Blog July 2, 2014: Understanding the Junior Resource Sector Bear Market

My Canadian Investor Conference 2014 keynote presentation in Vancouver on June 1, 2014, Recognizing Good and Bad Resource Sector Stories, focused on the structural and perceptual trap in which the junior resource sector currently finds itself, and posed the rhetorical question, "Is it just cyclical or is this time different?" The joke, of course, is that when this type of pessimistic innuendo is expressed, a turnaround lurks just around the corner. But this joke is butting up against the fundamental realities presented in slides 3-7 which show how weak the junior resource sector is in terms of market valuations, financial condition, and capital flows. Valuations are so low that raising any meaningful amount of capital requires heavy dilution, often at prices lower than the prior riskier financing even though exploration progress has been achieved.

Over 700 resource juniors have negative working capital, much of it not supported by saleable assets. Since nobody wants to provide fresh capital to pay off existing debts, these juniors are doomed to a cycle of converting debt into paper and undertaking stiff rollbacks that wipe out minority shareholders, followed by long term hibernation as shells or a refinancing that bulks up a new insider network which, courtesy of a tiny public float, can move the stock price to reflect the valuation script of whatever new story the junior adopts without interference from any but the stupidest of algo traders. This will be the domain of the usual suspects who may discover that the old methods for bringing institutional and retail capital pools into the after-market no longer work. In fact, it is my contention that unless the current "bad story" status of the four core narratives changes for at least one of them, we will need a new model to attract capital into the junior resource sector, one that I articulated in the February 15, 2013 Streetwise Interview: Can the TSX Venture be saved?. What the junior resource sector needs is an organic perception capture system which harnesses the wisdom of crowds at the same time as it educates the audience about how to visualize and bet on complex multi-parameter driven outcomes.

Another 300 plus juniors have barely enough money to stay listed (less than $500,000 working capital) and are surviving at the price of undertaking nothing that might create shareholder value unless they are fortunate enough to have projects farmed out to deep-pocketed partners. This group interests me the most from a bottom-fishing perspective, because if the junior still controls an interesting story, it is possible to rally and rebuild a retail shareholder following that gradually brings the valuation to a level where funding can be attracted from the custodians of other people's money. If these juniors manage to avoid a rollback, or limit the rollbacks to less than 5:1 and only do them in conjunction with a financing, they have the potential to become market champions because they will have evolved the only marketing mechanism that will be effective while this bear market runs its course and during the early stages of a turnaround, namely a base of knowledgeable retail investors.

The recently adopted "retail investor exemption" which allows a non-accredited investor (somebody with a net worth less than $1 million excluding equity in primary residential real estate) to buy up to $15,000 per year in a junior provided the investor is already a shareholder, is a very promising tool to help juniors restart themselves. However, the regulators are insisting that such financings be treated like rights offerings, creating a logistical nightmare that dooms this new financing mechanism as "dead on arrival". The regulators are insisting that the portion of a financing available under this new exemption be available to all shareholders. So if you are a retail investor who has finally made the difficult decision to buy the annual per company limit of $15,000 worth of restricted stock, and submit your documents and payment, you are at risk of being pro-rated down to a lower amount thanks to a flood of other retail investor subscriptions. No first come first serve allotment and a revision and money return headache for the company. This is regulatory cynicism at its perverse best.

The difficulty facing the barely alive juniors is their tiny market capitalizations, which limit the amount of capital the juniors can raise without getting shareholder approval for issuing more than 25% of issued stock in any six month period. The fact that warrants are included in the 25% calculation makes it especially difficult, especially when you consider that a viable exploration junior can expect to spend $500,000 annually on overhead and another $1 million on exploration, with the bulk going to the flagship project and the rest to the "Plan B" secondary projects. A truly healthy exploration junior should be maintaining working capital at $3 million or better. A small number of juniors meet this financial criterion, usually self-styled as prospect-generators, but their ability to farm out projects to other juniors has been seriously damaged by the perversely self-destructive absolutist celebration of the farmout model proclaimed by a certain school of pundits: "Only juniors that farm out are good. Avoid all juniors that are not good. Juniors that farm-in are not good. Those like Virginia Gold which choose to fund 100% of a project's exploration costs are also not good. Ergo, avoid all juniors whose farm-in capital could make the farm-in junior good not just in name but in results, and avoid those whose courage to take a full risk occasionally delivers the huge success that offsets the many failures." Now the good farmout juniors are stuck doing lousy deals with majors who set the terms because the four core resource sector narratives are in such an ugly state. And the rest are contemplating the advice, "roll back and let us show you the nature of the freedom fest that arises from the relationship between capital and idea".

Private placement activity in resource juniors did undergo a modest jump during Q1 of 2014 which tracked the uptrend in gold, but in the wake of gold's retreat has dropped to early 2003 levels not counting the crisis gap from mid 2008 to mid 2009. Risk capital, likely from Canadian sources, is flowing into the energy and non-resource sectors, and will continue to shun the resource juniors until any of the four core narratives escape their bad story traps. Visit the Junior Crisis Resource Center for the latest statistics about the health of the juniors.

Thanks to the "technology" and "diversified" sections the overall mood of the Cambridge conference was upbeat, making it easier for the refugees from the mining camp to feel good about doing their homework among the resource juniors that still bothered to exhibit. What I noticed missing were the bewildered faces of the retirees that clogged the aisles during the 400 plus exhibitor years, and what did strike me was the number of familiar faces from as far back as 1995 when I first started talking at Cambridge conferences. There was a wide consensus that the resource juniors have hit bottom, but there was great uncertainty as to how long the bottom would last, and concern that under the pressure of the structural problems afflicting the sector the bottom might last too long to prevent collapse of the Canadian resource junior sector as a viable institution. The question "Is it just cyclical or is this time different?" may be a joke among the establishment bank proponents of a Rocking Chair Nation, but to anybody connected with the resource juniors it is a dead serious question.

There was a palpable dread that today could be similar to early 2000 when the climaxing dot-com bubble lured desperate juniors stuck in a bear market that began in 1997 with the exposure of Bre-X as a hoax into "changes of business" involving nearly anything but the resource sector. Today we have a similar situation where senior equity markets, puffed up to record highs due to an unsustainable combination of low interest rates and quantitative easing without evidence of robust organic growth, appear poised for a major pullback whose impact on the resource juniors will be no different than what happened in 2000 when the dot-com bubble collapsed. In other words, not helpful unless by some miracle it causes the price of gold to soar past $1,500, a miracle that in relative terms did not materialize until several years after the dot-com bust.

