| |

Bottom-Fish Comment - March 16, 2016: Recommendation Strategy for Canalaska Uranium Inc

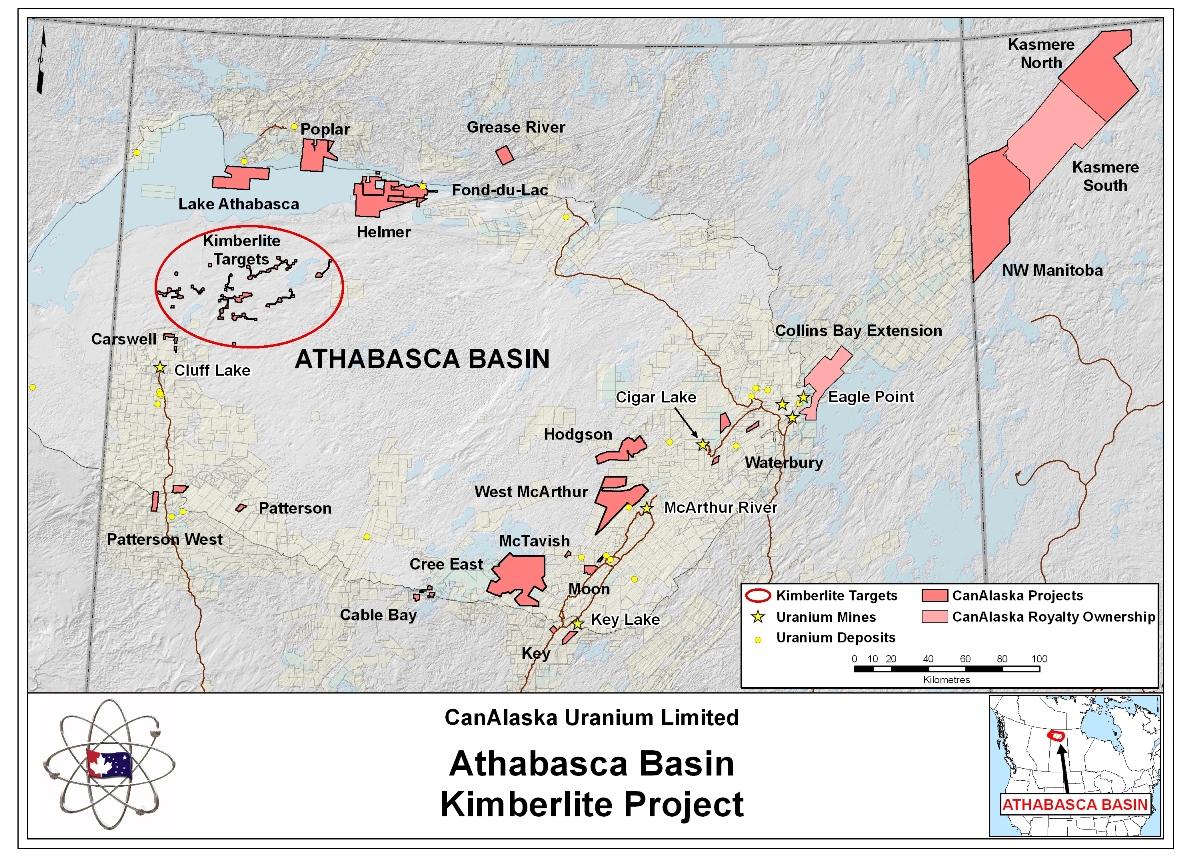

Canalaska Uranium Ltd was on the short list for the 2016 Bottom-Fish Edition but did not make the cut because its main Athabasca Basin uranium projects were stalled due to waning interest from the junior's Asian partners after considerable expenditure with no discovery, and its $800,000 treasury was too low to fund any meaningful Athabasca Basin exploration. In the case of the West McArthur project Mitsubishi (50%) funded most of the $17 million spent mainly in the Grid 1 area, and in the case of Cree East a Korean consortium led by KORES spent $19 million to earn 50%. Although Chuck Fipke's Northern Uranium Corp had decided to spend another $5.6 million to boost its interest in the Northwest Manitoba uranium project, the resulting 20% interest for Canalaska was not hope-inspiring given Fipke's track record since discovering Ekati. Although $800,000 working capital, only 26.2 million fully diluted since a 10:1 rollback in November 2010, and vested interests in strategic uranium prospects should have qualified Canalaska as a bottom-fish buy recommendation, I felt the uranium exploration story launched in 2005 as the uranium bubble got underway had pretty much exhausted itself and that Canalaska was destined to spin its wheels in a rut as its Asian partners slunk away. So why did I on February 19, 2016 add Canalaska Uranium Ltd to the 2016 Bottom-Fish Edition as a buy in the $0.10-$0.19 range? Canalaska Uranium Ltd was on the short list for the 2016 Bottom-Fish Edition but did not make the cut because its main Athabasca Basin uranium projects were stalled due to waning interest from the junior's Asian partners after considerable expenditure with no discovery, and its $800,000 treasury was too low to fund any meaningful Athabasca Basin exploration. In the case of the West McArthur project Mitsubishi (50%) funded most of the $17 million spent mainly in the Grid 1 area, and in the case of Cree East a Korean consortium led by KORES spent $19 million to earn 50%. Although Chuck Fipke's Northern Uranium Corp had decided to spend another $5.6 million to boost its interest in the Northwest Manitoba uranium project, the resulting 20% interest for Canalaska was not hope-inspiring given Fipke's track record since discovering Ekati. Although $800,000 working capital, only 26.2 million fully diluted since a 10:1 rollback in November 2010, and vested interests in strategic uranium prospects should have qualified Canalaska as a bottom-fish buy recommendation, I felt the uranium exploration story launched in 2005 as the uranium bubble got underway had pretty much exhausted itself and that Canalaska was destined to spin its wheels in a rut as its Asian partners slunk away. So why did I on February 19, 2016 add Canalaska Uranium Ltd to the 2016 Bottom-Fish Edition as a buy in the $0.10-$0.19 range?

