| | KRO MIF September 2019 Index

Publisher: Kaiser Research Online

Author: Copyright 2019 John A. Kaiser

|

| |

KRO Theme Index: KRO MIF September 2019 Index

| Index Criteria: Includes all companies presenting at MIF September 2019 which were listed and trading. The index has been backdated to January 2, 2019. |

| Index Method: Each member of a KRO Index is assigned a value of $1,000 when added to the index, which is divided by the closing stock price on the inclusion date to arrive at a quantity of shares which remains constant during the life of the index. In the event of a split or consolidation, the quantity is adjusted by that ratio. If a company is divided into separate entities, the surviving entity that meets the index criteria has its quantity recalculated by dividing the prior day value by the subsequent closing price of the surviving entity. If a company is delisted pursuant to a takeover bid or merger, the value on the delisting day remains part of the index and the total members will include that company. The same applies to companies which have lost their eligibility. The value of the index is the total value divided by the number of members, which will be 1000 at the official start date. The value of the TSXV Index on the offcial start date is normalized to 1000, and the resulting factor is used to adjust the TSXV Index for comparison purposes. |

| Index Start Date | September 6, 2019 | Current Date | December 31, 2020 |

| Index End Date |

| Current Value | 1798.8 |

| Index backdated to | January 1, 2019 | Total Members | 22 |

| KRO MIF September 2019 Index - Members as of December 31, 2020 |

|---|

| Ceased to be index members due to delisting or ineligibility - their value is frozen as of the end date and included in the daily index calculation. |

|---|

| Underwent a rollback or split which resulted in an adjustment to the share quantity used in the member's index value calculation. |

|---|

| Company | Active | Start | End | Quantity | Weight | Value | Chg |

|---|

| Avino Silver & Gold Mines Ltd (ASM-T) | Yes | 9/6/2019 |

| 1,235 | 5.1% | 2,038 | 103.8% |

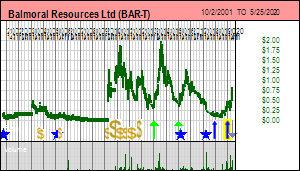

| Balmoral Resources Ltd (BAR-T) | Yes | 9/6/2019 | 5/25/2020 | 4,651 | 9.4% | 3,721 | 272.1% |

| Brixton Metals Corp (BBB-V) | Yes | 9/6/2019 |

| 3,333 | 2.5% | 983 | (1.7%) |

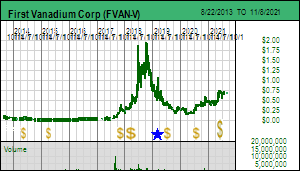

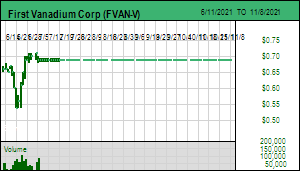

| First Vanadium Corp (FVAN-V) | Yes | 9/6/2019 |

| 3,030 | 3.6% | 1,409 | 40.9% |

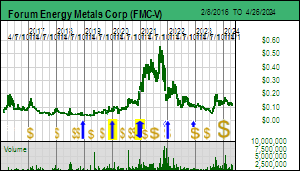

| Forum Energy Metals Corp (FMC-V) | Yes | 9/6/2019 |

| 14,286 | 8.8% | 3,500 | 250.0% |

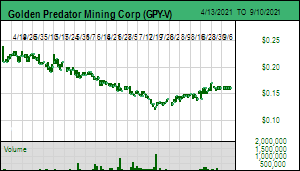

| Golden Predator Mining Corp (GPY-V) | Yes | 9/6/2019 |

| 2,632 | 1.6% | 632 | (36.8%) |

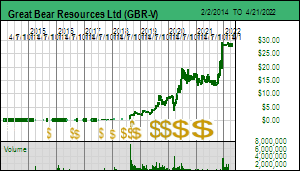

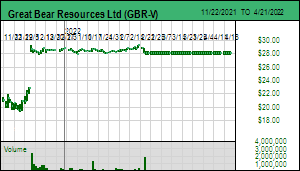

| Great Bear Resources Ltd (GBR-V) | Yes | 9/6/2019 |

| 124 | 5.3% | 2,101 | 110.1% |

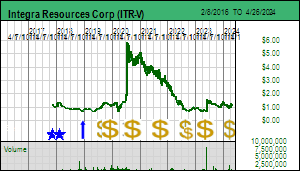

| Integra Resources Corp (ITR-V) | No | 9/6/2019 | 7/8/2020 | 769 | Not Applicable |

