| Kaiser Watch March 8, 2024: The California Gold Rush Metaphor |

| Jim (0:00:00): Why do you think the AI Dream will not suck the oxygen out of the resource junior room like the Dot-Com Bubble did in 2000? |

At the Metals Investor Forum in Toronto on March 2, 2024 I gave a presentation called Geopolitics, Energy Transition and the AI Dream in which I argued that while my two key themes from the past couple years, the raw material supply dependency of the Global West on the Global East, and the additional critical metal supply requirements of the energy transition's net zero emission goals for 2030, were not lighting a fire under the resource sector, the massive energy consumption of the AI Dream when it really gets cranking over the next few years will spark a new secular bull market for the resource sector. If this starts to happen we will see a five-fold increase in most of my bottom-fish collection just to adapt to a new reality where the resource juniors are seen as the key to turning the AI startup dream into reality, and then be positioned to deliver further 5-10 baggers when they individually deliver a discovery. It will take a distributed collective of hundreds of serious juniors properly capitalized to deliver the dozens of new discoveries in secure jurisdictions like Australia, Canada, United States and Scandinavia which the majors buy out and turn into mines. But you put your finger on a reality which has become a millstone for the resource juniors, namely language like 10 bagger upside.

After my MIF presentation I was dwelling on my experience nearly a quarter century ago at PDAC 2000 when dot-com stocks were going to the moon while resource juniors lagged in the dumpster. The hope we had was that the dot-com bubble would be transformational for the global economy, which in turn would spur raw material demand and unleash an exploration boom that would drag the resource juniors out of their post-Bre-X bear market. In fact, the dot-com bubble peaked during March 2000 and the resource juniors remained in a bear market until mid-2003 when the world began to notice the rise of China which launched a raw material super cycle that lasted until 2011 despite the 2008 interruption caused by the financial crisis engineered by Wall Street.

The resulting resource junior bull market was very different from the ones that defined the Canadian resource juniors from 1970-2000, namely price gains due to a major discovery or anticipation of such a discovery (Hemlo, Eskay Creek, Ekati, Voisey's Bay). The winners of the 2003-2011 super cycle bull market were largely juniors which acquired deposits in the newly opened third world frontiers (emerging market countries) that were marginal at the time of discovery or compromised in some manner by the political situation. Ross Beaty had spent the 1997-2002 bear market tracking down such deposits in Latin America on speculation that the emergence of post-Mao China with the biggest population in the world in the context of globalized trade would increase raw material demand by an order of magnitude that would generate real price gains for metals after decades of real price decline. This prediction became reality and the approach of dusting off old deposits and demonstrating their feasibility in terms of new super-cycle driven real metal prices became known as the "Lumina Model". About 200 juniors ended up disappearing through buyouts worth about $100 billion as the majors, which did not acknowledge the super-cycle until 2006, scrambled to expand their mine portfolio.

Ironically, this feasibility demonstration based boom was based on the very reason the resource juniors could not compete against the dot-com startups back in 2000: the value of a discovery defined by the discounted cash flow model (DCF), namely the present value of the cash flow in each year of a mine's life. Institutional capital loved the China super-cycle because it could see the resulting higher metal prices, the tonnage and grade of those forgotten deposits was already roughly understood, and the cost of building and operating a mine were reasonably understood. The project still had to be marched through the various stages of the exploration-development cycle, but the size of the eventual price could be quantified. The China super-cycle bull market was driven much more by number-crunching than discovery exploration. Eventually the mining industry proved far more successful at mobilizing new supply than needed, the United States adopted a strategy of quantitative easing rather than fiscal stimulus driven infrastructure renewal, and global growth slowed. The result has been a bear market for resource juniors since 2011 with only a few short-lived rallies in 2016 (when gold looked like it was developing an uptrend), H2 of 2020 (when gold breached $2000 in view of pandemic largesse), and in early 2022 (when energy transition goals gained traction and Russia's invasion of Ukraine destabilized metal supply). In 2023 the energy transition faltered and Russia's ability to bypass sanctions cooled concern that the growing geopolitical conflict between Global West and East would come to hunt the Global West whose economy was 60% of global GDP in 2023.

