| Kaiser Watch November 3, 2023: MinRes arrival heats up Azure takeover battle |

| Jim (0:00:00): Why is Azure Minerals now trading 10% above SQM's $3.50 cash takeover bid? |

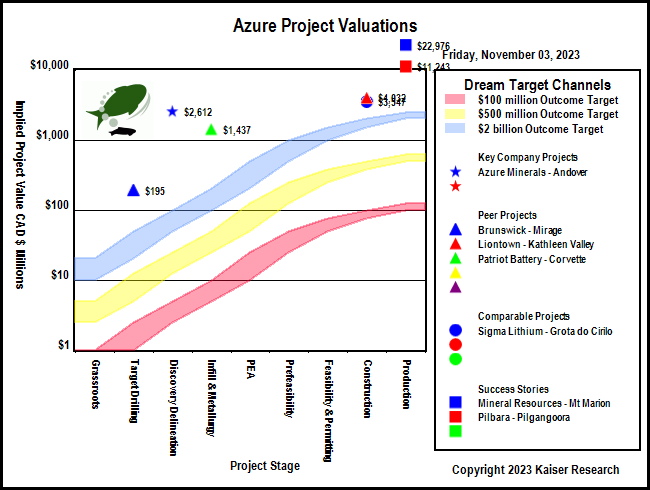

Last week's Kaiser Watch Episode featured the remarkable one year transformation of Azure Minerals Ltd with an unremarkable nickel-copper project in the West Pilbara into a lithium pegmatite play within the same property for which SQM has made an accepted takeover bid which priced the Andover project at AUD $2.4 billion on a 100% basis (Azure owns only 60%). The stock rose above $3.50 on Wednesday November 1, 2023 and peaked at $4.05 on Friday before closing at $3.85. Chris Ellison's Mineral Resources Ltd then filed a becoming a substantial shareholder notice reporting that MinRes and its subsidiaries had acquired 55.8 million shares representing 12.3% of Azure's issued stock. Of that the last 19.9 million shares were bought on Friday at an average $3.95 price. Last week we talked about Hancock's Gina Rinehart buying 18.3% of Azure, the last major chunk at the $3.50 non plan of arrangement price. At the $3.95 price Chris Ellison is willing to pay, the Andover project, which does not yet have a maiden resource estimate, has an implied value of AUD $2.8 billion on a 100% basis.

There is a major disconnect going on. Albemarle, which peaked at $334 a year ago, traded down to $116 this week, the lowest in 3 years as the media wrings its hands about slowing EV sales while the lithium carbonate price has sunk to $10.06/lb. SQM clearly does not share this negative sentiment, because trying to buy Azure today is about supplying lithium in 2030 and beyond. Toyota also doesn't seem concerned because it just announced it is building a battery plant in North Carolina (sorry Prime Reconciliation Minister, we'll take Canada seriously when you start taking your country's mineral supply potential seriously, and you can start by telling Chief NoCanDo that his claims about sacred territory are irrelevant to decisions that affect the interest of all Canadians, not just a 5% aristocracy).

Toyota's new found enthusiasm for the EV sector is based on its solid state lithium ion battery which will be commercialized through release of a high end model in 2026 or 2027 which promises to have a range of 1,200 km on a 10 minute charge. Since Toyota's breakthrough is in the form of a more efficient, cost effective manufacturing process, it is only a matter of time until even greater efficiencies have been engineered and Toyota can roll out a fleet of consumer friendly priced Camrys and Corollas. And Toyota is not the only one with a solid state breakthrough. Robert Friedland is promoting a solid state lithium ion battery being developed by Pure Lithium which will also use lithium metal in the anode instead of graphite. Not only is Pure Lithium involved in making a solid state battery, but it is also working on a process for extracting lithium directly from oilfield brines he thinks will make hardrock pegmatite supply irrelevant. In a Northern Miner interview done during its Canadian Mining Symposium in London on Oct 12-13 and posted online November 18 he even found it necessary to dismiss James Bay as nothing more than virtue signaling. The two holy grails of the EV sector have been the quest for a solid state lithium ion battery which is cheap and avoids the dendrite growth that causes shorts and thermal runaway, and the quest for an ultra cheap lithium supply from an ultra abundant source. The first holy grail seems to have been found, but the DLE holy grail on which a lot of hard work and money has been spent during the past decade still needs to deliver proof that it can deliver lithium at scale at a unit cost well below $5/lb lithium carbonate equivalent.

