| Kaiser Watch July 7, 2023: Tonopah Adventure Tour: Part II |

| Jim (0:00:00): What makes Carlin-type deposits so much better than epithermal deposits? |

Epithermal deposits primarily of the low and high sulphidation type were the source of most of the 28 million ounces of gold produced in Nevada from 1860 through 1980. But since the recognition of micron-sized gold encapsulated by pyrite in the Carlin district in the late 1970s, gold that you cannot see by crushing and panning a sample, epithermal deposit sourced production has paled in comparison to Carlin-type production, which has helped bring all time Nevada gold production from 1860-2022 to 249 million ounces. What makes Carlin-type deposits so special is that high grade and large scale come together in these sediment hosted deposits which, although structurally controlled, consist of a replacement type of mineralization rather than filling cracks, fissures and stockworks in the manner of epithermal deposits for whom grade and tonnage manage to have an inverse relationship. The company projects visited during the Tonopah Adventure Tour were either epithermal high grade small tonnage vein systems within the old Tonopah mining district or low grade disseminated deposits on the outskirts, some of which have been fussed with by others for decades. The challenge for the epithermal systems in the hundred plus historical mining districts throughout Nevada has been that the high grade deposits are too small for the majors, and the disseminated deposits too low grade to be worth mining at prevailing gold prices. The promotion of these epithermal systems by juniors thus either targeted older investors nostalgic for a past of bonanza grade mining or included an ideological pitch about how fiat currency debasement would cause the price of gold to soar and drag marginal low grade deposits into the money. Never mind that the idea of a gold price soaring in dollar terms because the purchasing power of a dollar is crashing does nothing to lower the real cost of extracting ounces from the ground. With Carlin-type deposits, most of which are too deep to be open-pit mined, the goal was simply find one and you have a winner. For this reason I have for the past 15 years been primarily interested in Nevada juniors exploring for Carlin-type deposits.

Nevada's epithermal gold-silver systems are younger than its Carlin-type deposits which themselves are relatively young, forming 42-25 million years ago. UNR's John Muntean developed a now widely accepted theory about what caused this extraordinary mineralizing event through his 2011 paper Magmatic-hydrothermal origin of Nevada's Carlin-type gold deposits. It is worth understanding Muntean's theory about how and why Carlin-type deposits formed, because there are similar sediment hosted gold deposits with the same pathfinder elements elsewhere in the world, but none have a comparable combination of grade and tonnage.

Although today the Pacific plate is rotating parallel to the western margin of North America, over 100 million years ago the ocean floor basalt called the Farallon slab was subducting eastwards under the continent. Around 60 million years ago the Farallon slab stalled and spent the next 20 million years dehydrating, a process that stripped metals out of the slab which ended up in brines that ponded within the lithosphere beneath the crust. Around 42 million years ago the edge of the slab began to founder, sinking into the mantle which generated magmatism that mobilized the ponded brines along cracks within the crust. An unusual aspect of northern Nevada was that it had once been a continental shelf which formed carbonates (ie limestone) in the shallower near-shore environment while finer sediments flowed farther out to sea where they formed siltstones. About 150 million years ago an island arc collided with the western margin which caused thrust faulting that pushed rafts of siltstones over the top of the carbonates. Today the siltstones are called Upper Plate rocks while the carbonates are called Lower Plate rocks even though they are the same age.

These two types of sediments have different physical characteristics; the siltstones have a much lower permeability than the chemically vulnerable and brittle carbonates. Ongoing compressive forces caused the Upper-Lower Plate stratigraphy to fold, the result of which the carbonates crackled beneath the tight rubber like wrapper of the siltstones. Deep seated fault structures would nevertheless propagate through this contorted stratigraphy, and served as conduits for fluids bearing gold and a collection of elements such as arsenic, mercury and thallium which have become known as Carlin pathfinders. Carlin-type mineralization formed when the vertical structures transitioned from permissive Lower Plate rocks to tighter Upper Plate rocks. Since fluids follow the path of least resistance they traveled sideways within the porous carbonates, largely avoiding the Upper Plate structural bottleneck. That is why Lower Plate rocks have much bigger and richer Carlin-type gold zones than Upper Plate rocks.

