| Kaiser Watch August 25, 2023: Go Deep Young Man or I Go Home! |

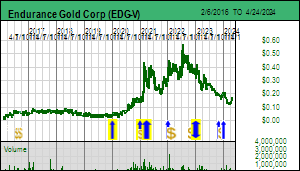

| Jim (0:00:00): Why does Endurance Gold's chart look like a lead finger is weighing on it? |

Endurance Gold Corp started the 2023 field season at its 100% optioned Reliance gold project in southwestern British Columbia in early May and as of August 3 had reported results for 10 core holes with results pending for 4 holes and hole 23-75 in progress. Earlier in the year the stock came under pressure when a major shareholder who wanted Endurance to mount a very aggressive 2023 drill program decided to bail, perhaps fearing he might not live long enough for Reliance to reach a tipping point confirming it has a major gold discovery. The stock had recovered back above $0.30 when drilling started, but then it really does look like a lead finger weighed in on social media about the not so good looking stock chart. By then the optimism we saw about the resource sector in Q1 had vanished, and nearly every resource junior's chart looked bad, so at least partly it is the market funk linked to gold's failure to turn $2,000 into a base rather than its ceiling that weighs on Endurance's stock price. But that doesn't explain why the shareholder bailed earlier this year when gold was above $2,000 and threatening to turn that into a base for higher prices down the road.

The Reliance gold mineralization is an epizonal orogenic system such as the nearby Bralorne gold system which produced over 4 million high grade ounces from a swarm of veins. Orogenic gold systems, also called "mesothermal", are different from epithermal systems whose vertical zonation is constrained by the interaction of metal bearing hydrothermal fluids with near surface groundwater circulation. This usually limites the vertical extent of mineralization to 200-600 metres. The latest Endurance presentation has a regional map showing the relationship of the Bralorne area orogenic systems associated with the Bendor Batholith and the Spences Bridge epithermal district to the east where Westhaven Gold Corp recently reported a PEA for its Shovelnose project. There is no genetic relationship between the two districts, but their juxtaposition does help illustrate what is special about Endurance Gold's Reliance project.

The Shovelnose PEA indicated a CAD $222 million after tax NPV at 6% and 32.3% IRR using $1,800 gold and $22 silver base case prices for an in situ 768,000 oz gold and 3,998,000 oz silver resource to which the market has reacted unkindly. The Shovelnose PEA envisioned a 1,000 tpd open pit mine with CAD $122 million CapEx which would yield 534,000 oz gold and 2,715,000 oz silver over 9.5 years. The PEA clears development hurdles, but the market prefers bigger scale. To be fair, the PEA is only based on the South Zone, so there is room for a bigger scale scenario if additional zones along strike or parallel end up being included. But this illustrates the difference between epithermal and orogenic systems. Westhaven cannot go much deeper and it has done sufficient nearby exploration to limit the immediate upside potential from parallel and on strike zones; although additional mineralized zones are not included in the PEA, the market has perhaps prematurely concluded that Shovelnose is as good as it is going to get.

Endurance's results so far suggest potential for a similar scale open-pittable resource between the Imperial and Eagle Zones and some shareholders have suggested maybe Endurance should focus on delivering a maiden resource estimate so that the number crunchers can assign outcome visualization based valuations to the project. However, that is not what our grumpy shareholder who bailed earlier this year wanted. He was focused on the geological fact that Reliance is an orogenic system, and given evidence the mineralization is very high in such a system, should have substantial vertical extent within which gold mineralization could blossom in grade, width and continuity so that it can become a high grade underground mining play such as Bralorne became a century ago. This shareholder declared to CEO Robert Boyd, "Go Deep Young Man or I go Home!" Robert Boyd's nature is one of cautious exploration that builds on incremental new information, and without an over-flowing treasury in place, was not going to drill deep speculative 1,000 m holes, at least not quite yet. So our grumpy shareholder called it quits and went home.

