| Kaiser Watch September 15, 2023: Best Bet on Rio Tinto James Bay Success |

| Jim (0:00:00): What's new in the James Bay Lithium play? |

The James Bay Lithium Index had a downward bias this past week until the last couple days when it perked up, though it is still down 6.2% from its initiation date August 1, 2023. During the past week I found four more ASX listed juniors with exposure to the James Bay region and have added them as members, bringing the total to 62 members of which 50 are Canadian listed and 12 are ASX listed juniors. One recent new ASX listing had the chutzpah to name itself James Bay Minerals Ltd! I've included a list below. If anybody is aware of Canadian or Australian companies missing from the list, please send me an email at [email protected].

The price of lithium carbonate weakened slightly but the second plunge following the May rebound seems to be slowing, though with regard to the James Bay Great Canadian Area Play where the goal is large deposits of 1% Li2O or higher we should not worry about lithium carbonate price fluctuations so long as it does not drop below $5/lb such as what ushered in the lithium winter for Australian lithium pegmatite plays in 2018-2020. Even at $5/lb the rock value of 1% Li2O is $273 per tonne, equivalent to 4 g/t gold and 3% copper at current gold and copper prices. The goal in the James Bay region is to find 50 million tonne plus deposits grading 1% Li2O or higher, of which two world class deposits have already been delineated, Allkem's Galaxy-Cyr within its James Bay project and Patriot Battery Metals' CV5 within its Corvette project. If you are having trouble convincing others about the merits of the lithium boom, show them my Lithium Rock Value Matrix and ask them where any junior is going to find a large open-pittable gold deposit grading 4-8 g/t gold.

The price of gold, which seems determined to keep $2,000 as its ceiling, continues to torture resource junior investors who are gold bugs and spend most of their energy wailing about how the price of gold needs to be a lot higher. We don't need a higher lithium price because the story is all about the extraordinary demand growth that lithium is undergoing as a result of the energy transition and the fact that the car sector is shifting its production lines away from ICE to EV cars regardless of energy transition policies. Russia and Saudi Arabia, in their effort to get Trump elected in 2024, are helping out by curtailing oil supply so that ICE car drivers pay through the nose for gasoline.

If lithium ion batteries continue to power the EV sector, the world will need a six-fold supply expansion by 2030, 12-fold by 2035 if Toyota's boast of a solid state lithium ion battery which uses lithium metal in the anode instead of graphite becomes commercial reality. (Fans of FPX Nickel Corp should check out this Electrek September 14, 2023 article by Peter Johnson which confirms that the cathode of Toyota's solid state battery will need lots of nickel.) Quebec's James Bay region may rival Western Australia in terms of LCT-type pegmatite endowment. And that is a good thing, because Australia can't do this on its own, which is why Australian investors and companies are swarming into Canada's James Bay region, for they understand that the Lithium Mania 1.0 that profited them handsomely is about to repeat as Lithium Mania 2.0. To appreciate why Canadians are generally asleep at the switch I recommend viewing the MIF Vancouver May 2023 Panel Discussion. But as I tried to emphasize last week, there is no shame in waking up today, because only a few boats have put out to sea, and most are still idling at the dock or puttering in the harbor. There is so much latent opportunity!

Uranium is starting to create some joy for uranium bugs; its spot price at $66.25/lb U3O8 is now at the highest level since 2011. The Russia backed coup in Niger, which supplies 4.1% of the world's uranium, seems to be the tipping point, though apparently, according to a Financial Times LEX blurb, Russia has figured out how to constrain Kazakhstan's ability to supply the world from its seemingly unlimited in situ leachable deposits. But at the $49.70/lb average price for 2022 the value of 2022 production was only $6.3 billion compared to $49.2 billion for 2022 lithium supply at the average $32.26/lb price. Very little U3O8 or lithium carbonate gets sold at their spot price because producers deliver into long term contracts. But when you compare the supply evolution charts for uranium and lithium, and realize that consumer demand is driving lithium demand while regulatory red tape stymies the growth of nuclear power capacity and accompanying uranium demand, the real game is all about finding LCT-type pegmatites big and rich to be put into fast-track production. I urge investors to consider, what if the passion that invigorates the uranium juniors discovers the Canadian pegmatite lithium sector? There is one James Lithium Index member which has its feet in both the uranium and lithium worlds, some of the latter in the James Bay region joint ventured with an ASX listed company. It trades at $0.02-$0.03 and has 342 million fully diluted which will shrink if management has the fortitude to resist the plea of warrant holders to extend their free lunch another couple years. (Yeah, there is a reason why $450 for a KRO membership might be worth the money.) For uranium bugs this junior is a free lithium lunch.

The big story this week was the European Union decision to initiate a probe into whether or not Chinese EV makers benefit from unfair state subsidies. European makers of solar panels are now going bankrupt after a 2018 decision to remove tariffs from imported Chinese solar panels in order to drive the cost down and encourage installation of solar polar as part of the energy transition agenda. Europe's car industry, however, is much more important to Europe's economy than solar panel makers. While China heavily subsidized its EV sector so that it can escape its oil import dependency, the Europeans, operating in the world of laissez faire capitalism, have been much slower to develop their EV divisions. No European in their right mind would ever want to buy an imported low quality Chinese ICE car, but in adapting to the brand new EV technology the Chinese car makers like BYD underwent a quality revolution. These Chinese cars are good and well suited for Europe's small spaces, not so much for America's wide open spaces.

