 |

$3.700 |

$0.070 |

1.9% |

2.5% |

2% |

| Evrim Resources Corp (EVM-V) |

|

230,400 |

$1.280 |

$1.180 |

$1.200 |

($0.050) |

-4.0% |

-3.5% |

9% |

| First Majestic Silver Corp (FR-T) |

|

507,400 |

$8.920 |

$8.610 |

$8.860 |

$0.110 |

1.3% |

1.8% |

2% |

| First Mining Gold Corp (FF-T) |

|

428,500 |

$0.540 |

$0.510 |

$0.530 |

($0.010) |

-1.9% |

-1.3% |

1% |

| Fission Uranium Corp (FCU-T) |

|

443,400 |

$0.670 |

$0.640 |

$0.650 |

($0.010) |

-1.5% |

-1.0% |

1% |

| Gold Standard Ventures Corp (GSV-T) |

|

34,700 |

$2.080 |

$2.010 |

$2.060 |

($0.020) |

-1.0% |

-0.4% |

3% |

| Golden Arrow Resources Corp (GRG-V) |

|

99,100 |

$0.490 |

$0.470 |

$0.475 |

($0.005) |

-1.0% |

-0.5% |

1% |

| Goldmining Inc (GOLD-V) |

|

201,200 |

$1.170 |

$1.120 |

$1.150 |

$0.020 |

1.8% |

2.3% |

2% |

| Ivanhoe Mines Ltd (IVN-T) |

|

1,292,500 |

$2.940 |

$2.830 |

$2.890 |

$0.020 |

0.7% |

1.2% |

4% |

| Kaizen Discovery Inc (KZD-V) |

|

0 |

$0.000 |

$0.000 |

$0.075 |

$0.000 |

0.0% |

0.0% |

0% |

| Lara Exploration Ltd (LRA-V) |

|

1,600 |

$0.670 |

$0.670 |

$0.670 |

$0.010 |

1.5% |

2.0% |

2% |

| Liberty Gold Corp (LGD-T) |

|

72,900 |

$0.415 |

$0.410 |

$0.410 |

($0.005) |

-1.2% |

-0.7% |

1% |

| Lucara Diamond Corp (LUC-T) |

|

407,900 |

$2.075 |

$2.010 |

$2.020 |

($0.020) |

-1.0% |

-0.4% |

1% |

| Lundin Gold Inc (LUG-T) |

|

15,200 |

$5.200 |

$5.130 |

$5.170 |

$0.010 |

0.2% |

0.7% |

1% |

| Lydian International Ltd (LYD-T) |

|

290,200 |

$0.380 |

$0.355 |

$0.380 |

$0.020 |

5.6% |

6.1% |

1% |

| Medgold Resources Corp (MED-V) |

|

22,000 |

$0.200 |

$0.200 |

$0.200 |

($0.010) |

-4.8% |

-4.2% |

2% |

| Midas Gold Corp (MAX-T) |

|

112,600 |

$0.980 |

$0.950 |

$0.970 |

$0.010 |

1.0% |

1.6% |

2% |

| Midland Exploration Inc (MD-V) |

|

3,100 |

$1.050 |

$1.000 |

$1.040 |

($0.020) |

-1.9% |

-1.4% |

1% |

| Millrock Resources Inc (MRO-V) |

|

30,500 |

$0.245 |

$0.245 |

$0.245 |

$0.000 |

0.0% |

0.5% |

1% |

| Miranda Gold Corp (MAD-V) |

|

0 |

$0.000 |

$0.000 |

$0.045 |

$0.000 |

0.0% |

0.0% |

0% |

| Mirasol Resources Ltd (MRZ-V) |

|

6,600 |

$1.900 |

$1.830 |

$1.900 |

$0.060 |

3.3% |

3.8% |

2% |

| Nevsun Resources Ltd (NSU-T) |

|

6,087,900 |

$4.735 |

$4.350 |

$4.460 |

$0.640 |

16.8% |

17.3% |

1% |

| NGEx Resources Inc (NGQ-T) |

|

126,900 |

$1.090 |

$1.040 |

$1.050 |

$0.040 |

4.0% |

4.5% |

1% |

| Novagold Resources Inc (NG-T) |

|

181,500 |

$6.340 |

$6.030 |

$6.310 |

$0.180 |

2.9% |

3.5% |

1% |

| Platinum Group Metals Ltd (PTM-T) |

|

241,900 |

$0.225 |

$0.200 |

$0.205 |

$0.000 |

0.0% |

0.5% |

0% |

| Premier Gold Mines Ltd (PG-T) |

|

133,900 |

$2.970 |

$2.930 |

$2.950 |

$0.000 |

0.0% |

0.5% |

1% |

| Pretium Resources Inc (PVG-T) |

|

321,700 |

$8.870 |

$8.620 |

$8.650 |

($0.210) |

-2.4% |

-1.8% |

1% |

| Pure Gold Mining Inc (PGM-V) |

|

101,800 |

$0.690 |

$0.670 |

$0.690 |

$0.000 |

0.0% |

0.5% |

5% |

| Radius Gold Inc (RDU-V) |

|

27,000 |

$0.110 |

$0.105 |

$0.110 |

$0.005 |

4.8% |

5.3% |

1% |

| Reservoir Capital Corp (REO-V) |

|

0 |

$0.000 |

$0.000 |

$0.050 |

$0.000 |

0.0% |

0.0% |

0% |

| Revelo Resources Corp (RVL-V) |

|

200,000 |

$0.025 |

$0.025 |

$0.025 |

($0.005) |

-16.7% |

-16.1% |

0% |

| Riverside Resources Inc (RRI-V) |

|

0 |

$0.000 |

$0.000 |

$0.255 |

$0.000 |

0.0% |

0.0% |

1% |

| Seabridge Gold Inc (SEA-T) |

|

36,000 |

$13.790 |

$13.580 |

$13.740 |

$0.140 |

1.0% |

1.6% |

2% |

| Transition Metals Corp (XTM-V) |

|

165,000 |

$0.140 |

$0.135 |

$0.135 |

($0.010) |

-6.9% |

-6.4% |

1% |

| Uranium Energy Corp (UEC-A) |

|

790,300 |

$1.600 |

$1.525 |

$1.560 |

$0.000 |

0.0% |

0.5% |

1% |

| Wheaton Precious Metals Corp (WPM-T) |

|

721,300 |

$27.860 |

$27.440 |

$27.790 |

$0.320 |

1.2% |

1.7% |

1% |

| MI% = change in member's index value, RS% = difference in change between overall index and member index values, W% = value weight of member |

| Sprott-Stansberry 2015 Symposium Exhibitors News Releases for May 6, 2018 to May 12, 2018 |

|---|

| Endeavour Silver Corp (EDR-T) | $3.70 |

| May 7, 2018 | 2018 Annual General Meeting Results |

| Gold Standard Ventures Corp (GSV-T) | $2.06 |

| May 8, 2018 | Infill Drilling Expands the Resource Potential at the Pinion Oxide Gold Deposit, Carlin Trend, Nevada |

| Ivanhoe Mines Ltd (IVN-T) | $2.89 |

| May 8, 2018 | (Part 2 of 2) Issues 2018 First Quarter Financial Results and Review of Exploration and Development Activities |

| May 8, 2018 | (Part 1 of 2) Issues 2018 First Quarter Financial Results and Review of Exploration and Development Activities |

| May 7, 2018 | Secures Long term Supply of Treated Bulk Water for the Platreef Platinum, Palladium, Nickel, Copper and Gold Mine in South Africa |

| Midland Exploration Inc (MD-V) | $1.04 |  | May 7, 2018 | Exercise of Warrants for $1,750,300 |

| Nevsun Resources Ltd (NSU-T) | $4.46 |  | May 8, 2018 | Nevsun Board Rejects Euro Sun Led Non Binding Unsolicited Proposal, Citing Inadequate Value and Problematic Structure |

| May 7, 2018 | Lundin Mining and Euro Sun Disclose Proposal to Acquire Nevsun Resources |

| Novagold Resources Inc (NG-T) | $6.31 |

| May 7, 2018 | Election of Directors and Voting Results from 2018 Annual Shareholder Meeting |

