| Kaiser Watch September 8, 2023: Albemarle gets serious about Liontown |

| Jim (0:00:00): What did you think about the FPX Nickel prefeasibility study? |

FPX Nickel Corp released the results of its Decar prefeasibility study on September 6, 2023 and they were very good for a mining project with a mining rate of 108,000-162,000 tpd. After tax NPV at 8% came in at USD $2.01 billion with an IRR of 18.6% using $8.75/lb as a nickel base case price (LME nickel has been range bound this year at $9-$10/lb). AT NPV at 8% discount rate is slightly below CapEx of $2.182 billion but close enough to clear that hurdle. The IRR at 18.6% is good for such a large project. The resource, now classified as probable which is higher quality than required for a PFS, is roughly the same as the PEA estimate but the LOM grade has improved from 0.121% to 0.13% nickel (DTR as opposed to total nickel grade). The 36 year mine life has been shortened to 29 years by expanding the operating rate from 108,000 tpd to 162,000 tpd in year 11. The PFS assumes selling most nickel concentrate to the stainless steel market with a 95% payability of the LME nickel price for contained nickel, while the mixed hydroxide product (6.5% of recovered nickel) is sold at 87% payability, presumably to the battery market. No revenues were assigned to the magnetite by-product. The cobalt and copper content in the ferro-nickel concentrate is also not included because it is only recoverable by processing the ferro-nickel concentrate with the nickel sulphate refinery.

FPX Nickel has included a refinery option with a scale that would annually produce 40,000 tonnes of nickel contained in a nickel sulphate product suitable for the battery sector. FPX does not disclose what cobalt price it assumes when it reduces the refinery OpEx with the cobalt and copper credits. The 300 tonnes of copper are meaningless, but 700 tonnes of cobalt dropping out as a mixed hydroxide product could be meaningful to a car maker using a battery that still requires cobalt, especially if being able to certify where it came from is important. The refinery is presented as an extra $448 million CapEx for a separate facility located in an urban setting where the talent needed to run a chemical plant is readily available. If you look closely at the refinery option numbers you can see the project NPV increases only $117 million from $2,010 million to $2,127 million while total CapEx swells to $2.67 billion, undermining the development hurdle that NPV should match or exceed CapEx. Furthermore, if the nickel sulphate refinery is presented as a standalone operation for a third party, its AT NPV of $117 million is woefully below the $448 million CapEx the third party would have to spend. The refinery option detracts from the economic value of the basic Decar mine producing ferro-nickel concentrate for the stainless steel market, and doesn't make much economic sense to an independent battery maker or battery precursor chemical company purchasing FPX's ferro-nickel concentrate at the $8.75/lb base case price. The inclusion of this economically non-sensical refinery option, however, is very important.

For whatever reason FPX chose not to spell out the annual nickel output for the two phases, quoting just 59,000 tpa LOM average, but by running the equation "operating rate x 365 days x grade x 88.7% recovery" for the 2 sets of operating rates and grades I get 47,203 tpa nickel output for Y1-10 and 67,133 tpa for years 11-29. What this means is that if the refinery option were developed at the proposed scale, and that would only happen with a hard offtake agreement that guarantees the refinery operator an annual ferro-nickel feed that contains 40,000 tonnes of nickel, during the first decade of production only 7,000 tonnes of nickel would be available for the stainless steel market.

FPX Nickel could have chosen any scale for the refinery option, but to choose this particular 40,000 tpa scale would have required external guidance. When FPX Nickel announced a $12 million investment by a mystery strategic investor last year CEO Martin Turenne let it be known that FPX would be listening to feedback of the mystery investor. Since there is no reason for a major mining company to be so secretive about a 9.9% equity stake in a company with a project it might eventually want to acquire and develop, nor for FPX management to need the wisdom of a mining company about how to build a basic open-pit mine yielding a ferro-nickel concentrate destined for the stainless steel market, and with nothing of technical importance possibly coming from the managers of a financial institution, it is fairly safe to conclude that the mystery investor is involved somewhere in the downstream supply chain of the EV sector, which could be a chemical precursor company, a battery maker, or even a car maker, of whom only the latter has any strategic need for secrecy about it backing a project that had not yet delivered a PFS.