Xi Jinping's mishandling of the covid pandemic as a demonstration of autocracy's superiority over democracy along with other oppressive measures have pushed Chinese consumers into a funk. The result is EV over-capacity and, of course, China wants to sell the surplus to the rest of the world. If the Europeans impose heavy tariffs to offset Chinese subsidies to its industry, which include environmental rules that are not enforced so that powerless downstream victims eat the cost for the greater good of China, something not possible in the Global West, they may discover a new problem, which is that although China is not a major lithium producer, it is the dominant processor of lithium concentrates and producer of lithium ion battery precursor chemicals. Supply chain ignorance (indifference as in the geopolitically blind mantra of globalized free trade supposedly dominated by shareholder serving corporations?) is the fatal flaw of the Global West. Trump sounded the alarm during his administration, and Biden, acting on behalf of America, took the torch and has run with it to foster the KAG goal of Keeping American Great. This, however, is a problem for Europe, for IRA is designed to serve American interests, not those of Europe, and it has lots of subsidies available to American companies and friends of America.

This is where Canada should end up playing a critical role, not just as a producer of lithium concentrates from the James Bay region and perhaps other parts of Canada, but as a downstream processor of lithium concentrates and perhaps even battery plants. And also with regard to lots of other useful metals such as niobium, nickel, rare earths and copper to name the more familiar ones. Canada's environmental rules are second to none, and enforcement is not a farce like in China. When a mine is going to be profitable after complying with Canada's permitting system, nothing should stop it from happening.

This is Canada's opportunity to shine. Now is the time for Prime Minister Justin Trudeau to stop cruising in social justice cul de sacs and start making it clear that local stakeholders such as First Nations and foolish young people who don't understand geopolitics and where physical things they take for granted come from will not prevent Canada from becoming a critical minerals powerhouse for the Global West, and in doing so provide an economic foundation that sustains what it means to be a Canadian. It is time for Canada to cease being the perpetual also ran. And one way to do so is to abandon the aspiration to ethical purity, and accept that, when a decision to "make it so" is made, there will be losers and acknowledge such. No decision that is good comes without some degree of shame, for the core principles humanity takes for granted are an inconsistent set, something Nietzsche made a lot of hay out of, and which underpins his definition of tragedy. The path to redemption beckons Justin Trudeau, but it requires him to become a tragic figure.

This weekend while reading reviews about the new movie "Dumb Money", it occurred to me that all these young people in 2021 buying a junk company like Gamestop, only to eventually get blown up either by Gamestop returning to fair value before they sold or recycling their profits into some other junk company that repeated the Gamestop cycle, could make a lot of money by getting their heads around the James Bay Great Canadian Area Play, most of whose junior participants are still very cheap. By swarming into the James Bay Great Canadian Area Play they would also help shape the future in terms that benefit them and their children.

This is not a fraud fantasy like cannabis or blockchain, frauds because cannabis production and supply has no competitive barriers and will become a low margin business, and because blockchain applied as crypto currency is a solution in search of a problem. Climate change is a pressing problem. Reliance on Global East titans China and Russia for key raw materials is a pressing problem. Young people are ill-equipped to solve most other of humanity's existential problems, but as a collective they are well equipped to deliver partial solutions to these two problems by backing resource juniors focused on lithium and other critical minerals. Let the not so dumb money discover the James Bay Lithium Index as a leveraged way to change the world.

September 15 is the start of the moose hunting season in the James Bay region which ends October 15. This is not when planeloads of camouflage dressed white people descend upon the region to bag their trophy whose meat will be donated to local homeless shelters. Moose hunting is for First Nations members only. In KW Episode September 1, 2023 I talked about how Q2 Metals Corp and Ophir Gold Corp were scrambling to get as much prospecting work done as possible on their respective Mia and Radis properties straddling the Yasinski greenstone belt where they have confirmed outcropping LCT-type pegmatites before the start of moose hunting season. Not everybody, however, is affected by this month long moose hunting closure.

September 15 to October 15 is open season in the James Bay region for members of First Nations to hunt moose. I don't know if there are any kill limits, but there are practical limits as to how many moose one can kill, dress, and store in freezer. None of this activity is characterized as "sportsmanship", the white person hunter-gatherer fantasy of the individual using his or her wits to stalk and bag a wild animal not necessary for the hunter's survival. I have heard stories about wonton slaughter for the sake bloodthirsty satisfaction, but that is third rail territory I prefer to avoid. My interest is in how resource juniors can work around moose hunting season, and I have heard from a number of juniors, unlike Q2 Metals and Ophir Gold, that their boots on the ground prospecting is not affected. It boils down to the location of your properties.

The biggest concern from First Nations is helicopter noise frightening the moose away. There are three ways to hunt moose: 1) drive along the roads until you see a moose and blast it, as that pair does in the Koneline segment I highlighted in the first segment of KW Episode September 1, 2023 (I do urge everybody to watch this Koneline clip so that, when you are stuck arguing with somebody braying about how wonderful indigenous rituals are, you can show them an example and ask what they think), 2) use boats on rivers and lakes to scan the shoreline for moose they can blast with high powered rifles, 3) set up a camp in accessible (aka near a road) "favorite" locations they know moose like to frequent and wait for them to show up so that they can blast them from the comfort of their camp. I am not very keen about stalking moose from a truck or boat, but I do sympathize with the camp strategy because 1) it reflects strategic prior observation and planning, 2) the waiting by the group creates an opportunity for reflection that makes this non-stalking form of the hunt rather spiritual, and, 3) you only kill what comes to you (which is probably not a lot of moose), and, when you are done, it is time to go home so your freezer is stocked with fresh frozen meat. The camping group, understandably is most worried about noise from helicopters passing over their camps and frightening away moose that might finally be approaching their hangout.

