| Kaiser Watch January 17, 2024: Is the Second Coming of Sullivan imminent? |

| Jim (0:00:00): What is the importance of the new financing by FPX Nickel? |

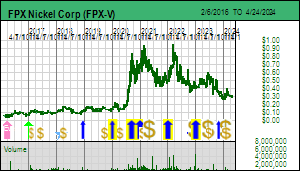

FPX Nickel Corp was a 2023 KRO Favorite for which I had very high hopes in 2023 that were dashed last August when out of the blue Chief Leslie Aslin of the Tl'azt'en Nation declared that Mt Sydney for whose desecration in the form of clearcut logging the band had collected millions was suddenly sacred territory and that his First Nations group would never accept an open pit mine in their backyard. The market, which knew FPX had maintained benefits agreements with the Tl'azt'en Nation for the past decade and had in the past year struck one with another group in the area reacted very negatively to this news which came in the form of a band press release. Even though the company was a month or so away from delivering a PFS, the stock dropped 30%-40% into the $0.30-$0.40 range. Some KRO members, including a few who had already suffered from similar arbitrary First Nation antics through NioBay Metals when a non-indigenous anti mining lobby hijacked the Moose Cree First Nation tribal council, dumped the stock at the open before I had even seen the news. Since this was a unilateral abridgement of an agreement to which FPX nickel was still bound, there was not much management could say about this development. The perception has emerged that while some First Nations groups are eager to be part of exploration and development, others, sometimes ones with territorial claims overlapping those of the eager participants, are quite happy to sabotage the efforts to find and develop Canada's mineral resources.

A couple months later after FPX Nickel had released its PFS, which included numbers for a downstream facility to convert the ferro-nickel concentrate into battery grade nickel sulphate, FPX announced an MOU whereby a joint venture comprised of JOGMEC, Panasonic and Toyota were to study the nickel sulphate conversion facility. This occurred at the same time Prime Minister Justin Trudeau and high level Japanese officials signed an agreement to support the development of downstream battery production in Canada. Why foreign companies would build manufacturing capacity in Canada for components intended primarily for the ten times bigger US market where they would have their car assembly facilities was a mystery unless there was an implicit understanding that Canada would become a supplier of critical minerals. FPX stock had started to climb back on the PFS news, and the market liked this MOU, which was important because in May 2023 Toyota, which had lagged in EV deployment, had announced a manufacturing breakthrough that would allow it to commercialize electric vehicles using a solid state lithium ion battery, the nholy grail of the EV sector.

This was a big deal because the best battery is one that allows lithium to be used as the anode instead of graphite. But graphite is used because the electrolyte is a fluid, and if lithium metal is the anode, the flow of lithium ions causes dendrites to grow like little spears which can puncture the electrolyte separators, cause a short circuit, which in turn creates the dreaded thermal runaway that turns an EV into a firebomb. The drawback of the graphite workaround solution is that it takes longer to recharge the battery and it has a shorter range, key obstacles to large scale adoption of EVs. Toyota boasted that an initial model planned for 2027 would have a range of 1,200 km on a ten minute charge. This is what is needed to spur mass adoption of electric vehicles, and it showed that it would be possible for EV sales to go exponential around 2030 when Toyota could be expected to have its popular affordable models like Camrys and Corollas available as EVs. It was especially good news for the lithium sector because it meant that IEA projections of a 600% required supply expansion by 2030 would be nowhere near enough. It gave legs to the Canadian pegmatite hunt, especially in the James Bay area of Quebec which was revealing a world class endowment of LCT-type pegmatites whose development cycle would coincide nicely with soaring demand in 2030.

