| Kaiser Watch June 9, 2023: James Bay Waiting for the Summer Rain |

| Jim (0:00:00): How will the Quebec forest fires affect the lithium pegmatite hunt this summer in the James Bay region? |

Last weekend Quebec exploration hit the wall when the provincial government suspended access to forests and ordered exploration companies to cease activities. The reason was that lightning strikes had started about 150 forest fires in southern Quebec which the province's forest fire fighting system had capacity to handle only about 25% (a June 9, 2023 NYT Article describes how budget cuts have diminished Canada's forest fire fighting capacity despite the country's official acceptance that global warming is a real trend that must be dealt with). All helicopters were requisitioned to support fighting fires in southern Quebec close to communities and infrastructure. By mid week Chibougamau was ordered to evacuate at 2 AM. The reason for the forest fire situation was an abrupt transition from spring thaw to record setting temperature and dry conditions.

Some have suggested that the fires were accelerated because the leaves from Quebec's deciduous trees (ie the maples responsible for spectacular fall color), preserved quickly by winter after falling last year, never had a chance to decay and quickly turned into flammable tinder. The trees in the northern part of Quebec which includes the James Bay region are conifers such as spruce. The smoke was so bad it reached as far as Florida, and New York at times matched the air quality of India's Delhi which has the worst air quality in the world. In 2020 California suffered major forest fires whose smoke traveled into the Bay Area resulting in one day that was like an all-day total eclipse (Sept 9, 2020 San Francisco Chronicle. But that was in September in the middle of a drought; summer hasn't even arrived yet in Quebec and we have a situation this bad already?

The fear experienced by everybody with exposure to Lithium Mania 2.0 juniors was that no boots would be allowed to pound the ground the entire summer, meaning there would be no targets to drill in the fall or early 2024. The whole point of Lithium Mania 2.0 is to find as soon as possible in places like Canada the second half of the 600% expansion in lithium supply that the IEA projects is needed to meet 2030 EV deployment goals to support net zero emissions by 2050 (limiting temperature rise to 1.5° C). Getting major new pegmatite deposits found over the next two years into production by 2030 is already a stretch of the imagination unless Canada figures out how to streamline its mine permitting system. Few missed the irony that greenhouse gas driven climate change would delay this mitigation effort because Canada was asleep at the firefighting switch.

Only a few fires were burning in the sparsely populated James Bay region and they are usually ignored unless they threaten hydro power facilities, exploration camps or get close to the few roads that connect this remote region. Natural Resources Canada provides an Interactive Map which allows one to track the fire danger and fires across Canada. When loading the interactive map the first time, use the "overlay" button to drop down a menu of settings to activate. I have provided a screenshot of the menu along with maps from June 5 and June 9. These show the dire situation last weekend moderating as rainy weather moves westward. A June 11 screenshot shows that although there still many active fires the fire danger is dropping in southern Ontario and Quebec thanks to wet weather. Eastern Canada does have wet weather during the summer, so the big hope is that the spring dry spell is over, the fire danger will diminish, and the restrictions on exploration will be lifted.

