| Kaiser Watch July 6, 2023: Tonopah Adventure Tour: Part I |

| Jim (0:00:00): In June you went on a multi-project site visit centered on the former Tonopah mining district in Nevada. What was the purpose of this Tonopah Adventure Tour? |

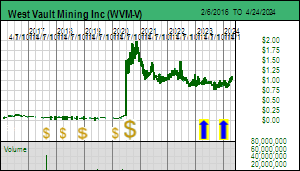

West Vault's CEO Sandy McVey organized and hosted a site visit on June 13-15 in the Tonopah area of Nevada for analysts, journalists, investors and newsletter writers that spanned several days and involved 5 gold-silver and 3 lithium claystone companies. I was at first reluctant to participate because I had already researched West Vault Mining Inc, made it a Good Spec Value Favorite on April 13, 2023, and featured it at the May 27, 2023 Metals Investor Forum. The company updated its PFS earlier this year for the permitted Hasbrouck-Three Hills open pit mines and has adopted a strategy where it will not spend any money on exploration nor attempt to build the mine. Instead it is presenting itself as a buyout target for an established producer and offering itself to investors as a leveraged proxy for the price of gold.

At the $1,790 per oz base case price, which is below recent levels, the project clears development hurdles and at a 5% discount rate has an after-tax NPV of USD $190.5 million and IRR of 47.7% (my DCF model based on Jan 2023 PFS assumption - WVM PFS has USD $205.2 million NPV and 51% IRR). For a project at the permitting-feasibility stage waiting for a construction decision the fair value range is 50%-75% of the outcome value, which means the stock should be trading between $2.11-$3.16, 125%-238% higher than the current $0.90-$1.00 range (0.75 USD:CAD, 60.2 million fully diluted, 100% net interest). The leverage to gold comes when you calculate the NPV after increasing the base case price by 68% to $3,000 which results in an NPV 200% higher at USD $573 million. The fair value would jump to a range of $6.30-$9.45 which is 577%-916% higher than the current price.

So why is West Vault such a bargain the market is ignoring? A key problem is that the Hasbrouck project would produce only about 70,000 oz annually over 8 years. That seems too low to be worth the bother for a gold producer to acquire and turn into a standalone mine. But what if a producer decided to make the Tonopah district into its backyard with multiple gold mines? While I would not gain much from visiting the Hasbrouck-Three Hills project apart from the tangible experience of being there, I could potentially learn a lot about who else is active in the area and could become a collective target for a producer like Centerra or AngloGold Ashanti, both of which are active in the southern end of the Walker Lane.

Centerra Gold Inc acquired the Goldfield (Gemfield) project from Waterton on Februry 22, 2022 for USD $206 million. Waterton acquired the project when it bought Chaparral Gold Corp on February 20, 2015 for about CAD $73 million at $0.61. An updated June 2013 feasibility study by International Minerals Corp (from which Chaparral was spun out when Hochschild bought IMZ in 2013) reported a proven and probable reserve of 17,260,000 tonnes at 1.0 g/t gold (567,000 oz in situ 482,000 oz at 85.5% recovery). Waterton spent about USD $7 million to get Hwy 95 moved to bypass the Gemfield deposit. Centerra owns much of the old Goldfield district but as its map indicates there are still plenty of inlier claims held by others. Centerra has not released its own resource estimate. These deposits are classified as high sulphidation epithermal.

AngloGold Ashanti Ltd has tabulated 8.4 million ounces gold at grades ranging 0.24-1.26 g/t gold in the Bullfrog district, with Silicon, which it acquired 100% from Renaissance Gold, hosting 4,220,000 ounces at 0.83 g/t. AngloGold has consolidated the district by buying out Corvus Gold to get North Bullfrog and Motherlode, and purchasing Sterling from Coeur. Silicon is currently the focus of a feasibility study. AngloGold has its hands full with North Bullfrog, but apparently does have exploration claims north of Tonopah.

