| Kaiser Watch February 9, 2024: The PutinXi Poodle Lifestyle |

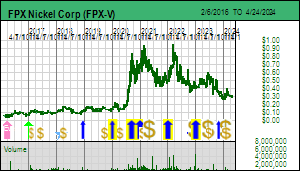

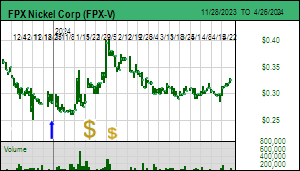

| Jim (0:00:00): Why did FPX Nickel jump last week despite weak nickel prices and a deepening bear market for resource juniors? |

The big story for FPX Nickel in mid January was a $14.4 million financing by Sumitomo at $0.48 which I discussed in Kaiser Watch January 17, 2024. Although almost everybody grumbled about the dilution created by this financing, I argued that it was significant because Sumitomo is a mining company, possibly the one which buys out the minority shareholders of FPX down the road, and, unlike the other strategic investors, will care that Decar has a decent after tax IRR and NPV, whereas the others simply want a secure clean supply of nickel for their downstream products like green stainless steel and EV batteries. Prior to Sumitomo's arrival the risk was that Decar gets developed on a breakeven basis that benefits the offtake parties who make their markup through the value-add within their product lines. In the case of Outokumpu that would be because it can charge a premium for "green" stainless steel whose nickel input is bought at LME refined nickel prices. In the case of the mystery strategic investor who is likely a downstream battery or car maker the value is added by being able to sell in jurisdictions that insist on clean inputs. A buyout could happen when nickel prices are depressed, as they are today, which would result in a low net present value, a percentage of which is the most minority shareholders can hope to get through a buyout offer. A mining company like Sumitomo will not want to build Decar unless it meets a producer's economic return thresholds, and, given the substantial CapEx Decar's development would involve, implies a future buyout price north of $2 per share.

Although FPX Nickel initially perked up with the Sumitomo news, whose $0.48 price was at a substantial premium to the $0.25-$0.30 range where FPX was languishing, the stock subsequently sagged as investors turned their attention back to concern that the Tl'azt'en Nation which desecrated Mt Sydney with clearcut logging would prevail with its new found claim that Mr Sydney is sacred territory. On February 1 2024 FPX announced that all 3 strategic investors had coughed up another $4.3 million at $0.48 to maintain their existing percentages which involved issuing another 8,981,971 shares at $0.48. This would have been an interesting iterative calculation because all three strategic investors have rights to maintain their holdings. While Sumitomo bought into FPX Nickel with eyes wide open after Chief Leslie Aslin unilaterally dumped a decade long benefits agreement to declare Mt Sydney off limits for future mining last August, Outokumpu and the mystery investor were already on board when the chief launched his surprise extortion ploy.

The fact that both strategic investors stepped up to maintain their equity stakes after Sumitomo came on board is a strong vote of confidence that Canada is not going to let some band of 1,561 indigenous people prevent the development of a major supply of clean nickel while similar indigenous groups with stronger territorial claims support the development of a mine that is good for the energy transition and for solid multi-decade local jobs. This extra financing brings working capital to $45 million and covers feasibility study costs through 2025. I think this is the last of the financings during the "value trough" of feasibility demonstration. Minority shareholders are now hoping that if any of the strategic investors want to increase their positions to 15% they will do so with open market purchases that drive the stock to a valuation more reflective of the underlying value. The mystery investor, of course, would have to reveal its identity as soon as it passes 10%, which could be how we eventually find out why the secrecy was so important.

Increasing equity stakes through open market purchase may not happen overnight because nickel is expected to be in surplus during 2024 following a major production ramp-up in Indonesia. The USGS just published its metal supply summaries for 2023 in late January which I have now absorbed into my database which goes back to 1930 when the USGS first started publishing annual supply stats. Since 2021 Indonesia's nickel supply has increased 73% to an estimated output of 1.8 million tonnes to represent 50% of 2023 nickel supply. Canada, Australia and New Caledonia increased supply modestly while Russia's supply, which comes mainly from Noril'sk, the world's dirtiest nickel mine, declined. Indonesia's 2023 production is more than double its peak in 2013 after President Joko Widodo declared a moratorium on the export of raw nickel laterite ore.