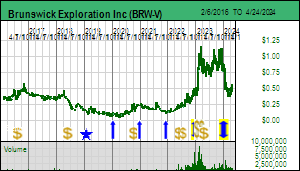

Quite a few juniors such as Brunswick Exploration Inc put out glum news releases that they had boots on the ground but had to pull out their crews. Although Brunswick has properties in other parts of Canada such as Manitoba, Ontario and Atlantic Canada where there are no restrictions, at least not yet, the indefinite closure of the James Bay region would be a major problem because Brunswick holds several strategic claim options from Osisko and Midland which have an escalating option payment structure. The plan was to hit hard the Plex and Mythril claims in the northern half of the James Bay region where Patriot Battery Metals is delineating the CV5 lithium pegmatite on its Corvette property. Patriot optioned Corvette from Osisko back in 2015 because this particular trend had visible pegmatite outcrops. But this northern half of James Bay has never been seriously investigated for LCT-pegmatites, and now there is a scramble afoot to take a close look at the areas parallel to the Corvette property as well as the continuation of the amphibolite trend to the west which in areas like Plex were targeted by Virginia Mines for their gold potential. Brunswick has now disclosed that the pegmatite encountered in holes testing the Orfee gold zone on the Plex property is not spodumene enriched. Killian Charles told me that the main encouragement his team got from visiting the Plex core shack was this was "evolved" pegmatite, just not to the extent needed to create an LCT-type pegmatite. Prospecting the numerous peripheral pegmatites, shooting them with an XRF or LIPS gun, and collecting channel samples is thus an essential task for this summer. This is "first order" exploration because pegmatites are known to exist, except nobody has ever bothered to classify them. In the case of the Mythril claims whose "rare mineral" potential Brunswick has optioned 85% from Midland the task is a little harder because of LCT-type pegmatites are present they will have more subtle exposure.

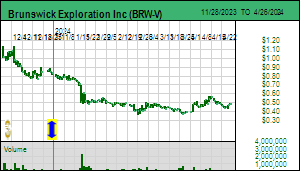

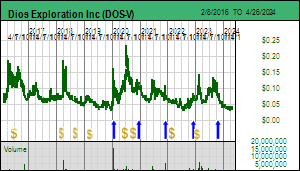

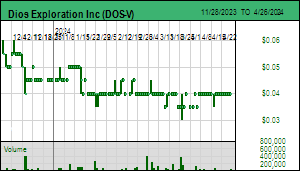

Although the prices of most James Bay lithium juniors sagged, Dios Exploration Inc managed to generate a modest uptick when it published an update about additional claims it had sticked with the LeCaron cluster. The press release included a large scale map showing the inland extent of the former Tyrell Sea and how it overlaps with the glacial moraine front of the last ice sheet. Dios' CEO Majire-Josie Girard explained to me that while the area covered by the Tyrell Sea has plenty of LCT-pegmatite potential, as is evidenced by the Galaxy-Cyr pegmatite Allkem is developing, the lake bottom sediment data in this area is largely useless for pinpointing nearby LCT pegmatites because of the sea floor reworking of sediments. The glacial moraine front shows the overlapping part where basal till sampling is useful.

This region saw all its major outcropping pegmatites like Cyr staked decades ago and is now target for "second order" exploration where secondary clues are used to track down locations for hidden or barely exposed LCT pegmatites. One technique being used by many companies involves studying high resolution government satellite imagery for "glimmers" of pegmatite. One of the properties Brunswick optioned from Osisko is the Anatacau group. Most of the attention has focused on the small Anatacau West claim where drilling by Brunswick this winter confirmed that the Galaxy-Cyr pegmatite systems trends at least 300 m onto Anatacau West. Brunswick plans to prospect the eastern extent of this property during the summer, but more important are its plans for the much larger main Anatacau block to the east. Brunswick has been rather penurious in publishing detailed graphics about its various properties, but it has indicated that pegmatite outcrops are present on Anatacau and that is a priority for boots on the ground because its is part of the expensive Osisko option, but it is also much closer to infrastructure than the "first order" targets in the northern half of James Bay. I've super-imposed a screenshot of the Anatacau property onto the map published by Dios to show the scale of Brunswick's property which also hearkens from the Virginia gold exploration days.

Nobody except Kenorland has done any recent till sampling in this region and Kenorland optioned 100% of the claims resulting from this till sampling to Li_FT Power whose attention has shifted to its collection of pegmaties in the Northwest Territories. However, about 15 years ago Sirios and Dios collaborated on a regional till sampling program done on a 2 km by 2 km grid with Sirios getting to stake any gold in till related targets while Dios got to stake diamond indicator mineral related targets. This till sampling program which extended somewhat beyond the glacial moraine front resulted in the discovery of the Pontax lithium system which Sirios and Dios spun out as a separate entity that became Stria Lithium which in turn has farmed out Pontax to ASX listed Cygnus. Sirios and Dios dissolved the till sampling JV but each kept a copy of the resulting proprietary database. The Dios exploration team has been quietly parsing the till database for more subtle LCT pegmatite clues and correlating them with lake bottom sediment data, satellite imagery, mapped geology, and archival research. The spice that Dios is adding to this secret sauce is the in-house experience with regard to the behavior of glacial transport that evolved during the two decades of futile diamond exploration trying to find another Renard cluster in the James Bay region.

