| Kaiser Watch March 15, 2024: A staking frenzy in America? |

| Jim (0:00:00): How is your 2024 Favorites Collection doing so far this year? |

The KRO 2024 Favorites Collection was hit hard during January when the sell-off in the lithium sector accelerated in the midst of media handwringing about slowing electric vehicle sales and the crash in lithium carbonate spot prices toward $6/lb. The collection includes lithium juniors Brunswick Exploration Inc, Patriot Battery Metals Corp and Winsome Resources Ltd which slumped hard, dragging the Favorites Index down 19.3% as of February 26. Since then lithium carbonate spot prices have recovered to $7.22/lb, enabling the KRO Index to retrace half its losses so that as of March 15, 2024 it is only down 9.8%.

The relentless sell off this year any time a junior put out a news release, which made the January Effect essentially a no-show, has calmed down amid signs that nickel has bounced off a bottom, copper is threatening to claw its way back above $4/lb, and lithium so far at least has avoided the 2018-2020 lithium winter crash that took carbonate below $3/lb at which price the net zero emission goals for 2030 in so far that they depend on lithium ion battery powered electric vehicles has a near zero chance of being met.

Still drifting lower are the magnet rare earths such as neodymium which is caused by China's weaponization of its dominant supply situation. China has also indirectly weaponized nickel by bankrolling Indonesian smelting capacity fired by dirty coal. In the case of nickel western producers are now urging the LME to create a "green" category to distinguish nickel supply with a low carbon footprint. Uranium's sharp rise since mid 2023 has peaked, with the price falling into the $80-$90/lb range; if $80 can hold as a floor for uranium it will be good for uranium juniors.

Copper is starting to benefit from a growing realization that as the AI Dream cranks up in its pursuit of innovation breakthroughs the resulting surge in energy demand will exceed the existing capacity of energy infrastructure. Building new power plants and expanding the transmission grid would not sharply boost copper demand (high tension transmission wire is made of aluminum with a small copper core), but the projected AI data centre near term energy shortages is helping focus attention on the IEA's projection that if EV net zero emission goals for 2030 are to be met, the world will need 50% more copper supply. Copper, while not part of the EV battery, is a much bigger part of an EV than an ICE car. But what industrial policy has had its head in the sand about is that the existing energy infrastructure is woefully inadequate to meet the charging needs if carmakers like Toyota deliver an affordable EV whose range and charging times meet the needs of ordinary consumers (think a Camry EV with 1,200 km range and 10 minute charging time). This type of EV that appeals to the North American masses will not be available before 2030, and there are plenty of recent skeptics who think that is a pipedream. But if a serious push for energy infrastructure renewal and expansion gets underway to accommodate projected AIU Dream needs, it will also provide the charging foundation for mass adoption of EVs during the 2030s. So producers and the market are starting to think that now is a good time to explore for copper deposits, especially in jurisdictions that will remain secure, which cannot so easily be assumed for Latin America.

The big surprise during the past few weeks has been the steady rise in the price of gold to new records without any obvious explanation. The rise stalled the past week when US CPI came in at 3.2% for February, slightly higher than expected. The result has been a change in expectations that interest rates will begin to decline during 2024, which should have made gold which generates no income more attractive. Gold's price rise is not being driven by retail investors because so far this year the GLD ETF has managed to lose 2 million ounces, but on Friday March 15 the GLD ETF registered a very large single day gain of 481,494 ounces. It is assumed that retail investors have been selling their gold ETF holdings in order to chase into BitCoin which itself has made a record high courtesy of Wall Street getting approval for stock exchange listed BTC ETFs that spare momentum gamblers the anxiety of owning a crypto wallet and having to trade through one of those cryptocurrency exchanges. The fact that both gold and BitCoin are making new highs may seem to be a paradox until one considers that the buying is coming from two different audiences. There is the smart money which knows that BitCoin is a digital mirage that refers only to itself, is priced in US dollars, is mainly used to facilitate the transfer of criminal proceeds, and represents a usage energy liability that will in future compete with AI and EV electricity demand. This smart money also knows that above ground gold is stored energy, the real cost of extracting what remains in the ground is outpacing the price of gold, and if the election outcome results in the fragmentation of the world into everybody for themselves autocracies, the US dollar will see its status as the sole global reserve currency erode quickly. The dumb money is buying BitCoin because the trend is their friend and the idea that nobody will be MAGALand's friend just isn't a concept. However, it is too soon to assume that $2,000 has finally been established as a floor for gold rather than a ceiling it can never stay above for long.