The China super-cycle depleted nickel warehouse stocks during the 2000s, causing nickel to soar over $24/lb in 2007. At the time nickel was produced from sulphide ores as concentrates that had to be smelted into refined nickel or from laterite ores via high pressure oxidation leaching (HPAL) which was an expensive process. Chinese steelmaker Tsingshan, however, became a national hero when it figured out how to make nickel pig iron by smelting lower grade laterite ore from Indonesia and the Philippines using its legacy (spelled very dirty) blast furnaces. Nickel pig iron did not yield high quality stainless steel, but it was good enough for Chinese needs. Production from Indonesia and the Philippines soared after 2010 as laterite ore was strip mined and shipped in bulk to China, clobbering the nickel price and inhibiting the development of supply from traditional sulphide and laterite deposits.

Indonesian supply dropped 85% after 2013 while that of the Philippines stabilized. Widodo's moratorium, however, worked as the Chinese reluctantly began to fund the development of smelting capacity in Indonesia. Indonesian supply began to grow in 2017 and is now more than four times that of the next biggest producer, the Philippines whose laterite ore still gets direct shipped to China. The problem for the world and its energy transition goals is that the Indonesian smelters are powered by coal-fired electricity, and while some of the nickel is converted to nickel sulphate for the batteries of China's growing EV fleet, a good part of the Chinese electricity grid is fed by coal power. To make matters worse for nickel producers elsewhere in the world, such as Australia and New Caledonia, the Indonesian nickel supply is not required to turn a profit for the owners which are part of China's extended state owned enterprise family. Indonesia does not care because from a government perspective it collects its royalties and the taxes paid by the providers of the "cost" which ends up matching revenues.

Widodo was unable to run for the Indonesian presidency due to term limits which he did not change like some aspiring autocrats have done. But he did a strange deal whereby he supported a rival called Prabowo Subianto, who was a special forces commander under the dictator Suharto, on the condition that he take Widodo's 36 year old son Gibrano Rakabuming Raka as his vice-president running mate. It appears that Prabowo has won the presidency in the recent election, but it is doubtful that Widodo's dynastic goals will come to fruition. The risk exists that one of the most corrupt nations in the world slides back into autocracy which would suit China fine because it in effect bankrolled the smelting capacity which will allow this Global East-Global South alliance to dominate global nickel supply. Major producers such as Glencore, Eramet, BHP and Anglo American are all squawking now because their operations are losing money and will need to be shut down. The Indonesian nickel operations may not be making money, but they bestow a strategic benefit to the Global East, which includes Russia whose dirty nickel sulphide mine will profit down the road when western nickel mines have disappeared.

Putin and his oligarchs could not care less that everything surrounding Noril'sk is an environmental wasteland, bestowing a lower cost structure than that of nickel sulphide mines elsewhere in the world which must comply with Global West environmental standards. New Caledonia's nickel laterite production using HPAL is currently losing money with Glencore trying to unload the Koniambo operation it bought in 2013, while others, according to a February 13, 2024 Financial Times article, are also "bleeding cash". So when Chief Aslin stands up to declare No-Can-Do to FPX Nickel with regard to a nickel mine that because it is neither sulphide nor laterite has a chance of achieving a zero carbon footprint, he is de facto working as a PutinXi Poodle against humanity's energy transition goals while also supporting a growing Global West nickel supply dependence on the autocratic Global East. Decar will not be in production before 2030 so what the price of nickel does during the interim is irrelevant, but the big picture story is how the Global West is being dragged into a reverse takeover by the Global East. Perhaps FPX Nickel's stock price perked up after the extra financing news because the market is beginning to understand that the juniors's strategic investors are members of the Global West making sure that their business plans do not fall victim to China's weaponization of nickel supply. |

FPX Nickel Corp (FPX-V)

