| Kaiser Watch June 23, 2023: Mirage a major Boots on the Ground discovery |

| Jim (0:00:00): What is the latest news for the James Bay region? |

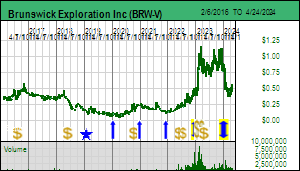

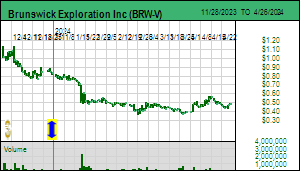

Last week I talked about how the forest fire closures in Quebec's James Bay region had been lifted thanks to the arrival of rain in southern Quebec, but on Monday June 19 came the bad news that the Quebec government had reinstated the closure all the way south to include the Abitibi region due to lack of rain. It is unclear when the James Bay area will reopen and many Quebec based service providers are preparing to offer their services elsewhere in Canada. Brunswick Exploration Inc has already given up on the James Bay region until the middle of July and is putting all its boots on the ground into other parts of Canada not yet hit by fire closures.

Brunswick apparently has good reason to hit its properties in other provinces hard while James Bay remains off limits. In last week's Kaiser Watch June 16, 2023 Episode I discussed the spodumene-bearing boulder field Brunswick reported on June 14 finding at its Mirage project in the eastern part of James Bay. I inferred from the news release that the 1.7 km long band of boulders was parallel to the ice direction which is roughly southwest. Brunswick emphasized that the boulder field was at the southern end of a land package that stretched 18 km up ice. This implied an up ice source which to be meaningful had to also be oriented in the ice direction. The downside risk was that the pegmatite body was either a narrow dyke or a short body with limited strike, neither of which had tonnage implications. If I had talked to Killian Charles last week I would not have gotten more than what was in the press release about Mirage which was deliberately vague because it turns out they have been scrambling to expand the land position based on a new understanding of the area's potential.

The team spent only 6 hours at Mirage and they had with them the geologist who found the spodumene boulder a couple decades ago to show them where to start looking. They were blown away by what they found. The 1.7 km long band of boulders is 200 m wide and its limits were not cut off because they had to leave the field. The boots on the ground were like kids in a candy store who just didn't want to leave. The stunning tidbit I gleaned from Killian was that the band of boulders is perpendicular to the ice direction. What they found so far straddles both the 100% optioned Globex ground and the BRW staked ground. The geologist who found the original boulder is actually a geomorphologist, an expert on how the physical landscape is shaped. He himself was surprised at the extent of the boulder field.

The situation is in fact much better than I assumed last week and I am now confident that Brunswick has a major "first order" discovery at Mirage. There is no way this boulder field can be described as a glacial train, and the abundance of sub-rounded and sub-angular boulders rules out the idea of glacial erratics from far away. If this narrow field of boulders stretching 1.7 km perpendicular to the ice direction were glacially transported it would have a fan like down ice dispersal pattern. The topography is flat, so it is not a case of boulders rolling off some mountain into a valley bottom. The source is very local and likely parallel to the strike of the 200 m wide band of boulders. The size and quality of the spodumene crystals, which needs verification by assays, suggests this is a major discovery. I have been grumbling about the lack of geology Brunswick includes with its disclosure graphics, but they have deliberately withheld geology about the Mirage property because it has implications for the potential of a wider region than initially staked by BRW. They are so optimistic about the Mirage discovery that they are initiating drill permitting with the goal of drilling by September. Quebec's permitting rules for drill holes are flexible enough to figure out later this summer where exactly to spot drill holes.

Killian Charles did attend the Fastmarkets Lithium Conference held in Las Vegas June 20-22. This conference focuses on lithium supply and demand but also included rare earth talks. Killian, who attended as a delegate, estimates about 1,000 delegates participated. Many of them were representatives of government agencies and downstream processors and fabricators, but in terms of the lithium supply side the conference was dominated by Australians who are aware of Canada's major lithium supply potential. They are shaking their heads at the lack of North American interest in Lithium Mania 2.0, namely the hunt for LCT-type pegmatites beyond Australia in secure jurisdictions like Canada. Why are Canadians and especially the financial community on Bay Street oblivious to this enormous potential in their own backyard? I think the answer is simply that they do not understand how to convert lithium grades into rock value and appreciate how pathetic Canadian precious and base metal plays are in comparison. |

Brunswick Exploration Inc (BRW-V)

Favorite

Fair Spec Value |

|

|

| Mirage |

Canada - Quebec |

2-Target Drilling |

Li |

Canada Wide Fire Map and Quebec Forest Access Closure |

Some Mirage geology from Globex web site |

Matrix for converting Li2O grades into rock value at various lithium carbonate prices |