Today the "change of business" analog for the resource juniors is the "green rush" into medical marijuana which derives its enthusiasm not from the misguided hope of profitably peddling relief to terminally ill people, but from the belief that a stealth decriminalization of marijuana is underway which will open the same realm of broad business opportunities that the end of Prohibition created for alcohol. I do not doubt the latter outcome but do regard this sector as better suited for private businesses than resource sector shells seeking a new pump and dump avenue. (For a peek at the resource juniors that have leapt onto the "medical marijuana" bandwagon, select the special parameter Companies Toying with Medical Marijuana in the KRO Search Engine - logged on active membership required.) The most successful marijuana juniors, at least as market plays, have been those who migrated to the Canadian Stock Exchange, which is becoming a destination listing for juniors fed up with the "super board of directors" that TMX officials have turned themselves into.

Similar conditions have admittedly existed during every junior resource sector bear cycle trough just before a bull cycle generates new records in these three categories of market valuations, financial condition and capital in-flows. But this time the turnaround must overcome the structural and conceptual industry obstacles I identify in slides 7-11. These obstacles are surmountable, and I do offer solutions in snapshot form to each problem, but explaining them will be a topic for a future blog comment. My goal in this commentary is to articulate how the junior resource sector has become entangled in the bad direction its core narratives have taken, why there is no general, predictable escape from this abyss, and why I see EMC Metals Corp and its scandium story as an extraordinary, history changing standalone path out of this morass for resource sector oriented speculators.

The four core narratives to which most junior resource sector stories subordinate themselves in one form or another are: 1) global macro-economic trends which dictate raw material prices, 2) geo-political trends which inflict disruptive impacts on raw material prices also known as "security of supply", 3) precious metal price trends which, particularly in the case of gold, are driven by a perceptual universe rather than the real world economy, and, 4) the possibility that the injection of innovation, human effort, and capital will generate new discoveries which reward shareholders and contribute to the wealth of the world. Most of the takeover activity during the past decade, which injected $135 billion worth of liquidity into Canadian resource juniors, focused on the first and third core narratives. The Roadmap to Resource Sector Speculation presentation I gave on June 25, 2014 to the University Club Investment Society in Chicago is an expanded version of my Cambridge presentation on this topic.

Core Narrative One: The junior resource sector is suffering because macro-economic trends are generating weak raw material demand growth at the same time that a robust supply mobilization response to the higher metal prices of the past decade is underway. This has especially been the case with copper and iron which are expected to be in surplus during the next couple years. Although base metal prices remain well above levels that prevailed when the "super-cycle" driven bull cycle got underway in 2003, much of the real price gains have been clawed back by mining sector cost escalation that has outstripped general inflation during the past five years.

Core narrative one is often described as the commodity cycle, whose basic principle is that higher commodity prices arise because an upswing in the business cycle creates surplus demand which, because the mobilization of new mine supply takes years to implement, leads to higher commodity prices and profits for existing producers whose output is not locked in at forward sale prices which usually do not anticipate future reality. The supply-demand imbalance, expressed as a metals supply deficit, prompts producers to invest capital in expanding existing mines or putting into production deposits that are profitable at the "boom" metal prices. The positive phase of the business cycle, however, tends to generate inflationary pressures thanks to a credit expansion premised on optimism about the business cycle. This attracts a monetary response from central banks which raise interest rates and force a credit contraction, which causes the business cycle to descend into a recession. The curse of the commodity cycle is that the lagged supply response to supply deficits kicks in just as demand declines in conjunction with the business cycle. This creates commodity surpluses which force down commodity prices and in turn wipe out the return on capital expectations underpinning the new mine supply. Mining companies are caught in an endless "game theory" process of trying to second-guess the business cycle trend and each other's supply mobilization responses. Inevitably the result is a boom-bust commodity price cycle which saddles mining companies with big losses during the price bust phase of the cycle.

What the miners really want are big new discoveries where grade and size are such that the mine will be profitable even at business cycle low commodity prices. Generating such big discoveries has been the game of the resource juniors, which can play itself out regardless of business cycle conditions. But every once in a while historical conditions create a structural demand shift which overrides normal business cycle conditions. The eruption of China as a capital intensive player on the global stage was such an occasion, which generates the term "super-cycle", namely a cycle that transcends the monetarily determined regular business cycle. Such large scale macro-economic trends affect commodities across the board, which is what we experienced during the past decade. But even super-cycles run their course as the driver of the super-cycle demand matures and capital markets fund a robust supply response. Smaller scale exceptions would be policy or innovation based demand drivers which are independent of the business cycle, or supply curtailers such as the natural depletion of existing orebodies or the disruption of existing supply for geopolitical reasons, both of which are also independent of the business cycle.

During the past decade 32 juniors with primary copper deposits representing net 220 billion "pounds in the ground" were taken over at a cost of about $23 billion. There remain 87 trading juniors representing 756 billion lbs copper which have a collective market value also at about $23 billion. Note that the biggest takeover was the sword upon which Barrick Gold plunged itself. Since 2007 economic studies have been completed for 73 copper deposits controlled by juniors. Most of this inventory grades below 1% and is awaiting its shot at development.

Copper surpluses are expected to last until 2017, which means that any junior contemplating the copper bottom-fishing strategy Ross Beaty deployed during the 1998-2002 bear cycle is going to have to be awfully patient and well financed for staying power. Overall takeover activity has slowed down after the aggressive base metals wave of 2006-2008 and gold wave of 2009-2012 while the super-cycle and gold bug core narratives remained intact as good stories.

|  |

Now we are in the cleanup stage of the takeover cycle where the risk for copper-gold juniors such as Geologix Explorations Inc is that they get scooped up at modest markups from their trough prices, though sometimes the markups can still be impressive such as has just happened for Lumina Copper Corp which First Quantum is buying at $10 for $470 million. The valuation being paid for Lumina's Taca Taca project in Argentina is well below the 10% after tax NPV implied by the project's PEA using a spot copper price as shown by the LOM sensitivity chart below for Taca Taca. Resource speculators can still profit bottom-fishing for advanced deposits, but it will be many years before a super-cycle narrative is actively driving a buyout frenzy.

