| Kaiser Watch December 1, 2023: Are those green shoots for real? |

| Jim (0:00:00): How is the end of the year shaping up so far? |

Although the capitulation selling is still widespread in the junior resource sector, and as far as I am concerned will continue to the bitter end of December, green shoots are sprouting here and there, suggesting that maybe 2024 will not be a requiem for the Canadian resource junior eco-system. White gold juniors are now getting competition from yellow gold which has breached $2,000 and is raising hopes that maybe this time around $2,000 will become the base rather than the ceiling. The market hope is that the high interest rate policy of the past 18 months has subdued inflation and that the Federal Reserve will begin easing rates next year and avoid a catastrophic recession for the US economy.

Inflation for October came in at 3.2% on an annualized basis, suggesting that inflation is stabilizing just over a point above the Federal Reserve's 2% target rate. General equity markets are creeping higher on the assumption that it is only a matter of time before Jerome Powell starts easing rates. Since late October the US dollar has begun to retreat against most currencies, but the change so far only qualifies as green shoots that a hard frost could easily wipe out. Short term rates (3 month T-bills) are 5.45%, a strong incentive for investors to keep their capital in money market funds, a major problem driving the capitulation selling in Canadian resource juniors. Gold without much corresponding fanfare among gold juniors and majors has quietly clawed its way back above $2,000, but it is too soon to conclude the green shoots we are seeing among beaten up gold juniors in the form of down-trending charts forming a bottom and exhibiting modest uptrends are sustainable.

The GLD ETF still has no visible pattern of net buying. I have assembled collages of all the key metal prices and in most cases there is no sign that the sideways pattern of 2023 is being broken on the upside. Even with gold you have to look very hard to see it. Battery metals are generally trapped in downtrends after experiencing abnormally elevated levels in 2022. The one notable metal exception is uranium, which at $81.38/lb U3O8 is at the highest level since 2008. Although the demand growth dynamics remain weak for uranium, the market loves the optics of a price uptrend. While I see green shoots of a turnaround at the macro level, it is too soon to conclude that 2024 will be a sustained turnaround for resource juniors, especially after Q1 of 2023 looked so strong only to fail massively to the point that Canada's national newspaper is writing an obituary series about the resource juniors.

And yet there are signs that a sub-class of speculators is starting to move into the resource juniors even while existing shareholders remain intent on liquidating the last of their positions. And this is creating an extraordinary bottom-fishing window for me. Every day I am adding juniors to the 2024 Bottom-Fish Collection, and some of them are starting to sprout as they put out news.

One example is Copper Road Resources Inc which I flagged as a bottom-fish for subscribers on October 25 at $0.085 on the premise that the market was woefully undervaluing the upside for pending drill results for the Copper Road project in Ontario, not to mention the big picture potential of a major rethink of the project's district scale copper potential from an IOCG model a decade ago, which a previous owner failed to validate by drilling, into a radical vision that beneath these high grade copper breccia pipes lie alkalic copper-gold porphyry intrusions such as Cadia Hill or Galore Creek, pencil like bodies whose copper-gold grades can improve at depth to support underground mining. This idea is radical because this part of Ontario has seen no intrusive activity since the Grenville orogeny stymied the Mid Continent Rift more than 1 billion years ago.

The drill program late summer did not test the deeper potential, but it tested known breccia pipes in the middle of the 30 km long property which had high grade underground mines operating until the early seventies at the western and eastern ends. The driver behind the radical rethink is Matt Rees, until recently chief geologist for IAMGold. The recent drilling yielded good copper results, but the holes were not deep enough to test the alkalic copper-gold porphyry hypothesis. That will come next year after the company completes a deep IP survey on a property that in its entire history has never had geophysical surveys that penetrate any deeper than 300 metres. On Thursday November 30 Copper Road released drill results which sparked buying of 7.8 million shares up to $0.16 before closing at $0.12. On Friday the stock was knocked back $0.035 to $0.085 on a tenth of Thursday's volume. There is good and bad news in this. The good news is that speculators who understood the bigger picture story stepped into the market and bought a lot of stock. The bad news is that pretty much all of $400,000 worth of flow-thru stock done in August at $0.07 per unit with a Bay Street brokerage firm which just came free trading was blown out into the market. In a sense this is good news for the buyers who did not have the chase the stock too much beyond the price before the news, but of course nobody likes to see their bottom-fish trade cheaper the day after loading up. The question to ask, now that this flow-through paper has been digested, how much stock will be available between here and $0.20?