Companies that have historically worked in James Bay have established relationships with the communities in the vicinity of their properties and consult the locals about where they do not want helicopter traffic that might spook their quarry. It's not like there is a total ban on helicopter usage, but there is a standing request that helicopters choose routes that do not impact moose hunting. That means Sept 15-Oct 15 is bad news for properties that straddle roads like the Trans Taiga, Billy Diamond, and various spurs, as well as waterways accessible by boat. Through consultation juniors can figure out where First Nations do not want helicopter traffic and design alternative routes. Yes that will cost extra money, but that is a small price to pay to allow First Nations to execute a seasonal ritual without disruption, especially given the size of the prize if your boots land on ground that proves to be an LCT-type pegmatite with large and abundant spodumene crystals.

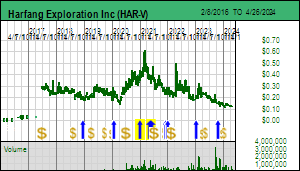

Although some James Bay juniors have to cool their heels over the next four weeks, others will be very busy with ongoing prospecting of their properties. One of these, whose CEO Ian Campbell claims that his company's properties fall outside areas First Nations have "reserved" for moose hunting, announced on September 13, 2023 that Harfang Exploration Inc had identified outcropping LCT-type pegmatite with a broad range of spodumene crystal sizes associated with a similar boulder field on its Serpent project. Ironically, Serpent was the focus of Harfang's exploration during the past few years based on a gold in till anomaly whose apron highlighted an area in the western part of the property. Drilling failed to yield a commercial scale explanation for the gold anomaly and in late 2021 CEO Francois Goulet chose to retire, which set the stage for a merger between Harfang and another junior with an adjacent property whose CEO Ian Campbell inherited Goulet's job. Goulet in turn went to work for Brunswick which had secured options on land once owned by Andre Gaumond's Virginia Mines and for whom Goulet worked as a junior geologist. Gaumond is the "godfather" of Harfang so it has been a somewhat difficult journey for somebody who was an exploration pioneer in the James Bay region seeking to establish its credibility as a source of precious and base metal mines, only to realize that those annoying pegmatites within the greenstone belts, whose outcropping mosquito and bush free ridges he strictly forbade junior geologists such as his protege Francois Goulet to waste time and money sampling, are in fact the world class foundation of the James Bay district.

Campbell was familiar with LCT type pegmatites because he had worked on the Big Whopper pegmatite the late Don Bubar's Avalon discovered in western Ontario in 1996. Once he got his head around the Lithium Mania 2.0 concept he used geology and lake bottom-sediment data to identify several other lithium prospects in the James Bay region he staked for Harfang. But the Serpent property had generated its own reports of pegmatites in the field, so when the forest fire closures ended he sent his boots to this ground first, and, lo and behold, the pegmatite dyke system is extensive, shoots via XRF as LCT type, and has large visible spodumene crystals. Just to make everybody feel stupid, the pegmatite system is located in the southeastern part of the property, far away from the Serpent gold target and the inlier claim owned by the Campbell company Harfang absorbed in 2022 in order to control the entire footprint of the gold system. It is too soon to determine what the average grade of the Serpent pegmatite system will be, or what sort of tonnage footprint it represents, but the market responded positively to it, sending the price from a $0.15-$0.16 range to as high as $0.23 before closing the week at $0.185 where Harfang's Serpent project has an implied value of only $12 million. Given that Harfang has $5 million working capital, multi-project exposure to James Bay, a top notch management team and backers, and now evidence of LCT type pegmatite outcrop on one its 100% owned projects, with boots heading to other projects in the next 6 weeks not impacted by the moose hunt restriction, why is the valuation so cheap?

In the case of Harfang it is possible that the selling is by grumpy gold bugs programmatically required to exit anything to do with climate change and energy transition policies. This sort of ideologically driven stock supply should be red meat for the Gamestop crowd; the enemy of the future is selling stock because the company may have a major lithium discovery in the James Bay region! Canadian companies, however, tend to have a different explanation for inexplicable selling activity, and that is the flow-through concept.

Canada has a system designed to encourage investment in exploration, where money spent by a junior can be written off against ordinary income by the investor who provided the money, often with a multiplier as is the case with Quebec, with the caveat that the cost base for the equity position becomes zero, so that whatever you sell the flow-thru stock at, all of it is subject to Canadian capital gains tax. Capital gains tax in Canada, however, has no long or short term distinction and has a favorable fixed rate rather than the progressively increasing rate applied to income. This allows all sorts of complicated strategies, though the expected outcome of them all is to postpone tax consequences into the future. This injects into the Canadian resource junior market a perverse investment dynamic that has little to do with fundamental outcome expectations. Harfang has done flow-through financings, so it is at risk of liquidation by shareholder who have neither knowledge about nor interest in Harfang's gold potential, let alone its relatively new lithium potential. Again, this is an opportunity for the Gamestop "Dumb Money", buying stock that the financial engineers are dumping as worthless.

