Home / Companies / KRO Profile

KRO Profile

|

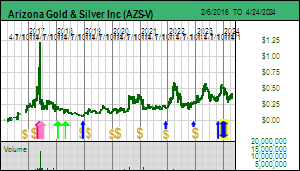

| Price: | $0.370 | Open Rec: | See Strategy |  |

| Market Cap: | $28,445,231 | WC % of Mkt Cap: | -1% |

| Working Cap: | ($308,941) | As of: | 11/30/2023 |

| Issued: | 76,879,002 | Insider %: | 11.1% | | Diluted: | 97,031,347 | Story Type: | Resource: Discovery Exploration |

| Key People: | Mike Stark (CEO), Dong H. Shim (CFO), Gregory A. Hahn (VP EX), |

SV Rating: Fair Spec Value - Favorite - as of December 29, 2023: Arizona Silver Corp was assigned a Bottom-Fish Spec Value rating at $0.20 on December 1, 2021 based on emerging evidence that the Philadelphia project in Arizona was evolving beyond a high grade gold-silver vein chasing exercise into a potential associated open-pittable bulk tonnage discovery. Arizona Silver listed on the TSXV on Nov 16, 2011 as a CPC called Damon Capital Corp which completed its QT on Nov 16, 2016 by acquiring a private company called Arizona Silver Corp with rights to the former Ramsey silver mine in Arizona. The driving force behind Arizona Silver was Mike Stark who handled marketing and is now the CEO, and Greg Hahn who handles the exploration strategy. Ramsey hosted a narrow high grade silver vein that was mined on a very small scale because its down-dip extension was cut off by a fault. Hahn developed the hypothesis that the remainder of the system had been fault offset to the northeast where it was buried under gravel cover. An IP anomaly suggested a comparison with the Real de Angeles deposit in Zacatecas where a high grade silver-lead-zinc vein ended up being the extension of a bulk tonnage system that became an open pit mine. May 18, 2017 outlined this play which caught the market's imagination, but the play collapsed when rush assays revealed that the silver grade was too low. I gave up in Tracker Jan 17, 2018. Arizona Silver still has hopes for testing a blind geophysical target to the east of the Ramsey vein interpreted as a bulk tonnage system, but Philadelphia has become the primary focus. After killing the deep IP Ramsey target Arizona Silver in March 2018 optioned the Sycamore Canyon project in Arizona which a pair of prospectors had generated during the 1980's but never managed to do any work on themselves or farm it out. Greg Hahn kne...(see Profile for full Overview) SV Rating: Fair Spec Value - Favorite - as of December 29, 2023: Arizona Silver Corp was assigned a Bottom-Fish Spec Value rating at $0.20 on December 1, 2021 based on emerging evidence that the Philadelphia project in Arizona was evolving beyond a high grade gold-silver vein chasing exercise into a potential associated open-pittable bulk tonnage discovery. Arizona Silver listed on the TSXV on Nov 16, 2011 as a CPC called Damon Capital Corp which completed its QT on Nov 16, 2016 by acquiring a private company called Arizona Silver Corp with rights to the former Ramsey silver mine in Arizona. The driving force behind Arizona Silver was Mike Stark who handled marketing and is now the CEO, and Greg Hahn who handles the exploration strategy. Ramsey hosted a narrow high grade silver vein that was mined on a very small scale because its down-dip extension was cut off by a fault. Hahn developed the hypothesis that the remainder of the system had been fault offset to the northeast where it was buried under gravel cover. An IP anomaly suggested a comparison with the Real de Angeles deposit in Zacatecas where a high grade silver-lead-zinc vein ended up being the extension of a bulk tonnage system that became an open pit mine. May 18, 2017 outlined this play which caught the market's imagination, but the play collapsed when rush assays revealed that the silver grade was too low. I gave up in Tracker Jan 17, 2018. Arizona Silver still has hopes for testing a blind geophysical target to the east of the Ramsey vein interpreted as a bulk tonnage system, but Philadelphia has become the primary focus. After killing the deep IP Ramsey target Arizona Silver in March 2018 optioned the Sycamore Canyon project in Arizona which a pair of prospectors had generated during the 1980's but never managed to do any work on themselves or farm it out. Greg Hahn kne...(see Profile for full Overview) |

