| Kaiser Watch November 10, 2023: A new emerging James Bay hotspot? |

| Jim (0:00:00): Is Vanstar Mining Resources ever going to escape your Bottom-Fish Collection and become a KRO Favorite again? |

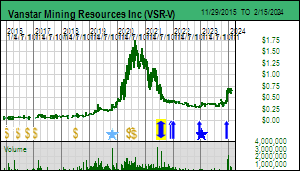

Vanstar Mining Resources Inc acquired the Nelligan property south of Chibougamau in 2010 and made a grassroots gold discovery which attracted IAMGold as a partner in 2014. IAMGold delivered a maiden resource estimate in 2019 consisting of 96,990,000 tonnes of 1.02 gold (3.2 million oz) which won the AMEQ discovery of the year award in 2019. The IMG deal leaves Vanstar with a 20% carried interest and the hope has been that IMG would shift into economic study mode and make a buyout offer for Vanstar. But IMG was busy developing its Cote gold project in Ontario which was suffering cost over-runs, and Nelligan became a low priority. Newsletter writer Peter Grandich discovered Nelligan in 2020 and, not comprehending the bad dynamic of a junior with a valuable asset but no decision making power about advancing it or the operator's unrelated problems, pumped Vanstar to a $1.75 peak during H2 of 2020 before abandoning Vanstar and sending it into a tailspin in 2021. The new low price prompted me to adopt Vanstar as a KRO Favorite in mid 2021 but by the end of the year, realizing that IMG's problems with Cote were only getting worse, moved Vanstar into the KRO Bottom-Fish collection where it is currently stuck waiting for IMG to commission Cote and turn its attention to Nelligan. IMG did complete a 10,000 m drill program at Nelligan which apparently was aimed at finding the limits of the deposit though we probably won't know the results until early 2024.

IMG updated the Nelligan resource in January 2023 which now stands at 5.2 million ounces within an open-pittable indicated and inferred resource of 186,300,000 tonnes at 0.87 g/t. Using cost numbers borrowed from the feaisbility study for First Mining's Springpole deposit in Ontario, which has a similar scale and nature, I created a speculative outcome visualization based on a 30,000 tpd open-pit mining scenario which would produce 4.7 million ounces over 18 years. This OV updates every night with the latest gold price and currency exchange rates. As of November 10, 2023 at $1,942 gold the future value on a 100% basis is a CAD $1.7 billion after tax net present value using an 8% discount rate. After adjusting for Vanstar's 20% net interest and 68 million shares fully diluted that translates into a future price of $4.93, more than ten times the current $0.30-$0.40 range. Under the rational speculation model the fair speculative value range is $0.25-$0.49 for a project that has not yet done a PEA. The speculative bet with Vanstar is that a PEA will be completed with a similar mining scenario that confirms the cost assumptions and prompts IMG to move Nelligan to the prefeasibility stage where the fair value range becomes $1.23-$2.47. That is the price range in which Vanstar shareholders could expect a buyout offer, but the stock is stuck in its bottom-fish rut because of uncertainty about when IMG will move Nelligan into feasibility demonstration. Vanstar is thus a triple bet that IMG's latest drill program will expand the resource, the timing of the shift to feasibility demonstration will be sooner than later, and also the higher valuation impact a higher real gold price would bring.

But back in 2020, recognizing the timing uncertainty, Vanstar's founder Guy Morissette staked several prospects in Quebec that supposedly qualified as analogs for Nelligan which was a new type of disseminated gold deposit for Quebec. The hope was to make a quick new Nelligan style discovery on a 100% basis that would offset investor fatigue caused by the IMG waiting game. Vanstar did drill the Felix property as a gold target with dud results, but only conducted a sampling program on Amanda also geared toward gold. Around the time Vanstar was peaking in August 2020 Morissette abruptly "retired" as CEO along with several other directors who were replaced by a group headed by Victor Cantore whose Amex Exploration Inc was flying high at the time. JC St-Amour was subsequently recruited as CEO which he has remained as the Cantore group gradually dropped off the board and were replaced by others such as Robert Boyd of Endurance Gold and JD Moore, a major bottom-fisher of Quebec juniors who is also the largest visible shareholder of Vanstar. Morissette resurfaced in 2021 as a CEO of Mosaic Minerals Corp which was listed on the CSE in late 2020. He has since disappeared into the shadows but is the behind the scenes brains of Mosaic.