Bottom-Fish Spec Value |

|

|

| Decar |

Canada - British Columbia |

7-Permitting & Feasibility |

Ni |

Global Nickel Supply - Indonesia and Phillipines |

Nickel Supply Charts for New Caledonia, Russia, Canada & Australia |

Nickel Price and Warehouse Stocks Chart |

Nickel Usage Chart |

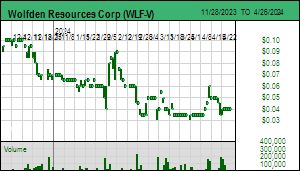

| Jim (0:08:57): Why did Wolfden Resources move up a couple pennies after announcing that the Maine Land Use Planning Commission staff changed its position on the Pickett project rezoning application and appears set to reject the rezoning? |

Wolfden Resources Corp has been trying to get approval from Maine's Land Use Planning Commission to rezone the minesite area at the Pickett zinc-lead-copper-silver VMS project for industrial use so that it can initiate a feasibility study and submit the project to Maine's Department of Environmental Protection for mine permitting. Under current law the DEP cannot process a mine permit application involving unincorporated land, all of which in Maine currently privately owned except state parks, unless the area in question has been rezoned for industrial use. The private property owners at the same time are free to harvest the timber growing on what represents just under half of Maine's land mass.

The LUPC had previously rejected an application which placed the mill and tailings facility at the 374 acre mine site but had hinted that it might be better equipped to judge a proposal that included just a hole in the ground with a head frame above it. So for the past couple years Wolfden has canvassed the surrounding township communities about their willingness to have the Pickett ore trucked from the minesite to a milling and tailings facility within their townships. After receiving support, over whose ultimate approval all local stakeholders understood the DEP has final jurisdiction, Wolfden resubmitted the Pickett mine application and worked with the LUPC staff to assess the proposal via a series of hearings in which anti-mining activists played a major role. A major hearing was held on December 13, 2023 where the LUPC staff was to present its recommendation. But because the chair of the commission was absent the hearing was hijacked by several commissioners who have an absolutist opposition to mining in Maine even though the state spent 7 years to reform its mining regulations so that the permitting cycle can be properly executed by the DEP which is made up of trained professionals. The LUPC staff had favored rezoning and prepared a pros and cons presentation to help the commissioners understand the proposal and make an informed decision. KW Episode December 15, 2023 discussed the outcome of this meeting which featured ignored objections such as that Wolfden does not have the capital to build a mine that has not even been submitted to the required permitting authority.

After the Bangor Daily crowed about how poorly the hearing went for Wolfden the LUPC staff changed their position to one of recommending rejection of the rezoning application. This KW episode was recorded before a February 14, 2024 meeting scheduled to discuss and possibly vote on the new recommendation to reject the rezoning, with only 8 commissioners out of 9 eligible, one of which is outgoing Lee Smith who never attended any of the public hearings leading up to the December 13 presentation whom Oxford County wants to replace with somebody more representative of the county's goals, and the vacant position for which Franklin County proposed Tom Dubois who was supposed to be approved in early January, but for some reason the Legislative Committee on Agriculture, Conservation and Forestry voted early January to reject the replacement nominees. Tom Dubois has since been reinstated as the proposed Franklin nominee, but not until after the February 14 hearing.

Wolfden asked on January 19 for a postponement of the decision until the new full 9 person commission is on board because LUPC rezoning requires a yes from 5 commissioners to pass. Currently 4 of the commissioners are overtly hostile to any mining on LUPC land, which is evident in the ignorance displayed during the December 13 meeting when staff was supposed to defend its recommendation that the rezoning be approved. As it turned out Wolfden's request was rejected and on February 14 the 5 of the 7 eligible LUPC commissioners turned down the rezoning application.

The primary agent behind the LUPC rezoning application rejection is the Natural Resources Council of Maine, a non-profit organization whose agenda appears to be to prevent any mining activity in the half of Maine's 21.3 million acres that is unincorporated and thus under the jurisdiction of the LUPC which makes development rezoning decisions through a commission of 9 volunteers which, when negative, prevents a project from being submitted to the Department of Environmental Protection for competent, professional evaluation. NRCM would, of course, oppose any mine permit application submitted to the DEP, but any decision would follow rules of law with professional accountability, not manipulation of potentially biased and gullible volunteers.