In the end I decided to participate in the Tonopah Site Visit so as to get a feel for the area and its potential to undergo a mining revival. Over the course of two days we visited the properties of West Vault Mining Inc, Allegiant Gold Inc, Black Rock Silver Corp, Summa Silver Corp and Viva Gold Corp. I call it the Tonopah Adventure Tour because on the second day we visited West Vault's Hasbrouck deposit which did turn out to be quite an adventure. On Tuesday we just piled into trucks and visited the properties of Allegiant, Blackrock and Summa. But on Tuesday morning after breakfast Sandy McVey handed out liability waiver forms for us to sign. It warned of Hasbrouck hazards like crazy donkeys, scorpions, lightning, poisonous snakes, flash floods and "other dangerous wildlife".

After Tuesday's tame site visits I wondered what awaited us. The adventure turned out to be a torturous drive to the top of Hasbrouck "mountain", which juts about 300 metres above the basin floor. The ascent with its hairpin turns was pretty interesting, but the descent promised to be rather hairy. One couple decided they would walk down, which took them only 20 minutes, so it really wasn't anything like my site visits in the Andes of Peru. We all survived without incident. And while I say the purpose of doing the Tonopah Adventure Tour was to assess the mining revival potential of Nevada's Walker Lane, there is something you get from a site visit that is never revealed by a technical report and corporate presentation: a sense for the sheer scale of a project. Standing on top of Hasbrouck it was amazing to realize that if everything works out, this small mountain will be gone, spread out on the valley floor below as 50 metre high piles of waste rock and heap leach pads contoured to blend in with the flat grazing land. |

West Vault Mining Inc (WVM-V)

Favorite

Good Spec Value |

|

|

| Hasbrouck |

United States - Nevada |

7-Permitting & Feasibility |

Au Ag |

Centerra Gold Inc (CG-T)

Unrated Spec Value |

|

|

| Goldfield |

United States - Nevada |

4-Infill & Metallurgy |

Au |

AngloGold Ashanti Ltd (AU-N)

Unrated Spec Value |

|

|

| Silicon |

United States - Nevada |

6-Prefeasibility |

Au |

Views from top of West Vault's Hasbrouck Deposit |

Hasbrouck-Three Hills Property Map & Location within Walker Lane |

Hasbrouck-Three Hills Numbers from West Vault's Jan 2023 PFS |

After-Tax USD NPV Hasbrouck DCF Sensitivity to Gold Price Model |

After Tax CAD NPV per share Hasbrouck DCF Sensitivity to gold price |

Map of Centerra's Goldfield Project and 2013 Reserve by Micon for IMZ |

2022 Gold and Silver Resources for AngloGold's North Bullfron Deposits |

| Jim (0:11:06): Is the southern part of the Walker Lane where Tonopah sits half way between Las Vegas and Reno receptive to a revival of mining? |

Do former mining districts like Tonopah and Goldfield want a revival of mining in their backyard, or are these towns more interested in tourism such as is the case for the western Sierra foothills of California or the steeper eastern side where Mammoth Lakes is a major summer and winter destination for Californians? I live in the Bay Area of San Francisco and have made many visits to Yosemite and Tahoe which sit within the metal poor granite batholith called the Sierra Nevada. But the western foothills which are not granite were the source of most US gold production from the 1848 discovery of placer gold in the American River at Sutter Creek until the 1950s. The source of this gold was the orogenic gold veins that formed in the foothill rocks (also known as "mesothermal" and "Motherlode" deposits). Orogenic systems host structurally controlled high grade gold mineralization that can persist over thousands of metres in vertical depth. I have family in the Sonora area where the Columbia gold field is now a historic park. In addition to a tourist industry the foothills are developing vineyards to compete with the coastal wineries. There is no geological potential for bulk tonnage open pit mines, and there is no interest in a revival of underground mining made possible by a higher gold price. The former Idaho-Maryland mine which juniors have tried to restart since the 1980s sits outside the former mining town of Grass Valley which people from the coast going to Tahoe make a detour to visit.

