| Kaiser Watch October 6, 2023: Chief slaps Prime Minister with NoCanDo |

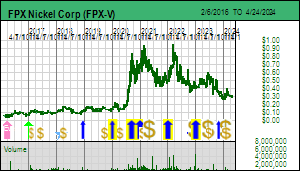

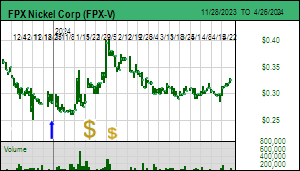

| Jim (0:00:00): Why, despite recent news that Toyota and Panasonic want to work with FPX Nickel on developing a nickel sulphate refinery, did the stock price drop this week? |

FPX Nickel Corp's stock price dropped on Wednesday October 4, 2023 after Chief Leslie Aslin published an October 4 Letter on behalf of the 1,565 member Tl'azt'en Nation repeating an August declaration that this First Nation had unilaterally cancelled a 10 year memorandum of understanding with FPX Nickel and would absolutely oppose any mine on Mount Sydney Williams which he had recently discovered was sacred despite his First Nation community collecting millions of dollars from clear-cut logging the region. I discussed this development in KW Episode August 11, 2023 and pointed out that there is a lot more going on behind the scenes than FPX Nickel can talk about because of confidentiality restrictions. But the latest iteration did knock the stock back below $0.40, and cynics might be forgiven for speculating about unregistered foreign agents acting behind the scenes to harm the Canadian mining sector, especially ones who are concerned about all this talk about cheap EV's with very dirty critical mineral inputs heading for North American and European markets.

Last week in KW Episode September 29, 2023 I talked about the cooperation deal Japanese officials signed in Ottawa with federal officials and pointed out that it made no sense for Japanese companies to invest in manufacturing capacity in Canada unless Canada can supply critical minerals that qualify as clean. If companies like Toyota and Panasonic cannot get clean nickel or lithium from Canadian mines, they might as well build their factories in the United States where the resulting quality jobs will be welcomed, even in states whose Republican leaders decry global warming as a scam and promise to pull the plug on all energy transition policies once in charge of America's destiny (Why Trump and the Rest of the G.O.P. Won't Stop Bashing Electric Vehicles).

On that same day JOGMEC and a JV between Toyota and Panasonic signed a non-binding agreement with FPX Nickel to collaborate on the development of a nickel sulphate refinery that would process ferro-nickel concentrate from the Decar mine that would otherwise go to the stainless steel market. The PFS indicated extra cost of this refinery coupled with the likely market value of the nickel sulphate output does not make economic sense for the operator of the future Decar Mine, but it does for a company like Toyota which wants to sell EVs in the United States it can claim are made from responsibly mined critical minerals (see KW Episode September 8, 2023). This news briefly boosted FPX Nickel's stock price back above $0.50 because the market assumed that Prime Minister Justin Trudeau would make policy decisions that are good for Canada as a whole rather than just for a 5% race based minority that aspires to aristocratic privileges not available to ordinary Canadians by playing a reconciliation guilt card for which the vast majority of Canadians bear no responsibility.

On Monday government employees got to enjoy a holiday funded by the taxes of the 95% of Canadians who do not have indigenous DNA which the Prime Minister calls Truth and Reconciliation Day. Chief Aslin's repeat of his earlier letter is not really aimed at FPX Nickel, because there is nothing new in it. What it really represents is a slap in the face of Justin Trudeau to remind him that all federal government decisions involving Canada's mineral resources must be subordinated to the will of Canada's First Nations who have traditional territory claims over a land mass several times the area of Canada thanks to overlapping and competing territory claims by different First Nation groups.

Trudeau, of course, will not have noticed because he lives in a bubble world fretting about stuff that is irrelevant to Canada becoming a key player in the energy transition and buttressing with real economic growth the values that distinguish Canadians from the increasingly lunatic Trump base in the United States. But FPX Nickel shareholders did notice, and, realizing that Trudeau may be just stringing the Japanese along with false promises, which they will soon enough figure out as they observe a complete absence of any pushback from federal and provincial governments face-slapped by Chief Aslin, dumped the stock back below $0.40.