Dios has plans to put boots on the ground in July, so the current disclosure has not disrupted any of its plans. But much will hinge on whether the summer rain dampens the fire risk in southern Quebec and the James Bay access closure is lifted. Dios managed to gain a few pennies this week, which still leaves it with less than a tenth of the valuation Brunswick is commanding. But it will likely continue to attract bottom-fishers while we wait for the summer rain, especially if Dios steps up its disclosures that help the market better understand its "second order" exploration strategy in the southern half of the James Bay region. In its recent MD&A quarterly filing which revealed that the marketing budget consisted of the equivalent of springing for a bottle of two buck chuck, Dios also included a shareholder pie chart including a "private investor" with an 8.5% stake. If my leg isn't being pulled by this investor, he is sitting on a windfall score in the form of over 1 million Patriot Battery Metals shares. Not every PMET investor below out his or her stock when it hit $2. Furthermore, given how many cheap warrants remain outstanding, there are plenty sitting on windfalls that will be turned into liquid cash or big company stock if PMET attracts a buyout later this year. Where to redeploy that windfall will depend on what boots on the ground in James Bay deliver this summer. |

Brunswick Exploration Inc (BRW-V)

Favorite

Fair Spec Value |

|

|

| Anatacau |

Canada - Quebec |

2-Target Drilling |

Li |

Dios Exploration Inc (DOS-V)

Bottom-Fish Spec Value |

|

|

| LeCaron Lithium |

Canada - Quebec |

1-Grassroots |

Li |

NRCAN's Canada Fire Map comparing June 5 to June 9 |

Updated NRCAN Fire Map for June 11, 2023 |

James Bay Map showing 1st and 2nd Order Pegmatite Potential |

Map showing the overlap of Tyrell Sea and ice sheet moraine front |

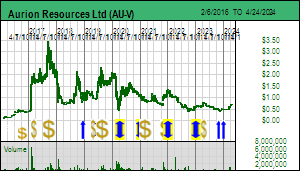

| Jim (0:12:37): What has your KRO Favorite Aurion Resources planned for this summer? |

I published Tracker June 8, 2023 which provides a detailed assessment of the district consolidation play brewing for the Central Lapland Greenstone Belt in Finland where Aurion Resources Ltd is the lynchpin. It also explains how the Savu acquisition news on May 23 not only provides Aurion shareholders with a meaningful Finland spinout if Rupert Resources Ltd reaches a plan of arrangement to merge with Aurion, but also exposes Aurion to a potential hallelujah event this summer if the boots CEO Matti Talikka puts on the ground at Savu stumble across a significant LCT enriched pegmatite. His secret sauce is a basal till sampling database which GTK, the Finnish geological survey, conducted on a 2 km by 2 km grind decades ago in the Savu region. It took some effort by Talikka to extract the database from the GTK archives, helped by the fact that he used to work for GTK and knew it existed. To his surprise the database included anomalous lithium values in the western part of the claim package he spent two years assembling. Unlike in the James Bay region where Dios is treating lithium in till as derivative of neary spodumene mineralized pegmatites, Talikka belives the lithium values are derived from precursor micas within granitoids. What makes the Savu play interesting is that nobody has every bothered to investigate rthe lithium potential of the Savu region which is best known for the Sokli carbonatite which hosts several hundred million tonnes of 12%-13% phosphate now owned by a government entity called Finnish Minerals Group. It turns out the southern part where there is a history of mineralized drill intersections was open so Aurion scooped it up. If the CLGB district consolidation does not rapidly unfold, a drill program by Aurion on the Kaares structural trend in the southern part of the 100% owned Risti property could deliver an Ikkari discovery scale surprise. Should that happen, B2Gold, which is the 70:30 partner with Aurion on the Kutovuoma property that is critical to optimal development of the 4.1 million ounce Ikkari gold deposit, would not waste time offering to buy out Aurion as a prelude to fighting Agnico-Eagle for control of Rupert. Although Aurion has not delineated a gold resource, a rising gold price would inject urgency into Rupert to approach Aurion, especially if a rising gold price pushes Rupert into an uptrend. |

