| Kaiser Watch July 28, 2023: Countdown for PMET resource estimate |

| Jim (0:00:00): Will Patriot Battery Metals deliver its maiden resource estimate in July as promised? |

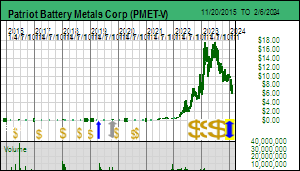

Patriot Battery Metals Corp did promise a maiden resource estimate in July and Monday July 31 is the last opportunity to deliver, with the ASX getting it on our Sunday night. Given that Night Market Research challenged PMET's credibility about its MRE timing, which I discussed in KW Episode July 14, 2023, I would be shocked if CEO Blair Way and Chairman Ken Brinsden fail to deliver. The real question is how will the market react to whatever is published? The tonnage reported will be meaningless because PMET will likely publish a set of inferrred resources at different cutoff grades so that they can isolate the higher grade Nova portion. They do have to pick a base case resource and that will probably be one that allows a resource just over 100 million tonnes to prove Night Market Research wrong.

The real one, however, which potential bidders for PMET will be looking at, will be the one which allows an optimal scale for that region. What do I mean by optimal? A key factor will be the combination of mine life and open pit mining scale. Pegmatites tend to be elongated bodies and CV5 is no exception, but when they outcrop or are close to surface they deserve to be open pit mined. But because of their elongated nature the waste to ore stripping ratio will be very high, so giant 100,000 tpd open pit operations such as you see with copper porphyry systems or what FPX Nickel contemplates for the Decar nickel project just isn't feasible for LCT type pegmatites. And since the dip is sub-vertical, chasing the dip to a vertical 300 m pit limit does constrain the tonnage available.

There is also the additional consideration of the ideal mine life. Normally one likes to aim for a 20 year mine life, but, given that we would be lucky to see a James Bay lithium mine producing by 2030, would it be wise to plan such a long mine life? Lithium is not like copper or nickel whose fundamental uses as an electricity conductor and stainless steel input are unlikely to change in the long run. But lithium use is linked to a specific technology which may be on its way out by 2040, possibly eclipsed by hydrogen fuel cells. The mission critical problem for energy transition goals is meeting the demand surge between now and 2035, which suggests choosing a mine life of 10-15 years.

For these reasons selecting a higher cutoff grade and a smaller operating scale may be more optimal than shooting for maxium size and economy of scale. In the case of Corvette, the 50 km trend may have multiple similar deposits. It might be prudent to develop multiple open pits at lower mining rates but higher grades feeding a larger capacity central processing facility that could also include a refinery so that you do not need to ship concentrates long distances. Anybody looking at PMET as a buyout target will be thinking in these big picture terms.

My prediction is that the maiden resource will be presented in a manner that allows bulls and bears alike to all claim victory, but what counts is what the Albemarles and Rio Tintos of the world see as their preferred development scenario. I wouldn't be surprised to see a range of resource estimates at different cutoff grades which includes NMR's 76 million tonne estimate all the way to 150 million tonnes. The key will be the open-pittable cutoff grade. What becomes the true "base case" will depend on the desired mine life in the eyes of a future developer. Generally when a discovery shifts from resource estimate delivery to feasibility demonstration, in essence "cost discovery", the eventual proven and probable resource ends up smaller and higher grade than the base case maiden resource estimate.

We should also keep in mind that the cut-off grade is half determined by OpEx considerations, but the other half is the revenue side. What lithium carbonate price is it reasonable to assume for the mine life? With established metals like copper and nickel the cost curves of existing mines and potential mines provide a guide to the future, linked to macroeconomic predictions about overall demand growth. Electric vehicles represent a policy driven disruptive technology that entrains lithium demand. The world has never seen anything on this scale, except perhaps in the post WW2 period when uranium as the fuel for nuclear energy caught the market's imagination. Seven decades later uranium supply limps along with an annual value below $5 billion while lithium supply, worth $200 million in 2005, is heading towards a $100-$200 billion annual market if EV deployment goals for 2030 are to be met.