| Africa Oil Corp, led by CEO and President Keith Hill, is an oil and gas focused exploration company with assets in Kenya and Ethiopia as well as Puntland (Somalia) through its 45% equity interest in Horn Petroleum Corporation. |  |

| Issued: | 456,617,074 | Working Capital: | $436,292,000 |

| Diluted: | 469,801,764 | As Of: | December 31, 2017 |

| Membership Start Date | July 28, 2015 | Price at Start | $1.88 |

| Membership backdated to | January 3, 2012 | Membership Quantity | 533 |

|

|

| Alexco is an emerging silver producer with an environmental services business focused on remediation of past producing mine sites. Alexco's primary focus is on the Yukon Territory's Keno Hill property, historically one of the world's highest-grade silver districts, where it is combining government-contracted remediation efforts with exploration intended to expand historical resources. Following a production decision in 2009, construction was financed in part through an agreement for Silver Wheaton to purchase 25% of Keno Hill's silver production at $3.90 per ounce in exchange for a $50 million staged payment. Initial production at the past-producing Bellekeno mine, at a rate of 250 tonnes per day, began in Q4 2010, with commercial production declared in early January 2011. For calendar 2011 the company produced 2 million silver ounces, and in 2012 produced 2.15 million ounces, with lead and zinc concentrates sold to Glencore. Going forward the company intends to continue exploration at Keno Hill in order to increase known resources, and to work towards production decisions in regards to potential capacity expansions from mining at the Onek, Lucky Queen and Silver King mine areas. During summer 2013 the company announced it would be suspending mining operations during the upcoming winter of 2013-2014, with plans to resume production in 2014 pending an increase in the silver price. |  |

| Issued: | 101,642,752 | Working Capital: | $18,414,000 |

| Diluted: | 116,035,435 | As Of: | December 31, 2017 |

| Membership Start Date | July 28, 2015 | Price at Start | $0.41 |

| Membership backdated to | January 3, 2012 | Membership Quantity | 2,469 |

|

|

| Almaden Minerals Ltd is a prospect-generator run by Chairman Duane Poliquin, his son, CEO Morgan Poliquin, and CFO Mark Brown which focused on projects in Canada and Mexico. On July 31, 2015 Almaden spun out all projects other than Tuligtic into a new public company called Almadex Minerals Ltd on the basis of 0.6 Almadex for each Almaden share. Tuligtic, located in Mexico's Puebla state, was farmed out to others in 2006-2010, after which Almaden mounted its own drill program that resulted in the discovery of a bulk tonnage epithermal gold-silver deposit called Ixtaca with a 43-101 M+I+I resource of 115,750,000 tonnes at 0.54 g/t gold and 30.9 g/t silver. A PEA completed in Oct 2014 proposed a 30,000 tpd open-pit operation with a 12 year mine life with a CapEx of USD $399 million and OpEx of $14.48 per tonne yielding an after-tax NPV of $515 million (at 5%) and 28% IRR using base case prices of $1,320 per oz gold and $21 per oz silver. The PEA included a ramp-up scenario starting at 7,000 tpd increasing to 30,000 tpd by year six. In Oct 2015 Almaden secured an option to purchase the 7,000 tpd Rock Creek Mill in Alaska for USD $6.5 million which had operated for several months before closing in 2008. |  |

| Issued: | 102,199,625 | Working Capital: | $16,065,496 |

| Diluted: | 119,921,887 | As Of: | December 31, 2017 |

| Membership Start Date | July 28, 2015 | Price at Start | $0.79 |

| Membership backdated to | January 3, 2012 | Membership Quantity | 1,266 |

|

|

| Altius Minerals Corp has evolved from a grassroots Newfoundland/Labrador focused prospect generator to an investment holding company with equity interests in the Voisey's Bay Mine royalty, uranium explorer Aurora Energy, an oil refinery study project called NLRC, and Rambler Metals. In December 2008 Altius added an iron ore exploration and royalty agreement with Kennecott Canada Exploration Inc. where KCEI may earn a 51% interest in eight exploration licences owned by Altius in Labrador. In December 2010 Altius announced a two-year exploration alliance with Cliffs Natural Resources where Cliffs will fund a $1.8 million generative exploration program to explore for ferro-alloy metals within specific areas of Newfoundland and Labrador. The company continues to explore in Newfoundland/Labrador and to generate new prospects. |  |

| Issued: | 43,187,291 | Working Capital: | $58,266,000 |

| Diluted: | 43,667,614 | As Of: | January 31, 2018 |

| Membership Start Date | July 28, 2015 | Price at Start | $13.75 |

| Membership backdated to | January 3, 2012 | Membership Quantity | 73 |

|

|

| Amerigo Resources Ltd has 100% ownership of the Minera Valle Central plant in Chile which processes fresh tailings of Codelco's El Teniente copper-molybdenum mine. MVC also has the right to process up to 45,000 tpd of the nearby Colihues tailings deposit which is estimated to host 214 million tonnes of 0.262% copper and 0.01% molybdenum. |  |

| Issued: | 176,435,635 | Working Capital: | ($4,500,000) |

| Diluted: | 187,435,635 | As Of: | December 31, 2017 |

| Membership Start Date | July 28, 2015 | Price at Start | $0.28 |

| Membership backdated to | January 3, 2012 | Membership Quantity | 3,636 |

|

|

| Atlantic Gold Corp changed its name from Spur Ventures in August 2014. The company is led by CEO and Chairman Steven Dean. In April 2014 the company announced it would be merging with ASX-listed Atlantic Gold NL and focusing on Atlantic's Touquoy and Cochrane Hill gold projects located in the Meguma terrane of Nova Scotia. |  |

| Issued: | 197,188,140 | Working Capital: | ($24,003,425) |

| Diluted: | 252,098,226 | As Of: | December 31, 2017 |

| Membership Start Date | July 28, 2015 | Price at Start | $0.28 |

| Membership backdated to | January 3, 2012 | Membership Quantity | 3,571 |

|

|

| Auryn Resources Inc listed on the TSXV on October 17, 2008 as a capital pool called Georgetown Capital Corp which completed its qualifying transaction in February 2011 by optioning the Tanacross porphyry prospect in Alaska from Full Metal Minerals Ltd after Ivan Bebek and Shawn Wallace acquired control of the shell in late 2009. About $700,000 was spent on Tanacross during 2011, but the option was dropped in early 2012 due to poor results. Georgetown changed its name to Auryn Resources Inc on October 11, 2013 and is currently a shell looking for a project in Eurasia. |  |

| Issued: | 85,858,441 | Working Capital: | $3,473,000 |

| Diluted: | 90,691,157 | As Of: | December 31, 2017 |

| Membership Start Date | July 28, 2015 | Price at Start | $1.22 |

| Membership backdated to | January 3, 2012 | Membership Quantity | 820 |

|

|

| Cornerstone Capital Resources Inc is a prospect generator focused on Ecuador and Chile. It's strategy involves staking grassroots properties based on geology and farming them out to majors and juniors. Its flagship is the Cascabel prospect in northern Ecuador in which SolGold plc has vested for 65% and is earning 85% by producing a BFS at a maximum cost of $20 million after which Cornerstone must participate. Cascabel is a new deep high grade copper-gold discovery made in late 2013. In southern Ecuador Cornerstone owns 100% of the Bella Maria, Cana Brava and Vetas Grande epithermail prospects that are available for farmout. The junior uses a regional stream silt geochemical sampling program to generate prospects. In northern Chile Cornerstone owns 100% of the Miocene gold-silver epithermal and copper porphyry prospect. Cornerstone is headed by CEO Brooke Macdonald. |  |

| Issued: | 589,519,508 | Working Capital: | $1,464,883 |

| Diluted: | 695,312,821 | As Of: | December 31, 2017 |

| Membership Start Date | July 28, 2015 | Price at Start | $0.02 |

| Membership backdated to | January 3, 2012 | Membership Quantity | 50,000 |

|

|

| Focus Ventures Ltd was a shell company controlled by Simon Ridgeway and Mario Szotlender. In March 2009 Radius Gold assigned its interest in the Nueva California gold-silver project in Peru to Focus, but that option was relinquished in March 2011. Focus is now advancing a number of early-stage properties in Mexico and Peru, including the polymetallic Santa Cruz and El Reventon projects in Mexico and the Santa Rosa and Chucara epithermal projects in Peru. |  |

