| Kaiser Watch August 11, 2023: Time for Canada to fix its First Nations Problem |

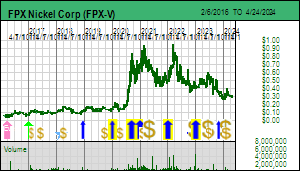

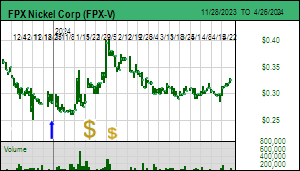

| Jim (0:00:00): Why did FPX Nickel drop sharply on Wednesday? |

FPX Nickel Corp released a vague Aug 9, 2023 Update on its 2012 MOU with Tl'azt'en Nation which the market didn't really understand until it tracked down the publication referred to by FPX, Dust'Lus Talo 'Ooza' August 2023, a monthly newsletter of the Tl'azt'en Nation. Page 4 contained a declaration by Chief Leslie Aslin, elected in June 2022, that after more than a decade of collecting from FPX Nickel whatever benefits accrued from the 2012 Memorandum of Understanding, the Tl'azt'en Nation has decided it is unequivocally against development of Baptiste, which would become the world's first awaruite based nickel mine in a secure jurisdiction, possibly with a zero carbon footprint, producing more than 4 decades of "clean" nickel relative to the dirty nickel Indonesia and Russia supplies (double that if Van is developed).

This is the same First Nation with a population of 1,802 on and off reserve members (Carrier Sekani Tribal Council) which through its Tanizul Timber Ltd division has benefited from clearcut logging within its vast "traditional territory". Some FPX shareholders, in particular Europeans who do not understand Canada's ridiculous First Nations problem, hit the panic button, assuming that this project into which Cliffs and FPX have sunk over $40 million, and for which a mystery strategic investor and the Finnish stainless steelmaker Outukumpu during the past year have invested almost $30 million is dead. If this turns out to be the case, it signals the death of Canada as a nation, because it would confirm that 1 million full status indigenous people who claim 400% of Canada as traditional territory thanks to their overlapping inter-tribal claims, represent a race based aristocracy with rights that over-ride those of the 37 million Canadians who are not descendants of an indigenous nation. It would not actually come to that, for a more likely outcome is that First Nations aspirations will end up on the scrap heap as 95% of Canada's 38 million people declare, "enough is enough", and force the federal government to pull out of the United Nations Declaration on the Rights of Indigenous Peoples.

When you read through the UN declaration it all makes perfect sense until you realize that Canada is the second largest country by area, and all of it technically is traditional territory of various peoples who managed to be the survivors still standing when the Europeans arrived. Unlike the United States which became independent from Great Britain in 1776 and waged physical genocide against its indigenous people and used shotgun diplomacy to strip groups of any legal rights, the British pretty much dealt with Canada's indigenous people by ignoring and marginalizing them. This is now decried as "colonial conquest" and the way generations of Canadians waged cultural genocide against indigenous people is indeed deplorable. But subordinating the interests of 37 million non-indigenous Canadians, most of whom are on their own to secure the means of survival in a modern economy, to those of a 5% minority whose membership is race based and which lineage can easily be established with DNA, just will not happen.

The problem is that Canada's failure to confront its complicity has engendered a guilt complex that encourages pussy-footing around First Nations land claims. Canada has a mineral title system which asserts that the crown owns the sub-surface mineral rights, and where crown land has not been set aside as a park or preserve encourages exploration and development activity by private parties. Canada has erected a massive environmental permitting regime to minimize negative downstream harm, but has not evolved the pragmatic wisdom to accept that when it comes to resource development, you cannot avoid a distribution of costs and benefits that makes some parties winners and others losers. The Canadian mentality is one of seeking ethical purity, which just isn't possible in a world of physical scarcity. There is a latent cowardice in the Canadian unwillingness to accept that whatever decision is made will involve a dirty compromise. Canadians want to be "clean" which has allowed the First Nations problem to escalate to a point where it threatens Canada's viability as a thriving sovereign nation, especially in its emerging role as a producer of raw materials that are critical to energy transition goals and which will also become a secure alternative to metal supply that is destined to become geopolitically compromised as the Global East axis of China-Russia escalates into a hot conflict with the Global West while the Global South aligns itself on the basis of expedience.