On February 18, 2016 Canalaska announced that it had staked claims covering 75 magnetic anomalies it interpreted as potential kimberlite pipes in the northwestern part of the Athabasca Basin. This area south of Lake Athabasca and north of the Carswell Structure (some say a meteor impact site, others say an ancient basement "pop-up" feature) is the least interesting from a uranium perspective because the unconformity sits under about 1,500-2,000 m of sandstone, too deep for any alteration chimneys to be discernible at the surface, and beyond the reach of geophysical surveys seeking conductive graphite beds that are the theoretical host for the Athabasca Basin's high grade uranium deposits such as the world class McArthur River deposit. It is a uranium exploration dead zone. In 2011 the Saskatchewan Geological Survey conducted a 400 m spaced airborne magnetic survey whose results were published in 2012. Nobody took much notice, but Canalaska's Peter Dasler and Karl Schimann, not having much to do after Fukushima crimped the spending activity of Canalaska's Asian partners, pulled the dataset and crunched it to see if anything encouraging for uranium targets was present. They were disappointed, but noted a cluster of discrete near-surface magnetic anomalies that made no sense given the monotonous nature of the basin's Proterozoic sandstone cover. The only plausible explanation was an igneous intrusion, and the only intrusion that would create such a circular magnetic feature would be a kimberlite style intrusion.

Dasler and Schimann meditated on this oddity for a couple of years, but in mid 2015 decided to stake postage stamp claims over each of the 75 magnetic anomalies they had identified. Canada's staking system requires the owner to spend assessment work on the claims, which, even though it might all have been focused on a skinny vein in a tiny area, can be allocated to all contiguous claims. Recognizing the high risk nature of this diamond hypothesis, and how the Canalaska shareholder base might not be thrilled about a diversion of capital from uranium into diamond exploration, management also staked strings of single claims that connect the postage stamps so that the claim map looks like a bunch of hydra in a petri dish viewed through a microscope. This allows focused exploration on a single target to keep all the "connected" targets alive. It would have cost a fortune in the old physical post staking days, but in the modern era of map-staking it was just an exercise in mouse-clicking. When I saw this cluster of targets spread out within a 100 km by 50 km area I was stunned, especially after I realized that this portion of the Athabasca Basin is underlain by the Archean aged Rae craton which is known to host diamondiferous kimberlites. Could it be that a random government funded data gathering exercise had generated the tell-tale signs of a kimberlite cluster that a junior terrified by the bear market afflicting the resource sector since 2011 took the trouble to investigate and spent not easily replaceable capital to stake? Was this the serendipity event that periodically hauls the Canadian juniors out of deep slumps?

