| Kaiser Watch October 6, 2022: Cheering Bell Tower Endurance |

| Jim (0:00:00): What is the significance of the latest news for the Rabbit North project of Tower Resources? |

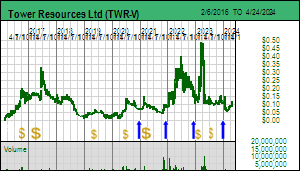

Tower Resources Ltd revealed 2 important developments with its latest update for the Rabbit North project in southern British Columbia. The first was that the last of 5 holes from the summer program drilled to cut through the Lightning Zone beneath the #26 discovery hole intersected similar mineralization with the bonus that the "crushed" appearance of the veinlets raises hopes of a higher gold grade because is evidence for deformation of the Lightning zone which enhances the capacity to absorb gold in an orogenic gold system. We dod not have assays for any of the holes yet, but the reported visuals indicate that the re-interpretation of the zone's initial ENE orientation to north-south has been confirmed. On this basis the downhole length of the #22-38 mineralized interval indicates a true width of 40-42 m over a 72 n vertical extent. The positive development is that additional till sampling has yielded evidence for a parallel structure a couple hundred metres west of the Lightning Zone that also disappears under thin basalt cover to the north. The Central Train is in addition to the Durant Creek Train inferred from the original 2021 till sampling about 500-1,000 m to the west of the Lightning Zone. Evidence for this train showed up 10 km down-ice, and in light of the Lightning zone being parallel to the Dominic Lake Train cannot explain the grains to west. The implication is that there are multiple north-south structures like Lightning whose past discovery may have been hindered by a thin post-mineral veneer of basalt. We hope to see assays by mid-November which will become the basis for funding a followup drill program that can run through winter. I've included the price based Ultimate Implied Outcome chart for the Rabbit North project. What this type of chart does is present the future valuation path of a project (assuming fully diluted does change much) in terms of share price for 2 scenarios. One is that the current implied value represents the mid-point of the fair spec value range as defined by the uncertainty ladder of my rational speculation model for the stage of the project. I am treating Rabbit North as being in the discovery delineation stage during which peak S-Curve valuation can take place. In fair value terms the current $39.2 million implied value indicates a future outcome of CAD $1.045 billion which translates into a $7.20 price target if there is no additional dilution (the blue channel). The other scenario assumes the $39.2 million implied value already represents peak S-Curve value which implies a future outcome of CAD $52.3 million or $0.36 per share as a price target (the yellow channel). Neither says what the fundamental outcome will be, but they provide a way of judging whether the current pricing represents good speculative value. For the blue channel outcome, you ask yourself, is $1 billion a plausible outcome for the sort of system and target footprint evident? The best way to find out is to do an outcome visualization for a plausible outcome based on the costs of an existing outcome already in production or for which an economic study has been published. I have not yet done that for Rabbit North. The $52.3 million peak S-Curve projected outcome is equivalent to saying the project is a bust because no mine in Canada with an NPV that low goes into production. The days of mom and pop mines in Canada are over. So that number is telling me Tower is not over-priced at this stage for a positive outcome. |

Tower Resources Ltd (TWR-V)

Bottom-Fish Spec Value |

|

|

| Rabbit North |

Canada - British Columbia |

3-Discovery Delineation |

Cu Au |

Drill Plan and Geology Map for Lightning Zone area of Rabbit North |

Gold in till trains and geology map for Rabbit North |

Pristine god grains from new Central Train till samples at Rabbit North |

Outcomes implied for North Rabbit if current value represents fair spec value or S-Curve peak value |

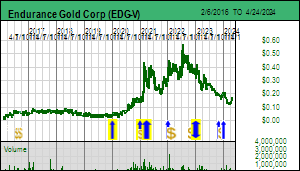

| Jim (0:03:24): What is the latest news from the Reliance project of Endurance Gold? |

