|

Tracker - March 13, 2019: PJX drilling deep hole to test Sullivan II target

PJX Resources Inc is half way to target depth with its deep hole testing a magneto-telluric anomaly on the 100% owned Vine project in southeastern British Columbia. The MT anomaly suggests a large massive sulphide body starting between 1,000-1,400 m depth with a potential 2,000 m down-plunge extent. John Keating thinks the MT anomaly represents a Broken Hill type of zinc-lead-silver system which is now understood as a Sullivan-type SEDEX system that has undergone remobilization as a result of deformation which in the case of Vine would be folding related to the regional Moyie Fault. In this regard his thinking differs from that of John and Gordon Leask with regard to their deep target on the adjacent Monroe property which they believe to host an intact variation of the original Sullivan deposit at a depth of about 1,200 m. Drilling by Highway 50 Gold Corp has been stymied by problems reaching the target which inconveniently sits beneath Monroe Lake. PJX Resources Inc is half way to target depth with its deep hole testing a magneto-telluric anomaly on the 100% owned Vine project in southeastern British Columbia. The MT anomaly suggests a large massive sulphide body starting between 1,000-1,400 m depth with a potential 2,000 m down-plunge extent. John Keating thinks the MT anomaly represents a Broken Hill type of zinc-lead-silver system which is now understood as a Sullivan-type SEDEX system that has undergone remobilization as a result of deformation which in the case of Vine would be folding related to the regional Moyie Fault. In this regard his thinking differs from that of John and Gordon Leask with regard to their deep target on the adjacent Monroe property which they believe to host an intact variation of the original Sullivan deposit at a depth of about 1,200 m. Drilling by Highway 50 Gold Corp has been stymied by problems reaching the target which inconveniently sits beneath Monroe Lake.

PJX attempted an angle hole on its Vine project in early February but had to abandon it because of deviation. Keating thinks that if the Broken-Hill hypothesis is correct the original flat-lying SEDEX style system would have been dragged and squeezed into multiple sub vertical massive sulphide lenses. So now PJX is drilling a vertical hole with the hope that they hit massive sulphides at depth, but, if not, with the plan to conduct down-hole geophysical surveys and drill wedge holes in the direction of any resulting anomaly.

The Vine property became the focus of exploration in 1976 when Cominco's Dave Pighen noticed a sulphur smell and found outcropping massive sulphides enriched with zinc, lead and silver that became known as the Vine vein. After Cominco gave up on it the Vine vein became the focus of a major stock promotion and drilling campaign in 1989-1991 by a junior called Kokanee Exploration Ltd. It was traced to a depth of 630 m but only yielded a pre-43-101 resource of 1.3 million tonnes of 3.12% zinc, 3.12% lead and 36.3 g/t silver. The claims lapsed and were staked by a junior which sold them to PJX in 2013 before wandering off into the CSE marijuana patch. PJX conducted a gravity survey over the Vine property which yielded two areas of higher density known as the West and East gravity targets.

On the assumption that the higher density was due to massive sulphide bodies at depth PJX drilled these targets in 2014-2015. The West gravity target hole VA15-06 did intersect massive sulphides consisting of pyrrhotite with minimal sphalerite and galena. Holes VA14-01, VA15-02 and VA15-04 drilled into the East gravity target failed to explain the gravity anomaly but did intersect sphalerite and galena within the folded phyllitic rocks in the hanging wall above the Moyie fault. The cartoon diagram above depicts the potential location of a conventional SEDEX type deposit within Lower Aldridge rocks as well as a Broken Hill type deposit within the deformed rocks at the Moyie fault.

In 2018 PJX conducted a magneto-telluric survey over the Vine property in an effort to see if conductivity related to massive sulphides existed at depth and was pleasantly surprised in November that such an anomaly did exist in the vicinity of the East gravity anomaly. However, when both datasets were integrated into a 3D model it became apparent that the two anomalies did not quite coincide, that the gravity anomaly was farther to the east than the MT anomaly. I have seen the offset in the 3D model Keating has on his computer, but I do not have a screenshot that shows this. The section diagram below shows the traces of the 2015 holes that tested the gravity target as well as the vertical location of the more conductive portion of the MT anomaly which is nestled deeper against the northwest dipping Moyie fault.

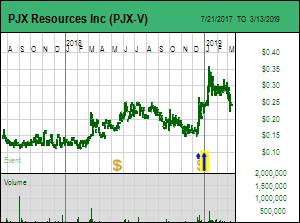

One of the problems with gravity data is that it measures relative density on a horizontal plane which creates interpretation problems if a plunging massive sulphide body is present. PJX thinks the MT data is much better at pinpointing a conductive body in space, though distortions can occur when multiple separate massive sulphide bodies are present. The point of the above diagram, however, is that the 2015 holes tested the gravity target without delivering a discovery, and that the MT anomaly is deeper and a much more viable target given the geological context of the Vine project whose outcropping Vine vein is only 800 m to the southwest and could represent a remobilized portion of the original SEDEX style deposit. PJX at 118.9 million shares fully diluted, a 100% net interest and a $0.245 stock price is implying a value of $29 million for the Vine project which is fair speculative value for a $2 billion outcome that is still at the target testing stage. Such a target value outcome is what an underground minable zinc-lead-silver a third the size of Sullivan would be worth. When I talked to John Keating at PDAC he figured another 2 weeks to reach target depth, but when I talked to him on Tuesday he indicated that progress has been slower and it is still a couple weeks, essentially the end of March before target depth is reached.

While the company may report intersecting visual mineralization, unless the interval is long and spectacular, the market will likely wait until assays are in hand before responding in a meaningful manner because at that depth we do need to see grades of 10% plus combined zinc and lead. For those reluctant to take the plunge ahead of a discovery hole but eager for some exposure to the upside, an alternative would be Bottom-Fish Spec Value rated Highway 50 Gold Corp on whose Golden Brew project in Nevada 50% farm-in partner Regulus Resources Inc is getting ready to start a drill program testing an under cover Lower Plate window. Highway 50 needs to raise money to resume drilling its own deep Sullivan II target at Monroe which would be more palatable if something is happening on the Nevada CTGD project and PJX pulls a discovery hole at Vine.

|