Why does Chief Aslin want Canada to become a NoCanDo Nation? Is he truly concerned about environmental harm caused by FPX Nickel's proposed Decar Mine? If he is truly concerned, he qualifies as an absolute simpleton. The Tl'Azt'en has had an MOU with FPX Nickel since 2012 which, in addition to undisclosed payments, will have included keeping it up to date about the nature of the Decar project. It is impossible for the Tl'Azt'en not to be aware that the Baptiste nickel deposit at Decar is very unusual, in effect a natural stainless steel deposit. What makes stainless steel special and so important in the world is that it does not react with most chemicals. The tailings will not only be benign, but the brucite content will actually sequester carbon dioxide permanently as an inert mineral. The ability to convert Decar's ferro-nickel concentrate into battery grade nickel sulphate should be of identical interest to Canada's 5% indigenous population as it is to the rest of the Canadian population.

But let's be honest. It is unlikely that Chief Aslin is a simpleton who has not bothered to read anything about the proposed Decar nickel mine and what it means not just in terms of revenues, but also in terms of energy transition goals and minimal environmental impact. Stupid people don't work their way into positions of power.

The alternative explanation is that Chief Aslin is a cynic engaged in an extortion racket being run by First Nations against the Canadian government facilitated by non-profit organizations such as MiningWatch which involves howling about how a mine in their traditional territory will forever change their lifestyle. Here is his big howl: "A fully developed mine on or near Tselk'un would be a devastating and irreversible environmental trauma to Tl'azt'en Nation members' lands and waters. It would also significantly and negatively impact Tl'azt'en Nation members' relationships with those lands and waters and all that they contain, and their cultural security as a distinct people." Gosh, what playbook did Chief Aslin grab this sob story from?

Consider this 2009 MiningWatch article, BC Government Breaks the Law - Nak'azdli vows to stop Mt. Milligan mine. Nak'azdli Band Councilor Anne Marie Sam wrings her hands: "This government is in a financial mess and lured by the promise of dollars it is willing to overlook the fact that the Mt. Milligan Mine will forever change the lifestyle of the people that have lived off the lands for generations and rush into an ill-prepared plan to extract low-grade copper and gold." It turns out she was absolutely right about the lifestyle impact.

Flash forward to 2012 and read this BC Government News article: Economic Development Agreement signed with Nak'azdli First Nation. Look at the grin on the face of Chief Fred Sam about the deal where about $24 million from the BC government's mineral tax on Mt Milligan will flow into the pockets of the Nak'azdli First Nation over the life of the mine. Yes indeed, the Mt Milligan Mine will forever change the lifestyle of the Nak'azdli First Nation, though how the individual members will benefit is a racist third rail nobody except an indigenous person will dare touch.

How does the Mt Milligan outcome impact MiningWatch? Its employees are just ordinary people (except the privileged indigenous ones) struggling to survive in a dog eat dog world. Donations to MiningWatch sustain the lifestyles of its employees who use this non-profit's pulpit to assist First Nations in an extortion racket pretending to be about protecting the environment in a country that has the most evolved mine permitting system in the world. I would really like to see a breakdown of the donors whose donations fund MiningWatch. Are there any donors to MiningWatch who have reason to care about the welfare of Canada as a whole on an increasingly hostile and unstable global stage? I'd like to hear from them and why they think stopping mines in Canada is not an appalling, hypocritical evil that inflicts harm on humans in jurisdictions controlled by thugs. I want to know why you think you do not have blood on your hands. |

FPX Nickel Corp (FPX-V)

Favorite

Good Spec Value |

|

|

| Decar |

Canada - British Columbia |

7-Permitting & Feasibility |

Ni |

How Tl'Azt'en Nation thinks about Trudeau's NoCanDo Nation |

| Jim (0:11:01): Are there any new developments in the James Bay Lithium Area Play? |