The eastern Sierra is a combination of the older granites and quite young volcanics which create a spectacular landscape of variously colored rocks with a jaggedness absent from Yosemite. This eastern flank of the southern half of the Sierra Nevada sits on the California side of the boundary with Nevada. Geologically it is still active with intrusive activity; the Long Valley caldera is very young, has hot springs in its center, and has the potential one day to blow up as a super volcano, similar to the predicament of Yellowstone Park. The former mining town Bodie north of Mono Lake has been preserved as a historic site that is absolutely fascinating to visit. Unlike the western flank the gold deposits are low sulphidation epithermal systems which have a much shorter vertical extent than orogenic systems. In recent years I have done summer vacations in the Mammoth Lakes area south of Mono Lake and I rave about the geological richness in Kaiser Watch Episode July 15, 2022. But juniors which hope to discover and develop a gold deposit on the Californian part of the Walker Lane are wasting their time. This area is for mountain climbing, hiking, skiing, geology watching and museum visiting. In terms of economic activity it is ranching and tourism support services.

Rather than fly to Las Vegas, rent a car, and drive to Tonopah like most of the people on the Tonopah Site Tour did, I decided to drive from the Bay Area to Tonopah, a trip that takes 7-8 hours depending on how many 30 minute delays you encounter thanks to the highway department laying culverts across roads. It takes about 5 hours to get to Mammoth Lakes from Los Angeles and 6-7 hours to get to Tonopah. It takes 6-7 hours to get to Mammoth Lakes from San Francisco, though only during summer because in winter one has to cross the Sierra via Tahoe (no fun in its own right) because Sonora and Monitor Passes are closed whereas Los Angeles residents drive past the southern limit of the Sierra. And the long way around the southern Sierra limit takes 10 or more hours from San Francisco. Sonora Pass opened the Friday (June 9) before my trip and at its summit there was still five feet of snow from this winter's record snowfall.

Why are these driving times relevant? The extra distance it takes to get to former mining towns like Tonopah and Goldfield from major Californian population centers makes them unlikely tourist destinations. It takes about 4 hours to drive from Reno to Tonopah and 3 hours from Las Vegas, the two urban centers of Nevada whose population is 3.25 million compared to California's 38.9 million. If you live in Reno and want to visit historic mining districts Carson City and Virginia City are less than an hour drive. And I am not sure the residents of Las Vegas are interested in historic mining districts. Furthermore, nobody who flies to Las Vegas for gambling will rent a car to drive 3 hours to Tonopah. The distances between Nevada towns is huge and when you finally drive through main street good luck finding a restaurant that isn't either a fast food chain or a dilapidated diner. The highway department posts helpful signs: "Next Gas 100 Miles". Although Tesla has a Gigafactory outside Reno, the rest of Nevada is not an EV friendly place. I heard that one Tesla owner coped with the charging problem by installing a fossil fuel generator in his trunk to recharge his battery if it ever dies in the middle of nowhere.

When I arrived in Tonopah on Monday evening and checked into the Mizpah Hotel I was shocked to see the lobby bar jammed with people who were clearly tourists. Maybe Tonopah had developed a tourist industry I thought. But the next two evenings the lobby bar was pretty much empty. It turns out that the Monday crowd was left over from an antique car festival, not there to check out the mining museum and tour the former mine site. While checking in I watched an Indian family respond with dismay after they asked the receptionist about Asian restaurants in Tonopah and heard there is one Chinese restaurant where the best dish to order is lemon chicken. I had seen billboard signs advertising the Tonopah Brewing Company so I checked it out and discovered a contemporary craft brew pub with a wide selection of beers and tasty dishes from its smoker. I had not seen anything like this during my long drive through Nevada. I had concluded that Nevada is no country for craft beer lovers, but the selection at TBC was outstanding. In particular I was impressed by "Mounds of Love", a pastry stout that comes as an 8 oz pour in a wine glass that compares with the best Californian versions of this style. A sign said ask for a Nevada Craft Beverage Passport which is an attempt by the Nevada Department of Agriculture to promote Nevada's craft breweries of which there exist several dozen. You are supposed to get your passport stamped when you visit a craft brewery, but they had none left. Most of the craft breweries are clustered around Reno and Las Vegas, but TBC's presence in Tonopah hinted at tourism potential.

