| Kaiser Watch September 1, 2023: Boots are Pounding James Bay Ground |

| Jim (0:00:00): What is happening in the James Bay lithium district? |

The James Bay Lithium Index is still flatlining, down 3.4% as of September 1, 2023 from its August 1 establishment date, but I expect it to perk up next week after the Labor Weekend kicks off the back to work season and leaves behind the summer doldrums. Most serious juniors have announced they are putting boots on the ground and it will probably be mid September before we start getting news from the field. The main index chart is self-explanatory but the second daily performance chart needs an explanation. It uses a bar chart to show what percentage the index (currently 54 companies) is up or down from the prior days level for the past 120 trading days (currently from March 14 to September 1). The performance chart shows that the index, set at 1000 on August 1, 2023, has had a bias to the downside, with negative runs (red bars) more dominant than positive runs (green bars). In some sense the overall trend has tracked the price of lithium carbonate which undertook a bungee plunge in late December that did not stop until early May. It rebounded to $20/lb in early June but has since then been in a downtrend, currently at $13.12/lb. The lowest it got was $11.62/lbf on April 24. The hope is that it will achieve an equilibrium between $10-$15/lb so that investors can stop paying attention to the short term price trend. But even if the long term price settles into the $5-$10/lb range, for pegmatite deposits grading 1% that is still a rock value of $273/tonne - open pittable! Between now and the end of the year I expect to see the James Bay Lithium Index performance chart deliver green streaks that signal Canadian investors are figuring this greatest exploration boom in Canada.

I expect to be very busy covering developments in what I think may be the greatest and final hurrah for the Canadian junior resource sector. A plague of coups in Africa are putting that continent off limits to juniors. A plague of resource nationalism is making Latin America, including Mexico, an ever harder sell for investors. The economic outlook in China has raised concerned that China's economy may be sinking into a difficult to reverse downturn, which will dampen demand for base metal prices. Few have the patience for how long it takes to get anything permitted in the United States, not just by the US Forest Service which has always been painfully slow to the point of deliberate obstruction, but also the BLM. Canadian exploration has been plagued by forest fires, and when there aren't outright access closures, helicopters have been requisitioned to support forest fighting capacity, especially where far flung First Nations communities are threatened. And the First Nations themselves are becoming ever more aggressive about their aristocratic claim to most of Canada and are becoming an obstacle to permitting even drill programs, especially in some provinces that for now does not include Quebec.

The world's future lithium needs require a 600% expansion of supply by 2030, more if Toyota's solid state lithium ion battery breakthrough boast is true. Guaranteed lithium supply mobilization that does not require cross your fingers process technology breakthroughs such as with oilfield brines and claystones will depend on jurisdictions like Canada, and the James Bay district is shaping up to be a world class district. I expect a wave of investors to discover the James Bay Lithium Great Canadian Area Play between now and early next year, and I will be very busy covering developments because according to Rio Tinto, the world needs 60 Jadars by 2035; a Jadar is the equivalent of PMET's Corvette project just in the CV5 deposit alone. The 3 month suspension of exploration this summer has been a huge disappointment, which intensifies the prospecting rush now underway.

Fire access restrictions have been lifted everywhere but the trend we saw August 23 toward low fire risk (blue) in SOPFEU's assessment has reversed somewhat as of September 1. I recommend bookmarking SOPFEU to track the fast changing fire danger assessments. Most of the James Bay district now has a moderate fire risk (green) and the coastal area which was still rated high (yellow) a couple weeks ago has reduced to moderate risk. Oddly a north-south band of high risk designation has moved inland in the western part of the James Bay region. A new problem is that persistent rainfall has not yet settled into the region, and this is creating a health hazard risk for the burnt out areas which are covered with dry soot that easily becomes airborne. Some field workers are refusing to put their boots on the ground where they are going to inhale a bunch of carcinogenic soot, so most of the prospecting is focusing on areas untouched by fire. Next year after rain has washed away the soot these areas will be a prospecting wonderland because so much brush will have been burnt away. They say in the old days unethical prospectors would set fires to areas so that they could go prospecting the following year. Now climate change is the arsonist doing the dirty work of crooked prospectors.