When the right temperature, pressure and chemical conditions are present sulphides encapsulating micron sized grains of gold would crystallize, forming the rich and extensive deposits in the so-called Carlin, Getchell, and Cortez "trends". This was not a type of mineralization the prospectors from the 19th and early 20th century had the capacity to recognize. The Carlin-type mineralization was not recognized until the 1970s and it was during the 1980s that Barrick, with its acquisition of the Goldstrike property within the Carlin trend, emerged with the foundation to become a giant gold mining competitor to Newmont, the established Nevada gold producer. Through the formation of the Nevada Gold Mine joint venture on March 11, 2019 Barrick (61.5%) and rival Newmont (38.5%) pooled their vast holdings in northern Nevada in order to more efficiently utilize roasting capacity for recovering gold from the refractory ore.

The Carlin-type deposit forming period ended around 25 million years ago when the Farallon slab had rolled back to what is now called the Walker Lane. John Muntean's map showing the ages of the Carlin-type gold deposits illustrates this deposition history. The youngest Carlin-type deposits are Quito and Northumberland which sit on the eastern margin of the Walker Lane. It is why the Carlin-type production is concentrated in Humboldt, Elko and Eureka counties. As the Farallon slab rolled into the vicinity of the Sierra's eastern flank the magmatism turned into volcanism which gave birth to the epithermal deposits. The Carlin-type deposits formed well beneath a surface that was probably fairly flat, but around 15 million years ago Nevada began to stretch apart in a northwest and southeast direction, which complicated future exploration for Carlin-type deposits.

This rifting had two major consequences. One was the creation of Nevada's basin and range topography, a series of northeast oriented mountain ranges and valleys whose bedrock in places is a mile deep. Erosion subsequently filled the valleys with gravel. The rifting fault lines had little to do with the structures along which the Carlin fluids traveled, but the resulting topography effectively hid half of Nevada's Carlin-type gold endowment. With 250 million ounces already identified within the uplifted ranges and the shallower pediment flanks of the basin valleys, a similar amount is likely lurking beneath gravel cover, not to mention under barren overlying Upper Plate rocks like at Fourmile. Finding these blind Carlin-type systems is terribly expensive and these days largely the domain of the Nevada Gold Mines JV between Barrick (61.5%) and Newmont (38.5%) whose exploration strategy, now that the claim boundaries of these former revivals no longer matter, involves groping into the brownfields around their mining operations for new zones. By dissolving claim boundaries the JV opened new opportunities to chase expansion potential and reduced the urgency to offset falling Carlin type production by exploring under cover in other areas of northeastern Nevada.

The other important consequence of the rifting was that the thinning of the crust allowed intrusions to work their way toward the surface where they erupted as volcanoes whose center blew or collapsed to form calderas whose margins became structural gateways for lingering magmas whose heat drove hot spring type systems that created epithermal deposits which form both high grade bonanza zones within veins and lower grade disseminated envelopes. Blackrock Silver's Bill Howald has created a nice slide showing how these caldera settings are created. Epithermal deposits generated most of Nevada's 28 million ounces of gold production from 1860 until 1979, or about 11% of total production. During the past four decades while the counties of Humboldt, Elko and Eureka overwhelmingly dominated gold production from Carlin-type deposits the Walker Lane limped through a series of failed open pit and underground mines, most of which ended up being acquired out of bankruptcy by Waterton which in the past few years has been spinning them out to majors and juniors eager to give them another shot.