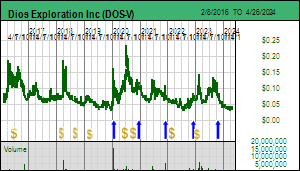

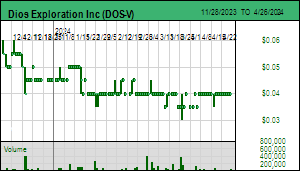

Another James Bay junior whose boots are pounding the ground and which is not affected by local moose hunting restrictions is Dios Exploration Inc. The stock should be trending up but is in fact sagging as a result of large scale selling through "anonymous". Who with a large position could possibly be selling at this stage in the story timeline?

The answer is so banal that it is a huge signal to post a bid below $0.10 and pray that you get lucky with a fill. In December 2022 Dios did a flow-thru private placement at $0.20 with two parties. One of the placees was a Toronto based entity called Marqeust that took 4 million shares at $0.10. The other 2.5 million was taken by the Maple Leaf group. When investors buy into a flow-thru fund they get a writeoff of their investment which starts at 100% and expands based on the province's special provisions. What happens to the stock in the flow-thru fund?

The Maple Leaf fund apparently transfers the entire stock portfolio into a general resource sector fund in which the FT fund holders receive units or shares they can elect to redeem or sell if it is publicly listed. That fund gets managed on the fundamental outcome potential of the companies in its portfolio. Given the way James Bay is shaping up I doubt the Maple Leaf fund manager will be in any hurry to sell its 2.5 million DOS shares.

Marquest, on the other hand, does a distribution in October which requires the fund holders to elect by some deadline to receive cash or shares. If 100% elect for shares all the stock ends up in the hands of individuals who will make independent decisions about those positions which does not constitute a structural overhang. This year, perhaps because of 5% plus interest rates being offered after a decade of near zero interest rates, apparently 70% of the Marquest fund has requested a cash distribution. This means Marquest must sell 70% of each stock position by the distribution date. In the case of Dios that is 2.8 million shares of which I estimate since last week about 1 million have been sold, leaving just under 2 million shares Marquest must still liquidate.

When the distribution date happens the fund holders who elected cash get a pro rata share of the cash pot while those who elected stock get a pro rata share of the remaining 30% of the original stock positions the fund purchased. Once we see another 1.8 million shares come out, probably through anonymous, Marquest will be gone. So I think if anybody wants to get a position below $0.10 without reaching for offers now is the time to post an open order.

Apparently none of the Dios properties are impacted by moose hunting restrictions due to their location. We probably won't hear any field results from Dios until late October when all the data has been received and analyzed unless something really obvious and big shows up. But how long will Dios and other James Bay juniors be able to prospect their properties?

As if it wasn't enough to lose 3 months of prime prospecting season to fire closures, and then in some cases another month to moose hunting season, now meteorologists are warning of an early hard winter arriving in October that will prevent random snow dumps from melting away. Once snow blankets James Bay boots on the ground are useless. If this weather trend prediction is correct, those companies hoping to get another 6 weeks of prospecting done after October 15 will be out of luck. The primary objective of serious James Bay juniors is to have an LCT-type pegmatite target sufficiently delineated to justify a drill program in Q1 of 2024 when the James Bay region is buried under a blanket of snow. From a market upside perspective, the bets on James Bay Lithium Index juniors will be about who will be in a position to drill a meaningful target in Q1 of 2024?