My James Bay Lithium Index has now grown to 68 members after I decided to include the Moblan project of Sayona and SOQUEM as part of the James Bay region, and spotted two additional ASX listings with claims in the region. The most important of these is MetalsTech Ltd which on September 27, 2023 optioned the 30,000 ha Sauvolles claim package to the west of what I have decided to call the Trieste District based on the name of the key greenstone formation associated with the LCT-type pegmatite Winsome Resources Ltd has discovered at its Adina project. KW Episode September 20, 2023 addressed this area and discussed that Rio Tinto has discovered spodumene bearing outcrop on the Galinee project optioned 70% from Midland Exploration Ltd on trend to the east of the Adina project. The arrival of MetalsTech in James Bay with its own 100% optioned property is a very interesting development because the Cancet and Adina properties were spun out of MetalsTech as the core James Bay projects of Winsome. MetalsTech has different management from Winsome, but it says a lot about Australian perceptions when the parent sets up shop next to the child to whom it bestowed what has become a discovery project.

The JB Lithium Index, however, continued to sag during the past week as markets meditated on the sinking price of lithium carbonate and American investment banks chortled about weak lithium prices for the next year. Lithium carbonate prices were stable this week, but that doesn't mean much because most of China spent the week celebrating Golden Week. This holiday combines the October 1 National Day with a week long harvest celebration, and is the first time since the outbreak of Covid in 2020 that the Chinese have been allowed to travel freely to visit family. An October 2, 2023 article in the Financial Times discusses the potential economic impact of 190 million people traveling by rail to their home towns to celebrate, with Beijing hoping the celebration will include a boost in consumption spending. China is now trapped in the jaws of an imploding real estate sector and a very pissed off and frightened population reluctant to spend ahead of a feared massive economic downturn. It will be interesting to see if Golden Week celebrations turned around this negative Chinese sentiment.

As far as I am concerned, the current lithium carbonate price is irrelevant to the potential for the James Bay Lithium Area Play to go ballistic on the upside. My lithium rock value matrix shows that deposits grading 1% Li2O or better are still very much in the money between $5-$10/lb lithium carbonate, and I am of the view that if we suffer another lithium winter where the price drops below $3/lb as it did in 2018-2020, that will merely reflect a temporary imbalance between supply and demand that is irrelevant in terms of how much supply will be needed by 2030 as EV sales go exponential, namely 600% more supply than in 2022 according to the IEA, and, in my view, 1,200% more if Toyota's claim about a solid state lithium ion battery breakthrough is true and can be commercialized for its popular and affordable Camry and Corolla models by 2030.

Resource junior investors have been trained to monitor the metal price, in particular gold, as a guide to market sentiment, but that nonsense needs to be shaken in the case of lithium plays. The world doesn't need any additional gold supply, so there is no imperative to find and develop new gold mines. Uranium is another metal where the market is obsessed with the spot price, and uranium has done quite well this year, turning Cameco into a 62% gainer. But uranium demand growth projections are linked to nuclear power plants plodding through 10-20 year approval and construction cycles, with the only hope for a pleasant upside demand surprise lying with small modular reactor technology which has much shorter adoption and deployment timelines. But even if we get an SMR demand explosion, speculation about uranium prices is burdened by concern that Kazakhstan may have an unlimited capacity to expand supply from its in situ leachable resources, similar to what CBMM can do at Araxa in Brazil with niobium supply.

