| Kaiser Watch November 22, 2023: Is a new age of discovery dawning? |

| Jim (0:00:00): What is the significance of the Hercules copper discovery? |

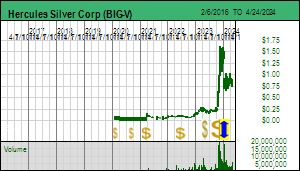

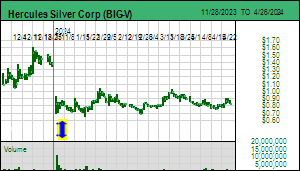

Although the market is in a very bad mood about the Canadian junior resource sector, and seems to be dumping everything as year end approaches because everything is doomed to failure, Hercules Silver Corp stands out about how not every bottom-fish testing a geophysical anomaly needs to have a negative outcome. Hercules Silver Corp used to be called Bald Eagle Gold Corp which had a low sulphidation epithermal gold play in Nevada called Hot Springs which it sold in 2021 and then acquired the Hercules Silver property in western Idaho. This was a CRD zinc-lead-silver system with 28,000 m of historical drilling and the name was changed to Hercules Silver so that the stock can be promoted to silver bugs. To fund the silver pivot Hercules had to do a couple dilutionary financings including 30.7 million units at $0.08 in June 2022 and 28.8 million units at $0.20 in April 2023. The result was about 242 million fully diluted. This year the stock has traded mainly in the $0.20-$0.30 range but started to trade more actively in September when the junior rewarded shareholders with some high grade silver assays.

What was interesting about the September 8 news release was that it included a discussion about a blind copper porphyry target that had emerged from the 2022 field season. The southeastern part of the property has some copper smoke at surface which was untested, so this year in addition to swiss-cheesing the CRD target they drilled hole 23-05 to test an IP target beneath the copper soil anomaly. The IP anomaly also extends underneath the shallow CRD mineralization. On October 10 Hercules reported the copper discovery hole assays, 185.29 m of 0.84% copper between 246-431 metres, which included 45.33 m of 1.94% copper. There is also a modest molybdenum credit and the silver is 2.6 g/t. This blind copper porphyry system sits beneath the rhyolite hosted silver system into which over 300 historical holes have been drilled.

The copper grade so far looks high enough to support underground mining. This is the sort of outcome we have been hoping for from Tim Marsh's Bell Copper Corp but the extraordinary 1,200 m depth of the Big Sandy porphyry target in Arizona has turned that into a drilling slog. The Hercules project is now shaping up to be a blind copper porphyry district play. This development is significant because it involved a junior with enough stock out to qualify for a rollback and which did science based exploration work on the entire property, not just the high grade silver portion where the goal was to please silver bugs with flashy assays while waiting for the long awaited silver boom. This geology driven approach that looks at the big picture potential of a prospect is what discovery exploration is all about, and even though the CRD silver-zinc-lead zone has become irrelevant, I doubt the silver bugs will complain that lurking beneath the silver zone is potentially something far more valuable.