This became more evident when this year FPX Nickel announced a $16 million investment by another strategic investor, this time Finland based Outokumpu, which specializes in producing relatively clean stainless steel for those markets which care about the ESG credentials of their inputs. The arrival of Outokumpu as a disclosed 9.9% strategic investor was a critical milestone, because a market concern has been that there might not be any stainless steel maker willing to utilize the Decar ferro-nickel concentrate, at least not without a deep payability discount. The PFS assumes that the nickel content of its ferro-nickel concentrate will be payable at 95% of the LME nickel price, even though Decar's nickel output will never pass through the LME or Shanghai refined nickel warehouses (the original Cliffs PEA assumed a much lower payability, though the concentrate was only 12% nickel compared to 60% today after FPX figured out how to apply a flotation circuit to the concentrate produced by magnetic separation). The Outokumpu financing grants the stainless steel maker an offtake right at market price for up to 7,500 tpa over 8 years at prevailing LME prices. Outokumpu would not have made its $16 million investment and asked for an offtake right if its due diligence had not confirmed that it can cost effectively work with the ferro-nickel concentrate. And since "cost-effective" is a function of what the stainless steel maker pays for the nickel feedstock, that 95% payability was probably worked out between FPX Nickel and Outokumpu before the deal was inked. Furthermore, given that Outokumpu could tap into global markets and secure nickel feedstock from any dirty source, possibly with a discount to the LME benchmark, asking for this benchmark linked right implies that Outokumpu sees economic and strategic value in having a nickel supply from Decar.

As I pointed out, the refinery option does not add much economic value to the PFS if a mining company were to build Decar, nor is it a rational proposition for a battery precursor chemical company. A more likely party to be interested in the sub-economic refinery option is a battery maker which will offset the low return from the nickel sulphate refinery through the markup it gets manufacturing batteries that include nickel in the cathode. Such a markup would not be vulnerable to accusations of "greenwashing" or geopolitical supply disruption.

There are, however, a number of battery makers and they face the risk that new battery configurations emerge with different metal inputs. The IEA, in its 2021 World Energy Outlook Special Report: The Role of Critical Minerals in Clean Energy Transitions, has a chart on slide 89 which shows how much of the different critical minerals each of the major lithium ion battery types requires. One of them is the lithium iron phosphate battery (LFP) which requires no nickel and less lithium than any of the other battery types. On slide 96 the IEA shows projections for 2020, 2030 and 2040 about the share it thinks the various battery types will represent for light duty (passenger cars) and heavy duty (trucks and buses) electric vehicles. The LFP battery is expected to gain only a fraction of the future light duty EV market but dominate the heavy duty EV market. Yet in 2023 we hear that the Chinese carmaker BYD is selling more LFP powered cars than the other battery types. And we hear that Tesla plans to offer LFP powered models to the American masses.

The LFP battery relies on graphite for the anode, which is why LFP cars are vastly inferior to a solid state lithium iron battery which uses lithium metal in the anode rather than graphite. In fact, in its 2023 report the IEA has switched to the view that the truck transport future beyond 2030 will be powered by hydrogen fuel cell technology, ironically, what Toyota has been working on at the expense of going beyond its hybrid offerings (Prius) into consumer EVs. So the question I ask, would a major battery maker be interested in making a strategic investment in a nickel project that will not be producing nickel before 2030?

I don't think a major battery maker would make a secret strategic investment in FPX Nickel to secure a future nickel supply unless it either possessed a killer battery technology that allows a solid state lithium ion battery to become reality, has a long term supply deal with a car maker determined to use a battery with nickel in the cathode in 2030 or beyond, or a relationship with a car maker that believes it has the key to a solid state lithium ion battery that still requires a meaningful nickel input for the cathode. That is why Toyota or a battery maker proxy remains my key suspect as the mystery investor. The NYT had an article on September 7, 2023 called Toyota, a Hybrid Pioneer, Struggles to Master Electric Vehicles which describes how Toyota is losing market share in China and North America because it has failed to provide a range of desirable EV models, choosing to stick to its hybrid offerings. Toyota has justified this stance by arguing that its hybrids have a lower carbon footprint than EVs and that current affordable battery technology just isn't good enough for wide scale adoption. That is why it was blockbuster news when a couple months ago Toyota boasted that it will begin selling a high end EV in 2027 with a 1,200 km range on a 10 minute charge made possibly through a solid state lithium ion battery which allows lithium metal to substitute for graphite in the anode. Toyota has not revealed what metals will be needed for the cathode, but if it still requires nickel, that has huge implications for FPX Nickel's Decar project.