Lithium is a completely different story, because even another Greenbushes discovery qualifies as merely 2 Jadars, with Rio Tinto projecting the world will need 60 Jadars by 2035, and that assumed a solid state lithium ion battery like now claimed by Toyota never becomes reality. No new lithium pegmatite discovery in James Bay will be in production before 2030, so what the lithium carbonate price does in the meantime is irrelevant. What matters is the growth in EV adoption. Yes, if the Putin Poodle Party gains control of the United States and pulls the plug on energy transition policies, electric vehicles might not end up displacing internal combustion engine cars. That is a risk we need to keep in mind, though ameliorating this risk is that the rest of the world, including China, really doesn't want to remain at the mercy of Russia, Saudi Arabia and the United States for their transportation fuel supply. If the Putin Poodle Party were to insist that Americans must buy ICE cars fueled by obscenely priced gasoline, and China is offering to dump super cheap EV cars into America, even the Trump base will Dump Trump or whatever sycophant ends up serving as his proxy, because at the end of the day, money talks. So while my chain regularly gets yanked by the blatherings of the Putin Poodle Party, I subdue my anxiety by reflecting on the fact that common sense eventually prevails. The EV replacement of ICE is an irreversible trend, especially if you dare to be an optimist and believe that by 2040 fusion energy will have become a commercial reality.

Canadian and American investors have not yet figured out this alternative to gold dynamic, though Australian investors have. However, Australian investors are currently witnessing the decline in revenues from lower lithium carbonate prices affecting their Lithium Mania 1.0 winners. So Australian appetite for emerging James Bay discovery stories is for now muted. The resulting lull, which has the James Bay Lithium Index down 21.8% from its August 1, 2023 creation date, is thus an opportunity for Canadians to take advantage of. But where to begin? Patriot Battery Metals is now in feasibility demonstration mode fully bankrolled by a $109 million financing by Albemarle, and the market has to digest a significant warrant overhang that expires in December. PMET at this stage is dead money, and most shareholders with windfall gains are waiting for 2024 to sell stock so as to defer the capital gains tax hit into 2025. The optics of the sagging lithium carbonate price will deter the Rio Tintos of the world from making an aggressive buyout move, for their shareholders would shriek, "what are you doing, Powell is going to crash the global economy with his 2% inflation target, just bide your time for when blood is in the streets". So PMET is not currently the ATM that fuels buying in emerging James Bay discoveries. The resulting lull in value traded can only be overcome by new money from the sidelines, ideally from Canadian investors. And because Canadians by nature are very risk averse, sledgehammer results will be needed to loosen their pocketbooks.

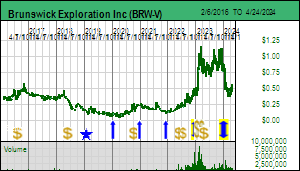

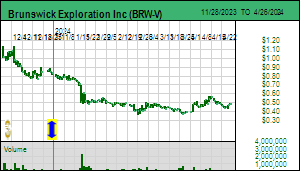

The most important James Bay development this week was an update from Brunswick Exploration Inc announcing on October 3, 2023 that it had discovered a spodumene-bearing outcrop on the Elrond project optioned 85% from Midland Exploration Ltd and that it had drilled 15 holes at Mirage (1,000 m) of which 12 intersected spodumene bearing pegmatite from 12 m to 52 m. The Elrond news is important because it adjoins the Serpent-Radisson project of Harfang Exploration Inc which reported on September 13, 2023 that its boots on the ground had found outcropping spodumene bearing pegmatite (see KW Episode September 15, 2023). Brunswick says the Arwen outcrop at Elrond is 250 m by 100 m and appears to be dipping to the north. Within it Brunswick has identified a spodumene bearing zone with dimensions of 75 m by 15 m. But, based on Brunswick's belief that the pegmatite is shallow dipping and that it does not know true width, the LCT-type enriched portion of this outcrop is quite narrow and does not signal a major discovery. Brunswick points out that this particular outcrop was not previously documented, but occurs uniquely within a collection of pegmatite outcrops that lean toward beryllium enrichment, which is a type of pegmatite that chills out earlier during the migration from the parental magma than the LCT-type pegmatites which fractionate elements with low melting temperatures so that 1% plus Li2O grading spodumene forms. As soon as you hear "beryllium" as the dominant element in a pegmatite, you know it is a bust because whatever lithium is present will not have an economic grade. One of the great puzzles geologists will be trying to solve over the next decade is what allows some pegmatites to outcrop, and in some cases, only a fraction of the zone to outcrop. As with the case of the similar sized Anais outcrop on the 90% optioned Anatacau project, Brunswick plans to drill Arwen in 2024.