Robert Boyd believes he has a big one on the line at Reliance, and does not want to risk losing this fish because he runs out of money in a bad market. This week Barrick's former exploration VP, Alex Davidson, came on board as an advisor. While conceptual geological plays like NuLegacy's Red Hill Carlin-type project in Nevada do intrigue him, what attracted him to Reliance was the "strength" of the mineralizing system and its geological context. Orogenic gold systems form well below the surface and deposit high grade mineralization over a great vertical extent that can run into thousands of metres such as is the case in the world's greenstone belts. These structurally controlled deposits end up exposed at surface thanks to extensive erosion. The difference between Bralorne and Reliance is that at Reliance the gold system associated with the Royal Treasure Shear is near the top of the system, based on the presence of other elements such as antimony which are not present at the bottom of an orogenic system.

The source of the orogenic fluids is linked to the Bendor Batholith on whose southwestern flank sit Bralorne's veins and whose chemistry implies the mineralization is more than 1,000 m deeper than the mineralization at Reliance which has associated antimony and arsenic. The tantalizing story about Reliance is that the mineralizing system at surface is very powerful with lots of high grade gold zones and chemistry indicating the top of an orogenic system. And so the question arises, how much gold was left behind at depth in rich zones? The northwestern end of the Royal Treasure Shear trend disappears under the Carpenter Lake hydro reservoir and it seems to fizzle out at the southeastern end for a total 1.5 km strike length (though this may be a function of physical access up the mountain and the fact that the gold zones appear to be like shoots interspersed with lower grade mineralization).

There remain untested near surface gaps such as between the Imperial and Eagle zones, but after 3 years of RC and core drilling Endurance could hunker down and crank out an open-pittable resource similar to what Westhaven has done, followed by a PEA. The sizzle, however, lies with going deeper, substantially deeper to the depth where Bralorne style veins might start to show up. And the Bralorne veins were much thicker, richer and continuous than what we have so far seen at Reliance.

The reason delineation of the Reliance gold system has taken so painfully long is partly due to Robert Boyd's cautious use of staged multi-data set collection to develop a geological understanding of what makes the mineralization within the Royal-Treasure Shear Corridor tick. Keep in mind that the Imperial zone was discovered in the 1980s by the late Charlie Boitard, a maverick who used dowsing methods to spot drill hole locations. Although Imperial yielded some spectacular intervals, subsequent drilling did not reveal the geometry of mineralization. When Endurance took on Reliance in late 2019 it explored the Royal-Treasure Shear by building a road along it up the mountain and surface sampling the road cuts. This became the basis for a shallow RC drill program in 2021 which confirmed that the gold mineralization was a shallow dipping gold zone within the foot wall of the Royal-Treasure Shear corridor separated by some sort of thrust fault from the southwest that had placed younger sediments as the hanging wall above the mineralized corridor. Due to the limitations of road access most of the core holes drilled in 2022 were spotted on the foot wall side, which, because these holes were drilled westward, chased a mineralized zone that was dipping southwest. This becomes a problem when you try to delineate the zone down dip.

The latest corporate presentation contains a longitudinal section which shows where mineralization has been encountered relative to an elevation scale on the right side of the section. The dots present ranges for the equation gold grade times metres. Hole 23-70, drilled from the footwall side and the last one reported this season, which yielded 3.7 m at 7.91 g/t gold, is represented as an orange dot for the 25-50 range at an elevation of 1,000 m, which is about 250 m beneath the surface. The section includes 3 deeper black dots representing grade x metres of less than 10. That makes it look like the mineralization is fading at depth, but Boyd explained that those holes were drilled from the foot wall side and never reached the mineralized structure hole 23-70 encountered. The longitudinal section is a two-dimensional plane onto which every mineralized pierce point is projected, so can be misleading. When the company tags the Eagle zone as open at depth that is actually the case. With the next update we will likely get a drill plan and sections for the Eagle Zone that allows us to better track what is unfolding.