It was very good news for FPX Nickel because Toyota's solid state battery still required nickel in the cathode, and if an EV was to be pitched as representing a low carbon footprint, using nickel from coal-fired Indonesian laterite operations bankrolled by the Chinese or nickel from smelted sulphide concentrates would be a hard sell. Among all the low grade nickel deposits being pumped as a future source of battery grade nickel, Decar was unique in that its nickel resided in a natural stainless steel called awaruite hosted by a magnesium rich rock that was very effective at sequestering carbon dioxide. While Decar may not achieve carbon neutrality, it will come a lot closer than other sources of nickel. The nickel sulphate conversion facility proposed by the PFS does not add much economic value in terms of extra NPV and IRR for the main ferro-nickel operation whose output would go directly into stainless steel mills such as those operated by the Finnish stainless steel maker, Outukumpo, which made a strategic investment in FPX earlier in the year as part of securing offtake rights at future market prices. Both Outokumpu and the downstream battery users would collect their markup through the marketing value generated by having verifiable ESG credentials for their products. So this Decar MOU coming in conjunction with Trudeau's endorsement of the Japanese building battery plants in Canada (lots of quality jobs) rather than in the United States which would be Toyota's primary market for future EV sales was a cause for celebration. But as soon as the news was out Chief Aslin climbed back on his pulpit and proclaimed No Can Do, this mountain is sacred territory, and down FPX Nickel's stock price went like a harpooned elephant.

The failure of top level Canadian government officials to stand up and declare that while consultation with First Nations is required, and their goals will be taken into account, a First Nations group saying no to exploration and mine development just because Trudeau has adopted a reconciliation policy will not stand in the way, has cast a cloud on Canada's mineral supply potential. The reality is that FPX Nickel is proceeding with its feasibility study and permitting efforts as if Chief Aslin is just a voice in the wind. That is how Outokumpu and the earlier mystery strategic investor look at the situation, but not how investors in resource juniors look at it.

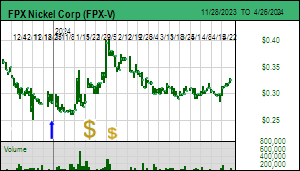

On January 17, 2024 FPX Nickel announced that it has completed a $14.45 million private placement of 30,104,488 shares at $0.48, double where the stock was before some cheaters started bidding up the stock the day before, causing it to be halted. The placee is another strategic investor, the Canadian subsidiary of Sumitomo Metal Mining Co. Ltd, which ends up with a 9.9% stake. The agreement includes a standstill that allows Sumitomo to increase its stake to 14.9% but vote its stake with management for the next two years. The financing boosts working capital to about $40 million, which, according to CEO Martin Turenne, takes the feasibility-permitting work well into 2026. Although shareholders were annoyed at the dilution created by the cheap price of FPX Nickel, which should be trading in the $2.00-$2.50 range based on the PFS outcome and the rational speculation model, this news is very important for several reasons. One is that for the next two years FPX does not need to issue any more treasury stock to push the Decar project through the dull feasibility demonstration trough. This in turn means that if Sumitomo does wish to increase its stake to 14.9% it will have to do so by purchasing stock in the open market, which the agreement grants it a green light to do. Another reason is that while the other strategic investors occupy positions downstream in the nickel supply chain, and really could not care less if mining Decar is profitable so long as they get their offtake supply at nickel market prices, Sumitomo is a mining company which will be very much focused on how big will be the NPV and IRR of producing ferro-nickel, regardless what end user ends up buying it. Sumitomo is among the world's largest nickel producers, and this is the first time an actual mining company has revealed itself as taking Decar seriously. And one final reason is that after Chief Aslin publicly face-slapped JOGMEC, Panasonic, Toyota and Prime Minister Trudeau, there will no longer have been any ignorance about the risk that Canada's reconciliation policy could allow a group representing 1,654 individuals block a multi-decade mine that supplies in a relatively clean manner metals critical to energy transition goals. Before doing this deal Sumitomo will have done serious due diligence into the risk that Decar goes nowhere because a First Nation group says No Can Do. Sumitomo is now a visible candidate to buy out FPX Nickel and develop the Decar mine, and thanks to Chief Aslin, it has gotten a foothold at a very lucrative price.