The reason back in 2000 it felt like the dot-com bubble was sucking the oxygen out of the PDAC convention center was that the quantifiable upside limit of a junior's potential discovery could not compete with the unlimited upside of a dot-com startup in a winner take all dynamic where each contender is the potential Amazon style winner until proven otherwise. Every resource junior's discovery is a thing in itself with lots of things potentially blocking it from ever becoming a mine. That was the problem in 2000 and I wondered if it would be a problem again today as countless AI startups get launched, any one of which could deliver fabulous breakthrough discoveries and until it didn't could be priced by the market as if it could. Unlike an exploration play where fundamentals are always staring in your face declaring what is not yet there, you don't need to know anything about the quantitative or even qualitative fundamentals of an AI startup to make money. You just need to be a momentum gambler riding the uptrend.

The resource juniors cannot compete against this type of junior and they have been in a secular bear market for more than a decade as winner take all alternatives like crypto and cannabis came along. Despite resource juniors struggling to regain relevance since 2011, and a general glumness about the resource sector overall, PDAC was shockingly busy (26,925 attended). I am still puzzled by this disconnect and can only explain it by the paucity of delegates wearing the $25 Exhibit Day Pass and the abundance of All Access passes which cost $400 or more depending when you bought it. Investors, unless they are aged 65+ and qualify for a $75 All Access senior pass, buy the Exhibit Day pass, but even that is misleading because individuals flogging services to the exhibitors also buy the cheap day pass. The vast majority of delegates at PDAC are industry and government employees whose bosses paid for their All Access passes. The abundance of delegates is thus an illusion about the health of the resource sector. For me my three days at PDAC were extremely productive; of the hundred or so juniors I had flagged to visit, I managed to make contact with about half and have a notebook full of ideas to follow up on during the coming weeks.

Despite my cynicism about the basis for the PDAC attendance I did emerge with a sense that 2024 will prove to be a turning point. Currently I am still offering a $450 KRO membership expiring December 31, 2024 whose members will be grandfathered to renew at that rate. My plan is to shift to a $200 per month auto-renewal membership in 2025, but I may stop the $450 rate and start the new rate earlier if a resource sector bull cycle emerges this year. The basis for my new found bullishness is the realization that the resource juniors with their finite upside limit should not try to compete with the sky's the limit AI startups. The challenge is to teach the audience how open-eyed fundamental outcome gambling works compared to blind momentum gambling. The upside valuation limit curse of an economic deposit also is the basis for quantifying where a project is relative to a potential outcome and using the uncertainty ladder of my rational speculation model to price the junior based on the stage of the project and what the revealed fundamental results indicate. What changes in the news flow from an AI startup? Nothing except hyped up assertions of progress in the case of technology stories and bigger money losing revenues in the case of information based services. Momentum gambling in AI Startups is for the true believers who occupy the bottom of the Belief Horseshoe, whereas fundamental outcome gambling is for critical thinkers who occupy the upper half of the Belief Horseshoe.

After giving my MIF presentation on March 2 I had a conversation with somebody whose thinking about the resource sector was along similar lines as mine. Somehow our conversation caused me to think about the California gold rush as a metaphor for the AI Dream. The AI startups are the gold-seekers passing through San Francisco on their way to the American River where any one of them could become fabulously rich. Most won't but until they don't each is a contender. But to have a shot at being successful each forty-niner needed to buy a pick and shovel along with other gear in San Francisco. The amount of money the San Francisco outfitters could make was a function of how many forty-niners traveled to the gold fields and how long the gold fields yielded a gold bounty. There was quantifiable limit as to how rich the outfitters could get, which was never as high as the fabulous riches collected by the successful gold-seeker.

The resource junior industry needs to sell itself as the pick and shovel outfitters for the AI startups. This was hard to do with the dot-com startups because those didn't need anything the resource juniors could provide. The AI Dream, however, relies on computation, which, unlike information delivery via existing communications infrastructure, is extremely energy intensive, especially at the scale being proposed. But the AI Dream has a problem, and that problem was the essence of my MIF talk. Once AI really gets rolling, and starts crunching organic and inorganic molecules, reducing the infinite configurations to a manageable set of possibilities that are stable and have potential properties with measurable benefits in all aspects of the physical world (I'm assuming the mental is a function of the physical), and the physical prototyping to confirm those properties starts to deliver those benefits to humanity, the AI computation demand will go through the roof as AI startups start hunting down such possibilities. Forget about Chatgtp and the rest stealing all the jobs from white collar workers in the existing knowledge economy. The upside for humanity from AI resides in the generation of new knowledge. But the existing energy infrastructure cannot generate such a new demand nor deliver it. It needs to be expanded and upgraded. This requires raw material inputs, much of it metallic. In its Electricity Report January 2024 the IEA projected a doubling to tripling of electricity demand for 2026 by data centres (AI) and crypto-miners, but that is likely a major under-estimate if the AI Dream starts delivering that make the world more prosperous.

