| Kaiser Watch August 22, 2023: Will NPK survive the 2023 sales slump? |

| Jim (0:00:00): How did Verde Agritech's alternative potash sales do during the first half of 2023? |

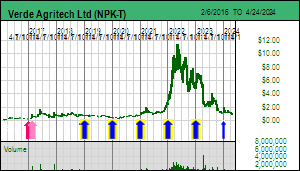

Verde Agritech Inc announced its Q2 results on August 14, 2023 and the market justifiably had a negative reaction. Revenues of $10.3 million in Q2 compared poorly to $24.9 million last year ($21.43 million H1 2023 compared to $36.165 million H1 2022), which was not surprising since potash prices declined 40% in H1 of 2023 after dropping 50% during H2 of 2022 from the 2022 peak. More disappointing is that physical volume in Q2 of 107,000 tonnes was just over half of the 202,000 tonnes sold in the same quarter last year. In total NPK sold 215,000 tonnes in H1 of 2023 compared to 314,000 tonnes in H1 of 2022. This is very disappointing because during H1 of last year NPK's capacity was only 600,000 tpa; today it is 3,000,000 tpa and NPK is not even achieving last year's first half capacity limit.

The company managed to squeak out a $133,000 net profit and EBITDA of $4.1 million (CAD) but that is not what caused the stock to fall below $3 on August 14 when the results were released. It is about concern that NPK's push to eventually sell 50 million tonnes of K Forte annually is failing. If Q2 sales volume during a key potash application period does not improve significantly in Q3, Brazil's second key fertilizer application quarter, Verde Agritech will fall well short of its 800,000-1,200,000 tonne 2023 target. It could end up achieving the same sales volume as in 2021. So an obvious question is, was the sales spurt in 2022 a temporary panic response to soaring KCl prices caused first by Lithuania's sanction related decision to stop letting Belarus ship its potash through the country, and then by Russia's Belarus backed invasion of Ukraine which raised fears potash supply from both countries would be disrupted? Or is there another reason why the demand slump this year may prove temporary, keeping alive NPK's dream of eventually supplying more than half of Brazil's potash demand?

According to the company the slump has been caused by a farm credit crisis that has prevented Verde Agritech from competing with the major potash importing fertilizer companies. Despite all the anxiety during 2022 about soaring food prices, an anticipatory global supply response reversed the crop price trend in H2 of 2022, and Brazilian farmers, hoping for a turnaround in Q2 of 2023 before financing their fertilizer input needs with crop forward sales, instead saw crop prices slump further in Q2 of 2023. A key driver for subdued food demand has been the high interest rate policy pursued by Global West central banks to bring inflation down to their 2% target. In 2022 Brazil increased its benchmark Selic rate to 13.75%, which halted the decline in the BRL against the USD. It also helped bring Brazilian inflation down to 3.99% which has prompted a modest decrease to 13.25% with a gradual decline to 8.25% projected for 2025. If the current inflation rate is stable, this implies a real interest rate of 9.26% which, of course, makes the real rate attractive relative to real rates elsewhere. For the farmers, however, all this is bad news because their crop prices have deflated. It is also bad news for NPK because the average rate for its lines of credit is 16.6%, which results in its lending rate to K Forte purchasing farmers to average 18.6%. The major fertilizer companies like Cargill, Nutrien and Mosaic, however, have access to credit in the 5%-6% range, which allows them to extend cheaper credit for the farmers' fertilizer purchases. They can also sweeten the deal by throwing in extra products the farmer might otherwise choose to do without. This credit crisis effectively froze out Verde Agritech as a supplier of alternative potash.

After the initial shock the stock has recovered but only because last month NPK disclosed that K Forte permanently converts about 120 kg of CO2 per tonne of K Forte into an inert mineral, or about 100 kg/t after accounting for CO2 emissions related to producing, grinding, shipping and applying K Forte to fields. The company is now focused on creating a carbon credit product it can sell to international groups such as Microsoft with voluntary goals seeking to offset their carbon footprints by purchasing carbon credits. Depending how much NPK gets for its carbon credits, it could use these proceeds to discount the price of K Forte relative to KCl and achieve market penetration in this manner. This potential to use carbon credit sales to escape the parity pricing strategy could attract a deep-pocketed buyer of the company.