Every lithium bear out there, just as during the rare earth boom of 2009-2012, will moan that lithium is everywhere, and that the world will never be caught screaming, "my kingdom for a pallet of lithium". Along with the astonishing demand trajectory there is also the reality that extraordinary lithium resources are sitting under everybody's noses, Bolivia's salars among the most staggering. But what does it take to mobilize these resources? What the Lithium Mania 2.0 detractors do not understand is that time is of the essence. How long will it take out for Chile, Mexico and Bolivia to sort out a fair split for the lithium windfall? In the case of direct lithium extraction (DLE), or claystone flow-sheets, how much CapEx and time needs to be invested in order to "know" this supply is truly part of the cost curve? Never before has so much uncertainty existed about the future price of a metal.

The reason the James Bay lithium deposits are on the radar of downstream lithium users is that their cost structure is reasonably well understood, with caveats regarding the risks that Canada's tolerance for the anti-mining lobby or First Nations extortion is absolute. But this structural opposition can vanish overnight, especially once politicians start to connect a destiny of "burn baby burn" with opposition to resource development. When PMET publishes its cutoff-grade defined range of CV5 resources, what actually matters will be in the eye of the beholders, and those beholders may include parties like Toyota who think they have secured the holy grail of a solid state lithium ion battery, and are plotting to seize the EV mass market in 2030 and beyond. The lithium input cost, even though the future commodity price may range widely, will still be a fraction of the future overall cost of an EV.

The main line of attack by NMR was that under the Lassonde Curve logic the market will lose interest as PMET shifts into the cost discovery portion of the project. This becomes a game theory problem for the potential bidders. If they all stay quiet the price will sink. But I don't think the producers have the discipline to stare down PMET as it moves into tedious feasibility demonstration. The competition in the wings are giants like Toyota who are grappling with an existential crisis. In addition there are the big oil companies. The stupid idealist view is that tomorrow we all stop combusting fossil fuels and the evil oil and coal companies can promptly descend into hell where they can burn. But the idea of an "energy transition" is not that of a cold turkey break with addiction; it is a gradual weaning of dependency.

Big oil is waking up to the fact that the period of denial and suppression is over, and is developing strategies to adapt to a future reality at odds with its historical business model. And this shift need not be because they finally cave to the climate change lobby. It could very much be because they are watching developments in fusion energy and smelling a tipping point that could deliver commercialization by 2040. Fusion energy, because it does not include the hopelessly high radiation mitigation costs that doomed the post WW2 nuclear energy dream, will blow away not just fossil fuels like coal and natural gas, but also the solar and wind renewable energy sector. What will persist is an electricity grid and the capacity to use electricity to create alternative fuels like green hydrogen whose distribution can repurpose natural gas pipelines. It isn't just companies like Toyota sensing an existential threat and potentially making moves that shatter prevailing norms; big oil faces its own existential crisis but does have an intrinsic platform it can adapt to ensure its survival. Night Market Research is assuming that the only players to buy and develop major new lithium projects like PMET's Corvette are traditional mineral or metal producers. Once PMET has its Corvette resource on the map, assuming it meets expectations, a much broader range of interested buyers stands ready to pounce.

But that is me extrapolating about big picture forces that may not be ready to deploy themselves. The Night Market Research critique I most respect is one I made earlier this year, namely the structural instability that comes from PMET's origin as a horribly flaky Canadian junior. PMET has the problem that 24 million in the money warrants sit in the hands of parties who are likely not institutional shareholders. For whatever reason they have chosen not to exercise and collect their profits over the past couple years. If the potential future owners of PMET are truly disciplined, PMET will suffer from the market question "what now?" after the maiden resource is issued. NMR correctly puts its finger on opportunity cost. The market will not care if PMET trumpets that it will go on a drilling rampage along its 50 km land package to show that there are as many as a half dozen CV5 deposits present. With a $2 billion implied value already in place, what is left, another double after you spend another 2 years duplicating CV5? That is not how retail investors think. James Bay is not like the Ekati project within the Slave Craton during the 1990s where Chuck Fipke didn't quite get it all, but did get most of it. Replication of PMET's success within the James Bay region has a much greater probability than during the diamond hunt of the 1990s.

