| Kaiser Watch March 29, 2023: Albemarle helps put Liontown into play |

| Jim (0:00:00): What are the implications of Albemarle's conditional bid for Liontown and its Kathleen Valley lithium project in Australia? |

Liontown Resources Ltd announced on March 28 that it had received a proposal from Albemarle to acquire the company at AUD $2.50 per share, which at 2.2 billion issued assigns a value of AUD $5.5 billion to the Kathleen Valley project in Western Australia. At current exchange rates that is about USD $3.7 billion or CAD $5 billion. However, the proposal, which offered a 64% premium above market, was only indicative, not binding. Albemarle wanted Liontown to agree to an exclusive due diligence period and a number of conditions such as regulatory approval before the offer would become binding.

Since December 2022 the price of lithium carbonate has been falling back to earth, and is currently between $17-$18/lb. The optics have had a negative affect on the price of lithium producers and advanced developers such as Liontown which was languishing between $1.40-$1.60 after peaking at $2.22 in November. I am assuming that lithium carbonate will bottom somewhere between $10-$15/lb, but until it does, the Lithium Mania 1.0 companies will be under pressure. The Albemarle proposal not only prevented Liontown from engaging in an auction of itself for other producers, but exposed itself to being tainted if Albermarle comes up with an excuse not to make the offer binding.

It turns out Liontown had received similar proposals form Albemarle at $2.20 on October 20, 2022 and at $2.35 on March 3, 2023 just before PDAC where Albemarle had a booth for the first time ever in the Investors Exchange. Unlike the earlier proposals which Liontown did not make public, this time Liontown went public and also stated that Albemarle has apparently accumulated a 2.2% equity stake in the open market. The stock traded 137 million shares on Tuesday, ten times its usual daily level, and closed up 69% at the day's high of $2.57. This development is a big deal because the producers are taking advantage of the lithium price slump to go after near production companies like Liontown. It is bad news for the investment banks who have been talking down the sector as over-priced because they hope to represent car and battery makers launching their own bids to secure their future lithium supply needs. And it its good news for the transition of Lithium Mania 1.0 to Lithium Mania 2.0.

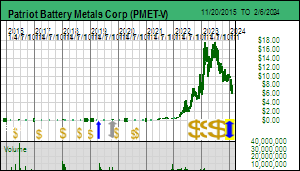

Lithium Mania 1.0 represents the awakening of the lithium boom in 2015-2018 when Tesla sales took off and the world started taking electric vehicles seriously as a partial solution to the energy transition goals of limiting global warming to 1.5 degrees celsius by 2050. During Lithium Mania 1.0 juniors focused mainly on hardrock pegmatites in Australia and brine salars in the Lithium Triangle of South America. Although some Canadian juniors such as Patriot Battery Metals' predecessor acquired Canadian pegmatite plays, these did not get the attention the Australian juniors attracted. PMET never got around to drilling its Corvette pegmatites in James Bay and inflicted two rollbacks on its shareholders until it caught the start of Lithium Mania 2.0 in 2021.

Liontown was a typical Australian junior with gold projects in Australia and Tanzania when in late 2015 it decided to branch into lithium exploration in Western Australia. It acquired the Kathleen Valley project in 2016 from gold producer Ramelius Resources for 25 million shares. The property had multiple LCT type pegmatite showings within a greenstone setting on the Yilgarn Craton. Lithium carbonate prices were in the $10-$15/lb range at the time which made developing 1%+ Li2O pegmatites very lucrative, but in 2018 the price crashed as new supply from Australian pegmatites came on stream and overwhelmed EV demand. Despite the slump Australian companies like Liontown persisted at the cost of diluting their issued shares into the billions.

In the case of Liontown exploration of its various lithium prospects resulted in Kathleen Valley becoming the flagship, with a PFS for a 2,000,000 tpa (5,000 tpd) mine delivered in December 2019. Although the lithium carbonate price didn't bottom at about $3/lb until late 2020, Liontown persisted with a DFS which it delivered at 2.5 million tpa scale in November 2021. The 2017-2020 Trump administration was hostile toward the idea of climate change and Trump did his best to promote the fossil fuel sector at the expense of climate change mitigation goals. The rest of the world, however, stuck to its EV rollout policy goals, especially China, which had a strategic reason for shifting away from ICE vehicles to electric vehicles. Much of China's electricity is generated by domestic coal, but its ICE fleet depends on imported oil, and that could become a problem for China's imperial goals. After voters dumped Trump in November 2020 the Biden administration started to support energy transition goals.

