| Kaiser Watch January 26, 2024: The Nightmare facing the Global West |

| Jim (0:00:00): What do you think could turn around the increasingly bearish attitude toward resource juniors? |

The presentation I gave at the Metals Investor Forum in Vancouver on January 20, 2024 was called "The Nightmare facing the Global West". The videos of my presentation, those of the three juniors in my session, and the backstage interviews I did with them, are now available on YouTube via my MIF Comment. A year ago I was very bullish about a bull market breakout for the resource juniors, then in the twelveth year of a secular bear market that began in 2011 that has had only a few short-lived rallies n 2016 and 2020. Stock prices had started to rise in early December 2022 and were still surging in late January. The crowd in attendance was the biggest I had seen since the MIF conferences began around 2015. But by April the resource sector and the juniors had become distinctly bearish, a financing winter began mid year, and the resource juniors finished off the year on a down-tick. Hopes that the tax loss selling season would transition into a January Effect were dashed on day one. What I saw as a capitulation trend last year was continuing with even greater vengeance in the new year. This year when a junior reports exploration results, regardless how promising, the stock has been hit by a wall of selling which I suspect is led by the traders who work for Canada's financial establishment and can exploit the absence of an uptick rule with impunity. Given this sour mood I was surprised that this year's Metals Investor Forum was as well attended as last year's when a strong January Effect was at work. About 750 delegates picked up their badges during the two day conference, and another 400 distinct viewers watched at least some of the live-streamed sessions. All of them are now available online via the Metal Investor Forum YouTube channel.

There is a deeply negative funk hanging over the resource juniors which was to be expected as the end of a bad year approached, but the fact that it has accelerated in the new year is deeply worrisome because now we have no seasonal sentiment cycle to use a reversal timing predictor. We are at the mercy of macro-economic trend indicators. The yield curve is still inverted which predicts that there will be an economic downturn that will require monetary easing to reverse. But the US economy is still doing well, which implies a disconnect with the bond market's expectations, unless you argue that the delayed impact from the rate hikes of the past two years has yet to manifest itself (is a soft landing scenario real, or will things shift rapidly into a hard landing?). The resource sector is notoriously lagging edge when it comes to macro-economic trends, and at this point it is still reflecting an expectation of a hard landing. But that is only looking at it through the eyes of the United States.

The bigger problem is that China, although a smaller economy than the US, is a much bigger consumer of metals and there appears to be a very serious problem in China which relied too much on a debt-fueled building boom that is now experiencing the Global West's 2008 financial crisis. Chinese citizens are petrified about the future, and, after being denied the opportunity to consume during the insane covid lockdown, are now hoarding their savings in anticipation of hard times. With real estate values having gone no bid Xi is in a pickle, especially because he has imposed a hyper-surveillance system on the Chinese in order to control the narrative in Beijing's favor. While there are stupid Chinese just like there are stupid Americans, the majority know what is going on and are operating in survival mode. A consumer led post-covid rebound is not happening.

With the growth of Chinese demand for raw materials easing, the surplus needs to go elsewhere and that is weighing on metal prices. Because Chinese and Russian raw material supply is subsidized by dumping environmental costs on powerless downstream victims, and both are happy to operate at break even because their "profit" derives from strategic "collective" considerations, this situation inhibits the ambition of Global West producers to expand supply and even forces many to suspend operation to avoid operating losses.

In addition there is a narrative emerging that the supply expansion for metals like copper, nickel and lithium required by the energy transition is not happening, so, rather perversely, metal demand expectations are once again being tied only to macro-economic trend projections, and with the uncertainty about China's economic destiny, that at best promises flat prices for 2024.

The theme of my talk was that the autocracy foundation of the Global East has zero chance of shifting to democracy within the sort of time frame that would help resource juniors. I expect the conflict between Global East and West to intensify during 2024, not just in actual terms, but especially in perceptual terms. That graphic I created comparing the relative raw material supply of the United States with that of China-Russia is something that the vast majority of residents of the Global West are ignorant about. That ignorance hinders investor interest in the resource juniors, especially among the younger generations who have no clue where physical stuff comes from and under what conditions. All that many of them know is that mining is bad and should not be done in the Global West. What they do not appreciate is how incredibly vulnerable democracies have made themselves by becoming addicted to metal supply from autocracies.