NRCM is a lifestyle organization which collects about $3 million annually in tax deductible donations to support a staff of a couple dozen people and various lawyers (see their NRCM 2023 Annual Report" TARGET=_blank>2023 Annual Report, one of which sent me a gloating email after the December 13 meeting. Their web site has an Anti-Mining in Maine page dedicated to Wolfden's Pickett project that is larded with misinformation including quotes from Native Americans who supposedly are worried about an area where they do not live or even visit, a theme echoed in the NRCM's February 14, 2024 Press Release. NRCM likes to point out that the Pickett project is within one of the watersheds of the Penobscot River which is critical habitat for Atlantic salmon while failing to mention that for decades no Atlantic salmon have migrated up the Penobscot River past Bangor to spawn in this habitat due to contamination from Maine's long fading pulp and paper industry.

The LUPC land is all privately held and can be clearcut logged at will. After that it looks like shit for several decades. If you use Google Earth in 3D mode to fly over this area east of Baxter State Park it is not the pretty area portrayed on the NRCM web site. It is boring rolling hills with second growth forest if any at all. I have not been to Maine but I have been to adjacent New Brunswick to visit the Sisson tungsten-moly project of Northcliff Resources Ltd and I have a good idea about how uninspiring the landscape is in this part of the world. I would be shocked if any NRCM employee or donor ever spent summer vacation time east of Baxter State Park where the Pickett deposit is located. Townships in the vicinity like Hersey, which hoped to get a boost to its local economy from the Pickett Mine, are located east of Mt Katahdin, famous as the end of the 2,200 mile Appalachian Trail celebrated by Bill Bryson in his 1998 book A Walk in the Woods. This was made into a movie in 2015 starring Robert Redford as Bryson and Nick Nolte as Katz. About 3 million people attempt this trail annually which starts in northern Georgia and follows the Appalachian Mountain chain until Mt Katahdin in northeastern Maine.

Bryson and Katz only completed a fraction of the southern end as a continuous slog, but Bryson went on later to sample segments of the trail to get a feel for the different parts. He and Katz teamed up to attempt the final slog in Maine at Monson where the 100 Mile Wilderness corridor ends up at Mt Katahdin. The entire Maine portion of the Appalachian Trail is 282 miles. Bryson and Katz gave up a third of the 100 Mile Wilderness way near the Katahdin Iron Works historic site, defeated by countless stream crossings and endless hill climbs. To do the Baxter State Park portion to the peak requires a free long distance hiker permit, but only 3,150 such permits are issued annually for a season that runs June through October. You don't really want to do it during June-July because this is horrible black fly season. The northern limit of the Appalachian Trail thus does not generate much in terms of tourist revenue because hardly anybody does this portion. The Appalachian Trail is not an economic panacea for rural Maine's woes.

The righteous absolutists at NRCM really do not seem to care at all about the people in rural Maine who might benefit from meaningful jobs other than minimum wage toilet scrubbing jobs offered by rural Maine's growing population of retirees who buy cheap lots and blast down to Bangor in a 100 mile or so drive in their SUVs to load up with whatever they might need. They don't need rural Maine to have an economy because they are living off their accumulated wealth. So they will oppose any commercial development. Maine spent 7 years developing a new mine permitting regime which excludes open pit mining. The NRCM claims it played a major role in this process, but now it is using a loophole in the system that allows a 9 person commission of non-expert volunteers vulnerable to manipulation by a professional anti-mining organization to arbitrarily keep half of Maine's territory off limits to mine development by simply withholding a rezoning to industrial use decision. Clearly NRCM has no confidence in the new mining law and Department of Environmental Protection to safeguard Maine's future. It's all about promoting the mining industry's past sordid history to encourage people to click the Donate Now button. And by invoking NIMBY the Natural Resource Council of Maine helps perpetuate America's growing reliance on raw materials primarily imported from the Global East and increasingly Global South nations who are shifting their allegiance to China and Russia. The supporters and members of NRCM are PutinXi Poodles occupying the bottom left side of the Belief Horseshoe, no better than those on the bottom right side.