That this financing was done is a sign of how difficult the resource junior market has become. The key backers behind Copper Road are Rob Cudney, Pat Sheridan Jr and a relative youngster called Jason Libenson. The best they could do during the summer was raise $400,000 flow-through at rock bottom prices from classic Canadian tax avoider flakes. You know things are bad when Rob Cudney can't flail his way out of a wet paper bag. But it is exactly these conditions which are creating the perception that the Canadian resource junior eco-system has crashed through the extinction threshold and is now terminally ill. And yet there was the green shoot buying on Thursday, and as bottom-fishers get their head around the Copper Road story, and start to believe that 2024 is going to be the opposite of a requiem, rather more like a resurrection, at least for resource juniors whose management has its act together and yet is still suffering bottom-fish valuations, the opportunity to load up ultra cheap is extraordinary.

But Copper Road isn't the only example of green shoots sprouting in the dead of winter. On October 4, 2023 I flagged Delta Resources Ltd as a bottom-fish at $0.165 based on its Delta-1 gold project in Ontario near Thunder Bay where drilling has been outlining a gold system that has potential to generate over 1 million ounces of open-pittable and underground mineable gold right next to a highway. The stock attracted strong market interest and funding in H1 of 2023 based on drilling that intersected high grade shoots within the shear structure. But when the drill marched past a fault it encountered lower grade mineralization, whose results came out just as a $10 million financing done at $0.45 for hard dollars and $0.63 for flow-through came free trading. This financing was brokered by at least 3 Canadian brokerage firms, and, no surprise, the stock got clobbered. Even though Delta has over $5 million working capital, an emerging gold discovery, and a potential VMS spinout property in Quebec it unimaginatively calls Delta-2 should a future resource estimate attract a buyout offer from a producer, the stock in the past month had sunk to $0.09 amid relentless capitulation and tax loss selling.

But on Wednesday November 29 without any fresh news the stock woke up and traded 4.6 million shares to close at $0.135. I called chairman Frank Candido to find out why this was happening, namely buying at the ask, coming from all sorts of brokerage firms. It turns out he was in Zurich where Delta was participating in a two day conference that began November 29. That morning there was a panel of talking heads, people like myself who try to explain what is happening and predict what will happen next on the big picture scale of economics, geopolitics, currency trends and metal prices. A closing question posed to the panel was to pick a couple junior stocks for the audience. One of the panelists mentioned Delta Resources Ltd, listing off all the reasons why it is a great bottom-fish buy. Delta itself presented its story later in the day. What happened that evening when the market opened in Canada was absolutely stunning. The buying originated from delegates who were at that conference in Zurich. As somebody who has been a speaker at this sort of conference in Zurich and Geneva I can vouch that this is extremely abnormal. The people who attend these mini conferences in Switzerland tend to be high net worth individuals and money managers who attend these conferences for 4 reasons: 1) they have nothing better to do, 2) they get to hob nob with each other in a congenial setting, 3) they get to consume good food and wine, and, sometimes if they already own a stock, 4) come to see if there is any reason to continue holding it for themselves or their clients. But what they absolutely almost never do is buy a new idea they encounter at the conference, especially not when trading opens in Canada that evening. This abnormal behavior in Switzerland is another sign of green shoots sprouting. Is there something they know that the Canadians blowing out their Delta shares at the first sign of a bid reaching higher do not? Perhaps.