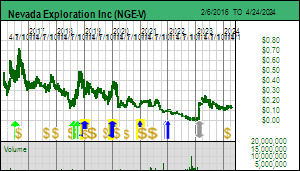

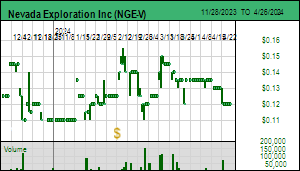

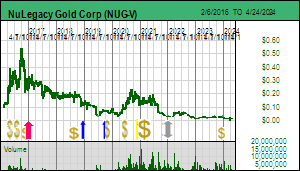

The Walker Lane became synonymous with old school pick and shovel underground mining fantasies with small sized prizes, and low grade bulk mining dreams which would become profitable if only the Federal Reserve would just stop manipulating the gold price downwards as part of a grand strategy to hide the true precarious status of the fiat currency system. That is why during the past decade I largely ignored the Walker Lane with its boring marginal bulk tonnage scenarios and skinny high grade fantasies. I chose to focus on the hunt for world class Carlin-type systems in northern Nevada. I hoped the gold in groundwater sampling strategy of Nevada Exploration Inc might lead to a major discovery under gravel cover. At South Grass Valley the method did result in the discovery of a previously unrecognized altered Lower Plate window that has been the focus of intense hydrothermal activity involving fluids with Carlin pathfinders, but no gold zone has yet been found within this deep system. In the case of NuLegacy Gold Corp whose Red Hill project is next door to the Goldrush deposit and not that far from Cortez Hills I hoped that creative geological hypotheses tested with well funded drilling would deliver a major discovery. Neither NGE nor NUG delivered, and in the case of NGE the stock crashed and burned after a series of strategic errors. |

Nevada Exploration Inc (NGE-V)

Unrated Spec Value |

|

|

| South Grass Valley |

United States - Nevada |

2-Target Drilling |

Au |

NuLegacy Gold Corp (NUG-V)

Unrated Spec Value |

|

|

| Red Hill |

United States - Nevada |

2-Target Drilling |

Au |

US Gold Production by state from 1848-2021 |

Pictorial Collage of Nevada's Evolution |

Pictorial Collage from Blackrock showing how Calderas form |

Nevada's Walker Lane Epithermal District & the Tonopah Calderas |

| Jim (0:14:12): Why do you believe the resource junior exploration focus is shifting back to epithermal deposits? |

I have come to the conclusion that discovery exploration for deep Carlin-type systems outside the known corridors controlled by Barrick-Newmont is just too difficult, time consuming and expensive for a junior to pursue. The Nevada Gold Mines JV includes an area of interest roughly 300 km by 250 km or 75,000 sq km (7.5 million hectares) which encompasses most of northeastern Nevada that is prospective for Carlin type deposits. If a junior makes an encouraging Carlin-type discovery, there is no longer any competition between Newmont and Barrick to do a farm-in deal or a buyout. Thanks to the Nevada rifting around 15 million years ago this part of Nevada does have potential for high grade gold-silver epithermal deposits like Midas, and juniors like Blackrock Silver which is currently drilling Silver Cloud are active in this area. But those projects are of no interest to the Nevada Gold Mines JV. The main hope for a junior lies with SSR Mining which operates the Marigold complex, and perhaps one day i-80 Gold Corp which purchased the Lone Tree complex from Newmont. Both these projects consist mainly of Carlin-type mineralization hosted by less permissive Upper Plate rocks.

The Walker Lane offers prizes with a smaller size than northeastern Nevada, but, unlike with under-cover Carlin-type exploration where it is always all or nothing, exploring for epithermal systems does allow incremental progress toward a prize to be demonstrated. That is critical for funding not to get trapped on a dilution treadmill as we witnessed with NGE's South Grass Valley project where a gold interval eluded Wade Hodges. Three gold producers have in recent years shown an interest in the epithermal systems in the Walker Lane. One of them is Newcrest which secured a major farm-in deal with Headwater Gold Corp, but Newcrest is being acquired by Newmont which is unlikely to have much interest in Nevada's epithermal systems. AngloGold Ashanti has focused on the Bullfrog district near Beatty at the southern end of the Walker Lane where it has been busy consolidating the district around its grassroots Silicon deposit discovery which is currently at feasibility stage. A more recent arrival is Centerra which has acquired the Goldfield project from Waterton after losing its Kumtor project in Kyrgyzstan.

AngloGold and Centerra, however, are interested in open pittable mining scenarios such as Allegiant Gold, West Vault Mining and Viva Gold have in the Tonopah region. It is more difficult to see who would want to acquire Blackrock Silver and Summa Silver in order to revive underground mining of the Tonopah silver-gold vein system at depth and along strike. Underground mining, however, has a much smaller surface disturbance footprint than open pit mining, so new discoveries and a higher real gold price which seems likely as a result of the growing geopolitical conflict between the Global West and Global East could attract the interest of producers that specialize in underground mining such as Hecla and Coeur. And then there is Kinross which operates the open pit Round Mountain Mine an hour north of Tonopah but which had an excellent experience developing the now depleted underground Buckhorn Mine in northeastern Washington when the anti-mining lobby denied a permit for an open pit mine.