What was not lost on the market is the reality that a lousy FPX Nickel share price is good for all these strategic investors, but not ordinary shareholders. Monday's cheaters paid the price because the stock immediately sank back below $0.30. I demoted FPX Nickel Corp from a KRO Favorite in 2023 to a member of the 2024 Bottom-Fish Collection because of the risk that the stock stays dead money over the next couple years, and perhaps undergoes a mercy killing at a valuation well below the economic value of Decar. This is the insidious consequence of the perception Trudeau has fostered where the UNDRIP backed rights of indigenous people have a veto over Canada's mineral potential, aggressively backed by the NIMBY anti-mining lobby headed by groups like Mining Watch Canada who perhaps unwittingly have become PutinXi Poodle agents for the Global East. Canadian resource juniors are retreating from Global South regions such as Latin America and Africa because many nations are becoming unstable or adopting nationalistic policies toward the resource sector. In light of the clash between Global West and East they should be retreating to Canada and the United States where their task is to find new deposits worth developing within secure Global West jurisdictions. Yet in the United States there is a formidable NIMBY obstacle course that drags out the permitting process even for early stage work. And in Canada there is the added complication of nebulous First Nations "consultations" that have neither a formal process nor are mutually binding (only the resource entity is bound by agreement terms) and a media primed to cast the mining and exploration sector as a blight on planet earth whenever somebody like Chief Aslin of the Tl'azt'en Nation, backed by a majority of council members", issues a thumbs down proclamation. Given how obsessed younger generations are with high speed momentum gambling, the Canadian resource junior eco-system is crashing through the extinction threshold.

The situation, however, is not entirely hopeless. Many First Nations groups are eager to see their communities evolve with the help of meaningful jobs. On January 12, 2024 the TN chief and tribal council published a letter about a Non-Confidence Petition that has been circulating in their community. I have not seen the petition and do not know who is behind it, but the conspicuous absence of signatures in the letter for two council members, Vincent Joseph and Vincent John, gives us a clue. FPX used to have just one agreement with the Tl'azt'en Nation, but several years ago, this group which had been artificially cobbled together several decades ago by government agents, split back into their original groups. One of them is the Binche Whut'en Nation with whom FPX Nickel quickly secured a benefits agreement which both sides have honored. Naturally these groups all have overlapping territorial claims, and it looks like the Binche claim over the Mt Sydney area is stronger than the Tl'azt'en claim. And this means Chief Aslin may eventually be remembered as just a foolish voice in the wind who ended up ensuring that the Binche people who supported Decar end up with all the related jobs as Decar goes ahead despite proclamations about sacred territory by TN. I suspect there are members of the Tl'azt'en Nation who look at the bigger picture, recognize that Decar is not one of those rape and pillage mining scenarios, and are concluding that this is the wrong battle to be fighting. And maybe the fact that the web site has not replaced the 2021-2022 financial statement with one for 2022-2023 is also a factor. Chief Aslin's letter urges members to ignore the petition because some rule changes are in motion which supposedly will result in a tribal council election later this year. Getting Chief Aslin and his council member backers ousted won't dissipate the First Nations cloud hanging over Canada's mineral potential, but it could restore investor confidence that when management works fairly and sincerely with First Nations groups, the project will proceed if it passes Canada's environmental permitting requirements. |

FPX Nickel Corp (FPX-V)

Bottom-Fish Spec Value |

|

|

| Decar |

Canada - British Columbia |

7-Permitting & Feasibility |

Ni |

| Jim (0:09:23): Why do you think PJX Resources could be the hottest junior at this weekend's Metals Investor Forum in Vancouver? |

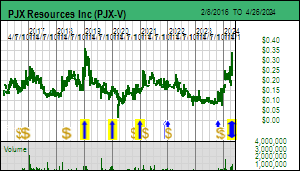

PJX Resources Inc appears to be in a position to finally deliver success for the century long Hunt for Sullivan Two. I picked up on this story in October when it first broke (see Tracker October 17, 2023), and again with Tracker January 15, 2024 after PJX published news of having found a mineralized outcrop at Dewdney Trail. The stock is surprisingly hard to buy so I am not going to regurgitate details here, and those Trackers are restricted to KRO members. But PJX is at the Metals Investor Forum in Vancouver on January 19-20 and will present Saturday afternoon. |

PJX Resources Inc (PJX-V)

Bottom-Fish Spec Value |

|

|

| Dewdney Trail |

Canada - British Columbia |

2-Target Drilling |

Zn Pb Ag |

| Disclosure: JK owns FPX Nickel; FPX Nickel and PJX Resources are Bottom-Fish Spec Value rated |