| Kaiser Watch October 27, 2023: What does SQM's Azure bid mean for James Bay? |

| Jim (0:00:00): Why is Azure Minerals such an interesting story? |

ASX-listed Azure Minerals Ltd came to my attention last week when it was halted on October 23 for an announcement on Monday that management had accepted a takeover bid from SQM, the Chilean producer of lithium from brines. I remembered Azure as one of the few ASX-listed juniors from the past decade that would exhibit at North American conferences while it was advancing a couple Mexican epithermal gold plays. By mid 2020 the market had lost interest in the Mexican projects and the stock was limping along just below $0.10. On July 17, 2020 Azure did a deal to acquire 4 projects in Western Australia's Pilbara region from Mark Creasy, the legendary Australian prospector. One of these was the Andover nickel-copper play near the coast just east of Karratha and south of Roebourne. The other 3 were gold plays of which the most interesting was Turner River which is in the area where De Grey Mining Ltdd made the Hemi gold discovery in 2020 by grid drilling shallow holes. Mark Creasy received 40 million shares and retained a 40% stake in Andover and a 30% stake in the gold projects.

The Azure story is very interesting because while the Australians were embracing Lithium Mania 2.0 with a focus on the emerging Corvette discovery of Patriot Battery Metals Ltd in the James Bay region of Quebec in Canada, they were ignoring a major emerging lithium discovery in their own backyard. Lithium Mania 1.0 kicked off in 2015 when the market started to notice the success Tesla was having with its electric vehicles. While Canadian resource juniors flocked to the Lithium Triangle of South America where SQM had long been the dominant producer from the lithium brines beneath the salars, Australian juniors flocked to exposed basement parts of the Pilbara and Yilgarn cratons in Western Australia where pegmatites had been documented ages ago. Most of the Pilbara craton is buried beneath the younger rocks of the Hamersley Basin which is a major producer of iron. But in the exposed area south of Port Hedland there emerged two world class lithium pegmatite mines, Pilgangoora controlled 100% by Pilbara Minerals Ltd, and Wodgina controlled 40% by Mineral Resources Ltd and 60% by Albemarle. The exposed western part of the Pilbara was dominated by precious and base metals exploration, most notably by Novo Resources Corp which developed the Wits 2.0 conglomerate gold play in 2016-2018 that was subsequently eclipsed by De Grey's discovery of 10 million plus ounces of conventional hydrothermally emplaced gold at Mallina.

The prevailing assumption within Australia seemed to be that its juniors had harvested all the low hanging pegmatite fruit in Australia as part of Lithium Mania 1.0, and the new frontiers for Lithium Mania 2.0 were the Archean cratons of Canada and Brazil, and Africa if one dared. Lithium Mania 2.0 emerged in 2021 when it became clear that the car makers had fully embraced EV deployment, the supply imbalance created by the productivity of Australian pegmatite mine developers reversed, and groups like the IEA started projecting a 600% increase in lithium supply by 2030 if EV deployment goals required for 2050 net zero emission goals are to be met. In 2023 Toyota announced a manufacturing cost breakthrough for solid state lithium ion batteries which allow lithium metal to be used in the anode instead of graphite without the problem of dendrite growth which can cause shorts and the dreaded thermal runaway that turns EVs into firebombs. The initial skepticism that the holy grail of the EV sector has been found is shifting to profound optimism, as indicated by this Financial Times October 27, 2023 Big Read: How solid state batteries could transform transport. If this is the coming reality, the world will need 1,200% more lithium supply than the 130,000 tonnes of lithium metal produced in 2022, and lithium will almost certainly become a $100-$200 billion annual market during 2030-2040.

Azure Minerals focused its initial efforts at Andover on delineating a couple small nickel-copper deposits for which an initial JORC estimate was delivered in March 2022 and updated again in 2023. In May 2022 Azure sold the Mexican projects for AUD $10 million cash and $10 million worth of stock in a private company that plans to secure a listing on a Canadian exchange. While Azure continued to explore Andover for nickel-copper zones, a separate exploration team in April 2022 started mapping and sampling outcropping pegmatites. Azure finally reported in October 2022 that it had outlined a swarm of 700 lithium mineralized outcrops within a 4 km by 9 km corridor that also contained the nickel-copper zones. Azure even mentioned that a hole testing a VTEM target for nickel had intersected spodumene. The nickel-copper zones are older than the pegmatites, but both seem to have exploited a structural zone of weakness within the Andover intrusion. The nickel-copper story had helped Azure get to the $0.40 level but by late 2022, despite this revelation and all the buzz about what PMET was accomplishing in Canada's James Bay region with pegmatite within what was once a Virginia greenstone belt gold play, the price had sagged back to about $0.20 by the end of 2022.