I will still keep an eye on juniors trying to make a world class Carlin-type discovery, but my interest in Nevada juniors is shifting to those exploring for epithermal gold-silver systems. A century of prospecting has killed the potential to find major new outcropping epithermal deposits, but newer concepts about alteration systems and deposit models coupled with digital compilation and the ability for 3D spatial presentation open the way for juniors with sophisticated geologists to trace seemingly inconsequential geological tidbits to something substantial that is not as deep as the Carlin-type targets in northeastern Nevada. But most important of all is the reality that exploration of epithermal targets allows construction of a data supported conceptual model towards whose validation exploration can progress incrementally. This is critical to retaining the attention of investors and being able to raise the next round of financing at a higher price, avoiding the dilution treadmill that plagues juniors engaged in all or nothing exploration for Carlin-type deposits. |

Map showing extent of the Area of Interest of the Nevada Gold Mines JV |

Map showing the portion of the Walker Lane where mining is possible |

| Jim (0:21:51): What is Allegiant Gold trying to accomplish in the Tonopah District? |

Allegiant Gold Ltd's flagship project is Eastside which Andy Wallace generated back in 2013 when Robert Giustra's Columbus Gold had projects all over the place, including the Montagne D'Or gold project in French Guiana. Allegiant was spun out to hold the Nevada gold assets and listed on January 30, 2018 while Columbus carried on as Orea Mining Corp which optioned 55% to Nord Gold, the Russian gold producer now burdened by sanctions thanks to Putin's invasion of Ukraine. Wallace was a partner with John Livermore in the Cordex Syndicate which became a major privately held Nevada prospect generator during the seventies. Fund manager Peter Gianulis became CEO in Septermber 2019 and has raised $16 million, including $4 million from Kinross in March 2022 which is now a 9.9% shareholder. Allegiant delivered an inferred resource estimate in July 2021 for the Original Pit, now renamed the McIntosh deposit, featuring 1,090,000 oz gold at 0.55 g/t and 8.7 million oz silver at 4.4 g/t. This is bigger than the combined Hasbrouck-Three Hills resource of West Vault Mining Inc, but why does Hasbrouck have an updated PFS and a mining permit while McIntosh is still inferred with no PEA?

McIntosh is stalled because the deposit sits underneath a couple hundred meters of barren rock which represents a major pre-stripping cost and ultimately a high waste to ore strip rate for an open pit mining scenario. Unless the price of gold goes to the moon this would qualify as just another example of why the Walker Lane is a graveyard for resource juniors. During the past year, however, Allegiant retained a structural geologist called Alan Roberts to become exploration VP and he has created a potential future for McIntosh. The historical drilling has consisted of vertical RC holes, but a core program designed by Roberts has revealed that the zone is cut by a set of en echelon northeast oriented fractures which contain higher grade gold than the space between. The next step will be a core drilling progam designed to intersect the fracture set at a perpendicular angle so as to properly quantify the deposit's gold grade for bulk mining. This will not turn McIntosh into a conventional underground mine, but it could become an underground block-caving operation. Further drilling will also assess new nearby targets.

Allegiant expanded the Eastside property to the south in 2021 with the acquisition of claims covering the former Boss Mine open pit and heap leach operation along with the Castle, Black Rock and Berg zones for which there is an inferred resource of 19,986,000 tonnes of 0.49 g/t gold at 0.15 g/t cutoff representing 314,000 ounces. What makes the Castle area interesting is that the Boss Mine was operated by a private group during the 1980s which managed to shut down before stringent new reclamation rules came into force.This has left the BLM stuck with the liability of reclaiming the disturbed area including waste rock dumps and the former heap leach pad, none of which has any vegetation growing on it. Allegiant does not have a retroactive financial responsibility for this mess, but if it can expand the resource to an extent where open pit mining is justified, any development plan would include reclaiming the old mine site. Allegiant has a permit for a 20 hole 2,300 m drill program which will start this year, but it has applied for a plan of operations that would allow an additional program of 50 holes of 5,900 m. Although the BLM is very eager to see the Castle area become a mine development candidate, the permit is still going to take until March 2024 to arrive. |

Allegiant Gold Ltd (AUAU-V)