| Last Corporate Change - Sep 22, 2023: 1:1 Name Change from Arizona Silver Exploration Inc (AZS-V) |

| Last KRO Comment - Apr 12, 2024: KW Excerpt: Kaiser Watch April 12, 2024: Arizona Gold & Silver Inc (AZS-V) |

| Recent News - Apr 10, 2024: Commences Reverse Circulation Drilling at the Philadelphia Gold Silver Project, Arizona |

|

| |

Project |

Interest |

|

Country |

Region |

Stage |

IPV

($mm) |

Target |

Deposit

Model |

|

Philadelphia |

100% WI |

|

United States |

Arizona |

3-Discovery Delineation |

$36 |

Gold Silver |

Low Sulphidation Epithermal  |

|

Sycamore Canyon |

100% WI |

|

United States |

Arizona |

2-Target Drilling |

$36 |

Gold Silver |

Breccia / Vein  |

|

Silverton |

100% WI |

|

United States |

Nye County |

2-Target Drilling |

$36 |

Gold |

Carlin Style  |

|

Ramsey |

100% WI |

|

United States |

Arizona |

2-Target Drilling |

$36 |

Silver Lead Zinc |

Vein  |

![]() |

|

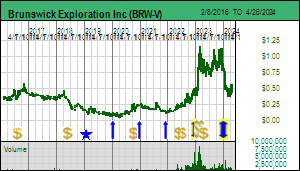

| Price: | $0.500 | Open Rec: | See Strategy |  |

| Market Cap: | $98,988,151 | WC % of Mkt Cap: | 10% |

| Working Cap: | $9,723,506 | As of: | 9/30/2023 |

| Issued: | 197,976,301 | Insider %: | 25.4% | | Diluted: | 215,577,659 | Story Type: | Resource: Discovery Exploration |

| Key People: | Killian Charles (CEO), Robert P. Wares (Chair), Anthony Glavac (CFO), |

SV Rating: Fair Spec Value - Favorite - as of December 29, 2023 SV Rating: Fair Spec Value - Favorite - as of December 29, 2023 |

| Last Corporate Change - Oct 6, 2020: 1:1 Name Change from Komet Resources Inc (KMT-V) |

| Last KRO Comment - Apr 5, 2024: KW Excerpt: Kaiser Watch April 5, 2024: Brunswick Exploration Inc (BRW-V) |