As far as copper is concerned my main interest is in the potential for world class discoveries, preferably funded by majors, as turned out to be the case for Reservoir Minerals Inc and its 25% net Timok project in Serbia. Small scale copper development projects are a hard sell for the juniors unless they are polymetallic and large projects will at some point require a major as a farm-in partner that carries the junior to at least a production decision, as is the case with Freeport-McMoran and Reservoir's Timok project. Usually such deals chisel the juniors down to a 15%-30% net interest, which limits the valuation upside for the junior in the event of a discovery worth developing and prevents the market pleasing price gain optics needed to rekindle the faith in rags to riches fairy tales. What I am on the lookout for are plays with conceptual potential to deliver monster discoveries. For these to have any degree of success potential they usually require extensive data collection to generate blind drill targets, which requires a deep-pocketed farm--in partner or a discovery bubble market of the sort we have not seen since the 1993-1997 discovery cycle.

|  |

Among potential copper discovery homeruns I am watching closely are the Alvalade project of Avrupa Minerals Ltd and the Xaudum project of Tsodilo Resources Ltd, both under option to competent majors. In the case of Alvalade where Antofagasta can earn 80% by completing a feasibility study, the target is another Neves Corvo, the second largest VMS deposit in the world after Kidd Creek. The project covers a 40 km segment of the Iberian Pyrite Belt that straddles Portugal and Spain which has the misfortune of being covered by barren younger rocks. Much work has been done in the past couple decades with no success, but what attracted Antofagasta was a re-interpretation by Avrupa's Paul Kuhn about the stratigraphic succession in this area. Antofagasta spent over $4 million on what might best be described as developing support for Kuhn's theory, and in February 2014 this exercise was rewarded with the first VMS intersection in 20 years (see SVH Comment - March 6, 2014). The hole did not by itself constitute a major discovery, but followup drilling has convinced the partners that they have latched onto a big system within which lurks a Big Score. Another round of drilling is slated to further map out the stratigraphy and bring the real target into focus.

|  |

In the case of Xaudum where First Quantum can earn 70% by making a production decision the hypothesis is that this 40 km by 10 km sedimentary belt in northern Botswana is an extension of the Lufilian Arc that hosts the world class Copperbelt which rips through northeastern Zambia and southern DRC before disappearing again under younger rocks in Zambia and Angola. The Xaudum area is largely covered by Kalahari sands and would still be regarded as worthless if Tsodilo's diamond exploration efforts had not revealed a previously unrecognized magnetic complexity. Tsodilo's followup drilling not only discovered the multi billion tonne Xaudum iron deposit, but generated geology and modest copper sulphide mineralization which struck Murray Hitzman and others as having a remarkable similarity to the Copperbelt setting. The geology is now viewed as the resurfacing of the Lufilian Arc. The potential to control multiple Copperbelt style deposits in possibly the most stable and least corrupt African country attracted First Quantum, which since August 2013 has spent $8 million drilling lines of stratigraphic holes to map the geology in three dimensions, drilled a grid of 200 shallow "geochemical" holes to map the bedrock under the Kalahari sands, and conducted EM and gravity surveys to establish the structural context for potential orebody targets. The compilation of this grassroots data is expected to be done by the end of July, at which point it will finally be clear if Xaudum also has classic Copperbelt drill targets. And even if there are promising drill targets on which First Quantum spends another $7 million during the next year, it may be that this part of the Lufilian Arc never facilitated the concentration of copper that took place in Zambia and the DRC. But if First Quantum comes up with one classic Copperbelt intersection, the prospect for multiple such deposits goes through the roof and Tsodilo becomes a double digit takeover target. The Avrupa and Tsodilo stories really belong in Core Narrative Four, and are exceptions to the dismal status of this narrative as I shall discuss later.

|  |

Demonstrating the feasibility of base metals in the ground no longer benefits from "super-cycle" talk. The "super-cycle" narrative that drove the past bull cycle has been suspended as the world frets about languishing advanced economies and the slowing of emerging economies such as China. Except in the case of zinc where an imbalance between depleting and new mine supply against a backdrop of general demand growth is evident, metal prices appear poised to drift sideways or lower during the next few years. Among the advanced zinc juniors my favorite is InZinc Mining Ltd whose Updated PEA implies that West Desert is feasible even at $1/lb zinc. The expectation of supply deficits over the next 5 years does not take into account the possibility that China's doubling of zinc supply during the past decade has stalled, but may even go into reverse as Beijing pursues its crackdown on pollution which has so badly contaminated China's water system with heavy metals that a soil study in 2010 documenting the contamination of China's food system was turned into a state secret.

In most other base metal cases there is no expectation of a looming supply-demand imbalance driven by projected economic growth that translates into sharply higher real prices due to the lagged nature of the mining industry's supply mobilization response both in terms of making the decision and making expansion or new mine supply happen. The only hope is that all the numbers collected by the expert consultancies are wrong, which, unfortunately, is not a futile hope.

|  |

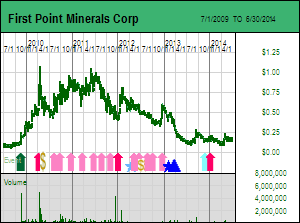

Nickel, which underwent a tremendous run in 2007 thanks to a supply squeeze, also appears to be an exception, though one that is likely to be short-lived. Nickel's price jump this year is due to Indonesia's decision to ban the export of concentrates and raw ore. Nickel will be volatile as the market responds to short term supply crunches that could be eased by further politically driven decisions such as a change of government in Indonesia and the realization that the shift to domestic beneficiation will require interim pain. Nickel linked promotions will be possible, but vulnerable to disruption courtesy of politics and the likelihood that nickel-pig-iron production will spread beyond China's borders. High grade discovery-oriented nickel plays such as North American Nickel Inc remain of interest, but in the low grade department I still only favor special "metallurgical" situations such as the Decar project of First Point Minerals Corp, though the advancement of that story is stalled because partner Cliffs has come under attack from hedge funds annoyed by its Bloom Lake iron blunder.

Uranium, which has been heavily pumped as a re-ascending star by the Sprott-Global complex, is suffering from the double whammy of Fukushima as a reminder that accidents involving nuclear energy can have far-reaching consequences, which prompted Germany to phase out nuclear power and put Japan on track to follow suit, and the shale gas revolution which offers abundant natural gas as an alternative to the dirtiness of coal-fired power and the capital intensity and dangers of otherwise clean nuclear power. Just as the thin spot market for uranium lent itself well to being manipulated to $140/lb during the uranium bubble of 2005-2007, so its thinness is contributing to the downside as German and Japanese utilities shed surplus fuel while other utilities still committed to nuclear energy stand back waiting for the spot price to drag down the more relevant long term contract price. The macro-economic narrative as it pertains to uranium is not good during the near term, which is why my interest in uranium focuses exclusively on the potential for world class discoveries in the Athabasca Basin where the richness and size of the deposits allow profitable exploitation even at $28/lb, and where new discoveries would not come on stream until the latest utility destocking cycle has run its course and new power plants have come on stream.