Aurion Resources Ltd (AU-V)

Favorite

Fair Spec Value |

|

|

| Risti |

Finland - Other |

3-Discovery Delineation |

Au |

Rupert Resources Ltd (RUP-T)

Unrated Spec Value |

|

|

| Ikkari |

Finland - Other |

6-Prefeasibility |

Au |

Map of Aurion holdings in Central Lapland Greenstone Belt |

Cross section of PEA Mining Plan for Rupert's Ikkari deposit |

Page 110 of PEA Technical Report has cluses for mine plan alternatives |

Map of 70:30 Kutuvuoma JV with B2Gold |

Comparison of Rock Sample Map and more recent Till Sample Map for Risti |

Map of Savu Region Claim Blocks and Till derived Lithium Values |

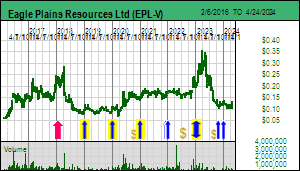

| Jim (0:28:22): Why has Eagle Plains Resources, another KRO Favorite which did well earlier this year, recently seen its price decline? |

Eagle Plains Resources Ltd was made a Fair Spec Value rated 2023 KRO Favorite based on its strategy as a prospect-generator-farmout junior focused on western Canada which also planned to drill its 100% owned Vulcan project in southern British Columbia. Vulcan is a candidate for the Sullivan Two Hunt that has bedeviled explorers since the 1970s, including Cominco, and later Ascot Resources for whom Eagle Plains CEO Tim Termuende worked as a junior geologist when Ascot drilled Vulcan. In recent years Eagle Plains has conducted two drill programs, the first one on the southern target area in 2020 to fulfill assessment requirements, and the second one last year in both the northern and southern target areas. The 2020 program was a bust in that the MT target turned out to be caused by graphite, but the two holes did answer a hypothesis about whether the assumed Sullivan Time Horizon, namely the contact between the Lower and Middle Aldrige formations, that guided past drilling was correct. It turned it was not, and Eagle Plans has been trying to develop a vectoring strategy to home in on a Sullivan scale zinc-lead-silver system based on this new understanding. The 2022 drilling on the southern and northern targets has turned EPL's attention to the northern Hilo-West Basin target where a 3,000 m 5 hole drill program is planned starting in mid June. This program will vector in on a new geophysical conductor which is likely pyrrhotite, but understanding it will give a clue where the less conductive zinc-lead mineralization is located. The drilling program is scheduled to begin by the third week of June.

By know I have been frustrated by so many failed Sullivan Two Hunts that my inclination is to just sit on my position and assume no discovery hole will be delivered. But it is always more fun to watch a game rather than wait to hear the outcome. EPL's Kerry Bates put together a 14 minute YouTube Video last year using a whiteboard and felt pens to explain the evolution of the original Sullivan deposit. It's worth watching to understand that Sullivan is actually a two stage system that starts with traditonal seafloor smokers that spew fluids into the water that form thin beds of mineralization interspersed with quiet period of sedimentation. The fluids come up the faults of a rift setting where blocks of rock are down-dropped to form "grabens". These traditional SEDEX deposits are not very interesting. in the case of southern British Columbia the stratigraphy was invaded by invaded gabbroic sills which did not introduce any mineralized fluids, but their heat convecting through the not yet consolidated sea floor bedding created mini explosions that fragmented the bending. In the case of Sullivan a later hydrothermal system found its way up the sides of a sub-basin filled this mess of mineralization, harvested the metals in it, and re-deposited them through a new sea-floor vent which in the case of Sullivan created a 150 million tonne monster. The work so far done in the Hilo area of Vulcan has delivered evidence that the first stage took place. Now they are looking for evidence that the second remobilization and enrichment phase took place. The final step will be to figure out where the resulting Sullivan 2 deposit ended up after post-deposition folding and faulting.