Friedland also made negative comments that nickel and cobalt will be unnecessary for the battery future though we do know that nickel is a key part of the cathode in Toyota's solid state battery, and there is no talk yet about lithium-iron-phosphate (LFP) batteries being able to substitute lithium metal for the graphite anode. Cobalt, however, does indeed look like it has no future in the solid state battery EV sector. All this is bad news for the Sunrise nickel-cobalt project in Australia's New South Wales. Friedland's Sunrise Energy Metals Ltd this week hit the lowest price since 2015 after adjusting for a 10:1 rollback in 2021. Sunrise has chewed through $300 million since inception and almost all of it has been written off. The Sunrise nickel-cobalt resource has no development future, which is bad news for Scandium International Mining Ltd because the original Syerston deposit which has no nickel or cobalt is the world's biggest and richest scandium deposit, and Sunrise owns the water rights in the region. So if Rio Tinto, which bought the Owendale scandium deposit next door for $14 million, hits a scandium demand tipping point that eclipses its Sorel-Tracy slag scandium by-product supply, Sunrise could return to its original Plan A and develop Syerston as a standalone and scalable primary scandium mine.

Either Friedland's thumbs down for the future of pegmatite sourced lithium would be news for SQM, Gina Rinehart and Chris Ellison, or they don't think too much about DLE's potential to produce unlimited amounts of lithium from oilfield brines at a cost well below the $5/lb lithium carbonate equivalent needed to make pegmatite deposits worth developing. The move by MinRes to build a stake in Azure Minerals above the $3.50 SQM bid is a pretty good sign that MinRes will make a higher offer for Azure Minerals that could involve its stock as currency. Now we just need to see if the other elephant, Pilbara Minerals Ltd, will also join the battle to control Australia's newest major LCT-type pegmatite field. |

Azure Minerals Ltd (AZS-ASX)

Unrated Spec Value |

|

|

| Andover |

Australia - Western Australia |

3-Discovery Delineation |

Li Ni Cu |

Sunrise Energy Metals Ltd (SRL-ASX)

Unrated Spec Value |

|

|

| Sunrise |

Australia - New South Wales |

7-Permitting & Feasibility |

Ni Co Sc |

Lithium Rock Value Matrix and Price Chart |

MinRes buying activity of Azure ahead of 12.3% ownership declaration |

IPV Chart for Azure Minerals |

| Jim (0:07:05): Any feedback about how the Quebec XPLOR conference went in Montreal this week? |

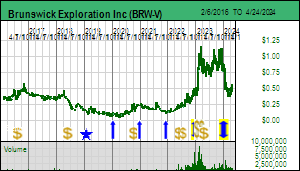

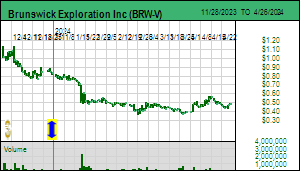

In last week's Kaiser Watch Episode I predicted that this year the annual XPLOR conference in Montreal would be a big deal, but it turns out it was not that big a deal. The flurry of news releases I expected from James Bay Lithium Index members did not happen, and Brunswick Exploration Inc put out a rather lame news release on Monday October 31 that sucked last week's momentum right out of the stock. Brunswick announced a $5 million flow-thru financing consisting of $1 million designated as Quebec flow-through at $1.15 and $4 million as national flow-through at $1.10 which is expected to close November 17. This will boost working capital back to the $10 million level by the end of the year ahead of what Brunswick promises to be delineation drilling at Mirage in Q1 of 2024.

What bothered the market was that Brunswick had nothing new to say about Mirage. All it said was: "Over the previous weeks, we have identified multiple spodumene-bearing outcrops at Mirage, and our inaugural drilling campaign has barely begun testing the potential of the project. With initial drill results forthcoming, this financing will enable the company to continue its aggressive drilling campaign at Mirage into Q1 2024 and beyond. Concurrent to our plans at Mirage, we will also complete follow-up drilling at our latest discovery at the Elrond project".