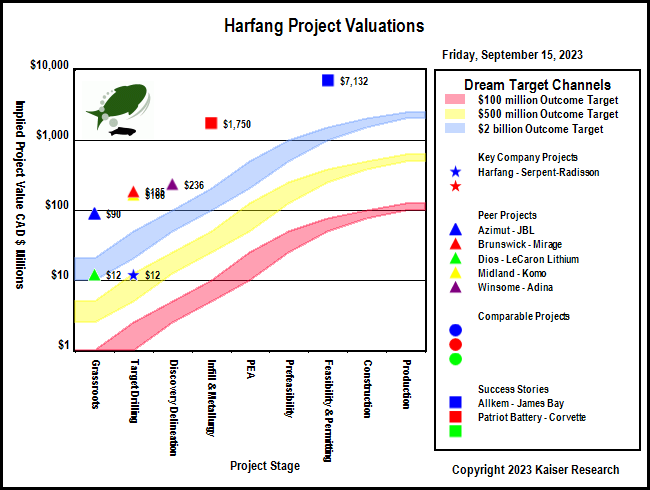

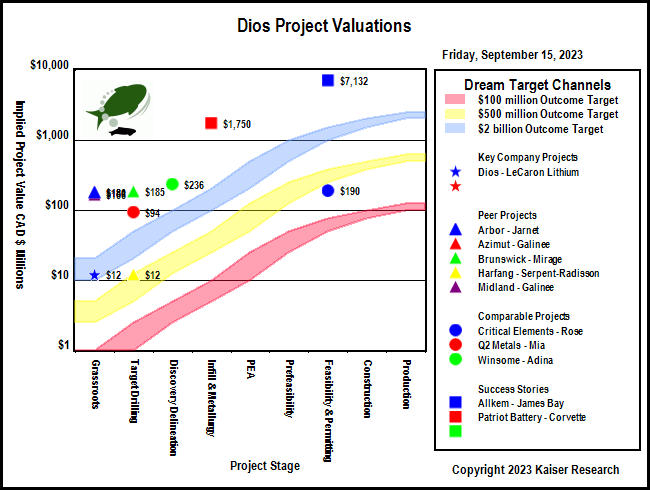

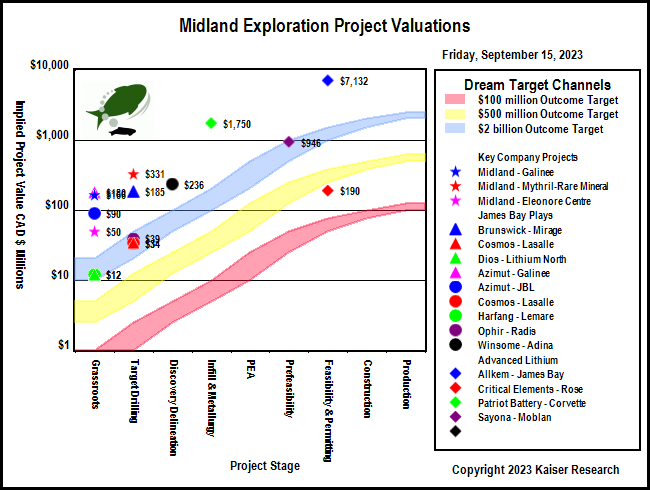

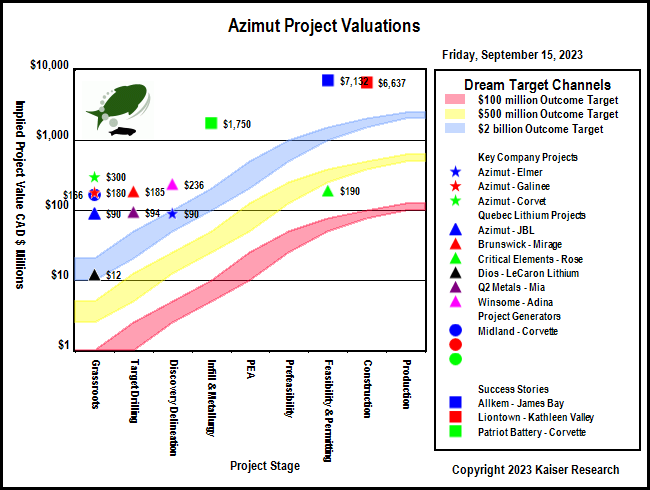

How can the Gamestop "Dump Money" learn to navigate the junior resource sector without getting nailed by juniors that have become over-priced because they are wasting shareholder money paying various social media entities to pump the stock, ones whose valuation is linked to an asset unrelated to the James Bay lithium exposure, or one whose flagship James Bay lithium play is farmed out, leaving the junior with a minority net interest that usually offers limited speculative upside during the early exploration stages? The key is to understand the rational speculation model and read my implied project value charts (IPV Charts) which visually show how a project's valuation on a 100% basis relates to the fair value certainty ladder for the different stages of the exploration-development cycle. An excellent tutorial is available in the Mining Stock Education Interview Bill Powers did with me in 2020, in particular the 21-46 minute segment.

The IPV Charts I have included for Harfang and Dios show that the 100% owned James Bay lithium projects have an implied project value of only $12 million (fully diluted X stock price X net interest) compared to $185 million for Brunswick's 100% owned Mirage project which for the moment is Brunswick's flagship play. Within two years Mirage could command a $1.75 billion valuation if it turns out host a deposit similar to Patriot Battery Metal's CV5 deposit. The Harfang and Dios prices can increase ten times from the current levels just by demonstrating they have a similar lithium tiger by the tail, and Brunswick can increase another ten times by delivering a lithium tiger identical to or better than CV5. |

Harfang Exploration Inc (HAR-V)

Bottom-Fish Spec Value |

|

|

| Serpent-Radisson |

Canada - Quebec |

2-Target Drilling |

Li Au Cu |

Dios Exploration Inc (DOS-V)

Bottom-Fish Spec Value |

|

|

| LeCaron Lithium |

Canada - Quebec |

1-Grassroots |

Li |

James Bay Lithium Index Chart |

Daily Performance of James Bay Lithium Index |

Lithium Price Chart and Rock Value Matrix |

Price Charts for Uranium and Gold |

Long Term Lithium Supply Evolution Chart |

Long Term Uranium Supply Evolution Chart |

List of Members of James Bay Lithium Index as of Sept 15, 2023 |

Regional James Bay Map showing locations of Harfang's projects |

Map of Harfang's Serpent Project showing Spoumene Discovery Location |

Photograph of Serpent pegmatite boulder field and spodumene crystals |

IPV Chart for Harfang Exploration |

IPV Chart for Dios Exploration |

| Jim (0:13:08): What is the best way to play Rio Tinto's exposure to the James Bay Great Canadian Area Play? |