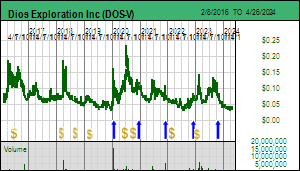

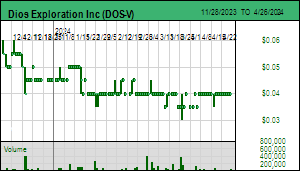

| Jim (0:11:53): What do you make of the latest James Bay acquisitions announced by Dios Exploration? |

On June 20, 2023 Dios Exploration Inc announced the acquisition of 3 new claim blocks called East Clarkie in an entirely new area to the east of its Lithium North and Lecaron areas. I've spliced together the new East Clarkie map with an older Lecaron geology map which does not include the Lithium Nord claims or the latest Lecaron addition. One of the frustrating things about the James Bay area is that companies tend to publish map fragments featuring only their projects, which makes it hard to see the big picture. To solve this I've tried to scale the spliced map to a Google Earth screenshot. The red box in the first graphic is supposed to be where the geology spliced map sits, with the yellow ovals representing the 4 groups in this area. I've also done a scan of the James Bay CEO.ca map published in December 2022 which only shows claims of companies that paid to be on it. I can't wait until a new one gets published.

It is now clear why Dios has been so secretive about its target generation strategy. Most of its target area is open to staking. In the third graphic is an update of my 1st versuss 2nd order regions which is interesting in terms of the absence of Brunswick claims in the Dios target generation area. The East Clarkie claims expand the focus about 100 km eastwards. Keep in mind that this area is closer to infrastructure than the northern Corvette trend area. What I also find interesting is that this is not a case of James Bay juniors focused on gold and base metal exploration waking up to the overlapping LCT type pegmatite potential like Azimut and Midland have largely done. There is no genetic relationship between precious/base metals deposits and LCT type pegmatites. Note the original Clarkie and Lecaron gold-related claim blocks in the middle of this area. If Dios is doing deep research based on a sophisticated understanding of glacial directions, a proprietary till sampling database, and studying high resolution satellite imagary, coupled with the lake bottom sediment data, in areas ignored for other metals, this would qualify as first order exploration when the boots hit the ground because nobody has ever had reason to look hard at these areas other than government geologists. |

Dios Exploration Inc (DOS-V)

Bottom-Fish Spec Value |

|

|

| East Clarkie |

Canada - Quebec |

1-Grassroots |

Li |

James Bay map showing focus area of Dios largely ignored by Brunswick |

Key Dios lithium focus areas in southern half of James Bay region |

Fragment of CEO.ca Dec 2022 James Bay showing how Dios focus area is largely open |

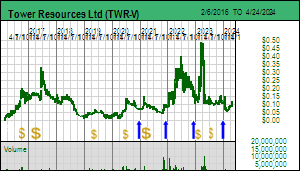

| Jim (0:15:46): What is causing Tower Resources to perk up in recent days? |

On June 22, 2023 Tower Resources Ltd announced that it had completed a ground magnetic survey at its 100% owned Rabbit North project in southern British Columbia which extends 2014 coverage to the area of recent focus, the Lightning and Thunder orogenic zones highlighted by the Dominic Lake and Centrain gold in till trains. As suggested by the recent drilling on the Thunder Zone the Chilcotin basalt flow is laterally more extensive than the band mapped at surface to the north. Although it is highly magnetic, it shows up as a magnetic low because of a polarity reversal at the time of eruption, which has the effect of partly masking what they see as a 250 m by 900 m magnetic high to the west of the Rainbow Cu-Au-Mo zone hit earlier this year while testing the Thunder gold target. The stock collapsed in April when Tower released the final results for the 4 holes drilled into the Thunder target.

In I pointed out that although the Thunder Zone has fallen short of expectations, the Rainbow zone intersected to the west of the Thunder Zone was an unexpected pleasant surprise that may be the edge of a blind copper-gold porphyry system to the west that is obscured by overburden and has never been drilled. Stu Averill believes the magnetic high to the west of the Rainbow intersection may be due to hydrothermal magnetite in conjunction with sulphides related to a porphyry system. There is no outcrop in this area and it looks like they plan to drill this Rainbow target.