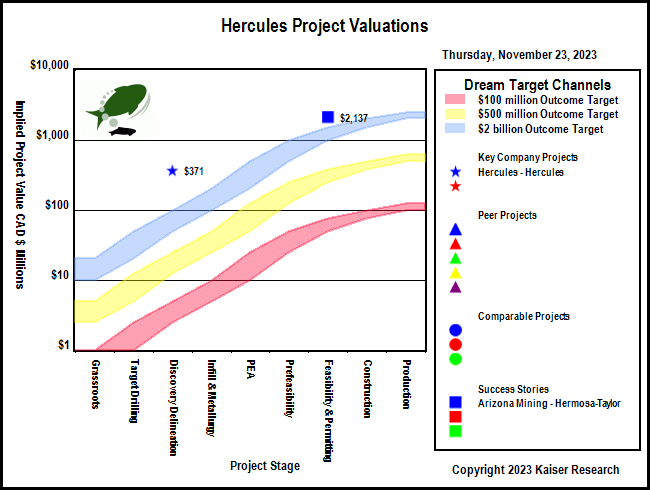

But what is even more significant is that a month later on November 6 the stock was halted for an announcement that Barrick was buying $23.4 million worth of stock at $1.10, a 37.5% premium from the prior day's close at $0.80. On the new fully diluted basis of 264.8 million that priced the Hercules project at $290 million. Barrick did this while assays for additional holes into the IP anomaly that represents the copper zone are still pending. Barrick now owns 33.6 million shares plus 6.8 million warrants. At Wednesday's $1.50 closing price Hercules had an implied value of nearly $400 million.

Finally, the discovery is significant because it reminds the market that when a major metal endowment is present in an area, it is worthwhile to rethink the bigger scale potential, as happened in 2015 after Richard Warke's Arizona Mining Inc had wasted $40 million demonstrating that the Hermosa-Taylor open-pittable silver oxide resource was worthless, and exploration VP Don Taylor started to investigate the zinc-lead silver sulphides at the base of the proposed pit limit. Out of this emerged a 92 million tonne deposit grading 4.2% zinc, 4.3% lead and 72.3 g/t silver (now bigger) which South32 bought in 2018 at $6.19 for $2.1 billion cash. This discovery also emerged from an extremely bearish market when everybody, including me, was blaming the malaise on the elimination of the uptick rule for short selling which turned the financial sector into a machine for stripping risk capital out of the resource junior market. Although daily value traded is higher today, the structural problems remain, and have been compounded by an anti-mining attitude against which Canada's government has failed to push back against, and has even worsened the situation by empowering First Nations to assert veto rights over Canada's mining future. To catch up on the structural problems, check out the first half of my Feb 15, 2013 Streetwise Interview: Can the TSX Venture be Saved?. You can also check out the Black Friday Short Selling Emergency Session. If you are a cynic you will recognize this as a sign of the dawning of a new age of discovery. |

Hercules Silver Corp (BIG-V)

Unrated Spec Value |

|

|

| Hercules |

United States - Idaho |

3-Discovery Delineation |

Cu Mo Ag |

Hercules Drill Plan for Holes into the Blind Copper Target |

Graphics showing how the IP Anomaly relates to the historical CRD Ag-Zn-Pb zone |

Plan and Section for 23-05 discovery hole |

Hermosa-Taylor OV showing how Rational Speculation Model works |

IPV Chart for Hercules Silver |

| Jim (0:09:35): Should the market be holding its breath for assays from Adamera's Buckhorn 2.0 drill program? |

I talked about Adamera Minerals Corp in my October 20, 2023 Kaiser Watch Episode as part of a discussion about Solitario's permitting delays at its Golden Crest project in South Dakota. At the time Adamera was scrambling to get a couple holes drilled into the VTEM-30 target located about 1.5 km from the former Buckhorn Mine in northeastern Washington. Adamera had just raised $250,000 through a nickel unit financing and the permit was set to expire at the end of October. The geophysical target was part of the dataset Adamera acquired from Kinross in 2021 which included VLF and VTEM surveys. These anomalies are supposed to indicate conductivity which can be explained by graphite or sulphides, but when Adamera drilled several such targets last year it didn't find any explanation for the conductivity. The VTEM-30 target was subtle and was located at a depth of 200-300 metres. Kinross wanted to drill it as part of its giant plan of operations permit application which the USFS rejected, causing Kinross to drop the land surrounding the Buckhorn Mine when it was depleted. Mark Kolebaba wanted additional support for this target and completed an audio magnetotelluric (AMT) survey over it this year which confirmed the anomaly.

The drill program had two purposes. One was to discover a disseminated sulphide body with economic gold grades that kicks off delineation drilling in 2024 when Adamera gets a new permit from USFS. The other was to find a disseminated sulphide body which, although it had little gold or none, confirmed that AMT surveys were useful for upgrading the other VLF/VTEM anomalies of which there are a lot. The first outcome would make bottom-fishers a lot of money. The second outcome would probably result in a rollback, but it would justify keeping the Buckhorn 2.0 story alive by applying AMT surveys to the remaining targets.