Vanstar wanted to maintain its brand as a yellow gold junior and with $2 million working capital left at the end of 2023 it was reluctant to do any work on Amanda whose documented pegmatite potential was generating interest. In late 2022 Mosaic went on a lithium staking binge in Quebec, assembling 5 prospects in James Bay, one in Nunavik and four in southern Quebec. In August 2023 Vanstar agreed to option Amanda to Mosaic which must issue 4 million shares and spend $1 million within 3 years, at which point Vanstar can elect to form a 50:50 joint venture or let Mosaic go to 80% by funding whatever it takes to deliver resource estimate by 2030.

The 7,677 ha Amanda property is interesting because it sits north of an area which Virginia Gold had explored for gold in 1997-2010. Unlike projects such as Plex where Virginia merely noted the presence of pegmatite in core from holes testing gold targets, at Auclair the crew logged spodumene as part of many pegmatite intervals. At one point the Auclair property included parts of Amanda which also has holes with unassayed documented spodumene intervals. The Auclair property was part of the Virginia Mines spinout when Goldcorp acquired Virginia Gold for the Eleonore discovery, which in turn was acquired by Osisko Gold Royalties in 2015. Osisko Gold transferred Virginia's exploration assets into Osisko Development Corp (ODV) which became a warehouse for projects like Cariboo that need a higher real gold price to be viable. During 2022 and early 2023 ODV's CEO Sean Roosen, despite PMET's success with Corvette, also a former Virginia gold project, did not yet appreciate the growing importance of white gold and happily farmed out the white gold potential of certain James Bay projects such as Plex and Anatacau scooped by Brunswick Exploration Inc whose Bob Wares, part of the Osisko group, had grasped the importance of white gold in late 2021.

ASX-listed Cygnus Metals Ltd, previously a gold exploration junior, had pivoted to lithium and the James Bay region in mid 2022 when it optioned 70% of Stria Lithium's Pontax project for which it delivered a maiden JORC estimate of 10.1 million tonnes at 1.04% Li2O in August 2023. But Cygnus, perhaps recognizing the limitations of the Pontax dyke system discovered by Sirios and Dios during the 2000s when lithium did not yet matter, optioned 100% of Auclair from ODV in late February 2023 on easy upfront terms and future milestone payments. Cygnus subsequently expanded Auclair through staking and optioning privately held ground so that it now consists of 33,700 ha straddling a 50 km northeast oriented trend. The Amanda project is now surrounded by Cygnus Metals on all sides except the west and an inlier claim controlled by Patriot Battery Metals.

In late October 2023 Cygnus reported discovering several parallel outcropping pegmatite dykes which extend the mineralized corridor to 6 km on its property. Auclair has all-weather road access and Cygnus is contemplating a winter drill program. The pegmatite trend passes through the Amanda property based on documented occurrences and continues to the northeast back onto the Cygnus property. Mosaic was able to mobilize boots on the ground in mid October and completed 10 days of sampling the known outcrops. The crew did not have an XRF unit nor did it include a QP with the qualifications to identify spodumene in the field. However, given existing evidence that this area is fertile with LCT-type pegmatites, it is very likely that by late December 2023 some of the 100 plus samples will have confirmed LCT-type outcrops. If these results turn out to belong to some of the better mapped and larger outcrops, Mosaic may be able to mount a drill program in Q1 of 2024. The Amanda property is probably too small to support a standalone lithium pegmatite mine, so it is a potential consolidation target for Cygnus Metals if drilling in 2024 confirms a major pegmatite field discovery. Such a development would represent a non-dilutive financing for both Vanstar and Mosaic which could then fund their respective gold and lithium exploration goals without undue dilution. |

Vanstar Mining Resources Inc (VSR-V)

Bottom-Fish Spec Value |

|

|

| Nelligan |

Canada - Quebec |

4-Infill & Metallurgy |

Au |

Mosaic Minerals Corp (MOC-CSE)

Bottom-Fish Spec Value |

|

|

| Amanda |

Canada - Quebec |

2-Target Drilling |

Li Gas |

Cygnus Metals Limited (CY5-ASX)