| Integra Resources Corp (ITR-V) | Yes | 7/9/2020 |

| 308 | 3.9% | 1,540 | 54.0% |

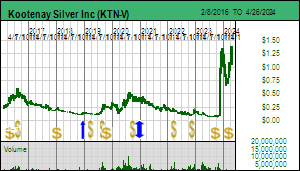

| Kootenay Silver Inc (KTN-V) | Yes | 9/6/2019 |

| 3,704 | 3.9% | 1,537 | 53.7% |

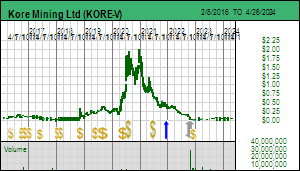

| Kore Mining Ltd (KORE-V) | Yes | 9/6/2019 |

| 2,532 | 10.9% | 4,330 | 333.0% |

| Libero Copper & Gold Corp (LBC-V) | Yes | 9/6/2019 |

| 6,061 | 1.3% | 515 | (48.5%) |

| Minera Alamos Inc (MAI-V) | Yes | 9/6/2019 |

| 5,714 | 9.8% | 3,886 | 288.6% |

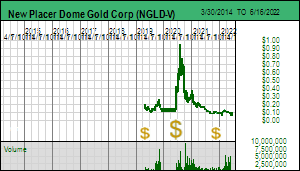

| New Placer Dome Gold Corp (NGLD-V) | Yes | 9/6/2019 |

| 5,556 | 5.0% | 1,972 | 97.2% |

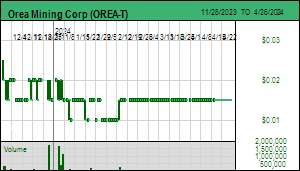

| Orea Mining Corp (OREA-T) | Yes | 9/6/2019 |

| 6,897 | 3.3% | 1,310 | 31.0% |

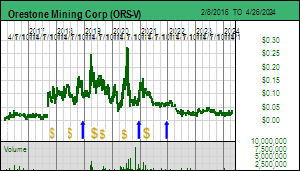

| Orestone Mining Corp (ORS-V) | Yes | 9/6/2019 |

| 7,143 | 2.4% | 964 | (3.6%) |

| Osino Resources Corp (OSI-V) | Yes | 9/6/2019 |

| 1,250 | 3.9% | 1,550 | 55.0% |

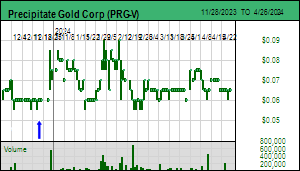

| Precipitate Gold Corp (PRG-V) | Yes | 9/6/2019 |

| 9,524 | 5.8% | 2,286 | 128.6% |

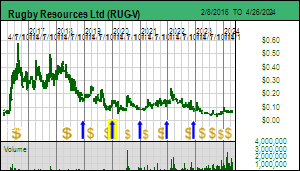

| Rugby Mining Ltd (RUG-V) | Yes | 9/6/2019 |

| 6,061 | 1.2% | 485 | (51.5%) |

| Tinka Resources Ltd (TK-V) | Yes | 9/6/2019 |

| 5,556 | 3.2% | 1,250 | 25.0% |

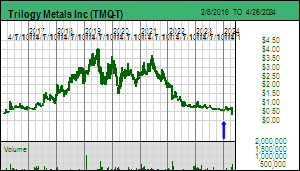

| Trilogy Metals Inc (TMQ-T) | Yes | 9/6/2019 |

| 446 | 2.9% | 1,133 | 13.3% |

| Western Copper and Gold Corp (WRN-T) | Yes | 9/6/2019 |

| 1,064 | 4.2% | 1,670 | 67.0% |

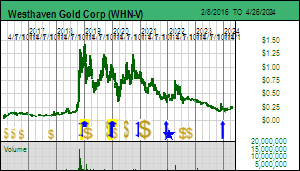

| Westhaven Gold Corp (WHN-V) | Yes | 9/6/2019 |

| 855 | 1.9% | 761 | (23.9%) |

KRO MIF September 2019 Index - Market Activity for December 31, 2020

| Company |

SVR |

Volume |

High |

Low |

Close |

Chg |

MI% |

RS% |

W% |

| Avino Silver & Gold Mines Ltd (ASM-T) |

|

84,700 |

$1.750 |

$1.620 |

$1.650 |

($0.050) |

-2.9% |

-3.5% |

5.1% |

| Brixton Metals Corp (BBB-V) |

|

483,400 |

$0.295 |

$0.285 |

$0.295 |

$0.010 |

3.5% |

2.9% |

2.5% |

| First Vanadium Corp (FVAN-V) |

|

89,900 |

$0.490 |

$0.460 |

$0.465 |

($0.025) |

-5.1% |

-5.7% |

3.6% |

| Forum Energy Metals Corp (FMC-V) |

