| Kaiser Watch June 16, 2023: Patriot rises as Rio Tinto enters James Bay |

| Jim (0:00:00): What is the status of fire restrictions in the James Bay region of Quebec? |

Although forest access restrictions remain in effect in southern Quebec they have been lifted in the James Bay region thanks to rain during the past week which has helped get fires in southern Quebec under control. Patriot Battery Metals, which announced more CV5 drill results earlier this week, is remobilizing all its crew and operations at the Corvette project. This week Dusan Berka who has been a director and CFO for more than a decade retired and was replaced by Pierre Boivin, a lawyer with McCarthy Tetreault. The company expects to have a maiden resource estimate out by the end of July which will include all results from the winter drill program that stopped in late April for spring thaw and the annual month long goose hunt. These holes encompass 3.7 km of strike for what is now called the CV5 zone. There remains another 1.5 km in the northeast direction to the CV4 pegmatite outcrop at the edge of the lake though the grade-thickness diminishes at the northeastern drill limit. The northeastern third called the Nova zone is a high grade 1,100 m segment assaying above 1.5% LiO. Assays for 12 holes are still pending but these are not going to make much difference about the size of the CV5 system. The company has 30,000 m of drilling planned for the summer season, much of it infill drilling to support a PFS for next summer, but also extending the CV5 in both a northeast and southwest direction.

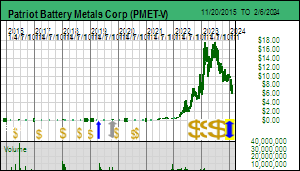

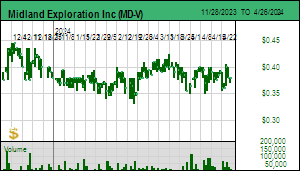

The lifting of the forest access ban helped PMET make a new high today at $17.80, surpassing the $17.69 high made on February 6. At Friday's closing price of $17.53 the 100% owned Corvette project at 135.3 million shares fully diluted has an implied value of CAD $2.4 billion. Why is the stock making new highs? I doubt very much it has anything to do with the pending assays for CV5, nor is the market speculating that the resumption of drilling will make CV5 more valuable by making it bigger. The stock is making new highs because on June 14 Rio Tinto tipped its hand as a potential bidder for PMET by securing a deal that will allow it to earn 70% of Midland's remaining 100% owned James Bay projects by spending $64.5 million over 10 years. All the juniors who still have 100% were applauding Midland for allowing Rio Tinto to take Midland offline as a target for Lithium Mania 2.0 speculators. |

Patriot Battery Metals Corp (PMET-V)

Unrated Spec Value |

|

|

| Corvette |

Canada - Quebec |

3-Discovery Delineation |

Li |

Drilled and Undrilled Targets on Corvette Property |

High Grade Nova Zone within CV5 Pegmatite |

| Jim (0:06:37): Why do you think the Rio Tinto-Midland deal is good for everybody except Midland? |

The Rio Tinto farmout deal announced on June 14, 2023 by Midland Exploration Inc allows Rio Tinto to earn up to 70% by spending $64.5 million over 10 years. Rio Tinto can go to 50% by spending $14.5 million over 5 years, with $2 million a firm commitment over the next 18 months. It also includes cash payments of $500,000 upfront and $100,000 at the end of each of the first 5 years. Rio Tinto can elect to earn 70% by spending $50 million over another 5 years. The deal is a disappointment for Midland shareholders because Midland should have spent its own $2 million over the next 18 months to see if there is any low hanging LCT type pegmatite fruit for boots on the ground to stumble over. Midland had about $5 million working capital at the end of March 31, 2023. Given the extraordinary size of the potential prize - a 1% Li2O grade at $10/lb lithium carbonate is equivalent to a 8-9 g/t gold or 6% copper grade - CEO Gino Roger should have taken the 100% risk, especially after being asleep at the switch when on November 10, 2022 Bob Wares managed to convince Midland to option to Brunswick the lithium and rare metal rights to the original Mythril copper property adjoining the north side of Patriot's Corvette property (the deal also included the Elrond property located much farther to the west). Brunswick can earn 85% by paying $345,000, issuing $355,000 in stock and spending $3.5 million over 5 years. The only good part of that deal for Midland was that its 15% is a carried interest on which Brunswick retains a right of first refusal. When I asked Bob Wares why Midland did such an easy deal, he just shook his head, saying that climbing up the lithium learning curve just wasn't on their to do list.