Tower has also concluded that the gold grains in the Durand Creek train are associated with a copper-gold porphyry system, and not another younger shear controlled orogenic gold system. Furthermore, its head appears to be well to the north of the Rainbow target in a magnetic low area 1 km to the west of Western Magnetite Zone which in 2017 yielded 247 m of 0.51% copper and 0.34 g/t gold starting at a depth of 208 m, too deep for open pit mining. Stu does not attempt to explain why this area is a magnetic low, though from the graphic the Western Magnetite Zone also appears to be a magnetic low. Although for the moment I am not optimistic the orogenic Lightning and Thunder Zones will amount to meaningful gold deposits, the focus on them has helped reveal a hidden copper-gold porphyry aspect of Rabbit North that has not been tested by past exploration due to the absence of any encouraging outcrop. Tower has not indicated when it plans to drill the Rainbow target, but bottom-fishers appear to be willing to give the Rabbit North story another chance. |

Tower Resources Ltd (TWR-V)

Bottom-Fish Spec Value |

|

|

| Rabbit North |

Canada - British Columbia |

3-Discovery Delineation |

Au Cu |

Exploration at Rabbit North shifting west into covered area |

New magnetic survey with new targets highlighted |

| Jim (0:21:12): What do the Honeybugle drill results mean for Scandium International? |

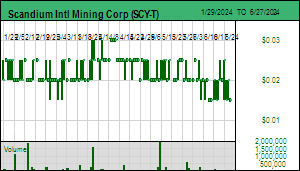

On June 20, 2023 Scandium International announced the results for a drill program completed on the Honeybugle project located 24 km southwest of the Nyngan scandium project in New South Wales. The market ignored the news, perhaps because it does not understand its meaning, perhaps it does understand what Rio Tinto's purchase of the Owendale deposit from Platina means for a future buyout of SCY, and perhaps because it knows that there remain four years of life for the 5 year warrants that accompanied last year's $3.5 million private placement at $0.09 when the Evensens kicked out Willem Duyvestyn and George Putnam.

The Honeybugle project emerged in 2014 when SCY was in danger of losing Nyngan to Till Capital which was calling its loans to the company. SCY ended up being bailed out by the Evensens when they loaned USD $2.5 million convertible into a 20% stake in Nyngan, which conversion would be triggered by SCY raising additional equity capital. The target amount was reached in the form of a private placement by Andy Greig who remains a major shareholder of SCY. They eventually converted the 20% project interest into a roughly 20% equity stake in SCY to become the largest shareholder.

The Honeybugle area was known to host 4 magnetic anomalies represented by ultramafic laterites which had previously been explored for nickel and platinum group metals without success, but were known to have scandium values at a time when nobody cared. SCY, eager to preserve its scandium "brand", drilled the Seaford target with 30 holes in April 2014 and confirmed that scandium values comparable to Nyngan were present, but did not publicly do any followup work when it had staved off the Nyngan default with the help of the Evensen financings. In Tracker June 7, 2021 I undertook a back of the napkin resource estimate based on the key results from Drill Area 1 of the Seaford anomaly which intersected good scandium values in both limonite and saprolite. The result was a speculative resource of 3,740,000 t @ 272 g/t Sc (ppm) for the Seaford zone which I used as the basis for an outcome visualization imagining a 1,000 tpd open-pit mining operation that would produce 127 tpa of scandium oxide, nearly 4 times what the proposed Nyngan mine would produce. I bugged former CEO George Putnam to spend a small amount on additional drilling to achieve the density needed for a resource estimate but he rejected that idea.

When I read the news release I was surprised to learn that work was done on Honeybugle in 2016 and 2018 which was never reported by SCY. The drill program of 32 air core holes done in Q1 of 2023 focused on a 300 m by 400 m area of the Woodlong anomaly and were disclosed as holes #76-#107. The news release included earlier drill resuls for holes #37-#60, and continued with holes #76-#107 from the 2023 program. This it was news to me that holes 37-60 were from drilling campaigns done in 2016 and 2018. The 2023 program runs from #76-107, which means there is another batch of holes #61-75 that must be on one of the other targets of which there are 4 defined by magnetic anomalies: Seaford, Woodlong, Yarran Park and Mallee Valley. In addition there must also be holes #31-#36 whose location is not disclosed. I am assuming the numbering sequence reflects holes drilled by SCY.

SCY provided a drill plan for all the holes drilled into the Woodlong target. The 2016-2018 drill sequence, which I have traced does not make a lot of sense with holes jumping all over the place with some yielding good values. But the 2023 drill sequence shows a determination to drill the Woodlong zone on a systematic grid that fills in the older holes and produces a grid with 50 m spacing between holes. The company also included a grade x thickness heat map on which I've circled all holes with a minimum 200 ppm grade. The holes are drilled on 50 m centers so I have assumed a 50 x 50 m block around each hole and multiplied the area by the mineralized interval and 1.88 as a specific gravity (assigned by the Nyngan DFS for the higher grade limonite ore that feeds the Nyngan mining plan), and then added the 26 holes that qualify to get the total tonnage which is 1,184,000 tonnes. Note that the southern part has some gaps, and given the nature of this type of laterite system, the back of the napkin resource can be rounded up to 1.4 million tonnes. The thickness of these 26 holes was 9.7 m with overburden ranging from 0-6 m but generally just1-2 m thick. For the average grade I multiplied the tonnage block of each hole by the grade, summed them, and divided by total tonnage to get an average grade of 394 ppm, which is better than I estimated for the Seaford mineralization.