The big surprise, however, was that the car makers, despite Trump knocking down fuel efficiency targets, had on their own made strategic decisions to embrace electric vehicles. It was no longer just Tesla the maverick, but all car companies designing and building EVs. While there are different configurations for the lithium ion battery, all of them require lithium. The over-supply situation began to reverse itself in the second half of 2020, and by the end of 2021 the lithium carbonate spot price had increased 10-fold. In fact the imbalance was so badly reversed that lithium carbonate spot prices spent all of 2022 in the $30-$35/lb range which is much higher than required to mobilize the six-fold supply expansion the IEA projects as needed to meet 2030 EV deployment goals. But it was a huge windfall for lithium producers, including Albemarle which has its Silver Peak brine operation in Nevada, Salar de Atacama in Chile, and joint venture stakes in the Greenbushes and Wodinga pegmatite mines in Australia.

Liontown is currently building a 3,000,000 tpa facility (about 8,000 tpd) with a projected CapEx of AUD $895 million, most of which is funded by equity and a credit facility. Construction is expected to be complete by mid 2024. It is based on a proven and probable reserve of 68.5 million tonnes at 1.34% Li2O, of which 65.4 million is slated for underground mining. At $17.15/lb lithium carbonate this reserve has an in situ value of USD $87.5 billion and a rock value of $1,280 per tonne. If we assume $10/lb as the long term reality, the rock value drops to $746/tonne, still an impressive number, while the in situ value drops to $51 billion (the recoverable value will be lower). The latter is equivalent to AUD $76 billion, which makes the Albemarle worth about 7% of the gross metal value. The reserve sits within a resource of 156 million tonnes of 1.4% Li2O, which gives the owner the capacity to double the production rate down the road. The price Albemarle is offering is thus reasonable. The big question now is whether other potential buyers of Liontown will come to the table and start a bidding war without conditions. The fact that Liontown's price is higher than the $2.50 Albermarle offer suggests that the market thinks so. |

Liontown Resources Ltd (LTR-ASX)

Unrated Spec Value |

|

|

| Kathleen Valley |

Australia - Western Australia |

8-Construction |

Li Ta |

Albemarle Corp (ALB-N)

Unrated Spec Value |

|

|

| Greenbushes |

Australia - Western Australia |

9-Production |

Li |

Liontown's Kathleen Valley Resource and Reserves |

Long Term lithium Carbonate Price Chart |

| Jim (0:13:47): What are the implications of the Liontown bid for Lithium Mania 2.0 juniors like Patrtiot Battery Metals and its much earlier stage Corvette project in the James Bay region of Canada? |

If Liontown does become the focus of a bidding war that results in it being acquired by a much larger company it will accelerate the transition from Lithium Mania 1.0 to Lithium Mania 2.0. Lithium Mania 1.0 was characterized by a rush into Australian pegmatites and Lithium Triangle salars. In both settings the low hanging fruit is now owned and already in production or heading into production. Whatever is left to be found in Australia will require riskier exploration probing under cover. When you use Google Earth to fly over Western Australia, you can see that the northern two thirds has little vegetation, swamp or lakes, very unlike much of Canada. Much of the bedrock is covered by dirt, but then most of eastern Canada is covered by glacial till and overburden. The difference between Australia and Canada is that exploration of Canada's outcropping pegmatite potential is just getting underway. Those LCT pegmatites such as Galaxy/Cyr, Rose, Wabouchi and Moblan which were found decades ago were acquired and explored as part of Lithium Mania 1.0. These are now heading into production.

Lithium Mania 2.0 is based on a market realization that the supply potential identified by Lithium Mania 1.0 is insufficient to meet the lithium demand projected for 2030 and beyond. Liontown's most recent corporate presentation has a very useful slide with a graph that presents supply and demand projections based on work done by Wood Mackenzie and Albemarle which also shows future supply deficits. This chart shows a balance being achieved in 2026, beyond which the supply deficit widens dramatically, peaking at 51% in 2036. This is based on lithium in the current supply mobilization pipeline. Lithium Mania 2.0 is about identifying the pegmatite supply that will take care of the supply deficits that emerge in 2028 and beyond.