Initially I was quite enthusiastic about this development, but only because I assumed that David Manning's study involved empirical measurements of glauconite grains combining with CO2 to form a carbonate mineral as they weathered, similar to what FPX Nickel Corp proposes to do with ultramafic rocks dominated by a magnesium mineral called brucite. While the European government regulated carbon credit market currently commands a price around $100/tonne CO2, according to an Aug 23, 2023 NYT article by Peter Coy, To Fight Climate Change, We Need a Better Carbon Market, the carbon credits peddled in the voluntary carbon credit market trade at $2/tonne or less because they have a, pardon the pun, a credibility problem. NPK's two press releases have referred to carbon credit prices ranging from $100 to $500, but has not indicated what price it hopes to get for K Forte linked carbon credits. When I stumbled upon a page within its web site on How it Works, I realized that Manning's study is about the theoretical concept where ground up rock undergoes chemical weathering which causes a reaction with atmospheric CO2 that results in bicarbonate ions dissolved in water. The bicarbonate ions do not permanently sequester the carbon until they flow into the ocean where they combine with calcium and magnesium ions to form mineral carbonates that settle onto the sea floor. NPK has not disclosed any details about Manning's study, but I now suspect it is just a computer simulation model rather than a physical measurement. My optimism has consequently shifted to skepticism until we learn how K Forte's carbon capture can be verified and what price the carbon credits could capture on a large scale approaching the 50 million tpa output goal.

That, however, does not affect the original reasons why I think the Brazilian agricultural sector could undergo large scale adoption of K Forte as an alternative fertilizer to imported potassium chloride (KCl). One key reason is that applying K Forte to soil does not punish it by killing beneficial micro-organisms that keep soil fertile as does the dissolved chloride ions that are left behind when plants take up the potassium. The other reason is that two nasty members of the Global East, Russia and Belarus, could soon undergo a major supply disruption again.

According to the USGS Belarus produced 8 million tonnes of K2O equivalent potash in 2021, which dropped 50% to 4 million tonnes in 2022. Russian production dropped from 9.1 million tonnes in 2021 to 6.8 million tonnes. Total world production in 2021 was 47 million tonnes of which Belarus and Russia represented 17% and 19.4% respectively or 36.4%. Global potash production in K2O eq terms) dropped to 40.9 million tonnes in 2022, which drops the Russia-Belarus share to 31.3%; most of the drop is attributable to the slump in Belarus and Russia output. Vancouver KCl prices soared over $1,200/t in early 2022 when Russia invaded Ukraine, though the price had already risen from its $200/t holding pattern to $800/t in 2021 as the world rebounded from the covid pandemic. During H2 of 2022 the price came down sharply as the supply disruption from Belarus and Russia ended (no sanctions were imposed on potash exports), a vigorous policy of interest rate hikes to combat not so transitory inflation got underway at the halfway mark, and farmers decided to cut back on potash usage in light of abnormally high prices. Potassium, which plays a role in plant resilience to disease and thus boosts overall yield in a negative sort of way, is the only one of the 3 key fertilizers (nitrogen, phosphorous and potassium) that a farmer can omit for a couple years before crop yields decline.

The recovery of potash supply from Belarus and Russia may, however, only be temporary. Russia's invasion of Ukraine has now settled into a war of attrition between Russia and Ukraine which Russia will win the instant the United States withdraws its support for Ukraine, a goal for some of the Republican 2024 presidential candidates, including Donald Trump, who admire much about Putin and his autocracy. Putin's invasion of Ukraine has been such a disaster on all fronts that Yevgeny Prigozhin, head of the Wagner mercenary group which had been called into Ukraine to help out, mounted a strange coup attempt in late June. Instead of using aircraft to wipe out the convoy on its way to Moscow, Putin let the march plod onwards until magically Lukashenko brokered a deal that caused Prigozhin to call off the coup attempt which supposedly was aimed at Putin's military commanders rather than Putin himself. Putin offered a deal for the Wagner mercenaries to join the regular Russian army, and those who declined were allowed to relocate to Belarus, supposedly to train Belarusian troops how to fight. Since then the world has witnessed a strange charade where Prigozhin seemed to be flitting about Russia while his mercenaries seem to have returned to the Sahel where they were possibly helping Niger's military overthrow its democratically elected leader, Mohamed Bazoum, on July 26.