| Issued: | 58,710,710 | Working Capital: | $1,220,137 |

| Diluted: | 89,757,969 | As Of: | November 30, 2017 |

| Membership Start Date | July 28, 2015 | Price at Start | $0.22 |

| Membership backdated to | January 3, 2012 | Membership Quantity | 4,651 |

|

|

| Denison Mines Corp. is a diversified intermediate uranium producer within the Lundin group of companies that was formed through the combination of Denison Mines Inc. and International Uranium Corporation on December 1, 2006. Denisonís assets include an interest in two of the four licensed and operating uranium mills in North America, with its 100% ownership of the White Mesa mill in Utah and its 22.5% ownership of the McClean Lake mill in Saskatchewan, three active mines in the United States, and a portfolio of exploration projects. Both mills are fully permitted and operating. Denison's 2009 Canadian production guidance forsees 750,000 pounds of U3O8 production, and expected U.S. uranium production for 2009 is between 1.2 million and 1.6 million pounds after factoring in the loss of 200,000 pounds of expected production due to the suspension of mining operations at the Tony M mine. In April 2009 Denison announced a proposed offtake agreement with Korea Electric Power Corp for 20% of Denison's production beginning in 2010, as well as a private placement for up to 19.90% of the company. |  |

| Issued: | 559,183,209 | Working Capital: | $29,140,000 |

| Diluted: | 572,655,936 | As Of: | December 31, 2017 |

| Membership Start Date | July 28, 2015 | Price at Start | $0.59 |

| Membership backdated to | January 3, 2012 | Membership Quantity | 1,695 |

|

|

| Eurasian is a prospect generator following the farmout model, and as such has a variety of joint ventures around the world, including Haiti, Kyrgzstan, Turkey, and Serbia. In October 2009 Eurasian announced the planned acquisition of Bronco Creek Exploration Inc. (BCE), a privately owned exploration company based in Tucson, Arizona that has a portfolio of gold and copper properties in key mining districts of Nevada, Wyoming and Arizona that are joint ventured with a variety of major and junior mining companies as partners. In February 2011 the company also announced the formation of a strategic alliance for copper exploration in Sweden with Antofagasta Minerals SA. In April 2011 the company also announced a regional exploration alliance with Vale to explore for copper projects in the western United States. In August 2012 Eurasian completed the acquisition of Bullion Monarch Mining, Inc, which holds several exploration properties in Nevada, as well as a currently paying 1-per-cent gross smelter return royalty on several projects on the Carlin trend in Nevada, including the Leeville mine and the Four Corners project operated by Newmont Mining Corporation. |  |

| Issued: | 79,480,187 | Working Capital: | $7,309,556 |

| Diluted: | 87,410,993 | As Of: | September 30, 2017 |

| Membership Start Date | July 28, 2015 | Price at Start | $0.60 |

| Membership backdated to | January 3, 2012 | Membership Quantity | 1,667 |

|

|

| Endeavor Silver is a junior silver producer with three operating mines in Mexico. In addition to its operating Guanacevi, Bolanitos Mines, and El Cubo mines, the company has two exploration projects, Parral and Arrayo Seco. 2008 was the company's fourth consecutive year of record silver production, totalling 2.34 million ounces silver, up 9 per cent over 2007, while gold production rose to 8,187 ounces in 2008, up 27 per cent compared with 2007. Cash costs for 2008 were $9.03 per ounce of silver produced, net of gold credits. For 2009, the company produced 2.6 million ounces of silver, with cash costs around $6 for the year, and in 2010 produced 3.2 million ounces at net cash costs of $5.71 per silver ounce. Net earnings for 2010 were $7.1 million on revenue of $65.5 million. For 2011 Endeavor had silver production of 3.7 million ounces with net cash costs declining to $5.08 per ounce. 2012 production rose to 4.3 million silver ounces and 39,000 gold ounces, with cash costs increasing to $7.33 per silver ounce, largely a result of El Cubo being added to the production mix. For 2013, production has been estimated at around 5.0 - 5.3 million ounces with cash costs in the $9 - $10 range. |  |

| Issued: | 127,488,410 | Working Capital: | $66,246,000 |

| Diluted: | 133,281,210 | As Of: | December 31, 2017 |

| Membership Start Date | July 28, 2015 | Price at Start | $1.72 |

| Membership backdated to | January 3, 2012 | Membership Quantity | 581 |

|

|

| Evrim, which is focused on Northern Mexico, has several copper and polymetallic projects that have been partially optioned to partners. The company's properties were themselves acquired through a September 2010 agreement with Kiska Metals allowing Evrim to acquire a package of nine properties for 2 million Evrim shares and annual payments of either 10,000 or 50,000 shares per property, depending upon status, during a five year period. In January 2012 the company also announced an agreement with Newmont for generative exploration within study areas in the Trans Mexican volcanic belt (TMVB) in Mexico. |  |

| Issued: | 65,645,542 | Working Capital: | $3,844,704 |

| Diluted: | 86,057,626 | As Of: | September 30, 2017 |

| Membership Start Date | July 28, 2015 | Price at Start | $0.11 |

| Membership backdated to | January 3, 2012 | Membership Quantity | 9,091 |

|

|

| First Majestic, led by CEO Keith Neumeyer, operates five producing silver properties in Durango, Coahilhua, and Jalisco states of Mexico, with additional development projects in proximity to their operating mines. Total production during 2008 reached 4,244,756 ounces of silver equivalent, representing an increase of 18 per cent compared with the previous year's 3,584,265 ounces silver equivalent. In September 2009 the company also announced an agreement to acquire Normabec Mining and its 42 milllion ounce (all categories) Real de Catorce (La Luz) project in Mexico's San Luis Potasi state for $13.5 million in First Majestic shares. For 2009 silver production was 3.8 million ounces, at net cash costs of $5.61 per silver ounce, and in 2010 production climbed to 6.5 million silver ounces at net cash costs of $5.85 per ounce. For 2011 production was 7.1 million silver ounces at cash costs of $8.25 per ounce. 2012 production was 8 million silver ounces at total cash costs of $9.08 per ounce. Forecast production for 2013 is between 11.1 and 11.7 million silver ounces. |  |

| Issued: | 165,728,029 | Working Capital: | $116,283,000 |

| Diluted: | 165,728,029 | As Of: | December 31, 2017 |

| Membership Start Date | July 28, 2015 | Price at Start | $4.12 |

| Membership backdated to | January 3, 2012 | Membership Quantity | 243 |

|

|

|  |

| Issued: | 557,471,616 | Working Capital: | $19,399,584 |

| Diluted: | 642,424,025 | As Of: | December 31, 2017 |

| Membership Start Date | July 28, 2015 | Price at Start | $0.38 |

| Membership backdated to | April 6, 2015 | Membership Quantity | 2,667 |

|

|

| Fission Uranium Corp, led by CEO and Chairman Dev Randhawa and President and COO Ross McElroy, is focused on its Patterson Lake South uranium discovery in Saskatchewan's Athabasca Basin. Fission Uranium acquired the property after its predecessor company, Fission Energy Corp, was acquired in April 2013 by Denison Mines. Following numerous successful drill intercepts during 2013, in late 2013 Fission acquired 100% of Patteron Lake South by acquiring its 50:50 JV partner Alpha Minerals. Patterson Lake South currently has six identified mineralized zones, relatively shallow mineralization, and drilling ongoing. |  |

| Issued: | 485,651,038 | Working Capital: | $40,717,792 |

| Diluted: | 531,496,038 | As Of: | December 31, 2017 |

| Membership Start Date | July 28, 2015 | Price at Start | $0.71 |

| Membership backdated to | April 30, 2013 | Membership Quantity | 1,408 |

|

|

| Gold Standard Ventures Corp is the successor to Ripple Lake Diamonds Ltd which completed an IPO on Jan 7, 2005, changed its name to Devonshire Resources Ltd on Oct 10, 2007 with a 10:1 rollback, and again on Nov 18, 2009 to Gold Standard with a 4:1 rollback. In Feb 2010 Gold Standard acquired the Railroad project in Nevada through an RTO of JKR Gold Resources Inc involving the issue of 24.8 million shares that shifted management to Jonathan Awde and David Mathewson. JKR had acquired the Railroad project from Royal Standard Minerals in November 2009 for $1.2 million. Albert Friedberg's FCMI invested $12 million in Gold Standard in early 2011, which raised another $20 million on June 12, 2012 in conjunction with a NYSE listing. The Railroad project is within a historic polymetallic mining district at the southern end of the Carlin Trend in which 15 companies have drilled 382 holes. The 7,000 hectare Railroad project is south of Newmont's Rain deposit. Since 2010 Gold Standard has drilled over 70,000 ft in pursuit of Carlin-type mineralization mainly in the North Bullion Fault Zone target area. For H1 of 2013 Gold Standard planned to spend $4 million on 24,000 ft of drilling at Railroad. |  |