The absence of a clear reason for gold's uptrend explains why the three gold related juniors in the 2024 Favorites Collection have not yet developed uptrends. Arizona Gold and Silver Corp is still waiting for a BLM permit that will allow it to test the bulk tonnage potential of its Philadelphia project in Arizona. West Vault Mining Corp, a shovel ready proxy for a higher real gold price is still treading water in the $0.90-$1.00 range. And Solitario Resoures Corp is still waiting for a permit that will allow it to drill its Golden Crest project in South Dakota. The longer gold can hold above $2,000 the more these gold-focused Favorites will attract attention, with two of them potentially benefiting from a near term event unrelated to the price of gold, a permit that lets them start drilling for a gold discovery that works at the existing gold price. |

KRO 2024 Favorites Index |

Table of 2024 KRO Favorites |

Daily KRO 20245 Favorites Performance |

GLD ETF Daily Changes in Ounce Holdings |

Key Metal Price Charts |

| Jim (0:03:58): What are the implications of the final results Hercules Silver released for last year's drill program? |

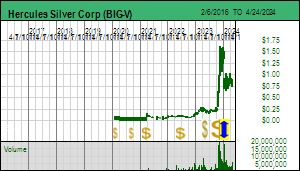

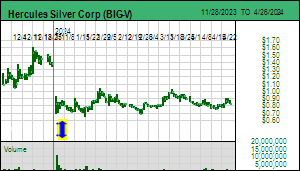

Hercules Silver Corp released the final results from the 2023 drilling on February 28, 2024 which the market liked for a couple days because it had fancy silver grades but then became disgruntled when it learned that drilling would not resume until May or later because of ground conditions. The stock has since recovered as the market began to appreciate that the meat in the final results news release was not the high grade silver-lead-zinc mineralization beneath the Hercules Adit near the contact between the "upper plate" rhyolite that hosts the silver-lead-zinc veins and the "lower plate" andesites that host the copper mineralization, but rather the geological discussion about a reinterpretation of the fault history of the area, much of which has been obscured by a thin veneer of much younger flood basalts.

An IP survey done in 2022 had revealed a substantial 1 km long IP chargeability anomaly beneath the known Hercules silver mineralization into which 400 hundred holes have been pumped since 1965, including some by Anne Mark's Anglo-Bomarc during the bull market of 1978-81. Hole 23-05 delivered in October 2023 confirmed a substantial copper porphyry system beneath the silver zones with high enough grades to support underground mining. This attracted a $23 million financing from Barrick Gold at a premium to the market (Hercules currently has $27 million working capital). But the followup holes drilled laterally and to the southeast of the IP anomaly had lower copper grades, and when released at the start of 2024 caused the stock to tank, enabling me to add Hercules Silver Corp (soon to be renamed Hercules Metals Corp) to the 2024 Favorites Collection. The company has since expanded the IP survey and stated that its footprint now extends several kilometres, but it has not published graphics for the new survey.

With the help of Barrick Chris Paul's team has done a lot scientific geology such as age dating and structural analysis, which has led to two important conclusions alluded to in the recent press release. One is that this porphyry system underwent multiple mineralizing phases, which is important for building big and rich deposits because successive fluid pulses remobilize mineralization from earlier phases and redeposit it in greater concentrations. The other is that the rhyolite "plate" that hosts the high grade silver was thrust from the northwest in a southeast direction over the andeslite "plate" that hosts the copper mineralization. This sort of high grade silver-lead-zinc mineralization one could expect at the peripheries of a porphyry system, but there is no zonation continuity between the rhyolite silver host and the underlying andesite copper host. The silver mineralization has been decapitated from the intrusive center that created it. Hercules had marched the drills along the length of the IP anomaly which turns out to have been the wrong direction. The proper direction appears to be in the northwest direction under cover rocks where no work has previously been done. Although Chris Paul would not spell out details, reading between the lines the IP anomaly extends beyond the Hercules Adit a couple kilometers.

So why the secrecy? The realization seems to have emerged among majors like Rio Tinto and Barrick that a 200 km trend of very fertile copper porphyry intrusions is located in western Idaho largely hidden by younger basalt cover rocks. Hercules has only a 2 km area of interest surrounding the existing property, beyond which Barrick is free to stake whatever it wants. And while Barrick may have seen the new IP survey data and perhaps even helped with the interpretation of the implications, there is no point in sharing those insights with other copper producers such as BHP, Rio Tinto and Freeport. Idaho, like the rest of the United State still requires old fashioned post staking so this is expensive and time consuming, plus those areas under state jurisdiction have different rules than BLM land. There is an old-fashioned copper focused staking frenzy unfolding in America!

Unlike in Arizona where major copper discoveries will be deep blind ones like Bell Copper Corp is chasing at Perseverance and Big Sandy in the hope of finding another Resolution scale deposit, these targets in Idaho, while likely still requiring underground mineable grades above 0.6% Cu, will be easier to discover and delineate if this trend hypothesis proves correct. The Hercules story is important because the big picture concept is that old mineralized systems which are typically dismissed as dead horse recycling plays can be evidence of something much bigger going on beneath the surface. All it takes is a fresh geological perspective, a willingness to think outside the box, and engage in extra data gathering that includes drilling geological scout holes. This is something the lifestyle juniors cannot accomplish, and when the resource juniors are pressed into service as the new heroes which will secure new metal supply in secure destinations, the lifestyle juniors will be left stranded at the dock as the serious boats put out to sea in search of whales. |