Patriot Battery Metals was bootstrapped in 2021 by Australian investors who understood what was happening to future lithium demand and the limits of Australian pegmatite and Lithium Triangle brine supply alone delivering that demand. The outcropping spodumene enriched pegmatite zone on the 55 km long Corvette trend represented low hanging fruit similar to what the Australian juniors harvested in Western Australia during 2015-2018. Lithium Mania 1.0. however, was haunted by uncertainty about whether consumers would actually embrace electric vehicles on a large scale. While the logic behind future lithium demand was sound, the timing of its arrival was uncertain, and that ripped the rug out from underneath Lithium Mania 1.0 when the Australians proved highly efficient at mobilizing new supply and tanked the price of lithium carbonate to a level where nobody has economic incentive to develop pegmatite based lithium supply. But today the car makers have gone beyond the point of no return and the future supply requirements are so well understood that car makers themselves are willing to violate the taboo about getting involved with upstream raw material supply. Furthermore, if the recent slowdown in demand from the Chinese EV sector does threaten to drop the price of lithium carbonate below $10/lb, the battery and car makers will soak up the surplus supply and stockpile it because they understand that if Lithium Mania 2.0 collapses, and the resource juniors who are the exploration engine behind identifying the new supply lose their funding audience, there simply won't be sufficient lithium to make planned EV sales for 2030 and beyond a reality. Albemarle making a tentative move on Liontown in the current environment of a plunging lithium carbonate price reflects this reality.

PMET has during the past 18 months drilled over 150 holes into the CV5 pegmatite and is now marching 6 drill rigs along strike to try to double the footprint by demonstrating that the CV4 outcrop on the north shore of the lake is part of the CV5 pegmatite system. Drilling will pause on April 20 for a month to accommodate the Indigenous goose hunting season. The potential to delineate a 50-100 million tonne body grading 1%-2% Li2O is already visible through the published drill results, which would make CV5 comparable in scale to Liontown's Kathleen Valley deposit. On Wednesday afternoon ahead of the Thursday ASX trading session PMET published the first batch of assays for the 2023 drilling. The results include significant intervals in the 3%-5% Li2O range.

PMET currently has an implied project value approaching CAD $2 billion which represents S-Curve territory ahead of a maiden resource estimate, but that milestone should be achieved by the end of Q2. It has been 7 years since Liontown acquired Kathleen Valley from Ramelius as a pegmatite prospect, with production scheduled by year 8. PMET acquired Corvette at the same time but is only in its second year delineating the CV5 discovery and one might think its valuation is very far ahead of the fundamentals. However, PMET has the Lithium Mania 2.0 advantage over Lithium Mania 1.0 in the form of very big stakeholders understanding the urgency behind identifying the lithium supply that will prevent supply deficits from emerging in 2028 and beyond as Wood Mackenzie projects. While Corvette may look like another Kathleen Valley, the project still needs a couple years of de-risking to attract a bid with a comparable valuation, but the times are such that a $2-$3 billion offer from a party that wants a district scale trend with a flagship deposit already outlined is not inconceivable. The Lithium Mania 1.0 operations were all developed with scales that reflected the uncertainty about the size and timing of the EV future. In the Lithium Mania 2.0 context a much more aggressive production scale can be justified as soon as Corvette passes the maiden resource estimate milestone. |

Patriot Battery Metals Corp (PMET-V)

Unrated Spec Value |

|

|

| Corvette |

Canada - Quebec |

3-Discovery Delineation |

Li |

Liontown's Lithium Supply-Demand Chart |

Initial 2023 Drill Results for PMET's CV5 Target |

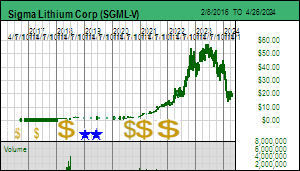

| Jim (0:22:11): Is the Albemarle proposal for Liontown good news for Sigma Lithium and its Grota do Cirilo project in Brazil? |

Sigma Lithium Corp has been the subject of rumors that Tesla is planning a buyout which have never panned out. With 102 million shares fully diluted its flagship Grota do Cirilo lithium project in Brazil's Minas Gerais state has an implied value of CAD $5.2 billion based on the TSXV $51 closing price on Wednesday. Sigma's primary market is NASDAQ where it closed at USD $37.62. The project is similar to Liontown's Kathleen Valley project except that it expects phase 1 to be in commercial production next month. The proven and probable resource at 54.8 million tonnes at 1.44% Li2O is similar to Kathleen Valley's 68.5 million tonnes at 1.35% though it does not have a total resource more than the double the reserve within it. Albemarle's CAD $5 billion conditional bid for Liontown is good news for Sigma Lithium that a buyout at the current valuation is plausible. It is not so good news for Grizzly Research and short sellers who think a proper valuation should be 50%-75% lower.