Brunswick started drilling on September 11 and provided an update on October 3 which stated: "The company began drilling on Sept. 11, at the Mirage project with a single helicopter-supported drill rig. To date, 15 holes have been drilled with current total metreage over 1,000 metres. Significant spodumene-bearing pegmatites have been intersected in 12 holes over widths ranging up to 52 metres (true thickness presently unknown). The first set of assays from the inaugural drill campaign at Mirage are expected in the second-half of October. Brunswick Exploration will continue drilling as long as fall weather permits. Further drill programs for winter 2024 are currently being planned".

Not only did this week's update not include any assays, but it literally included no useful new information about Mirage. It mentioned Brunswick had found more pegmatite outcrops, but did not specify whether these were within the 800 m by 2,700 m corridor of outcrops reported in early September or beyond it so that the scale of the pegmatite field's footprint has been expanded. I subsequently heard that assay lab turnaround time has become terrible and that assays had been received for only one hole which would be meaningless to report. But the press release could have included information about how many more holes have been drilled and how many intersected spodumene bearing pegmatite and the range of intervals. No graphics were included showing the location of known outcrops and drill holes including drill direction traces. The market wants to know what sort of pegmatite dyke geometry is emerging as the result of drilling. Are we dealing with a series of parallel continuous thick and long zones such as PMET's CV5 resource which now stands at 109 million tonnes of 1.42% Li2O? Or are we dealing with sets of en echelon short and narrow dykes which can still average out as a world class resource such as we see at Allkem's Galaxy-Cyr project? Or a collection of randomly ordered dykes too thin and spread out to ever average into a world class mineable resource? There is a rule of thumb in the resource junior sector that states, "if you have nothing positive to report, don't report anything". Brunswick sold off during XPLOR because Killian Charles had lots of reasons and time to put out a proper update about Mirage showing progress if there were any, but failed to do so. In doing so he neglected to feed a key aspect of Great Canadian Area Plays, which is that speculation in the race to deliver a "me-too" discovery is a form of entertainment that a junior must feed if it can, and it can only do so by operating exploration programs that at least incrementally build the potential for a major discovery.

The way Brunswick's financing was described also left one suspicious that Brunswick still had to find the buyers for this financing, and, of course, there can be no material press releases until it closes, giving the market another three weeks of no news to build confidence. Killian did tell me that the financing was "pre-sold" to a collection of high net worth, technical and a few institutional investors, none of which qualify as the tax avoidance type of investor that has become the bane of juniors with Canadian projects. Under Canada's flow-through system a flow-through stock purchaser can write off the entire investment against income, which means that the tax saving will be based on the taxpayer's marginal income tax rate (obviously most lucrative for the highest income earners). In the case of provinces like Quebec the amount written off against provincial income tax gets boosted by an extra 20%. The only hitch is that the cost base of the shares is reduced to zero, which means that whatever you get for selling the stock is treated as a capital gain, though in Canada which has no short or long term distinction as in the United States, only 50% of the capital gain has to be added to one's income and get taxed at the taxpayer's marginal rate. Flow-through is most useful to high income earners because it allows one to defer tax consequences into the future. As a result the type of investor a junior attracts with flow-through stock tends to be one that is not placing a longer term fundamental outcome bet, but is just deploying a tax deferral strategy. All this paper typically comes back into the market as soon as the four month hold restriction ends. Killian insists that the investors lined up for the $5 million flow-through private placement are investing in the fundamental success of Brunswick. Subscription agreements only went out at the end of the week, so if it does close on November 17 it will qualify as a well placed financing.

The financing is split 80% national and 20% Quebec for an interesting reason. Quebec refunds as cash a certain percentage of money spent in Quebec on exploration if the junior has a business presence in Quebec. The percentage varies depending on the location: 1) below the 49th latitude which would include all the Abitibi Greenstone Belt, 2) the near north between 49-55 degrees which includes the James Bay region, and, 3) the far north above 55 degrees where the size of the prize needs to be monumental to justify development because of the lack of infrastructure. Funds raised as flow-through with the Quebec designation for Quebec residents are not eligible for the refund calculation. But for some reason any funds raised with the national flow-through designation are eligible. Since hard dollars have become very difficult to raise companies such as Brunswick are favoring national flow-through to boost their hard dollar cash refund in 2025. The downside of this rationale is that people such as myself who think Mirage is potentially a major discovery that will be confirmed well before 2025 and allow raising lots of money at much higher prices as turned out to be the case with PMET are forced to wonder if management is not quite so optimistic.