The energy transition goals have made it clear the world needs more of certain metals which will take at least 6 years to mobilize. But not much is being done to make this reality. Why not? One reason is that the boomers who control most of the capital are not excited about making the sacrifices required of the energy transition because most will not live long enough to find out if it made a difference. The other is that because energy transition strategies are staged (ie the EV adoption rate curve which I argue is not going to be linear but more like the S-curve in the exploration-development cycle), the need to do something about it can easily be postponed. Although the talking heads are brimming with urgency, those with capital not so much.

The geopolitical conflict between Global East and West is something everybody wants to ignore and assumes will disappear as everybody gets back to the globalization concept of making money wherever is best possible. Most people have no idea how dependent the Global West is on raw material supply from the Global East, and to a large degree the Global South which the Global West believes wants to become part of the Global West club. I do not see the autocracy basis of the Global East dissolving into the democracy basis that still underpins the Global West. I see a greater risk of the democracy basis dissolving into autocracy and the world splintering into competing thug nations (ie MAGA Land against everybody else). While I am optimistic that will not happen, I strongly fear the geopolitical conflict will get hot. And when that happens the Global West has a huge metal supply deficit which it will have to solve through domestic sources because in all likelihood the Global South will be either unstable or will align itself with the Global East. These two themes have been my core narrative for the past few years but its implications have not translated into a secular bull market for the resource juniors which I have been forced to acknowledge thanks to the severe slump in funding and market interest in the resource juniors, along with evidence that the Global East's weaponization of metal supply as a loss leader is undermining the profit foundation of Global West sourced metal supply.

My recent epiphany about how the AI Dream is not another Dot-Com bubble sucking the oxygen out of the resource junior room, but rather, thanks to its enormous future energy demands, an argument for mobilizing the resource junbiors as "picks and shovels" providers, has me excited. At any point in time a massive panic attack could jolt the Global West out of its stupor, perhaps driven by Russian nuke detonated in Ukraine, or people waking up to the energy consumption needs of the AI Dream which is no showing up in mainstream as a concern. When this happens there will be a public outcry to renew and expand America's energy infrastructure. That would crank the national debt into the stratosphere. Will the Boomers, lusting about AI innovations whose biomedical implications could extend their lives, or other innovations boost prosperity in the near term, object like they have about the energy transition related debt expansion?

No, it will be their children and grand-children who will object. They will argue, how dare you saddle us with all this debt while nothing serious is being done about net zero emission goals? Screw you! But hey, let's make a deal. We will buy in to this national debt expansion if you agree to make net zero emission goals part of the infrastructure renewal spending so that we will benefit if indeed it turns out to have made a difference in slowing global warming.

Is a broad-based agreement of this nature conceivable? Should we worry about the outcome of the Biden-Trump election? Trump has been a fossil fuel pumper and his signal has been that he plans to continue in this role and do his best to dismantle anything that fosters energy transition goals. The AI Dream, however, is something different, and it is anathema to monotheistic fundamentalists who do not like the idea of humans aspiring to godhood, which both Donald Trump and Elon Musk aspire to in different ways (Musk as an intelligent designer, Trump as an Old Testament style god craving worship). Musk recently met Trump and I am sure it was not to talk Trump into supporting electric vehicles. More likely Musk was selling Trump a vision of renewing America's infrastructure to accommodate the growing needs of the AI Dream. The general view is that a victorious Trump would immediately go to work implementing the playbooks of the Heritage Foundation and Christian nationalists, which would probably destabilize the United States and benefit the Global East, making America not so great anymore. But there is also the empirical fact that no Republican president has ever failed to increase the national debt by a greater amount than any predecessor, and Biden currently holds the record. The Republican Party blocked Trump's call for infrastructure renewal during his first term, but now he owns the party. How much of a stretch is it to speculate that if he is the new president in 2025 he might throw his fundamentalist base and the Heritage Foundation under the bus, and embark on a massive infrastructure renewal boom that does expand send the national debt skyward but also enables the AI Dream and its game-changing potential?

