| Kaiser Watch October 20, 2023: A queen's gambit or a $400 million bath? |

| Jim (0:00:00): After Albemarle withdrew its $6.6 billion bid for Liontown on Monday, the company undertook an equity financing at a 36% discount to last week's closing price which caused Gina Rinehart to take a $400 million bath on her 19.9% stake. Was that part of the plan? |

Liontown Resources Ltd was halted on Monday October 16, 2023 after Albemarle announced that it was formally withdrawing it non-binding offer to purchase Liontown at AUD $3.00 per share which is about AUD $6.6 billion or USD $4.3 billion. KW Episode October 13, 2023 described the drama created by Gina Rinehart accumulating 19.9% of Liontown's issued stock. Albemarle had spent just over a month conducting due diligence and did not indicate any reason for the decision other than "noting "growing complexities associated with the proposed transaction as a factor in its decision". The complexity was the announcement on October 12 by Gina Rinehart that the 180 or so subsidiaries of Hancock Prospecting Pty Ltd had purchased 19.9% of Liontown's 2.2 billion issued stock at a price close to Albemarle's "final offer" of $3 per share. Under Australian law if a purchaser exceeds 19.9% it must make a bid for the entire company. As I discussed in last week's KW Episode, Hancock first disclosed having a substantial 7.72% position last April when Liontown made public the second private overture Albemarle had made in the prior 12 months. When Liontown agreed to open its books in early September for a 30 day due diligence period after Albemarle made a final $3 offer that was not binding, Gina stepped up her buying activity, most of which took place close to the $3 offer price.

The threat this presented to Albemarle was that the acquisition, if it decided to make it biding, would require a shareholder approval vote of 75% of votes cast. If Gina chose to vote her 19.9% against the deal, at least 1.3 billion shares or 60% would have to be voted yes, more if there were other shareholders casting no votes. Liontown management would have a hard time getting enough yes votes cast to pass the deal. With a vote likely a waste of time and money Albemarle had no choice but to withdraw.

The big question is what would cause Gina to vote in favor of the acquisition? Since the cost base of her position is close to the acquisition price, there are only two rational objectives for her to have. One is to grind a higher price from Albemarle, which would hurt Albemarle's market credibility. If she got a 10%-20% boost out of Albemarle that would be a tidy short term profit. But the risk that Albemarle might walk away was high, so it makes no sense that Gina's goal was to extort a short profit.

The other rational goal is that Gina did not want Albemarle to acquire Liontown whose Kathleen Valley is the only large Australian lithium pegmatite deposit going into production within a year that is owned by an independent pre-production company. Was the reason some sort of Australian patriotism to keep Kathleen Valley out of the hands of another foreign company? That may be a reason but it would not be the reason. The most obvious goal would be that Gina has a plan to make hardrock lithium production a counterpart to Hancock's iron mining business. That makes a lot of sense if you believe lithium demand will grow 600%-1,200% by 2035 and become a $200 billion annual market in the same league as gold and copper production.

Gina won the battle to keep Liontown out of the hands of Albemarle, but ended up taking a $400 million bath when Liontown used the trading halt to secure a AUD $365 million equity financing with institutions at $1.80, which was a 36% discount to Friday's $2.79 closing price. When trading resumed on Friday October 20, 2023 the stock traded 54 million shares to close at $1.90. Liowntown also secured a $760 million debt financing package which partly refinances an existing debt facility and with the equity financing allows Liontown to complete construction with production projected in Q3 of 2024. Non-institutional shareholders will be eligible to participate in a share purchase plan to buy up to $30,000 each at $1.80 for a total of $45 million. I'm not sure if Gina's 180 subsidiaries each qualiy as an eligible shareholder, but if they do she can only buy about 3 million shares for $5.4 million. If she buys no stock her position drops to 18.2% after the equity financings.

Does Gina simply like expensive baths, or has she in effect played a queen's gambit opening? If her goal is to ultimately own 100% of Liontown, she has a year to make her move in the form of a hostile unconditional all cash offer which may end up being less than what Albemarle was prepared to offer. It is possible that Albemarle might come back with a higher bid if Hancock does make a bid, but the Foreign Investment Review Board might be an obstacle. The queen may have taken an expensive bath, but the gambit hands her control of Liontown's destiny unless Pilbara Minerals or Mineral Resources make paper bids for Liontown. |

Liontown Resources Ltd (LTR-ASX)

Unrated Spec Value |

|

|

| Kathleen Valley |

Australia - Western Australia |

8-Construction |

Li Ta |

Albemarle Corp (ALB-N)