Australian investors ignored this lithium development which occurred in the middle of an area Quinton Hennigh had briefly made famous with Novo's Wits 2.0 gold in conglomerate play. SQM, however, was paying attention and approached Azure with a proposal to invest $20 million at $0.26 to secure a 19.9% equity stake which Azure accepted in January of 2023. The market remained unimpressed, even though SQM is a 50:50 partner in the Mt Holland project with Wesfarmers which acquired its stake by paying $776 million in 2019 to acquire Kidman Resources Ltd even as the chill of lithium winter was bringing Lithium Mania 1.0 to an end.

On February 13, 2023 Azure finally reported the assays for the pegmatite interval in the nickel hole, 7.2 m of 1.52% Li2O. That still didn't do much for the stock. In February 2023 they started drilling Target Area 1. On March 15 they reported visuals for the first two lithium focused holes (second graphic). After the May 10 RIU conference where Azure showed some "spodumene" drill section photos the volume began to pick up. On May 31 Azure adds two RC rigs to the 2 core rigs in an effort to speed up "mapping" the pegmatites.

On June 12, 2023 Azure published assays that included 105.0 m @ 1.26% Li20 (including 22.8m @ 3.57% Li20) and all hell broke out as the Australians rushed back home even as a short seller published a report denigrating the resource potential of CV5 (wrong - see KW Episode August 2, 2023) and highlighting the seedier aspects of Canadian marketing methods (cringe). On August 14 in response to ASX pressure about market speculation Azure put out news that on July 12 it had received a non-binding offer at $2.31 from SQM which Azure rejected. Adjusting for the 60% project interest and the 400 million shares fully diluted, this implied a value of AUD $1.6 billion on a 100% basis. On August 22 Azure raised $120 million at $2.40.

On October 25, after being halted on Monday October 20, Azure announced that it had accepted a binding offer from SQM at $3.52 per share which prices Andover at AUD $2.4 billion (Mark Creasy is going to likely get a wonderful payday for his 40% whose implied value is $960 million). The only conditional is that Foreign Investment Review Board (FIRB) needs to approve the takeover. Gina Rinehart, who from June 29 thru October 17 had bought 21,509,214 shares in the market, buys 53,979,114 shares at $3.50 the day trading resumes (Oct 26), and another 6,073,886 on October 27 when she files a substantial shareholder report disclosing that she owns 81,562,214 shares (18.3%).

The SQM bid has 2 components. The $3.52 offer is the plan of arrangement type Albemarle tried with Liontown which required approval from 75% of votes cast for the $3.00 offer which Gina's 19.9% Liontown stake was large enough to de facto block, so Albemarle walked away. That was bad news for shareholders who didn't sell, because Liontown subsequently did a deeply discounted equity financing as a part of a major financing to make sure Kathleen Valley is funded to production by mid 2024. On paper Gina Rinehart took a $400 million bath on what may be a temporary queen's gambit sacrifice (see KW Episode October 20, 2023). Last week I was not sure I was correct about my speculation that Gina is on the warpath to secure a major stake in a future lithium market that will be in the $100-$200 billion annual value range. But her decision to step into Azure with a major equity stake in a project that won't be in production until about 2030, probably later than PMET's CV5 deposit in James Bay, and where the takeover structure is more nuanced that with the Liontown-Albemarle bid, convinces me that Australia's richest citizen is dead serious, and is going to leave Australia's iron men sitting on the fence picking their noses.