What could dramatically turn around the fortunes of the resource juniors this year is a rapid widespread awakening to this vulnerability. I believe that by the end of the year everybody will have acquired a deep understanding of the American raw material supply vulnerability. It does not matter who wins the election. If Trump wins the 2024 election he will try to stick to his promise of turning America into MAGA Land, a budding autocracy that competes against all other nations. When the rest of the Global West in turn dissolves into independent autocracies America will have no friends nor any respect. As members of the Global East like China, Russia, North Korea and Iran cheer, the rest of the world will wonder why it still needs to use the US dollar as the primary means to settle international trade. This will boost demand for gold, a metal that otherwise is not needed to keep the economy humming.

America will be seen as an aging toothless tiger whose only capacity to project power will be to blow things up with long range weapons of which only nuclear bombs would have a noticeable impact. The Global South, whose members supply a fair portion of the raw materials, have already signaled that they will be friends with whoever butters their bread most lavishly. When MAGA Land realizes that the biggest economy is dependent on importing raw materials from its enemies, an absolute panic will grip the nation. Canada and Australia stand to benefit enormously if they can keep the First Nations and NIMBY opposition from acting as PutinXi Poodles by blocking exploration and development.

Even if Biden wins the election and is not toppled by an insurrection, keeping the Global West alliance intact, the geopolitical conflict with the Global East is not going away. And in so far that the Global West remains committed to the energy transition, not only must exploration and development within their territory replace supply that has predominantly come from the Global East, it must also secure domestic supply to meet the extra demand created by energy transition goals. The only thing that can reverse the dying out of the Canadian resource junior eco-system is the widespread realization that raw material self-sufficiency begins at home.

A tidbit I picked up in Vancouver is that the big producers are rebuilding their exploration departments after winding them down during the past decade. Why? They realize that the Canadian resource junior eco-system is dying because it lacks the support of the financial, regulatory and political establishments of Canada, which in turn deters a vibrant retail audience from taking resource juniors seriously. They know that the First Nations and NIMBY blockade is deadly to the resource junior speculation cycle which requires a reasonably regular flow of exploration results to sustain their financing capacity which is also being undermined by the Canadian risk capital stripping system run by the Canadian banks that prevents price discovery from working properly.

The result is insufficient scale and diversity of risk capital inflow for the resource juniors to function as a collective exploration force from which the producers pluck the winners when they materialize. The BHPs and Rio Tintos of the world know that they cannot operate in China and Russia, and, with Global South nations increasingly allied with the Global East and evolving their own autocratic regimes, the western majors know it will become hard to compete in resource rich Latin America and Africa. They are gearing up to once more do exploration themselves. But by nature the producers are slow-footed bureaucracies that will not get the exploration and development job done in a timely manner. If the thumb squashing the juniors is lifted, and what they do becomes celebrated as an existential necessity, the resource juniors could roar back to life as the warriors delivering salvation to the Global West or MAGA Land if that is the outcome.

For now I have embraced a defensive strategy which assumes metal prices will be weak or flat during the rest of the year, and that means focusing more on discovery exploration juniors than those trying to demonstrate the feasibility of mining existing ounces or pounds in the ground. The presentation included a slide listing the 90 juniors I have so far tagged as members of my 2024 Bottom-Fish Collection. Deciding which one to accumulate requires understanding their proposed story path to success. But to see that investors will have to buy a $450 KRO membership which expires December 31, 2024. |

Regardless who wins the US election the Global East conflict will worsen |

Global West nations dominate top 20 GDP |

GDP evolution broken down into Global West, East and South |

Raw Material Supply broken down as Global West, East and South |

US share of raw material supply relative to China-Russia combined |

2024 Bottom-Fish Collection as of January 17, 2024 |

| Jim (0:12:23): Your three James Bay lithium favorites have taken a beating. Is Lithium Mania 2.0 already dead? |

China has been the primary driver of lithium demand because its EV deployment has been driven by the desire to escape import dependency on oil as a transportation fuel. China's replacement of its ICE fleet is vastly ahead of that in the rest of the world. Right now in the Global West the EV demand is sagging because of high interest rates and the fact that the economic slice which contributed to EV adoption is approaching saturation. The reality is that for ordinary people good EVs like Teslas are too expensive, and the cheap sort such as BYD produces are inferior in terms of how long one can drive before recharging, where to recharge and how long to recharge. This is the reason Toyota avoided charging into the EV sector and instead chose to focus on hybrids while working on hydrogen leapfrog technology. The latter, however, is for a future decade because there is nothing happening to create widespread hydrogen refueling stations whereas electricity supply is ubiquitous, you just need a place to park and plug in.