The market was not impressed by the Arwen outcrop at Elrond, but it was even less impressed by the update Brunswick provided about the Mirage drilling program. Some KRO members fretted in the KRO Slack Workspace that Brunswick had drilled only 1,000 m in September, which works out to an average of 67 m per hole. (KRO members are extended the privilege of being members of a Slack workspace in which I have created multiple topic channels where members and I post comments, links and engage in discussions - a civilized version of CEO.ca, Stockhouse and HotCopper, civilized because I can suspend anybody I feel is violating basic courtesy principles. I had to do this with one red glowing rocket clown show who immediately cancelled his KRO membership when he realized he had not paid for the opportunity to spam KRO members with his pump jobs.)

The question at Mirage is whether this 2,700 m by 850 m corridor of outcrops up ice from a 3 km train of spodumene bearing boulders represents a giant Greenbushes scale LCT-type body with randomly outcropping tips of the underlying iceberg, or a lacework of skinny dykes which individually have high grades over narrow widths, but are too erratic to mine underground, and, when averaged out to create an open pit mineable deposit, will see the grade collapse well below 1% Li2O, turning it into a Pontax style system. The current drill program of shallow holes from multiple drill pads is designed to help Brunswick understand the geometry of the Mirage pegmatite system. Although the press release stated that drilling will continue as long as weather permits, and planning for a 2024 winter program is underway, the tone left me with the impression that the Mirage system is not really hanging together in a manner that would allow Brunswick to shift into PMET mode after it had sorted out the geometry of the CV5 pegmatite and started resource delineation drilling. The wording of the Mirage part of the press release left the market wondering if Mirage was turning out to be little more than what its name signifies.

Before I had a chance to grill Bob Wares or Killian Charles I came across a October 5, 2023 Betweenplays Interview of Killian Charles by Albert Laurin, which is very useful for somebody like me because when I talk to management directly, I have to be very careful about what I can conclude and make available for public consumption. In a recorded interview such as this, I am absolutely free to interpret and comment on what management has already approved for release to the public. Given that I started out with the impression from the news release that Mirage was not shaping up as well as one might wish, I was surprised by the language and tone of the first 15 minutes. Much of it was blather about Brunswick as a lithium exploration ETF, "blather" not because it isn't true, but "blather" because the stock's current valuation more than fully prices this strategy, and thus is of little interest to me. What interests me is whether the boots on the ground is turning any of the prospects into a discovery delineation play that could become the next PMET.

Once Killian gets focused on Mirage he emphasizes that they keep finding new outcrops within the Mirage property, which tells me that the scale of Mirage's LCT-type pegmatite field keeps expanding, but the most important thing he says is that Brunswick is already preparing for a winterized exploration camp so that apart from the Christmas break they can keep drilling in January 2024. Now the press release does state that, but when I hear the excitement in his voice, I get a much more optimistic message. Some of my KRO Slack members, who may be suffering from a decade long bear market and the hyper-cynicism that tends to spawn, have grumbled that Killian comes across like a perpetual jack-in-the-box, who is trying to buy time from his audience. Since that is his job to do if in fact Mirage has not yet shaped up into a discovery delineation story, one has to pause and wonder. The cynical strategy would be to keep everybody focused on Mirage drilling well into 2024, and before bad news has to come out, shift the market's attention to drilling of the Anais and Arwen targets at Anatacau and Arwen. But then Killian does something which means he is either a super-sophisticated evil demon of the sort that terrorized Descartes, or he is entirely authentic.

