|

Tracker 2008-16

March 31, 2008

Serengeti Resources Inc (SIR-V: $1.50)

Spectacular hole supports new theory but does not signal a sweet spot starter pit

On the evening of March 25, 2008 I issued a top priority buy recommendation for Serengeti Resources Inc (SIR-V: $1.50) in the $0.50-$0.75 range based on the junior's strong working capital position of $16.5 million, a geologically experienced management team, and the hypothesis that an underground mineable high grade copper-gold deposit was taking shape on the 100% owned Kwanika project in the Quesnel Trough of north-central British Columbia. This hypothesis was critical because drilling during 2007 around the Kwanika 06-09 discovery hole had indicated that the higher grade mineralization was restricted to a roughly 250 metre wide northeast-southwest trending corridor that was dipping to the west beneath a sedimentary basin, with a higher grade 25-50 metre thick slab of supergene enriched mineralization tracking the unconformity between the basin and the mineralized basement.

The market had reacted negatively last year when it became apparent that the open-pittable resource at a meaningful grade in the new Kwanika zone was likely less than 100 million tonnes, which is probably insufficient for the development of a standalone mine even though the location of the Kwanika project is considerably more favorable from an infrastructure standpoint than projects such as Novagold's Galore Creek in the Stikine Arch to the northwest.

I recommended Serengeti on the basis of management's theory that the western boundary of the 500 metre wide 5,000 metre long IP anomaly at Kwanika was an illusion created by the presence of a barren sedimentary basin that overlay the mineralized country rock. Drilling had suggested that the supergene enrichment which had given the new zone its sizzle persisted within the host rock to the west beneath the unconformity well beyond the apparent limits of the IP anomaly and perhaps as much as 500 metres further until reaching the regional north-south Pinchi Fault. The theory was that the supergene zone had been exposed in the discovery hole K-09 area of the IP anomaly and subjected to erosion through glaciation, but towards the west the basin sediments had served as a protective cover that preserved the supergene zone from erosion.

The diagram above does not really do justice to the theory, because management now knows that while the basin unconformity is near vertical near the surface it converts to a 35 degree slope at the western limits where holes #59 and #60 have been drilled. The drill plan below shows the outlines of the supergene zone and the edge of the basin, all of which is covered by 20-40 metres of glacial till.

The downside of the theory was that the high grade copper-gold mineralization would likely build tonnage at depths below 300 metres, which implied an underground mining scenario. The market had not yet cottoned to this idea when I made my recommendation, which was a key factor in my decision to recommend a cash rich junior that was being priced as if it was just a grassroots exploration junior with a geologically decent land position.

Unfortunately for bottom-fishers, Serengeti released assays for 5 holes prior to the open on March 26, and one of those holes, K-08-62, was a spectacular hole consisting of 610 m of 0.74% copper and 0.78 g/t gold, of which the first 383.9 m interval starting at 130.9 m graded 1.06% copper and 1.09 g/t gold which computes into a rock value of $116 per tonne at $935 per oz gold and $3.60 per lb copper.

The location of hole K-08-62 on the drill plan at least 100 metres from every prior hole suggested that Serengeti had tagged into a lucrative open-pittable sweet spot within the Kwanika IP anomaly, and the market's temptation was to take a compass and draw a 100 metre radius circle around this hole, do a quick tonnage calculation to a depth of 400 metres, and visualize a new open-pittable $4 billion in situ value resource at a grade that most definitely would be economic. As a result Serengeti's stock price took off at the open, and traded about 18 million shares over a 3 day period, peaking at $1.85 before settling back to $1.50.

During this period I and no doubt a number of analysts have taken a close look at how hole #62 relates to previous holes, and my conclusion is that hole #62 does not signal a new and spectacular open-pittable sweet spot for Kwanika. It was drilled at a 58 degree angle to the west and as such scissors several holes (#43, 49, 51) which yielded more modest intervals of copper-gold mineralization. As the news release itself spells out, hole #62 was drilled "beneath and sub-parallel to the westward-dipping sedimentary basin contact that onlaps the mineralized zone along its western edge". In other words, much of the rich interval is the result of cutting the 25-50 metre thick supergene enrichment zone at a very shallow angle which yielded an interval that is very far from a true thickness.

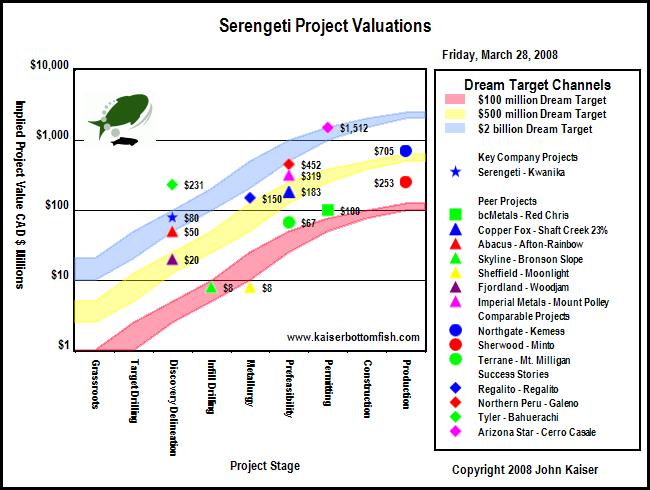

Conclusion: While this means that Serengeti is not going to zoom to $5 plus during the next couple weeks, it does support the theory that Kwanika hosts an underground mineable high grade copper-gold zone that tracks the basin unconformity, and it appears to eliminate a nagging concern management has had that its earlier holes through the supergene zone owed their high grade to near vertical structures that concentrated copper-gold mineralization locally. Seregenti has completed another 16 holes up to #78, many of them testing the extension of the supergene zone to the west of the basin boundary. The implied project value of $80 million is nearly three times what it was at the $0.58 price when I recommended Serengeti as a top priority bottom-fish buy, and to represent fair speculative value the current prices requires a $2 billion world class dream target. The evidence and model does not at this stage support such a dream target, which requires something on the scale of Cerro Casale which Barrick priced at $1.5 billion went it recently took over Arizona Star. I expect the market for Serengeti to weaken during the next week as the market adjusts its expectations to the more modest one Serengeti management has been offering all along, and then to strengthen in subsequent weeks after the analyst tours scheduled April 3 and 4.

Although there is not much to see through a site visit -- as the aerial phot above shows Kwanika is located in a flat overburden covered valley which currently still has snow on the ground - I will be participating in the analyst tour. The main objective will be to achieve a more detailed understanding of what management sees taking shape at Kwanika, and develop a sense of how extensive this supergene zone could turn out to be. In the meantime I am converting the bottom-fish buy recommendation to a Spec Cycle Hold 100% recommendation, while keeping in mind that nobody had a chance to buy in the recommended $0.50-$0.75 range.

|