One reason Canada has failed to establish a relationship with its indigenous people that balances their interests with those of the 95% non-indigenous Canadians is that the various First Nations groups have these overlapping traditional territory claims. Chief Leslie Aslin's decision to assert a veto right over the future of FPX Nickel's Baptiste Mine, which hasn't yet been validated as economically viable - the PFS due in September will tell us a lot about how vulnerable the economics are to dirty Indonesian and Russian nickel supply - could engender a massive backlash of resentment towards First Nations goals. FPX management has followed best practices in its engagement with local stakeholders, Decar has attracted international investment because of its potential to supply clean nickel for both stainless steel and lithium ion batteries, and the mining plan will be benign relative to bulk tonnage sulphide based mines. This story has the potential to become a publicity nightmare for Canada.

The government withholds drill permits on exploration projects until a company has struck "benefit" agreements with First Nation groups within whose traditional territory the project sits. If there are overlapping traditional territory claims the company has to do a deal with all of them. None of these agreements have a binding nature because the First Nations groups do not have legal rights to the land covered by mineral claims. They are also competing against each other, and not necessarily in a friendly manner. I heard one bizarre story going back to the 1980s when a junior with a copper project on Vancouver Island did a benefits agreement with the local indigenous group. This junior, which was ahead of the times, got a letter from an indigenous group to the south complaining that the junior has no right to do an agreement with that group, that the southern group had kicked this group's ass centuries ago, and has since allowed them to occupy that land at their discretion.

Because a project's potential to deliver a discovery requires a drill permit, the investors in a junior will lose if there is a holdout among these overlapping transitional territory claims. This is comparable to a shopkeeper having to pay protection to multiple street gangs competing for the shopkeeper's neighborhood, none of which agreements are binding and promise no long term protection. These benefit agreements are one-sided because if the junior breaks the terms of the agreement it gets cremated in the court of public opinion with the help of a mindless mainstream media, but if a First Nation scraps the agreement, as the Tl'azt'en Nation has done with FPX Nickel Corp, the junior has no enforcement recourse. Canada needs a good dose of bad publicity for running a mineral claims system that is effectively fraud because the rights a company thinks it has are at the mercy of groups whose decisions have no accountability.

The FPX situation, however, will not result in massive bad publicity for Canada, though if it did the whole world would find out about the Decar nickel project and perhaps start buying the stock. FPX Nickel has been vague in its response to the Tl'azt'en Nation's "Unequivocal No" because it is engaged in confidential discussions with multiple stakeholders. FPX last year announced a June 21, 2022 MOA with Binche Keyoh Bu Society, which is a business organization created after the Binche Whut'en Nation split off from the Tl'azt'en Nation in 2019.

It turns out that in 1959 government bureaucrats arbitrarily combined 4 distinct indigenous groups into one entity they called the Tl'azt'en Nation to simplify administration. The Vanderhoof Omenica Express provided background in an article published Apr 6, 2015: Binche finalizes separation from Tl'azt'en First Nation, and the outcome in Apr 3, 2019: Binche and Tl'azt'en have officially separated. FPX, recognizing that Decar also falls within the traditional territory of the Binche Whut' en, announced a FPX June 21, 2022 MOA with Binche Keyoh Bu Society. This coincided with the election of Leslie Aslin as the new chief of Tl'azt'en Nation. This was followed by the Aug 24, 2022 Forest & Range Consultation and Revenue Sharing Agreement between Binche Keyoh Bu Society, representing the Binche Whut'en First Nation, and the Province of British Columbia.

I am not privy to what is going on behind the scenes, but when you scroll to the Appendix you find a map showing the Binche Whut'en Consultative Boundary. The southern portion overlaps the traditional territory map of the Tl'azt'en Nation. When you go to the Tl'azt'en Nation web site you will find a link to the Tanizul Timber web site which has lots of maps and information about the timber harvesting of the past decades, though the financials have not been updated since 2019 when Bince Whut'en Nation split off. The Binche Whut'en web site doesn't have any links to business divisions but its home page currently sports an announcement for a recent fishing derby surrounded by logos of corporate sponsors such as FPX Nickel, Canfor (a forestry company) and Centerra Gold, operator of the Mt Milligan copper-gold mine which is to the east of the Tl'azt'en Nation traditional territory.