He points out that, unlike a gold play where the core visuals don't reveal much about what the gold assays will be, with spodumene bearing core you get a real time and meaningful visual estimate about what assays will deliver as well as what the geometry of the mineralized system is shaping up to be. This is something I have been writing and talking about, but Brunswick doesn't subscribe to KRO and as far as I know ignores whatever I publish via Kaiser Watch. So I don't think Killian Charles is blowing back something he thinks I want to hear so that I keep saying nice things about Brunswick and Mirage. In his Betweenplays interview with Albert Laurin he has in effect revealed that at Mirage they have hooked a lunker, are busy reeling it in, and are not at all worried about losing it. There isn't enough concrete information to justify new money coming in and taking the stock higher, but, in the current apocalyptic market environment, there is enough information to justify holding one's position and waiting for assays whose grades and intervals confirm Mirage is another Jadar (ie CV5) in the making, and become the green light for new money seeking a PMET repeat.

It is worth noting that Killian Charles repeatedly emphasizes what I have been saying, namely that James Bay clearly has a world class endowment, and he acknowledges that every week a new outcrop discovery is being made, and not just by Brunswick. This is a message whose importance the market must appreciate. It is resource junior industry practice for a junior to pound its own chest while crapping on all the other juniors with a similar story (ie the Fipke and Friedland curses - Fipke turned out not to get all the diamond potential at Lac de Gras, though Friedland did in Labrador with his Voisey's Bay nickel-copper discovery). I cannot over-emphasize the importance of this, because it is the abnormal willingness to thumbs up bona fide success by others which will be mutually reinforcing for the James Bay Lithium Area Play as we trudge through the misery facing us during the end of 2023 ahead of lift-off in 2024. |

Brunswick Exploration Inc (BRW-V)

Favorite

Fair Spec Value |

|

|

| Mirage |

Canada - Quebec |

2-Target Drilling |

Li |

James Bay Lithium Index Chart |

James Bay Lithium Index Daily Performance Chart |

Lithium Rock Value and Price Charts |

Brunswick's Mirage Map and Outcrop Corridor |

| Jim (0:17:22): What do the latest Northway results from VR Resources tell us about the potential for a diamond field in the James Bay Lowlands? |

On September 28, 2023 VR Resources Ltd released the final caustic fusion results for the last two holes at Northway which penetrated fresh kimberlite, as opposed to the discovery hole which only penetrated 39 m of crater facies material. In KW Episode September 15, 2023 I pointed out that the recovery of 1 micro diamond fragment from 139.7 kg left open hope for better results from the other 2 holes, but the recovery of only 4 micro diamond fragments in the smallest sieve sizes from 895.5 kg of diatreme material at a minimum tells us that on the basis of micro diamond size distribution results Northway-1 so far has zero macro grade potential. That doesn't mean the 1.2 km wide Northway-1 kimberlite complex is barren, because in the case of the Victor pipe a couple hundred km to the northwest in the Attawapiskatt region, which graded about 25 cpht with a very high carat value, the micro diamond portion of the diamond population was missing. But, from a practical perspective, for a pipe buried beneath more than 200 m of post emplacement cover rock, it will be extremely expensive to extract the sort of large diameter drilling or underground mining bulk samples needed to demonstrate macro grade in a kimberlite whose small end of size distribution curve is missing. Not unexpectedly Northway-1 appears to be a multi-lobed body, which allows eternal optimists to dream that the diamonds are in one of the lobes not yet sampled.

Furthermore, it appears that Northway-1 is a Group II Kimberlite, which Roger Mitchell suggested in the 1990s should be called "orangeite" after the Orange state in South Africa where Group I and II kimberlites existed in close proximity to each other. The good news is that as an orangeite Northway-1 has an origin in the mantle beneath the lithosphere where the diamond stability field exists, and, if diamonds were present at the time of the magma's ascent, the magma could have entrained diamond bearing xenoliths. Less positive is that Group II Kimberlites are less frequently diamondiferous, with the best examples Finsch and Roberts Victor in South Africa. They are closer to the lamproite family than Group 1 kimberlites, of which the most famous example is the Argyle pipe in South Africa which graded a very high 500 cpht but whose diamond population tended to be below 2 carats in size, tinted a brownish color euphemistically called "champagne" or "cognac", and only earned grudging respect because it contained a sub-population of very high value pink diamonds. The negative market reaction, however, correctly signals that the odds for a commercial macro grade at Northway are extremely long at this point.