|

537,300 |

$0.260 |

$0.230 |

$0.245 |

($0.005) |

-2.0% |

-2.6% |

8.8% |

| Golden Predator Mining Corp (GPY-V) |

|

50,700 |

$0.245 |

$0.240 |

$0.240 |

$0.005 |

2.1% |

1.5% |

1.6% |

| Great Bear Resources Ltd (GBR-V) |

|

73,900 |

$17.020 |

$16.650 |

$16.940 |

$0.100 |

0.6% |

0.0% |

5.3% |

| Integra Resources Corp (ITR-V) |

|

70,000 |

$5.000 |

$4.800 |

$5.000 |

$0.050 |

1.0% |

0.4% |

3.9% |

| Kootenay Silver Inc (KTN-V) |

|

354,300 |

$0.425 |

$0.410 |

$0.415 |

($0.005) |

-1.2% |

-1.8% |

3.9% |

| Kore Mining Ltd (KORE-V) |

|

19,800 |

$1.730 |

$1.690 |

$1.710 |

($0.020) |

-1.2% |

-1.8% |

10.9% |

| Libero Copper & Gold Corp (LBC-V) |

|

33,000 |

$0.085 |

$0.080 |

$0.085 |

$0.000 |

0.0% |

-0.6% |

1.3% |

| Minera Alamos Inc (MAI-V) |

|

424,400 |

$0.690 |

$0.670 |

$0.680 |

$0.000 |

0.0% |

-0.6% |

9.8% |

| New Placer Dome Gold Corp (NGLD-V) |

|

470,000 |

$0.360 |

$0.335 |

$0.355 |

$0.020 |

6.0% |

5.4% |

5.0% |

| Orea Mining Corp (OREA-T) |

|

2,444,700 |

$0.205 |

$0.150 |

$0.190 |

$0.050 |

35.7% |

35.1% |

3.3% |

| Orestone Mining Corp (ORS-V) |

|

300,700 |

$0.145 |

$0.135 |

$0.135 |

$0.000 |

0.0% |

-0.6% |

2.4% |

| Osino Resources Corp (OSI-V) |

|

27,700 |

$1.260 |

$1.230 |

$1.240 |

$0.010 |

0.8% |

0.2% |

3.9% |

| Precipitate Gold Corp (PRG-V) |

|

18,400 |

$0.240 |

$0.235 |

$0.240 |

$0.005 |

2.1% |

1.5% |

5.8% |

| Rugby Mining Ltd (RUG-V) |

|

24,000 |

$0.080 |

$0.080 |

$0.080 |

$0.000 |

0.0% |

-0.6% |

1.2% |

| Tinka Resources Ltd (TK-V) |

|

109,500 |

$0.235 |

$0.225 |

$0.225 |

($0.005) |

-2.2% |

-2.8% |

3.2% |

| Trilogy Metals Inc (TMQ-T) |

|

9,300 |

$2.560 |

$2.540 |

$2.540 |

($0.040) |

-1.6% |

-2.1% |

2.9% |

| Western Copper and Gold Corp (WRN-T) |

|

58,900 |

$1.630 |

$1.570 |

$1.570 |

($0.030) |

-1.9% |

-2.5% |

4.2% |

| Westhaven Gold Corp (WHN-V) |

|

41,500 |

$0.890 |

$0.880 |

$0.890 |

$0.000 |

0.0% |

-0.6% |

1.9% |

| MI% = change in member's index value, RS% = difference in change between overall index and member index values, W% = value weight of member |

|  |