There is an additional problem facing juniors in parts of the region, and that is moose hunting season which runs from September 15 to October 15. Two juniors called Q2 Metals and Ophir Gold which had hoped to be drilling right now are only now racing to refine their drill targets before taking a moose hunt break. To appreciate the cultural importance of the moose hunt I recommend watching the 57-69 minute segment of Nettie Wild's Koneline: Our Land Beautiful, set in northern British Columbia and featuring the Tahltan Nation. It interweaves two pairs of hunters, one pair using rifles to hunt moose, the other pair long bows to hunt sheep of which they have never bagged one during their annual traditional hunting ritual that started in 1975. |

KRO James Bay Lithium Index Chart |

120 Day Chart of Relative Performance of James Bay Lithium Index |

Lithium Carbonate Price Chart |

This Rock Value Matrix is the key to understanding Lithium Mania 2.0 |

Comparison of current James Bay Fire Danger with two weeks ago |

| Jim (0:08:29): Why did Q2 Metals and Ophir Gold think they would be drilling by now? |

Q2 Metals Corp and Ophir Gold Corp respectively control the southwestern and northeastern portions of the Yasinski greenstone belt in the western part of the James Bay region. Both companies have been tagged with Fair Spec Value ratings because they have all the ingredients in place to deliver major upside for investors. Q2 Metals has $10 million working capital while Ophir has $5 million. Both juniors have permits to drill their Mia and Radis properties. Both have the problem that their teams only had boots on the ground for 2 days to collect samples from known pegmatite outcrops before being chased out by forest fire closures. At the moment Q2 Metals is in the stronger position because it has the benefit of outcrop sampling by the vendor during the two years prior to the sale to Q2 in late 2022. However, Ophir managed to get 1%+ values from the Navet and Chou outcrops during its 2 days, confirming that the pegmatites within its portion of Yasinski belt are also fertile. Both companies have achieved the step of turning their first order targets defined by archives and satellite imgaery to confirmed LCT-type pegmatite.

The short term problem both companies face is that their properties are in an area where moose hunting season unfolds from Sept 15-Oct 15 when it is best to cease exploration activity. Both mobilized during the past week - they share exploration camps - and are scrambling to better define their targets for drilling. In the case of Ophir a key is to sample a 300 ft by 90 ft pegmatite outcrop documented in 1975. When the crew arrived early June it assumed it could sample the trend systematically in the most efficient manner. In retrospect the boots should have landed on this outcrop on day one. But we will know by the time moose hunting season ends if this outcrop is LCT enriched and the first place to start drilling. Q2 already had plans for a 10,000 m drill program set to begin July, though this was premised on at least a month of target refinement. What is not yet understand about either Mia or Radis is the orientation of the pegmatite bodies, a problem that Brunswick also faces at Mirage and hopes to resolve with a September scout drilling program. The satellite imagery published by Q2 Metals suggests an Allkem style series of short en echelon dykes within the Mia trend. As long as the grade is above 1% Li2O, it doesn't matter which type it is, so long as the system persists along strike for multi-km.

The stocks are rated Fair Spec Value because the valuation already reflects the presence of high grade LCT type pegmatites within a conventional geological context. Q2 Metals is likely to drill in late October and continue as long as weather allows, resuming in January. Ophir, which has a lot more target development work to do, will likely not start drilling until Q1 of 2024. However, it does stand to benefit from whatever Q2 Metals learns from its 2023 drill program. I published Spec Value Rating Trackers for both companies this week (Aug 30, 2023: Q2 Metals Corp Spec Value Rating and Aug 29, 2023: Ophir Gold Corp Spec Value Rating) which explain the origin of these juniors and their particular advantages, but because neither has yet been promoted to Favorite status, these trackers are behind a paywall for KRO members only. |

Q2 Metals Corp (QTWO-V)

Fair Spec Value |

|

|

| Mia |

Canada - Quebec |

2-Target Drilling |

Li |

Ophir Gold Corp (OPHR-V)