Unrated Spec Value |

|

|

| Auclair |

Canada - Quebec |

2-Target Drilling |

Li |

Outcome Visualization Chart for Nelligan |

Table showing fair speculative value ranges for the Nelligan stages |

Regional Auclair Map from Cygnus Metals |

Aurclair area map with names of claim holders |

Graphic showing how Amnada claim slots into middle of Cygnus Aurclair property |

Mosaic's Amanda Map with pegmatite details |

| Jim (0:18:19): Why did the market ignore news from Scandium Ineternational Mining that construction has started at Nyngan? |

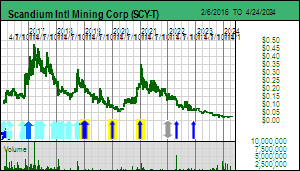

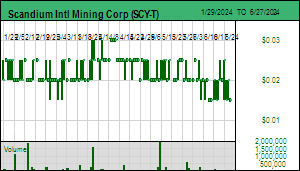

In last week's KW Episode I talked about how Robert Friedland's gloom about the future for nickel and cobalt spelled a death knell for his Sunrise nickel-cobalt project in Australia's New South Wales. This would require a pivot back to Plan A, the Syerston scandium enriched deposit on the margins of the nickel-cobalt deposit which is the richest and biggest scandium deposit in the world, to pull Sunrise Energy Metals out of a death spiral. That, of course, will not be easy to pull off, Friedland having dumped all over the scandium space by pointing out that his warehouse will be piling up concentrates containing 75 tonnes of scandium oxide annually which Sunrise could sell at whatever price somebody is willing to pay. Well, that "growing" stockpile is no longer going to happen because cobalt is irrelevant to a new generation of solid state lithium ion batteries among which Friedland backed Pure Lithium is a contender, and nickel has become a non-issue because China has successfully gained control of Indonesia's coal powered nickel supply which Indonesia is petitioning the Biden administration to certify as an acceptable input for EV subsidies under the IRA act. Friedland's hopes about "smarter markets" facilitating ESG credentialed metal supply for consumers who care is about to go up in smoke, and most certainly will do so if Trump or a clone assumes the presidency in 2025. Friedland has not yet moved to embrace the scandium deposit at Sunrise, but on November 9, 2023 Scandium International Mining Corp decided it was time to announce than its Nyngan scandium project was moving to the first stage of construction.

The market ignored the news because it amounted to little more than an announcement that a bunch of trailer units would be parked on the property and somebody would start to mark out where more buildings would be constructed. Given that the Nyngan DFS was done in 2016 and has not had its cost structure updated, which by now must be at least 20%-40% higher in both CapEx and OpEx terms, while the world continues to think that the future price of metals has no direction other than lower thanks to the blind eye even Greta Thunberg types turn to the source of the materials that feed into the technology that powers their worlds, it is hard to imagine what the Evensen family that now controls SCY is thinking with this move. I can probably be forgiven for suspecting that the western half of Nyngan where SCY owns the surface rights is in fact being prepared as a studio set for future filming of an Australian version of the Trailer Park Boys. The hard question is whether Julian, Ricky and Bubbles need to move to Australia or if Australia has its own counterparts.

The less interesting explanation for the announcement is that New South Wales, having granted a mining lease under messed up circumstances, and gone through hell to deal with the extortion efforts of the slighted objector when their bureaucratic incompetence came to light, is now presenting a "use it or lose it" ultimatum. So Peter and Chris Evensen, having raised $3 million at $0.09 with FIVE YEAR warrants which some think was simply mindless borrowing from the Katusa Rule Book for exercising opportunistic contempt for resource juniors, but others think it reflects acknowledgement of how long it will take Rio Tinto to crack the chicken-egg marketing problem that has left scandium, despite the wonderful things it does when alloyed with aluminum, a perpetual dream, were forced to at least pretend to do something about Nyngan. Whatever the reasoning, the timing may in fact be good.

The Financial Times has embraced the story that Toyota, a laggard as far as the EV future was concerned, is now making a mad dash to control the EV future which the market has assumed belongs to Elon Musk's Tesla with all the other car companies scrambling to catch up. The impetus for this Toyota change of heart was news in May that it had captured the solid state lithium ion battery holy grail which allows lithium metal to substitute for graphite as the anode. The punch line is: 1,200 km on a 10 minute charge. For now this promise applies only to high end models Toyota plans to roll out in 2026 or 2027. The holy grail breakthrough, however, is not about a new battery configuration with expensive raw material inputs, but rather in the form of manufacturing ingenuity which allows Toyota to build a solid state battery with known configurations more cheaply than was previously possible.