| Issued: | 89,568,682 | Working Capital: | $16,859,000 |

| Diluted: | 96,054,682 | As Of: | September 30, 2020 |

| Membership Start Date | September 6, 2019 | Price at Start | $0.81 |

| Membership backdated to | January 1, 2019 | Membership Quantity | 1,235 |

|  |

| Issued: | 144,595,374 | Working Capital: | $3,579,875 |

| Diluted: | 189,577,322 | As Of: | June 30, 2020 |

| Membership Start Date | September 6, 2019 | Price at Start | $0.30 |

| Membership backdated to | January 1, 2019 | Membership Quantity | 3,333 |

|  |

| Issued: | 53,402,582 | Working Capital: | $1,345,625 |

| Diluted: | 75,958,899 | As Of: | August 31, 2020 |

| Membership Start Date | September 6, 2019 | Price at Start | $0.33 |

| Membership backdated to | January 1, 2019 | Membership Quantity | 3,030 |

|  |

| Issued: | 118,427,052 | Working Capital: | $357,524 |

| Diluted: | 156,973,868 | As Of: | August 31, 2020 |

| Membership Start Date | September 6, 2019 | Price at Start | $0.07 |

| Membership backdated to | January 1, 2019 | Membership Quantity | 14,286 |

| Dec 17, 2020 | Discovery Watch with HoweStreet.com - 0:00:01 |

| Oct 15, 2020 | Discovery Watch with HoweStreet.com - 0:14:23 |

| Aug 12, 2020 | Tracker: What's Next for Forum Energy Metals Corp? |

| May 7, 2020 | Discovery Watch with HoweStreet.com - 0:00:01 |

| Feb 27, 2020 | Discovery Watch with HoweStreet.com - 0:08:32 |

| Feb 26, 2020 | Tracker: Rio Tinto settling in for the long haul, Love Lake palladium play starting to make sense |

| Jan 30, 2020 | Discovery Watch with HoweStreet.com - 0:06:58 |

| Nov 12, 2019 | Tracker: Forum Energy scores a free ride on the broken Katusa-Rule uranium clock |

| Sep 4, 2019 | Tracker: Did the Janice Lake bear get lost looking for Love Lake? |

| May 10, 2019 | Tracker: Spec Value Rating for Forum Energy Metals Corp (FMC-V) |

| Dec 22, 2020 | Private Placement Non Brokered |

| Dec 22, 2020 | Closes $1,500,000 Private Placement |

| Dec 21, 2020 | Update on Uranium Projects in the Athabasca Basin, Saskatchewan |

| Dec 7, 2020 | Increase in Financing to $1,500,000 |

| Dec 3, 2020 | Budget for 6,000 Metre Drill Program at the Fir Island Uranium Project, Saskatchewan |