If the James Bay fire access restrictions ease and other juniors start finding LCT pegmatites, we will see PMET warrant holders exercise and exit PMET in order to redeploy the gains into new upside potential. This will create a tax hit in 2024 for them, which will create psychological incentive to engage in gambling on other much cheaper juniors, with potential horrific consequences in December when they dump the duds in order to collect the losses to offset the crystallized PMET gains. While that worry should deter, on the contrary, precisely because this negative outcome can be contemplated, profit soaked ex-PMET shareholders will be unable to resist rolling the dice again, this time without wondering about the legitimacy of Lithium Mania 2.0 or the strange ambitions of management such as merging with some private rare earth company. This time the story has solid legs.

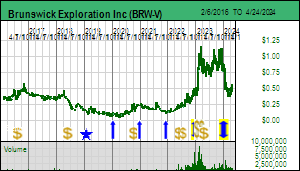

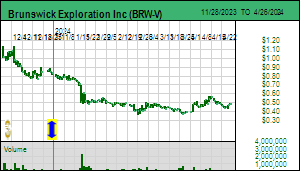

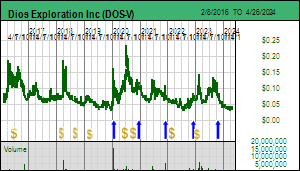

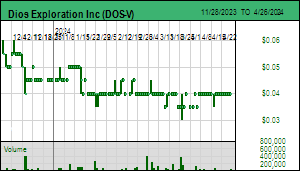

But what will be the driver that explodes the James Bay lithium junior space? This week Brunswick Exploration Inc announced that it has boots on the ground on the Mirage project where the goal is to find the bedrock source of a 1,700 m by 200 m field of spodumene bearing boulders. Should Brunswick report success in the next week or so, this junior with a tenth of the implied value of PMET will start to attract recycled PMET dollars. Within a few weeks Dios Exploration Inc which has a hundredth of the implied value of PMET will have boots on the ground checking out its second order precision targets. I have been following this junior's methodology closely, and I dare to say, its profound discovery potential value is not obvious from their news releases, their web site content, or their invisible corporate presentation. But Dios has significant individual shareholders whose holdings in PMET have a value bigger than the entire market capitalization of Dios. What happens if circumstances create a liquidity event that enables or forces them to exit the mother ship?

At the moment the James Bay lithium junior prices are tracking sideways. While the Canadian media is oblivious to Lithium Mania 2.0, along with both retail and institutional investors, the Australian equivalents, having experienced Lithium Mania 1.0, are completely plugged in. If PMET delivers a multi-grade cutoff set of resource estimates which allows everybody to claim to be a winner, be they bulls or bears, Australian capital could step up to absorb the paper from warrant exercise and sales by the earlier stage motley crew. This could jump start Lithium Mania 2.0 in the James Bay region in August after the juniors spent two months in the penalty box thanks to forest access bans created by Canada's pitiful firefighting capacity. I can't promise execution, but I can confidently point out the setup. |

Patriot Battery Metals Corp (PMET-V)

Unrated Spec Value |

|

|

| Corvette |

Canada - Quebec |

3-Discovery Delineation |

Li |

Brunswick Exploration Inc (BRW-V)

Favorite

Fair Spec Value |

|

|

| Mirage |

Canada - Quebec |

2-Target Drilling |

Li |

Dios Exploration Inc (DOS-V)

Bottom-Fish Spec Value |

|

|

| Nemiscau-North |

Canada - Quebec |

1-Grassroots |

Li |

The 2 key Night Market Research Short Attack Arguments |

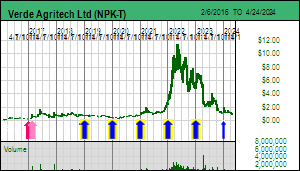

| Jim (0:08:56): Why did Verde Agritech jump this week? |

Last week Verde Agritech announced that it had received a study from Newcastle's Professor David Manning which confirmed that a tonne of K Forte was capturing 120 kg of CO2. This opened the potential for the sale of carbon credits linked to each tonne applied to a farmer's field. The company said it was still working on a life cycle analysis of the CO2 generated in mining, grinding, shipping and applying the K Forte so that we know how much net CO2 per tonne could be packaged as a carbon credit. I liked this strategy because if it is a meaningful amount, the company could offer a meaningful discount relative to potassium chloride which should motivate farmers to adopt K Forte as an alternative to KCl.