Unrated Spec Value |

|

|

| Greenbushes |

Australia - Western Australia |

9-Production |

Li |

Graphic showing how Kathleen Valley compares to other lithium deposits |

Timeline Path to Production for Kathleen Valley |

Liontown's Offtake deals with LG, Tesla and Ford |

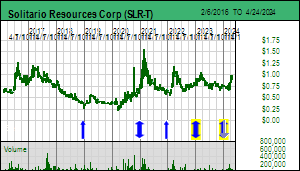

| Jim (0:12:01): Any permitting breakthrough yet for Solitario Resources? |

Solitario Resources Corp is still waiting for the US Forest Service to publish a "finding of no significant impact" (FONSI) for the Golden Crest plan of operations Solitario first filed in February 2022. CEO Chris Herald had hoped to reach this milestone by the third week of August because that would still allow time to mobilize a drill program in Q4 of 2023. Once the USFS publishes a FONSI it kicks off a two month period that allows the public to comment on the FONSI and the USFS is required to defend its decision. Since the permit application is only for a drilling program, not developing a mine, the FONSI usually survives the comment period. But with October more than half over there will be no drill program until May of 2024 due to winter conditions in South Dakota. The urgency around the drill permit is now gone, though getting the FONSI tomorrow and surviving the two month comment period would still be a welcome development. It has been almost two years since Solitario applied for a drill permit, a ridiculously long time, and shareholders are beginning to wonder if a permit might never be granted.

On October 13, 2023 Solitario announced that it had raised USD $4,747,500 at USD $0.55 with non-US investors. This follows an August 2 announcement that Newmont had invested USD $2.5 million by purchasing 4,166,667 shares at $0.60 bringing its stake to 9.95%. The latest financing boosts working capital to about USD $9.5 million with 77.6 million issued and 87.2 million fully diluted. About 80% of the latest financing was taken down by a Canadian institution which had conducted due diligence for the past couple months. Apparently this is a serious institutional investor with the capacity to invest more down the road.

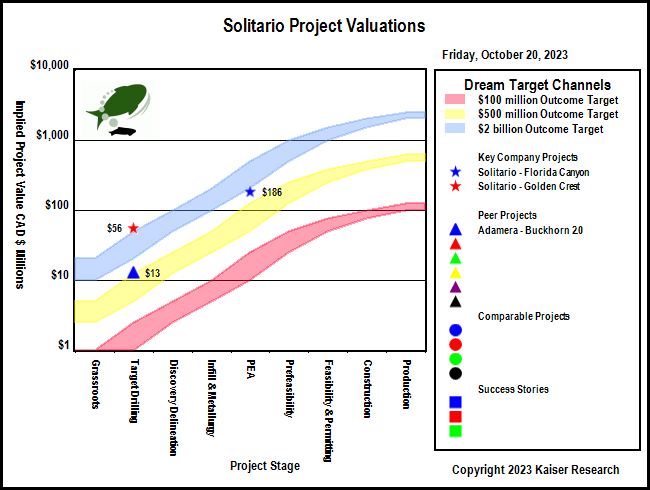

Solitario is two stories in one package. It has a 30% carried interest in the Florida Canyon zinc-lead-silver project in Peru where Nexa is conducting a prefeasibility study for an underground mining operation. If you go by the rule of thumb that NPV must match or exceed CapEx, and assume Florida Canyon will have a CapEx of USD $350 million, Solitario's 30% share would be USD $105 million which based on 87.2 million fully diluted would be worth USD $1.20 per share. The uncertainty is the timing of a decision by Nexa to buy out Solitario's 30% stake, but if you adopt a two year time horizon and double the current USD $0.55 stock price that is a good worst case scenario return.

The best case scenario, however, is the second story, namely Golden Crest which I described in Tracker December 20, 2022. Golden Crest covers the northwestern portion of the Black Hills region opposite of the area which has yielded over 90 million gold ounces from the Homestake mine and the Wharf and Gilt Edge open pit mines. The 14,000 hectare Golden Crest property covers a limestone plateau that has very little evidence of past exploration. Homestake drilled 3 holes through the younger sedimentary rock package into the Precambrian basement back in the 1980s and confirmed that the formation which hosts the Homestake deposit is present in two holes but never did any followup exploration. The rocks at surface are younger than the ones that host the Wharf deposit and it was assumed that if any gold mineralization is present it would under barren cover. But Solitario started exploring in 2021 the company was amazed to discover discrete zones og gold mineralization at surface. Although it cannot yet drill any holes, Solitario has been free to conduct surface prospecting and channel sampling during the past couple years, and some time before the end of this year will publish a update. They have now unearthed evidence of a powerful hydrothermal thermal system with a 40 sq km lateral footprint covering a 200 m thick package of receptive carbonates. That this was overlooked by the prospectors of yore is a mystery.

Golden Crest is the last American frontier wehre a massive gold discovery not hidden by barren cover rocks or gravel can still be made. The scale is such that Solitario now has a couple additional plan of operation applications underway covering new areas of mineralization distinct from the targets covered by the 2022 application. Once Solitario starts drilling it can target 3 types of deposit: the banded iron formation hosted type such as Homestake in the basement rocks, the Deadwood formation sediments that host the Tertiary aged Wharf system, and the overlying Mission Canyon limestone missing in the Wharf area but at whose surface Solitario has encountered high grade values. Finding a Homestake style deposit in the basement rocks between 300-500 m depth might seem like a longshot, if any such deposit outcropped before the sediments buried the basement, they may have formed placer deposits as happened in the vicinity of Homestake. If Solitario encountered a thin veneer of paleoplacer gold it could use those intersections to vector towards the source. The bluesky is that Golden Crest is a mirror image of the Homestake district, which, if confirmed, allows shareholders to dream of a $100 stock price. There is a larger range of lesser outcomes which initial drilling could tease into view, making a $1-$5 target range plausible within a year of a drill program's commencement. Perversely, some investors are delighted that the USFS is so slow, because now they have another 6 months to accumulate the stock. And Chris Herald is happy because with the recent financing he doesn't have to worry about trying to loadthe treasury if the permit arrives in the midst of an economic and market meltdown.