Hercules Silver Corp (BIG-V)

Favorite

Fair Spec Value |

|

|

| Hercules |

United States - Idaho |

3-Discovery Delineation |

Cu Mo Ag |

Plan View of Hercules Discovery |

Section View of Hercules old IP Anomaly |

| Jim (0:10:13): What is the latest news from Solitario Resources Corp about its Golden Crest project in South Dakota? |

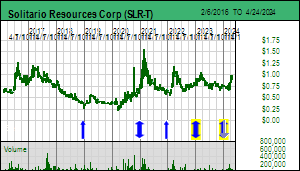

Solitario Resources Corp provided an update on February 27, 2024 ahead of PDAC which highlighted a new gold zone called Wild Rose which appears to be part of a 4 km northeast trend extending from the Downpour showings first reported in 2021. Solitario applied to the USFS in 2022 for a plan of operations that would allow it to drill targets generated by surface sampling on the Golden Crest project in the western part of the Black Hills National Forest in South Dakota. The property boundary extends almost to the Wyoming border, and when I asked if there was a reason to avoid Wyoming, the answer was that there is a structural break in the rocks that happens to coincide with the Wyoming-South Dakota border, to the west of which the geology is not prospective for gold mineralization.

The 75 day comment period following the FONSI ruling by the USFS in December 2023 with regard to the first plan of operations application Solitario filed in 2022 has concluded and the USFS is preparing its responses to those comments that have standing. Solitario's COO Walt Hunt thinks the USFS may be finished by mid April, which is still a month ahead of when Solitario in terms of physical access could hope to start drilling at Golden Crest. The USFS has published a project location map which outlines the prospects for which drill permits are sought. On March 18, 2024 (after this KW episode was recorded) Solitario published an update about the Geyser Zone which it first reported on in February 2024. Once again surface sampling has yielded multi-ounce gold values.

What is intriguing is Solitario's announcement that it has filed the Ponderosa Plan of Operations which it describes as being a non-contiguous part of the Golden Crest project which the December 2023 presentation depicts as 3 distinct claim blocks. When I google Ponderosa POO I get a USFS splash page which contains no information other than the approximate location, which turns out to be east of Highway 85 which tracks Spearfish Canyon. Although Solitario's map shows 3 claim blocks, a medium sized one to the north, a small one to the northwest, and the main large one, the latter is in fact a couple blocks because Solitario had the wisdom not to stake claims over sensitive areas like Spearfish Canyon.

At PDAC I took a photo of a dull looking rock which assays just under 1 opt gold, a testament as to why this western part of the Black Hills has 1,500 prospect pits (based on LIDAR analysis) compared to a hundred times as many in the eastern half where Homestake yielded 60 million ounces out of a 90 million ounce endowment for the area. CEO Chris Herald tells me that no claims have been staked since the end of 2022, and admits they were surprised to discover the Geyser Zone and were obliged to expand the land package. It turns out that the new Wild Rose zone is outside both the original Golden Crest POO and the Ponderosa POO applied for in 2022. Based on the prospect pit locations in the original Golden Crest POO and the recently revealed location of the Ponderosa POO the impression is created that the middle of the land package is an unprospective doughnut hole. That, however, is an artifact of the permitting strategy which has limited Solitario's surface sampling focus to areas accessible by logging roads and where bedrock has been exposed thanks to logging.

Last year Solitario conducted an IP survey along two 11 km lines which yielded a weak, 2 km wide chargeability high projected around a depth of 400 m just above the Precambrian basement where the Lower Deadwood formation that hosts the Wharf gold system, a 10 million ounce system with high grade zones within a lower grade envelope whose high grade was plucked out 120 years ago, with the rest being open pit mined since the 1980s after heap-leaching technology was invented. If something similar is present within this doughnut hole ay Golden Crest it would have to be underground mined, but with the high grade intact such a system might run 2 g/t gold or better which is $129 rock at $2,000 gold. Both this deep IP target and Wildrose will have to wait for future plan of operation applications. If the permit is granted drilling would start at the Downpour target for which Solitario has provided a conceptual target cartoon which shows a laterally extensive Wharf style target within the Deadwood Formation just above the Precambrian basement, and gold mineralization within the feeder structures which they are tracing with high grade surface values. Oddly, during the past week Solitario came under selling pressure through its NYSE listing which may have been a forced liquidation by an institutional shareholder. Such liquidity on the bid side will be a thing of the past if the USFS decides to confirm the Golden Crest POO. |

Solitario Resources Corp (SLR-T)

Favorite

Fair Spec Value |

|

|

| Golden Crest |

United States - South Dakota |

2-Target Drilling |

Au |

Regional Map showing locations of Solitario's Plan of Operations Applications |

Map showing location of new Wild Rose target relative to Downpour |

Conceptual cartoon of Golden Crest targets using Downpour as example |

| Disclosure: JK owns none of the stocks mentioned; Hercules Silver and Solitario Resources are Fair Spec Value rated KRO Favorites |