Toyota is not going to salvage its shrinking car market share by offering an expensive competitor to the models Tesla currently sells in North America. It has dominated the car market with its Camry and Corolla models which the masses embrace because they are affordable and high quality. The solid state lithium ion battery breakthrough was not accomplished with a new configuration, but rather a manufacturing process breakthrough. The media tends to focus on the physical input costs for an EV which requires a much broader range of metals than an ICE car. The choice of the best battery configuration will be limited by the manufacturing cost. If a highly effective solid state lithium ion battery configuration has already been established, but is extremely expensive to make, then it is useless for the EV sector. But if Toyota has solved the manufacturing problem enough to offer a high end model by 2027, how long will it take before the manufacturing process has been further refined so as to make such a battery affordable to install in a Camry or Corolla? Is 2030, about the time when Decar should come on stream if its permitting cycle is not blockaded, a reasonable estimate for Toyota to launch a massive comeback with EV versions of its popular models built in Canada or the United States that blow away LFP powered cheap EVs? A lot of effort went into figuring out the refinery flow-sheet and the scale of the refinery option seems designed for a carmaker's future needs. We don't know what battery technologies will power cars in 2040 and beyond; it could even be the hydrogen fuel cells Toyota has been working on. But it is important that Baptiste is primarily a supplier to the stainless steel market and would continue to be so in 2040-2060 when it expands mining to 162,000 tpa, with an option to divert 85% of the first decade's nickel output to the battery sector.

Missing from the PFS news release is any talk about Decar being a clean source of nickel, other than the company pointing out that CO2 output will be 2.4 tonnes per tonne of nickel as a result of being able to use hydro power. That means the project as described is not achieving the holy grail of carbon neutrality. Concrete news about the carbon sequestration potential of the brucite rich tailings could stir future market interest. But, based on slide 196 in the 2021 IEA report, a 2.4 t CO2/t nickel footprint compares nicely to 11 tonnes CO2 for sulphide sourced nickel, 19 tonnes for HPAL processed laterite, and about 60 tonnes CO2 for matte nickel made via nickel pig iron, the primary production method used in Indonesia after massive investments by Chinese entities when Indonesia banned the export of raw laterite ore during the past decade. The Indonesian nickel is not only dirty because of its huge CO2 footprint, which is due to Indonesia's heavy reliance on coal powered electricity, but also because Indonesian nickel mines emit a lot of downstream pollution that hurts surrounding communities. Nickel sulphate from Decar would not only qualify for IRA subsidies because it is sourced from Canada which for now is deemed friendly by the United States, but also because the Decar nickel will have a certifiable chain of custody that would allow a car maker to plausibly claim ESG credentials for the nickel input. There will be no second-guessing questions that nickel sulphate made from refined sulphide concentrates ultimately came from the dirtiest nickel sulphide mine in the world operated by a country in the grip of a thug.

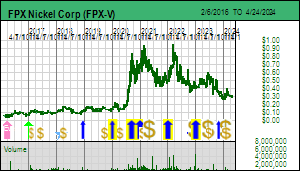

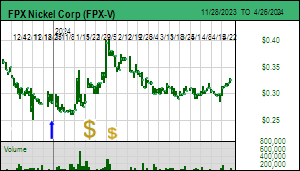

How does one convert the PFS outcome into a fair price for FPX Nickel Corp stock? Under the rational speculation model fair value is defined by the value of the expected outcome (the after tax net present value) multiplied by the certainty of that outcome. FPX has stated that the certainty of the PFS is plus or minus 25%. The project is now shifting to the permitting-feasibility study stage which is expected to lead to mine approval in 2027. The certainty ladder range for a project at this stage is 50%-75%, which is USD $1 billion to $1.5 billion or CAD $1.3 billion to $2 billion. Divide that by 258 million fully diluted shares and the fair value range is $5.00-$7.75 per share. The lower number reflects the 3 years Decar can expect to spend in the next stage of the exploration-development cycle. So why has the stock dropped a couple pennies to $0.38 since the PFS news where the market is assigning an implied value of only CAD $108 million to Decar?