| Issued: | 254,254,777 | Working Capital: | $17,511,874 |

| Diluted: | 264,487,783 | As Of: | December 31, 2017 |

| Membership Start Date | July 28, 2015 | Price at Start | $0.50 |

| Membership backdated to | January 3, 2012 | Membership Quantity | 2,000 |

|

|

| May 8, 2018 | Infill Drilling Expands the Resource Potential at the Pinion Oxide Gold Deposit, Carlin Trend, Nevada |

| Apr 24, 2018 | Confirms Certain Property Boundaries at Railroad Pinion |

| Apr 17, 2018 | Positive Infill Drilling Results at the Pinion Oxide Gold Deposit, Carlin Trend, Nevada |

| Apr 11, 2018 | Reports Infill Drilling Success At The Dark Star Oxide Gold Deposit, Carlin Trend, Nevada |

| Feb 26, 2018 | US$ 25.8 Million 2018 Development and Exploration Program for the Railroad Project, Carlin Trend, Nevada |

| Golden Arrow is part of the Grosso Group of companies and is focused on Argentina where it controls 100 per cent of seven properties, totalling 12,488 hectares in the Frontera district of northwestern San Juan province. Golden Arrow also has a 1% NSR on Yamana Gold's Gualcamayo gold mine in San Juan, Argentina. In May 2009 Golden Arrow received its first royalty payment, and anticipates annual revenue of approximately $2 million at gold prices around $900. In September 2009 the company announced an agreement in principle with the minister responsible for state companies in the province of Rio Negro for the purpose of jointly exploring potential mining projects in the province. In November 2009 the company announced plans to spin-out its Peruvian and Colombian mineral assets to a new company. In May 2012 Golden Arrow announced it had agreed to sell its Gualcamayo royalty to Premier Gold for $16.5 million in cash, with plans to use the funds to acquire new projects. |  |

| Issued: | 97,234,434 | Working Capital: | $8,819,665 |

| Diluted: | 97,866,934 | As Of: | June 30, 2017 |

| Membership Start Date | July 28, 2015 | Price at Start | $0.30 |

| Membership backdated to | January 3, 2012 | Membership Quantity | 3,333 |

|

|

| Brazil Resources Inc listed in May 2011 after completing a $2.5 million IPO at $0.65 under the leadership of President Stephen Swatton and Chairman Amir Adnani with a focus on grassroots exploration properties across the Gurupi Gold Belt in northeast Brazil. In November 2013 BRI acquired Stephen Dattells' Brazilian Gold Corp on the basis of 0.172 BRI shares for 1 Brazilian Gold share. The assets included a 75:25 JV with Areva in the Rea project in the Alberta portion of the Athabasca Basin where work is stalled while a cariboo protection plan is assessed. The Brazilian gold projects are currently stalled while they await renewal of licenses or new exploration work permits. In mid 2015 BRI acquired the Whistler project in Alaska from Kiska Metals Corp. Whistler hosts two low grade gold-silver-copper deposits called Whistler and Island Mountain. BRI expects its holding costs to be $1.5 million for 2016. Marin Katusa's various funds are a major shareholder. Swatton left in December 2014 for personal reasons. It is not clear from BRI's disclosures what work the junior is planning in 2016 that will change project fundamentals. |  |

| Issued: | 134,255,070 | Working Capital: | $11,654,533 |

| Diluted: | 154,593,033 | As Of: | November 30, 2017 |

| Membership Start Date | July 28, 2015 | Price at Start | $0.58 |

| Membership backdated to | January 3, 2012 | Membership Quantity | 1,724 |

|

|

| Ivanhoe Mines Ltd is a Robert Friedland company focused on Sub-Saharan Africa where it has two projects in the Congo and the Platreef project in South Africa. In the Congo Kamoa is a past-producing copper property with a 53 billion pound copper resource, while Kipushi is a zinc-copper prospect with a 10 billion pound copper resource. Platreef is a nickel-copper-pgm deposit includes the underground Flatreef Deposit of thick, platinum-group elements, nickel, copper and gold mineralization in the Northern Limb of the Bushveld Complex, approximately 280 kilometres northeast of Johannesburg.

In the Northern Limb, such mineralization primarily is hosted within the Platreef, a mineralized sequence that is traced more than 30 kilometres along strike. Ivanhoe's Platreef Project, within the southern sector of the Platreef, is comprised of three contiguous properties: Turfspruit, Macalacaskop and Rietfontein. The northernmost property, Turfspruit, is contiguous with, and along strike from, Anglo Platinum's Mogalakwena group of properties and mining operations. |  |

| Issued: | 790,387,168 | Working Capital: | $179,337,000 |

| Diluted: | 817,193,615 | As Of: | December 31, 2017 |

| Membership Start Date | July 28, 2015 | Price at Start | $0.66 |

| Membership backdated to | October 23, 2012 | Membership Quantity | 1,515 |

|

|

| Kaizen Discovery Inc is the successor to Concordia Resources Corp, itself the successor to Western Uranium Corp, following a reorganization on December 6, 2013 where Concordia rolled back 5:1, spun-out 1 Meryllion Resources Corp share for each post-rollback share, and issued 106,489,003 shares to Robert Friedland's BVI based HPX TechCo Inc in exchange for rights to use the HPX TechCoTechnology Cluster, an 85% option on the Fairholme copper-gold porphyry prospect in Australia, and 100% of the Ebende grassroots project in the DRC. Kaizen has the right to deploy the HPX Typhoon data acquisition system ultimately owned by High Power Exploration Inc which allows IP and EM surveys to be done simultaneously and "see" through difficult cover such as caliche soils. The technology has been in operation since 2011 and is intended for settings where deposits are blind due to barren cover. Kaizen has a collaboration agreement with the Japanese trading house Itochu Corp to participate in projects to which HPX will be applied. |  |

| Issued: | 276,766,636 | Working Capital: | $3,442 |

| Diluted: | 287,723,303 | As Of: | December 31, 2017 |

| Membership Start Date | July 28, 2015 | Price at Start | $0.21 |

| Membership backdated to | December 6, 2013 | Membership Quantity | 4,878 |

|

|

| Lara Exploration is a Brazil-focused project generator with both 100% owned and joint ventured gold, bsae metals, potash, and tin projects. The company is led by Miles Thompson. In September 2009 Lara announced a letter of intent to acquire Maxy Gold, which has gold and copper-gold projects in China and Peru, on the basis of one Lara share for each Maxy gold share. In July 2012 the company announced a three year, $1.8 million exploration alliance with Kiwanda Mining Partners LP to generate, acquire and develop coal projects in Peru and Colombia. |  |

| Issued: | 34,450,940 | Working Capital: | $2,051,695 |

| Diluted: | 38,789,065 | As Of: | December 31, 2017 |

| Membership Start Date | July 28, 2015 | Price at Start | $0.25 |

| Membership backdated to | January 3, 2012 | Membership Quantity | 4,000 |

|

|

| Pilot Gold Inc, led by President and CEO Matt Lennox-King and chairman Mark O'Dea, is the spin-off company that emerged from the April 2011 acquisition of Fronteer Gold by Newmont Mining. Pilot holds Fronteer's non-core assets in Turkey, Nevada, and Peru. In Nevada the company holds a portfolio of gold exploration properties, some 100% owned, others optioned to JV partners, and in Turkey its Halilaga and TV Tower projects are held in joint ventures with Teck Exploration. For 2012 Pilot plans a 16,000 m drill program at TV Tower as part of a deal to increase its stake from 40% to 60% over 3 years, whose goal will be an initial 43-101 resource estimate by early 2013. On the 40:60 Haligaga JV with Teck a 16,000 m drill program is planned to expand on the 43-101 resource estimate for a bulk tonnage copper-gold deposit leading to a PEA by 2013. At Kinsley Mountain in Nevada south of Long Canyon Pilot is earning up to 65% from Nevada Sunrise Res Corp with the objective of rethinking the historic gold mine in terms of the Long Canyon model. |  |