On July 26 the US State Department issued a Level 4 Travel Advisory not just advising people not to travel to Belarus, but also stating that "US Citizens in Belarus should depart immediately". Since then there has been a build of Polish, Lithuanian and Latvian troops on their side of the Belarus border, supposedly to stop an influx of refugees, not Belarusians, but rather refugees from the Middle East that Lukashenko has imported with the goal of exporting them to NATO Europe as a destabilization tactic. This advisory was not reported on by the media until this week. It made me wonder if the Wagner group was going launch a suicide mission from Belarus into Ukraine as part of an escalation by Russia of the conflict. The Russian ruble was tanking against the USD and this time around even a major interest rate hike was not working to stop the decline. Since the Wagner group has now been disowned by Putin, any military action by Prigozhin's mercenaries would be fair game for US intervention. The resulting mess could turn Belarus into a hot conflict zone and take its potash supply offline.

So were my thoughts when I recorded the KW episode on August 22. But on August 23 while preparing the written comments and graphics we learned that a private airplane with 10 passengers on board had crashed about 30 minutes from Moscow on its way to St Petersburg where Prigozhin has his headquarters. Prigozhin's name and that of his Wagner lieutenant Dmitri Utkin were on the passenger list. All 10 bodies have reportedly been found though identities have not yet been revealed. The NYT reported: "Russia's Investigative Committee, a top law enforcement body, announced the opening of a case on the plane crash, on suspicion of a violation of air transport safety rules." If Prigozhin is among the dead, this probably spells the end of the Wagner group. It also simplifies Putin's war on Ukraine and ramps up the likelihood that a major escalation will happen before the end of the year. Given how hopelessly deep a hole Putin has dug for himself, anything could happen, though that might also include a safety issue with one of his airplanes, which really would require all of us to rethink the future. |

Verde Agritech Ltd (NPK-T)

Favorite

Good Spec Value |

|

|

| Cerrado Verde |

Brazil - Other |

9-Production |

K |

Verde Agritech results for H1 of 2023 |

Examples of crop price behavior |

How Brazil's high real interest rates push NPK to the sidelines |

Verde Agritech's 2023 volume sales guidance looks hopelessly high |

Global Potash Supply in 2022 |

Potash Supply of Belarus & Russia relative to Global Supply |

Potash price and USD:RUB exchange rate charts |

| Jim (0:12:20): Anything new with the James Bay Lithium Great Canadian Area Play? |

The fire access restrictions for much of the James Bay region of Quebec have been lifted. The SOPFEU fire map shows red outlined burned areas as no longer opaque, meaning the fires are subsiding, and much of the James Bay area is rated low (blue) or moderate (green) fire danger. The exception is the area on the southeastern side of James Bay which is still rated high fire danger (yellow) and is the reason the Billy Diamond Highway is still closed, making it impossible to access the east-west Trans Taiga Highway that passes through the heart of the northern part of the James Bay region where Patriot Battery Metals recently reported a world class lithium resource. Rain is now drenching much of the region and it looks like the fire season is over.

Many juniors have announced that boots are being mobilized onto the ground. The bad news is that barely more than 2 months of the regular 5 month summer exploration season remains for juniors to prospect key areas of the James Bay region where a variety of exploration strategies have identified pegmatite targets to be assessed as being of the LCT type. I haven't seen the confirming document, but apparently Quebec has extended claims assessment deadlines by one year, which is bad news for serious juniors but good news for armchair speculators who have map staked in prior years without doing any actual exploration work but are now enjoying an influx of Australian juniors willing to do outlandish option deals.

There is no reason to complain, because these ASX-listed juniors come with an army of Australian investors who not only understand the big picture energy transition story and its need for a 600% expansion of global lithium supply by 2030 to keep on track the EV contribution to net zero emission goals for 2050, but they also understand that Canada has an extraordinary geological potential to rival Western Australia in terms of hardrock sourced lithium supply. In fact, some may even be wondering if Canada hosts a pegmatite deposit to rival Greenbushes, which is comparable in scale to Brazil's Araxa niobium deposit, but, in contrast, woefully insufficient to supply the world's future lithium needs. Serbia's Jadar lithium deposit isn't quite a Greenbushes, but Rio Tinto claims the world needs 60 Jadars to meet 2035 demand, though Rio Tinto does assume claystone, Lithium Triangle salars, and oilfield brines will prove to be non-events.