Eagle Plains, however, did not gain 50%-75% earlier this year because Sullivan 2 Hunt addicts were getting worked up the upcoming drill season. In January Eagle Plains announced a plan to put all its royalties into a subsidiary and spin it out on the basis of 1 Eagle Royalties share for every 3 Eagle Plains shares. As usual this process took longer than expected by May 18 was the day of record, which meant that with two day settlement May 16 was the last day to buy EPL to get the spinout. The deal was structured so that the subsidiary would merge with a private company that would conduct a $3 million financing before listing on the CSE. The terms implied a value of about $0.30 for Eagle Royalties share or about $0.10 of value created for each Eagle Plains share. Once the spinout happened there was a $0.10 drop in the price of Eagle Plains. Eagle Royalties began to trade on the CSE on May 24 but has been fairly illiquid because there was a delay getting the spinout shares into the EPL shareholder accounts. Also, the spinout stock will be escrowed with 20% released on listing and 20% each 3 months. For US residents such as myself I am happy to wait a year because the cost base is zero and I prefer to pay long term capital gains.

Eagle Royalties now owns royalties on 52 properties still owned by Eagle Plains. They generally consist of a 2% NSR of which Eagle Plains can buy back 1% any time for $1 million. The most important royalty is a group of 0.5%-2.0% covering parts of Banyan's Aurmac gold deposit. There is no buyback on that royalty which is Eagle Royalties' flagship royalty. When I added Eagle Royalties to KRO I was surprises how many there were. I assumed that Eagle Plains was spinning out the royalties it had retained when it farmed out properties. In fact, Eagle Plains invented a 2% NSR for every property not yet farmed out and retained an unrestricted right to buy back 1% from Eagle Royalties for $1 million. In other words, if any of these projects gets developed into a mine, a 1% NSR will be worth more than $1 million, which EPL can repatriate for the benefit of Eagle Plains shareholders. EPL is operator of these projects, most of which do not currently have active farmouts, and it is typically retained by the farm-in junior to operate the program. Now that the 2% NSR exists, Eagle Plains will not have to negotiate with a farm-in partner about keeping a royalty. All it needs to focus on is the combination of cash, stock and spending timeline the other party must fulfill to earn an interest. Eagle Plains has also retained about 5.2 million Eagle Royalties shares. I had not understood this aspect of the spinout deal. I thought Eagle Plains was giving away its collection of royalties and it would be Eagle Royalties shareholders who benefit from any future upside. I think Eagle Plains will soon recover the $0.10 drop is suffered after the spinout. It is a gift to Eagle Royalties that will keep giving back as long as Eagle Plains sticks to its prospect-generator-farmout strategy. If Eagle Plains gets lucky with a Vulcan homerun, the prospect portfolio would survive through a spinout. |

Eagle Plains Resources Ltd (EPL-V)

Favorite

Fair Spec Value |

|

|

| Vulcan |

Canada - British Columbia |

2-Target Drilling |

Zn Pb Ag |

Hilio Drill Target at Vulcan Sullivan 2 Hunt |

Map showing how much of Aurmac Royalty overlaps with BBanyan's gold deposits |

| Disclosure: JK owns shares of Brunswick, Dios and Eagle Plains; Aurion, Brunswick a Eagle Plains are Fair Spec Value rated Favorites; Dios is Bottom-Fish Spec Value rated |