On Thursday November 16 Adamera reported that it had completed two holes, one a near vertical hole at 85 degrees angle, and the other at 50 degrees. The 2 holes drilled from the same pad intersected 60 m of disseminated sulphides for the first hole and 90 m in the second angled hole at the expected depth of the flat 1,000 m x 400 m AMT anomaly. Although the news release says true width is unknown, the anomaly's shape and drill intersections suggest a laterally extensive body about 60 m thick. The tonnage footprint of such a body is in the 60-80 million tonne range, so if this contains zones enriched with gold at underground mineable ore grades, VTEM-30 would be a major discovery.

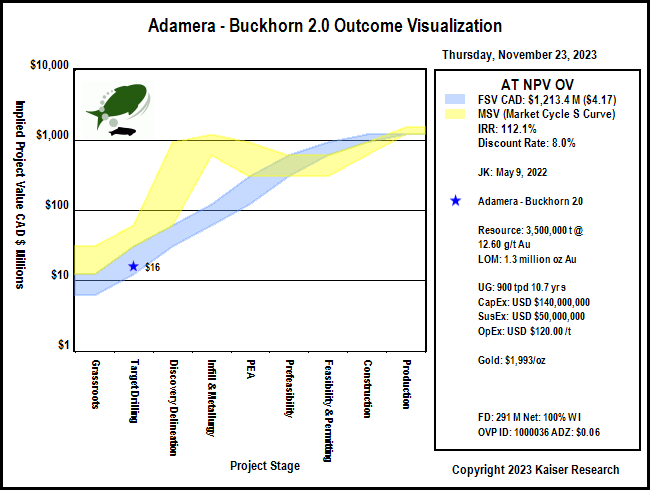

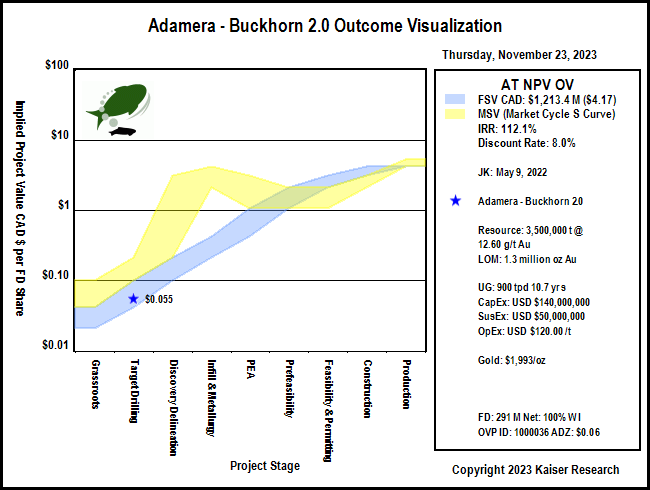

What the press release did not say, which may explain why the stock dropped a penny on the day of the news, was that the intensity of the sulphides varies within the intervals depending on the host rock, and that chalcopyrite (copper) is present along with the iron sulphide pyrrhotite which is responsible for the magnetic and conductive features of this anomaly. Peter Cooper, the now retired former chief geologist for the Kettle River operations of Kinross and who would be very intimate with the Buckhorn 1.0 mine's mineralogy, apparently told Mark that mineralization of this nature has never been seen on the Buckhorn property. Kinross mined 3.5 million tonnes at an average 12.6 g/t gold grade from the Crown Jewel from 2008-2017, recovering about 1.3 million ounces gold. In May 2022 I created an Outcome Visualization for Buckhorn 2.0 that shows what a new Crown Jewel might end up being worth today. At CAD $1.4 billion it is not a world class outcome, but depending on dilution along the way it would deliver 50-100 times price gains for Adamera for current levels. The Crown Jewel gold was hosted by flattish skarn zones with magnetite and garnet, but these features are not present in the VTEM-30 intersections. The new mineralization looks like a structurally controlled zone that cuts through both limestone-marble and clastic shales, but it may very well have been the subject of the same hydrothermal system that created the nearby Crown Jewel. At this early stage we don't have to assume VTEM-30 might be only as big as Crown Jewel; for now the geophysical context allows speculators to dream much bigger.