The most important thing I picked up walking the floor of VRIC was how widespread was the ignorance among the top people of lithium juniors such as Brunswick's Bob Wares about what Toyota announced in May. Bob was dumbfounded when I explained it to him, because he instantly recognized that if Toyota is not bullshitting, and has figured out how to build a solid state lithium ion battery that uses lithium as the anode instead of graphite, which facilitates ranges over 1,000 km on 10 minute charge times, and, because it is based on a manufacturing breakthrough rather than some new configuration which requires a scarce and expensive input such as scandium or even worse iridium, has the potential to undergo further efficiencies just as has happened with solar panels, Toyota will be in a position to offer affordable EV Camrys and Corollas by 2030, provided there is enough lithium supply in place to do so.

The Hertz debacle is no surprise. If I fly to some unfamiliar city and rent a car to explore the surrounding area, I don't want to worry about how long before I need to find a charging station. But if I pick up a rental car with a full charge that gives me 1,000 km, I don't have to worry about it. If lithium junior heads don't know about the Toyota breakthrough and its implications, then it is safe to assume hardly anybody else does. But groups like Albermarle, SQM and Gina Reinhart know, which is why Gina and SQM are paying the equivalent of AUD $2.7 billion to buy out Azure Minerals which doesn't even have a resource estimate yet. They know lithium will be a $200 billion annual market during the 2030s and spodumene pegmatites are the most predictable supply source today while we wait to see what the salars, claystones and oil brinefields can deliver at what unit cost.

The idea of Lithium Mania 2.0 is tied to the solid state lithium ion breakthrough which turns EVs into an affordable and acceptable option for ordinary people, and we will not hit that inflection point until 2030, which means exploring for pegmatites has to go full throttle today. If Toyota delivers on this promise, EVs cease to be a "political" choice. Toyota is not the only outfit chasing the holy grail. The secrecy surrounding solid state innovation R&D makes it hard to quantify the potential lithium need implied by success. I do know that outfits like IEA and Rio Tinto who have the inhouse expertise caveat their demand projections with the "disclaimer" that they assume no solid state LiB will ever become reality. And I do not think they mean success would require less lithium. So at a minimum it will require more, maybe a lot more. But what is also obvious is that if they have an affordable EV with long range and very short charge time, the adoption rate will go exponential from a flat-lining or gently uptrending annual sales base, and that is not possible if the lithium supply is not in place.

Toyota itself promises a high end model only for 2027 or 2028. But by then they will know what it takes to make an affordable version whose production could be tooled up by 2030. The key thing is that Toyota has not invented a new configuration that avoids the dendrite problem but still allows all the benefits of a lithium metal anode; it has simply figured out how to make a configuration that is already known to work at a much lower cost than previously indicated. Presumably the manufacturing cost vastly exceeded the raw material cost prior to this breakthrough.The thing about manufacturing costs being the largest component of a technology is that over time the engineers achieve ever greater manufacturing efficiency, as we saw with solar panels whose cost has dropped 90% over the past decade and not because the materials became cheaper.

The solar adoption curve hinged on individual decisions helped out with government subsidies. EV adoption is something being pushed by the carmakers and only partly because of government energy transition policy. The cost of operating an ICE vehicle has always been at the mercy of the oil price which is vulnerable to an escalating geopolitical conflict between Global East and West. The carmakers develop and promote cars, but the oil producers reap the benefit created by the captive audience generated by the carmakers. The volatility of global oil prices allows the oil producers to harvest the cost of the changing price from the pockets of consumers who get nothing in return other than to continue to drive to where they want to.

Tesla not only pioneered a breakaway from this asymmetric oil price burden on consumers, but it also melded the car with digital technology whose provision it alone provides and profits from in so far that consumers want the digital extras. Whether the electricity supply shifts away from fossil fuels to carbon neutral sources such as nuclear, wind, and solar, or stays dependent on coal and natural gas is irrelevant to the carmakers, as we see in China where the primary government goal behind the rapid EV deployment is to escape dependency on oil imports which are vulnerable to disruptions at source or during transport. As a driver of an ICE car I am keeping a wary eye on the Middle East which could spin out of control, sending gasoline to $10-$20 per gallon unless the United States reintroduces a ban on oil exports to keep the domestic cost down while the rest of the world suffers.

There is thus a much greater urgency among the carmakers to deliver the sort of EV the masses will want, so cranking through manufacturing efficiencies could happen very quickly. EVs in their current form are just not ready for prime time. But it looks like they can be by 2030.

