| Kaiser Watch May 12, 2023: James Bay gets a Lithium Champion |

| Jim (0:00:00): What are the implications of the proposed Allkem-Livent merger for the James Bay region? |

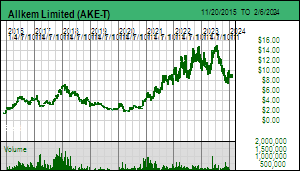

On May 10, 2023 Allkem Ltd and Livent Corp announced a merger of equals whereby Livent shareholders will get 2.406 Allkem shares with the resulting company trading on the NYSE and the ASX. The TSX listing will disappear. The combined company had a value of USD $10.6 billion when the deal was announced, which has since risen because both stocks responded positively to the news. Pro-forma 2022 revenues would be USD $1.9 billion and EBITDA would be $1.2 billion. This merger combines the Argentine brine operations of both companies and the Australian Mt Cattlin pegmatite mine of Allkem. The Argentine portfolio has expansion potential and includes one project under construction. But the real synergy comes from the Quebec James Bay project of Allkem and the 50% owned Nemaska project of Livent.

The Nemaska project consists of the Whabouchi deposit which was developed during Lithium Mania 1.0 but ended up in bankruptcy in December 2019 when lithium carbonate prices had crashed below $5/lb. In October 2020 Orion Mine Finance and The Pallinghurst Group acquired 50% of the asset and a government agency called Investissment Quebec acquired the other half. Livent acquired a partial stake on Dec 1, 2020 and on June 6, 2022 Livent issued 17,500,000 shares to acquire the other 25% to hold 50%. Livent and IQ are working to bring Wabouchi on stream and are building a lithium hydroxide facility at Becancour on the St Lawrence River half-way between Montreal and Quebec City. Livent, which was part of the FMC Corporation, went public on the NYSE by IPO in 2018 with the Hombre Muerto brine project in Argentina.

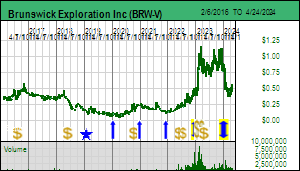

Allkem went public in 2007 as Orocobre and by 2015 had put the Olaroz brine project into production. In August 2021 it diversified into pegmatite sourced production by acquiring Galaxy Resources. Galaxy had put the Mt Cattlin deposit into production in 2010 and in 2012 acquired Lithium One which gave it ownership of the Sal de Vida brine project in Argentina and the Cyr pegmatite project in the James Bay region of Quebec. Allkem published a feasibility study in December 2021 for the Cyr project which it now calls the James Bay project. Last week Allkem published partial results of drilling it has been doing at James Bay which revealed the discovery of the NW Sector. It is an under-cover jog to the northwest for the existing Cyr deposit which has a Li2O grade in the 1.5%-2.0 % compared to the 1.3% grade of the largely outcropping main deposit. It also reported extensive drilling activity to the east right up to the boundary of Brunswick's Anatacau West project but did not report any assays. Brunswick has traced the pegmatite system at least 300 m onto its property and is awaiting assays.

The merger between Allkem and Livent is important for the James Bay region because future spodumene concentrates from both James Bay and Wabouchi can be shipped to the Becancour lithium hydroxide refinery which in turn can supply battery makers based in North America. Allkem-Livent, or whatever the merged company ends up being called, will be a potential aggregator of new lithium discoveries in the southern half of the James Bay region if another major lithium producer does not show up. The James Bay region can be divided into a southern half south of the Eleonore Gold Mine and the northern half where Patriot Battery Metalsis drilling off the Corvette lithium deposit whose results so far indicate a world class resource potential in the 50-100 million tonne range grading 1.5%-2.0%. That puts it in the league of deposits such as Liontown's Kathleen Valley which are currently priced in the $4-$6 billion range.