Unrated Spec Value |

|

|

| Eastside |

United States - Nevada |

4-Infill & Metallurgy |

Au Ag |

Allegiant's Eastside Property |

Resource estimates and deposit locations for Allegiant's Eastside project |

| Jim (0:28:22): Does Viva Gold's Tonopah project have development potential? |

Viva Gold Corp acquired the Tonopah project in March 2017 from Midway Gold which had filed for bankruptcy in 2015, paying USD $50,000, 1.5 million shares and a 2% NSR plus assuming clean up obligations for past drilling activity. The Tonopah low sulphidation epithermal deposit has received exploration attention since 1986, including by some majors, but when Midway acquired it in 2002 its goal was to assess the potential for underground mining high grade zones within the low grade envelope of this system. Most low grade epithermal deposits like at Allegiant's Eastside and West Vault's Hasbrouck have boring core that never exhibits visible gold. But the Tonopah deposit is different, and during the tour I heard a story about how long ago a driller pulling core observed an inch wide seam of gold of the sort you can encounter drilling orogenic vein system in greenstone belts. They call this gold porn in mining circles.

Such an occurrence is atypical even for the Tonopah system, but when you come across it for the first time the imagination runs wild. Supposedly the driller drove to town about 30 minutes away and bought as much stock as he could. Stockwatch has a news database that goes back a long way, so I checked it to see if I could find when this happened in Midway's history. I turns out this happened in May 2002 when Midway Gold, then called Red Emerald Resource Corp, reported on May 24, 2002 that drilling on Tonopah (then called the Midway project) intersected a 2 cm by 3 cm seam of solid gold. The day before the stock had jumped $0.10 to $0.45 on 61,500 share volume compared to 6,000 shares the day before. The stock ran as high $1.75 before June 10 when the junior reported 5 ft of 4,112.7 g/t gold (132 opt). The stock slumped after the news was out, proving the adage, buy on rumor sell on news.

Under CEO James Hesketh, an engineer, Viva has treated Tonopah as a bulk tonnage scenario for which it has raised $16 million. Viva delivered a PEA in Aprl 2022 that envisions a series of open pits with a 4.6:1 waste to ore strip ratio that would crush and stack 7,500 tpd of ore with 71.8% heap leach recovery. The mining plan exploited only 12.5 million tonnes, half the M+I+I resource of 23,556,000 tonnes of 0.79 g/t gold. For some reason they used $1,400 gold as a base case which yielded an after-tax NPV (5%) of USD $44 million with a 22% IRR which, because of the USD $58 million CapEx, fails the development hurdle. By running the DCF model at $2,000 gold Viva shows that the pre-tax NPV would be USD $148 million with 67% IRR, so in after-tax terms the project likely clears development hurdles at the current gold price just above $1,900. However, what hurts this project is the small scale; over 5 years the mine would yield 219,000 ounces or about 43,000 ounces annually, which makes West Vault's Hasbrouck look like a champion in comparison. Hesketh was not able to be present when we visited the Tonopah property which is right beside Highway 376, so we were not able to grill him. Drilling last year apparently gave rise to the recognition that there may be a set of north-south fracture controls within this east-west oriented zone. A 3,000 m program to assess this hypothesis will be done this year ahead of an updated PEA which will likely use a base case gold price better reflecting current reality. Given that Midway Gold tackled this deposit as a potential underground mine, it seems odd that the high grade controls are not already fully understood.

Viva Gold, which has Dundee Corp and RAB Capital as 20% and 18% shareholders respectively, hopes to make a decision later this year to proceed with a feasibility study and environmental permitting. However, it is not clear to me if the Tonopah project will ever get permitted. Here is where the value of a physical site visit becomes manifest. Just 4 miles down the road is a plant that pumps water from the basin to supply Tonopah about 25 miles away by road. Next to it the district has created a literal oasis consisting of two artificial ponds around which it has set up picnic tables and BBQ grilles. Each table even has a canopy to protect visitors from the thunder storms that roll by during the summer. The water is clean and cold enough to support trout which people can catch with a fly rod. The Town of Tonopah has planted sterile white grass carp in the ponds to keep them clean so that trout can flourish; the sign asks that fishermen gently release them if they catch one. Nobody was at the oasis on Wednesday afternoon when we dropped by to check it out (many thanks to Blackrock's Bill Howald who took the Northern Miner's Henry Lazenby and myself off the tour track to visit this oasis and Goldfields). In my view for Viva Gold to become a buyout target for a producer it needs to make the Tonopah deposit bigger, which reluctance to do through exploration drilling nearly got Hesketh kicked out by dissident shareholders a few years ago, but at the same time Vivat must convince the town of Tonopah that an open pit mine will not ruin its water supply. Achieving both these goals may be a challenge. |