The cloud hanging over the project is the Tl'atz'en Nation's unilateral declaration that its clearcut logged traditional territory is now sacred, and that it will not allow a mine to be built on it. On August 9, 2023 FPX Nickel announced that it was aware of a new development involving one of the First Nations groups with which it has had a cooperation agreement since 2012 and the stock tanked. Because of confidentiality agreements and a complex underlying turf war between different First Nation groups claiming overlapping "traditional territory" FPX is not in a position to shed light on the problem which I discussed in KW Episode August 11, 2023: Time for Canada to fix its First Nations Problem. Retail investors are spooked and institutional investors are too worried about China's slow motion implosion and the risk of a global recession arising from central bank monetary policies to take the resource sector seriously. FPX Nickel's strategic investors don't care because with $30 million working capital the company can fund all the permitting and engineering stuff required over the next couple years; their standstill agreements prevent them from buying stock in the open market. A potential competitor in the car or battery sector might want to secure a strategic equity stake, but probably will not do so by buying stock in the open market and triggering an upwards repricing of the stock to better reflect the implications of the PFS. The most obvious type of investor to take advantage of the Very Good Speculative Value offered by the current FPX Nickel stock price is a high net worth family office which doesn't have to explain its actions to anybody. But their eyes are on Ottawa where the Prime Minister has blathered a lot about critical minerals and climate change mitigation while at the same time encouraging Canada's First Nations to aggressively pursue their UNDRIP rights which in Canada involves asserting traditional territory control to 400% of the country (thanks to overlapping claims).

A recent Financial Times article wondered out loud why Canada, the second largest nation in the world by land mass, with a population similar to California but vastly better endowed with resources, ranks around 16th place in global GDP compared to fifth place for California. The failure of the federal and provincial government leaders to stand up and declare that local "stakeholder" objections will not stop Canada from becoming a major supplier of reasonably clean critical minerals so as to enable the 2050 net zero emissions goals to become reality is a key reason the market has shrugged at the PFS results. There is a growing sense that Canada has become a NoCanDo Nation. |

FPX Nickel Corp (FPX-V)

Favorite

Good Spec Value |

|

|

| Decar |

Canada - British Columbia |

7-Permitting & Feasibility |

Ni |

FPX Nickel PFS Parameters |

Decar Flowsheet and Recoveries |

29 year Mining Schedule for Decar |

Projected Development Schedule leading to Production in 2030 |

Refinery Option to make Nickel Sulphate for Battery Market |

IEA 2021 Report table showing carbon footprints for different nickel sources |

Metal requirements for different EV battery types |

IEA's vision in 2021 about future battery type demand |

IPV Chart showing Fair Spec Value range for PFS Outcome |

| Jim (0:17:50): Will Albemarle end up acquiring Liontown? |

ASX-listed Liontown Resources Ltd, which is building the Kathleen Valley lithium pegmatite mine in Western Australia, announced on September 4, 2023 that it had received and accepted a conditional and non-binding proposal from Albemarle to purchase the company for AUD $3.00 per share. This follows a similar proposal made on March 28, 2023 to purchase Liontown for AUD $2.50 per share which I discussed in KW Episode March 29, 2023. Liontown rejected the March offer because it was conditional on an exclusive due diligence period which denied the potential for a bidding war and exposed Liontown to downside risk if Albemarle subsequently declined to make a binding offer. The proposal occurred in the midst of lithium carbonate prices crashing from their $30-$35/lb range in 2022. This time around Liontown has agreed to grant Albemarle an exclusive due diligence period and signaled its willingness to accept a binding offer at $3.00, barring a superior bid. Both have agreed that $3 is Albemarle's final offer unless Liontown receives a superior bid, in which case Albemarle, with the benefit of having done due diligence, can up its bid. Liontown has not told us how long this due diligence period will be. Based on 2.2 billion fully diluted the AUD $3 per share price values Liontown at AUD $6.6 billion, which at current exchange rates is about USD $4.2 billion or CAD $5.8 billion.