On July 27 Verde Agritech surprised us with a brief news release that it is in advanced negotiations to sell carbon credits to major international corporations that are established purchasers of permanent carbon offsets. That was a surprise to me because when I talked to Cris Veloso last week he suggested that the independent life cycle analysis by a Canadian consultancy was still 3-4 weeks down the road. How can you be in serious negotiations to sell a carbon credit when you don't know the net number? I guess the answer is that they already have a reliable internal net number and the independent verification is just a formality. The company did state that at its current production capacity, it could generate 300,000 tonnes of carbon credit annually. Since production capacity is 3,000,000 tpa which would pack away 360,000 tonnes of CO2 at Manning's rate of 120 kg/tonne K Forte, that means the carbon footprint is 20 kg per tonne of K Forte. So each tonne of K Forte generates 100 kg of saleable carbon credit. What is that worth? That depends on the quality of the carbon credit.

The press release included a link to a 58 page document produced by Microsoft called Criteria for High-Quality Carbon Dioxide Removal. This pdf document is worth reading because it describes the pros and cons of 8 key ways to remove CO2 from the atmosphere that do not involve capturing CO2 emissions at source. Microsoft has committed to becoming carbon negative by 2030, as opposed to carbon neutral, because it also has the goal of by 2050 to have captured and permanently stored all of its net CO2 emissions since Bill Gates and Paul Allen founded Microsoft on April 4, 1975. Microsoft works with Carbon Direct to establish carbon capture investments whose credits would offset Microsoft's emissions.

The sections relevant to Verde Agritech are pages 36-40 on Enhanced Rock Weathering in Croplands, and pages 41-45 on Carbon Mineralization. What is interesting is that ERW seems to involve dissolving CO2 in water with the help of silicates strewn onto fields which form a bicarbonate ion which supposedly ends up in the ocean which is the ultimate carbon sink. This represents a huge measurement problem and requires care not to add harmful elements to the field. Although NPK uses the term ERW, in this week's news it stated that the K Forte weathering permanently locks CO2 into a new mineral structure. That makes it the carbon mineralization type of capture similar to FPX Nickel's brucite strategy, except superior because it is also a fertilizer that provides non-salt related potassium.

Carbon credits are getting more and more media attention. Rio Tinto this week admitted that it would miss its 2025 carbon reduction goals and would as a "last resort" have to buy carbon credits. The Financial Times on July 27 had an article predicting that Brazil's Lula administration plans to launch an energy transition plan by September which will include trading carbon credits. Because Brazil generates 90% of its electricity from hydropower it wants to focus on renewable hydrogen technologies. Carbon credits related to shifting Brazilian potash consumption from 95% potassium chloride imports to a domestic source that does not harm the long term fertility of Brazil's farmland would seem to be low hanging fruit. Verde Agritech stated that it hopes to have its first carbon credit sale in Q3 of 2023. That may be too late to allow a discounted pricing strategy for 2023, but whatever sales news the company delivers for what will have been a difficult year in 2023 for the Brazilian farm sector, the market will have a basis for absorbing the 2023 results and then shifting its focus to a 2024 assisted by carbon credit sales. |

Verde Agritech Ltd (NPK-T)

Favorite

Good Spec Value |

|

|

| Cerrado Verde |

Brazil - Other |

9-Production |

K |

Microsoft/Carbon Direct: Criteria for High-Quality Carbon Dioxide Removal |

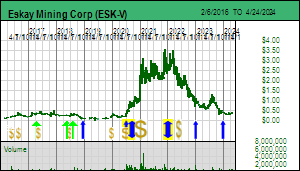

| Jim (0:17:21): Why has Eskay Mining developed an uptrend? |

Eskay Mining had a difficult first half of 2023 amid uncertainty about its balance sheet and how it was going to fund a summer drill program. The stock traded as low as $0.50 on May 17 when CEO Mac Balkam put out a depressing news release about the need to conserve cash and plans to further develop targets at the 100% owned Eskay project in British Columbia's Golden Triangle. These plans included "potential drilling" which sent a signal to the market that this summer not much might change. This contrasted sharply with the big plans outlined in the January 2023 corporate presentation which, in addition to following up 2022 work in the Scarlet Ridge-Tarn Lake area with further drilling, would include "extensive drilling at SIB-Lulu" and "exploratory drilling at poorly-explored VMS targets property-wide". Oddly this presentation has not been updated on the company's web site.