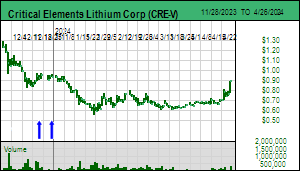

The lithium pegmatite deposits in the southern half of James Bay such as Cyr, Rose, which is owned by Critical Elements Lithioum Corp, and Whabouchi were found 3-5 decades ago because these pegmatites outcrop to such a degree you can see them from Google Earth satellite imagery. Simply walking the ground and looking for outcropping pegmatites that are lithium enriched is what I call "first order" exploration. The southern half is now regarded as an old exploration frontier because it is assumed that the best pegmatites are those that are sticking out of the ground. The exciting new exploration frontier is the northern half where outcropping pegmatites such as within the Corvette trend were observed during the past couple decades, but because of the remoteness they were never delineated. Plus the global lithium market was tiny and dominated by production from Greenbushes and the Chilean brines. Lithium Mania 1.0 kicked off in 2015 when Tesla EV sales took off and the world realized that electric vehicles powered by lithium ion batteries were becoming a reality. Lithium Mania 2.0 is based on projections by groups such as the IEA that lithium supply will need to undergo a 600% expansion by 2030 to make EV rollout projections reality. James Bay is turning into a Great Canadian Area Play because it is a prime candidate in a secure and stable jurisdiction to deliver the second half of the required supply expansion.

While the exploration glamour resides in the northern half of James Bay where simply first order walking the ground with an XRF gun this summer could lead to high success potential drill programs in the fall and certainly by Q1 of 2024, the southern half has been viewed until recently as an also ran. But the realization has started to set in that the known deposits may simply be the result of local topographical coincidences which created a tunnel-visioned exploration focus. The Allkem feasibility study at James Bay should have had a pit centered on the higher grade NW Sector, but the past delineation drilling focused on what was visible. This old frontier is undergoing a renewal in the form of "second order" exploration which seeks to home in on pegmatites close to surface but obscured by swamp, bush and overburden. Lake bottom sediment data, glacial history reconstruction, and geology are the keys to second order exploration. An early example of a second order discovery was the Pontax pegmatite system now being explored by Cygnus Metals and Stria Lithium. It was discovered a couple decades ago by Sirios Resources as a by-product of regional till sampling for diamond indicator minerals spawned by Ashton's discovery of the Renard kimberlite cluster.

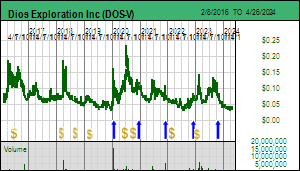

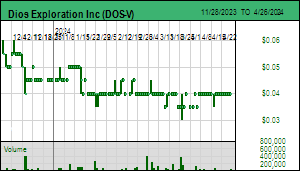

Juniors like Dios Exploration Inc which was spun out from Sirios have been quietly conducting second order exploration in the southern half of James Bay which to a large degree is archival research. The recent NW Sector news from Allkem is an alarm bell that the best may yet be found just beneath the surface in this area which is much closer to infrastructure than the northern half. The Allkem-Livent merger creates a lithium champion for this region. Why is Dios limping along at a nickel? One reason is that the junior has been reluctant to disclose what it has been staking and why; there is a certain degree of paranoia afflicting juniors whose management knows what it is doing and is worried about a wave of speculative staking randomly staking ground with second order potential. But the simpler reason Dios remains so unloved may be that the company's marketing budget in Q1 of 2023 collapsed 97.5% from $81 in Q1 last year to $2 this year. What could that expense have been? Well a bottle of two buck chuck during a one on one presentation to an analyst can go a long way. |

Allkem Limited (AKE-T)

Unrated Spec Value |

|

|

| James Bay |

Canada - Quebec |

7-Permitting & Feasibility |

Li |

Livent Corp (LTHM-N)

Unrated Spec Value |

|

|

| Nemaska-Wabouchi |

Canada - Quebec |

8-Construction |

Li |

Critical Elements Lithium Corp (CRE-V)

Favorite

Fair Spec Value |

|

|

| Rose |

Canada - Quebec |

7-Permitting & Feasibility |

Li Ta |

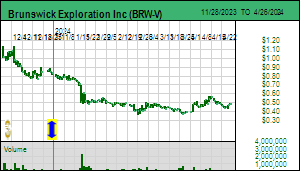

Brunswick Exploration Inc (BRW-V)

Favorite

Fair Spec Value |

|

|

| Anatacau |

Canada - Quebec |

2-Target Drilling |

Li |

Dios Exploration Inc (DOS-V)

Bottom-Fish Spec Value |

|

|

| Lithium North |

Canada - Quebec |

1-Grassroots |

Li |

Allkem-Livent Merger Syngery resides in James Bay assets |

Becancour Lithium Hydroxide Refinery is key to Allkem-Livent Merger |

History Snapshot of Allkem and Livent |

Current Lithium Supply Growth Plan for Allkem-Livent |

Understanding the 1st and 2nd Order Exploration Nature of North and South James Bay |