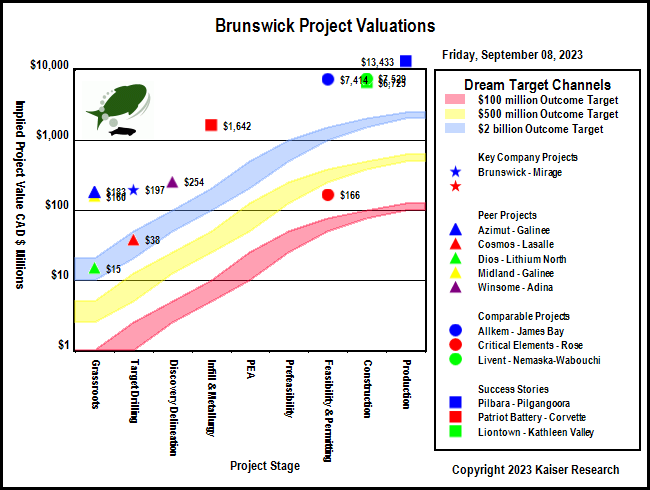

This revised proposal which Liontown management appears willing to accept if it becomes binding after Albemarle completes its due diligence is an important development for the Lithium Mania 2.0 emerging in Canada, especially the James Bay district of Quebec. Liontown acquired the Kathleen Valley project in 2016 from gold producer Ramelius based on LCT-type pegmatite showings as part of Lithium Mania 1.0. Liontown is now in the midst of constructing an 8,000 tpd facility for its Kathleen Valley deposit which has a resource of 156 million tonnes of 1.4% Li2O. The mine, which is projected to cost AUD $895 million already funded by equity and credit, is expected to begin production in mid 2024, 8 years after exploration began. Keep in mind that this project's advancement had to navigate the lithium winter in 2018-2020 when lithium carbonate prices sank from the $10-$15/lb range to below $3/lb where the world will never see the supply expansion it needs to meet net zero emission goals via EV's that use the lithium ion battery. The lithium winter was caused when the supply mobilization from new Australian hardrock mines overwhelmed the demand requirements of the nascent EV sector. This imbalance reversed in 2021, leading to abnormally elevated lithium carbonate prices in the $30-$35/lb range in 2022 which is now trying to find a new equilibrium in 2023.

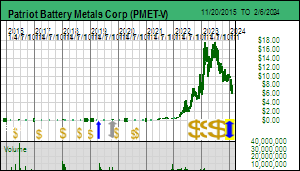

Liontown's Kathleen Valley story, a manifestation of Lithium Mania 1.0 in which Australians very profitably participated, is a poster child for the Lithium Mania 2.0 that is now unfolding in Canada and Brazil with regard to LCT type pegmatite deposits. For Canadian investors snoozing in the new found glory of 4%-5% savings deposit yields after a decade of near zero yields, understanding the Liontown story is a good way to rediscover the notion of rapid 1,000% plus returns in less than two years. The Canadian poster child is the Corvette project whose similar pegmatite showings in the James Bay region of Quebec Patriot Battery Metals Corp began exploring in 2021 (after doing nothing with it during Lithium Mania 1.0 while it held the option on it as an ambulance chasing junior). In July 2023 PMET delivered a maiden resource estimate of 109.2 million tonnes at 1.42% Li2O for the CV5 zone. The next day Albemarle stepped up to buy CAD $109 million in stock at CAD $15.29 per share to acquire a 4.9% equity stake and an agreement to discuss a future lithium hydroxide refinery somewhere in North America. The financing price implied a CAD $2.2 billion value based on 142 million shares fully diluted. PMET stock has since retreated into the $11-$12 share price range as the project shifts into the feasibility demonstration stage and the holders of a large warrant overhang at exercise prices below $1 per share figure out how to exercise the cheap warrants before they expire in December. A short report by Night Market Research has argued that the valuation is excessive given the stage of the project and Canadian risk factors such as arbitrary First Nation wishes and absolutist environmental policies that favor torching the planet to save a few fish.

At Friday's PMET close of $11.68 the Corvette project has an implied value of about CAD $1.7 billion. That is about 29% of the value Albemarle is assigning to Kathleen Valley, which is reasonable given the certainty range for a project at the PEA stage is 10%-25% of the projected outcome value (according to my rational speculation model). Given the similarity in size and grade between Kathleen Valley and CV5 (the proven and probable resource for Kathleen Valley is 68.5 million tonnes at 1.34% Li2O, most of it slated for underground mining), the Albemarle buyout proposal validates the current valuation of Patriot Battery Metals. This is important because the seemingly inbred timidity of Canadians discourages them from taking seriously anything homegrown. (Back in the eighties and early nineties when I worked as an analyst in the Canadian brokerage industry the running joke was that Canadians never accepted a Canadian discovery until it was validated by American buying; with regard to Lithium Mania 2.0 the validation will be created by Australian buying.)