Viva Gold Corp (VAU-V)

Bottom-Fish Spec Value |

|

|

| Tonopah |

United States - Nevada |

5-PEA |

Au |

Maps showing location of Viva Gold's Tonopah project and proposed pits |

Viva's April 2022 PEA for Tonopah project |

The good old days when a seam of visible gold moved stocks higher |

Fly-fishing BBQ Oasis next to Tonopah water supply down the road from Viva's deposit |

| Jim (0:34:19): Will Blackrock Silver and Summa Silver revive underground mining beneath the town of Tonopah? |

The Tonopah silver district boomed from 1905 until 1930 after which mining gradually faded until 1950. Mining ended because it became too expensive and technically difficult to chase the veins deeper. To the east where the Mizpah Formation was the primary host the veins were cut off by the Halifax fault and to the west where the Extension Breccia and Tonopah Formation are the primary hosts the veins seemed to peter out. About 55 km (34 miles) of underground workings exist with four main levels at 800, 1,200, 1,540 and 1,800 ft. During our tour we visited the site of the 1,800 ft deep Belmont shaft from which wafts the smell of sulphur. The Tonopah silver district produced 174 million ounces silver and 1.8 million ounces gold, a 100:1 grade ratio with the average grade 44 opt silver amd 0.5 opt gold. That is not quite as productive as the Comstock which produced 225 million ounces silver and 7.2 million gold, but the timing of the Tonopah, Goldfield and Bullfrog booms in the Walker Lane coincided with stock markets that made rampant speculation possible. Supreme among the newsletter writers was con-artist George Graham Rice (real name Jacob Simon Herzig) who switched from marketing a horse racing tip sheet to promoting mining stocks. What makes him different from the rest is that while waiting to go to jail he wrote "My Adventures with your Money" in which this somewhat unreliable narrator describes the mining sector's shenanigans. It is hard to imagine today the speculative frenzy, even though what is unfolding in the lithium sector is of far greater scale.

In early 2020 two unrelated juniors undertook to revive the Tonopah silver district. Summa Silver Corp, which listed on the CSE on Feb 12, 2020 as a shell only to be halted a day later, acquired the Hughes project from a numbered company for 10.5 million shares and $400,000. The initial $5 million private placement at $0.25 included Eric Sprott who is an even bigger silver bug than a gold bug. On August 25, 2020 Summa expanded its silver portfolio by optioning 100% of the Mogollon project in New Mexico from Allegiant Gold for USD $2.8 million over 3 years. Mogollon was a high grade silver district that produced 16.4 million ounces silver and 339,000 ounces gold during 1880-1942. The Cordex Syndicate had checked it out during the seventies. CEO Galen McNamara has raised $40 million, most of it between $0.80-$1.00, and Eric Sprott remains an 18% shareholder. About $20 million has been spent on the Hughes project and $10 million on Mogollon. Summa had about $11 million in working capital as of February 2023 and 121.2 million shares fully diluted. Summa has finished chasing the Tonopah veins at depth and is currently focused on trying to find where the north-south Halifax fault displaced the Tonopah veins on the eastern side. Some silver zones such as Ruby have been found east of the fault where Summa was drilling during the site visit, but the displaced continuation of the rich veins, "gray ledges" as the outcropping tops were described during the early discovery days, remains elusive. Summa has not yet completed a resource estimate but will likely do one for early 2024 if the drilling east of the Halifax Fault does not find the missing eastern extension. The main exploration focus in 2023 will be chasing the Mogollon veins along strike and at depth using digital compilation to understand the system.

Blackrock Silver Corp started off as Blackrock Gold whose prior management optioned the Silver Cloud project in the Midas-Hollister district from Carl Pescio in October 2017. Midas is a low sulphidation epithermal system with bonanza veins that became the Ken Snyder Mine. These epithermal deposits in the midst of Carlin-type country formed during the rifting of Nevada about 15 million years ago. In May 2019 a shareholder called Andrew Pollard became grumpy about the way the company was being run, and when he knocked on the door as a dissident shareholder he was handed the keys. He promptly recruited Bill Howald to join the company as chairman due to his Nevada experience (Placer Dome, Rye Patch) and familiarity with Silver Cloud, which I remember Atna optioning during the 1990s and Geologix during the 2000s.