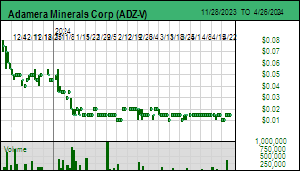

Chris Herald is also a director of Adamera Minerals Corp which owns the Buckhorn 2.0 property surrounding the now depleted Buckhorn Mine which Crown Resources Corp, at the time run by Mark Jones and Chris Herald, discovered during the 1990s. Kinross acquired Crown and developed the gold enriched skarn deposit as an underground mine. As the mine approached depletion Kinross applied for a monster plan of operations to drill targets in the vicinity, but the USFS never granted approval and Kinross eventually dropped all the surrounding claims and now only owns the original mining lease. Adamera acquired all the surrounding ground and last year cut a royalty deal with Kinross for its database which included a 2009 geophysical survey. Permitting has been a headache because the BLM, Washington State and the USFS all have jurisdiction over certain parts. Adamera has reprocessed the geophysical data and identified several dozen VTEM anomalies. Adamera drilled several of these last year on the BLM ground for which it had received permits, but the results were disappointing in that not only did they fail to intersect gold, but they didn't even intersect iron sulphides or graphite to explain the conductor. The USFS finally granted a permit in late 2022 but it expires at the end of October 2023.

Adamera's treasury was low, the stock price had sagged beneath a nickel, and despite a promising start 2023 has proved to be very difficult for resource juniors. VTEM-30 was a subtle conductor located about 1.5 km southwest of the mined out Buckhorn deposit and interpreted to be 200-300 m deep. Chris Herald, who along with Mark Jones had joined Adamera's board after CEO Mark Kolebaba generated the Buckhorn 2.0 play, pointed out that the Crown Jewel skarn deposit was a nearly flat lying body that dipped about 15 degrees, and was found because it outcropped. To build confidence about VTEM-30 Adamera conducted an audio frequency magneto-telluric survey over the conductor. AMT surveys can see conductors much deeper than VTEM surveys. Much to their delight the AMT survey revealed to strong flat laying conductors at 200-300 m depth. The company has produced a which explains why they view this as a compelling target. I've assembled several screenshots from the video and mashed them up to give a quick portrait of this target.

On October 4, 2023 Adamera announced it had scheduled drilling of the VTEM-30 target at Buckhorn 2.0 but did not state when. On October 18 Adamera announced that it is doing a private placement of 5 million units at $0.05 (with a full 3 year warrant at $0.05) to raise $250,000, plus $58,000 flow-thru at $0.05 to pay for work being done at its new Hedley gold project in British Columbia. When I discovered the USFS permit expires at the end of October, I realized management was scrambling to mobilize a rig and get at least one hole into this target before having to stop and re-apply for a permit. With 229 million issued and 291 million shares fully diluted (30 million warrants at $0.10-$0.14 plus the new 5 million at $0.05) Adamera's stock is screaming for a rollback. This drill program if successfully completed to target depth has 3 potential outcomes. One is that a Crown Jewel style skarn zone is intersected which assays in early December confirm as gold bearing, signaling a new discovery without needing a rollback. Adamera would need to reapply to the USFS for a drill permit, but this might take only a few months during which, as with Solitario's Golden Crest project in South Dakota, wouldn't matter because Adamera would not be drilling again until Q2 of 2024. The second outcome is that the VTEM-30 anomaly corroborated by the AMT survey is indeed a conductor, either graphite or iron sulphides, which provides Adamera with a new tool to upgrade its VTEM anomalies as legitimate drill targets, one of which might be gold bearing.. That outcome will likely require a rollback to put Adamera on a better footing to fund the Buckhorn 2.0 storty. The third is that no conductor of any sort is encountered, which would not be good news for anybody. If there ever was a hail mary hole, this VTEM-30 hole would qualify. |

Solitario Resources Corp (SLR-T)

Favorite

Fair Spec Value |

|

|

| Golden Crest |

United States - South Dakota |

2-Target Drilling |

Au |

Adamera Minerals Corp (ADZ-V)

Bottom-Fish Spec Value |

|

|

| Buckhorn 2.0 |

United States - Washington |

2-Target Drilling |

Au |

Maps showing relative location of Dakota Gold and Solitario properties |

Schematic showing potential target types at Golden Crest |

The data sets supporting Adamera's VTEM-30 target at Buckhorn 2.0 |

Adamaera's VTEM-30 Target validated by AMT survey |

IPV Chart showing current project valuations for Solitario and Adamera |

| Disclosure: JK owns shares of Adamera; Solitario is a Good Spec Value rated Favorite; Adamera is Bottom-Fish Spec Value rated |