Albemarle is the top diversified lithium producer not dependent on making battery grade lithium precursors in China which has built up excess battery making capacity. A recent Lex blurb in the Financial Times about Albemarle revealed confusion about the difference between the production of lithium and its conversion into battery grade feedstock. China's economy is spiraling into the toilet because Xi Jinping's Maoist vision for China as a totalitarian state enhanced by hyper-surveillance and an alliance with other authoritarian states such as Russia is crushing Chinese citizens into a defensive fetal position even as the rest of the world struggles to reduce its dependency on Chinese production. China's emperor for life has boxed himself into a cul de sac from which the only way to escape domestic insurrection is to create a patriotic distraction in the form of annexing Taiwan. Should it come to this, the excess Chinese lithium concentrate processing and battery making capacity becomes mere dust in the wind. Albemarle getting serious about Liontown goes far beyond enhancing long term shareholder value; it is a strategic move designed to establish it as a premiere supplier of battery grade lithium for the non-Chinese EV sector.

The high probability that the current $3/share proposal will result in Albemarle acquiring Liontown underscores the gain potential participants in the James Bay Lithium Great Canadian Area Play can hope to achieve if they make a similar discovery. And don't worry about too many such discoveries being made; Rio Tinto predicts that by 2035 the world will need 60 Jadars in production in order to supply the lithium needs of the EV production scale required to keep the world on track for its 2050 net zero emission goals. Kathleen Valley and CV5 are each equivalent to one Jadar (btw, the original Jadar is suspended in limbo because its location has been designated by Serbia as a permanent stage for future Heidi movies).

Rio Tinto's 2021 Jadar prediction assumes that the IEA is correct in its 287 page 2021 World Energy Outlook Special Report: The Role of Critical Minerals in Clean Energy Transitions. Slide 6 reveals that an EV will require about 206 kg of critical minerals (excluding aluminum and iron), of which about 10 kg consists of lithium and 67 kg consists of graphite. Rio Tinto's Jadar predictions are based on this lithium requirement, which I assume is represented as lithium metal (many of these demand projections in various venues never mention the lithium units, so it can be confusing).

That IEA report is a couple of years old and is a good illustration of how rapidly assumptions about energy transition related technologies are changing. That report imagines that future heavy duty EV vehicles will be dominated by LFP type batteries which will only feature modestly in light duty vehicles. But today we known the Chinese carmakers like BYD have shifted to LFP batteries for the mass market, and Tesla is contemplating selling LFP cars to the masses in North America. The IEA Energy Technology Perspectives 2023 report released last January in contrast predicts that in 2030 and beyond hydrogen fuel cell technology will dominate heavy duty transport vehicles.

Brand new, however, is Toyota's claim of a manufacturing breakthrough involving solid state lithium ion batteries that provide a 1,200 km range on a 10 minute charge. If true this would involve replacing the 67 kg of graphite in the anode with lithium metal. If the substitution works out to an equal volume basis, then, based on lithium's specific gravity of 0.53, about 23.5% of carbon's 2.26 specific gravity, the anode would require 16 kg of lithium metal, with 51 kg less weight of juice sucking battery material. Assuming the overall battery still needs 10 kg of lithium for the cathode and electrolyte, bringing the total to 26 kg of lithium metal for a light duty EV, the world would need 156 Jadar equivalent mines by 2035. If that became reality, the annual lithium market would easily be worth $200-$300 billion by 2035, more than ten times what it was in 2022, and a thousand times what it was in 2005.

If Albemarle does indeed swallow Liontown, its Australian shareholders will likely deploy a good part of that CAD $5.6 billion liquidity event into the James Bay lithium hunt because Australia cannot fulfill that looming supply gap with more low hanging fruit. And carmakers cannot afford to wait for claystone mines and direct lithium extraction of oilfield brines to demonstrate its lithium carbonate equivalent cost of production. Forget about Africa's LCT-type potential. Zimbabwe has not emerged from Mugabe style authoritarian control. Congo's pegmatite rich interior remains within reach of murderous warlords and corrupt politicians. And the Sahel is spiraling into a battleground between Russian and Islamic thugs. Carmakers thinking about lithium supply in 2030 and beyond when EV adoption goes exponential are all looking at Canada (also Brazil, but the Chinese will out muscle them there).