Among the world's major mining companies Rio Tinto is the only so far to take a serious interest in the lithium sector. More than a decade ago Rio Tinto discovered the Jadar lithium deposit in Serbia which is similar to claystone deposits except that the grade is comparable to the better LCT-pegmatites. No other deposit like it has yet been discovered, and Rio Tinto invested a fair amount of effort in developing a flowsheet for the jadarite mineral that hosts the lithium. The Jadar project, however, is now in limbo after Serbia revoked the license, ostensibly because mining would alter the bucolic nature of the valley that hosts that deposit. Rio Tinto is on record stating that the world will need 60 Jadar equivalent mines by 2035 if the EV contribution to net zero emission goals is to become reality. Jadar is equivalent to Allkem's Galaxy-Cyr deposit and Patriot Battery Metals' CV5 deposit. In its statement Rio Tinto underlined that its projection assumed a solid state lithium ion battery that uses lithium metal in the anode instead of graphite would never become commercial reality. We now know that Toyota claims it has solved the problem, and if it can continue to bring the manufacturing cost down to the level where it can offer its popular Camry and Corolla models as affordable quality cars with excellent range and very short charging times in 2030 and beyond, the world will need 120 Jadars by 2035. And unless there is a miraculous DLE breakthrough that crashes the production cost below $5/lb lithium carbonate, a substantial part of the future lithium supply will have to come from LCT-type pegmatites. And that means the future lithium market will be worth $200 billion annually, up ten times from $20 billion in 2022 (assuming lower long term contract prices than the spot average for lithium carbonate), which in turn is up a hundred times from the $200 million value of lithium supply in 2005.

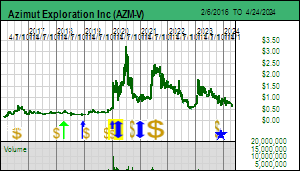

Rio Tinto gets this concept, but it is also reluctant to buy out Australian success stories such as Liontown, or emerging success such as Patriot Battery Metals. Instead it has chosen to do farm-in deals with juniors that have strategic land positions in Quebec's James Bay. Rio Tinto did its first deal with Midland Exploration Inc in June which I blasted in KW Episode June 16, 2023 because Midland gave to Rio Tinto the first pass opportunity to harvest low hanging fruit on its properties. In July Rio Tinto did a similar deal with Azimut Exploration Inc which I described as superior in KW Episode July 14, 2023 because Azimut retained the option once Rio Tinto vests for 70% to elect to reduce to a 25% carried interest, whereas Midland will have to contribute 30% of costs once Rio Tinto vests. The Azimut deal did not annoy me because it included only two properties, Corvet and Kaanaayaa, both located south of PMET's Corvette trend. Jean-Marc Lulin has dressed them up with 99% percentile lithium lake bottom sediment colors, but by themselves these numbers don't mean much because we do not know from where the sediments were transported. Midland in contrast included 10 properties scattered throughout the James Bay district which Rio Tinto selected for their LCT type pegmatite potential, including the Komo project west of Allkem's Galaxy-Cyr and Galinee east of Winsome's Adina project.

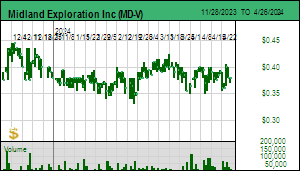

Both Azimut and Midland have since become a lot more enthusiastic about the lithium potential of the James Bay district where they have explored for gold and base metal deposits for decades. Azimut has staked a collection of new claims it calls the JBL group northwest of the Eleonore gold mine which it plans to explore on a 100% basis. Midland has not disclosed staking any additional James Bay properties for lithium potential, but it is now taking a close look at the properties Rio Tinto did not option. I suspect we will eventually hear more about Midland's 100% owned properties. But the question is, what is the best indirect bet on Rio Tinto being successful in the James Bay lithium district?

The hands down winner is Midland for multiple reasons. First, I do not think Azimut's properties will deliver any joy for Rio Tinto, and I was of the view that Rio Tinto would drop them in 2024 after Azimut has spent $3 million on them. However, the 3 month fire closure has pushed most of that spending into 2024, so Azimut will get to talk about its Rio Tinto farmout until at least 2025. As operator Azimut will of course do a very detailed exploration program that should generate lots of information about the non-lithium potential which was the reason Azimut staked them more than five years ago. Rio Tinto, in contrast, is operator of the Midland portfolio, and for the very reason I was annoyed by the farmout deal, has incentive to take a very hard and fast look to see if there is any low hanging fruit that can be quickly harvested. I would not be surprised if Komo and Galinee end up with drill programs in 2024, though the other properties could also deliver surprises. Within a year I expect Rio Tinto to have turned one or more of the 10 properties into discoveries that become the focus for discovery delineation. Since it is unlikely Rio Tinto will stay at 50% if it has a potential Jadar on its hands, Midland will be carried for the first $64.5 million exploration required for Rio Tinto to vest for 70%. And 30% of a $2 billion prize would be worth $6.75 based on 88.8 million fully diluted.

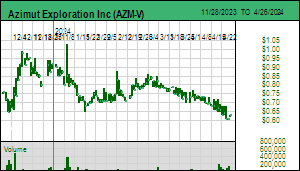

The second reason Midland is the better choice is the cheaper implied project value its exposure to Rio Tinto represents. Azimut's grassroots properties farmed out to Rio Tinto have an implied project value of $300 million based on 85.6 million fully diluted, a $1.05 stock price and a net 30% interest. In contrast Midland's portfolio of Rio Tinto farmouts has an implied value of $180 million, just over half that of Azimut, thanks to its $0.56 stock price. The reason Azimut is more expensive is that the company its being priced on the basis of its 100% owned Elmer gold project on which it has spent $25 million since 2020 without delivering a resource estimate. Elmer has an implied project value of $90 million. The problem with Elmer is that unless Azimut can duplicate the zone with similar discoveries within its shear corridor, Elmer is worth zero, and a black hole for exploration capital. This week Azimut secured an $8 million flow-thru bought deal which has prompted Agnico-Eagle to exercise certain rights to increase its equity stake from 10.06% to 12%. Azimut does not disclose what the money will be spent on, but you can be sure much of it will go into Elmer. For Azimut to become an interesting James Bay lithium play it needs to spin out Elmer as a separate company. As long as Elmer muddies the valuation water because we do not know what it is worth, Azimut offers poor speculative value even for its 100% owned lithium projects which share the $90 million implied project value of Elmer.