But what is the potential economic value of this bak of the napkin resource estimate? Here is where the market runs in comprehension challenges, and the company cannot help out until it has converted the data into a 43-101 resource estimate. First you multiply the 394 ppm Sc grade by 1.534 to convert to Sc2O3, the form that gets marketed and to which a price is assigned. Then you multiply by $2,000/kg Sc2O3 (the price SCY used as a base case for Nyngan, Sunrise uses $1,500/kg, Niocorp $3,600/kg, and sneaky Imperial Mining uses $6,500/kg inside its master alloy) and divide by 1,000 (ppm means parts per million and is the same as g/t - there are 1 million grams per tonne) to get a rock value of USD $1,208/t. The Nyngan DFS assumed an 84% recovery, so the recoverable rock value is $1,015 per tonne for about 600 recoverable tonnes Sc2O3 worth USD $1.2 billion.

SCY mentions that a thinner horizon of saprolite sits below the limonite horizon, and while it is lower grade than the limonite, does run at least 200 ppm Sc. The Sunrise and Owendale deposits do not have a saprolite horizon. But what does it matter if the Seaford and Woodlong zones are richer and possibly bigger than the resource targeted for development at the nearby Nyngan deposit? In Kaiser Watch Episode May 5, 2023 I discussed the potential negative implications for SCY presented by Rio Tinto's decision to purchase the Owendale scandium deposit from Platina for USD $14 million. Owendale is substantially bigger and richer than Nyngan, so if Rio Tinto gets it into production, it will never need to develop SCY's Nyngan deposit. However, Owendale has a water rights problem and does not own the surface rights for a property in an area that is agriculturally more productive than in the Nyngan-Honeybugle area. At Nyngan SCY already owns the surface rights for the western half of the mining lease where all the infrastructure would be located and where the first ten years of mine production at 240 tpd would take place.

The new SCY management has talked about getting a partner to develop Nyngan, perhaps on a smaller scale, and Rio Tinto is the most likely party to be in need of additional scandium supply when its Sorel-Tracy facility hits its scandium by-product limit. But Rio Tinto would strike a hard bargain that is not beneficial to SCY, as we saw with the terrible deal it did on Midland's James Bay lithium project (Gino Roger wants everybody to know that the number of years Rio Tinto has to earn 70% is 10 rather than 12 years as I mistated last week!) However, having Rio Tinto spend the money to prove that the Nyngan flow-sheet works as predicted and possibly ruin the expansion potential of Nyngan would be very beneficial for Honeybugle because the mineralogy is likely to be similar. If SCY decides to deliver a JORC or 43-101 resource estimate for the Woodlong zone, even though it is small, combined with the Seaford zone it would be an attractive development target for another major eager to piggyback on any success Rio Tinto has had building scandium offtake demand to a tipping point where a lot of end users might want to use aluminum-scandium alloys for the lightweighting benefits in the transportation sector.

Today one also has to take into consideration potential demand from the defense sector; a decade ago when I first became enamored with scandium China was still expected to become more like the Global West thanks to the demands of a rising middle class. But under Xi Jinping China has defined itself as an autocracy aligned with other autocracies such as Russia, the Global East, which sees itself in economic competition with the United States led Global West. As a result today both American political parties support defense spending and even venture capital is investing in new military technology startups. When it comes to pushing materials to new functional limits, scandium, shunned for decades because as a dispersoid it does not concentrate into rich deposits like other metals, is a contender. While consumer applications are very sensitive to input costs, military applications are not. The chicken and egg problem that has plagued scandium forever could be solved quickly through "military intervention". That wasn't a plausible concept a decade ago. I think it is a wise decision by CEO Peter Evensen to make Honeybugle more visible as an asset, which allows Nyngan to be rapidly developed as a pilot plant facility with larger scale potential 24 km down the road at Honeybugle. |

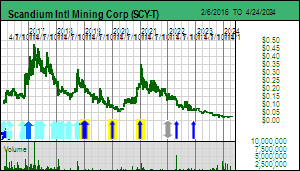

Scandium Intl Mining Corp (SCY-T)

Bottom-Fish Spec Value |

|

|

| Honeybugle |

Australia - New South Wales |

3-Discovery Delineation |

Sc |

Nyngan-Honeybugle scandium deposits location map |

Honeybugle Drill Plan showing drilling sequence in 2016-18 compared to 2023 |

Woodlong drill results and back-of-the-napkin resourcer estimate |

| Disclosure: JK owns Brunswick, Dios & Scandium Intl; Brunswick is Fair Spec Value rated Favorite; Dios, Scandium Intl and Tower are Bottom-Fish Spec Value rated |