The northern prairies have had a number of diamond exploration waves, of which the most recent is the Pikoo area in the northern part of the Saskatchewan Craton where North Arrow Minerals Ltd discovered dykes that appear to have high grade diamond potential of 100 cpht plus based on micro diamond size distribution curves. But the Pikoo dykes have limited tonnage potential, and until somebody finds a larger high grade body, this area is largely a science project. That may change if another bottom-fish called Alto Ventures Ltd turns several circular geophysical anomalies associated with nearby diamond indicator minerals into kimberlite discoveries. In the central part of the Saskatchewan Craton we have the Fort a la Corne field of large low grade kimberlites apparently erupted into a submarine environment that are covered by several hundrd metres of unconsolidated sediments. What is intriguing about the FALC kimberlites controlled by Shore Gold Inc is the high upper limit of the carat value modeled by WWW which also assigns a base case value in the upper half of the range. This suggests the presence of large, high quality diamonds of the sort that have been infrequent in major Canadian diamond mines such as Ekati, Diavik and Victor. In northern Alberta we have the Buffalo Hills cluster of weakly diamondiferous kimberlites that Ashton found on the basis of magnetic anomalies initially spotted by a petroleum geologist. That spurred an area play in the 1998-2001 period that fizzled when mini bulk sampling delivered very low grades. Another cluster of barren kimberlites was found to the east in the Birch Mountain area. But what tweaked the interest of Dasler and Schimann was a regional till sampling program which yielded kimberlite indicator minerals north of Fort McMurray whose source has never been resolved and which was never pushed beyond the Carswell structure into the area of the Athabasca Kimberlite play. The kimberlite indicator mineral hits are more than 100 km down-ice from the Athabasca Kimberlite project which sits on an Archean Craton that is much more prospective for diamonds than whatever underlies the Buffalo Hills and Birch Mountain kimberlite clusters.