Fair Spec Value |

|

|

| Radis |

Canada - Quebec |

2-Target Drilling |

Li |

Map showing Mia and Radis propertties of Q2 Metals and Ophir Gold |

Satellite Map showing possibler en enchelon structure of Mia pegmatites |

| Jim (0:22:33): Why did Brunswick Exploration take a beating on Monday? |

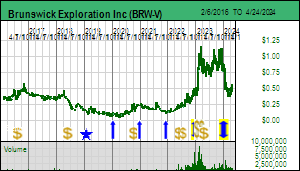

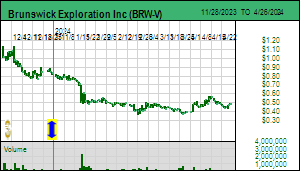

Brunswick Exploration Inc captured the market's imagination during the prior week on news that boots on the ground had identified a 2.7 km trend of outcropping pegmatites up ice from a 1.7 km long by 200 m wide boulder train announced in June which itself has now been extended to 3 km down ice. Key to the excitement is that these outcrops have a similar impressive distribution of spodumene mineralization as the down ice boulders, supporting the conclusion that the source of the boulder train is within the Mirage property. Whether this is a series of short en echelon pegmatites perpendicular to the geological trend as is the case with Allkem's world class Galaxy-Cyr deposit, or a series of parallel elongated pegmatites such as PMET has with the world class CV5 deposit on its Corvette property, is not yet known. Brunswick is mobilizing a scout drilling program to sort out the geometry of these dykes and set the stage for a major discovery delineation program in Q1 of 2024.

On Monday August 28, 2023, however, Brunswick dropped a big cowpie on the market with an update about what its boots on the ground accomplished in other parts of Canada while its access to James Bay was blocked by fire restrictions. A big talking point for CEO Killian Charles has been how the company's prospect generating strategy of researching assessment work archives and matching verbal descriptions of pegmatite occurrences with commercial quality satellite imagery has revealed 800 outcropping pegmatites, none of which have been seriously explored, and any one of which could be the tip of a world LCT-type pegmatite iceberg. Well, the boots on the ground armed with an XRF gun could not confirm any of these pegmatites as LCT type located in Saskatchewan and Manitoba. In cases where the assessment work archives claimed to have observed spodumene there was no such mineralization present. Those pegmatites which registered beryllium and which might have rare earth or uranium potential are not what Brunswick is looking for. At best they are indications of a setting that spawned pegmatites from a granitoid intrusion, but one has to look farther off-board to find the LCT type that can become a future lithium mine. None of the targets in Saskatchewan or Manitoba delivered any joy, and where Brunswick had optioned claims from juniors like Eagle Plains and Searchlight, the absence of any obvious low hanging fruit has prompted Brunswick to drop those options. Yes these juniors got some pennies up front for what appear to have been worthless lithium properties all along, though closer exploration may reveal high hanging fruit, but Brunswick had a cheap crack at harvesting low hanging fruit and came up empty. The outcome is not a cause for celebration by either side.

The market did not like this news because it underlined the suspicion that historical documentation of a pegmatite, confirmed by satellite imagery, is not likely to be good enough. Yes, when you start with 800 such targets, the process of elimination should leave you with a few world class candidates. But when Brunswick declared that it was giving up on Saskatchewan and Manitoba, suspending its boots on the ground investigation of its Ontario targets, and allocating all its resources to its prospects in Quebec's James Bay region, that was a body blow to the idea that much of Canada has meaningful lithium potential. The market reacted negatively because the next question is, how do we know that your boots won't also crush all your other James Bay pegmatite outcrops?

But may Brunswick's exodus from these provinces is not really a thumbs down for mineral potential. The elephant in the room is the threat to critical mineral supply development posed by Canada's First Nations who Prime Minister Justin Trudeau has put on steroids with his embrace of UNDRIP, the United Nations Declaration of the Rights of Indigenous People. Take the time to read the July 13, 2023 CBC article First Nations won't be excluded from critical minerals 'gold rush,' say leaders to understand how Trudeau has sabotaged Canada's mineral supply potential. From past experiences like Alto's Oxford project in Manitoba which Ontario lawyer Kate Kempton torpedoed when she parachuted into town with stories about the need for archeological studies, and Fjordland's futile effort to get a drill permit for a nickel project optioned from Canalaska, I already know that Manitoba's First Nations are a major exploration obstacle for resource juniors. The CBC article tells you that a Saskatchewan pegmatite lithium boom will be still born, though the thrust seems to be more about capturing whatever DLE can extract from oilfield brines.