| Issued: | 176,906,048 | Working Capital: | $1,510,334 |

| Diluted: | 192,354,128 | As Of: | December 31, 2017 |

| Membership Start Date | July 28, 2015 | Price at Start | $0.39 |

| Membership backdated to | January 3, 2012 | Membership Quantity | 2,597 |

|

|

| Apr 11, 2018 | Second Tranche Of Drill Results From The Black Pine Oxide Gold Project, Great Basin, USA |

| Apr 5, 2018 | Liberty Gold Commence Drilling Program at Kinsley Mountain Gold Project |

| Mar 27, 2018 | Year End Financial And Operating Results |

| Mar 22, 2018 | Provides Exploration Update for Goldstrike Oxide Gold Deposit, Great Basin, USA |

| Feb 8, 2018 | Maiden Resource Estimate for Goldstrike Deposit, Utah |

| Lucara Diamond Corp, led by CEO and Chairman Wiliam Lamb, is a new diamond producer. It's two key assets are the Karowe mine in Botswana and the Mothae project in Lesotho. The 100% owned Karowe Mine is a newly constructed state-of-the-art mine which was fully commissioned in Q2 2012 . At the 75% owned Mothae project the company has completed the trial mining stage. The Mothae plant was put on care and maintenance while the Company investigates further development options. |  |

| Issued: | 382,619,334 | Working Capital: | $83,640,000 |

| Diluted: | 387,759,261 | As Of: | December 31, 2017 |

| Membership Start Date | July 28, 2015 | Price at Start | $1.99 |

| Membership backdated to | January 3, 2012 | Membership Quantity | 503 |

|

|

| Fortress Minerals is a Lundin-group company that was previously focused on its 100% owned Svetloye gold project located in the Russian Far East, a high sulphidation epithermal project that was previously explored by Freeport. After rising concerns about political and financcing risk during the market weakness of 2008, in June 2010 Fortress announced an agreement to sell the Svetloye project to Macritchie Metals Pte Ltd. For $8 million U.S. and in turn abandoned its other Russian projects. Following a 20-1 rollback in November 2010, the company remains a well-funded shell with over $21 million working capital. In October 2014 Fortress announced it would be acquiring the Fruta del Norte project in Ecuador for $240 million in cash and shares. |  |

| Issued: | 119,666,840 | Working Capital: | $26,794,000 |

| Diluted: | 124,292,340 | As Of: | December 31, 2017 |

| Membership Start Date | July 28, 2015 | Price at Start | $3.66 |

| Membership backdated to | January 3, 2012 | Membership Quantity | 273 |

|

|

| Lydian International Ltd. is a British mineral exploration and development company focused on Eastern Europe, primarily in the Balkan and Caucasus regions where it operates a joint venture with Newmont Overseas Exploration Limited, a subsidiary of Newmont Mining Corporation, for projects in Armenia and Azerbaijan, including its flagship Amulsar epithermal gold project that has a 1 million ounce inferred resource. The company also has the support of the International Finance Corp., a member of the World Bank Group, and the European Bank of Reconstruction and Development, which jointly completed a $2.99 million financing in May 2009. In February 2010 the company announced it was terminating the Newmont joint venture, and making staged, conditional payments of $25 million to acquire 100% of the Amulsar gold project where the two companies have identified 996,000 inferred gold ounces through late 2009. |  |

| Issued: | 754,849,326 | Working Capital: | $2,814,000 |

| Diluted: | 780,267,927 | As Of: | December 31, 2017 |

| Membership Start Date | July 28, 2015 | Price at Start | $0.39 |

| Membership backdated to | January 3, 2012 | Membership Quantity | 2,564 |

|

|

| Emerick, led by CEO and President Ralph Rushton and Chairman Simon Ridgeway, was moved to the NEX board in January 2012 as a result of its lack of exploration properties. The company had previously explored for gold at the Grew Creek property in the Yukon, and had signed, then cancelled additionall potential property acquisitions. In May 2012 Emerick announced it had singed a letter agreement for an RTO with Medgold Resources Ltd, a private company incorporated in England and Wales focused on the exploration and development of precious and base metals in Western Europe. Should the transaction be completed, Emerick would control Medgold's existing property options for two early-stage gold properties in Italy. |  |

| Issued: | 89,458,124 | Working Capital: | $1,900,226 |

| Diluted: | 95,583,124 | As Of: | September 30, 2017 |

| Membership Start Date | July 28, 2015 | Price at Start | $0.09 |

| Membership backdated to | December 2, 2013 | Membership Quantity | 11,765 |

|

|

| Midas Gold Corp is focused on permitting a 20,000 tpd open-pit mining operation for the Stibnite project (formerly Golden Meadows) in Idaho which acccording to a PFS published in December 2014 would produce 337,000 oz gold annually plus an antimony by-product credit over a 12 year mine life. The project cosnsist of 3 deposits with refractory sulphide ore within a larger mineralized system that has room for the development of additional zones that could exytend the mine life. The site is a historic mining district where antimony-tungsten were recovered in WWII, mercury until 1963, and oxide gold until 1997 through heap leaching. The property has historic reclamation liabilities, some of which the Stibnite plan would remediate. There is a risk that environmental regulators might prefer to leave the area undisturbed in its present form, but such a decision would forfeit the opportunity to restore salmon migration into the upstream watershed and forgo a domestic supply of antimony whose production is currently dominated by China. Midas Gold listed on the TSX in July 2011 and is led by President and CEO Stephen Quin and Chairman Peter Nixon. In February 2016 Midas undertook a $55.2 million debenture offering convertible at $0.3541 for 7 years of which $34.5 million is being taken down by a group led by Paulson & Co. In Feb 2018 Midas released an updated resource estimate. |  |

| Issued: | 186,356,265 | Working Capital: | $15,743,114 |

| Diluted: | 202,287,015 | As Of: | December 31, 2017 |

| Membership Start Date | July 28, 2015 | Price at Start | $0.35 |

| Membership backdated to | January 3, 2012 | Membership Quantity | 2,899 |

|

|

| Jan 10, 2018 | SVH Tracker: Recommendation Strategy for Midas Gold Corp |

| Jan 5, 2018 | Discovery Watch with HoweStreet.com - 0:23:23 |

| Jun 30, 2017 | Discovery Watch with HoweStreet.com - 0:14:31 |

| Jun 9, 2017 | Discovery Watch with HoweStreet.com - 0:04:20 |

| Feb 24, 2017 | Discovery Watch with HoweStreet.com - 0:00:00 |

| Jan 17, 2017 | SVH Tracker: Recommendation Strategy for Midas Gold Corp |

| Mar 22, 2016 | SVH Tracker: Recommendation Strategy for Midas Gold Corp |

| Jan 5, 2016 | Discovery Watch with HoweStreet.com - 0:00:00 |

| May 26, 2015 | SVH Tracker: Midas raises $8 million to eliminate financing risk over next 12 months |

| Feb 15, 2015 | Excerpt from Express 2015-01: SVH 2015 January Review - Midas Gold |

| Midland Exploration is a junior explorer focused on gold, base metals, uranium and REE projects in Quebec. Led by CEO Gino Roger and Chairman Jean-Pierre Janson, the company has several joint ventures, including the Dunn gold property optioned to Osisko, the LaFlamme copper-gold project optioned to North American Palladium and properties in the Maritime Cadillac region where Agnico-Eagle can earn up to 75% in a gold property contiguous to the Lapa Mine. In September 2009 the company staked the Ytterby rare earth property that is located five kilometres south of Quest Uranium's Strange Lake property. |  |