Further evidence of NRCM's lifestyle non-profit nature is evident in the support it leant NextEra Energy's $20 million effort to block a transmission corridor through western Maine that would bring clean hydroelectric power from Quebec to New England (see MainePublic.org's Documents reveal NextEra's hidden attempts to derail CMP's transmission line corridor). NextEra operates the Seabrook nuclear power plant in New Hampshire whose electricity rates would suffer from the arrival of cheap hydro power from Quebec. Why is NRCM stumping for high electricity rates and blocking the arrival of clean energy for higher demand?

So why did Wolfden's stock go up a bit when it looked like the NRCM had engineered a defeat for the LUPC rezoning application? First of all, the press release included a statement that implies somebody orchestrated an end run around the wishes of the Oxford and Franklin counties rejecting their replacement nominees for the LUPC. Until now Wolfden has been very discreet about the application process, but now we are seeing a shift in attitude where it will no longer be an asymmetric situation where an anti-mining lifestyle organization not dissimilar from the cynical lifestyle companies that pollute the Canadian junior resource sector gets to play dirty while the serious resource junior has to bite its tongue in case the Bangor Daily gets some fresh quotes that can be spun into a song about how a mining company will destroy Maine's pristine wilderness.

Wolfden has spent about $10 million advancing the Pickett project with exploration and about $10 million in acquisition costs since 2017 after the new mining law came into effect. The market liked that finally Wolfden, seeing the potential for a $20 million writeoff despite acting in good faith, is rolling up its sleeves and shaking off its naivete that Maine's decision making is a science based professional process. In its February 15 press release Wolfden's Ron Little was quite blunt about the hyprocrisy underlying the LUPC decision.

Second, there is hope that rural Maine will wake up and stand up to the Bangor elites who bear none of the suffering of rural Maine and in fact through the tax deductible donations to NRCM divert revenue from public services to sustain lawyers acting for NRCM and native groups. Wolfden may have suffered a Valentines Day Massacre, but within two years there could be political change in Maine which makes a simple change in the rules that allow the LUPC to grant a rezoning application conditional on the project passing the DEP permitting system, thus eliminating the pressure placed by the anti-mining lobby on the LUPC staff and commissioners that if anything ever goes wrong it is their fault alone (this sort of bullying is typical of absolutists at the bottom of the Belief Horseshoe).

Third, some investors are already contemplating that if the LUPC votes to deny the rezoning application, Wolfden will move on and secure a new project in a jurisdiction less vulnerable to the machinations of lifestyle entities who in the name of NIMBY are PutinXi Poodles promoting America's growing raw material vulnerability to the Global East. Wolfden did want to do a "ground" geophysical survey over the lake covered portion of its Nickel Island project in Manitoba where it sees potential expansion of the existing deposit which needs to grow bigger to be worth developing. This winter has been warmer than usual and it is now believed the ice will be solid only until early April. The problem for Wolfden is that it needs to start the program within a week or so ago, but needs a green light from the local First Nation stakeholders who are preoccupied with the possibility that the winter ice road from the northern end of Lake Winnipeg may not open this year. A positive geophysical survey would allow planning for a winter drill program in 2025. Manitoba First Nations declared a state of emergency on February 6, 2024, though apparently the network did open though with some load limitations. Wolfden's stock price sagged in late February so whatever optimism fluttered earlier in February has dissipated. |

Wolfden Resources Corp (WLF-V)

Bottom-Fish Spec Value |

|

|

| Pickett Mountain |

United States - Maine |

7-Permitting & Feasibility |

Zn Pb Cu Ag Au |

US Raw Material Supply compared to China-Russia Supply |

Where do Democracy & Autocracy sit within the Belief Horseshoe? |

Maine portion of the Appalachian Trail |

Aerial View of Pickett deposit area and adjoining Hersey township |

| Disclosure: JK owns shares of FPX Nickel and Wolfden Resources Corp; FPX and Wolfden are Bottom-Fish Spec Value rated |