From our perspective the question is when will the public begin to understand this, and when will the Toyotas take steps to secure their lithium supply by 2030? On January 19, 2024 BMO Capital Markets published a report that includes a section on lithium. For anybody with access to this report it is well worth getting hold of; I've grabbed and annotated a couple graphics to illustrate the difference between the consensus outlook and my alternative solid state LiB based vision for the EV adoption curve. The BMO sales growth chart assumes a constant rate between now and the rest of the year, which is at odds with my cartoon that is based on the view that EV sales growth will slow down as the larger consumer pool beyond the elites balks at buying EVs that do not meet their cost, range and charge time needs. The parade of headlines in 2024 about slowing EV sales will hang over the market of lithium juniors. The spot price of lithium carbonate may stay below $10. Because Toyota was a laggard with regard to EV deployment it is not in its interest to hype the solid state future, which we saw in Chairman Toyoda's recent dismissal of EVs in favor of its existing hybrid line. But while the public may be ignorant of the looming dynamic, the carmakers will not be ignorant, and the trashing received by the Canadian exploration focuses lithium pegmatite juniors represents an opportunity for investors who can grasp the bigger picture unfolding.

These investors will see that Toyota is plotting a run to eclipse Tesla in 2030 and does not need to compete in EV sales until then. Tesla is stuck rolling out BYD style LFP cars to a reluctant American market. The Global West government sentiment is to block the Chinese invasion of their car markets. Tesla has to know internally that if Toyota can deliver on its solid state LiB, this poses an existential danger to Tesla whose market cap is bigger than that of Toyota. So you can bet that internally it is all hands on deck with regard to developing a solid state LiB that matches what Toyota promises. The market perception, in so far that the market even knows about the solid state idea, is that the solid state LiB is a Holy Grail story, something that will never be achieved.

The inflection that puts Lithium Mania 2.0 back on track will be widespread recognition that a solid state LiB is no longer a Holy Grail, and has become the subject of a hugely consequential and intense commercialization race. If Trump becomes president he will do his best to dismantle EV incentives but it will not matter because the expectation will emerge that a highly desirable EV is coming. If Trump turns America into a MAGA Land alienated from the Global West it will most assuredly hasten conflicts that disrupt global oil supply. He is unlikely to annoy his oil backers by banning oil exports so as to protect American consumers at the expense of Exxon shareholders. When gasoline prices soar the anticipation of EV salvation will go through the roof. But salvation will not come if the corresponding lithium supply is not in place by 2030. Lithium Mania 2.0 is all about securing the supply needed when the carmakers deliver an EV that the masses want and can afford, which will not be before 2030. The time to act to mobilize that future supply is now, and waiting 3-4 years to see if DLE or claystones are a large scale solution is not an option for the likes of Toyota. Albemarle and SQM understand this. Gina Reinhart, who is not pumping her book as would be the case with Mineral Resources and Pilbara Minerals, also seems to understand that lithium will become a $200 billion annual market during the 2030s.

The general view seems to be that lithium will be in over supply this year with the Australian producers scrambling to curtail production while the Chinese are not curtailing their higher cost lepidolite production or what they have going on in Africa. Suppressing the price of lithium serves China's interests because even though the headlines scream slowing Chinese demand, China's far greater EV deployment than the rest of the world means it will be a much bigger consumer over the next few years than the rest of the world for whom mass adoption of EVs will not be realistic until a much better battery in an affordable car becomes available. The most important message the market must absorb is that today's lithium price is irrelevant to resource juniors exploring for and advancing lithium pegmatite deposits.

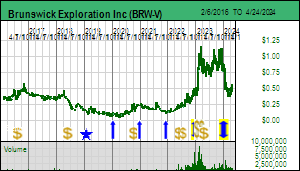

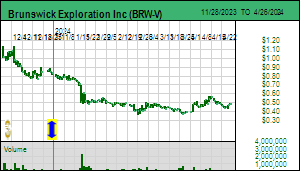

When will Brunswick Exploration Inc reverse its decline? Should one buy now or wait for it to fall lower? In the case of Brunswick we know there will be drill results coming from Mirage with visuals possible by March. The main spodumene boulder field remains unexplained by what they have encountered through drilling outcrops. They have just begun and they are starting with bonanza grades, just not bonanza widths. But those boulders with their size and distribution suggest something big remains to be found. Bob Wares says they will probably have to drill angled scout holes along a grid in the vicinity of the boulders to sort out from where they came from. They will not do that until the summer, but beyond delineating the current Mirage zones, that could be the "scale the discovery bigger" event during the summer.