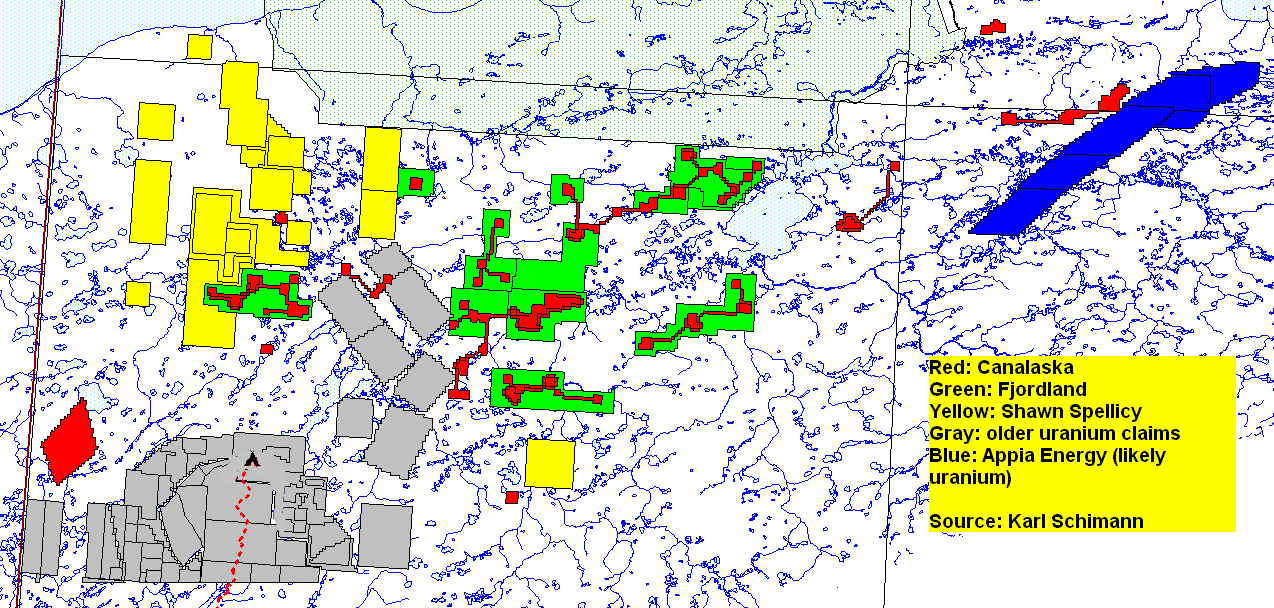

At this point we do not know if Canalaska's magnetic targets are actually kimberlites, and while the down ice indicator minerals apparently signal some diamond potential, confirmation that the "kimberlites" are indeed diamondiferous is even more speculative, let alone economically diamondiferous. Canalaska will have to wait until summer to collect till samples, ground truth the targets to see if they outrcrop as was the case in the Buffalo Hills, and conduct detailed geophysical surveys before drilling any targets in late fall or next winter. But the intrusions that make up these targets do represent meaningful tonnage, with few alternative explanations, so if indeed Canalaska has snagged most of a new diamondiferous kimberlite field, a major exploration play will emerge. I use the word "most" because not everybody believes that the 400 m spacing of the geophysical grid flown by the SGS had sufficient resolution to highlight all kimberlite targets. While the sandstone is magnetically quiet, a magnetic geophysical anomaly merely measures relative magnetic difference. A kimberlite pipe need not have a prominent magnetic signature that shows up on a 400 m grid survey. More subtle magnetic signatures might only show up on a survey flown on 100 metre lines. On March 16, 2016 Fjordland Explorations Inc announced that it had staked 26,223 hectares in the same area as Canalaska's claims on the premise that Canalaska did not get it all. I contacted Fjordland's CEO Dick (DA) Atkinson and discovered that Fjordland's claims surround Canalaska's "postage stamp" claims. The rationale is that any field of kimberlites will have clusters of closely spaced kimberlites, of which the Renard and Gahcho Kue clusters are good examples. A staking strategy that places just enough claims to cover distinct magnetic anomalies could miss nearby kimberlites with geophysical signatures that do not show up on the scale of the government survey. The snapshot below from the Saskatchewan MARS claims system enhanced by Canalaska's Karl Schimann shows the extent of current area play staking.

At this stage of the Athabasca Kimberlite play Fjordland's Dick Atkinson is grasping at straws, but the situation reminds me in many ways of 1992 when Dia Met Minerals announced that it had discovered a diamondiferous kimberlite at Point Lake in a god-forsaken part of the Northwest Territories called the Slave Craton where very few juniors had ever dared to tread and which a Canadian subsidiary of De Beers called Monopros had sampled without any luck that led to a kimberlite discovery. At the time the juniors were stuck in a bad bear market, a bear market so bad my brokerage firm employer decided a window office was wasted space when occupied by research analysts and moved the research department into a windowless former storage space in the middle of our floor. Although we knew nothing about diamonds, my research associate Andrew Muir and I recognized that the Dia Met discovery was significant, and initiated detailed coverage of the emerging area play. Chris Jennings helped us up the learning curve with his collection of diamond slides he had assembled during his career as a diamond explorer (yes, the old fashioned physical kind). We adopted the simple premise that Fipke did not "get it all", and focused on a rag-tag bunch of juniors with names like Aber, Commonwealth, Southernera, Tyler, Fibre-Klad, Kettle River, Dentonia, Horseshoe, Almaden, Williams Creek and Troymin and recommended clients build a portfolio of these juniors surrounding Dia Met on the speculation that important pipes would be found outside the Dia Met-BHP property boundaries. In 1993 this prediction became reality, and proximity juniors which increased ten-fold from pennies during 1992, increased another 10-20 fold in 1993. I remember one of the banker partners hustling back an forth between his window office and the trading desk with blue buy tickets muttering over and over again "unbelievable". By 1994 the research department had been moved into a windowed corner office. That this could ever repeat itself today seems unbelievable to me.