|  |

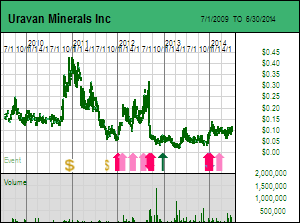

My favorite uranium pick is Uravan Minerals Inc which has developed a new tool for identifying high probability targets at depths which offer no clues at surface. I have written extensively about Uravan's radiogenic lead isotope sampling strategy (see SVH Comment: Dec 17, 2013, SVH Comment: Sept 12, 2012, and SVH Comment: Feb 3, 2012), but at this point there is nothing left to say until Cameco drills two holes on the Stewardson Lake target whose footprint is substantially larger than that of Cameco's Centennial deposit on which a full-blown case study was conducted in 2013. If these two "stratigraphic" holes planned for August 2014 deliver confirmation that an alteration envelope indicative of an Athabasca Basin style unconformity associated uranium deposit is present, it will set the stage for a major drill program in 2015 by Cameco and offer proof of concept for Uravan's target generation methodology. It is also possible that Cameco may "spear" high grade uranium mineralization with one of these two holes, which is a reason to own Uravan now rather than later, especially given Uravan's old school share structure.

As with my copper picks, Uravan is not a function of Core Narrative One, but rather a function of Core Narrative Four, discovery exploration. Currently there is a lot of hype by juniors hoping to duplicate the success of Fission's Patterson Lake South high grade discovery, but this discovery narrative will fall flat for two reasons: 1) Fission may not have done all the work needed to deliver a resource later this year that matches market expectations, and, 2) there are no major unresolved uranium boulder trains south of the basin where the sandstone no longer overlies the basement rocks. More potential for big discoveries at the unconformity exists on ground to the north of Fission within what is clearly a prolific structural corridor, but here the target depth is too deep for radon gas sniffing or boulder train chasing. This is where Uravan's radiogenic lead isotope based surface geochemical sampling strategy would be helpful, but the exploration strategies of the property owners is restricted to spearing geochemically blind geophysical targets.

Many of the advanced base metal projects drummed up by the juniors during the past decade have been taken over by producers and are in the development pipeline. Until robust global economic growth is back on track, which to be visible will take several years, invoking the "return of the super-cycle" for "pounds in the ground" plays will be a "bad" story that falls on deaf ears unless grade and location are exceptional. The juniors will only get their hands on such deposits by making new discoveries, and that is, unfortunately, a "bad" story because exploration risk capital is even more scarce than feasibility demonstration capital.

Core Narrative Two: The junior resource sector is suffering because the geopolitical conflicts that threaten to disrupt supply, especially in the case of critical metals whose supply is dominated by emerging market economies such as China and Russia, are assumed to be temporary skirmishes fated to stabilize under the umbrella of globalized trade. While the market is aware that raw material supply from Russia and China could be curtailed if the Ukraine situation spins out of control, or China's assertion of territorial rights in the South and East China Seas becomes so aggressive the United States and its southeast Asian allies have no choice but to push back, with far-reaching consequences, nobody is factoring into metal price projections this particular outcome even though the recent rare earth bull cycle stands as a precursor of such an outcome that was predicted by observers such Jim Dines and myself. While Dines was not the first party to publicly describe the potential for a rare earth boom, he put the story on the map for everybody to see a year ahead of schedule, and arguably created the perceptual foundation for the boom from which the Molycorp backers so handsomely profited.

The anxiety engendered by the prospect that China will eclipse America created a "security of supply" narrative in 2009 for which rare earths became a flashpoint. The Chinese obliged by creating a rare earth price bubble through export quota restrictions in a move designed to shift more production of advanced goods to China where technology transfer can be more effectively achieved. But now it seems to be much more cost effective for China to use military backed cyber-espionage to pry technological secrets from non-Chinese manufacturers.

Chinese machinations first pushed up export prices for rare earths, followed by sharply higher domestic prices, which gained more than 1000% from their 2009 base to their peak in August 2011. The rare earth price bubble brought non-Chinese supply on stream, though only for the light rare earths and not the heavy rare earths for which China has its own domestic supply problem a decade from now. It also unleashed end-user substitution, from which the producers are still suffering while end-users await the emergence of geographical supply diversity before re-building reliance on critical metals in their commercialized applications. The rare earth juniors underwent a tremendous valuation boom that raised a lot of capital, but they are now floundering in the expensive and complex details of rare earth production and separation while rare earth prices hover only 100% above their post-Crash prices.

|  |

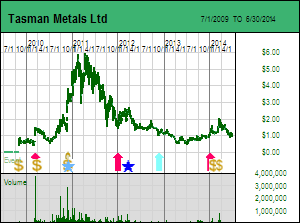

Among the rare earth juniors the only ones for which I still have open recommendations are Namibia Rare Earths Inc and Tasman Metals Ltd. Namibia Rare Earths is a potential small scale but earlybird non-Chinese HREO supplier with some scalability through its Lofdal Area 4 deposit that makes it similar to EMC Metals Corp and its scandium story. Tasman is a large scale, medium term potential heavy rare earth supplier whose Norra Karr has an ideal location in Sweden. Quest's Strange Lake deposit is still the world's greatest HREO enriched deposit, but the remoteness of its location and the heavy associated CapEx make this a long term supply solution when the Chinese have run out, assuming demand for heavy rare earths remains. Substitution has proven to be a killer for rare earths as end-users dealt with security of supply not by bankrolling non-Chinese upstream supply, but by figuring out how to do without or a lot less. The rare earth security of supply problem seems to have vanished, but I suspect it is merely in a lull that may last a couple more years.

The security of supply narrative has lost force overall because of a growing sense that China is losing control of its own economy, that a shadow banking system which emerged courtesy of bank interest rate controls has set China up for a credit bubble collapse similar to what western nations suffered in 2008. The perception is that while China's economy is destined to eventually eclipse that of the United States, that journey will involve a couple of intervening face-plants which will diminish China's enthusiasm for raw material supply manipulations. The possibility that a "cold war" of sorts could stifle trade between China and western nations is largely discounted.

But what may sabotage the growing complacency over security of supply is China's effort to control a problem with dangerous domestic implications, namely its dreadful environmental record. The Chinese population can probably live with rising inequality because, unlike in advanced economies such as the United States, the perception remains that any individual could still become a member of the better-off class. But the Chinese are unwilling to live with the contamination of their food supply, water and atmosphere by an elite whose operations achieve an international competitive edge by turning their own people and land into a garbage can for their waste products and emissions. A Chinese crackdown on pollution will encompass the many small mines and smelters that underlie China's dominance in the production of critical metals such as rare earths, graphite, tungsten, indium and antimony as well as more supply diversified metals such as molybdenum and zinc. But until we see soaring metal prices due to supply curtailed through the implementation and enforcement of environmental rules, it will be tough to get investors excited about security of supply stories such as the tungsten-molybdenum Sisson project of Northcliff Resources Ltd.

|  |

The security of supply narrative does not apply to scandium because scandium's narrative is one about the "creation of supply", a rather unique metals story. It also does not have the false linkage between material and application that has been created for graphite and graphene where nobody doubts the enormous application potential of graphene, provided the technical problem of making graphene from graphite or any carbon source on a commercial scale gets solved. With the aluminum-scandium alloy applications it is already well understood how to make an aluminum-scandium master alloy and blend it into specialized aluminum alloys. It is an application market waiting for a reliable supply.