The best strategy in this nasty market environment over the next 6-8 weeks is to buy some Brunswick, and if it goes lower, buy some more, and if goes higher, buy some more, but only if this is happening in the context that the market is starting to understand the Toyota implication, because once you accept that, it doesn't matter what the price of lithium carbonate is this year. And Toyota could help out by making additional more aggressive announcements.

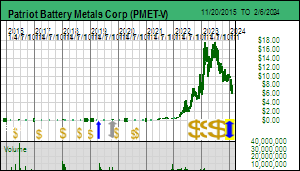

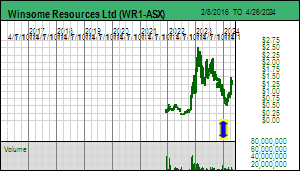

Patriot Battery Metals Corp is the most advanced of the James Bay explorers and has the largest prospective footprint. Its implied project value today at $6 is only about CAD $900 million, roughly 8 times that of Winsome's AUD $125 million at $0.60. I made PMET a Favorite because it should be trading at a $2 billion plus valuation ahead of higher valuations after economic studies are delivered. Ken Brinsden taking the helm from Blair Way is an important development because he has already built a lithium pegmatite producer from scratch and has what it takes to repeat doing so with PMET in James Bay.

PMET is 5-7 years from production so should not be priced by cash flow multiple metrics, as the Australian producers currently have to endure, but in the absence of strong leadership traders can use the short term lithium and EV sector sentiment to kick the stock price around. With Brinsden in charge it is now conceivable that PMET becomes another Pilbara Minerals, a future lithium producer giant that is not acquired by an existing mining giant. In fact, PMET could become an aggregator of James Bay lithium deposits and become a new Canadian mining champion. PMET has much more upside than downside from current levels unless you believe in DLE or sodium miracles, but the upside is a double to quadruple over the next few years, and it will take at least that long for a DLE or sodium miracle to become reality. But its asset solidity is the reason I made it the lithium flagship of the 2024 Favorites.

Winsome Resources Ltd is more advanced than Brunswick and currently has a similar valuation and is better funded. Adina has no chance of becoming as big as the collection of deposits on PMET's land package because others own the surrounding ground. So far, however, Adina appears to have the keystone of the pegmatite system in this area. A tidbit I picked up from Midland's Gino Roger is that Rio Tinto has decided that it will use RC to drill the Galinee project to the east of Adina, starting late in the season. That has several seasoned experts shaking their head. Does Rio Tinto think it is prospecting with a drill bit for blind kimberlite dykes? Bob Wares loathes the idea of prospecting with a drill bit, but when BRW goes to work to solve the mystery of the Mirage boulder field it will use a core rig. As am aside, Bob says they have tried every geophysical method including gravity to try and see pegmatite bodies under cover and found all of them useless, though Winsome seems to think gravity is helpful at a very local scale.

Winsome with Adina alone does not have the footprint to deliver a billion dollar plus prize, but an eventual valuation in the $300-$500 million range is plausible. Importantly, it does have the funding and experience to become involved in other James Bay projects. Given the similar valuation with Brunswick and the fact that it will be flowing Adina news on a constant basis well before Brunswick starts reporting results again I would expect a rebound back over $1 to happen earlier than for Brunswick. |

Brunswick Exploration Inc (BRW-V)

Favorite

Fair Spec Value |

|

|

| Mirage |

Canada - Quebec |

3-Discovery Delineation |

Li |

Patriot Battery Metals Corp (PMET-V)

Favorite

Fair Spec Value |

|

|

| Corvette |

Canada - Quebec |

4-Infill & Metallurgy |

Li |

Winsome Resources Ltd (WR1-ASX)

Favorite

Fair Spec Value |

|

|

| Adina |

Canada - Quebec |

4-Infill & Metallurgy |

Li |

Lithium Carbonate Price Chart and Rock Value Matrix |

Example of brokerage analyst lithium demand growth and price assumptions |

Example of how brokerage analyst supply projection assumes no solid state LiB |

IEA breakdown of how much of each metal an EV needs |

Alternative EV adoption curve premised on soilid state LiB commercialization |

| Disclosure: JK owns shares of Brunswick; Brunswick, Patriot Battery and Winsome are KRO 2024 Favorites |