But what really triggered this flashback memory was my conversation with Dick Atkinson, now in his seventies, who was a big star in past decades. He decided to become CEO of Fjordland a couple years ago when Tom Schroeter retired after a valiant exploration effort to discover new copper-gold deposits in British Columbia. Atkinson, who steered Fjordland into a potential revival of the South Voisey's Bay nickel play, quickly discovered that this bear market was the mother of all bear markets that humbled all superstars without infinitely deep pockets to self fund a junior. When I spoke with him he was sitting in Fjordland's new office, a windowless former storage space in an office floor whose window offices were occupied by juniors that generally still had positive working capital. He had decorated the walls with his art collection; Andrew and I decorated our walls in 1992 with maps. Atkinson lamented that he would have staked more ground, but there was not enough money, and he was having trouble in light of his two cent stock price persuading the holders of five cent warrants to exercise them. For now he owns 100% and has not resorted to a DHK style syndicate. It may be that a year from now Peter Dasler has demonstrated his targets to be nothing more than another field of barren kimberlites, in which case this will be nothing more than a sad anecdote. However, I mention this story because it has a textbook resemblance to other great discovery stories that erupted from a bear market abyss with the help of desperate entrepreneurs as was the case with the Lac de Gras diamond play.

The Athabasca Kimberlite play is a free lunch for bottom-fishers who own Canalaska Uranium Ltd because the junior's more obvious upside resides in the potential of its West McArthur uranium play. On January 21, 2016 Canalaska announced that it had a deal to purchase Mitsubishi's 50% stake in West McArthur for $600,000 cash and a 1% royalty. That was not an overly promising development, because it depleted Canalaska's treasury and signaled a loss of confidence in West McArthur by the Japanese partner. But on February 24, 2016 Canalaska announced that Cameco was optioning 60% of West McArthur which requires it to pay $725,000 up front and spend $5 million over 3 years with $1 million guaranteed in 2016 to earn 30%, and another $6,275,000 over an additional 3 years to earn 60%. Cameco's interest is clearly in the Grid 5 area into which the C conductor with which its Fox Lake deposit is associated projects. However, the deal does require Cameco within two years to drill two deep holes in the Grid 1 area where Canalaska and Mitsubishi spent most of the $17 million sunk into West McArthur (see SVH Tracker - March 4, 2016 for a more detailed discussion). Cameco has earmarked $7 million for its Fox Lake deposit (386,700 tonnes of 7.99% U3O8) in 2016 which it views as a candidate for "top tier" development status. The grade is high enough, but the deposit needs more tonnage. The deal with Canalaska gives Cameco free rein to chase the Fox Lake system along the C Conductor in the direction of the West McArthur project which it now has tied up for 60%. A hole about which nothing has been disclosed was drilled within 500 metres of the property boundary. Previous holes by Canalaska and Mitsubishi near the C Conductor failed to intersect uranium mineralization, but did indicate the presence of a major hydrothermal system. Thrust faulting in the area has created a confusing geological picture which is best left sorted out with somebody else's money, in this case Cameco whose technical team probably better than any other knows how to follow the uranium "threads" once they come into view. Cameco is expected to start a drill program shortly. With only 26.2 million shares fully diluted and a stock price of $0.32 the market is assigning a value $21 million to the 40% net West McArthur play, and only $8.4 million the Athabasca Kimberlite play. Canalasaka looks very ripe to deliver the 500% plus gain expected for a member of the 2016 Kaiser Bottom-Fish Editon. It will take at least six months for the diamond play to reach a tipping point, but the West McArthur tipping point that justifies a Spec Value Hunter buy recommendation could be within reach in 4-8 weeks. One should keep in mind that a discovery comparable to McArthur River in grade and tonnage would be worth billions.

|