| Issued: | 58,854,411 | Working Capital: | $12,630,496 |

| Diluted: | 82,666,980 | As Of: | December 31, 2017 |

| Membership Start Date | July 28, 2015 | Price at Start | $0.65 |

| Membership backdated to | January 3, 2012 | Membership Quantity | 1,538 |

|

|

| Millrock Resources is an Alaska-focused exploration company with a number of joint venture properties targeting precious, base and strategic metals. The company is led by President and CEO Gregory Beischer. In an effort to diversify its property holdings, Millrock has also acquired, whether by staking or through option agreements, several properties in Arizona. In June 2009 Millrock also announced a a strategic alliance with Altius Minerals to fund prospect generation, principally for gold, in five areas in Alaska through a private placement in Millrock that would give Altius 11% ownership of the country. In December 2009 Millrock announced an exploration alliance with Kinross Gold that pertains to a 900-square-kilometre area of interest that includes Millrock's Albion and Council properties, as well as other mining claims on the Seward Peninsula in western Alaska. In October 2011 the company also announced a strategic alliance with Vale for copper-gold porphyry deposits in target zones of Alaska identified by Millrock where Vale will provide initial funding and retain the right to earn up to 75% in selected properties. In May 2014 the company announced an agreement to acquire a portfolio of Mexican exploration properties. |  |

| Issued: | 49,370,123 | Working Capital: | $3,954,873 |

| Diluted: | 81,538,444 | As Of: | September 30, 2017 |

| Membership Start Date | July 28, 2015 | Price at Start | $0.20 |

| Membership backdated to | October 24, 2014 | Membership Quantity | 5,000 |

|

|

| Mar 27, 2018 | Stock Option Grants |

| Mar 20, 2018 | Millrock Partner PolarX Reports Maiden Resource for the Zackly Copper Gold Deposit, Alaska Range Project, Alaska |

| Mar 6, 2018 | Drill Results From La Navidad Gold Project, Sonora State, Mexico |

| Mar 5, 2018 | Significantly Expands Cecilia Project Area |

| Feb 2, 2018 | Reports Potential Business Transaction Concerning Its Exploration Projects In The Golden Triangle District, British Columbia |

| Miranda Gold Corp is a former Nevada-focused gold explorer run by CEO Ken Cunningham which in 2013 shifted its focus to Colombia where it has generated prospects since 2010. Miranda follows the prospect generator model, with the bulk of its properties farmed out to other companies while it is focused on early-stage exploraton that can generate targets that can become more joint ventures. In July 2012 the company announced a non-binding letter of intent to form a three year joint venture with Agnico-Eagle Mines Ltd. for precious metal exploration in central Colombia where Agnico would be able to acquire 70% of designated properties. |  |

| Issued: | 105,005,077 | Working Capital: | $844,697 |

| Diluted: | 160,663,932 | As Of: | November 30, 2017 |

| Membership Start Date | July 28, 2015 | Price at Start | $0.08 |

| Membership backdated to | January 3, 2012 | Membership Quantity | 12,500 |

|

|

| Led by President and CEO Mary Little, Mirasol is an Argentina-focused project generator with a portfolio of gold-silver epithermal and vein projects. Among the company's joint venture partners are Pan Am Silver and Coeur d'Alene mines, the latter of which is earning 71% in the Joaquin project where a 67 million ounce indicated and inferred silver resource has been established. |  |

| Issued: | 49,161,078 | Working Capital: | $19,134,811 |

| Diluted: | 52,143,204 | As Of: | December 31, 2017 |

| Membership Start Date | July 28, 2015 | Price at Start | $0.85 |

| Membership backdated to | January 3, 2012 | Membership Quantity | 1,176 |

|

|

| Nevsun Resources is a gold and base metal developer led by CEO and President Clifford Davis that is focused on the rapid completion and production of the Bisha Mine in Eritrea, Africa. The Bisha Project is a fully financed and permitted high-grade gold, copper and zinc deposit with resources in all categories of 1.6 million gold ounces, 40.6 million silver ounces, 998 million copper pounds and 3.028 billion zinc pounds, with construction currently underway and operations to commence in late 2010 and the company anticipating a declaration of commercial production during Q1 2011 for the initial planned 10 year mine life. Given that Bisha's feasibility studies and mine plans are based on relatively low metal prices ($400 per ounce gold, $1.05 per pound copper, 50 cents per pound zinc) expectations that the open pit size and depth will be able to be expanded considerably using higher metals prices. After declaring commercial production in 2011, the company produced 379,000 gold ounces during the year. For 2012, the company expects to produce 190,000 to 210,000 gold ounces from the oxide zone at the Bisha mine, with production expected to transition to the underlying supergene and primary zones in 2013. |  |

| Issued: | 302,212,480 | Working Capital: | $162,319 |

| Diluted: | 311,576,913 | As Of: | December 31, 2017 |

| Membership Start Date | July 28, 2015 | Price at Start | $4.39 |

| Membership backdated to | January 3, 2012 | Membership Quantity | 228 |

|

|

| Canadian Gold Hunter, led by Chairman Lukas Lundin, has a variety of gold properties in Canada as well as a joint venture with Almaden Minerals on the Caballo Blanco epithermal gold-copper project in Mexico's Veracruz state. In April 2009 the company completed a business combination with Suramina Resources, also part of the Lundin group of companies, that held the South American property portfoilio of Tenke Resources after Tenke was merged into Lundin Mining. In June 2009 the company announced plans to merge with Sanu Resources, offering to acquire the company on the basis of 0.5725 share of Canadian Gold Hunter for each one Sanu share. In September 2009 the company changed its name to NGEx Resources. |  |

| Issued: | 213,774,830 | Working Capital: | ($986,282) |

| Diluted: | 219,744,830 | As Of: | December 31, 2017 |

| Membership Start Date | July 28, 2015 | Price at Start | $0.75 |

| Membership backdated to | January 3, 2012 | Membership Quantity | 1,333 |

|

|

| Novagold, led by CEO Rick Van Nieuwenhuyse, is focused on Alaska and Northwest BC where it has interests in a variety of advanced stage gold, gold-silver, and gold-silver-copper projects, and a cumulative resource inventory of 28 million gold ounces and 7.5 billion copper pounds. In mid-2008 Novagold briefly became a producer when its 100% owned Rock Creek mine in Alaska began commercial production, but operations were quickly halted due to environmental and permitting problems. Among the feasibilty stage projects in Novagold's portfolio are a 50% interest with Barrick in the 32 million gold ounce Donlin Creek project, 100% control of the 1.8 million gold ounce Cape Nome project, and a 50% interest with Teck in the 13 billion copper pound and 12 million gold ounce Galore Creek project. |  |

| Issued: | 322,302,000 | Working Capital: | $76,446,000 |

| Diluted: | 342,395,000 | As Of: | February 28, 2018 |

| Membership Start Date | July 28, 2015 | Price at Start | $4.01 |

| Membership backdated to | January 3, 2012 | Membership Quantity | 249 |

|

|

| Platinum Group Metals Ltd, led by CEO and President R. Michael Jones, is a South-Africa focused near-term producer of platinum group metals. The company's flagship is its Western Bushveld Joint Venture (WBJV) where it owns a 49% interest of the construction stage project where production is expected from the project's first stage in the near term. |  |

| Issued: | 150,910,006 | Working Capital: | ($22,077,000) |

| Diluted: | 154,537,206 | As Of: | November 30, 2017 |

| Membership Start Date | July 28, 2015 | Price at Start | $0.40 |

| Membership backdated to | January 3, 2012 | Membership Quantity | 2,532 |

|

|

| Premier Gold Mines, led by President and CEO Ewan Downie and Chairman John Cook, is a gold-focused exploration company with a portfolio of projects in the Red Lake and Beardmore regions of Ontario, as well as the Santa Teresa project in Baja California. Premier, which listed on the TSX in August 2006 as a spinoff of the gold properties of Wolfden Resources, is focused on its Hardrock joint venture with Roxmark where it has a 70% interest in an area of past producing mines and where the company is conducting an $8-10 million dollar exploration campaign during 2009. Other Premier projects include PQ North project located within Goldcorp's Musselwhite holdings, Rahill-Bonanza where it has a 49:51 joint venture with Goldcorp and an inferred resource of 900,000 gold ounces, and Eastbay, where Goldcorp is joint venture operator and has a 65% interest. In June 2011 the company announced it would be acquiring Goldstone, the successor to Roxmark, in order to consolidate ownership of the Hardrock property. |  |