Which is a better marketing spend: a bottle of two buck chuck or a quarter million dollar twinkie? |

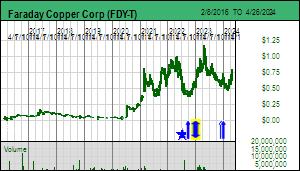

| Jim (0:13:59): What is next for Faraday Copper following the release of its PEA? |

Faraday Copper Corp delivered a PEA for its Copper Creek project in Arizona on May 3 to which the market did not react positively. I watched the May 4 webcast and it was clear right from the start that this PEA is a steppingstone for Faraday. Paul Harbidge's opening remarks make it clear that this PEA is not going to be the basis for mine development. It "is a solid foundation which the team can build upon".

Copper Creek has a complex mining plan that starts with 7 open pits feeding a 30,000 tpd flotation plant that in year 9 transitions to underground mining. Low grade ore from the pits is stockpiled and processed in the final 3 years of the 32 year mine life. The resource and mining plan is based on 200,000 m of drilling. The market knew from the project's history that the mining plan would be complex but it was hoping for better economic numbers than the PEA delivered.

The PEA requires initial CapEx of USD $798 million. The headline after-tax NPV is $713 million, but it is calculated at a discount rate of 7%. In a separate table the NPV at 8% is $566 million. The rule of thumb is that CapEx should at a minimum match the NPV. The IRR, which is not linked to the discount rate, is 15.6%, just barely above the minimum IRR developers want to see.

The base case price is $3.80/lb copper, which is reasonable because that is roughly where copper is today. Faraday uses conservative prices for silver ($20/oz) and molybdenum ($13/lb). The silver byproduct is small, so there is little upside optionality from higher silver prices. But using $23/lb for moly does add $129 million to the 7% NPV calculation. The current price for molybdic oxide is $20.60/lb, though in late December it spiked almost to its $40 high in 2005.

Faraday provided NPV and IRR figures for $4.25/lb and $5/lb copper prices, and at these prices Copper Creek does clear the development hurdles. Copper Creek is thus a copper optionality play which benefits from future higher real copper prices. Are higher real copper prices possible? The IEA predicts that the 2030 goals for the energy transition require a 50% expansion in global copper production. Such an expansion is not in the pipeline, so to make it happen a higher real copper price is needed. But when will that happen?

The company is well financed and is completing a 10,000 m drill program whose results are not incorporated into the PEA and are expected by the end of Q2. The company will go into a lull during Q3, but plans to begin a 20,000 m drill program in Q4. I believe they have about $20-$25 million working capital after the $40 million financing earlier this year and the USD $12 million acquisition of the Mercer Ranch.

Faraday has completed a high resolution EM survey and also plans a spectral survey which will guide an exploration strategy whose goal is to see if the scale can be increased from the proposed 30,000 tpd operating rate. The block caving studies indicate that a 30,000-45,000 tpd rate is feasible for the UG Keel and American Eagle deposits. Since the flotation mill needs to be built up front, if it is to start with the 45,000 tpd rate, the resource needs to be expanded if mine life is not to be shortened. If this can be accomplished they can deplete the open pit resource more quickly and start on the higher grade underground resource sooner.

Toward the end of the webcast Harbidge provided a slide called "opportunities and next steps" which makes it clear that Copper Creek is shifting back into exploration mode. This is not a giant porphyry deposit like we hope Bell Copper will find at Big Sandy but rather a system of breccia bodies exploiting a couple of faults on the property called Western and Holy Joe, only a portion of which has seen drilling activity. Chalcopyrite and bornite are the main copper minerals with very little pyrite; below one of the pits the mineralization qualifies as massive sulphide with an interval of 15 m at 10.83% copper and 1.65 g/t gold. Gold was not historically assayed but FDY has observed the presence of gold in some zones. One goal of the next round of exploration will be to see if gold can be a recoverable metal.

I had hoped to upgrade Faraday Copper from a Fair Speculative Value rating to Good Speculative Value after the PEA, but because the numbers now fall short of a key development hurdle Faraday does not justify a Good Spec Value rating with a $1.50-$2.00 range as a Fair Spec Value target. The current $0.80-$1.00 price represents fair speculative value for copper price upside optionality and the exploration potential for scaling the mining plan bigger. The company meanwhile will continue with feasibility demonstration work that includes permitting, metallurgical studies, and seeing if they can get away with a coarser grind size.