What I am saying is that it may not matter who wins the election; either winner may embrace the AI Dream. And when the realization kicks in that the metals aren't available to support a sustained buildout of the AI Dream, who they gonna call? They gonna call Rio Tinto and ask, when can you increase copper supply 50% in reliable jurisdictions? Uhh, 2040 maybe? Why not earlier? Because all the really good stuff is located in the lands of the Global East and South, and everything good near surface in the Global West has already been mined out. Well, can't you explore a little bit deeper? We could, but we don't have exploration departments. So why don't you rebuild your exploration departments and start looking? Because when big companies like us try to explore all these NGOs and First Nations instantly show up to obstruct the permitting requirements. Useless majors, who we gonna call now to mobilize all these picks and shovels we need to enable the AI Dream?

This is where the resource juniors stand to become the San Francisco pick and shovel outfitters. The metaphor isn't quite exact, because this effort involves hundreds of motivated, entrepreneurial, technically competent groups scouring the historical geological data and coming up with ways to rethink the geological potential of systems that never made it to the level of the marginal deposits found earlier in third world frontiers that became the basis for feeding the China super cycle.

The metaphor isn't exact because most of these juniors will fail to find something that can be made into picks and shovels; it is their critical mass as a distributed process that delivers the picks and shovels. The super-cycle boom attracted institutional capital in 2003 which applied the DCF model to these deposits while the majors snoozed until 2006. The finite nature of resource stories was what attracted the institutional capital and eventually the 200+ buyouts by majors worth about $100 billion.

This time around we are back to a discovery exploration model which the juniors are best at. But the resource juniors have been in general orphaned. When will the glass flip from 90% empty back to half full? It may have started happening a couple weeks ago. I now have a story why I think it can continue and ultimately end up 90% full so that instead of the rest of this decade being the slow disappearance of the Canadian resource junior ecosystem it goes from a deplorable zero to a hero celebrated side by side with the AI startups as their pick and shovel outfitters. At PDAC I tested this narrative on many of the executives I talked to and most liked how I had connected these dots that were already swirling in their heads. And one even told me this was the third time that day he had heard this story. The California Gold Rush is about to happen again, and this time the resource juniors will be the providers of picks and shovels for the AI Dream, which, unlike placer gold fields, has no limit in terms of what could be accomplished. |

China-Russia Raw Material Supply vs US Supply |

Raw Material Supply broken down as by Global West, East and South |

Extra Metal Demand projected by IEA needed to meet 2030 energy transition goals |

IEA projection of extra AI related electricity demand by 2026 |

Price Charts for Key Metals |

| Jim (0:15:38): Why did you restore Canalaska Uranium to your Favorites Collection? |

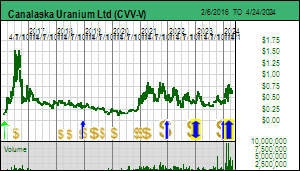

Canalaska Uranium Ltd was made part of my 2023 Favorites Collection based on its intersection of high grade uranium within basement rocks of its West McArthur project in Saskatchewan's Athabasca Basin. Hole 67 reported in August 2022 yielded 9.0 m of 2.4% U3O8 including 6.0 m of 3.5% U3O8. This hole was located about 6 km southwest of the 42 Zone Canalaska had discovered earlier. Canalaska immediately began to drill wedges off this discovery hole in an effort to define the geometry of this mineralization below 900 m depth and trace it back to the unconformity between the crystalline basement rock and the overlying basin sandstone.

The Athabasca Basin has the world's highest grade uranium deposits of which Cameco's Cigar Lake and McArthur are the world class champions. They are so high grade they are mined remotely with machines. Freezing technology is used to prevent water from pouring into the underground excavations. The Athabasca Basin is unusual in that it is traversed by a series of northeast oriented faults which over time accumulated graphite within the faults at the unconformity and also within the basement. These faults served as gateways for hydrothermal systems which circulated through the sandstone from which the fluids harvested uranium. When these pregnant fluids intersect the graphite the uranium drops out of solution. Constant repetition causes very high grade zones to develop at the unconformity along the fault like a string of pearls, but also within the underlying feeder structures. Because the graphite is conductive exploration companies use geophysical surveys to identify these fault structures, which in the case of Canalaska's West McArthur project is called the C10 South corridor.