The Azure situation is more complicated because SQM also has a takeover offer at $3.50 which does not require shareholder approval. If I understand this correctly, assuming no FIRB objection, SQM can buy everything that comes out at $3.50 while Gina has to stop at 19.9%. If nobody else steps in with a superior bid, SQM could end up in an 80:20 JV with Gina. But that is for only 60% of Andover, with Mark Creasy owning the other 40%. No doubt he is in talks with SQM and Gina about selling his stake because as a private party he can do whatever he wants unless there is a right of first refusal held by Azure which I have not spotted as a disclosure and is not something Creasy would likely have tolerated. If it does exist, and Gina is willing to a higher implied project value (on a 100% basis) for Creasy's 40%, SQM may have to boost its Azure bid and thus secure for Gina a short term trading profit. The problem for SQM is that if Gina scoops Creasy's 40%, SQM's 80% of 60% is 48%, though that may be fine for SQM because at this stage Gina's Hancock Prospecting will have to acquire in house lithium expertise if she is indeed bent on owning part of the lithium supply future.

Why is this so interesting? It is monstrously interesting because this takeover drama is unfolding before there is even a maiden resource estimate, and this has interesting for the sleepy Canadians who are shunning Lithium Mania 2.0. On October 17 Azure published a new presentation which declares an exploration target of 100-240 million tonnes of 1.0%-1.5% Li2O for 3 target areas. A 100,000 m drill program using both RC and core rigs is underway and a maiden resource estimate is expected in Q1 of 2024. This is amazing because 1 year ago this was a crappy nickel-copper play pumped as a battery story with a feeble resource estimate. A year later SQM is prepared to pay $1.4 billion cash for 60% of a property whose swarm of pegmatites Quinton Hennigh and I probably drove over in 2016 when he gave me a site tour of the region and its Wits 2.0 gold story. And Australia's richest person has bought an 18.3% stake in the open market at close to that valuation. This is absolutely stunning!

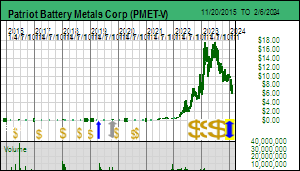

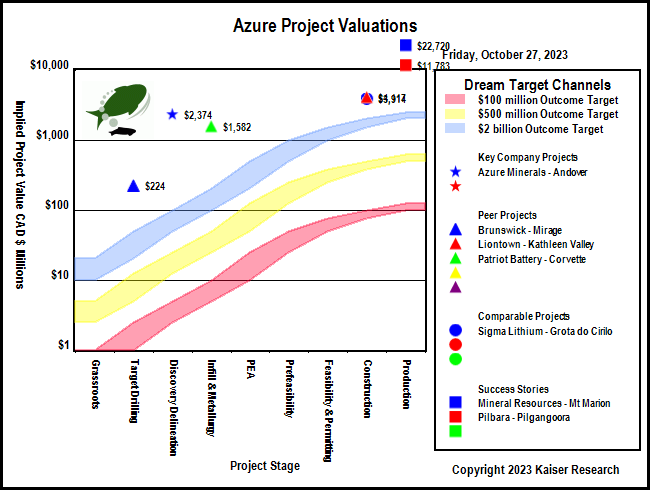

In August Patriot Battery Metals reported a maiden resource estimate of 109 million tonnes of 1.42% Li2O for the CV5 zone within the Corvette project in the James Bay region. The 55 km trend has multiple LCT type outcrops and plausibly shares the same 100-240 million tonne exploration target range as Azure's Andover project. When Albemarle invested $109 million in PMET stock for a 4.9% equity stake it priced PMET at CAD $2.3 billion. Corvette is at least a year ahead of Andover. The aggressive nature of SQM's bid and Gina Rinehart's willingness to get close to a 19.9% stake at the implied AUD $2.4 billion. SQM's only other hardrock lithium exposure is the Mt Holland project where Wesfarmers is the 50% partner after buying out the Australian junior that discovered the deposit. The Chilean government is trying to grind a bigger state share of Chile's lithium portion of the Lithium Triangle, an excellent recipe for fast track supply mobilization. SQM and Albemarle are the primary non-Chinese producers of lithium for the EV sector. Are they going to let the lithium supply future end up being dominated by others? What if Rio Tinto, BHP, Anglo, Glencore and Vale wake up? PMET is currently priced at about $1.5 billion, more advanced than Azure with a similar expansion potential footprint, but only two-thirds the value. PMET is now a sitting duck for a takeover battle. And watch out if Gina Rinehart notices what is happening in Canada's James Bay region.