By PDAC Midland had come to understand Lithium Mania 2.0 and the potential for James Bay to turn into a Great Canadian Area Play. It had staked additional claims and created excellent graphics for projects such as Komo to the west of Allkem's Galaxy-Cyr project and Galinee to the east of Winsome's Adina discovery. Since 2006 Midland has spent $80 million on projects in Quebec, of which $39 million was provided by farm-in partners. And remarkably Midland still has only 88.8 million shares fully diluted. I talked to exploration VP Mario Masson at PDAC and hoped out loud they would do a boots on the ground lithium first pass this summer on a 100% basis so that they could reap any first order discoveries. I was taken aback by the sad look on Mario's face and wondered if Gino was still shell-shocked from the failure of his Mythril copper keeper moment in 2018-2019 to deliver.

The Mythril copper play, which was generated by following up with boots on the ground a copper showing mapped by the government, stirred hopes that James Bay, which has largely failed as a gold district, might in fact host a major copper district. At the October 2018 AMEQ in Montreal Gino had button-holed me in the same manner Virginia Gold's Andre Gaumond did at the November 2004 Hard Assets show in San Francisco when he showed me a rock from Eleonore and insisted this was a keeper. That decision to buck the farmout rule drew a sell recommendation from a Carlsbad guardian at the start of a 100% funded play that resulted in Virginia disappearing at $14 in a $750 million buyout by Goldcorp a couple years later. When Midland mounted its own Mythril copper drilling play in 2019 the inexplicable selling was relentless. At the time Midland was too busy to accept my invite to MIF so I instead invited 92 Resources Corp which had optioned the adjacent Corvette property from Osisko for its lithium potential. But by 2019 lithium carbonate prices had tanked below $5/lb thanks to Australian pegmatite sourced supply, so the project was undrilled. 92 Resources did conduct a drill program in 2019 on what were gold targets which like most gold targets in James Bay failed to deliver much. That program was also accompanied by relentless selling, after which the junior did a 10:1 rollback to become Gaia, relisted on the CSE, and for good measure did another 3:1 rollback when it changed its name to Patriot Battery Metals. As it turned out, the high grade copper seams at Mythril were too narrow and widely spaced to deliver a bulk tonnage mineable ore grade and the play flopped. Azimut drilled its Pikwa extension in 2020 but was apparently so ashamed by the results that the Pikwa outcome was never reported.

The Rio Tinto farmout deal is terrible for Midland shareholders because Rio Tinto only needs to spend $2 million over 18 months which as operator it will do with its own boots on the ground. It's as if Rio Tinto has borrowed Midland's James Bay properties as a training school for its geologists. Rio Tinto will make quick work of the 10 properties to make sure nothing obvious is sticking out of the ground, but its real target will be to take out Patriot Battery Metals or any other junior that makes a major LCT-pegmatite discovery in the James Bay region over the next couple years. The Rio Tinto CEO is on record grumbling that lithium pegmatite projects are too expensive, though that did not stop Albemarle from making a conditional AUD $5 billion offer for Liontown's Kathleen Valley project which has a scale and grade similar to what the CV5 zone at Corvette may approach when the maiden resource estimate is delivered in late July.

Rio Tinto clearly understands that lithium could evolve into a $100-$200 billion annual market, putting this until recently obscure metal in the same league as copper and gold. In 2004 Rio Tinto discovered the Jadar deposit in Serbia which is a sediment hosted system similar to Nevada's claystones except the lithium grade within a mineral called jadarite is 10 times higher. By 2017 Rio Tinto had solved the metallurgical challenges and applied to develop a reserve of 118 million tonnes of 1.8% Li2O. This was met by opposition from the European anti-mining lobby which complained that mining would disrupt the pastoral setting of the project area. The Serbian government canceled the license and Jadar is going nowhere. In an October 2021 Investor Seminar Rio Tinto provided a slide which declared that the world will need 60 Jadar equivalent mines by 2040, and that did not include the possibility that a solid state lithium battery allowing lithium metal as the anode would become reality.

Back in the 1990's when Dia Met and BHP made the Ekati diamond discovery in the Northwest Territories of Canada Rio Tinto was quick to show up through its North American subsidiary Kennecott to option properties that Aber and the DHK group had staked south and east of the Ekati block. Kennecott was very aggressive because BHP owned 51% of Ekati and so there was opportunity to acquire Ekati. Kennecott discovered the DO27 kimberlite which was large with good grade but low value diamonds. It then went on to discover the high grade Diavik pipes on Aber's ground and developed them into mines. Patriot Battery owns 100% of Corvette and does not have any major shareholders who could block a hostile takeover bid. The Corvette property is also 2-3 years ahead of any other potential world class grassroots discoveries in the James Bay region. If Rio Tinto makes a successful bid for PMET, that will become its focus, while the Midland farm-in deal limps along for the next decade. If Rio Tinto is beaten out by another party, that would be construed as good news for Midland because then Rio Tinto will become very aggressive exploring the 10 properties. However, if a takeover battle for PMET emerges, it will send market interest in the James Bay Great Canadian Area Play through the roof, and other juniors like Champion Electric, Dios and Brunswick who have majority stakes in promising James Bay properties will become the target of speculators and the Bay Street financiers. Midland did not farm out all its James Bay projects; let's hope that wasn't because they have zero LCT-type pegmatite potential. |