Core Narrative Three: The junior resource sector is suffering because market sentiment is closely linked to the trend in gold prices, which is range-bound between $1,200-$1,400 with the argument for a breakdown below $1,200 enjoying the upper hand thanks to the dominance of a gold narrative that has become highly politicized, and whose underlying "fiat currency debasement" logic has minimal positive consequences for the profitable exploitation of gold deposits that are marginal in the current range. After gold resisted closing 2013 below $1,200 it underwent a strong uptrend during Q1 of 2014 which generated nearly $1 billion in bought deals for advanced gold projects. By mid March even exploration juniors with good drill results were attracting financings. It looked very much like we had a selective resource junior bull cycle underway, but when gold failed to breach $1,400 after it became apparent that the geopolitical crisis in Ukraine would not start World War III, the air went right out of the juniors as investors concluded that the PDAC Curse would not be on vacation this year.

Although resource junior prices will track short term gold price rallies and slumps, until gold blows past $1,500 for reasons that appear to have staying power, future gold price predictions amount to little more than wishes and guesses. Tomorrow gold could be at Goldman's sub $1,000 target or it could be at $2,000. The greatest hope for a rapid, broad-based turnaround in the junior resource sector resides in the fact that gold could be at $2,000 tomorrow without it signaling the end of the world. But that hope is offset by the fact that gold could just as easily slump below $1,000 and stay there for a few years, in which case the extinction of the Canadian junior resource sector as an institution would be quick and definitive.

Unfortunately, the belief that gold could be at $2,000 tomorrow is held by a shrinking pool of investors who believe it for reasons that are irrelevant to the resource juniors. Apocalyptic gold bugs have hijacked gold as the symbol for a libertarian ideology that attributes all problems to the absence of an unfettered free market that somehow on its own prevents a free market stifling "winner takes all" outcome. Support for gold has become a rallying cry for the Tea Party. Although elsewhere in the world gold is treated simply as a hedge against human folly, in America gold has been turned into a symbol of allegiance to human folly. This has turned the topic of gold into a pariah of sorts, something to be shunned by people with money who dream of a flourishing future for themselves and their children, who see themselves as dispensers of divine grace rather than righteous punishment, and who recoil at the innate mean-spiritedness and twisted conspiratorial thought of the current owners of the gold narrative. The poisonous politicization of gold has unnecessarily constrained the pool of potential resource sector investors. And the unfortunate outcome is that the de facto owners of the gold narrative by virtue of their apocalyptic mentality have no interest in the resource sector, especially the juniors. The gold narrative needs to be restructured so that it is of interest to the entire political spectrum and offers a reason to expect the higher real prices that are beneficial to the developers and miners of gold.

Although base metal juniors did get taken over after the 2008 Crash, it was usually at prices below pre-Crash peak prices. The real takeover action involved the gold juniors. The driver of the mid 2009 to mid 2011 bull cycle for resource juniors was gold which peaked at $1,921.50 in September 2011 though the gold seniors and juniors had already peaked in December 2010. Gold equities disconnected from the gold price because the main gold narrative, which argued that gold was important because of its status as a hard asset of which more cannot be readily created in the manner of fiat currency, did not promise the higher real prices needed to boost the profitability of gold production. The warning that hyper-inflation or the collapse of the US dollar against other currencies was imminent was plausible, but the inference that somehow costs would remain stable while the gold price rose, thus implying higher profitability and in turn higher stock prices for gold miners and developers, was nonsense. In fact, by 2011 it was becoming apparent that costs specific to the mining sector were escalating at a greater rate than general inflation. The result was a clawback of the big margins that had opened up during the rapid metal price increases of the past decade, the awareness of which caused the market to disconnect gold equity and metal prices.

The only argument for a higher real gold price was the GATA conspiracy theory that the existing market for the 5.5 billion ounce global gold stock was being artificially suppressed by an alliance of central banks eager to prop up the US dollar and prevent the world from recognizing that the United States was in fact not the world's biggest economy and sole super-power. Why other nations would want to help the United States pursue its "Manifest Destiny" if even in illusion is not clear. Nor is it clear why America would embrace a policy to keep the price of gold low while allowing the private sector and potentially hostile central banks such as those of China and Russia to soak up the resulting "cheap" gold over the decades. The conspiracy theory would make a lot more sense if the gold available at "artificially" suppressed prices were being secretly soaked up by the Federal Reserve, but the price suppression conspiracy theory is twinned with the suspicion that in fact the United States has been secretly liquidating its gold, that the 256 million ounces supposedly in Fort Knox along with the holdings of other central banks stored at Fort Knox are long gone.

The apocalyptic gold bug story was bad for the resource sector because the conditions supporting its becoming reality are unlikely to generate rational (through greater profitability) or irrational (momentum chasers) demand for gold equities. It was bad because so far the predicted inflation outcomes have not materialized on even a modest scale. Whatever inflation we are experiencing is caused by a gradual erosion of China's competitive advantage as the migration of low cost laborers from the hinterland slows and the ability of China's factories to dump their true production costs on downstream victims comes under attack from Beijing. The prevailing gold narrative really does not offer any special reason for capital to gravitate to the resource sector.

There is an alternative narrative which is compatible with most Wall and Main Street interests because it links a higher real gold price to robust global economic growth. Rather than threatening America with impoverishment, it offers growing prosperity, but with a catch. The catch is that prosperity growth is globally distributed rather than concentrated in a handful of advanced economies. As a result the American share of the world economy will shrink, as it must due to the geographically confined and relatively small population of the United States within a globalized economy. Over time the ability of the United States to project unilateral military and economic power will shrink and geopolitical uncertainty will rise. A world with a growing collective wealth will seek to hedge that rising uncertainty through gold ownership, both at the private and official sector level. This alternative gold narrative, which is compatible with all the other interests of Wall Street and Main Street, is described in greater detail in the KRO Gold Resource Center which also explains some of the tools we have developed to spot companies whose projects stand to benefit from real gains in the price of gold.