The third reason Midland is the better choice is that its remaining 100% owned James Bay projects carry an implied value of $50 million, which admittedly is 4 times what the market is assigning to the 100% owned projects of Harfang and Dios, but just over half what Azimut commands. To achieve parity pricing with, for example, Brunswick's Mirage project, Midland would only increase 4 times in price if it found a similar outcropping LCT-type pegmatite system. The fourth reason is that Midland is a prospect-generator-farmout junior with an extensive portfolio in the Abitibi greenstone belt with a number of those gold projects farmed out. Plus it has base metal farmouts in northern Quebec to Rio Tinto. Any one of these projects could deliver a discovery that justifies an upwards repricing of Midland's stock. Midland doesn't have the explosive upside potential of Harfang and Dios, but it has downside protection from as a result of its business model. |

Midland Exploration Inc (MD-V)

Bottom-Fish Spec Value |

|

|

| Corvette |

Canada - Quebec |

1-Grassroots |

Li |

Azimut Exploration Inc (AZM-V)

Fair Spec Value |

|

|

| Corvet |

Canada - Quebec |

1-Grassroots |

Li |

James Bay Map showing Midland's Projects |

James Bay Map showing Azimut's Projects |

IPV CHart for Midland Exploration |

IPV CHart for Azimut Exploration |

| Jim (0:23:07): Will the James Bay Lowlands become a major diamond play? |

The James Bay Lowlands should not be confused with the James Bay Lithium District which is in Quebec east of James Bay whereas the James Bay Lowlands are west of James Bay in Ontario. This vast area which drains northern Ontario is a water-logged black fly and mosquito infested region whose only communities are populated by First Nations. The only commercial activity to emerge from this region was the Victor diamond mine developed by De Beers which recently decided to shut down operations in the face of relentless criticism from the Attawapiskat First Nations and outside NGOs (see the anti-mining film After the Last River). The Ontario Cree are different from the Quebec Cree because the James Bay region was developed to produce hydro power for Quebec and the Quebec Cree have benefited from both the infrastructure and economic opportunity in their backyard. Northern Ontario in contrast is an absolute shit hole with no productive economy, and zero chance of developing one except through mining such as the Victor Mine. It is home to First Nation communities who subsist on government welfare payments, complain that they deserve more, and block any effort to create a real economy through mining. NioBay Metals' James Bay niobium project is in limbo thanks to a power structure within the Moose Cree First Nation that gives the upper hand to the NoCanDo members of the community.

During past periods of global warming when sea levels rose the James Bay Lowlands were covered by water, as a result of which the older basement rocks are hidden beneath a limestone cover that itself has zero mineral potential. The area from Moosonee south to Kapuskasing is known as the Kapuskasing Structural Zone. The KSZ was active between 2-1 billion years ago during which various intrusive bodies such as carbonatites made their way to surface. NioBay's James Bay deposit is an example of a carbonatite sufficiently enriched with niobium to be economic at current niobium prices which are not going lower because CBMM controls the niobium supply from its giant Araxa deposit in Brazil. VR Resources Ltd in recent years has explored the Ranoke and Hecla-Kilmer intrusions, the first as a potential IOCG system, and the second now as a rare earth system. There have been waves of exploration starting in the 1960s by large companies, including Selco which tested magnetic anomalies in the hope that they represented kimberlites. No kimberlites were ever found, and none of the carbonatites yielded commercial quantities of metal except the James Bay niobium deposit which was never developed because of its remote location and the superior Niobec niobium deposit in southern Quebec.

In September 2022 VR Resources drilled a longshot hole into large 1.2 km wide magnetic low anomaly called Northway which was never tested because there was no obvious explanation for what sort of orebody it might represent. It turned out to be a diatreme breccia body that erupted during the Devonian period before the area was covered by limestone, much younger than the carbonatite intrusions. Its magnetic low signature turned out to be due to the earth's magnetic poles being reversed during that period. When a magma cools and magnetite crystals form they line up according to the earth's polarity, which in this case was the opposite of the polarity when the basement rocks crystallized. It doesn't mean there is less magnetic material in Northway-1 than the country rock, just that the polarity is reversed. Because Northway-1 had the textures of a kimberlite, and was associated with a different emplacement period than the nearby much smaller alnoites Selco drilled in the 1970s, VR, on the hypothesis that a blind kimberlite field was hidden under the James Bay Lowlands' limestone cover, went on to stake 19 additional magnetic low anomalies ranging 100 m to 500 m in width.