It was no surprise that Patriot Battery Metals Corp won the AEMQ Discovery of the Year award for its CV5 lithium deposit in the James Bay region. Last year's winner was Azimut's Elmer gold project for whose pencil shaped Patwon deposit a maiden resource estimate is still missing in action despite having sucked up over $25 million in exploration dollars. I was not in attendance at XPLOR but I polled a number of people who were present and I got a wide range of perceptions. The mood was downbeat about the state of the resource junior in general but upbeat with regard to the emerging lithium potential in the James Bay region. Retail investors were completely absent, though this is a technical show for the exploration and mining sector, and it is consistent with the disappearance of retail investors at PDAC, the big annual show held in Toronto in early March which has the distinction of marking the peak of the new year rally in most years, known as the PDAC Curse. There was no lack of service providers flogging their wares at the handful of juniors with exhibit booths on November 1-2. One financial sector person who did attend said that he saw very few fund managers and zero brokers. A lot of Australian resource junior executives were present, perhaps feeling out XPLOR's vibe and considering a booth presence in 2024. The critical mineral and lithium technical talks on the final day November 2 were well attended; perhaps this is equivalent to March 1993 at PDAC when the Lac de Gras diamond play was just over a year old and Pat Sheahan organized a short course on diamonds that was very well attended at what proved to be still early days in a multi-year Canadian diamond exploration boom. Sayona had a multi-booth exhibit that was very busy, and Brunswick also had constant traffic. But others such as Harfang Exploration Inc received less traffic. One executive told me that if you do not already have a pegmatite system with a visible footprint of 50 million tonnes at 1% L2O or better, nobody is interested.

That statement captures the tragedy of the 2023 forest fire closure which shrank the 5 month prospecting window of June-October into less than two months, with a few companies lucky enough to get boots on the ground by mid August, and some of those having to stop work again for the moose hunting season during September 15-October 15. Predictions of an early winter have proven correct; snow has arrived in Quebec, and unlike Montreal in southern Quebec where it quickly melted away, it blankets the ground farther north in the James Bay region. The boots on the ground prospecting season is over.

News flow that should by now have delivered up a dozen or more interesting prospects with significant size potential and ignited market interest in the James Bay lithium area play has also been hampered by logistical problems. For example, some juniors had field crews that lacked designated qualified professionals who can visually identify spodumene in the field, and many seemed to lack an XRF unit to take potassium to rubidium ratio readings. The James Bay region is absolutely loaded with pegmatite outcrops, but only a small percentage will be LCT type. Many juniors simply collected samples from outcrops, in some cases hundreds of samples, which are now in backlogged assay labs. News updates frequently do not mention spodumene because in many cases the samples were shipped directly to the lab by the service contractor without the junior's in-house QP getting a chance to examine them.

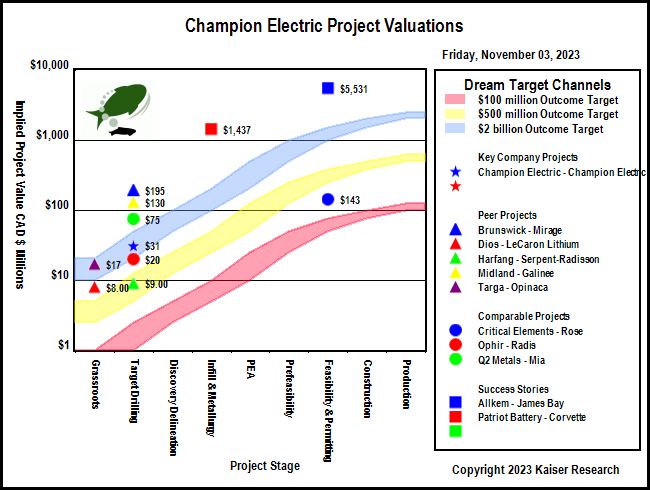

One partial exception is Champion Electric Metals Inc which did a LIDAR survey last year on the greenstone portion of its large land position north of PMET's Corvette trend property. I say partial because the company did not report finding any spodumene bearing outcrops like some juniors have done, which I initially read as a bust declaration. But Champion did publish a map of K-Rb ratios for all the pegmatite outcrops its crew sampled. I have not seen such a map published before by any junior but if an XRF unit is used in the field this sort of map which posts various colored crosses representing different K-Rb ratio ranges should be demanded by investors from companies that have sent outcrop samples to the lab.