By the end of 2022 it was clear that to test the Eagle and Imperial zones properly at depth the holes had to be spotted on the hanging wall side of the Royal-Treasure Shear corridor and drilled toward the northeast. But that first required permitting and building roads up the mountain, which Endurance has accomplished this year.

So far Endurance has drilled 10 core holes, 4 of them testing the Imperial Zone at depth though 2 had to be abandoned. The second pair, 23-65 and 23-66, revealed that the Imperial zone is alive and well at depth, and the 2 holes into the Diplomat Zone along strike to the northwest also show the mineralization persists toward Carpenter Lake. Road building has focused on the higher elevation Eagle Zone where holes 67-74 have been drilled from the hanging wall side, with results reported through hole 70. Drilling earlier in the season was done at the lower elevation Imperial and Diplomat zones while the roads traversing the hanging wall side of the Royal-Treasure Shear were built. Holes 71-73 were shipped for assays in late July, but hole 74 is still in the box awaiting sampling, and hole 75 is partly done, with no holes drilled since then. On August 3 Endurance Gold reported that it had to suspend exploration work because Goldbridge had been ordered to evacuate due to forest fire in the vicinity of Gun Lake.

The Reliance project is not threatened by fire which is limited to the north side of Carpenter Lake. But Endurance had rented a building near Gun Lake to house its exploration crew, and once the evacuation order came, there was no place to stay. The fire torched a number of houses, including the residence of the landlord, but only came within 500 m of the rental house. Fire also caused the evacuation of the Shalaith First Nations community from which Endurance sources a number of workers, though apparently that evacuation order has been lifted. Currently there is no road access to Goldbridge except for emergency and fire support vehicles, both from the Pemberton Meadows and Lillooet access routes.

The authorities have given no guidance when they will lift the evacuation order and restore general access. Robert Boyd is hopeful Endurance can resume drilling in September but is frustrated that the entire month of August has been lost. Drilling without a winterized camp can continue into early December and resume in April. He figures with the current budget he could get 15-25 more holes done with one rig, but would like to increase the drilling rate by adding a second rig. However, given his cautious nature, he only wants to add a second rig if he can raise additional funds, and that he does not want to do at the current price level unless it involves a premium priced charity flow-thru financing. Most of the remaining holes will test the down plunge extent of the Eagle Zone, while others will attempt to fill the 400 m gap between the Imperial and Eagle zones. This gap exists because there is limited outcrop due to topography which has allowed a thicker blanket of ash from the Mt Meager eruption to settle, so was not part of the initial surface sampling work.

The immediate goal is to extend the Eagle zone into the 900-1,000 m elevation depth (23-70 is at about 1,000 m - deeper means lower elevation). Boyd is reluctant to drill big deep stepouts because the team thinks the mineralization's plunge has a rake to the southwest which they want to confirm in order to spot productive holes. He much prefers to follow the zone with incremental stepouts before becoming more aggressive. That means it will be a while before Endurance reaches the depth where Bralorne style veins will be present. On the other hand, with each incrementally deeper hole, the potential exists for the mineralized zone to blossom, and once that happens, Endurance's drill rig will have something to chase which can revive anticipatory speculation. Except in the James Bay Lithium Great Canadian Area play positive outcome speculation is pretty much absent from the Canadian junior resource sector, which creates an early "bottom-fishing" season for stocks like Endurance Gold which have the capacity to generate game changing news.

The importance difference between last year and this year is that the new hanging wall access roads allow chasing the Royal-Treasure Shear structure down plunge from the hanging wall side and intersect the structure at an angle closer to a perpendicular. If the Royal-Treasure Shear zones start to blossom at depth, and the plunge-dip remains generally toward the southwest, Endurance will be able to add a second rig and become more aggressive with deeper stepouts. Should this tipping point happen the disgruntled shareholder might even come back into the market, and the breakout chart pattern could prompt lead finger's impact on the market to undergo an alchemical transformation in the social media world where it wags.