The only group not looking at Canada are the 95% of Canadians who do not qualify as indigenous. The 5% who claim to own 400% of Canada most certainly are looking at Canadian's lithium supply potential, and while that might explain why Canadians are ignoring Lithium Mania 2.0, they should wake up to the reality that if Canada is to become a major critical metals supplier, the money that pours into the pockets of the indigenous aristocracy will not come from shareholder profits, but rather from the pockets of the 95 percenters in the form of diverting the taxes federal and provincial governments will collect from profitable critical mineral producers. To preserve the idea that Canada's mineral riches will be discovered and developed by venture capital, Canada should adopt a rule that all federal and even provincial income taxes from mining operations should be earmarked for distribution to Canada's First Nations, with no percentage of the project required to be assigned on a carried basis to local First Nations groups, nor should companies be required to waste any effort on "co-operation" deals that are only binding on the companies. The government will collect plenty of tax revenues from the CapEx and OpEx part of the mining equation, which, to ensure development decisions are based on competitive economic factors, should not be required to be larded with inflated local First Nations service contracts. The 95 percenters cannot afford to let Canada become a NoCanDo Nation. |

Liontown Resources Ltd (LTR-ASX)

Unrated Spec Value |

|

|

| Kathleen Valley |

Australia - Western Australia |

8-Construction |

Li Ta |

Albemarle Corp (ALB-N)

Unrated Spec Value |

|

|

| Greenbushes |

Australia - Western Australia |

9-Production |

Li |

Patriot Battery Metals Corp (PMET-V)

Unrated Spec Value |

|

|

| Corvette |

Canada - Quebec |

4-Infill & Metallurgy |

Li |

Table of Major Australian Pegmatite Deposits with 2 James Bay deposits added |

IEA 2021 report table showing how much critical minerals required for EV |

IPV Chart showing how PMET's Corvette valuation compares to Liontown's Kathleen Valley |

| Jim (0:27:35): How did the James Bay Lithium Index do this week? |

The James Bay Lithium Index slipped this week despite the news about Albemarle's revised proposal for Liowntown and more announcements that juniors were getting boots onto the ground. Part of the drag comes from the gloomy news about China's shrinking economy and the threat of higher interest rates to curb inflation lowering expectations for metal demand in the near term. But the continuing drop in the price of lithium carbonate also doesn't help with the optics, though investors should familiarize themselves with my lithium rock value matrix.

Even if lithium carbonate drops to $5/lb, the rock value of an LCT type pegmatite grading 1%-2% Li2O is $273 to $545 per tonne. That's the same as 4.2 to 8.4 g/t gold at a $2,000 gold price. Nobody is ever going to find an open pittable hundred million tonne gold deposit with those grades. There are plenty of skeptics who pooh pooh lithium as having a high crustal abundance, as they do with rare earths and even scandium, but that merely reveals how ignorant they are about the cost of extracting lithium and concentrating it into a form usable for making batteries. Below $5/lb lithium carbonate the world will never see enough lithium supply to make lithium ion battery based EV deployment goals a reality unless there is some miraculous DLE process technology breakthrough. So consider $5/lb a worst case long term floor for the price of lithium carbonate, and then place your exploration bets on juniors with the assumption they will deliver LCT type pegmatite deposits grading 1% Li2O or higher. By the end of 2024 boots on the ground in James Bay may have identified a dozen such deposits with 50 million tonne plus scale implications, sending the valuations of those lucky juniors north of $1 billion. Never before has there been such a low hanging fruit exploration boom dominated by Australian and Canadian resource juniors!

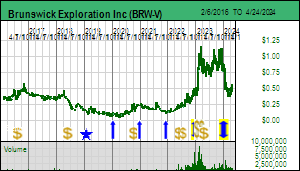

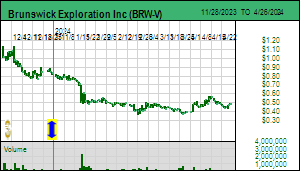

The big news this week was that Brunswick Exploration Inc has started a 5,000 m drill program on its Mirage project where it has identified a 3 km long train of spodumene mineralized boulders down ice from a 2.7 km trend along which it has found multiple pegmatite outcrops with similar mineralization. In fact, according to the September 7 news release which had a conspicuous absence of graphics, this 2,700 m corridor of pegmatite outcrops is now 850 m wide, a result of additional prospecting in the past few weeks. They do not yet know the orientation and geometry of these pegmatite dykes within this corridor which question the scout drilling program will seek to reveal.