The structure of the Canadian resource junior market has changed in a profound way since I launched Kaiser Research as an independent commentary in 1994. From a simple stock-picking newsletter specializing in "bottom-fishing" Kaiser Research evolved to become an information portal covering all Canadian and Australian resource listings. How else was I supposed to be able to identify bottom-fish if could not use a search engine with corporate an project level filters to discard all the garbage and home in on potential diamonds in the rough? But in 2011 a never-ending bear market afflicted the Canadian resource juniors, exacerbated by structural changes in how the financial sector and the markets worked. Retail investors were able to find information online, whether through pumps received by signing up for free email lists or lurking in stock forums. The idea of paying a meaningful amount for specialized commentary focused on resource juniors has largely disappeared as a concept for retail investors.

Kaiser Research itself evolved into what I call a Bottom-Fish Workshop where I use the KRO search engine and its company profile resources to identify resource juniors which are missing some piece that keeps them from flourishing. In the KRO Slack Forum I introduce them and members carry on a conversation about what needs to happen to turn these Bottom-Fish into Favorites which receive check marks for all the things retail investors expect. The problem with Favorites is that they offer only fair speculative value, which means upside is dependent on one of two factors. The first is fundamental outcome success, which is the only thing that drives a resource junior higher in a bear market. The second is that the resource sector, or at least the resource sector focus of a junior, be it geography (area or country play) or metal focus (white or yellow gold), achieves a bubble status that lifts all the boats, the better ones at a faster rate to higher levels. Unless one has a strong argument for an emerging bubble dynamic, a Favorite is a stock pick that offers speculators no particular edge. Trying to explain to novice retail investors why a bottom-fish with major missing check marks is worth accumulating in the expectation of outsized gains of 500% or better is a hopeless challenge.

I do not know if 2024 will be a continuation of the extinction trend currently afflicting the Canadian resource junior eco-system. 2024 may prove to be much worse than 2023. And yet the green shoots I am seeing, in the big picture context of geopolitically driven supply disruption, the new metal demands required by the technologies of the energy transition, and the seemingly relentless decay of the rules based liberal order associated with the Global West, give me hope that 2024 will be a resurrection rather than a requiem. So I am changing the KRO membership model to accommodate these two divergent paths.

Effective January 1, 2024 new KRO memberships will be available only on a USD $200 per month auto-renewal basis. Current and former KRO members will be grandfathered at the current $450 per year membership provided they renew before the end of 2024. The grandfathered $450 memberships will run only for the calendar year of January 1 to December 31. Any memberships completed in 2023 will expire on December 31, 2024. Any grandfathered memberships taken up in 2024 will expire December 31, 2024 and be charged an amount prorated for what is left in the year. When 2025 arrives grandfathered memberships will be given the opportunity to renew for another year at $450. Those who do not renew lose the grandfathering privilege, but can always return under the $200 per month auto-renewal program. I am doing this to allow those present and past members who understand the concept of a bottom-fishing workshop to continue to participate at the old rate while I shift away from trying to teach a new generation of retail investors what bottom-fishing is all about.

If 2024 proves to be a resurrection year I do not want a flood of new retail investors jumping onto the resource junior bandwagon who see KRO as a magic ticket to profits, especially not ones that cannot afford a $2,400 annual membership. I suspect if the market gets hot enough some will be tempted to sign up for the $200 monthly auto renewal. They can submit a discontinue notice to prevent auto-renewal if they realize Kaiser Research Online does not serve their needs. The audience I believe KRO will serve best are sophisticated investors who appreciate the time saving value of KRO as a research platform. They may or may not be interested in the Bottom-Fish Workshop which I am preserving as a community for resource junior bottom-fishers. The YouTube hosted Kaiser Watch episodes will continue to be free, generally featuring Favorites which have graduated from the Bottom-Fish Collection. And if 2024 turns out to be a requiem, it may be time to accept the death of the Canadian resource junior ecosystem. But maybe those green shoots are for real. It has been a long time since I have felt this excited during the final months of the year when I show up each morning in the office to engage in bottom-fish research. |