Whether or not my speculations about the likes of SQM, Albemarle and Hancock turning their attention to the emerging lithium discoveries in Canada's James Bay region prove correct, the most important aspect of the Azure story is that there may be a lot more left to find in Australia than is assumed. The very way the Australians ignored the news flow from Azure about Andover, news flow that North American audiences are starting to appreciate with regard to Canadian lithium pegmatite plays, tells us that the Australian mindset has shifted to seeing greener pastures abroad. For North American investors there may be a Canadian listed opportunity in the form of Quinton Hennigh's Novo Resources Corp which continues to be a substantial landholder on the Pilbara craton, especially the western part where Andover is located. It is also an opportunity for Australian investors because Novo recently secured a dual ASX listing. Despite having a property next door to Azure's Andover project, Novo is crawling along the bottom and may not even qualify for a bottom-fish spec value designation. Why? Because Novo is backed by people like Eric Sprott and Backhoe Bob who are right wing gold bugs not keen about the energy transition. Unlike Gina Rinehart who is a Trumper but not when it comes to assessing business opportunities, these folks are just plain ideologues. The corporate presentation on Novo's web site has a slide which highlights the properties in the West Pilbara and notes that a "divestment process is underway" for the tenements that have "battery" potential. WTF?

Back in 2017 this region was the focus of Novo's Wits 2.0 play, the hypothesis that the gold nuggets fossickers were finding with metal detectors originated from a thin conglomerate bed sitting between the 3 billion plus year old Pilbara Craton and the slightly younger Mt Roe flood basalt that covered everything except a 10-50 km strip between the coast and the edge of the basalt. The steady erosion of the basalt had over time exposed the conglomerate bed whose gold nuggets spilled into the overburden and with rising and falling sea levels got reworked into marine terrace deposits on the basement beyond the edge of the Mt Roe wedge. Quinton Hennigh's hypothesis was that these nuggets were laterally extensive within these conglomerate beds as they are in the Witwatersrand Basin in South Africa. The prevailing view is that the Wits 1.0 gold endowment formed when gold precipitated out of seawater as the first forms of organic life, blue algae, blossomed in shallow lagoons and started emitting oxygen which changed the chemistry of the water. The difference between Wits 1.0 and Wits 2.0 is that the detrital gold grains from Wits 1.0 have the thickness of a hair whereas those in the northern Pilbara were placer style nuggets often the size and shape of watermelon seeds.

In South Africa when you drill through a 1-2 m Wits 1.0 horizon it yields a consistent high grade gold assay because the gold is fine and distributed evenly throughout the horizon. Drilling in the Pilbara had never encountered such gold grades within the conglomerate at the unconformity between Pilbara basement and Mt Roe basalt. The nuggets in the Pilbara craton flats were dismissed as an exotic novelty with no commercial source. Quinton proposed that something similar to Wits 1.0 but also different was going on during the algae cycle in the Pilbara area which caused nuggets to form rather than fine grains that rolled around on the sea floor and abraded their edges to make them look like placer gold. Furthermore, this took place on a systematic large scale. The reason it was not found before was because it is hard to intersect a nugget with drill core. The Wits 2.0 hypothesis was that an enormous gold endowment was embedded within the thin conglomerate bed between the older Pilbara basement and the younger Mt Roe basalt which preserved these beds. Novo staked or acquired all the land straddling the edge of the Mt Roe basalt. The story foundered when it became clear that a resource could only be established with bulk samples which needed to be on a scale of 100,000 tonnes. Under Australian permitting rules that was equivalent to mining which could only be done with the support of a JORC resource estimate. This became a Catch-22 problem because without a large bulk sample Novo could not deliver a JORC resource estimate.