The existing gold stock is already allocated; new demand that tracks GDP growth will have to come from new mine supply. But at the current $1,250 gold price, which is only 14% higher than the $1,100 price that $400 gold in 1980 translates into if adjusted by the annual US CPI, it is difficult to increase profitable mine production. When gold ran from $35 to stabilize at $400 in 1980, the real price gain was a substantially larger 419% which turned a lot of high hanging fruit into low hanging fruit, fruit that was lowered even further by processing innovations such as heap leaching. The mining industry harvested 2.3 billion ounces during the subsequent three decades, and at the current gold price, it is safe to say, there is very little low hanging fruit left to harvest. The graphic above shows only a modest annual percentage increase in the supply of new mined gold over the prior year's gold stock since 2005 even though the current gold price is 400% above the multi-decade low.

If we plot the value of the gold stock against nominal global GDP, it now stands at just under 10%. If the annual gold supply cannot expand beyond the current absolute output, the global GDP keeps growing at a rate greater than that of the gold stock, and the current status of gold as reflecting 10% of GDP remains stable, there is only one direction for the price of gold and that is up in real terms toward $1,500 over the next couple years. That price growth is insufficient to mobilize a powerful gold mine development response that could bring the gold stock growth back in line with GDP growth, so eventually there will be an imbalance that forces the price of gold toward $2,000 in real terms. This sort of narrative is compatible with the undesirable outcome of fiat currency debasement and hyper-inflation, but more importantly it strips the case for gold ownership from the ideological baggage imposed by the current owners of the gold narrative.

If the global economy shifts back into recession, or even worse, the depression that would result if full-blown austerity measures such as propounded by the proponents of the politicized gold bug narrative were implemented, gold will stay at current levels or head lower. The chart above shows what happens to the gold price if you allow the gold stock value to represent 25.2% as it did when gold peaked at $850 in 1980, or 3.8% as it did during its nadir in 2001. The bubble and bear equivalents in today's economy are $3,424 and $480.

Ironically, the main Wall Street argument supporting lower gold prices is in fact the argument that the American economy is improving, that the worst is over, that the tapering of quantitative easing will eventually end money-printing, and that robust global economic growth will soon be back on track. The evidence, however, suggests that this is not the case at all. Although US household value of equities is at an all-time record, as is net real estate equity, mortgage debt deleveraging continues, housing starts are improving but still low in historical terms, and bank deposits are at an all time record. Much of this is captured by the Velocity of M2 Money chart below which reflects the ratio of the value of economic transactions over a time period relative to money supply defined as cash, checking accounts, and "near money" such as term deposits and mutual funds, theoretically restricted but effectively liquid capital.

Michael Berry regards the multi-decade low and steep downtrend as a sign that the enormous increase in the money supply created by quantitative easing has failed to stimulate the economic activity needed to grow the economy organically and pose an inflation risk. The people of America are paralyzed with fear about the future; the shriveling middle class has no spending power and the elite has no desire to spend its accumulating net worth. Banks are not lending because there is no vision of America's economic future, businesses are not investing capital because they do not see a growing consumption demand, and the wealthy are preparing to ride out the deflation that will accompany the return of interest rates to normal levels. But Michael Berry also warns that this spending aversion could turn around quickly, bringing on inflationary pressures that the Federal Reserve may be reluctant to move against aggressively for fear of spooking sharp declines in the bond market that brings back the deflationary threat. It is a frightening tightrope situation. A near term path out of the gold narrative trap would be a scenario where something triggers a rise in American consumption that risks a return of inflation that in turn spooks an anticipatory rush back into gold. This is the fingers-crossed hope for a September 2014 rally in the junior precious metals sector. But the drumbeat from Wall Street is that the economy is improving, the taper will end quantitative easing, inflationary pressures are far in the future, and there is no reason to own gold.

Not only do I think that Wall Street's assessment is wrong about the underlying strength of the economy, but I also think that if something could trigger a perceptual inflection that unleashes a credit expansion that restores robust, broad based growth to the American economy, my predicted impact on the price of gold is the exact opposite of Wall Street's prediction. For the moment Wall Street appears conflicted between supporting the "no-more-taxes" mantra of the Tea Party and its own tax-payer bleeding games. Somewhere along the line, possibly when the Republicans once again dominate all levels of government, and Obama's call for massive infrastructure renewal as the key to reviving America as a nation with a future is no longer his story, the "austerity" program of the Tea Party will vanish in place of what a Republican administration has always done, namely supersede the record perpetually held by Republicans, the absolute amount by which the national debt is expanded during the term of a "president". At the moment the neocons are struggling for re-ascendency, but it will take another decade before memories have faded sufficiently for that narrative to have potency again. All the gold narrative needs is for absolute power to land in the hands of either the Republicans or Democrats. But as you can guess, I'm pretty pessimistic that either of these outcomes lies ahead.

Wall Street will eventually embrace my alternative gold narrative, but not until it has pummeled the prevailing poisonous gold narrative into dust, an exercise with which I have some degree of sympathy. That, and a return to robust economic growth, I'm afraid will still take several years during which gold could stay stuck in a range of $1,000-$1,500 where the economics of putting advanced gold deposits into production are lousy in most cases, the profitability of most operating mines is marginal, and the bar for what counts as a major exploration discovery is very high. Only severe geo-political stresses could drive gold prices sharply higher in the short term, but the eruption of such gold price drivers, and their sustainability, are unpredictable and belong in the category of "be careful what you wish for".

Core Narrative Four: The junior resource sector is suffering from a dearth of world class discoveries because 1) after decades of surface anomaly focused exploration in a world generally no longer off-limits due to political factors, the low hanging fruit has already been harvested or secured by the mining industry, and, 2) the risk capital needed to support exploration for new discoveries "under cover", a process that was eclipsed by the feasibility demonstration nature of the bull cycle during the past decade, has become horribly scarce. This is a problem, because when the other three core narratives are sidelined, discoveries have historically extracted the resource juniors from bear cycles.

Historically bear cycles in the junior resource sector have ended with a major new exploration discovery. My own experience with the resource juniors started in 1978 when sharply rising precious and base metal prices in response to inflationary pressures drove a major bull cycle until 1981 when Volcker's monetary shock treatment created a deep recession based bear cycle for the juniors in 1982. The world class 20 million ounce Hemlo gold discovery breathed life back into the juniors in 1983, and with gold stabilized at about $400, which represented a 419% real increase from its $35 price in 1972 to 1980, the resource juniors settled into a discovery driven bull cycle. From 1983-1990 the exploration focus was mainly Canada, which started with Hemlo and ended with Eskay Creek, what one might call the Murray Pezim era, and the United States, where the Carlin discoveries put Nevada into the gold big leagues and gave birth to Barrick, today the world's biggest gold producer.