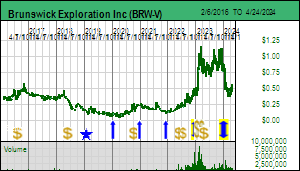

It will be at least 2-3 years before we know if these other sources will be a reliable supply source, so the EV sector is looking hard at Lithium Mania 2.0, namely the hunt for LCT type pegmatites whose size and grade can be quickly quantified, and whose conversion into battery grade lithium carbonate or hydroxide does not hinge on new process technologies that will take another 2-3 years to demonstrate commercial scale viability. It is possible that in 3 years process technologies aimed at these alternative sources of lithium will show that a nearly unlimited supply of lithium can be mobilized at a cost well below what is needed for pegmatite supply, which currently is about $5/lb lithium carbonate. That would be the preference of the car makers. But time is of the essence and they cannot afford to gamble on innovative process technology stories when demonstrated process technologies can be taken to the bank. It is the reason why Albemarle, which produces lithium ion battery precursor materials, stepped up and handed PMET $109 million for a 4.9% equity stake at an implied value approaching $2 billion for a project that has only just delivered a maiden resource estimate. The Canadian exploration scene has a 2-3 year window to show what it has, the Australians get it, and Canadians are slouching on the sideline like a bunch of sad sacks. No wonder some KRO members who are mainly based in North America and Europe are trying to figure out how to trade ASX listed stocks and why Brunswick Exploration Inc has resigned itself to seeking a dual listing on the ASX.

I initially planned to create a Lithium Index representing all serious Canadian, US and Australian listed lithium companies, but given how successful ASX-listed companies were as they embraced the Lithium Mania 1.0 cycle between 2015-2018, after which their success tanked the lithium carbonate price during the 2019-2020 period now called the "Lithium Winter", I'm not sure what an all lithium types index trend would tell us today, especially if I apply an equal weighting for all index members on the starting date. Once I saw PMET deliver a world class maiden resource estimate for its Corvette project in the James Bay region, I decided to create an index consisting of juniors with land in this part of Quebec.

The criteria for membership is that the company must have a land position in the James Bay region. The index is based on $1,000 worth of stock based on the closing price of August 1, 2023, and it has been backdated to December 30, 2022. Initially I wanted the company to have a stated intent to explore for lithium to qualify for membership, but as I surveyed the field I realized that a lot of horrible juniors had claims in the James Bay region covering ground with questionable LCT-type pegmatite potential, and yet there were a number of pig-headed anti-lithium gold or base metals focused companies sitting on very lithium prospective ground. So I shanghaied those juniors and included them in the KRO James Bay Lithium Index along with the flaky juniors, because the nature of Lithium Mania 2.0 is such that any patch of ground could turn out to host low hanging fruit in the form of a major lithium pegmatite deposit.

Currently there are 54 members which are presented in the snapshot table below. I am sure there are some ASX juniors that are missing, and perhaps even some Canadian juniors, so this index will be retroactively adjusted over the next month. Please email me at [email protected] with the name of any company you think belongs in this index.

I have created the index as a tool to measure market response to the Great Canadian James Bay Lithium Area Play that is emerging in the James Bay region of Quebec and as an analytical framework. Most weekly Kaiser Watch episodes will include updates on developments within the James Bay region. But the Index link above will be behind the KRO paywall, and, through a combination of posts within the KRO Slack forum and Trackers posted to KRO itself, KRO members will get real time commentary on James Bay Lithium Index developments. The overall junior resource sector is in bad shape, and there are too many forks in the road to the future for me to predict which region or metal will become the next hot trend. But I am confident the lithium story which is linked to the energy transition goal is only going to get bigger. Prime Minister Justin Trudeau through his foolish dance with Canada's First Nation wolves could scuttle Canada's role as a major supplier of critical minerals needed for the energy transition, but for now I am betting Canadians will say no way to second class citizenship subordinated to a race based aristocracy.