The town of Tonopah has a linear layout between two hills which tracks Highway 95, in contrast to Goldfield, a 30 minute drive to the south, which sprawls in all directions. When I walked around Tonopah I was surprised to see so many ramshackle dwellings, some still occupied with junk littering their yards, others with smashed windows and falling apart. While the Mizpah Hotel, which sits on top of old silver mine workings, is in excellent shape, much of Tonopah has the look of economic despair. The used book store was "temporarily" closed due to "unforeseen circumstances". A red sports car with license plate "Assayer" had a $58,000 for sale sign. One exception that stood out was a building across from the Mizpah Hotel with the sign Tonopah Lithium Corp, the office for American Lithium Corp which has a lithium claystone project in the flats to the north of Tonopah.

Goldfield had a similar dilapidated look and feel. We stopped for a beer at the Santa Fe Club Saloon, an old style bar with a narrow corridor, slot machines on the side, dingy, dark and smoky. It was at the edge of the former mining area across from a preserved locomotive and old mining equipment. I got some spectacular photos with the mine dumps in the background under a dark sky bringing thunderstorms. The Saloon was trapped in a time warp; the bottled beer selection came right out of the seventies: regular and lite versions of Bud, Millers and Coors plus Heineken as the token foreign beer. Clearly the Saloon was catering to locals rather than tourists. As though to illustrate the fadedness of this former mining boom town a corner of it has been turned into the International Car Forest, a car burial ground with a twist. Junked cars of all sizes are partly buried face down so that they stick up into the sky. The founders, who have turned it into a non-profit, allow visitors onto the site free and have offered the cars up as canvases for graffiti artists. It reminded me of the unofficial cemetery on the outskirts of Tonopah, which, if you stumbled upon it without being warned it is for pets, you would freak out. These are informal expressions of local communities which hint at hope for a revival that is not going to come from tourism, but from the mineral sector. These former Nevada mining towns, hopelessly distant from urban centers, would endorse a mining revival if the economics supported it. |

Past, Present and Future Images of Tonopah |

Is Nevada no country for craft beer lovers? |

The View from the Santa Fe Club Saloon in Goldfield |

Weird and wonderful cultural activities in former mining districts |

| Jim (0:24:30): Does Nevada need a revival of mining in the Walker Lane? |

Given the dominant role of Nevada in US gold production, with over 80% coming from deposits outside the Walker Lane, the obvious answer would seem to be no. Nevada accounted for 75% of just over 6 million ounces US gold production in 2021 and 39% of the 633 million ounces of US gold production since 1848. US gold production peaked at 11.8 million ounces in 1998, the same year Nevada's production peaked at 8.9 million ounces. In 2022 total US production dropped to 5.5 million ounces, with most of the drop attributable to declining Nevada gold production. Nevada's importance as a gold producer emerged only during the 1980's when the combination of a ten-fold increase in the price of gold and new heap-leaching technology allowed large scale open-pit mining of low grade oxidized gold systems. But that was only part of the story.

Historically gold production focused on high grade epithermal vein systems within the Walker Lane where the state of Nevada butts up against the eastern flank of the Sierra Nevada. The first major boom was the Comstock silver-gold district at Virginia City during the 1860s whose silver production helped fund the Union side in the Civil War (225 million oz silver 7.2 million oz gold (15-30:1 Ag:Au grade ratio). The second boom occurred during the 1900-1930 period in the Tonopah and Goldfield districts, with Tonopah also being silver rich like Comstock with a 100:1 silver to gold grade ratio (174 million oz silver 1.8 million oz gold averaging 44 opt silver and 0.5 opt gold). Nevada is called the "Silver State" because during the epithermal age the physical volume of silver produced far exceeded gold production. California gold production greatly exceeded Nevada gold production until the late 1950's when production tailed off as the orogenic vein systems in the foothills on the western flank of the Sierra Nevada could no longer be chased deeper with the gold price fixed at $35 per oz. Nevada gained the upper hand in the mid sixties, and although southern California re-emerged as a gold producer in the 1980s, Nevada gold production soared to unheard of levels with the discovery of the Carlin-type systems in northeastern Nevada.