In the update Brunswick mentioned that it had found a new 175 m long outcrop 4.5 km up ice from the center of the 2.7 km long outcrop trend. They don't yet know what's under the boulder train to the southwest, but LCT type pegmatite outcrop has now been spotted along a 6 km trend from the up ice head of the boulder train. The less exciting outcome scenario is that this wide corridor is a mish mash of variously oriented pegmatite dykes whose spodumene crystal distribution and size will result in high pegmatite hosted lithium grades that will end up being diluted down when all the waste rock between the dykes is included in a bulk mining scenario. But at this stage of the game it is also legitimate to speculate in an anti-Hearst scenario. Brunswick this winter drilled about 2,000 m on a 65 m long outcropping pegmatite at the Hearst project in Ontario. The hope was that Hearst would be the tip of an iceberg, but the drill showed that along strike there was nothing and at depth the body quickly pinched out to nothing. It was as if the tip of an iceberg had fallen from the sky and buried itself upside down in the Ontario dirt. Well, why not dream about the opposite outcome? What if the outcrops within this 2,700 m by 850 m corridor are all local tips of a giant iceberg, turned into "tips" by glaciation and local topography? What if lurking highly connected beneath the surface is a Greenbushes body capable of sinking multiple Titanics? We don't know yet where within this bleakly pessimistic and hyper-optimistic spectrum the Mirage pegmatite field will turn out to sit, but by early October Brunswick will have a rough idea about the geometry, and by late October assays that will allow back of the napkin tonnage estimates.

James Bay prospecting activity after a 3 month forest fire closure is just getting underway. Brunswick's field crew has found a second spodumene boulder train 2 km west of the southwest oriented boulder train, suggesting a parallel pegmatite corridor which my plotting estimates suggest is within the property boundaries. Given the scale of the Mirage pegmatite field, Brunswick is now the hottest emerging discovery junior in the James Bay region. But the discoveries are just getting started. Brunswick found the boulder train during the first two days in the field in late May before getting kicked out because of the fire closures. And it was able to return to the field in late July because Mirage is in the eastern part of the James Bay region where fires were less a problem than in the western part. If Brunswick's drilling starts to give meaningful shape to its pegmatite dykes over the next few weeks, and the other juniors start reporting LCT type pegmatite outcrops later this month, we will see Lithium Mania 2.0 go crazy in the James Bay region in October, setting the stage for many winter drill programs in Q1 of 2024.

At the May MIF conference in Vancouver I hosted a panel of independent commentators such as myself, and some of the panelists shrugged that they had missed the boat, though one Trumper dismissed the energy transition as a liberal conspiracy by fretting that Wyoming is populated by bumpkins who had never heard of a tungsten enhanced saw that could cut a defunct wind turbine blade down to size for recycling (tungsten, unlike silver, is not a biblical metal).

Yes, they and myself included missed the PMET boat. But PMET is just one Jadar, and according to Rio Tinto the world needs 60 Jadars by 2035, and if my calculations are correct about how much more lithium will be needed if Toyota's boast about a solid state lithium ion battery is not bullshit, the world will need 2-3 times as many Jadars as Rio Tinto predicts. We only missed one Canadian boat. And Brunswick, which KRO members boarded a year ago, is only just leaving the harbor. The JB Lithium Index now has 57 members after I added three ASX listed companies this week. More are coming. If Brunswick's Mirage proves itself to be another Jadar (heaven forbid a Greenbushes!), which within 2 years can command a $2 billion valuation, and, after it gets walked through another 4 years of feasibility demonstration, can attract a $4-$6 billion valuation buyout by the likes of Albemarle, which in a couple years will have serious competition from major mining companies like Rio Tinto, BHP, Anglo American and perhaps even dirty metal producers like Glencore, there is still so much money to be made by latecomers. Brunswick has barely left the harbor and the other boats are just starting to put out to sea. |

Brunswick Exploration Inc (BRW-V)

Favorite

Fair Spec Value |

|

|

| Mirage |

Canada - Quebec |

2-Target Drilling |

Li |

James Bay Lithium Index Chart |

James Bay Lithium Index Daily Up-Down Chart |

Map of Brunswick's Mirage Discovery |

IPV Chart for Brunswick Exploration Inc |

Rock Value Matrix and Lithium Carbonate Price Chart |

| Disclosure: JK owns shares of Bnswcik and FPX Nickel; Brunswick is Fair Spec Value rated, FPX Nickel is Good Spec Value rated |