Copper Road Resources Inc (CRD-V)

Bottom-Fish Spec Value |

|

|

| Copper Road |

Canada - Ontario |

2-Target Drilling |

Cu Ag |

Delta Resources Ltd (DLTA-V)

Bottom-Fish Spec Value |

|

|

| Delta 1 |

Canada - Ontario |

3-Discovery Delineation |

Au |

Inflation, Prime and Real 1 Year T-Bill Rates |

Short term momey market funds are draining risk capital away from the resource juniors |

General Equities have avoided a repeat of the 1930's crash |

A snapshot of key currency exchange rates |

Base Metal Price Charts |

Price Charts for Fertilizer, Uranium, Coal and Alloy Metals |

EV Metal Price Charts |

Precious Metals Orice Charts |

Daily Change in GLD gold trust Holdings |

House Summaries for Copper Road on Nov 30 and Delta on Nov 29 |

IPV Chart for Copper Road |

IPV Chart for Delta Resources |

| Jim (0:10:35): What's new in the James Bay lithium area play? |

The month of November was not kind to the James Bay Lithium Index as investors ratcheted up what they want to see in the form of fresh news from juniors while watching the lithium carbonate spot price crash through $10/lb, closing at $8.07 on Friday. Chinese spodumene refineries and battery makers are currently negotiating long supply contracts with concentrate producers, so are delighted by the price trend. Audiences that track the Canadian resource juniors are worried that the lithium price will suffer another lithium winter as happened in 2018 when the Australians were faster at mobilizing new supply from their pegmatites than demand growth from the EV sector. The lithium carbonate price crashed from a $10-$12/lb range below $3/lb, crashing lithium junior stock prices, discouraging new exploration, and stalling feasibility demonstration work on advanced pegmatites. That imbalance reversed itself in late 2021 and the spot price shot into the $30-$35/lb range where it stayed all of 2022 before new supply came on stream in 2023.

The problem with North American investors is that they are overly obsessed with metal prices which comes from decades of braying and praying for higher gold prices and hooking market sentiment to the trend in the price of gold. They do not understand that lithium, which was a $200 million market in 2005 when about 20,000 tonnes of lithium metal was produced, has undergone a nearly 600% supply growth since then, producing 130,000 tonnes in 2022 which at the nominal average spot price in 2022 was worth about $49 billion, but at long term contract prices likely worth in the order of $20 billion. The rapid demand growth experienced by lithium thanks to its key usage in electric vehicle batteries is unprecedented, and is required by an EV sector whose annual sales are still less than 10% of car sales. The IEA projects a 600% lithium supply expansion is needed to meet EV sales goals for 2030, and if claims about commercially viable solid state lithium ion battery breakthroughs by the likes of Toyota are true, the expansion need will hit 1,200% by 2035. That means the future lithium market will be worth $100-$200 billion annually.

The $30-$35/lb lithium carbonate range was never sustainable because at that price an awful lot of LCT-type pegmatites are in the money. If lithium carbonate stabilizes in the $5-$10/lb range that is high enough to encourage exploration and development of pegmatites grading 1% Li2O or better, and that is where the James Bay region is important because it is now host to several world class lithium pegmatite deposits, with Patriot Battery Metals' CV5 being confirmed as the biggest and richest when it delivered its maiden resource estimate in August 2023. PMET's CV5 and any other new discovery will not be in production before 2030, given Canada's anti-mining attitude and Prime Minister Justin Trudeau's apparent desire to bestow on First Nations the final say on Canada's future mineral development.