The story died because there was never an explanation for how "nuggets" formed in the quiet lagoons as a result of precipitation from seawater which begins at a microscopic scale. Wits 1.0 has no nuggets, just tiny grains the width of a hair whose edges have been rounded off. Eventually even Quinton Hennigh concluded that these Pilbara nuggets formed from conventional hydrothermally emplaced gold deposits from which they eroded and ended up in these conglomerate beds as is the case on the coast of Alaska and lots of other paleoplacer settings. This killed the Wits 2.0 story which hinged on the idea that the nugget distribution was laterally systematic from lagoon precipitation rather than following some localized river delta pattern emanating from a pinpoint source. Backhoe Bob's vision of just start mining the thin edge of the wedge would have ended up in bankruptcy. Ironically De Grey found such basement hosted gold deposits within the Pilbara craton in 2020 and emerged from the penny gutter to its current trading range between $1-$2 where its 1.5 billion shares give its Mallina project a $2 billion value. Novo has even formed a joint venture with De Grey.

The Azure folks were also initially only interested in the nickel-copper style "battery metals" associated with Andover intrusion. But the team headed by chairman Brian Thomas and managing director Tony Rovira were scientists, not ideologues, and diverted capital to assess this lithium pegmatite potential that was barely visible in the reddish landscape and historically ignored because as recently as 2005 the value of the annual lithium market limped along at around $200 million, far cry from the 1,000 times bigger potential $200 billion future annual market value. This is the story now unfolding on Canada's cratons, and other cratons such as in Scandinavia and Brazil, where pegmatite outcrops were viewed as places to have lunch away from insects. It may be that Quinton Hennigh has already secretly assessed all Novo's Pilbara holdings and concluded there is no LCT-type potential, and is plotting to dump the critical mineral rights onto some sucker group. But until we hear that from Novo management it might be foolish to assume that the Andover intrusion is just a local LCT-type pegmatite freak show which the ever clever Mark Creasy staked for nickel-copper and managed to grab only that part of the intrusion with pegmatite potential, while the Canadian chumps staked the western portion which just had pathetic nickel-copper potential. My gut, however, is that even though Novo's staking strategy was guided by the Wits 2.0 hypothesis, its vastness could very well have captured all sorts of LCT type pegmatite potential obscured by the red landscape. We shall see. |

Azure Minerals Ltd (AZS-ASX)

Unrated Spec Value |

|

|

| Andover |

Australia - Western Australia |

3-Discovery Delineation |

Li Ni Cu |

Patriot Battery Metals Corp (PMET-V)

Unrated Spec Value |

|

|

| Corvette |

Canada - Quebec |

4-Infill & Metallurgy |

Li |

Novo Resources Corp (NVO-T)

Fair Spec Value |

|

|

| Karratha |

Australia - Western Australia |

1-Grassroots |

Au |

The complex gold and lithium dynamics of the West Pilbara |

Chart showing major news events for Azure Minerals |

Andover and Ridgeline Ni-Cu Resources |

Andover Pegmatite Distribution & Exploration Target Scale |

Example of how initial assays improve once the geometry gets sorted out |

Beware Novo's plan to ditch energy transition related upside |

IPV Chart for Azure's Andover and similar projects |

| Jim (0:19:02): Anything new with the James Bay lithium area play? |

The James Bay Lithium Index, which now has 70 members, had a good week, managing to close up modestly every day, but it is still down 23.3% from August 1, 2023 when I created it. Lithium Mania 2.0 has by no means caught on with general audiences. The lithium carbonate price weakened this week again as more bad economic news emanated from China which retaliated against western moves to limit export dumping of state subsidized electric vehicles by declaring export restrictions for natural and synthetic graphite. This is really a warning shot about potential measures that would be much more drastic for car makers outside China. While China dominates in graphite production from natural sources, and making synthetic graphite from hydrocarbon sources, the rest of the world could easily ramp up synthetic production from hydrocarbons, especially the United States. But because China is the lowest cost jurisdiction (don't mention the downstream victims of lousy emission and worker safety standards), everybody is happy to import cheap Chinese graphite. The same applies to gallium and germanium whose export China has also restricted; the way to strip gallium from bauxite conversion to alumina and germanium from zinc smelters is present outside China when the will to do so develops.