| Issued: | 202,366,087 | Working Capital: | $107,461,246 |

| Diluted: | 211,120,087 | As Of: | December 31, 2017 |

| Membership Start Date | July 28, 2015 | Price at Start | $1.90 |

| Membership backdated to | January 3, 2012 | Membership Quantity | 526 |

|

|

| Pretium Resources went public after completing a $265 million IPO in December 2010. The company was created as a vehicle for spinning out the Snowfield project, consisting of the Silvertip and Brucejack deposits, of Silver Standard in Northwest B.C. |  |

| Issued: | 182,337,874 | Working Capital: | ($334,409,000) |

| Diluted: | 188,792,201 | As Of: | December 31, 2017 |

| Membership Start Date | July 28, 2015 | Price at Start | $6.14 |

| Membership backdated to | January 3, 2012 | Membership Quantity | 163 |

|

|

| Laurentian Goldfields is a Canada-focused junior with gold projects in Nunavat and Ontario. The company is run by CEO Darin Labrenz and chairman Brian Fowler whose target generation strategy involves taking lake bottom groundwater chemistry measurements in regions whose surface geology is generally dismissed as unproductive for gold potential. The methodolgy is similar to that of Nevada Exploration Inc's gold-in-groundwater approach to Nevada's gravel covered basins, except in the case of Laurentian Goldfields the theory is that the unprospective cover rocks overlie older more prospective rocks which have structures that either host gold mineralization not too deep beneath the cover rocks, or which were reactivated after the cover rocks were emplaced so that economic deposits might be hosted by the "unprospective" rocks. The out-of-the-box approach targets "golden haystacks" that signal the potential presence of lode deposits where they are not supposed to exist. In May 2009 the company announced an exploration alliance with Kinross Gold for the Uchi geological subprovince of Ontario and Manitoba targeting the highly prospective Red Lake, Rice Lake, and Pickle Lake greenstone belts. In July 2012 a further exploration alliance was announced with Antofagasta Minerals for generative copper exploration in Southern Quebec, Canada. In October 2012 the company announced it would be asking shareholders to vote on a potential 10:1 rollback at the November AGM. |  |

| Issued: | 223,219,384 | Working Capital: | $12,133,682 |

| Diluted: | 241,637,717 | As Of: | December 31, 2017 |

| Membership Start Date | July 28, 2015 | Price at Start | $0.12 |

| Membership backdated to | November 23, 2012 | Membership Quantity | 8,696 |

|

|

| Radius Gold Inc is Simon Ridgeway's exploration vehicle for Central America. The one-time flagship play in Ecuador, an option on the Cerro Colorado high sulphidation epithermal play generated by Newmont during the nineties but never drilled because of local community problems has been pushed to the back burner. As its flagship Radius now has its Tambor vein project in Guatemala where Kappes Cassiday and Associates (KCA) -- a Reno-based engineering group -- can earn a 51-per-cent interest in Tambor by putting the property into commercial production. The company also has a portfolio of Nicaraguan exploration projects that have been optioned to B2 Gold. Other Radius joint ventures are located in Canada and Mexico. In May 2011 Radius announced it would be spinning out its Alaska and Yukon gold properties into a new company in which it will be retaining a 20% interest. |  |

| Issued: | 86,675,617 | Working Capital: | $9,035,669 |

| Diluted: | 91,745,617 | As Of: | September 30, 2017 |

| Membership Start Date | July 28, 2015 | Price at Start | $0.08 |

| Membership backdated to | January 3, 2012 | Membership Quantity | 13,333 |

|

|

| Mar 21, 2018 | Options The Coyote Property, Elko County, Nevada |

| Mar 5, 2018 | Update on exploration activities planned for 2018 |

| Dec 18, 2017 | Additional high grade sampling from Amalia Project, Mexico |

| Nov 21, 2017 | Completes Summer Exploration Program At Bald Peak Property, Nevada |

| Oct 4, 2017 | Options System Of Gold silver Rich Diatreme Breccias In Chihuahua, Mexico |

| Reservoir Capital Corp is a Serbian-focused company,with interests in precious metals and renewable energy projects led by Chairman Miles Thompson. Reservoir currently has eight active mineral exploration permits and applications for three run-of-river hydro-electric permits. In March 2010 it also announced it was undertaking due diligence on the potential acquisition joint venture interests in several advanced-stage Turkish hydro projects. |  |

| Issued: | 48,164,424 | Working Capital: | $344,416 |

| Diluted: | 60,150,006 | As Of: | January 31, 2018 |

| Membership Start Date | July 28, 2015 | Price at Start | $0.39 |

| Membership backdated to | March 18, 2014 | Membership Quantity | 2,564 |

|

|

| Iron Creek Capital is focused on Chile, where the company has joint venture interests in three early stage projects. The company is led by CEO Michael Winn and President Tim Beale, a former Anglo American and Hochschild Mining exploration geologist. Amongst Iron Creek's projects are the Pampa Buenos Aires gold project where it has option 50% from Andina Minerals, and the Vaquillas copper project where Hochschild is earning 50%. In September 2014 the company announced it had agreed to merge with Polar Star Mining Corp, with shareholders receiving 3.82 Polar Star shares per Iron Creek share. In November 2014 the companies announced the transaction would be restructured, with Polar Star to acquire Iron Creek. |  |

| Issued: | 167,405,027 | Working Capital: | ($776,960) |

| Diluted: | 264,729,484 | As Of: | October 31, 2017 |

| Membership Start Date | July 28, 2015 | Price at Start | $0.13 |

| Membership backdated to | April 15, 2014 | Membership Quantity | 8,000 |

|

|

| Riverside Resources Ltd is a Mexico-focused exploration junior led by Jean-Mark Staude which adheres to the prospect-generator farmout model espoused by principal shareholder Rick Rule. Riverside's two-pronged exploration strategy involves staking grassroots ground based on regional reconnaissance work such as Cerro Azul in southern Mexico, and optioning existing projects from private owners, such as Libertad and El Capitan (Penoles), and turning them into district scale plays by staking a significantly larger land position surrounding the optioned claims. Riverside is also a bottom-fisher of sorts as is indicated by its option on the low grade Sugerloaf Peak gold deposit in Arizona which has a historic resource estimate of 1.2 million gold ounces. Riverside has formed a strategic alliance with Kinross in the Mesa Central region of eastern Mexico where Riverside's objective is to generate large system plays such as Penasquito and San Agustin, and in June 2010 it announced the formation of an exploration alliance with Cliffs Natural Resources to explore for iron-oxide copper gold (IOCG) projects in northwest Baja California state and along the Pacific coast from western Sinaloa state to Oaxaca state, Mexico. In July 2011 the company also announced the formation of a 3-year generative exploration alliance with Antogagasta targeting copper-gold projects in British Columbia. The company also has an exploration alliance with Hochschild Mining in Mexico. |  |

| Issued: | 44,409,313 | Working Capital: | $5,007,495 |

| Diluted: | 50,845,080 | As Of: | December 31, 2017 |

| Membership Start Date | July 28, 2015 | Price at Start | $0.17 |

| Membership backdated to | January 3, 2012 | Membership Quantity | 6,061 |

|

|

| Seabridge Gold is a Rudi Fronk company that acquired a number of previously explored gold projects that were considered uneconomic at lower gold prices. Cumulatively the company holds more than 25 million ounces of gold resources in Mexico, the United States, and Canada, and continues to conduct exploration and metallurgical work on its various holdings. Seabridge's principal assets are the KSM gold-copper project in British Columbia with 19 million indicated gold ounces and 5.3 billion copper pounds, and the 10 million ounce Courageous Lake gold project located in Canada's Northwest Territories. |  |