KRO James Bay Lithium Index - Market Activity for August 22, 2023

| Company |

SVR |

Volume |

High |

Low |

Close |

Chg |

MI% |

RS% |

W% |

| Allkem Limited (AKE-T) |

|

20,800 |

$12.470 |

$12.070 |

$12.070 |

($0.130) |

-1.1% |

2.8% |

1.8% |

| ALX Resources Corp (AL-V) |

|

157,000 |

$0.030 |

$0.025 |

$0.025 |

($0.005) |

-16.7% |

-12.8% |

1.9% |

| Arbor Metals Corp (ABR-V) |

|

813,200 |

$3.360 |

$3.270 |

$3.290 |

($0.010) |

-0.3% |

3.6% |

1.9% |

| Arctic Fox Lithium Corp (AFX-CSE) |

|

237,000 |

$0.120 |

$0.110 |

$0.120 |

($0.010) |

-7.7% |

-3.8% |

1.9% |

| Auq Gold Mining Inc (AUQ-V) |

|

35,000 |

$0.080 |

$0.080 |

$0.080 |

$0.000 |

0.0% |

3.9% |

1.2% |

| Azimut Exploration Inc (AZM-V) |

|

4,000 |

$1.050 |

$0.990 |

$1.010 |

$0.040 |

4.1% |

8.0% |

1.5% |

| Battery X Metals Inc (BATX-CSE) |

|

8,300 |

$0.075 |

$0.070 |

$0.070 |

($0.040) |

-36.4% |

-32.5% |

2.7% |

| Benz Mining Corp (BZ-V) |

|

500 |

$0.360 |

$0.360 |

$0.360 |

$0.005 |

1.4% |

5.3% |

2.0% |

| Brascan Gold Inc (BRAS-CSE) |

|

240,000 |

$0.015 |

$0.015 |

$0.015 |

($0.005) |

-25.0% |

-21.1% |

1.2% |

| Brigadier Gold Ltd (BRG-V) |

|

423,000 |

$0.045 |

$0.040 |

$0.045 |

$0.000 |

0.0% |

3.9% |

1.4% |

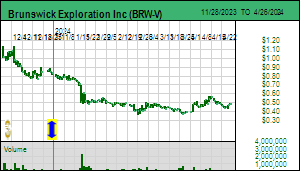

| Brunswick Exploration Inc (BRW-V) |

|

220,500 |

$0.990 |

$0.920 |

$0.980 |

($0.020) |

-2.0% |

1.9% |

2.2% |

| Bullion Gold Resources Corp (BGD-V) |

|

0 |

$0.000 |

$0.000 |

$0.025 |

$0.000 |

0.0% |

0.0% |

1.6% |

| Champion Electric Metals Inc (LTHM-CSE) |

|

397,900 |

$0.125 |

$0.115 |

$0.125 |

$0.010 |

8.7% |

12.6% |

1.9% |

| Clarity Metals Corp (CMET-CSE) |

|

18,000 |

$0.075 |

$0.075 |

$0.075 |

$0.005 |

7.1% |

11.0% |

1.8% |

| Comet Lithium Corp (CLIC-V) |

|

16,500 |

$0.590 |

$0.520 |

$0.520 |

($0.070) |

-11.9% |

-8.0% |

2.6% |

| Cosmos Exploration Ltd (C1X-ASX) |

|

664,882 |

$0.585 |

$0.530 |

$0.540 |

($0.040) |

-6.9% |

-3.0% |

2.7% |

| Critical Elements Lithium Corp (CRE-V) |

|

584,400 |

$1.420 |

$1.320 |

$1.380 |

$0.030 |

2.2% |

6.1% |

1.5% |

| Cygnus Metals Limited (CY5-ASX) |

|

881,829 |

$0.230 |

$0.215 |

$0.220 |

($0.010) |

-4.3% |

-0.5% |

1.4% |

| Dios Exploration Inc (DOS-V) |

|

415,000 |

$0.100 |

$0.095 |

$0.100 |

$0.005 |

5.3% |

9.1% |

1.9% |

| Fury Gold Mines Ltd (FURY-T) |

|

4,400 |

$0.495 |

$0.490 |

$0.490 |

$0.005 |

1.0% |

4.9% |

1.8% |

| Genius Metals Inc (GENI-V) |

|

10,000 |

$0.055 |

$0.055 |

$0.055 |

($0.005) |

-8.3% |

-4.5% |

1.5% |

| Green Battery Minerals Inc (GEM-V) |

|

13,500 |

$0.050 |

$0.050 |

$0.050 |

$0.000 |

0.0% |

3.9% |

1.9% |

| Harfang Exploration Inc (HAR-V) |

|

119,500 |

$0.175 |

$0.160 |

$0.170 |

($0.010) |

-5.6% |

-1.7% |

1.9% |

| Infinity Stone Ventures Corp (GEMS-CSE) |

|

10,000 |

$0.045 |

$0.045 |

$0.045 |

$0.000 |

0.0% |

3.9% |

1.3% |

| Li-FT Power Ltd (LIFT-CSE) |

|

17,700 |

$8.590 |

$8.350 |

$8.500 |

$0.100 |

1.2% |

5.1% |

1.8% |

| Lithium Lion Metals Inc (LLM-CSE) |

|

11,000 |

$0.045 |

$0.035 |

$0.035 |

$0.000 |

0.0% |

3.9% |

1.0% |

| Lithium One Metals Inc (LONE-V) |

|

115,000 |

$0.240 |

$0.205 |

$0.230 |

$0.020 |

9.5% |

13.4% |

1.6% |

| Livent Corp (LTHM-N) |

|

2,373,800 |

$22.258 |

$21.750 |

$21.980 |

$0.120 |

0.5% |

4.4% |

1.7% |

| Loyal Lithium Limited (LLI-ASX) |

|

3,754,858 |

$0.810 |

$0.650 |

$0.710 |

($0.080) |

-10.1% |

-6.3% |

4.3% |

| Manning Ventures Inc (MANN-CSE) |

|

250,000 |

$0.020 |

$0.020 |

$0.020 |

$0.000 |

0.0% |

3.9% |

1.3% |

| Max Power Mining Corp (MAXX-CSE) |