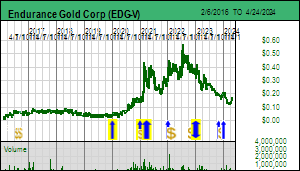

Endurance Gold Corp keeps delivering positive results for the Reliance gold project in southern British Columbia but is not getting any market upside from results even on a day when gold jumped up a lot and most stocks whether focused on gold or not were up. The problem is that Endurance is building its understanding of the Eagle-Eagle South Feeder system through incremental stepout and infill drilling which do not deliver no-brainer discovery holes, at least not yet. They have reported only half the holes drilled and there are only3-4 left before they pause to wait for assays to catch up. The next batch of holes will be downhill at the northwestern end of the Royal-Treasure shear corridor, starting to fill in the gap between the original Imperial zone and Eagle. If these are good the market will be surprised and it would become the focus of lower elevation winter drilling. The really important batch will be #47-54 which are 100-150 m stepouts uphill to the southeast of the structural corridor. If these are positive it would give Endurance a strike of 400 m to infill within which there appear to be multiple parallel quartz veins which themselves are barren but their flanks attract gold like barnacles on pier pilings. There is even a hint that the structural corridor is much wider than 300 m suggested by the Royal and Treasure faults. The hanging wall to the southwest are unrelated argillite sediments appropriately colored gray. This appears so be a somewhat low angle post mineral fault. We should get the final assays by the end of November which will kick off a fund-raising effort because Robert Boyd is the wise sort of CEO who watches the company's bank account. The implied outcome chart shows a fair value outcome of $1.7 billion or $11.20 per share based on $64.3 million implied value which needs a medium to high grade outcome of 3-4 million ounces gold to justify. I don't see the mineralized tonnage footprint yet so it means that this discovery delineation stage project is in S-Curve territory. But if we assume the implied value represents peak S-Curve valuation, the projected outcome is only $86 million or $0.56 per share which is also equivalent to a bust. I see at least a $300-$500 million future outcome value emerging from the current mineralized system footprint, so Reliance still has a lot of S-Curve upside potential. What it needs is an intersection longer and richer than anything so far reported to ignite the market's animal spirits. Endurance might, however, get help in Q4 from its rare earth Bandito project in Yukon. This summer the company carried out a LIDAR survey which reveals subtle topographical variations. Although the host target is a large "red" syenite intrusive body that fractionated niobium and rare earth metals to a level that has created quite an interesting geochemical anomaly over the southeastern half that has been soil sampled, field workers did find outcrop or at least big boulders from which they took grab samples. One of these at the northern limit of the sampling grid kicked 3.491% TREO grade, which is not that interesting (the metasomatized fenite structures to the southwest of the red syenite kick that high), but this heavy rare earth component was 76.7% which is very unusual. The tonnage footprint of this intrusion is over 500 million tonnes to a depth of 200 m, so the exploration question is, does this body contain any structural zones where grade enrichment over meaningful tonnage volumes took place? Such structures may either weather recessively, or the opposite, like pegmatites, sticking out like subtle ribs. The LIDAR survey may just deliver topographical noise, but if there are any linear structures that correlate with elevated TREO-Nb values in the soil sample grid, CEO Robert Boyd will have a hard time maintaining a serious demeanor. This Bandito system could become a heavy rare earth monster, and while its location looks as remote as Strange Lake, the world's biggest and richest HREO enriched deposit, it is actually very close to British Columbia's all-weather road network. In 2023 Endurance could rocketing with dual gold and rare earth thrusters. |

Endurance Gold Corp (EDG-V)

Bottom-Fish Spec Value |

|

|

| Reliance |

Canada - British Columbia |

3-Discovery Delineation |

Au |

Endurance Gold Corp (EDG-V)

Bottom-Fish Spec Value |

|

|

| Bandito |

Canada - Yukon Territory |

2-Target Drilling |

Nb Ta REM |

Locations of recent assay batch and upcoming batches for Reliance |

Secition for recent drill hole assays at Reliance |

Outcomes implied for Reliance if current value represents fair spec value or S-Curve peak value |

Geology of Bandito and limit of 2012 soil sampling of Red Syenite |

Rare Earth and Niobium values for Bandito soil sampling |

Bandito Location and high value sample REO Distribution pie chart |

Comparison of Bandito and Strange Lake remote locations |

| Jim (0:09:45): Does Bell Copper's Big Sandy qualify as an emerging discovery? |