|  |

| Issued: | 172,333,720 | Working Capital: | $6,901,842 |

| Diluted: | 185,219,610 | As Of: | September 30, 2020 |

| Membership Start Date | September 6, 2019 | Price at Start | $0.38 |

| Membership backdated to | January 1, 2019 | Membership Quantity | 2,632 |

|  |

| Issued: | 52,879,958 | Working Capital: | $36,039,363 |

| Diluted: | 56,984,958 | As Of: | September 30, 2020 |

| Membership Start Date | September 6, 2019 | Price at Start | $8.05 |

| Membership backdated to | January 1, 2019 | Membership Quantity | 124 |

|  |

| Issued: | 54,608,177 | Working Capital: | $41,304,796 |

| Diluted: | 59,097,477 | As Of: | September 30, 2020 |

| Membership Start Date | July 9, 2020 | Price at Start | $5.27 |

| Membership backdated to | July 9, 2020 | Membership Quantity | 308 |

|  |

| Issued: | 309,996,675 | Working Capital: | $12,488,454 |

| Diluted: | 435,995,721 | As Of: | September 30, 2020 |

| Membership Start Date | September 6, 2019 | Price at Start | $0.27 |

| Membership backdated to | January 1, 2019 | Membership Quantity | 3,704 |

| Dec 17, 2020 | Kootenay Silver And Aztec Minerals Sign Joint Venture Agreement for the Cervantes Project, Sonora State, Mexico |

| Nov 12, 2020 | Intercepts 933 GPT Silver Equivalent Over 2.25 Meters From Final Drill Holes Completed at Copalito Silver Gold Project, Mexico |

| Oct 27, 2020 | Results from 29 Holes of the First Ever Drill Program at the Copalito Silver Gold Project, Mexico |

| Oct 5, 2020 | Discovers Broad Area of Silver Mineralization at J Z Zone Hosting New Hydrothermal & Stockwork System at Columba Project, Mexico |

| Sep 25, 2020 | Private Placement Brokered |

|  |

| Issued: | 106,058,280 | Working Capital: | $7,299,265 |

| Diluted: | 117,741,580 | As Of: | September 30, 2020 |

| Membership Start Date | September 6, 2019 | Price at Start | $0.40 |

| Membership backdated to | January 1, 2019 | Membership Quantity | 2,532 |

|  |

| Issued: | 148,418,422 | Working Capital: | $1,684,537 |

| Diluted: | 229,765,502 | As Of: | September 30, 2020 |

| Membership Start Date | September 6, 2019 | Price at Start | $0.17 |

| Membership backdated to | January 1, 2019 | Membership Quantity | 6,061 |

|  |

| Issued: | 438,227,453 | Working Capital: | $24,356,511 |

| Diluted: | 463,877,401 | As Of: | September 30, 2020 |

| Membership Start Date | September 6, 2019 | Price at Start | $0.18 |

| Membership backdated to | January 1, 2019 | Membership Quantity | 5,714 |

| Dec 23, 2020 | Files Technical Report for Cerro de Oro Mineral Resource Estimate of 630,000 Ounces Contained Gold |

| Dec 21, 2020 | Results of Annual General Meeting |

| Nov 24, 2020 | Provides an Update on Federal Permit Approvals for the Fortuna Gold Project, Durango, Mexico |

| Nov 16, 2020 | Mineral Resource Estimate of 630,000 Ounces Contained Gold |

| Nov 9, 2020 | OTC Markets Group Welcomes Minera Alamos, Inc. to OTCQX |

|  |

| Issued: | 91,143,336 | Working Capital: | $5,129,861 |

| Diluted: | 160,393,573 | As Of: | September 30, 2020 |

| Membership Start Date | September 6, 2019 | Price at Start | $0.18 |

| Membership backdated to | April 29, 2019 | Membership Quantity | 5,556 |

|  |

| Issued: | 195,921,000 | Working Capital: | $5,591,000 |

| Diluted: | 213,597,250 | As Of: | June 30, 2020 |

| Membership Start Date | September 6, 2019 | Price at Start | $0.15 |

| Membership backdated to | January 1, 2019 | Membership Quantity | 6,897 |

|  |

| Issued: | 39,247,829 | Working Capital: | $730,822 |

| Diluted: | 65,365,249 | As Of: | July 31, 2020 |

| Membership Start Date | September 6, 2019 | Price at Start | $0.14 |

| Membership backdated to | January 1, 2019 | Membership Quantity | 7,143 |

|  |

| Issued: | 67,368,495 | Working Capital: | $25,899,899 |

| Diluted: | 96,830,338 | As Of: | September 30, 2020 |

| Membership Start Date | September 6, 2019 | Price at Start | $0.80 |

| Membership backdated to | January 1, 2019 | Membership Quantity | 1,250 |

|  |

| Issued: | 106,313,031 | Working Capital: | $1,911,233 |

| Diluted: | 118,933,641 | As Of: | August 31, 2020 |

| Membership Start Date | September 6, 2019 | Price at Start | $0.11 |

| Membership backdated to | January 1, 2019 | Membership Quantity | 9,524 |

| Dec 15, 2020 | Barrick to Commence Drilling with Two Drills at Precipitate's Pueblo Grande Project, Dominican Republic |