Some parts of Ontario have First Nations groups eager to participate in the mineral sector on simple commercial terms based on the fact that this is happening in their backyard and they have a strategic advantage. Others such as the First Nations in northern Ontario are split between supporting mineral development and pretending they are still engaged in traditional activities. Check out Stan Sudol's articles from last December describing the Ring of Fire situation: Northern Ontario's Ring of Fire can save province's auto sector and Ontario has moral obligation to develop Ring of Fire. Brunswick makes no suggestion that the First Nations obstacle course was a factor in its decision to focus on Quebec. And Quebec is no cakewalk as far as First Nations are concerned (moose and goose slaughter seasons are necessary why?), though a difference between the Cree in Quebec and those in Ontario is that the Quebec Cree have figured out how to collaborate with commercial developments in their backyard. That doesn't mean Quebec will not also collapse into a showdown between a DNA defined aristocracy representing 5% of Canada's population and the 95% without indigenous DNA about who gets to shape Canada's supply of minerals critical for the energy transition. It just means that the starting point will be a win-win rather than winner-take-all outcome.

Brunswick has decided to concentrate on the James Bay region of Quebec because PMET's CV5 maiden resource estimate and Allkem's Galaxy-Cyr resource update show that this is a world class lithium pegmatite district, whether the pegmatites occur as an enchelon set of dykes repeating along great distances within dilation zones of a regional structural feature, or as elongated parallel zones within these structural corridors. Currently Brunswick's James Bay strategy has three prongs: 1) optioning large land packages like Plex and Anatacau which cover greenstone belts Andre Gaumond's Virginia companies once explored for precious and base metals deposits, 2) staking claims on top of documented pegmatites corroborated by commercial satellite imagery, and, 3) serendipity deals such as Mirage which emerged because Bob Wares managed to remember that a long time ago Remi Charbonneau pitched him and others on these spodumene boulders in the middle of nowhere north of the Renard diamond discovery at a time when global supply of lithium was worth $200 million and dominated by Australia's Greenbushes pegmatite and Chile's salar brines.

The first strategy is similar to what Q2 Metals and Ophir Gold have undertaken with their Mia and Radis claims covering the 30 km Yasinski greenstone belt. But Q2 and Ophir already have confirmed high grade LCT-type pegmatite outcrop and will both be drilling by Q1 of 2024. Brunswick is only now getting boots on the ground at Plex and the Mythril property north of PMET's Corvette property optioned from Midland. Mirage is more a function of madness than method, though if it is another CV5, no Brunswick shareholder will complain. Again, it is important to keep in mind that Rio Tinto says the world will need 60 Jadars by 2035, and CV5 is only one Jadar.

The wild card for Brunswick is the second category of projects, namely properties it staked 100% using the same method as it applied to properties in Saskatchewan, Manitoba and Ontario. The Monday news included a description of what the Hearst outcrop proved to be all about after a 2,000 m winter drill program. Its small surface expression was the opposite of the tip of an iceberg because it was an upside down iceberg that pinched out at depth and had nothing along strike. Plus the lithium content was marginal and not spodumene. The only part of Ontario that seems to have world class lithium pegmatite potential is the northwestern part where Frontier Lithium has its Pak/Sparks deposit. But this area faces challenges in the form of remoteness and remote First Nations communities who prefer things to remain remote. But the James Bay region is different and the best way to frame this is to contrast the greenstone belts of the Abitibi region with those of James Bay. The deep seated structures within the Abitibi greenstone belt have yielded a 100 million ounce gold bounty. In contrast the greenstone belts of James Bay have yielded Eleonore, Eau Claire, and Azimut's award winning pencil deposit, Patwon, for which Azimut has not dared to provide a resource estimate. Looking for gold in James Bay is like tilting at windmills. Looking for lithium in the Abitibi is almost the same. But today looking for lithium in James Bay is like looking for gold in the Abitibi a century ago. Even though Monday's Brunswick news was greeted as a downer by the market, what Bob Wares in effect declared, forget everywhere else, if you want lithium, James Bay is the place to be!