Most of the unconformity associated deposits have been discovered along the eastern flank of the Athabasca Basin where the unconformity depth dips westward. During the past decade new substantial basement hosted deposits like NexGen's Arrow and Fission's PLS were discovered in the southern half of the Athabasca Basin where the overlying sandstone has been eroded away. Canalaska's exploration strategy has been to probe deeper into the basin on the eastern flank in search of McArthur scale deposits. The discovery in 2022 indicated that a powerful hydrothermal system had been active in the Pike area of the C10 South corridor, and the speculation was that it would only be a matter of time until Canalaska traced the zone back to the unconformity where richer and bigger zones could be expected to be present. I made Canalaska a 2023 KRO Favorite because uranium prices had emerged from their post-Fukushima slump and I was optimistic that by the end of 2023 Canalaska would be delineating a world class uranium discovery at the unconformity. While the uranium price has continuted to improve, Canalaska's followup drilling failed to encounter unconformity associated mineralization and the basement zone seemed to be a dancing squirrel twisting and turning away from the drill bit. So I did not continue Canalaska as a 2024 Favorite and instead made it part of my 2024 Bottom-Fish Collection.

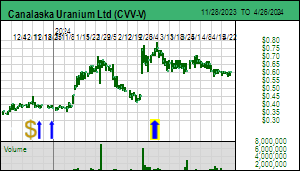

On February 28, 2024 Canalaska surprised the market with news that it had intersected 16.8 m of 13.75% eU3O8 including 4.7 m of 40.3% eU3O8. The grades have an "e" attached to them because these are "radiometric equivalent" readings from an instrument that are very reliable if calibrated properly (something we can expect from the ex-Cameco people running Canalaska). If anything, when the grade gets this high, the eU3O8 understate what the geochemical assays will eventually deliver. The stock jumped $0.285 to close at $0.74 in response to the news and traded nearly 12 million shares. The stock has since cooled off, which gave me the opportunity to make Canalaska a 2024 Favorite on March 7 at $0.74 with a Good Spec Value rating. The reason was that the press release indicated hole WMA082-4 had intersected the high grade uranium at the unconformity, which confirmed that in this area a powerful system was at work of which the earlier intersections were a basement hosted manifestation, and, more importantly, revealed where exactly the unconformity was located. This allows the drill crew to spot followup holes with a much greater chance of delineating the geometry of the zone. The crew has become so accurate in targeting the wedge holes that delineation can now unfold much more systematically than in 2023 when they were trying to chase the structurally controlled basement zone. The market has paused because there is a chance that the first stepout may have guessed wrong about the direction of the unconformity, which would cause a modest price slump when word got out. But that does not worry me because the information gained will allow the next wedge hole to vector towards where the zone continues. The winter drilling will continue into April. The hope now is that by the end of April Canalaska will have a decent understanding of the geometry of the zone at the unconformity and will resume drilling after spring thaw to delineate a McArthur scale world class discovery. There has been some grumbling about the depth of the intersection at 796.6-813.4 m, but that depth does not really matter because the zones will be delineated laterally along the unconformity.