Rare earths are another matter, but apart from Japan, what non-Chinese nation makes the rare earth based magnets required for electric vehicles? China exports magnets made from its super-abundance of rare earths, and it is unlikely China will curtail the export of a value added down stream product. However, if supply curtailment turns out to be not China's explicit choice, but rather a functional by-product of western reaction to Chinese aggression such as trying to annex Taiwan or becoming more overt in supporting Iran's proxy war against Israel and Russia's invasion of Ukraine, then Global West car makers will have a problem. And everybody has their heads in the sand about the future rare earth supply problem. Not so, however, about the future lithium supply problem. Although Goldman Sachs thinks China will become a limitless supply of cheap lithium, nobody else does. The corporate takeover actions of major lithium suppliers like Albemarle and SQM in Australia signal that nobody believes China will own global supply for lithium as it does for rare earths, antimony, graphite, and tungsten. China's stranglehold on lithium today involves downstream refining of spodumene concentrates into battery grade lithium hydroxide and carbonate. This vulnerability, however, is well understood, and so it only takes an abundance of will to harness the existing way into conversion capacity outside China.

The scramble afoot now is to secure the future lithium supply needed for an EV sector on an unstoppable track to displace ICE cars. Nothing highlights this more than SQM's decision to try to buy out Azure Minerals Ltd for the astronomical implied amount of AUD $2.4 billion before Azure even has a maiden resource estimate for its Andover pegmatite field which nobody knew about until just over a year ago. Meanwhile, Patriot Battery Metals Corp, which had a similar implied value for its CV5 maiden resource and on trend expansion potential when Albemarle invested CAD $109 million to acquire a 4.9% equity stake in August, is bumbling along at a value of about CAD $1.6 billion. Is this a Prime Minister NoCanDo discount being applied to Canadian resource projects? Gina Rinehart has injected complexity into SQM's straight forward bid for Azure's 60% stake because Mark Creasy, owner of 40%, represents a wild card. However that plays out, what matters is that Gina is no longer just looking at near term production assets, but is also looking at emerging pegmatite lithium discovery plays with world class footprints, discoveries that will not come into production before 2030. Gina Rinehart now personifies the vision of lithium supply becoming a $100-$200 billion market in the 2030's, not as big as iron, but rivaling copper and aluminum, and gold if you want to include useless metals. The iron lady is brushing aside the iron men as if they were mere tin men from the land of Oz.

Next week is important for the James Bay juniors because the AEMQ will hold its annual mining and exploration XPLOR 2023 conference in Montreal from October 30 through November 2. Only 8 James Bay Lithium Index members are exhibiting, but I am sure representatives of all the serious juniors will be present to network and sponge up information. Hopefully government officials will be plugged into what is happening in the James Bay region. The Abitibi greenstone belt activity at this stage is largely a mechanical process which cynics might even dismiss as lifestyle activity. There is zero buzz about Quebec's gold potential. Nor does anybody care about base metal projects. The buzz is all about Quebec's lithium potential, with anxiety focusing on what stance Quebec's First Nations will ultimately take about the development boom in their backyard, and to what Canada's Prime Reconciliation Minister will do to stymie mine exploration and development.

This conference I wish I were attending so that I could take the pulse about the will to turn Quebec into a critical supplier of the lithium needs of the energy transition. The ones I attended during the past decade were fun while held in Quebec City, because they had the cozy feel from when PDAC took place in the Royal York and Roundup in Hotel Vancouver. But the later ones in Montreal were held in this dreary Soviet style concrete dungeon attended by very few delegates, though the low attendance was because the resource junior bear market had extended well beyond the usual 2-3 years of gloom. Attendance was so sparse in 2015 I got to hang out with the Osisko gang (and discover why all these new Osisko juniors were named after scotch brands) which enabled me to have a chat with Bob Wares. I had noted unusual zinc-lead-silver assays coming out of the Hermosa-Taylor project of Arizona Mining, and because Bob was a director we started chatting about it. Based on that happenstance conversation I took a closer look at it, tagged it as a $0.35 bottom-fish for the 2016 collection, and, after I met Don Taylor at the VRIC conference in January 2016 who walked me through the geological story, I turned it into a major recommendation whose $2.2 billion South32 buyout outcome at $6.25 I accurately projected with the help of my rational speculation model, outcome visualization method, and IPV charts. That was so long ago.