Last week an outfit called Grizzly Research which claims to be short Sigma published a 42 page report titled Bogus Feasibility Studies & Production Delays will leave Investors Praying for a Buyout. Over the next couple days the report knocked the stock down from USD $36.50 to as low as $31.57 on Friday. The Liontown news has helped the stock bounce back though in CAD terms it is still below the $54.23 peak achieved on October 31. The Grizzly Report makes two key arguments.

One is that Tesla is unlikely to buy Sigma Lithium because Elon Musk thinks the world is over-flowing with lithium and the real bottleneck is lithium refining capacity to make battery grade material. Tesla is building such a facility in Texas which would process spodumene concentrates into battery grade lithium hydroxide. He also supposedly thinks that Nevada's claystone deposits are the most likely lithium supply for his GigaFactory near Reno. The nature of claystone deposits is such that a mine would produce battery grade lithium, so separate refining capacity is not needed. The problem with the claystone deposits is that it remains to be demonstrated that proposed flow-sheets for projects like Lithium Americas' Thacker Pass and Ioneer's Rhyolite Ridge will operate as predicted. It will take several years to find out. Pegmatite mines that produce spodumene concentrates which get converted into battery grade material with established technology do not have that technical risk.

Grizzly also thinks that Musk would not want to rely on lithium supply from a country run by a left-winger like Lula rather than a wannabe autocrat like Bolsonaro. Given the ignorance Elon Musk has publicly demonstrated about the nature of the mining industry and its timelines, I tend to share Grizzly's skepticism that Tesla is a serious contender to buy out Sigma Lithium and turn Grota do Cirilo into an in house supply of pegmatite sourced lithium. A much likelier candidate would be one of the Chinese companies who would have no problem doing business with a right or left wing government. Grizzly warns that the Canadian government would not allow such a bid, just as it forced a Chinese shareholder to divest itself of an equity stake in Lithium Chile even though Lithium Chile has no properties in Canada. However, the American shareholders of NASDAQ listed Sigma such as Blackrock would tell Justin Trudeau to piss up a rope if he tried again to interfere with the sovereignity of other nations. With Albemarle willing to pay AUD $5.5 billion for Liontown in a country that is no longer happy with China and which would probably block a takeover by a Chinese company, Sigma Lithium may lot more appealing today.

Grizzly nitpicks about a number of issues that seem frivolous, but its second important argument for a lower takeout price in the CAD $10-$20 range is that it falls into the Goldman Sachs camp which predicts lithium surpluses as we approach 2030 that justify using lower long term prices. This is the opposite of what Albemarle and Wood Mackenzie predict in that Liontown supply-demand graph. In that regard the Albemarle bid is very inconvenient for Goldman Sachs, which seems to be in the business of talking down the price of lithium producers and developers on behalf of the car and battery makers who would prefer to pay as little as possible for their long term lithium supply which internally they know could very well be in deficit by 2030. Lithium Mania 2.0 is premised on the idea that it is better to know where the future supply can come from than to speculate about China's supposed domestic supply expansion capacity, Russia and China somehow getting the giant Bolivian salar into production as well as the DRC deposits, and direct lithium extraction becoming viable for oilfield brines. Lithium Mania 2.0, the search for LCT pegmatites in relatively unexplored jurisdictions like Canada, Scandinavia and Brazil, is insulated for the next few years from the outcome of this supply debate. |

Sigma Lithium Corp (SGML-V)

Unrated Spec Value |

|

|

| Grota do Cirilo |

Brazil - Other |

8-Construction |

Li |

Reserves and Resources for Sigma Lithium's Grota do Cirilo Project |

| Disclosure: JK does not own any of the companies mentioned and they are not rated |