Blackrock optioned Tonopah West from Ely Gold in February 2020 for USD $3 million over 4 years and a 3% NSR, and, when the monetary covid mitigation response started, caught the gold-silver rally in July, raising $7.5 million at $0.72 of which Eric Sprott put up $5 million, sensing that if Tonopah East was any good, so would be Tonopah West. The name was changed to Blackrock Silver on March 17, 2021, not so much because the junior wanted to resonate with silver bugs, but more because the Nevada subsidiary had the same name as the parent which became a filing headache. Pollard has raised $58 million since taking charge, with the last financing raising $4.4 million in units at $0.37 that come free trading around August 17. The company had $3.5 million working capital as of April 30 and 242.3 million shares fully diluted. Eric Sprott is still a shareholder but below the 10% reporting threshold.

Unlike the owner of Tonopah East, Blackrock Silver delivered a resource estimate in April 2022 based on a good portion of 150,000 metres of drilling that reported 19.9 million ounces silver at 208 g/t and 238,000 ounces gold at g/t. Metallurgical studies have been done, but a PEA has not been initiated because the resource is short of critical mass for building a mill and resuming underground mining.

Similar to Summa Silver's effort to find the displaced extension of the veins east of the Halifax Fault, Blackrock has been trying to figure out where the veins reappear to the west. The Tonopah silver veins sit on the southern rim of the Fraction caldera, which formed about 20.2 million years ago. It seems to butt up against the Klondyke caldera to the south and it would seem the intersection of these margins might be relevant. However, the Klondyke caldera erupted only 17.3 million years ago, after the silver veins formed within the Mizpah and Tonopah Formations about 20 million years ago. The western rim of the Klondyke Caldera disappears under basin gravels to the northwest, so Blackrock has been drilling the "Northwest Extension" in the hope of finding rich veins. RC drilling last year was disappointing, but when the geologists looked closely at the assays for all the other elements, they saw a major pathfinder element spike in one interval. The hole was twinned with a core hole which delivered a high silver grade along with the pathfinders; the Denver Vein is a blind discovery which Blackrock will be delineating this summer with a 20,000 m RC and core drill program.

Tracing the inferred caldera rim beneath the basin to the north failed to intersect any silver-gold mineralized structure, but the post-mineral Siebert Formation yielded intervals of 800-1,100 ppm lithium, indicating a mineralized claystone horizon similar to that of American Lithium Corp farther north. Blackrock has optioned 70% of the shallow lithium rights to Tearlach Resources Ltd, the company Keith Schaefer was paid $250,000 last year to pump to his list. Tearlach must spend USD $5 million by January 9, 2026 to earn 50%, after which it can earn 70% by spending another $10 million by 2028. Tearlach has given the name Gabriel to Tonopah North. Last year as Lithium Mania 2.0 was catching on Tearlach raised $7.5 million through a $0.50 unit, but despite Keith's gushing praise while the stock was above $2 it has crashed and burned, trading to $0.10. The treasury has also been burned through huge marketing expenses, consulting overhead and property option payments; Chuck Ross has had to become interim CEO after the prior CEO bolted and it is not clear how Tearlach will go about raising money to vest even for 51% of Tonopah North. Whatever money Tearlach does spend will be for Blackrock's perhaps 100% benefit.

Blackrock is currently conducting a 2,200 m drill program on its Silver Cloud property where last year a hole intersected a 1.5 m bonanza vein interval of 70 g/t gold and 600 g/t silver. There is a good reason to wish Blackrock and Summa a lot of luck with their Silver Cloud and Mogollon drill plays. It is obvious to everybody that Tonopah West and East (Hughes) must be consolidated into a single property. If their respective pieces of the Tonopah silver district is all what each company is about, negotiating merger terms will spawn a clash of egos. But if Silver Cloud and Mogollon start shaping up as emerging discoveries, creating the potential for meaningful spinouts by each company, flexibility will emerge in sorting out the combination terms for the two properties whose whole will be worth more than the sum of the parts. |

Summa Silver Corp (SSVR-V)