On September 12, 2023 VR Resources Ltd reported caustic fusion results for the 30 metre crater facies interval from the first hole. The market reacted strongly because the company reported that a diamond fragment had been recovered. The company did not disclose the size of the diamond fragment recovered by caustic fusion, but apparently it is tiny and caught by the smallest sieve size which is usually 0.1 mm. That means it could be from another micro diamond that might have been caught by a 0.4 mm sieve, and thus is not indicative of macro grade potential. In any case, if you want to project a macro diamond grade from micro diamond results, you need a size distribution curve and that was clearly not yielded by the first sample.

The important micro diamond results will come from holes #2 and #3 representing 430 m of core, most of it in fresh diatreme breccia which is the magma chilling in the vent rather than being blown out and falling back into the country rock excavated pit. Because the first hole was so heavily altered it did not furnish a lot of recognizable indicator minerals, but eclogite and websterite has been confirmed. This is not going to be a traditional kimberlite with a peridotitic diamond population associated with harzburgite (G10) and lherzolite (G9) like most of the Ekati-Diavik kimberlites.

If Northway-1 is going to be a commercial kimberlite it will be more like Victor, Orapa and Venetia which lack the pryope garnet suite. These tend to me located on craton margins, which makes sense because eclogite forms from subducted ocean plate basalt that somehow gets shoved deep enough to occupy the diamond stability field where diamond formation takes place. The caustic fusion results for the larger volume of kimberlite will arrive later this year.

If Northway-1 is like Victor, the micro diamond results will be disappointing, because the smaller end of the diamond size distribution spectrum was missing at Victor. Because the websterite chemistry did not fit De Beers' knowledge base, it almost discarded Victor and the entire Attawapiskat field. But a decision was made to collect a larger sample in which indications of macro grade potential showed up. Although the grade was only about 25 cpht, further bulk sampling revealed an exceptionally high quality diamond population and Victor became a mine.

If Northway-1 is similar, its large size and the 200 m of post emplacement cover rock will make establishing macro grade and carat value very expensive and time consuming. Large kimberlites have the additional problem of frequently having multiple eruptive phases with a wide range of diamond content including none. Unless the remaining hole results do deliver a micro diamond distribution curve that allows us to project grade, raising the money for further exploration will be a hard sell. The most important information to expect from the remaining holes is a larger suite of indicator minerals whose analysis will firm up the conclusion that the Northway-1 magma is kimberlitic, meaning that it had its origin in the mantle well below the diamond stability field where a tight combination of pressure and temperature allows diamonds to form. That is only half the story, for the other half is whether any older diamond populations survived the thermal upwelling that spawned the carbonatite intrusions, or younger populations formed when the lithosphere cooled again.

Mike Gunning believes the next sensible step is to secure permits for each of the other 19 magnetic low targets which range from 100-500 m in diameter, and drill each one to see if it does represent a kimberlite. This would not happen until Q1 of 2024 at the earliest, with results not arriving until late Q2. If a kimberlite cluster is present, any one of them could be a commercial diamond pipe. It is perhaps too much to ask that the biggest pipe, Northway-1, be the one with sufficient diamond grade and quality to become a mine. The violence of Northway-1's eruption will have excavated a much deeper portion of the country rock than the smaller kimberlites, so these smaller kimberlites may be closer to surface and thus cheaper to assess with sampling. If the width of the anomalies represents the width of the pipe, it is worth keeping in mind that a 500 m wide pipe could represent over 500 million tonnes.

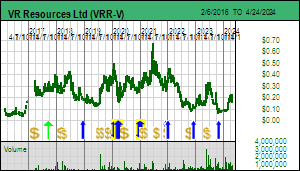

VR has $1.7 million working capital, enough to fund a 3,000 m dril program of 3 deep holes at New Boston in Nevada where based on new IP data VRR thinks Conoco's past efforts were based on a misunderstanding of the porphyry system's center, guided in part by a 1970s interest in molybdenum (before China emerged as a major moly producer in the 1980s). VR has permits pending for 2 holes into the untested eastern side where it thinks copper grade developed, and 1 hole into the western side dominated by molybdenum. The purpose of these holes will be to confirm the new hypothesized geometry of the system, and, with luck, intersect ore grade copper, though realistically the expectation should be to allow vectoring of a followup program. Gunning thinks the drill permits will be received in 2-3 weeks. The location next to the highway at Luning would allow drilling to be done in October-November. If this drilling gets done, positive visuals would be in hand by year end, giving shareholders Cu-Mo assay hopes for Q1 of 2024, even as an upcoming test of the other Northway magnetic low targets gets underway. The problem for VR is that the New Boston program will cost about $1 million, leaving the treasury rather low. The junior hopes to attract a strategic equity investor for the New Boston drilling; both Rio Tinto and BHP are interested in copper, and while BHP has pulled out of diamonds, Rio Tinto still has 60% of Diavik and in-house experience. Further encouraging Northway results from the remaining holes just might entice one of these majors. A copper mine in this part of Nevada is not going to generate any NoCanDo indigenous objections as a diamondiferous kimberlite field in the James Bay Lowlands inevitably would. |

VR Resources Ltd (VRR-V)

Bottom-Fish Spec Value |

|

|

| Northway |

Canada - Ontario |

3-Discovery Delineation |

D |

Map showing relative locations of James Bay Lowlands and James Bay Lithium District |

Map of VR's James Bay Lowlands claims |

Plan and Section of Northway-1 Magnetic Anomaly |

Geological Section for Northway-1 |

| Disclosure: JK owns shares in Dios and Brunswick; Dios, Harfang, Midland and VR are bototm-fish spec value rated; Azimut is unrated |