| Recent News - Apr 11, 2024: Property Asset or Share Purchase Agreement |

|

| |

Project |

Interest |

|

Country |

Region |

Stage |

IPV

($mm) |

Target |

Deposit

Model |

|

Mirage |

100% WI |

|

Canada |

James Bay |

3-Discovery Delineation |

$108 |

Lithium |

Pegmatite  |

|

Pontiac |

100% WI |

|

Canada |

Abitibi Belt |

1-Grassroots |

$108 |

Lithium |

Pegmatite  |

|

Anatacau |

90% WI |

|

Canada |

James Bay |

2-Target Drilling |

$120 |

Lithium |

Pegmatite  |

|

James Bay |

100% WI |

|

Canada |

James Bay |

1-Grassroots |

$108 |

Lithium |

Pegmatite  |

|

Mythril-Rare Mineral |

85% WI |

|

Canada |

James Bay |

2-Target Drilling |

$127 |

Lithium |

Pegmatite  |

|

Plex |

90% WI |

|

Canada |

James Bay |

2-Target Drilling |

$120 |

Lithium |

Pegmatite  |

|

Trans-Hudson |

100% WI |

|

Canada |

La Ronge Belt |

2-Target Drilling |

$108 |

Lithium |

Pegmatite  |

|

South Mountain |

100% WI |

|

Canada |

Nova Scotia |

1-Grassroots |

$108 |

Lithium |

Pegmatite  |

|

Lake Athabasca |

100% WI |

|

Canada |

Athabasca Basin |

1-Grassroots |

$108 |

Lithium |

Pegmatite  |

|

Lynn Lake |

100% WI |

|

Canada |

Northern Manitoba |

2-Target Drilling |

$108 |

Lithium |

Pegmatite  |

|

Hearst |

100% WI |

|

Canada |

Northwest Ontario |

2-Target Drilling |

$108 |

Lithium |

Pegmatite  |

|

Caledonia |

100% WI |

|

Canada |

New Brunswick |

1-Grassroots |

$108 |

Tin |

Greisen |

|

Catamaran |

100% WI |

|

Canada |

New Brunswick |

1-Grassroots |

$108 |

Lithium |

Pegmatite  |

|

Hankshaw |

100% WI |

|

Canada |

New Brunswick |

1-Grassroots |

$108 |

Lithium |

Pegmatite |

|

Hermitage |

100% WI |

|

Canada |

Newfoundland |

1-Grassroots |

$108 |

Lithium |

Pegmatite  |

|

North Shore |

100% WI |

|

Canada |

Southern Quebec |

1-Grassroots |

$108 |

Lithium |

Pegmatite  |

![]() |

|

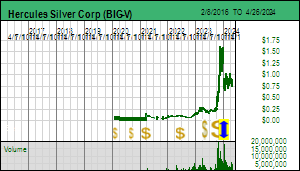

| Price: | $2.150 | Open Rec: | See Strategy |  |

| Market Cap: | $383,727,165 | WC % of Mkt Cap: | 1% |

| Working Cap: | $3,440,946 | As of: | 10/31/2023 |

| Issued: | 178,477,751 | Insider %: | 50.8% | | Diluted: | 193,998,051 | Story Type: | Resource: Feasibility Demonstration |

| Key People: | David Austin (CEO), Andrea Yuan (CFO), John T. Perry (COO), |

SV Rating: Fair Spec Value - Favorite - as of December 29, 2023 SV Rating: Fair Spec Value - Favorite - as of December 29, 2023 |

| Last Corporate Change - Oct 12, 2010: 2:1 Name Change from Ananda Capital Corp (ANN.P-V) |

| Last KRO Comment - Jan 6, 2023: KW Excerpt: Kaiser Watch January 6, 2023: Colonial Coal International Corp (CAD-V) |

| Recent News - Dec 14, 2023: Results of AGM and Appointments |

|

| |

Project |

Interest |

|

Country |

Region |

Stage |

IPV

($mm) |

Target |

Deposit

Model |

|

Huguenot |

100% WI |

|

Canada |

Northeast BC |

6-Prefeasibility |

$417 |

Coal - Metallurgical |

Seams  |

|

Flatbed |

100% WI |

|

Canada |

Northeast BC |

6-Prefeasibility |

$417 |

Coal - Metallurgical |

Seams  |

![]() |

|

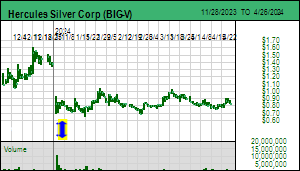

| Price: | $0.810 | Open Rec: | See Strategy |  |

| Market Cap: | $174,446,973 | WC % of Mkt Cap: | 1% |

| Working Cap: | $1,974,372 | As of: | 9/30/2023 |

| Issued: | 215,366,633 | Insider %: | 6.1% | | Diluted: | 264,838,275 | Story Type: | Resource: Discovery Exploration |

| Key People: | Christopher Paul (CEO), Luis C. da Silva (Chair), Peter Simeon (Chair), Raymond Harari (Pres), Keith Li (CFO), Christopher Longton (VP EX), Antoine Soucy-Fradette (VP EX), |

SV Rating: Fair Spec Value - Favorite - as of January 4, 2024 SV Rating: Fair Spec Value - Favorite - as of January 4, 2024 |

| Last Corporate Change - Aug 24, 2022: 1:1 Name Change from Bald Eagle Gold Corp (BIG-V) |

| Last KRO Comment - Mar 15, 2024: KW Excerpt: Kaiser Watch March 15, 2024: Hercules Silver Corp (BIG-V) |

| Recent News - Apr 9, 2024: Showcases 2023 Deep Seeking Geophysics in Advance of 2024 Drilling |