Unrated Spec Value |

|

|

| Hughes |

United States - Nevada |

3-Discovery Delineation |

Ag Au |

Blackrock Silver Corp (BRC-V)

Unrated Spec Value |

|

|

| Tonopah West |

United States - Nevada |

4-Infill & Metallurgy |

Ag Au |

Tonopah District Silver Production History |

Stratigraphic Rock Type Column for Tonopah District |

Scaled Matchup showing how Tonopah West and East adjoin |

Summa Silver's Tonopah East (Hughes) Discovery Potential |

Blackrock's April 2022 Tonopah West Resource Estimate |

Blackrock's Tonopah West Property and current Denver Vein discovery drilling focus |

Blackrock's Silver Cloud Epithermal Play in the Carlin Heartland |

| Jim (0:47:09): Are you watching any Walker Lane prospect-generator-farmout juniors? |

The more I have studied the potential for Nevada's epithermal bounty to make a comeback as enthusiasm for Carlin-type discovery exploration by juniors fades, the more I like Mike Power's Silver Range Resources Ltd, which I have had in my bottom-fish collection for several years now. Insiders own 17.4% and Doug Eaton's Strategic Metals owns another 16.4%. Silver Range started off as a prospect-generator-farmout junior with a Yukon-NWT-Nunavut focus, but in recent years CEO Mike Power has focused exclusively on high grade systems in southwestern United States, with a particular emphasis on Nevada's Walker Lane. The latter makes sense since Mike lives in Goldfield and is even a director of the non-profit responsible for the International Car Forest.

He is not interested in low grade epithermal envelopes like the properties of Allegiant and West Vault; these need to be at surface in order to be open-pittable. Finding a deposit like Allegiant's McIntosh under a couple hundred metres of barren rock or gravel is not going to move the needle; and anything outcropping such as Hasbrouck and Three Hills has been owned by somebody since the seventies. His target is high grade underground mineable deposits grading at least 5 g/t Au or 500 g/t Ag. His acquisition strategy involves staking, which is not cheap in Nevada because it involves post staking and hefty annual BLM fees every August 31. But this means no accidental competition from map staking speculators. The bad rap Nevada's epithermal deposits earned during the past 4 decades while Carlin-type deposits earned all the glory and dollars also limits competition, especially from private geologists for whom there is a dearth of juniors eager to option a property that might allow a flashy lure to be trolled past Eric Sprott.

As a geologist Mike Power uses modern tools to see beyond what is sticking out of the ground, because if any gold-silver rich Comstocks, Goldfields or Tonopahs remain to be found, it will only be by following subtle clues at surface. Silver Range has 44 projects in Nevada, a number of which have been farmed out, with Mike favoring the Ely Gold model where the partner gets to earn 100% through spending obligations, payments and a royalty. The beauty of this approach on a large scale is Silver Range gets to ask for decent earn-in requirements, which more often than not the partner fails to meet, giving Silver Range back the property with enhanced data, as recently happened when Atac dropped the East Goldfield property, which has already been re-optioned.

Mike is also an information junkie who collects and digitizes the terms of all the deals he sees announced by juniors, which gives him a deep understanding of the variety of option terms and what works for different areas and types of prospects. In fact Tim Termuende of Eagle Plains sits on the board as an independent director, which is not a conflict because the two juniors specialize in different parts of North America. Recently Silver Range has attracted a generative alliance deal with Altius Minerals which invested $500,000 in a no warrant private placement at $0.15 in exchange for the right to select three properties in an undisclosed area of interest in which it will hold a 1% NSR if Silver Range acquires any. Interestingly, Silver Range is getting the strongest farm-in interest from private parties hoping to eventually go public and Australian companies who despite a complete absence of success in Nevada remain keen. I may be wrong about my thesis that discovery exploration for gold-silver epithermal deposits in Nevada is making a comeback, but Silver Range Resources Ltd is a cheap and leveraged proxy bet for being right. |

Silver Range Resources Ltd (SNG-V)

Bottom-Fish Spec Value |

|

|

| East Goldfield |

United States - Nevada |

2-Target Drilling |

Au |

Silver Range's Nevada Properties |

East Goldfield example of Silver Range Prospect-Generator-Farmout Strategy |

| Disclosure: JK owns none of the companies featured, all of which are currently unrated except Silver Range which has a bottom-fish spec value rating |