| Dec 10, 2020 | Unaware of Any Material Change |

| Dec 3, 2020 | Magnetic 3D Inversion Refines Drill Targets at Copey Hill Zone, Ponton Project, Dominican Republic |

| Sep 14, 2020 | Renews Exploration & Drill Targeting at Juan de Herrera Project, Tireo Gold Camp in West Dominican Republic |

| Sep 10, 2020 | Ground Magnetic Survey Further Refines Drill Targets Within Copey Hill Zone at Ponton Project, Dominican Republic |

|  |

| Issued: | 102,707,020 | Working Capital: | $711,885 |

| Diluted: | 135,306,662 | As Of: | August 31, 2020 |

| Membership Start Date | September 6, 2019 | Price at Start | $0.17 |

| Membership backdated to | January 1, 2019 | Membership Quantity | 6,061 |

|  |

| Issued: | 340,740,717 | Working Capital: | $20,872,770 |

| Diluted: | 355,117,717 | As Of: | June 30, 2020 |

| Membership Start Date | September 6, 2019 | Price at Start | $0.18 |

| Membership backdated to | January 1, 2019 | Membership Quantity | 5,556 |

|  |

| Issued: | 142,978,805 | Working Capital: | $11,841,000 |

| Diluted: | 152,645,184 | As Of: | August 31, 2020 |

| Membership Start Date | September 6, 2019 | Price at Start | $2.24 |

| Membership backdated to | January 1, 2019 | Membership Quantity | 446 |

|  |

| Issued: | 115,719,335 | Working Capital: | $2,554,937 |

| Diluted: | 124,144,335 | As Of: | September 30, 2020 |

| Membership Start Date | September 6, 2019 | Price at Start | $0.94 |

| Membership backdated to | January 1, 2019 | Membership Quantity | 1,064 |

|  |

| Issued: | 102,622,409 | Working Capital: | $2,384,256 |

| Diluted: | 114,602,660 | As Of: | September 30, 2020 |

| Membership Start Date | September 6, 2019 | Price at Start | $1.17 |

| Membership backdated to | January 1, 2019 | Membership Quantity | 855 |

| Dec 11, 2019 | Discovery Watch with HoweStreet.com - 0:00:01 |

| Nov 11, 2019 | Tracker: Westhaven stepping into new target areas at Shovelnose |

| Oct 16, 2019 | Discovery Watch with HoweStreet.com - 0:17:39 |

| Sep 13, 2019 | Tracker: Seeing Westhaven's potential beyond the South Zone at Shovelnose |

| Sep 10, 2019 | Discovery Watch with HoweStreet.com - 0:22:40 |

| Sep 3, 2019 | Discovery Watch with HoweStreet.com - 0:07:28 |

| Aug 30, 2019 | Tracker: Game on again at Shovelnose beyond the fault that appeared to limit the South Zone |

| May 31, 2019 | Discovery Watch with HoweStreet.com - 0:17:53 |

| May 6, 2019 | Tracker: Westhaven leaves market gasping with end of spring season cliffhanger |

| Apr 29, 2019 | Tracker: Is the South Zone 1 vein offset hypothesis at Shovelnose valid? |

| Index Members Delisted or Closed Out |

|---|

|  |

| Issued: | 178,573,041 | Working Capital: | $7,092,139 |

| Diluted: | 200,795,024 | As Of: | March 31, 2020 |

| Membership Start Date | September 6, 2019 | Price at Start | $0.22 |

| Membership End Date | May 25, 2020 | Price at End | $0.80 |

| Membership backdated to | January 1, 2019 | Membership Quantity | 4,651 |

|

| |

| | You can return to the Top of this page

|

|