The hope is that Toyota will learn how to extract even greater efficiencies from the manufacturing process so that it can sell cheap EV versions of its Camry and Corolla models in 2030 and beyond. Currently there is a lot of nattering about how the EV boom has hit its limit, and it is time for ICE to reassert its long term dominance. But that sort of belief requires you to believe that the three Abrahamic monotheisms, Judiasm, Christianity and Islam, all of them burdened with the concept of absolute truth that translates into a universally binding prescriptive moral code, will avoid a mutually self-annihilating clash, for which the Gaza-Israel conflict will not become ignition. China, whose ideology is grounded in atheism and can join Mercutio in pronouncing a pox on all their Abrahamic houses, has made an irreversible shift away from ICE to EV based transportation, not because it is gung-go about slowing climate change (much of China's electricity comes from coal), but because it wants to escape the vulnerability that comes with oil import dependency. The EV transition is happening whether or not it makes any difference to climate change.

So far the energy transition story has not entrained scandium as a critical mineral input other than through the vague idea that aluminum-scandium alloys will create new strength that allows less volume and thus weight to be used in cars, which "light-weighting" effect will reduce energy consumption. This applies to ICE or EV cars. On November 9, 2023 the Financial Times had another intriguing article about Toyota, Toyota takes on Tesla's 'gigacasting' in fight for the future of EV carmaking. Tesla's manufacturing approach involves casting large chunks of a car as aluminum parts, such as the under carriage of a car. The Toyota manufacturing process which revolutionized car manufacturing many decades ago became a new standard which involved a team that worked on a single car gradually assembling numerous parts typically through welding and stamping. This deviated from the old assembly line method where a car moved along a conveyor belt allowing stationed workers to add and tweak their parts. The old "cog-in-the-machine" approach was not good for morale and productivity, but the Japanese concept of a "team" participating in all stages of an individual car's production did wonders for worker morale.

The problem with the Japanese method was that it was linear, which wasn't a competitive problem until Elon Musk came up with the idea of breaking up a car's production line into multiple paths involving major parts that would eventually converge into final assembly of the car. Tesla's "gigacasting" involves casting large car components as an aluminum alloy, such as the under-carriage. Each of these "chunks" has its own production path with a team of dedicated workers. By allowing these cast chunks to be "upgraded" through parallel paths Tesla harvests manufacturing efficiency. In the FT article a Toyota executive acknowledges the boosted efficiency of Tesla's approach, admits Toyota's approach is different, and pretty much signals that embracing "gigacasting" is something being internally investigated.

How is this remotely relevant to scandium? During 2018-2020 when George Putnam was still CEO Scandium International adopted a "letter of intent" strategy to develop an offtake market by collaborating with potential end users to test products utilizing aluminum-scandium alloys. In 2017 the market and people like myself embraced the "build it and they will come" field of dreams idea. Everybody knew how scandium was the ideal marriage partner for aluminum, supply, so the chicken-egg cracking solution was to build the mine, demonstrate the supply, and sell out the product like hot cakes. Unfortunately, no sources of capital were willing to take the risk that nobody would buy at the price needed to pay back capital and deliver a profit. The reality was that until there were offtake orders in place at a price which guaranteed a mining profit, there was no point funding primary scalable scandium supply, and until scalable supply was a demonstrated reality, no end no end user would make plans to incorporate aluminum-scandium alloys into its products. Robert Friedland spent $300 million demonstrating the non-feasibility of the Sunrise nickel-cobalt scenario, far more than it would have cost to build the initial scandium only operation. But even Robert balked at the field of dreams idea and pivoted to the larger scale nickel-cobalt scenario.