The PEA has created the cost structure foundation for what ultimately is a higher grade underground mine relying on block-caving which does not always work. If you believe the predictions that the energy transition will require a 50% expansion in copper supply by 2030, and that American politics will not torpedo the energy transition, the world will need a higher real copper price. |

Faraday Copper Corp (FDY-T)

Favorite

Fair Spec Value |

|

|

| Copper Creek |

United States - Arizona |

5-PEA |

Cu Mo |

Snapshot of Faraday Copper's PEA for Copper Creek |

Mining Schedule for Faraday's Copper Creek PEA |

Faraday's Copper Creek Open Pit and Underground Zone Resources |

Faraday Copper's Value Building Strategy for Copper Creek |

Faraday's Copper Creek Expansion via Exploration Strategy |

The dreary path for mobilizing new mine supply in the United States |

Copper Price and Warehouse Stock Chart |

Why it is just a matter of time before copper undergoes a major real price gain |

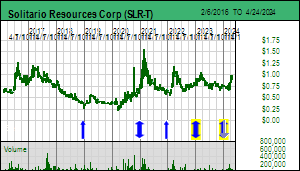

| Jim (0:24:12): When can we expect Solitario to start drilling at Golden Crest? |

Solitario Zinc Corp announced on May 11, 2023 that the US Forest Service has released a draft environmental assessment for a 25 drill site plan of operations at the Golden Crest project in South Dakota. A 30 day comment period ending June 8 has begun. Once that is over the USFS will write a response and then begins an objection period to which the USFS has to respond before making a final decision. Given the timeline involved the earliest approval possible is mid to late August. The exploration season in this area runs from May through November. If Solitario gets a drill permit by the end of August it will mobilize two rigs to get as much done as possible before the snow flies. Meanwhile the company will continue with an intensive program of surface exploration which includes prospecting and trenching.

Solitario expected to be at this stage 2 months ago, with a permit in hand by the end of Q2 2023. What went wrong? The Golden Crest permitting cycle became roadkill thanks to an unrelated controversy that erupted as a result of a private company applying for a plan of operations in the area surrounding the Pactola Reservoir in the South Black Hills which is a key water supply for Rapid City. This created an uproar which apparently attracted the full attention of the USFS, effectively putting work on Solitario's Golden Crest application on hold for a couple months. The USFS dealt with the Pactola problem by proposing a 20,574 acre mineral withdrawal around the reservoir. This is roughly a 9 km by 9 km area. Golden Crest, which is 13,473 ha or about 11 km by 11 km, is located in the North Black Hills which has a mining history that the South Black Hills do not.

Although with permitting anything is possible, the view is that the Golden Crest application will not be rejected. In fact, Solitario two months ago submitted a second application with an additional set of drill sites based on the target development work done last year. The delay is frustrating because Golden Crest is an extraordinary exploration play which represents the last major gold frontier in the United States that isn't buried somewhere under barren cover and difficult to vector towards. It is possible that the western half of the northern Black Hills is a mirror image of the eastern half which hosts the Wharf and Homestake mining district in which 90 million gold ounces have been identified of which two thirds have been mined. The difference is that there is a couple hundred extra metres of younger carbonate rocks at Golden Crest. There is very little evidence of past exploration but Solitario's surface work has revealed widespread evidence that gold bearing fluids pumped this region, fluids that would have the same age as the 50-60 million year old fluids that created the Wharf mineralization that is still being mined. The basement hosted Homestake style gold mineralization is about 1.8 billion years old. Everybody who looks at the results so far generated by Solitario's surface work is stunned that this area has seen only a couple scout holes by Homestake which confirmed the depth of the Precambrian basement rocks that host the Homestake deposit. It would be nice to see approval in place for drilling to start in September, but one has to keep in mind that the debt ceiling problem could result in a shutdown of government agencies, and that would delay the start of drilling to May 2024 at the earliest. |

Solitario Zinc Corp (SLR-T)

Favorite

Fair Spec Value |

|

|

| Golden Crest |

United States - South Dakota |

2-Target Drilling |

Au |

Relative Locations of Golden Crest project and Proposed Pactola Reservoir Mineral Withdrawal |

Golden Crest as a Potential Mirror Image of Homestake District? |

This conceptual model is key to understanding why Golden Crest is the Last Great American Gold Frontier |

| Disclosure: JK owns shares of Dios and Brunswick; Brunswick, Faraday Copper and Solitario are Fair Spec Value rated KRO 2023 Favorites; Dios is Bottom-Dish Spec Value rated |