Given the shortened summer exploration season a key question is what Endurance will have gotten done on the Olympic and Sanchez properties it optioned 100% last year from Avino and a private party. These properties cover the western and northwestern flank of the Bendor Batholith. One concern I initially had was that the Reliance project was a relatively small property which carried the risk that the discovery could turn into a Shovelnose outcome if grades fizzle at depth or the zone disappears thanks to a blind low angle fault. That concern heightened in 2021 when it became apparent that the gold mineralization had a shallow southwest dip that raised the risk that it would stop when it ran into the thrust fault that separates the unmineralized sediments and the Royal-Treasure Shear mineralized corridor. But in 2022 drilling established that dyke like sub-vertical structures were present within the corridor on whose flanks gold mineralization was present, so that concern ameliorated somewhat.

In the case of Westhaven's Shovelnose project and the other properties it owns within the Spences Bridge epithermal belt, the junior can continue to explore on a district scale even if the South Zone and its nearby zones fall short of development critical mass. Endurance went after the Olympic and Sanchez properties on the premise that similar orogenic zones could be present on the other flanks of the Bendor Batholith. One would think that intensive prospecting a century ago in the wake of the Bralorne discovery would have found anything if it were to be found. But the Bendor Batholith is steep, has a lot of forest cover, and is burdened by thick ashfall from the Meager Creek eruption. A century ago prospectors did not deploy soil sampling and definitely not biogenic sampling methods which Endurance used to identify elevated arsenic levels that fir trees are absorbing from soils above mineralized bedrock (arsenic is a pathfinder at Reliance). Fortunately Endurance started early with its Olympic-Sanchez sampling program and completed it before the fire evacuation notice. Results expected later this year will tell us if the Olympic-Sanchez claims do indeed offer district scale potential for additional orogenic gold systems. There is reason to be optimistic; Robert Boyd grumbled about how the sampling medium is thick and difficult in this area, which gives hope that prospectors did not find anything because nothing was there, but because it was pretty much hidden "under cover". |

Endurance Gold Corp (EDG-V)

Favorite

Fair Spec Value |

|

|

| Reliance |

Canada - British Columbia |

3-Discovery Delineation |

Au |

Orogenic and Epithermal Districts in southwestern British Columbia |

Google Earth Map showing Fire Locations |

Longitudinal Section of Royal-Treasure Shear Corridor |

Illustration of how net roadwrok will facilitate deep drilling |

District Scale Potential created by Olympic-Sanchez Property Options |

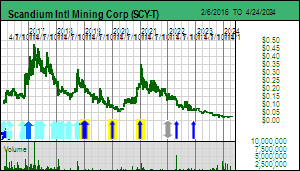

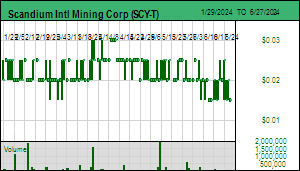

| Jim (0:17:50): What you think of Scandium International's Nyngan results? |

Scandium International Mining Corp reported on August 8, 2023 the results for a small drill program conducted on the Nyngan property. Earlier in the year the company announced that it planned two small drill programs, one to test additional targets on the Honeybugle property, and the other to assess the limis of the western zone at Nyngan. The Honeybugle results were announced June 20, 2023 in a press release with a detailed assay table and drill plan which allowed me to undertake a speculative back-of-the-napkin resource estimate for the Woodlong anomaly. Back in 2014 when SCY was in danger of losing the Nyngan property to creditors it drilled the Seaford magnetic anomaly on the Honeybugle property it had staked about 20 km from Nyngan. The results were better than reported for Nyngan and Honeybugle could have become a replacement project for Nyngan. But SCY managed to stave off foreclosure when the Evensen family extended a USD $2.5 million loan that was convertible into a direct 20% project equity stake. So SCY stuck with Nyngan which was more advanced and delivered a DFS in 2016 for which a mining lease was granted in 2017. The CEO George Putnam decided to embark on an offtake deal development strategy as a pre-condition for trying to develop Nyngan, a rejection of the notion "if you build the supply the demand will come".