Unlike the epithermal systems in the Walker Lane which formed near the surface in hotspring settings fueled by intrusive activity whose hydrothermally driven fluids intersected with groundwater which created a boiling zone that constrained vertical extent of gold-silver mineralization, the Carlin-type mineralization formed well below the surface from 42-25 million years ago. The recognition of the Carlin-type gold deposits marked the transition of gold mining in Nevada from the epithermal age to the Carlin-type age. In 2021 Carlin-type gold mines accounted for 82.5% of Nevada's gold production compared to 16.6% from epithermal mines and 0.9% from gold as a by-product of porphyry copper mines. The Nevada Division of Minerals Open Data Site is an excellent place to explore Nevada's mineral history and potential. Of particular interest is the Interactive Historic Mining Districts Map which highlights all of Nevada's historic mining districts, each of which is clickable for more detailed information.

Although I am optimistic that interest in exploring for and developing epithermal gold-silver deposits in the Walker Lane both as open pit and underground mines is making a comeback, the new story in the Walker Lane is the potential to develop claystone lithium deposits to feed the domestic electric vehicle sector. Strip mining thin but laterally extensive claystone deposits would seem like an environmental permitting nightmare. But a domestic supply of lithium would be helpful for energy transition goals, and while it is hard to imagine the anti-mining lobby supporting another gold or silver mine, the claystone situation is forcing everybody to think hard about priorities. The feature presentation during the second evening of the tour by ecologist Tamzen Stringham was an eye-opener about the possibilites. |

US Gold Production from 1848-2021 |

All time total and 2021 US Gold Production by State |

Nevada 2021 Gold Production by Mine and Deposit Type |

| Jim (0:36:08): How was Tamzen Stringham's presentation about rangeland restoration received by a bunch of investors, analysts, geologists and mine developers? |

I thought perhaps Sandy McVey would bring in an academic from the University of Reno to talk about the geological potential of the Walker Lane for the after-dinner presentation on the second day, so I was surprised to hear that the presentation would be by an ecologist from UNR who specializes in the restoration of areas disturbed by fire, grazing and mining with an emphasis on Indian Ricegrass, Utah's state grass. The presentation by Tamzen Stringham (do not call her "Tammy") focused on strategies she is developing for reseeding disturbed areas with native plants that hold the soil together, have extensive root systems that pack carbon away into soil, and provide habitat for species diversity. Indian Ricegrass is the opposite of Cheatgrass, an invasive species from Eurasia that is rapidly taking over western rangelands. Indian ricegrass is a perennial bunch grass with a massive root system - if you lay all the roots within a cubic foot of soil in a single line it would stretch over a mile.

Cheatgrass in contrast is an annual with a single shallow tap root that reseeds very rapidly in disturbed areas. One would think this is a good thing, except that it is so effective it dominates the landscape, creating a monoculture that is unstable and does not foster habitat diversity. It is especially effective at moving into burnt grassland, a growing problem as climate change increases the prevalence of fires. Unlike a forest where periodic fires allow an ailing forest to regenerate itself, grassland fires are devastating to existing vegetation because there is no regeneration mechanism. Burned grasslands are vulnerable to rapid colonization by cheatgrass which prevents useful vegetation from getting a foothold. This is a major problem because when sage grouse lose their preferred habitat they move into less hospitable areas the mining companies thought were safe from protected species.