Midland Exploration Inc (MD-V)

Bottom-Fish Spec Value |

|

|

| Komo |

Canada - Quebec |

2-Target Drilling |

Li |

Map of Midland properties in James Bay region |

Midland Exploration Spending History |

Maps of Komo and Galinee Projects |

Rio Tinto's Vision of the Lithium Demand Future |

| Jim (0:17:02): How significant is this week's news from Brunswick about its Mirage project? |

Brunswick Exploration Inc announced on June 14, 2023 that during the 2 days it had boots on the ground at the Mirage project the team managed to identify 20 spodumene bearing boulders within a 1.7 km band aligned with the ice direction. A bedrock source has not been established, but the company did point out that the property stretches 18 km up ice from the boulder field. The largest boulder was 6 m by 5 m. Light grey spodumene crystals up to 50 cm representing 5% to 50% of the pegmatite were observed. The boulders vary from sub-angular to sub-rounded. As a rule the more angular a boulder the more local the source. When rocks end up in river beds they quickly become rounded. But they also become rounded when they get stuck in the base of an ice sheet and dragged along bedrock. This boulder field was first noticed by a prospector 25 years ago but nobody was interested. Bob Wares remembered the episode and tracked down the area. Part of it was staked by Jack Stoch's Globex Mining Enterprises Inc as the Lac Escale project for its precious metals potential. Brunswick staked the open ground it felt was relevant for LCT-pegmatite potential and then optioned Lac Escale on January 24, 2023 100% for $500,000 and $1 million exploration over 3 years.

This development is significant because such a large number of boulders with a distinct rock type within a constrained area aligned with the ice direction suggests an up ice source possibly oriented in the same direction as the ice sheet's movement. Large boulders can travel enormous distance from their source and are called "glacial erratics" because they have no relationship to nearby geology. Until Brunswick finds the bedrock source there will be questions about how far this field of boulders traveled, especially given the sub-rounded appearance of some of them. However, in climates where there are dramatic seasonal changes granitic rocks undergo exfoliation which gives then a rounded look despite being stationary.

I saw this first hand when I visited the Strange Lake site in September 2009. The original Strange Lake deposit had been found decades earlier by the Iron Ore Company on the Labrador side. The speculation with Quest Rare Minerals was that perhaps half of the Main Zone sat on the Quebec side of the boundary which is defined by the watershed divide. By the time we got there a survey had established that only 15% of the known deposit was on the Quebec side where Quest had staked claims (the Labrador side had been withdrawn into a provincial mineral reserve). But then management took us for a walk and showed us a field of boulders which were assaying up to 1.5% TREO with 45% represented by heavy rare earths. It turned out that these boulders emerged from their source through frost-heaving. By April 2010 Quest had delineated a resource of 114 million tones of 1% TREO for what became know as the BZone. Within the BZone a 20 million tonne enriched zone grading 1.44% TREO became the focus for economic studies. The problem with the Rare Earth Mania of 2009-2012 was that the rare earth market was dominated by China which has since managed to grow its supply 200% to keep pace with EV related demand growth. Lithium demand has a much bigger demand growth trajectory and no country has a near monopoly of supply as China does with rare earths. With the fire restrictions now lifted in the James Bay region the Brunswick teams top priority is to get those boots back on the ground, figure out the bedrock source, and establish enough understanding of its orientation to support permit applications for a drill program in the fall. |

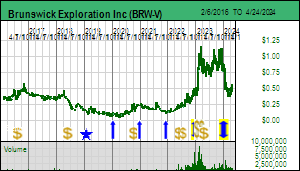

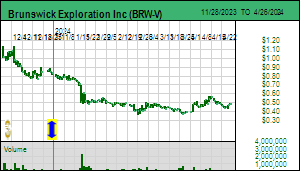

Brunswick Exploration Inc (BRW-V)

Favorite

Fair Spec Value |

|

|

| Mirage |

Canada - Quebec |

2-Target Drilling |

Li |

Pegmatite Boulders from Mirage Project |

Exfoliated frost heaved boulder at Strange Lake |

| Disclosure: JK owns Brunswick; Brunswick is a Fair Spec Value rated Favorite; Midland is Bottom-Fish Spec Value rated |