| |

Quadra FNX Mining Ltd (QUX-T)

| Quadra Mining, led by President and CEO Paul Blythe, is a base metals development and operating company with interests in a number of advanced exploration, development and producing properties including the Robinson Mine in Nevada, producing copper and gold, and the Carlota copper leach project in Arizona, as well as the Sierra Gorda advanced exploration copper-molybdenum project in Chile and the Malmbjerg molybdenum development project in Greenland. In March 2010 the company announced plans to merge with Sudbury-focused FNX Mining in a transaction that will leave Quadra shareholders owning 52% of Quadra FNX Mining. The merged company anticipated 2011 production of approximately 300 million pounds of copper and 150,000 ounces of precious metals. In December 2011 the company agreed to a takeover offer from KGHM Polska Miedz SA for $15 cash per Quadra share in a $3.5 billion transaction. |

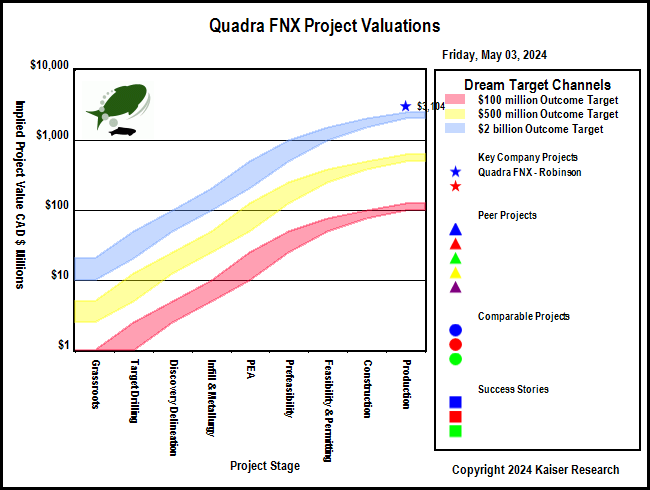

Key to Understanding IPV Charts and Spec Value Hunter Tables

| An IPV Chart is a graphical presentation of a Spec Value Hunter table that has been constructed according to the Rational Speculation Model developed by John Kaiser. The IPV Chart allows speculators to identify which projects offer poor, fair or good speculative value in both absolute and relative terms. The speculative value depends on the project stage, the project's implied value as calculated by the company's fully diluted capitalization, stock price and net project interest, and the dream target deemed appropriate for the project. A dream target is what a project would be worth in discounted cash flow terms once in production. |

| Green background indicates the dream target judged appropriate for this play by John Kaiser - otherwise unranked. |

Poor Speculative Value -   |

Fair Speculative Value -  |

Good Speculative Value -   |

Note:   narrow arrows indicate IPV is outside the fair value channel but within 25% of the fair value limits narrow arrows indicate IPV is outside the fair value channel but within 25% of the fair value limits |

| Click on the company name to view the company profile, the project name to view project details. |

| Click on the project icon if its background is shaded to get the IPV Chart for that company. |

Quadra FNX Project Valuations

| Company | Project | Country | Stage | IPV $

MM |

$100 | UPV

$500 |

$2000 | Target Metals | Deposit Style |

| Key Company Projects |

|

Quadra FNX Mining Ltd (QUX-T) | Robinson |  | United States | Production |

$3,104 |  |  |

| Copper Gold | Porphyry |

|

|

| Peer Projects |

|

|

|

|

|

|

| Comparable Projects |

|

|

|

|

| Success Stories |

|

|

|

| Sierra Gorda |  | 55% WI | Chile | 6-Prefeasibility |

|---|

| Sierra Gorda 43-101 Economic Study (USD except where noted otherwise) |

| PEA | Jul 1, 2009 |

| | Sierra Gorda |

| Mining Scenario | TR | Mining Costs |

| Mining Type: | OP |

| Cost Currency: | USD |

| Processing Type: |

|

| Capital Cost: | $1,661,000,000 |

| Operating Rate: | 110,000 tpd |

| Sustaining Cost: | $734,000,000 |

| Operating Days: | 365 |

| Operating Cost: | $9.38/t |

| Strip Rate: | 2.5 |

| BC Cash Cost per Unit: USD | $1.23/lb Cu |

| Mine Life: | 25 years |

| BC Cash Cost Net By-Products: USD | $0.51/lb Cu |

| LOM Tonnage: | 989,331,000 t |

| BC All-In Cost Net By-Prod: USD | $0.82/lb Cu |

| Est Startup: |

|

| Spot All-In Cost Net By-Prod: USD | $0.76/lb Cu |

| Production Potential |

| Metal 1 | Metal 2 | Metal 3 | Metal 4 |

| Metal: | Cu | Mo | Au |

|

| Grade: | 0.42% | 0.03% | 0.07 g/t |

|

| Recovery: | 88.0% | 67.0% | 42.0% |

|

| Annual Output: | 306,000,000 lb | 16,000,000 lb | 36,000 oz |

|

| LOM Output: | 7,650,000,000 lb | 400,000,000 lb | 900,000 oz |

|

| Base Case Price: | $2.00/lb | $12.00/lb | $800/oz |

|

| Spot Price: | $3.10/lb | $12.10/lb | $1,315/oz |

|

| Base Case NSR: | $15.24/t | $4.78/t | $0.72/t |

|

| Spot NSR: | $23.63/t | $4.82/t | $1.18/t |

|

| Base Case Valuation |

| Reported Valuation Currency: | USD |

| Pre-Tax NPV: |

|

| Discount Rate: | 10% |

| After-Tax NPV: | $622,000,000 |

| Total Base Case NSR USD: | $20.74/t |

| Pre-Tax IRR: |

|

| Total Spot NSR USD: | $29.63/t |

| After-Tax IRR: | 16% |

| Annual Pre-Tax Cash Flow Base Case and Net CF/FDSH USD: | $456,193,000 | $1.13 | Pre-Tax Payback: |

|

| Annual Pre-Tax Cash Flow Spot and Net CF/FDSH USD: | $812,934,800 | $2.08 | After-Tax Payback: | 7.1 y |

| Enterprise Value CAD : | $3,032,130,426 | $14.64/sh | Share Price: | $14.99 |

| Note: |

| Comparative Valuations using Life of Mine Averages |

| Discount Rate: | 0% | 5% | 10% | 15% |

| Base Case Pre-Tax NPV USD: | $9,009,825,000 | $4,147,391,087 | $2,012,163,838 | $954,880,127 |

| Base Case Pre-Tax Net NPV/Sh USD: | $23.93 | $11.01 | $5.34 | $2.54 |

| Premium BC PT NPV over EV: | $12.54 | ($0.37) | ($6.04) | ($8.85) |

| Spot Pre-Tax NPV USD: | $17,928,370,000 | $8,935,866,471 | $4,955,945,288 | $2,960,125,501 |

| Spot Pre-Tax Net NPV/Sh: | $47.61 | $23.73 | $13.16 | $7.86 |

| Premium Spot PT NPV over EV USD: | $36.23 | $12.35 | $1.78 | ($3.52) |

| The comparative NPV calculations assume constant annual cash flow based on the life of mine average annual payable production and CapEx spent in year one. The operating cost includes the LOM sustaining capital. Due to details such as ore scheduling these NPV figures may differ from those of the 43-101 economic study. |

| After-Tax Valuations using Spot By-Product Prices |

|

|

|