When Mark Kolebaba first looked at the core in the box he was disappointed but once the core was washed clean and looked at through a hand lens he was surprised to see the extent of sulphides. The vertical hole also intersected a deeper sulphide body that the AMT survey had indicated, but those sulphides looked less interesting. Last weekend Mark drove back to Buckhorn 2.0 armed with an XRF unit to do a qualitative assessment of what goodies and pathfinders are present within the sulphide intervals. You cannot use an XRF unit to conduct a preliminary assay of core but it can give a qualitative sense of what elements are present with what sort of abundance range but this does not work for gold. He was surprised at the high level of pathfinder elements such as mercury and tellurium along with copper, which was already evident visually as chalcopyrite. In fact even silver kicked, which is interesting because although the Crown Jewel is treated as a gold deposit, it had a silver credit at a 1:1 ratio to the gold grade. 10-15 g/t silver has a tiny rock value relative to 10-15 g/t gold, but if this VTEM-30 sulphide mineralization was precipitated by the same hydrothermal system that drove the Crown Jewel, the presence of a silver kick gives reason to be optimistic. But it is the presence of the other pathfinders which are a reason to hold one's breath for the assays. Kolebaba had been quite despondent about the market reaction but on Wednesday somebody decided to clean out the offers and the stock closed at $0.055 on 980,700 shares. He says his phone started to ring that morning as people familiar with the story called to ask why the stock was up. We are in an interesting market.

He says the hole also confirmed the deeper anomaly as sulphides but that interval is not as "interesting" as the shallower zone. Because of the large footprint of the zone all we need from initial assays is confirmation that gold is present to justify additional drilling to determine what might control richer zones. While the XRF readings cannot predict gold content, the variations of key elements could become a benchmark for assessing the potential of future drill holes.

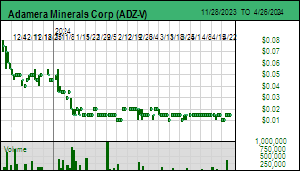

Adamera will have to apply for another USFS permit which, if similar to this one, could take only 3 months to get and would allow only 4 holes or so. A permit to allow discovery delineation drilling would probably take a year to secure for the USFS ground. However, if Adamera has good enough gold grades to justify such a permit application, the combination of confirming there are meaningful gold zones beyond Buckhorn 1.0 and having AMT as an extra tool to refine targets elsewhere on the property would attract market attention. Adamera's approach to Buckhorn 2.0 is an example of persistence and applying a geologically based rethink to an area with a strong metal endowment. The company is running on cash fumes and the structure is screaming for a rollback. Should assays confirm that gold is present at meaningful grades and distribution within this sulphide system, it would signal a major turnaround for this junior. But in the current hostile environment which is threatening to close out 2023 with a massive wave of capitulation selling, you have to be a true bottom-fisher to buy stock ahead of results. Perhaps this is the dawning of a new age of discovery for the Canadian resource juniors? |

Adamera Minerals Corp (ADZ-V)

Bottom-Fish Spec Value |

|

|

| Buckhorn 2.0 |

United States - Washington |

2-Target Drilling |

Au |

Graphics showing the evolution of VTEM-30 into a Drill Target |

What the AMT supported VTEM-30 anomaly looked like before drilling |

Buckhorn Clone Outcome Visualization IPV Chart in total value terms |

Buckhorn Clone Outcome Visualization IPV Chart in $/ADZ share terms |

IPV Chart for Adamera Minerals |

| Disclosure: JK owns shares of Adamera; Adamera is Bottom-Fish Spec Value rated; Hercules is unrated |