George Putnam's idea was that by working with end-users to demonstrate how they could benefit adopting Al-Sc alloy he could coax offtake deals from them. By the end of 2020 it was clear that SCY's multiple LOI arrangements had failed to deliver any offtake deals, and the company embraced a new strategy of incremental demand development through incremental supply development involving deals to strip critical mineral goodies out of base metal leaching operations such as Barrick's Phoenix Mine in Nevada. This coincided with Rio Tinto's development of a way to recover scandium from the titanium slag at its Sorel-Tracy plant in Quebec as part of its need to upgrade the slag to the purity required by pigment makers. The Sorel-Tracy plant which smelts iron ore from the Lac Tio Mine has a theoretical annual supply limit of about 50 tonnes of scandium oxide toward whose recovery Rio Tinto can build gradually as it develops its own offtake markets. SCY planned to do something similar but before the concept could be vindicated the Evensen family pulled the plug on SCY management, fired George Putnam and Willem Duyvestyn, and turned SCY into a long term optionality bet on scandium one day becoming a hot commodity everybody wants.

SCY management may have started slapping trailer units onto the Nyngan property to appease regulators, but the timing may actually be good. Back in early 2020 I wrote some Trackers about David Weiss and Eck Industries with whom SCY had a productive LOI relationship. Eck was working on ways to combine aluminum, magnesium and cerium into an alloy very suitable for casting parts. Adding some scandium to the mix was explored, with less being needed if zirconium was added (in a typical aluminum melt the element with the highest melting point crystallizes first, which would be scandium, but because scandium is a dispersoid the atoms move away from each other so that when they crystallize the result is a matrix around which the metals with lower melt points eventually solidify - zirconium has the second highest melting point in the batch and it migrates toward the scandium seed grain, reinforcing the matrix, which reduces the amount of scandium needed to achieve strength gains in the aloy). I have no idea where Eck's Al-Mg-Ce-Sc-Zr alloy stands today. David Weiss retired from Eck in January 2023 and is now a free agent working with whoever appreciates his insights. But if Eck's casting alloy innovation creates significant value through its use of the rare earth cerium, this might prove to be a big deal for Toyota, Tesla and anybody else who embraces large aluminum module casting as an EV manufacturing strategy.

The price of cerium has collapsed to $0.99/lb FOB and $0.75/lb domestic. My rare earth supply evolution chart shows REO output ramping from 100,000 tonnes in 2009 to 300,000 tonnes in 2022 (USGS data). Most of this output comes from carbonatites like Bayan Obo, Mountain Pass and Mt Weld whose rare earth distribution is dominated by the light rare earths. The distribution chart for Bayan Obo is typical. Note that cerium is 50% of the content while the light magnet rare earths neodymium and praseodymium are about 25%. Actual composition of the global total will be somewhat lower because heavy rare earth enriched deposits like the ionic clays have a significant yttrium component - I do not have a breakdown of the individual rare earths from which the USGS totals are summed.

Rare earth demand growth is driven exclusively by magnet growth for which the EV sector is the biggest driver, with hybrids jump-starting demand during the 2009-2011 Rare Earth Mania 1.0 boom. The IEA in its January 2023 report projected neodymium demand growth to double by 2030. If we assume Nd and Pr are combined in that number and that they represent 25% or 75,000 tonnes of the 2022 REO supply, making cerium 150,000 tonnes, it means that by 2030 REO production will have doubled to 600,000 tonnes of which 300,000 tonnes will be cerium nobody needs beyond glass polishing needs. Because you cannot avoid dropping cerium out of solution along with the desired Nd and Pr, the price will go even lower or be very stable for new applications that come along. Cerium's supply is growing as a by-product of demand growth for the rare earth magnets. Barring a miracle usage innovation for cerium, the price of cerium long term will be stable or declining to the point that it might become a storage or disposal liability. If cerium is the magical ingredient that makes aluminum-magnesium alloy special for casting purposes, enhanced by scandium where extra functionality is needed, and Toyota or even Tesla adopts it, scandium could find itself with demand that allows the Evensens to accelerate the Nyngan Trailer Park into a scandium mine. |

Scandium Intl Mining Corp (SCY-T)

Bottom-Fish Spec Value |

|

|

| Nyngan |

Australia - New South Wales |

8-Construction |

Sc |

Rare Earth Supply Evolution Chart |

Price Charts for Cerium and Neodymium |

IEA Demand Growth Projections for 2030 Energy Transition Goals |

Rare Earth Physical and Value Distribution Chart for Bayan Obo |

Rare Earth Physical and Value Distribution Chart for Ionc Clays |

| Disclosure: JK owns shares of Scandium Intl; Vanstar and Mosaic are Bottom-Fish Spec Value rated; Cygnus Metals is unrated |