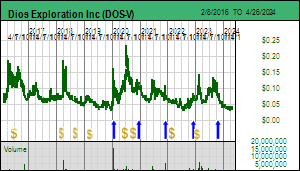

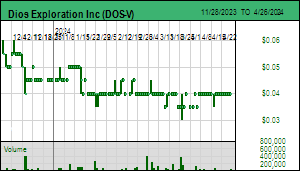

Brunswick was made a KRO 2023 Favorite because it had assembled a broad portfolio of projects in Canada representing 800 pegmatites documented by past exploration. This was cool because it is only since 2021 that the world has recognized that the EV revolution is real, and begun to understand the lithium demand implications. Bob Wares and his team jumped onto this concept and parsed the archival universe. Hearing this past week that the pegmatites in Saskatchewan and Manitoba are all dogshit was not so cool. The implication that Brunswick's brute force process of elimination universe has shrunk to its 100% staked James Bay projects, the ex-Virginia Osisko optioned blocks, and the Mirage miracle, while cooling the market's enthusiasm for now, did spark interest in a bottom-fish junior called Dios Exploration Inc. This junior has a horrible web site, no corporate presentation, and issues strange sounding press releases; not even close to qualifying as a KRO Favorite. Nevertheless I have been encouraging paying KRO members to accumulate Dios as a bottom-fish since last September because once I saw this perennial James Bay precious and base metals explorer start acquiring lithium prospects, I took the trouble to contact CEO Marie-Jose Girard whom I have known since around 2000 when Ashton discovered the Renard diamond cluster.

Since being spun out of Sirios in 2002 so that it could focus on diamond exploration, Dios has plodded through the past couple decades as a survivor which has never done a rollback, and still has only 121.3 million shares issued. Fully diluted drops from 135.8 million to 125.7 million if 9,090,000 warrants at $0.20 expire unexercised on September 11. MJG, as we call her on the KRO Slack Forum, works closely with her long time exploration VP Harold Desbiens. During Q2 of 2022 she was focused on the K2 gold prospect next door to Azimut's Patwon gold discovery, the famous pencil deposit beloved by Agnico-Eagle and celebrated by AMEQ in 2022 as the discovery of the year. Like Azimut's Jean-Marc Lulin, she was dismissive of all this Lithium Mania 2.0 blather from the likes of John Kaiser and Bob Wares, and wasted no opportunity to pooh pooh CV5 because it was under a lake and in a remote location.

By September something or somebody had gotten to her (perhaps as she did the drill hole math she saw what was evolving at CV5?), and she began a stealth prospect generating strategy. What intrigued me was how MJG and HD were applying their deep knowledge about James Bay geology, which has nothing to do with kimberlites that come up where they do, and the glacial history which was very relevant to their quest for kimberlite clusters outside the Renard cluster controlled by Ashton. When I listened to how they were combining lake bottom sediment data published by the government with glacial transport history to vector in on geology that was permissive for the formation of LCT type pegmatites, sometimes seeing scant references to outcropping pegmatite in assessment files, and then hearing that they had a regional proprietary till sampling database which managed to capture lithium minerals despite these not qualifying as the sort of "heavy minerals" till sampling for diamond indicator minerals targets, I coined the term "second order" exploration to distinguish the Dios targets from those generated by Brunswick's "first order" exploration.

When you look at a Brunswick map showing the location of its "first order" generated claims, and compare with the slowly emerging locations of the claims Dios has staked, a startling pattern becomes apparent. All of the Dios properties are emerging within a giant hole devoid of Brunswick claims. The Dios market perked this week because some investors began to understand that there is something special going on at Dios. The Brunswick claims are all "first order" targets based on archival references to pegmatite showings confirmed by satellite imagery. These may indeed be low hanging fruit Brunswick could harvest in the remainder of the 2023 prospecting season. Brunswick as the early bird got all these worms, which is why it commands a valuation tenfold that of Dios and why KRO members own more Brunswick than Dios. But Dios as a late bird is going after fruit hanging mid-tree, harder to see and reach, but with no less potential to be world class. During the past week Dios sent boots onto the ground to start checking out these "second order" targets. The sad reality may be that when the field workers from Jody Dahrouge's geological service company hit the ground, nothing that qualifies as LCT-type grading 1%+ Li2O shows up, even where assessment files documented pegmatite. That is why Dios continues to drift as a bottom-fish, with mysterious blobs of stock periodically pounding the bids, a two person show with either no marketing skills or no time to deploy them. All that could change within a couple weeks. |

Brunswick Exploration Inc (BRW-V)

Favorite

Fair Spec Value |

|

|

| Mirage |

Canada - Quebec |

2-Target Drilling |

Li |

Dios Exploration Inc (DOS-V)

Bottom-Fish Spec Value |

|

|

| Lithium North |

Canada - Quebec |

1-Grassroots |

Li |

James Bay Regional Map showing Brunswick's 3 strategy types |

How the Dios projects occupy a hole in Brunswick's James Bay Property Map |

| Disclosure: JK owns Brunswick and Dios; Brunswick is a Fair Spec Value rated Favorite; Q2 Metals and Ophir Gold are Fair Spec Value rated; Dios is bottom-fish spec valued rated |