No offtake deals emerged, but what did emerge was an extortion attempt Owen Carter had launched during the mining lease application period in 2016. He had sold the surface rights to the western half of the Nyngan claim to Jervois, then the owner of the project before SCY acquired it 100%, but retained the eastern half's surface rights which he then claimed qualified for protection as "agricultural land" which would have shielded it from eminent domain acquisition by SCY at fair market value. Unfortunately Carter's complaint letter disappeared into a wrong file and was never reviewed by the NSW permitting department which granted the mining lease. It resurfaced in late 2018 and NSW was forced to cancel the mining lease while it conducted a review of the agricultural claim's validity. The problem would have disappeared if SCY purchased the surface rights from Carter, but by then Carter, perhaps borrowing from the "sacred territory" handbook of Canada's First Nations, wanted a lot more money than the land was worth as marginal farmland. Eventually NSW ruled that it was not "agricultural land" and undertook steps to reinstate the mining lease for the eastern half (the mining lease for the western half, where all the infrastructure was to be located and which hosts the West Pit to be mined in the first decade of the mine's life at the initial planned operating scale, remained intact). News about the mining lease uncertainty no doubt was heard by SCY's various LOI "study" partners and likely helped derail whatever deal was close to happening.

SCY was vague about why it was necessary to conduct additional drilling at Nyngan, but I surmise it was based on a hope that the size of the West Pit could be expanded, pushing further into the future the date when it would become necessary to purchase the surface rights from Carter or his heirs. Since John Thompson who knows his mining stuff was on top of the resource data, and the resource targeted for mining was the higher grade near surface limonite horizon, I wondered what room there was to find additional tonnage. In contrast to the Honeybugle results, all that SCY reported was that "the drilling results have better defined the western boundary of the existing resource and reserve that are the foundation of the 2016 feasibility study and are therefore adding to our knowledge of how to optimize development of the project when it goes into production". There was no table of results nor a drill plan, but SCY did include two graphics, one a contour map of the limonite horizon with average grades for drill holes labeled, and the other a limonite thickness contour map. I'd never seen such graphics, so it was hard to tell to what extent the drilling changed anything. So I decided to look up the DFS technical report, couldn't find it saved on my PC, groaned at having to navigate the fabulously crappy new SEDAR Plus ClickaLot system created by the Canadian regulators in their tireless campaign to discourage investors from independently researching companies, but fortunately found it in Stockwatch's SEDAR archive. The grade contour map overlaps nicely with the existing West Pit design, so I guess what SCY learned was that West Pit limonite reserve was properly delineated. The company did not say how much meterage was drilled or how many holes. So it is fair to conclude that nothing new and positive was learned from the Nyngan drilling.

What is discouraging from the press release is that the company effectively declared that owning SCY will be dead money until their ongoing efforts to "engage with partners and customers to secure arrangements that will allow the Nyngan project to move into production" bear fruit. The Honeybugle results, which I described in KW Episode June 23, 2023, were very good, and coupled with the older Honeybugle results for the Seaford anomaly whose implications I described in Tracker June 7, 2021, should become the focus for a maiden resource estimate. Former CEO George Putnam was always reluctant to do that because supposedly it would increase the holding costs for Honeybugle, which sort of hints at the near eternal timeline he had in mind in terms of when the world would embrace aluminum-scandium alloy.