On December 1, 2023 President Biden, becoming ever more aware about the Global West's vulnerable dependency on raw material supply from China and Russia, took another step to limit EV tax credits to cars whose inputs are not sourced in the Global East (US Limits China's Ability to Benefit From Electric Vehicle Subsidies). If anything gets PM Trudeau bounced out of office, it will be his failure to understand Canada's critical role as a producer of minerals like nickel and lithium essential for energy transition goals. The Canadian financial sector also needs to pull itself out of its anti-mining funk and start bankrolling resource juniors engaged in exploration. The key to regenerating a robust resource junior eco-system starting with lithium is to understand that the current lithium price is irrelevant to market sentiment. Even if it does crash back below $3/lb, this would be short-lived because that price is too low to mobilize the future needs of EVs replacing ICE cars.

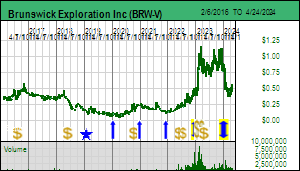

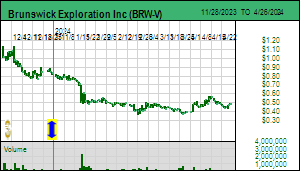

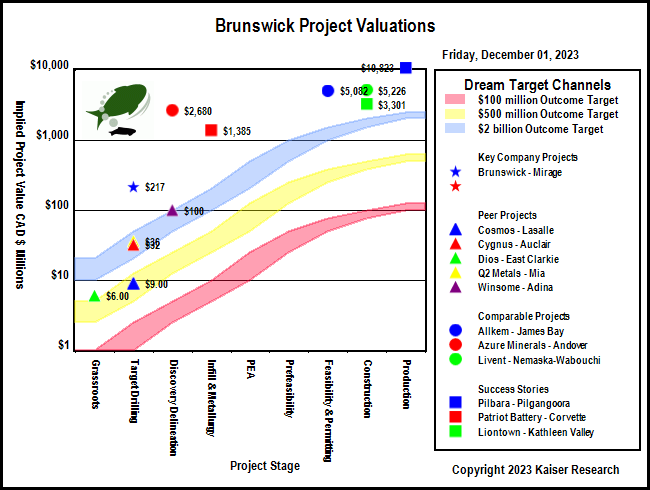

What the Canadian resource juniors now need is a Canadian lithium discovery champion. Patriot Battery Metals, although it started on the CSE and now trades on the TSXV, its initial funding and price appreciation came from Australian investors, and it is now dual listed on the ASX which sets the day's trading tone. PMET has lost a third of its value since Albemarle invested $109 million at $15.25, largely because the story is now in feasibility demonstration mode even though exploration drilling is building the resource bigger. So far the best shot at a Made in Canada lithium discovery champion is Brunswick Exploration Inc which is sporting an implied value of about $200 million based on speculation that its Mirage project in the James Bay region has world class scale.

Brunswick last provided a meaningful update on October 5 when it announced that drilling at Mirage has intersected spodumene bearing pegmatite over lengths up to 52 metres, though it cautioned that true width is unknown. The junior blew a chance to provide an update ahead of the XPLOR conference in Montreal during the first week of November, choosing instead to announce a $5.7 million flow-through financing which blacked out any further updates until it closed on November 17. This has left the market wondering if Brunswick is still struggling to grow a PMET out of a Peanut at Mirage. Assay turnaround for pegmatite core has been terrible, and the company is now caught in a trap where if it releases only a handful of intervals, the market might declare, "not good enough". What the market wants now is evidence of scale for Mirage and confirmation that Brunswick's drilling has yielded an understanding of the geometry of the Mirage pegmatite field. Assays can wait until January when Brunswick has hopefully received enough 1% Li2O intervals to allow the number-crunchers to start estimating potential tonnages and grades. What the market is dreading is news such as what Q2 Metals Corp reported for initial drilling limited to one end of the LCT-type pegmatite trend on its Mia project in the James Bay region. The market saw only a peanut sized scale and, unfairly and impatiently, trashed the stock.