The footprint that the Baptiste open pit mine would represent is smaller than most of the logging clear cut patches within the overlapping territories of these two First Nation groups which were once part of the same First Nation group. Given the willingness of the Tl'azt'en Nation to benefit via Tanizul Timber from commercial logging within its traditional territory, it really looks like Chief Leslie Aslin's sudden need "to say an unequivocal No to the proposed mine at Mt Sidney Williams within our sacred territory" is the opportunism of a hypocrite. This really seems to be a territorial conflict between distinct First Nations groups with different agenda. Given that the FPX story has potential to become an international scandal, doing plenty of damage to the interests of both Canada's mining sector and First Nation goals, I do not think this uncertainty about the future of FPX Nickel's Decar project will last long. But in buying at the current distressed prices you do have make a bet that Canada is not as spineless as it seems, and that is hard to do given the current leader and his handlers. |

FPX Nickel Corp (FPX-V)

Favorite

Good Spec Value |

|

|

| Decar |

Canada - British Columbia |

6-Prefeasibility |

Ni |

Tl' Azt' en Nation historical desecration of its "sacred" territory |

Decar Property and Baptiste Footprint within Tl'azt'en traditional territory |

Map of clearcut logging activity from which Tanizul Timber benefits |

After the split into 2 First Nations groups, who benefits from logging? |

Overlapping traditional territories of Binche Whut'en and Tl'azt'en Nations |

Guess which First Nation wants FPX Nickels Baptiste Mine if it is viable? |

| Jim (0:11:35): Any new developments in the James Bay region? |

The main new development everybody is looking for, namely a lifting of the forest access closures, has not happened yet. The main problem is that the western part of James Bay still has an extreme fire danger according to SOPFEU, as a result of which the Billy Diamond Highway remains closed. Although the Trans Taiga Highway which runs east-west in the north James Bay area to service the hydroelectric infrastructure is open, that is of no help because access via Billy Diamond remains closed. The Quebec government's SOPFEU fire map is not well endowed with explanatory legends, but I had somebody explain the legend system. The eastern part of the James Bay region now has a low fire danger though the western part along the eastern side of James Bay has high to extreme fire danger. The irregular red outlined areas are fires that are being "observed", meaning they are being let to burn out on their own because they do not threaten infrastructure. Those that are solid red are still burning actively while those with just a red outline are fading.

There is talk that the Billy Diamond Highway will soon open which will allow road transport to the greenstone belts along the Corvette "trend", which is critical because it will allow boots on the ground which do not need helicopter support to begin prospecting. Companies such as Dios Exploration Inc which were set to do helicopter supported prospecting on their eastern claims by mid August have been notified that there will be a delay of at least another week due to a shortage of helicopters. The Canada wide Interactive Fire Map shows that British Columbia, Yukon and Northwest Territories are now forest fire hotspots. The Yukon, already constrained by a very short exploration season, is now seeing drill programs curtailed because helicopters are being requisitioned to fight its fires. Between First Nation aggression and forest fires the resource juniors operating in Canada are having a tough time, hampered by a market that has become very subdued. Juniors in the James Bay region are consoling themselves with silver lining jokes about how next summer when the winter-spring rains have washed away all the soot there will be a bounty of visible pegmatites previously obscured by brush and moss. Some are already making arrangements for commercial satellite photos next May-June.

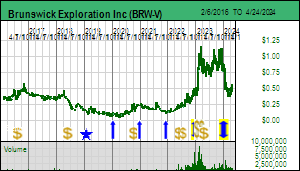

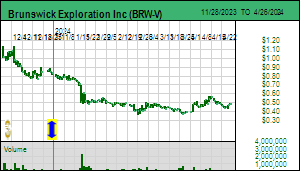

At the moment the main hope for major discovery news resides with Brunswick Exploration Inc which has had boots on the ground at its Mirage spodumene boulder field for two weeks now. The stock price has started to sag after a burst of market interest over a week ago when theJuniorExplorer published an hour long interview with Brunswick's CEO Killian Charles. Killian doesn't reveal any secrets about Mirage but the interview does a very good job explaining why what I call Lithium Mania 2.0, the search for lithium pegmatites in places like Canada which don't make anybody's list of where the 600% supply expansion required for 2030 EV deployment goals is supposed to come from, has barely started. It is especially valuable for individuals who feel they missed the lithium boat because they didn't own Patriot Battery Metals Corp. Although investors have been reluctant to act, juniors have scrambled to acquire land in the James Bay region during the past year. I have identified 54 public companies with land in Quebec's James Bay region and created the KRO James Bay Lithium Index with August 1, 2023 as the effective date ($1,000 worth of stock was bought for each company and the index was set at 1,000). The index has been back-dated to December 30, 2022. The index members begin with equal weighting because the point of the index is to identify and track emerging lithium discoveries. I see the James Bay Great Canadian Area Play as the ultimate and final mineral exploration boom ideally suited for the resource junior eco-system which is on its deathbed.