So what did I think of the results? The press release is a downer for SCY shareholders because it signals that nothing will change for a long time. A year ago the hope was that Rio Tinto would end up buying SCY or becoming the funding partner for Nyngan's development if Rio Tinto's efforts to develop the scandium offtake market bore fruit. The reason Rio Tinto is the best hope for this happening is because scandium offtake is stuck in a chicken-egg trap. No end-user wants to commit to an offtake agreement that has a risk that in the three years it takes to develop a scandium mine the result will not match cost and recovery expectations. And then all the tooling up and pre-marketing would be a writeoff. And no financier wants to provide CapEx to build a mine for whose output there is no guaranteed market.

Rio Tinto has the potential to crack this problem thanks to a solution it developed for the threatened evaporation of the market for the titanium slag by-product from its Sorel-Tracy facility in Quebec that smelts iron-titanium ore from its Lac Tio Mine. Pigment makers, especially those located outside China, are switching to a process that requires a higher purity feedstock, rutile equivalent that is about 95% TiO2. In developing a way to upgrade its 80% TiO2 slag to a purity demanded by pigment makers, Rio Tinto noted that the 50 ppm Sc naturally present in the Lac Tio ore was reporting to the titanium slag when the iron ore was first smelted to recover the iron. Rio Tinto figured out a way to recover the scandium as part of the titanium slag upgrading process. Although Rio Tinto has not published any details, it looks like Sorel-Tracy could produce up to 50 tonnes of scandium oxide annually based on the smelting scale at Sorel-Tracy.

Current global scandium supply estimates, which are very sketchy, are in the 15-25 tpa range and supply comes from a hodge-podge of by-product sources that are not scalable. The lack of supply scalability to match rising demand is part of the chicken-egg problem that deters aluminum-scandium alloy adoption. But if Rio Tinto could gradually double or triple global supply with its Sorel-Tracy by-product, it could push scandium to a tipping point as more end-users become comfortable deploying it in what are initially elite product lines but could be deployed on a broader scale if scandium has a scalable supply with a stable price. When Rio Tinto senses it is approaching that tipping point the best way to increase supply would be to develop the shovel-ready Nyngan project.

Hopes that Rio Tinto might be getting close to such a tipping point were dashed on April 28, 2023 when Platina announced that it had sold its Owendale deposit in New South Wales to Rio Tinto for USD $14 million. Owendale is part of the complex that hosts the similarly rich and large Syerston scandium project that sits on the flank of Sunrise Energy Metal's low grade nickel-cobalt resource which Robert Friedland is pitching as a clean alternative to the dirty nickel Indonesia is supplying to China and anybody else who doesn't care about the environmental footprint (NYT: China's Nickel Plants in Indonesia Created Needed Jobs, and Pollution). Owendale, although it completed a DFS, is nowhere near shovel-ready. Sunrise has a lock on water rights in the region, so Owendale's scandium ore has to be trucked offsite to location where water is available and the tailings dumped somewhere. Owendale also sits on farmland that is much more fertile than in the Nyngan area and Platina does not own the surface rights. A mining lease has not been granted and no doubt the "agricultural land" claim will be invoked once the permitting cycle is initiated. Platina has repackaged itself as a gold exploration junior so it was happy to sell a dead asset for USD $14 million. In KW Episode May 5, 2023 I floated some complex scenarios about how this Owendale purchase might not be a death signal for SCY's buyout hopes, but the simplest scenario is that Rio Tinto bought Owendale cheaply because it has realized it will be a very, very long time before its Sorel-Tracy supply builds offtake demand to a tipping point where it will need to secure scalable supply elsewhere. The acceptance of this glum timeline is implicit in SCY management's failure to signal that it will do anything with the Honeybugle results. |

Scandium Intl Mining Corp (SCY-T)

Bottom-Fish Spec Value |

|

|

| Nyngan |

Australia - New South Wales |

8-Construction |

Sc |

DFS Pit Layout Plan with Limonite Thickness and Grade Contour Maps |

| Disclosure: JK owns Endurace Gold and Scandium Int; Endurance is a Fair Spec Value Favorite; Scandium Intl is Bottom-Fish Spec Value rated |