|

| |

Project |

Interest |

|

Country |

Region |

Stage |

IPV

($mm) |

Target |

Deposit

Model |

|

Hercules |

100% WI |

|

United States |

Idaho |

3-Discovery Delineation |

$215 |

Copper Molybdenum Silver |

Porphyry  |

![]() |

|

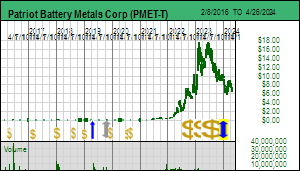

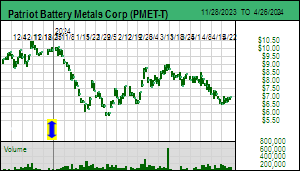

| Price: | $6.830 | Open Rec: | See Strategy |  |

| Market Cap: | $899,305,834 | WC % of Mkt Cap: | 10% |

| Working Cap: | $90,084,000 | As of: | 12/31/2023 |

| Issued: | 131,669,961 | Insider %: | 0.4% | | Diluted: | 145,534,535 | Story Type: | Resource: Discovery Exploration |

| Key People: | Ken Brinsden (CEO), Pierre Boivin (Chair), D. Blair Way (COO), Bradley Seward (VP CD), Darren L. Smith (VP EX), Kelly Pladson (Sec), |

SV Rating: Fair Spec Value - Favorite - as of December 29, 2023: 92 Resources Corp has a Bottom-Fish Spec Value rating based on the strategic location of its Corvette "lithium" project within the apparent trend of the emerging Mythril copper discovery of Midland Exploration Inc. NTY, which has 87.8 million issued and 104.6 million fully diluted, of which declared insiders own less than 2%, and about $600,000 in flow-thru capital that must be spent in 2019, would not qualify for a Bottom-Fish or higher Spec Value rating if it were not located near ground zero in what appears to be shaping up as a Great Canadian Area Play, a resource junior market phenomenon which we have not seen since 2007-2008 when Noront ignited the McFauld's Lake region with its nickel discovery which failed to achieve world class scale. The James Bay region had a mini area play in 2004-2006 when Virginia Gold discovered the Eleonore gold deposit. This time around Quebec has formalized James Bay as part of Plan Nord, a government initiative to develop the northern two-thirds of the province. The James Bay Plan Nord Area Play does not yet have confirmation of a world class discovery, which could come in early May when Midland reports results from its initial 11 hole program at Mythril, though will more likely unfold during the 2019 summer as Midland gets 3 drill rigs turning and a better understanding emerges for this new copper system which has attracted the attention of BHP, the world's biggest copper producer which is not interested in anything with less than world class scale. The realization that NTY is positioned to become the third hottest junior after Midland and Azimut Exploration Inc during the emerging stage of the James Bay Plan Nord Area Play has lit a fire under a group that has suffered as the resource junior bear market trudges along in its eighth y...(see Profile for full Overview) SV Rating: Fair Spec Value - Favorite - as of December 29, 2023: 92 Resources Corp has a Bottom-Fish Spec Value rating based on the strategic location of its Corvette "lithium" project within the apparent trend of the emerging Mythril copper discovery of Midland Exploration Inc. NTY, which has 87.8 million issued and 104.6 million fully diluted, of which declared insiders own less than 2%, and about $600,000 in flow-thru capital that must be spent in 2019, would not qualify for a Bottom-Fish or higher Spec Value rating if it were not located near ground zero in what appears to be shaping up as a Great Canadian Area Play, a resource junior market phenomenon which we have not seen since 2007-2008 when Noront ignited the McFauld's Lake region with its nickel discovery which failed to achieve world class scale. The James Bay region had a mini area play in 2004-2006 when Virginia Gold discovered the Eleonore gold deposit. This time around Quebec has formalized James Bay as part of Plan Nord, a government initiative to develop the northern two-thirds of the province. The James Bay Plan Nord Area Play does not yet have confirmation of a world class discovery, which could come in early May when Midland reports results from its initial 11 hole program at Mythril, though will more likely unfold during the 2019 summer as Midland gets 3 drill rigs turning and a better understanding emerges for this new copper system which has attracted the attention of BHP, the world's biggest copper producer which is not interested in anything with less than world class scale. The realization that NTY is positioned to become the third hottest junior after Midland and Azimut Exploration Inc during the emerging stage of the James Bay Plan Nord Area Play has lit a fire under a group that has suffered as the resource junior bear market trudges along in its eighth y...(see Profile for full Overview) |

| Last Corporate Change - Feb 1, 2024: New Exchange Listing |

| Last KRO Comment - Mar 22, 2024: KW Excerpt: Kaiser Watch March 22, 2024: Patriot Battery Metals Corp (PMET-T) |