As far as I am concerned Northway-1 is a dead story, but VR Resources has staked 19 other similar magnetic low anomalies ranging 100-500 m in width. VR interprets the magnetic low signature as a consequence of planet earth's magnetic pole reversal at the time of emplacement during the Devonian period. Earth's magnetic poles periodically disappear, apparently because the molten iron core stops spinning, and reappear when the core resumes spinning, except sometimes it spins in the opposite direction so that the north and south poles switch. When a magma is still molten minerals such as magnetite have a random orientation, but when the magma chills, the magnetic minerals orientate themselves according to the existing poles. The country rock will have done the same when it was molten, but when a younger intrusion solidifies at a time when the poles are reversed, the magnetite minerals will be oriented in the opposite direction. When a magnetic survey is done such bodies will show up as magnetic holes, so called magnetic lows. It doesn't mean the rock is less magnetic, just that the polarity of the crystallized minerals is opposite that of those in the country rock. (Do not ask what happens to the world as we humans know it if earth were to enter a zero pole phase or abruptly reversed the poles.)

The polarity interpretation is important for VR Resources because regardless of the magma content of intrusions that happened during this period of earth's reversed polarity, they would all have magnetic low signatures. The existence of 19 other magnetic low anomalies in the vicinity of Northway-1 suggests that during this time period there was a wave of kimberlite eruptions, all of them buried underneath the younger cover rocks. The next step for VR Resources is to test this hypothesis by drilling some of these other magnetic low targets. But that should not be the junior's priority. The main obstacle still to be overcome is the fact that the Kapuskasing Structural Zone formed 2-1 billion years ago in what could be called a thermal event, whose modification of the pressure-temperature regime of a craton could have caused all existing diamonds to turn into graphite. The PT regime may have returned afterwards and allowed new diamond populations to be formed, but we are no longer dealing with an ancient craton such as the Slave where multiple diamond populations formed over time and were preserved because the craton remained cool and stable.

At this point my preference would be for VR Resources to focus on its New Boston copper-moly-silver project near Luning in Nevada. This was a play developed in the 1970's by a major, but never taken to make or break status because of the inflation turmoil at the start of the 1980s. Whereas diamond plays are always all or nothing with the next round of results, a porphyry system will have zonation and alteration halos which means a drill program can bring a company "closer" to the prize, a process called vectoring. When VR drills New Boston it could get lucky and drill a discovery hole, but a more realistic outcome is evidence the mineralized porphyry system is present, and now we need to figure out where the commercial grade guts of the system is located. Reducing the uncertainty in this manner for a porphyry play should give the VR stock price a lift, and perhaps enable a higher priced fund raising of which some money can be used to revisit the other targets in the Northway diamond play. |

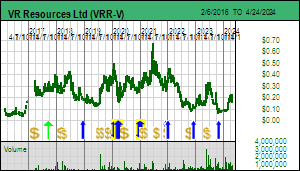

VR Resources Ltd (VRR-V)

Bottom-Fish Spec Value |

|

|

| Northway |

Canada - Ontario |

3-Discovery Delineation |

D |

Micro Diamond Results for VR's Northway Project |

Plan View of Northway-1 revealing 2 potential lobes |

Plan and Section Magnetic Views of Northway-1 |

| Disclosure: JK owns shares of Brunswick and FPX Nickel; Brunswick is Fair Spec Value rated, FPX Nickel is Good Spec Value rated; VR Resources is Bottom-Fish Spec Value rated |