On November 27, 2023 Brunswick did toss a bone to the market when it announced "Brunswick have notified Globex that they have met the minimum $1,000,000 exploration expenditures and Globex has received an additional $212,500 in cash and 216,395 Brunswick shares, representing a cash equivalent of $212,500 (216,395 shares at 30-day VWAP average of $0.982/share). The full exercise of the option has occurred approximately 11 months after signature of the 4-year option agreement." The market was not sure what to make of this accelerated 100% vesting in the Globex option. It was already a given that the low expenditure requirement would be fulfilled this year. The $500,000 in cash and/or stock is not much money at all, so it does make sense to take care of it all right now rather than be an over-optimizing accountant dribbling out the bits each year when they come due. The main reason to do this now is that it forces a vesting acknowledgement from Globex Enterprises which eliminates the risk something small that needs to be done at a later date gets overlooked and triggers a default, and the risk that if Mirage is a PMET rather than a Peanut, Jack Stoch's lawyers find some legal hook to claim the option deal was not valid. In my view getting rid of the title risk now can be interpreted as a sign that internally Brunswick thinks it has the goods.

The more impressive part of the announcement was that a winterized camp is now in place to support a 15,000 m drill program in 2024, not just for 2024, but to be executed during the Q1 winter. This is a sign they are shifting to delineation drilling, that they have sorted out the geometry of key pegmatite zones, and that the spodumene visuals are strong and abundant enough to signal grades over meaningful widths will run over 1% Li2O. The market, in its current bad mood, however, is in a mood of show me at least physically what the pegmatite field looks like, where have you found outcrops, where are your holes located so that we can see that your understanding of the geometry is evolving and you are seeing good geometry. If Brunswick can give this sort of update in early December, an entirely new audience can start to embrace Brunswick and its Mirage project as a new Canadian discovery champion in the James Bay region. And while Brunswick does not yet have an ASX-listing, Australian investors have quite a bit of experience interpreting LCT-type pegmatite results, especially having napped for 6 months after Azure Minerals Ltd first reported evidence of a big pegmatite field at its Andover nickel project in the West Pilbara region of Australia in October 2022 that attracted SQM as a 19.9% shareholder but not much respect from Australian investors until assays started showing up. The Andover project is now sporting an implied value of AUD $2.7 billion on a 100% basis and Azure has not even delivered a maiden resource estimate. That is ten times higher than Brunswick's Mirage implied value. (see KW Episode Oct 27, 2023).

The emergence of Brunswick as the new Canadian discovery champion for the James Bay region would also do a lot for all the other juniors that managed to get some work done after losing most of the 2023 boots on the ground prospecting season due to Quebec's forest fire closures. If the American transition from ICE to EV cars remains on track, dozens of world class lithium pegmatite mines will need to be built in Quebec by the 2030s. During the past week the James Bay Lithium Index sprouted a run of green shoots, despite the lithium carbonate price sinking lower. If Brunswick were to deliver concrete evidence that Mirage is another PMET rather than a Peanut, this greening trend could continue well into the new year. After this KW Episode was recorded Friday I joined Albert Laurin for a free-wheeling Lithium & James Bay Discussion which my KW audience may find entertaining. Brunswick, however, is key to getting the Canadian financial sector into the James Bay lithium play before the Australians once again eat their lunch. |

Brunswick Exploration Inc (BRW-V)

Favorite

Fair Spec Value |

|

|

| Mirage |

Canada - Quebec |

2-Target Drilling |

Li |

Azure Minerals Ltd (AZS-ASX)

Unrated Spec Value |

|

|

| Andover |

Australia - Western Australia |

3-Discovery Delineation |

Li Ni Cu |

James Bay Lithium Index |

Daily Performance of James Bay Lithium Index |

Lithium Rock Value Matrix and Price Chart |

IPV Chart showing implied values of Brunswick's Mirage and Azure's Andover |

| Disclosure: JK owns Brunswick; Brunswick is a Fair Spec Value rated Favorite; Copper Road and Delta are Bottom-Fish Spec Value rated |