| Recent News - Apr 17, 2024: Achieves Key Permitting Milestone for Corvette with Receipt of Guidelines from the Ministry |

|

| |

Project |

Interest |

|

Country |

Region |

Stage |

IPV

($mm) |

Target |

Deposit

Model |

|

Corvette |

100% WI |

|

Canada |

James Bay |

4-Infill & Metallurgy |

$994 |

Lithium |

Pegmatite  |

|

Pontax River |

100% WI |

|

Canada |

James Bay |

2-Target Drilling |

$994 |

Lithium |

Pegmatite  |

|

Hidden Lake |

10% TC |

|

Canada |

Northwest Territories |

2-Target Drilling |

$9,940 |

Lithium |

Pegmatite  |

|

Eastmain |

100% WI |

|

Canada |

James Bay |

1-Grassroots |

$994 |

Lithium |

Pegmatite  |

|

Lac du Beryl |

100% WI |

|

Canada |

James Bay |

1-Grassroots |

$994 |

Lithium |

Pegmatite  |

|

Silver Sands |

100% WI |

|

Canada |

Northern BC |

1-Grassroots |

$994 |

Vanadium |

Sediment Hosted  |

|

Golden Silica |

100% WI |

|

Canada |

Southeast BC |

4-Infill & Metallurgy |

$994 |

Silica Sand |

Mineral Sands  |

![]() |

|

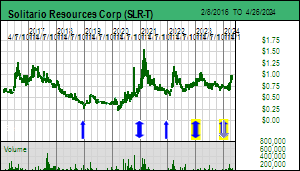

| Price: | $0.980 | Open Rec: | See Strategy |  |

| Market Cap: | $77,994,631 | WC % of Mkt Cap: | 12% |

| Working Cap: | $9,309,000 | As of: | 12/31/2023 |

| Issued: | 79,586,358 | Insider %: | 12.3% | | Diluted: | 83,414,858 | Story Type: | Resource: Feasibility Demonstration |

| Key People: | Christopher E. Herald (CEO), Brian Labadie (Chair), James R. Maronick (CFO), Walter H. Hunt (COO), |

SV Rating: Fair Spec Value - Favorite - as of December 29, 2023: Solitario Zinc Corp was made a Fair Spec Value rated 2023 Favorite at $0.84 on Decxember 30, 2022 based on the potential of the relatively new Golden Crest project in South Dakota to turn into a major gold discovery, and the sleeper potential of the company's Florida Canyon and LIK zinc projects. The key missing piece is a plan of operations permit which would allow Solitario to begin drilling targets it has developed on the 13,500 ha Golden Crest project which the junior began assembling in early 2021. Environmental assessment work was initiated in February 2022 and approval is expected in Q2 of 2023 with drilling underway in H2 of 2023. Golden Crest covers an unexplored plateau to the west of the Black Hills where 93 million ounces have been identified within a 12,000 ha area. Of these 68.3 million ounces are attributable to the Precambrian basement hosted banded-iron-formation Homestake deposit, 8.2 million ounces to the Paleozoic sediment hosted Wharf Mine, and the rest in a variety of deposits including the Richmond Hill/Maitland land package assembled by Bob Quartermain's Dakota Gold Corp. Whereas the exploration activity in the Black Hills to the east involves rethinking the existing geology in the hope that past exploration overlooked significant gold zones, Solitario's work at Golden Crest to the west is old-fashioned grassroots exploration so far limited to geophysical surveys with surface prospecting and trenching. Golden Crest has seen limited exploration beyond a few old-timer prospect pits that didn't come up with much, and several scout holes drilled by Homestake in the 1990s which confirmed the presence of Homestake Formation within the Precambrian basement at a depth of 300-400 m but never attracted further attention from Homestake. The major also condu...(see Profile for full Overview) SV Rating: Fair Spec Value - Favorite - as of December 29, 2023: Solitario Zinc Corp was made a Fair Spec Value rated 2023 Favorite at $0.84 on Decxember 30, 2022 based on the potential of the relatively new Golden Crest project in South Dakota to turn into a major gold discovery, and the sleeper potential of the company's Florida Canyon and LIK zinc projects. The key missing piece is a plan of operations permit which would allow Solitario to begin drilling targets it has developed on the 13,500 ha Golden Crest project which the junior began assembling in early 2021. Environmental assessment work was initiated in February 2022 and approval is expected in Q2 of 2023 with drilling underway in H2 of 2023. Golden Crest covers an unexplored plateau to the west of the Black Hills where 93 million ounces have been identified within a 12,000 ha area. Of these 68.3 million ounces are attributable to the Precambrian basement hosted banded-iron-formation Homestake deposit, 8.2 million ounces to the Paleozoic sediment hosted Wharf Mine, and the rest in a variety of deposits including the Richmond Hill/Maitland land package assembled by Bob Quartermain's Dakota Gold Corp. Whereas the exploration activity in the Black Hills to the east involves rethinking the existing geology in the hope that past exploration overlooked significant gold zones, Solitario's work at Golden Crest to the west is old-fashioned grassroots exploration so far limited to geophysical surveys with surface prospecting and trenching. Golden Crest has seen limited exploration beyond a few old-timer prospect pits that didn't come up with much, and several scout holes drilled by Homestake in the 1990s which confirmed the presence of Homestake Formation within the Precambrian basement at a depth of 300-400 m but never attracted further attention from Homestake. The major also condu...(see Profile for full Overview) |