A minor bear market bogged down the resource juniors during 1990-1992 as investors pocketed their profits from Eskay Creek and Placer's jilted bride purchase of Mt Milligan, and the Vancouver Stock Exchange undertook reforms to deal with the largely non-resource sector related excesses of the eighties. The resource juniors shifted back into a bull cycle in 1993 as it became apparent that the diamond discovery by Dia Met in Canada's arctic was not just real, but had replication potential that stretched beyond area play action to a global conceptual focus for Canadian juniors.

At the same time the collapse of the Soviet Union opened up third world frontiers, in particular Latin America, where exploration had been in hiatus since the seventies when their economies got blown up through the deadly combination of foreign currency denominated debt and government corruption that spanned the entire political spectrum. The rush into third world frontiers was driven neither by discovery nor higher metal price expectations; it was all about the recovery of existing deposits abandoned by their earlier discoverers such as Cerro Cassale. But once it became clear that these frontiers were open to exploration, Canadian exploration teams rushed in to secure and explore whatever looked geologically good at surface. This was the age of color anomalies spotted from space and followed up with boots on the ground. The best success story was Arequipa's discovery of the Pierina gold-silver deposit in Peru which Barrick bought out for $1 billion without a published initial resource estimate.

The bull cycle that began in 1993 through the diamond discoveries received a boost in 1995 when Robert Friedland's quest for diamonds in Labrador stumbled onto the Voisey's Bay nickel-copper deposit for which Friedland engineered a $4 billion buyout by Inco. The nature of the Voisey's Bay Ovoid lent itself to delineation drilling with predictable outcomes, an unusual circumstance that groomed the market for the remarkable Busang deposit that began to take shape in mid 1995 after Bre-X attracted capital from sources that normally would never waste a second, let alone a cent, on drunks operating in a difficult location like Indonesia. This major discovery cycle came to an abrupt end in 1997 when Busang was revealed as the greatest mining fraud ever.

The resource juniors descended into a major bear cycle that lasted from 1998-2002 during which the regulators created SEDAR and the NI 43-101 resource reporting system, new discoveries were scant as risk capital chased into the dot-com bubble, gold sank to $250 courtesy of a dollar-gold carry trade pursued above all by the gold producers, base metal prices languished as the Asian Tigers underwent self-immolation, and then finally the post dot-com bubble recession arrived, helped out by the 911 terrorist attack. With no help coming from new discoveries or higher precious and base metal prices, 2002 was a year when industry observers asked themselves, "is this just cyclical, and if so, how much longer will this trough last, or, is this time different, are we witnessing the extinction of that institution called the Canadian junior resource sector?"

The shift from bear to bull cycle took place in mid 2003 when the sleepy copper market woke up as China's high growth rate hit that inflection point where demand for raw materials overwhelmed the existing supply system. Financial deregulation which facilitated the risk obfuscation needed to fuel a real estate bubble, globalization of trade which facilitated the deindustrialization of advanced economies, and a war invented by the Bush administration as cover for massive money-printing converged to create an export market for China. The devil's bargain was a deal whereby China shipped dollars acquired from American consumers back to America in exchange for treasury bills and other debt instruments, which enabled China to build up a $1 trillion plus foreign reserve while America fabricated an illusion of expanding wealth that vanished during the 2008 financial crisis.

The mining industry never saw China coming. It forward sold nickel and copper until about Q1 of 2006 when there was a collective adoption of the "super-cycle" narrative to explain why raw material prices were soaring well beyond what the miners had forward sold at. Gold, which had clawed its way back into the $300-$400 range in late 2002, broke $500 in early 2006 and embarked on an exponential price rise that was briefly interrupted during the liquidity crisis of 2008 and peaked in 2011 at a record nominal high, though still short of the inflation adjusted peak achieved in 1980. Uranium underwent a price bubble as emerging market economies put nuclear power plants on the drawing board, investors did the math on the existing supply infrastructure, and a thin spot market succumbed to manipulation.

The rapid metal price rises of 2003-2008 created the greatest ever bull cycle for the resource juniors which went beyond discovery exploration to embrace feasibility demonstration as they hauled out of the woodwork the discarded failures of past exploration cycles that just might be profitable to mine at the record high nominal metal prices. Institutional capital, attracted by the number-crunching nature of feasibility demonstration, flooded into the resource sector, followed by an unprecedented takeover binge by producers which absorbed TSX and TSXV listed resource juniors for cash or paper worth more than $135 billion from 2003-2014. During the main phase of the takeover cycle the capital inflows from the producers were recycled into the junior resource sector, something that is no longer happening during the current final phase of predatory takeovers at modest markups from bear market bottoms.

The 2008 financial crisis blind-sided the resource sector as equity prices crashed to pre-2003 levels during the second half of 2008. At the time it looked like the Great Recession that began in 2007 could very easily lead to a Great Depression to rival the one that followed the 1929 stock market crash, but this major bear cycle lasted only one year thanks to the quantitative easing policy adopted by the United States. China, recognizing the severity of the situation, chose old-fashioned Keynesian fiscal stimulus to keep its economy from collapsing by launching a $600 billion infrastructure development program designed to stitch the country together and allow factory construction to shift inland away from the coastal plains. Raw material prices, which had plummeted, but not back to pre-2003 levels, rebounded sharply, which fueled a fresh round of aggressively priced takeover bids though the juniors generally did not receive pre-crash peak prices.

During the bull-bear-bull-bear cycles of 2003-2014 there were very few major grassroots discoveries by Canadian juniors. Most major junior plays such as Ivanhoe's Oyu Tolgoi, Northern Dynasty's Pebble, and Antares' Haquira were brownfields expansions of existing systems. The most notable exceptions were Virginia Gold's Eleonore, Aurelian's Fruta del Norte and Au-Ex's Long Canyon discoveries. None spawned an area play approaching the excitement of Hemlo, Eskay Creek, Casa Berardi, Lac de Gras, and Voisey's Bay of the eighties and nineties. The closest to an area play occurred in the Ring of Fire in late 2007 when the market thought Noront had found another Voisey's Bay. The Eagle proved to be just an Eaglet and within a year the Ring of Fire area play had fizzled. Although money was spent on grassroots exploration, it was far more lucrative to explore the failures of past exploration cycles in the hope of expanding those deposits or demonstrating that in the context of record high nominal base and precious metals prices these deposits were in fact worth developing into a mine.