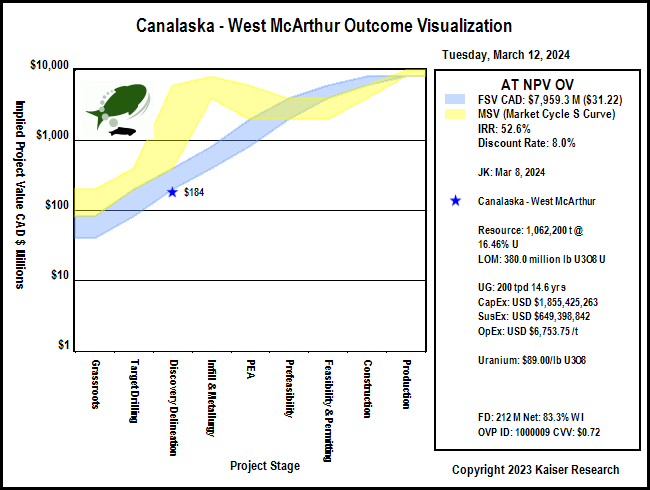

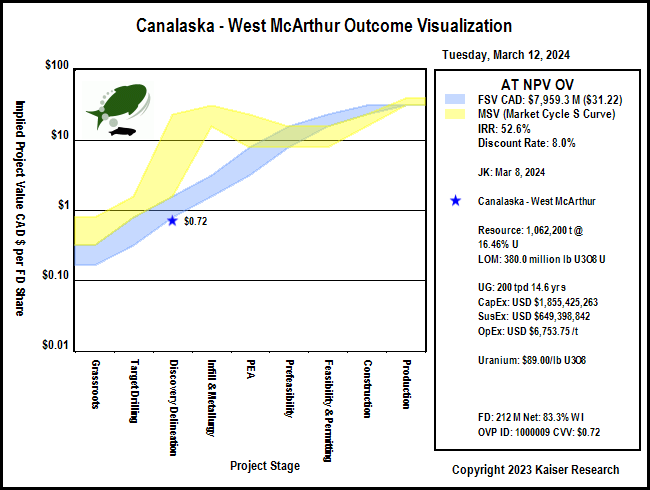

The Good Spec Value rating is the result of an updated outcome visualization I have done which reveals what a West McArthur clone discovery would be worth today. I first created an OV in 2016 when I was covering Canalaska based on cost numbers I dug up from Cameco's filings. I have boosted all CapEx and OpEx costs by 25% to reflect the inflation of the past few years and rerun the OV. As of March 12, 2024 with uranium at $89/lb U3O8 a McArthur River clone consisting of 1,062,200 tonnes of 16.46% U3O8 containing 380 million lbs would be worth just under CAD $8 billion when ready to be put into production. If there were no further equity dilution that would translate into a future $31 price target for Canalaska based on 212 million fully diluted and a 83.3% net interest (Cameco is not participating in 2024 so this net interest will increase further by the end of 2024). Now we are still a long way from delineating 1 million tonnes of 16% U3O8, and the certainty range of a project at the discovery delineation stage is 2.5%-5.0% of the expected outcome value under my rational speculation model, which means fair speculative value for a McArthur outcome is $0.78-$1.56. With the stock trading below this range its price qualifies as Good Speculative Value.

Keep in mind that if you reduce the potential outcome to a smaller, lower grade deposit the stock would probably represent poor speculative value. This is before we start thinking in terms of S-Curve market action which will not kick in until the market has confirmation that CEO Cory Belyk and exploration VP Nathan Bridge have indeed figured out the geometry at the unconformity. The S-Curve action would then kick in because the Pike Zone at West McArthur could turn out to be bigger and better than McArthur or Cigar Lake. This is the closest a resource junior can come to a sky is the limit AI startup style valuation. The important point IO wish to make is that Canalaska Uranium is a "pick and shovel" story which cannot go the moon due to the finite nature of any mineral deposit and the fact that it will be valued on the basis of cash flows discounted from the years in the life of the mine. An $8 billion outcome is about as good as it can get for a resource junior discovery, and it will not be delivered overnight. But that is another 4,000% from the current price, and 8,000% from the price level when Canalaska was part of the 2024 Bottom-Fish collection. For those who wish a refresher course on how to think critically about fundamental resource junior outcomes, I recommend the Mining Stock Education Interview I did with Bill Powers in late 2020. |

Canalaska Uranium Ltd (CVV-V)

Good Spec Value |

|

|

| West McArthur |

Canada - Saskatchewan |

3-Discovery Delineation |

U |

Athabasca Basin Map showing Canalaska Project Locations |

Athabasca Basin Deposit Geometries and Depths |

Athabasca Basin Deposit Model |

Pike Zone Discovery Map relative to McArthur River Mine |

Satellite View of Pike Zone and surrounding area |

Pike Zone before and after unconformity discovery hole |

Outcome Visualization Scenario for McArthur River Clone |

Cost Assumptions for McArthur River Clone Outcome Visualization |

Fair Speculative Value Ladder for McArthur River Clone OV |

Economic Outcomes for OV at different uranium prices |

Implied Project Value Chart for West McArthur OV |

Implied Value per Share Chart for West McArthur OV |

| Disclosure: JK does not own any of the stocks mentioned; Canalaska Uranium is a Good Spec Value rated Favorite |