|

155,700 |

$0.640 |

$0.600 |

$0.630 |

($0.010) |

-1.6% |

2.3% |

1.9% |

| Medaro Mining Corp (MEDA-CSE) |

|

22,500 |

$0.135 |

$0.130 |

$0.135 |

$0.010 |

8.0% |

11.9% |

2.4% |

| MegaWatt Lithium & Battery Metals Corp (MEGA-CSE) |

|

0 |

$0.000 |

$0.000 |

$0.185 |

$0.000 |

0.0% |

0.0% |

2.0% |

| Midland Exploration Inc (MD-V) |

|

0 |

$0.000 |

$0.000 |

$0.485 |

$0.000 |

0.0% |

0.0% |

1.6% |

| Mont Royal Resources Ltd (MRZ-ASX) |

|

0 |

$0.000 |

$0.000 |

$0.225 |

$0.000 |

0.0% |

0.0% |

2.2% |

| Mosaic Minerals Corp (MOC-CSE) |

|

21,000 |

$0.065 |

$0.065 |

$0.065 |

$0.000 |

0.0% |

3.9% |

1.8% |

| Musk Metals Corp (MUSK-CSE) |

|

67,500 |

$0.100 |

$0.065 |

$0.065 |

($0.035) |

-35.0% |

-31.1% |

1.3% |

| Ophir Gold Corp (OPHR-V) |

|

22,100 |

$0.420 |

$0.370 |

$0.390 |

($0.010) |

-2.5% |

1.4% |

1.5% |

| Opus One Gold Corp (OOR-V) |

|

1,000 |

$0.020 |

$0.020 |

$0.020 |

$0.005 |

33.3% |

37.2% |

1.5% |

| Patriot Battery Metals Corp (PMET-V) |

|

152,100 |

$11.950 |

$11.140 |

$11.400 |

($0.600) |

-5.0% |

-1.1% |

1.5% |

| Q Battery Metals Corp (QMET-CSE) |

|

91,600 |

$0.030 |

$0.030 |

$0.030 |

$0.000 |

0.0% |

3.9% |

1.7% |

| Q2 Metals Corp (QTWO-V) |

|

83,300 |

$0.850 |

$0.810 |

$0.820 |

($0.030) |

-3.5% |

0.3% |

2.0% |

| QCX Gold Corp (QCX-V) |

|

0 |

$0.000 |

$0.000 |

$0.050 |

$0.000 |

0.0% |

0.0% |

2.1% |

| Quebec Precious Metals Corp (QPM-V) |

|

189,000 |

$0.080 |

$0.075 |

$0.075 |

$0.010 |

15.4% |

19.2% |

2.1% |

| Recharge Metals Ltd (REC-ASX) |

|

252,731 |

$0.230 |

$0.205 |

$0.205 |

($0.005) |

-2.4% |

1.5% |

1.7% |

| Sirios Resources Inc (SOI-V) |

|

122,000 |

$0.045 |

$0.045 |

$0.045 |

$0.000 |

0.0% |

3.9% |

1.7% |

| Spod Lithium Corp (SPOD-CSE) |

|

0 |

$0.000 |

$0.000 |

$0.110 |

$0.000 |

0.0% |

0.0% |

1.8% |

| Stria Lithium Inc (SRA-V) |

|

21,500 |

$0.225 |

$0.210 |

$0.215 |

$0.000 |

0.0% |

3.9% |

2.0% |

| Superior Mining Intl Corp (SUI-V) |

|

65,000 |

$0.455 |

$0.410 |

$0.420 |

($0.040) |

-8.7% |

-4.8% |

2.1% |

| Tearlach Resources Ltd (TEA-V) |

|

105,000 |

$0.110 |

$0.105 |

$0.105 |

$0.000 |

0.0% |

3.9% |

1.8% |

| Visible Gold Mines Inc (VGD-V) |

|

71,500 |

$0.135 |

$0.135 |

$0.135 |

($0.010) |

-6.9% |

-3.0% |

2.5% |

| Vision Lithium Inc (VLI-V) |

|

30,000 |

$0.085 |

$0.080 |

$0.080 |

($0.010) |

-11.1% |

-7.3% |

1.7% |

| Winsome Resources Ltd (WR1-ASX) |

|

582,548 |

$1.620 |

$1.570 |

$1.580 |

($0.030) |

-1.9% |

2.0% |

1.7% |

| MI% = change in member's index value, RS% = difference in change between overall index and member index values, W% = value weight of member |

The big development this week in the James Bay region was news on August 21, 2023 that Brunswick Exploration Inc has identified the source of the 1,700 m by 200 m spodumene bearing boulder field it reported in June following one day it had boots on the ground on the Mirage project before being forced to evacuate by Quebec's forest fire closure. The news was very positive because it indicated that the boulder field had been extended to 3 km, but, more importantly, that up ice a cluster of spodumene bearing outcrops resembling the boulders had been prospected along a 2.7 km trend that was still open to the northeast.