Despite nominal metal prices that remain well above their starting levels in 2003, this game of rethinking past exploration discoveries that fell short of economic feasibility at the time of their discovery is no longer relevant thanks to the escalation of mining sector costs that have clawed back the real price gains initially represented by the sharp nominal price increases. Three decades of extensive modern exploration and nominal prices that are just modestly above their 1980 inflation adjusted counterpart have eliminated low hanging fruit. The greater regulatory expense to permit not just mine development, but even exploration, coupled with social license extortion has further raised the bar for what qualifies as a major new discovery. Until a junior makes a major discovery based on sound methodology which enriches a broad shareholder base, attracting risk capital for discovery exploration is a hard sell.

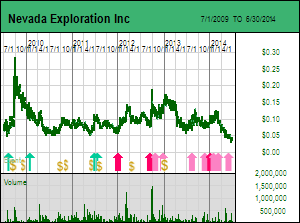

Nowhere is this more evident than the example of Nevada Exploration Inc, which has generated the keys to Nevada's missing gold, but lacks the financial means to turn those keys so as to unlock another 300 million gold ounces hidden under Nevada's basin gravels. The irony is that Barrick Gold has now figured out the gold in groundwater assaying protocol and has embarked on a plodding campaign to find Nevada's missing gold by staking claims on large patches of gravel in conceptually interesting locations, collecting a grid of groundwater samples, and, if golden haystacks with Carlin type toxics materialize, assembling the conventional datasets needed to bring targets into focus, including stratigraphic drill holes. (See May 29, 2014 Comment.)

|  |

NGE, which has spent $12 million during the past decade collecting over 5,000 groundwater samples in similar "off-trend" locations, with several dozen areas showing the potential start of golden haystacks, can only stand by helplessly, waiting for the lumbering gold giant to slap claims down on open ground NGE already knows is prospective. Meanwhile Newmont has apparently managed to make Long Canyon smaller after drilling over 300 holes. At stake in Nevada is the plausibility of John Muntean's theory of how the Carlin type gold formed, a theory Barrick has publicly endorsed and which clearly underpins its quest to own all of Nevada's gold endowment. By the end of 2014 Barrick will have boosted its Goldrush resource into the 25-40 million ounce range and likely absorbed Newmont, creating a true David and Goliath situation in Nevada where control of almost all of Nevada's future gold production potential could end up in Barrick's hands. The trouble with the exploration juniors is that if they cannot raise capital or farm out their prospects on non-punitive terms, those big jaw-dropping discoveries with replication potential cannot be made. The discovery narrative is bad because it is stuck in a chicken and the egg trap.

An Alternative Narrative: Given the frustrating situation I have described for the core narratives that normally drive the resource juniors, I have looked for other narratives within the resource sector and come up with EMC Metals Corp and its scandium story which I have articulated in comments published April 23, 2014 and May 9, 2014. EMC and a Scandium Rush cannot turn around the junior resource sector, but they can serve as a life-raft for those like myself who intend to stick out the bear trough for as long as necessary. I believe extraordinary speculative value resides in carefully selected resource juniors - forget about the 900 zombie juniors which have no future in the resource sector. But the four core narratives that under-pin junior resource sector sentiment are currently in a bad state which will take time to overcome and over which companies and individuals have limited influence.

In contrast, the EMC scandium story has properties which by-pass the current bad state of the core resource sector narratives. Macro-economic trends that affect supply and demand are irrelevant because the $100 billion aluminum market has a latent annual $1 billion scandium demand through aluminum-scandium alloy applications that has never been met for the simple reason that the deposits needed to support a primary, scaleable, multi-sourced scandium supply at a reasonable price did not until very recently exist. Geo-political factors are irrelevant because the tiny existing scandium supply comes from a variety of geographically dispersed by-product sources, and the potential new primary supply sits in Australia which ranks at the top of geo-political stability and has a mining tradition. Metal price trends are irrelevant because the scandium market is so small that reported prices are meaningless, involving transactions for small amounts of scandium oxide at various purity grades. And the question of whether or not mother nature will cough up a world class discovery is irrelevant because the Nyngan deposit is already delineated and others are in the wings. For scandium the critical mass in the form of "kilograms in the ground" is already present with sufficient richness and size to turn the latent aluminum sector demand potential into reality by simply delivering the scandium supply.

As for the chicken and egg problem, where offtake agreements from the aluminum alloy end users that are strong enough to facilitate capital cost funding of a scandium mine simply will not happen until the end users see a successful demonstration of scaleable primary scandium supply, the solution resides in Bloom Energy's critical need for scandium in its solid oxide fuel cells called Bloom Boxes whose sales are on track to go exponential by 2017 right around when EMC should have its first scandium mine in production. The 20-30 tpa scandium oxide production scale contemplated by EMC would fulfill Bloom's initial needs and serve as a demonstration plant for the aluminum alloy sector. If EMC can demonstrate that scandium oxide supply at $2,000/kg or lower is possible from a very large resource with a profit margin for the producer, the capital needed to multiply production output will be abundantly available. The announcement on June 24, 2014 that EMC has effectively sold a 20% interest in Nyngan and Honeybugle for US $2.5 million from a family run private equity group, enough to retire an existing debenture and make the final acquisition payment, plus raised $910,500 through a private placement at $0.085, grants EMC an important first mover advantage and puts in on track to becoming the world's primary scandium oxide supplier, a role that gives EMC substantially more upside value potential than apparent from the initial planned production scale along the lines I have modeled below.

The EMC scandium story boils down to turning an existing scandium deposit into a scandium mine, something that hinges only on human effort, not macro-economic trends, geo-political developments, gold price swings, or discovery holes. And while there is competition from similar deposits recently discovered in New South Wales, EMC has a first-mover advantage in that its management team has spent the past three years working on the feasibility of producing scandium from Nyngan and developing deep relationships within the potential offtake community. For a very detailed discussion on the EMC scandium story, see my 36 page Recommendation Strategy for EMC Metals Corp and to keep track of the scandium story visit KRO's Scandium Resource Center. For quick video snapshots visit my Cambridge Interview with Vanessa Collette and my BNN Commodity Talk Interview with Andrew Bell. I have my fingers crossed that the four core narratives affecting the resource juniors will escape their current traps sooner than I prefict, but I see no need to cross any fingers in the case of EMC and the Scandium Rush. EMC has the earmarks of a very high profile Big Score unfolding over the next few years that may only be worth billions to shareholders, but whose ramifications reshape the future. I do not think I will ever again see so meaningful and exciting a resource sector story controlled by a Canadian junior!

*John Kaiser owns shares of EMC, Nevada Expl, InZinc, Uravan, Avrupa, Northcliff, Namibia Rare Earths, Tasman, Tsodilo, Geologix, First Point