| Issued: | 57,677,118 | Working Capital: | $17,397,000 |

| Diluted: | 61,295,627 | As Of: | December 31, 2017 |

| Membership Start Date | July 28, 2015 | Price at Start | $5.28 |

| Membership backdated to | January 3, 2012 | Membership Quantity | 189 |

|

|

| Transition Metals Corp listed on the TSXV on Aug 26, 2011 after completing a Haywood IPO that raised $2.9 million for a portfolio of early-stage gold projects in Ontario. Headed by Scott McLean, Transition conducted a 2:1 rollback on Aug 19, 2013 and issued 15,391,200 shares to acquire privately held and Rick Eule backed HTX MInerals Corp, owner of the Aer-Kidd nickel-copper-PGM property covering part of the Worthington offset dyke at the western end of the Sudbury Basin, and a partner in strategic alliances with Implats and the Nunavut Resources Corp. Transition follows a strict interpretation of the prospect-generator farmout model where it either farms out exploration work directly to third parties, or transfers assets into a subsidiary in which third parties purchase equity with the expectation that the subsidiary will eventually go public. As of Q3 2016 Transition owned 36% of Sudbury Platinum Corp which has raised $7 million since 2014 for exploration of the Aer-Kidd project where the goal is to discover massive sulphide zones of nickel-copper-PGM mineralization similar to the Totten and Deep Victoria deposits located on the same offset dyke. In August 2016 SPC began a 16 hole drill program that includes 4 deep 1,700 m platform holes from which wedge holes will be drilled if downhole geophysics reveals off-hole EM conductors. The other 12 holes will test for smaller deposits below the 300 m level where mining took place during the fifties. SPC also owns the Lockerby East claims surrounding the mine that bankrupted First Nickel. Transition owns 71% of Canadian Gold Miner Corp into which it has transferred its Abitibi gold projects southwest of Kirkland Lake. Transition owns projects on the Mid-Continent Rift where Sunday Lake is under option to Implats though work has stalled. It retains 20% of a strategic alliance with the Nunavut Resources Corp which must spend $18 million over 5 years on grassroots work near a proposed road corridor. In Saskatchewan southeast of the Athabasca Basin it owns Janice Lake, a sediment hosted copper prospect analagous to Udokan in Russia. Its Haultain gold prospect in Ontario is farmed out to Aldershot. For 2016 Transition expects $4 million to be spent on its prospects by other parties. |  |

| Issued: | 33,769,433 | Working Capital: | $493,442 |

| Diluted: | 36,939,433 | As Of: | November 30, 2017 |

| Membership Start Date | July 28, 2015 | Price at Start | $0.09 |

| Membership backdated to | August 6, 2013 | Membership Quantity | 11,111 |

|

|

| Uranium Energy Corp is focused on becoming a near-term ISL uranium producer in the United States led by CEO Amir Adnani and Chairman Alan Lindsay. The company possesses a significant portfolio of advanced and exploration stage properties in the western United States, and has acquired an extensive library of historic uranium exploration and development work. A Draft Mine Permit was recently issued for the Company's lead project, the Goliad ISR Uranium Project in south Texas. |  |

| Issued: | 97,834,087 | Working Capital: | $6,246,920 |

| Diluted: | 116,275,586 | As Of: | July 31, 2015 |

| Membership Start Date | July 28, 2015 | Price at Start | $1.32 |

| Membership backdated to | January 3, 2012 | Membership Quantity | 758 |

|

|

| Silver Wheaton is a silver-focused company which has long term contracts in place to purchase at fixed prices all or part of the silver production from a number of operating mines around the world. In 2008, the company had sales of 11.1 million ounces of silver. Annual silver sales are expected to increase to 15 to 17 million ounces in 2009, and to approximately 30 million ounces by 2013. |  |

| Issued: | 442,724,000 | Working Capital: | $91,272,000 |

| Diluted: | 456,956,260 | As Of: | December 31, 2017 |

| Membership Start Date | July 28, 2015 | Price at Start | $16.86 |

| Membership backdated to | January 3, 2012 | Membership Quantity | 59 |

| Index Members Delisted or Closed Out |

|---|

| Kaminak Gold Corp, led by President and CEO Eira M. Thomas and Chairman John Robins, is focused on the 100% owned Coffee gold project in the Yukon for which the junior released a feasibility study on Jan 6, 2016 which envisions a 14,000 tpd open pit heap leach operation involving 4 pits with a 10 year mine life for a resource of 46.4 million tonnes of 1.45 g/t gold. The project had a CAD CapEx of $317 million, sustaining capital of $161 million, and OpEx of $24.10/t with an all-in cost of USD $775 per oz gold. With a recovery of 86.3% the Coffee project was projected to produce 1,862,000 ounces gold. At an exchange rate of 1.282 CAD:USD and base case price of $1,150 gold the FS yielded an after-tax NPV of CAD $445 million at 5% and IRR of 37% with a 2 year payback period. The plan for 2016 was to proceed with permitting and further feasibility work plus conduct exploration on the 80% portion outside the project area at a cost of $24 million to be funded from $33 million working capital as of the end of April 2016. On May 12, 2016 Kaminak accepted a friendly takeover bid from Goldcorp on the basis of 1 Kaminak share for 0.10896 Goldcorp shares which priced the offer at $2.62 per share at a 40% premium to market which priced Kaminak at about CAD $520 million. |  |

| Issued: | 185,958,847 | Working Capital: | $18,481,571 |

| Diluted: | 194,984,847 | As Of: | March 31, 2016 |

| Membership Start Date | July 28, 2015 | Price at Start | $0.65 |

| Membership End Date | July 20, 2016 | Price at End | $2.69 |

| Membership backdated to | January 3, 2012 | Membership Quantity | 1,538 |

|

| Index Members Delisted or Closed Out |

|---|

| Northair Silver changed its name from International Northair Mines in November 2014. The company is led by President and CEO Fred Hewett, is focused on Mexico, where it has several precious metals and polymetallic exploration properties. The company's flagship is its La Cigarra epithermal silver property, where it has been exploring since acquiring a 100% option on the property in 2009. |  |

| Issued: | 150,137,069 | Working Capital: | $2,647,713 |

| Diluted: | 202,067,069 | As Of: | November 30, 2015 |

| Membership Start Date | July 28, 2015 | Price at Start | $0.04 |

| Membership End Date | April 21, 2016 | Price at End | $0.16 |

| Membership backdated to | January 3, 2012 | Membership Quantity | 25,000 |

| Index Members Delisted or Closed Out |

|---|

| Reservoir Minerals Inc, led by CEO and President Simon Ingram, is an exploration company with projects in Europe and Africa that listed on the TSXV on November 1, 2011 after its parent, Reservoir Capital Inc, transferred its Serbian projects into a shell for 9 million shares that it distributed as a dividend in specie. Prior to listing Reservoir completed a $9.6 million unit private placement at $0.65. The company's flagship is the Timok project in Serbia, subject to a farm-in agreement with Feeport-McMoran since Mar 18, 2010 which can earn 75% by completing a feasibility study. Freeport-McMorRan drilled a high grade discovery hole in July 2012 that led to an initial resource estimate in early 2014 reporting 3.7 billion copper pounds and 3.1 million gold ounces at grades of 2.6% and 1.50 g/t Au, respectively. The company has additional European prospects and joint venture agreements, largely in Serbia, as well as gold exploration targets in Cameroon and Gabon. |  |

| Issued: | 47,787,665 | Working Capital: | $30,346,371 |

| Diluted: | 49,601,665 | As Of: | February 29, 2016 |

| Membership Start Date | July 28, 2015 | Price at Start | $4.15 |

| Membership End Date | June 24, 2016 | Price at End | $9.23 |

| Membership backdated to | January 3, 2012 | Membership Quantity | 241 |

|

| Index Members Delisted or Closed Out |

|---|

| Riverstone Resources, led by CEO Dwayne Melrose, is focused on its flagship Karma gold project in Burkina Faso which is comprised of four exploration permits. A May 2009 resource estimate for the Karma properties described a cumulative indicated resource of 21 million tonnes grading 1.2 grams per tonne gold for 825,000 ounces, and inferred resource of 12 million tonnes grading .82 grams per tonne for an additional 321, 000 ounces. In January 2012 the resource was updated to 54 million tonnes indicated grading 1.02 g/t Au (1.77 million ounces) and 37 million inferred tonnes grading 0.80 g/t Au (958,000 ounces.) Riverstone holds additional properties in Burkina Faso as well, with the entire portfolio representing over 2,300 square kilometers in 13 exploration licenses. |  |

| Issued: | 398,841,229 | Working Capital: | ($2,032,432) |

| Diluted: | 422,607,164 | As Of: | September 30, 2015 |

| Membership Start Date | July 28, 2015 | Price at Start | $0.18 |

| Membership End Date | April 27, 2016 | Price at End | $0.67 |

| Membership backdated to | January 3, 2012 | Membership Quantity | 5,556 |

|

|

| |

| | You can return to the Top of this page

|

|