When I first read the June news release I assumed the boulder field was parallel with the ice direction which in this part of James Bay is generally from northeast to southwest. Brunswick had not published any maps of its Mirage land position or anything showing the location and orientation of the boulder field. But when Brunswick first announced the Mirage project, which included a 100% option of the Lac Elsace claims owned by Jack Stoch's Globex Enterprises Inc, I tracked down an old claim map on Globex's web site and had a rough idea of what the geology looked like. The claims in the area were tracking greenstone belt trends prospective for gold and base metals system which Andre Gaumond's Virginia companies had chased in prior decades when Remi Charbonneau noticed pegmatite boulders he had the skill to recognize as containing spodumene, the preferred lithium mineral. He had pitched the idea to various people, including Bob Wares, but decades ago (2005) lithium was a $200 million market supplied by Chilean salar brines, Australia's Greenbushes pegmatite monster, and Albemarle's puny Silver Peak brine mine in Nevada, so nobody cared.

In early 2022 Bob's encyclopedic memory resurfaced the spodumene boulder story and he tracked down the source (Remi Charbonneau now works for Brunswick). Much to his annoyance Jack Stoch's Globex, which benefited handsomely from Bob's conversion of the depleted Malartic underground vein play into a major bulk tonnage gold mine, owned claims covering the approximate location of the boulders. So he did a reasonable deal which Jack was happy to do because he knew James Bay was a monstrously disappointing precious and base metals also ran. But Globex did manage to keep a net 2% NSR. The area, however, was a dog's breakfast of fragmented claim ownership, and while Brunswick staked open ground covering what was the obvious geological trend that would also be prospective for LCT type pegmatites, there were holes owned by others.

Having obtained only a one day visual snapshot of the boulder area before being forced to evacuate, Brunswick became concerned about tying up additional ground. It mentioned that it already controlled 13 km of the up-ice direction of the boulder field, so people like myself concluded that it would only be a matter of time before the up-ice source would be found. Although no diagrams were provided by Brunswick, the news release led one to conclude the 1,700 m by 200 m boulder field was parallel to the ice direction. After 3 decades of diamond exploration everybody is quite familiar with the idea that an indicator mineral train identified through till sampling will lead back to a circular pipe-like kimberlite source. But while kimberlites are created by sub-vertical magmas starting from a depth of more than 150 km, below the diamond stability field, pegmatite bodies are lateral magmatic flows that exploit linear zones of weakness.

Since the Globex map showed the northeast trend of the prospective rocks, I assumed the source would be an elongated pegmatite parallel to the ice direction. That left plenty of size potential open, but also the negative scenario of a pinpoint source with limited tonnage potential - for example, a 200 m wide kimberlite pipe equivalent. When I explained this to Brunswick CEO Killian Charles he reacted quite adamantly that the boulder field was perpendicular to the ice direction, emphasizing that if this were not the case, the source could be an inconsequential pinpoint. To me that was a very significant revelation, because there was no way such a configuration could exist in glaciated terrain unless the pegmatite source was very local, with the boulders possibly frost-heaved. So in KW Episode June 23, 2023 I declared that, based on the spodumene crystal composition of the Mirage boulders and the distribution of the boulder field relative to the ice direction, Brunswick was sitting on a major lithium discovery.