| Last Corporate Change - Jul 18, 2023: 1:1 Name Change from Solitario Zinc Corp (SLR-T) |

| Last KRO Comment - Mar 29, 2024: KW Excerpt: Kaiser Watch March 29, 2024: Solitario Resources Corp (SLR-T) |

| Recent News - Mar 28, 2024: Discovers Significant New Gold Zone Sleeping Beauty New Multi Gram Gold Assays Over a 1,600 Meter Trend |

|

| |

Project |

Interest |

|

Country |

Region |

Stage |

IPV

($mm) |

Target |

Deposit

Model |

|

Golden Crest |

100% WI |

|

United States |

South Dakota |

2-Target Drilling |

$82 |

Gold |

Banded Iron Formation  |

|

Florida Canyon |

30% FC |

|

Peru |

Northern Peru |

5-PEA |

$272 |

Zinc Lead Silver |

Mississippi Valley  |

|

Lik |

50% WI |

|

United States |

Alaska |

5-PEA |

$163 |

Zinc Lead Silver |

Sedex  |

![]() |

|

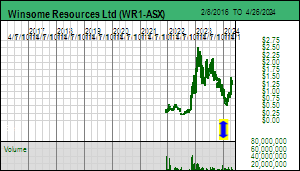

| Price: | $1.275 | Open Rec: | See Strategy |  |

| Market Cap: | $236,002,500 | WC % of Mkt Cap: | 14% |

| Working Cap: | $33,607,507 | As of: | 6/30/2023 |

| Issued: | 185,100,000 | Insider %: | 24.8% | | Diluted: | 208,800,000 | Story Type: | Resource: Discovery Exploration |

| Key People: | Christopher Evans (MD), Sephen Biggins (Chair), Justin Boylson (Chair), Carl Caumartin (VP EX), Peter Youd (Sec), |

SV Rating: Fair Spec Value - Favorite - as of December 29, 2023 SV Rating: Fair Spec Value - Favorite - as of December 29, 2023 |

| Last KRO Comment - Apr 5, 2024: KW Excerpt: Kaiser Watch April 5, 2024: Winsome Resources Ltd (WR1-ASX) |

|

| |

Project |

Interest |

|

Country |

Region |

Stage |

IPV

($mm) |

Target |

Deposit

Model |

|

Adina |

100% WI |

|

Canada |

James Bay |

4-Infill & Metallurgy |

$266 |

Lithium |

Pegmatite  |

|

Decelles |

100% WI |

|

Canada |

Abitibi Belt |

1-Grassroots |

$266 |

Lithium |

Pegmatite  |

|

Mazerac |

100% WI |

|

Canada |

Abitibi Belt |

1-Grassroots |

$266 |

Lithium |

Pegmatite  |

|

Cancet |

100% WI |

|

Canada |

James Bay |

3-Discovery Delineation |

$266 |

Lithium |

Pegmatite  |

|

Sirmac-Clapier |

100% WI |

|

Canada |

Chibougamau |

2-Target Drilling |

$266 |

Lithium |

Pegmatite  |

![]() |

|