Bell Copper Corp is indeed an emerging discovery in the sense that evdience for a Big Score is present, but the market is not buying it, even though Quinton Hennigh and Crescat were cheering for Big Sandy earlier this year. Tim Marsh thinks he has figured out the location of the displaced top of Diamond Joe, a porphyry intrusion on the west side of the Big Sandy Basin which has a large 6 x 5 km footprint, bigger than most world class copper deposits. Several large companies drilled it from 1959 onwards, but it eventually became clear that faulting which created Arizona's basin and range topography decapitated this intrusion and likely mineralized top slid off to the east along a low angle fault and probably suffered the additional indignity of being down-dropped by block faulting. Attempts have been made to drill the middle of the basin which is over 1,500 m deep, including by Bell Copper briefly in 2010-2013 when it was called Kaaba. Meanwhile Tim turned BCU's attention to the Perseverance project to north where there was a similar situation of the Wheeler Wash exposed porphyry root whose top disappeared under the basin gravels to the east. This project is now under option to Friedland's Cordoba which has yet to find a seriously mineralized zone. But knowledge gleaned from Perseverance and frustration over no longer having any control over the exploration cycle prompted Tim to revisit the Big Sandy area. He crossed the Big Sandy River and started inspecting the range front on the eastern side which led to the discovery of copper exotica. This wasn't the missing Diamond Joe top, but copper leached and transported from a nearby source. His rethink involved recognizing that the displacement was much farther than thought, at least 13 km to the northeast, so Bell Copper staked claims and conducted a magneto-telluric survey which yielded a large anomaly of conductivity starting at 400 m depth. He plotted 4 drill holes as a plan to vector in on the copper shell of Diamond Joe's missing head. The first hole confirmed the edges of a porphyry system though shot to hell the conclusion that the MT anomaly represented sulphides in bedrock only 400 m deep when in fact bedrock is over 1,000 m deep. The second hole 1,600 m to the south intersected Precambrian granite which was the country rock into which Diamond Joe intruded. Tim didn't call it "tombstone", but calling it "countertop" had the same effect in Big Sandy Presentation to the Arizona Geological Society on Sept 6, 2022. The link starts at about 8 minutes and the Big Sandy discussion lasts until the 48 minute mark. I strongly urge anybody who accepts my contention that Big Sandy is a major emerging discovery spend the 40 minutes needed to watch this presentation so you fully understand the story. Tim has been reluctant to provide graphics to accompany his word salad press releases, but he does cough up a section that helps investors understand why hole BS-3 was not a bust, but the third vectoring hole needed to set up a sniper kill shot, BS-4, which is now permitted, pad and road have been built, a drill company with a rig that can do the pre-collar for 1,000 m plus of basin gravel, and even the casing needed for this. The reason is that Freeport has over time bought up all the surface rights straddling the Big Sandy River, effectively ranches, and pretends it is in the ranching business. So it has become a little cranky that a wee junior like Bell Copper might make a monster copper discovery in this area and put a spotlight on it. I suspect the river runs over Diamond Joe's missing head, but that doesn't matter because if the copper shell does indeed have a high grade supergene enrichment blanket of at least 0.8% copper in the form of chalcocite above the hypogene primary chalcopyrite, it will be an underground mine. The only thing missing at this stage is money. The last hole cost USD $700,000 and Tim Marsh does not want to start another expensive hole without the money in the bank. The geological context suggests that the risk hole BS-4 will not hit the bulls-eye is very low, but the real risk is that the grade did not get high enough to support profitable underground mining. We are in a bear market where the glass is 90% empty, so the market is choosing to assign an implied value of only $25.7 million to Big Sandy, which if fair value represents a future outcome worth CAD $686 million or $4.67 per share with no further dilution (of which there will me more). If the implied value represents peak S-Curve pricing, the outcome will be worth only $34.3 million or $0.23 per share. In other words, given the huge CapEx of these underground copper mines like Resolution, the market is saying the Big Sandy story is a bust. This is a classic bottom-fishing opportunity in a bear market that could very well worsen. But if somebody steps up with $1 million to allow this hole to be drilled, which Tim thinks will go a lot faster than BS-3, the emerging Big Sandy discovery could turn into a full blown discovery play whose S-Curve peak would exceed $10 per share. |

Bell Copper Corp (BCU-V)

Bottom-Fish Spec Value |

|

|

| Big Sandy |

United States - Arizona |

3-Discovery Delineation |

Cu Mo |

The futile exploration history of Diamond Joe and its missing top |

The large footprint of Big Sandy's root rivals those of world class copper deposits |

Bell Copper has vectored in on the center of the displaced Diamond Joe top |

Big Sandy Section showing bulls-eye target for next hole |

Google Earth View of Big Sabdy relative to Freeport's Bagdad Mine |

Outcomes implied for Big Sandy if current value represents fair spec value or S-Curve peak value |

| Disclosure: JK owns Endurance Gold; Bell Copper, Endurance Gold and Tower Resources are Bottom-Fish Spec Value rated |