Monday's news release revealed that my conclusion was based on nonsense. The diagram published by Brunswick showed that the boulder field, which had grown from 1,700 m to 3,000 m, was parallel to the ice direction. The good news was that up ice as the frequency of boulders decreased, Brunswick had prospected outcropping pegmatite with similar spodumene crystal composition along a 2.7 km trend that was still open to the northeast. This suggests an elongated pegmatite zone similar to the CV5 PMET has at Corvette. Based on spacing Brunswick has reported that there appear to be 5 pegmatite dykes with apparent widths of 25-80 meters and a maximum exposed length of 100 m. The importance of the width depends on the dip of the dykes, which we will not know until they are drilled. If they are shallow dipping the width is not significant, but if sub-vertical the widths represent substantial tonnage potential. The observed strike length is a function of bush, over-burden, swamp and water. What matters is the distribution of outcrops along 2.7 km up ice from a 3,000 m long 200 m wide train of boulders most likely barfed up from this minimum 2.7 km outcrop trend. The market reacted positively to the news because it saw a setting similar to what has delivered a $2 billion valuation to PMET for its Corvette project.

So why did the CEO blow misleading nonsense into my ear? It is impossible that field workers like Francois Goulet were confused about ice direction and its relationship to the boulder field's orientation. The best explanations are that the CEO was very confused because he is so busy interfacing with the market rather than the field, or he fed me misinformation in order to assist with an underlying task of tying up additional ground in this area of fragmented claim ownership. Neither of these explanations pleases me.

On the plus side, thanks to maps being published by others with claims they hope to option to other juniors, and no thanks to Brunswick which has not published any useful claim maps, it is clear that Brunswick has struggled to consolidate its ownership of what appears to be a major new lithium sub-district within the James Bay region. Monday's news release included comments on two option agreements. The more important one was about 8 claims that have been folded into Brunswick's bigger 90% option from the Osisko group which includes Plex, Anatacau West and Anatacau Main. There are no extra payments or spending requirements, but Brunswick nets only 75% in these claims while Osisko is carried to a production decision. If the claim map submitted into the KRO Slack forum by a member is valid, these claims sit inside the Globex option, and while they do not cover the area identified by Brunswick as having pegmatite outcrops, some appear to be immediately up ice.

Brunswick also announced an expensive staged earn-in option on ground owned by IMinerals, which appears to be the successor to a company called 1Lifestyle Holdings which managed to secure extremely onerous terms for pasture proximal to PMET's Corvette project from the Keith Schaefer pump job called Tearlach Resources. My googling efforts to find out who is behind this entity failed, so anybody who does know, feel free to shoot me an email whose source will remain confidential. Tearlach, whose treasury Schaefer helped load has been depleted in such a monstrous manner I may eventually turn the financials into an educational case study of bad management, has almost zero chance of vesting in any of its properties.

I was thus appalled to see the deal Brunswick did. I'm not sure where those 1Minerals claims are located, but it looks like this vendor has lifted at least $500,000 from Brunswick's treasury just to prevent those claims from ending up elsewhere, possibly in Aussie land. I suspect there is a temporary strategic reason for this option, which may allow Brunswick to drop the option before its onerous terms kick in, but I have to admit I am not impressed. In any case, there is clearly a lot of intrigue, and that is one key aspect of a Great Canadian Area Play. Eventually I may learn why it was important to make me look like a fool by feeding me the false perpendicular story, which could prove beneficial to my ownership of Brunswick and the fact that Brunswick is a KRO Fair Spec Value rated Favorite that KRO members loaded up on last year when I tagged it as a Lithium Mania 2.0 linked bottom-fish. But based on basic disclosures it looks like Brunswick has harvested some low hanging fruit which it has threatened to drill in September. I think this story will repeat itself over and over again within the 54 company collection that currently makes up the KRO James Bay Lithium Index. |

Brunswick Exploration Inc (BRW-V)

Favorite

Fair Spec Value |

|

|

| Mirage |

Canada - Quebec |

2-Target Drilling |

Li |

SOPFEU Map of Fire Situation in James Bay as of Aug 23, 2023 |

Tentative Map of Brunswick's Mirage Arera |

Globex Property Map : Before lithium and after lithium |

Brunswick Mirage Boulder-Outcrop Distribution |

KRO James Bay Index featuring Brunswick Exploration Inc |

| Disclosure: JK owns shares of Brunswick and Verde Agritech; Brunswick is a Fair Spec Value rated Favorite, Verde Agritech is a Good Spec Value rated Favorite |