Lithium Mania 2.0 was premised on the idea that after the Canadian awakening in 2022 about the world's future lithium supply needs the summer of 2023 would be the most intense "boots on the ground" prospecting season in the history of Canadian exploration. Alas, nobody foresaw that in 2023 Canada would go up in smoke. The most depressing moment for me this year was that weekend in early June when word got out that most of Quebec had been closed to exploration due to unprecedented forest fires. Not only were vast regions closed for safety reasons, but all air transport equipment such as helicopters were requisitioned to support fighting fires in the vicinity of threatened communities. This was not something on could complain about. It was a shot from left field that had to be absorbed. The James Bay region lost two critical prospecting months, and in many areas even August was not accessible. Most juniors got boots on the ground in early September, but many of them had to cease work on September 15, the beginning of the Cree moose hunting season which runs until October 15.

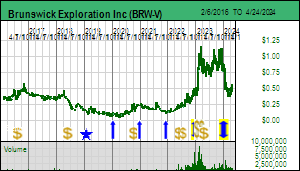

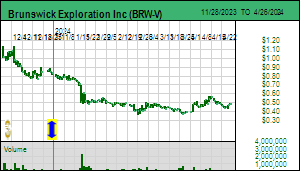

As a result only a handful of juniors are currently drilling pegmatite targets, and only a handful have done enough target development work to justify mobilizing a drill program in Q1 of 2023. Not much gets done during Q2 in the James Bay region other than wrapping up drill programs because spring thaw is a nasty, foggy time of the year, and May is the Cree goose hunting season. Work does not resume until late May when the fog has dissipated and the ground is exposed for prospecting. But within several days of prospecting kickoff in 2023 all field crews were called home to sit out most of the summer. The only consolation emerging from the lost 2023 exploration season is that so much forest burned that 1) not much is left to catch fire in 2024 if we get the same intense conditions, and, 2) a lot of otherwise hidden outcrop will be exposed after the spring rains have washed away the soot. In rugged terrains like northern British Columbia the retreating glaciers give prospectors fresh hope to discover newly exposed goodies, but the glacial retreat is of an incremental upslope nature. The vegetation "retreat" caused by the 2023 forest fires will be laterally monumental. I might add that a third consolation is that all those people who felt they missed the boat will have in fact missed only a very few boats. One I think they will have missed which I introduced in Q2 of 2022 is Brunswick Exploration Inc which has done sufficient work to shortly be in a position to lift off in the manner Azure Minerals did in June 2023.

On September 7, 2023 Brunswick Exploration Inc announced that it had started a 5,000 m drill program at its Mirage project. On October 3 Brunswick reported that it had drilled 1,000 m representing 15 holes of which 12 had intersected spodumene bearing pegmatites up to 52 m in width. A big question with pegmatite outcrops is the orientation and extent of the bodies beneath the surface. "True width" talk is not allowed until drilling has sorted out the geometry. Brunswick indicated assays would be available in the second half of October. Brunswick, unlike Azure, has not been overly helpful with providing graphics to help shareholders understand what is unfolding. KW Episode October 6, 2023 is the most recent discussion about what might be going on at Mirage. An update early next week ahead of the XPLOR conference in Montreal is reasonable to expect. Mirage has the scale to be comparable to Azure's Andover pegmatite field. If Gina Rinehart knows about Canada, and Brunswick delivers evidence that Mirage is a major emerging lithium discovery, be prepared to hold onto your hat. We already know Albemarle knows about Canada. The real question is whether or not SQM also knows about Canada. SQM so far is missing in action as far as Canada is concerned, but SQM did have a booth at PDAC this year along with Albemarle. In light of what happened with Azure Minerals the past week, do not be surprised if positive news from Brunswick about Mirage lights a fire under the James Bay Great Canadian Area Play. |

Brunswick Exploration Inc (BRW-V)

Favorite

Fair Spec Value |

|

|

| Mirage |

Canada - Quebec |

2-Target Drilling |

Li |

James Bay Lithium Index |

James Bay Lithium Index Daily Performance |

Lithium Carbonate Price Chart and Rock Value Matrix |

James Bay Lithium Index Members as of October 27, 2023 |

Brunswick Price Chart |

Maps showing distribution of Mirage outcrops and boulder train |

| Disclosure: JK owns shares of Brunswick; Brunswick is a Fair Spec Value rated Favorite |