Some of the companies are truly awful pukeworthy juniors which you can tell from the nature of the property deals they have done and the IR contracts in management's history that a pump and dump is the primary objective of exposure to the James Bay Great Canadian Area Play. I decided to include all of them because the nature of the lithium pegmatite hunt is such where the most horrible junior could actually make a world class discovery, so long as they go to the trouble to put boots on the ground. And even that may not be necessary because a serious junior next door might find a CV5 equivalent pegmatite projecting onto the lifestyle junior's property. I've even included gold or base metals focused juniors not (yet) interested in lithium because the kind of geology prospective for those metals in many cases is also prospective for LCT type pegmatites. In fact what makes Lithium Mania 2.0 such a compelling story is that countless pegmatites were noted through the course of past exploration but ignored because as recently as 2005 the annual lithium market was worth only $200 million compared to $20 billion in 2022, and amply supplied by Australia's Greenbushes pegmatite monster and the brines in the Chilean part of South America's Lithium Triangle.

I will be regularly sharing the KRO James Bay Lithium Index chart on Kaiser Watch and talking about important developments, but the KRO James Bay Lithium Index web page and associated comments will be available only to KRO members, which costs USD $450 annually for an individual membership and $1,000 for a corporate multi-user membership.

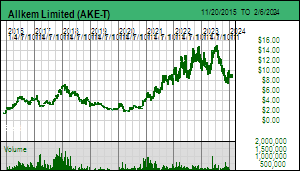

The big news for the James Bay region was an updated resource estimate from Allkem Limited for its James Bay (Galaxy-Cyr) deposit published on August 11, 2023. The main resource, which stops just west of the Billy Diamond Highway and for which a feasibility study has already been done, increased from indicated 40.3 million tonnes at 1.4% Li2O using a 0.62% cutoff in the December 2021 feasibility study to 54.3 million tonnes @ 1.3% indicated and 25.3 million tonnes @ 1.15% inferred using a 0.5% cutoff grade. The big surprise, however, was the NW Sector which yielded 30.7 million tonnes @ 1.42% inferred. We only heard of this zone in 2023 when Allkem published intersections with higher grades than we saw with the main zone. Somehow Lithium One and Galaxy both missed this blind jog to the northwest while they delineated a set of 200-400 m long pegmatite dykes oriented north-south within an east-west deformation corridor. The NW Sector remains open at depth and along strike in a northwest direction. When the two zones are combined Allkem has 110.2 million tonnes of 1.3% Li2O in indicated and inferred categories containing in situ 1,430,000 tonnes of Li2O, which is equivalent to 3,536,000 tonnes of lithium carbonate or 664,000 tonnes of lithium metal (2022 global supply was 120,000 tonnes of metal).

The significance of the NW Sector resource is that if the Main Zone did not happen to be outcropping nearby to the extent it is visible with Google Earth, finding it would have required second order exploration methods which combine multiple data sets to vector in on high probability locations for LCT-pegmatites, followed by detailed boots on the ground prospecting. The northern half of James Bay where PMET's Corvette project is located involves first order exploration where all it may take is to look hard at something seen in the past but ignored because there was no demand for lithium. The NW Sector shows that second order exploration in the southern half of James Bay by groups like Brunswick and Dios can bear high grade fruit with large tonnage implications.

One missing aspect of the Allkem update was the lack of any mention about drilling within the deformation corridor east of the Billy Diamond Highway. The map shows three drill holes to the east of the Main Zone described as testing the limit, which means the Main Zone does not cross the highway. But Allkem did drill holes farther east right up to the boundary with Brunswick's Anatacau West property where Brunswick successfully demonstrated that the set of 200-400 m en echelon lithium pegmatite dykes continues for at least 300 m eastwards within the deformation corridor. Allkem has now completely surrounded the Anatacau West claim block. Allkem and Livent expect to complete their merger later this year which may be when the new Allkem Livent plc will be in a position to acquire Brunswick's Anatacau West claim block. |

Allkem Limited (AKE-T)

Unrated Spec Value |

|

|

| James Bay |

Canada - Quebec |

7-Permitting & Feasibility |

Li |

Brunswick Exploration Inc (BRW-V)

Favorite

Fair Spec Value |

|

|

| Mirage |

Canada - Quebec |

2-Target Drilling |

Li |

Making sense of the SOPFEU Fire Map |

Location of James Bay fires being allowed to burn out |

Canada's forest fires now hitting BC, Yukon and NWT hard |

Updated Resource Estimate for Allkem's James Bay project (Galaxy-Cyr) |

3D View of James Bay Pegmatite Zone |

Plan and Section Views of new NW Sector |

Property Map showing Allkem enclosure of Anatacau West |

| Disclosure: JK owns shares of Brunswick, Dios and FPX Nickel; Brunswick is a Fair Spec Value rated Favorite, FPX is a Good Spec Value rated Favorite; Dios is Bottom-Fish Spec Value rated |