The stock, however, began to perk up in June when Eskay Mining announced on June 7 that Seabridge had agreed to terminate the Coulter Creek Access Road agreement under which Eskay Mining was to contribute $6.25 million of the estimated $12.5 million cost. This deal in July 2021 seemed a bad idea at the time because Seabridge needed this road for its KSM copper-gold project which has been taken through feasibility while Eskay Mining was still a long way from a maiden resource estimate. It was as if the adjacent Hubris Peak had cast its shadow on Eskay management. Drilling during the past couple years on the TV and Jeff zones delivered lots of short high grade intervals but suffered from "structural complexities" which the company planned to think about in 2023 while trying to make a real Eskay Creek 2 discovery. By the start of 2023 Seabridge had loaned $2.7 million to Eskay Mining which was classified as a current liability. Since Seabridge was not going to focus in 2023 on the segment relevant to Eskay if and when a discovery with mining potential is ever made, Seabridge agreed to cancel the agreement which removed this amount from the current liabilities section of the balance sheet.

That was not good enough to help Eskay Mining raise any money to fund a serious drill program, but on July 10, 2023 Eskay Mining achieved a non-dilutive financing when it announced that Skeena Resources Ltd agreed to purchase 5 claims for $4 million of which $2 million was due immediately, $1 million on Oct 31, 2023 and the final $1 million on Dec 31, 2023. Skeena did not even put out a news release and Eskay Mining did not include a map with its press release, but disclosed that the claims were to the northwest of the main claim block. By comparing the map in the January 2023 presentation with the one included in the July 27 news release we can see that at least 4 claims were a floater block west of Skeena's property which was unlikely to yield a standalone discovery for Eskay Mining.

With the extra cash Eskay Mining announced on July 27 plans for 6,500 m of drilling 5 target areas missing from the January map. The immediate focus will be the Scarlet Knob-Tarn Lake area in the middle of which sits the Bruce Glacier target, and the new Storie Creek target to the west where the Eskay Creek Contact Mudstone has been found outcropping. The only older target to be drilled is TV South where one hole will be drilled in August south of where a gabbro dyke cuts off the TV zone. Two entirely new targets are Hexagon-Mercury northwest of the Jeff Zone and the Maroon Cliffs target in the northeastern corner of the property. These appear to be mainly geophysical targets. A surprise is the Cumberland target 6 km south of TV which was drilled a couple decades ago and which will receive two holes. My bet will be on the Storie Creek-Tarn-Lake-Bruce-Glacier-Scarlet-Knobb target group for which Eskay Mining provided a geological long section. I like Quinton Hennigh's declaration that "sharp-shooting multiple high-quality targets is the best approach to make one or more new discoveries in 2023". It gives me much greater hope for an Eskay Creek 2 score than a couple years spent swiss-cheesing the TV and Jeff Zones that emerged in 2020 when the company drilled areas that had previously delivered "smoke but no cigar" and ultimately only delivered ashes. |

Eskay Mining Corp (ESK-V)

Bottom-Fish Spec Value |

|

|

| Eskay |

Canada - British Columbia |

2-Target Drilling |

Au Ag Cu Pb Zn |

Eskay Mining Plans in January 2023 |

Eskay Mining Plans August 2023 after claim sale to Skeena |

| Disclosure: JK owns Brunswick Expl, Dios Expl and Verde Agritech; Brunswick is a Fair Spec Value rated Favorite, Verde Agritech is a Good Spec Value rated Favorite; Dios Expl and Eskay Mining are Bottom-Fish Spec Value rated |