Government agencies are responsible for restoring these disturbed habitats but the methods for prevailing against invasive species like cheatgrass are not very effective. So part of Tamzen's job is to research more effective ways to enable desirable seeds to flourish. The problem with reseeding strategies is that most seeds in a disturbed area fail to germinate and even when they do, they fail to grow into a viable plant. She described research projects developing coatings that involve mixing nutrients with a binder that is applied to seeds as a coating that not only protects the seed during the germination phase but also provides a nutrient boost so that it has a chance in competition with fast replicating flashes in the pan like cheatgrass. She also talked about "fecal" strategies which involve feeding coated seeds to cattle who become distribution agents via their cow pies. That sounds like a no-brainer until you realize that a cow's digestive tract destroys just about everything the cow eats. Her colleague William Richardson provided additional material on this topic. It was a fascinating presentation and when they were done a very lively discussion ensued, driven by people from the company side such as Douglas "Stretch" Baker whose job it is to comply with restoration obligations that range from reclaiming drill sites to waste rock dumps and heap leach piles.

A big frustration that became palpable is that the companies are supposed to apply a mix of seeds prescribed by the BLM. But these mixes were invented decades ago and have the problem that they are not customized for the range of soil conditions that show up in Nevada. Some complained that they have done everything required such as contouring waste piles and seeding them, but years later nothing is growing on the disturbed land and everybody is mad at the companies as if they shirked their duties. Tamzen said that there is a gap between older BLM seeding solutions and new sensor technology that allows the surface conditions to be analyzed to facilitate selection of a seed mix that works for that particular soil. Some of the company people have figured out which seeds work in what location and supplement the seed mix prescribed by the BLM. But when BLM workers show up to inspect the restoration effort, they are unhappy to see plants growing that were not in the mix, and the absence of certain plants that were supposed to be in the mix. These plants are missing because the soil was unsuitable for them, but the restoration effort gets a failing grade. A major attitude change is required within the BLM agency, though the BLM is eager to make reclamation more efficient because its budget is partly paid for by annual mining lease fees.

While the US Forest Service seems to be run by anti-mining people, the BLM simply wants things done properly so that they are beyond reproach from the anti-mining lobby. That is why BLM officials keep asking Allegiant Gold about progress at the former Boss Mine which is located at the southern end of the Eastside property next to US95 Highway. It was operated by a private company which shut down operations in the early 1990s just before new reclamation rules came into effect. Three decades later the heap leach pad still has nothing growing on it. Reclaiming the Boss Mine is the BLM's financial responsibility, unless a redevelopment gets permitted, in which case it becomes Allegiant's responsibility. Allegiant hopes to have a plan of operations for an expanded drill program approved by March 2024.

Towards the end the discussion shifted to funding for the research academics like Tamzen's team are doing to make restoration efforts more effective. Some wanted to know if there is a way to make corporate donations to support research. In fact, a reason Sandy McVey was able to attract Tamzen Stringham as a speaker was that West Vault and others have already been sponsoring research projects. The University of Reno is the obvious place to donate funds, but the problem is that 51% of earmarked donations disappear into the university's overhead coffers. The researchers have in response started to set up special foundations where the majority of donations goes into the proposed research. All of this is of great interest to the lithium claystone developers because they will be stripping overburden from vast areas to mine a lithium enriched horizon 20-40 m thick. Removing and stockpiling the overburden for replacement after completion of strip mining will be done, but this process does destroy the vegetation. New technologies that accelerate the growth of desirable plants at the expense of invasive cheatgrass would benefit everybody, including ranchers who do not in the long run benefit when grazing depletes desirable vegetation. We did not get any geology in the presentation but the ecology lesson was much appreciated by everybody. And from Sandy McVey's perspective, better re-vegetation strategies helps reduce the future reclamation cost and the institutional reluctance to permit open pit mines. Something that the anti-mining lobby does not seem to comprehend is that the mining industry has changed, that it understands the need to minimize the environmental impact and to plan for restoration when the mine is depleted. Former mining towns like Tonopah and Goldfield want mining to return to the Walker Lane to support their local economies. |

Dr. Tamzen Stringham - Ecologist Researching Reclamation Strategies |

Douglas "Stretch" Baker - Tonopah's Get Things Done Hero |

| Disclosure: JK does not own any of the companies mentioned; West Vault Mining is a Good Spec Value rated Favorite |