Evident Corp has a helpful Case Study: Lithium Exploration in LCT Pegmatites using Portable XRF which includes one graphic that shows you want K-Rb ratios below 10:1 if you hope to see meaningful Li2O grades. Champion's map shows that XRF K-Rb readings below 20 (red crosses) show up in only three areas while the rest of the sampled area is a sea of blue crosses indicating barren pegmatites. A LIDAR survey reveals topography which can be helpful because pegmatites tend to be harder than the country rock and will weather less unless oriented in the ice direction and located within a structural zone of weakness (a favorite place for these wanderers to end up) where they can end up covered by a lake as is the case with most of PMET's CV5 pegmatite. Champion has now done a LIDAR survey on the rest of the property which will be prospected during the summer of 2024; assuming sample values confirm the XRF readings Champion should be in a position to drill several targets in Q1 of 2024.

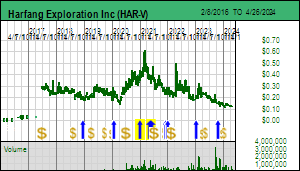

Those juniors which do not bother to equip their boots on the ground with an XRF unit and somebody trained to use it should be downgraded in one's preferred list of James Bay area players. At least as far as next year is concerned because this year the uncertainty about the forest fire closures made it difficult to coordinate programs. An XRF unit may be preferable to a LIBS unit which can only measure light elements like lithium because the XRF unit can check rocks for the presence of heavier elements including base metals; who knows what James Bay after decades of disappointment might cough up via lithium prospecting. An example would be Harfang Exploration Inc which failed to publish an update ahead of XPLOR because it is still waiting for assays from the spodumene bearing pegmatite outcrops at Serpent-Radisson it last reported about on September 13. This outcrop which did not exhibit significant scale is in the vicinity of the Mista copper showing found several years ago; it has an untested associated IP anomaly that stretches under garbage rock at surface. Although Harfang did not publish a K-Rb ratio map in its press release I did find such a map in the November corporate presentation. Harfang, which is well financed, plans to mount a dual purpose drill program in Q1 of 2024 at Serpent-Radisson.

As a sign of the collective capitulation now underway in the Canadian resource junior sector Harfang's CEO Ian Campbell had to suffer the indignity of having to explain why on November 1 as he manned his XPLOR booth Anonymous went on a selling rampage during the last half hour of trading. Since then Anonymous has dumped nearly 3 million shares at an average price of $0.145. Ian tells me that Harfang has avoided doing flow-through private placements with tax avoiders and presumably has a shareholder base of investors focused on fundamental outcomes. He is puzzled who at this stage with a possible drill program in Q1 of 2024 would blow out such a large position at a price just above the $0.10 cash breakup value of Harfang. KRO members had their mitts open to catch some of this paper dump, but in the KRO Slack Forum some were mumbling about the wisdom of bottom-fishing, reinforcing the notion that if bottom-fishing on the bid side doesn't make you feel sick when you get a fill it probably will not work out well in the long run. One thing that puzzled me about XPLOR was that the Canadian resource junior executives I talked to were ignorant about the amazing Azure Minerals story I talked about in last week's Kaiser Watch Episode. Only Brunswick's Killian Charles was aware of Azure and its implications for the James Bay Lithium Area Play, which was largely due to Brunswick exploring a dual ASX listing. When even James Bay resource junior executives are ignorant about the big picture, how can we expect Canadian investors to become interested in Canada's potential future role as a major supplier of pegmatite sources lithium? |

Brunswick Exploration Inc (BRW-V)

Favorite

Fair Spec Value |

|

|

| Mirage |

Canada - Quebec |

2-Target Drilling |

Li |

Champion Electric Metals Inc (LTHM-CSE)

Unrated Spec Value |

|

|

| Champion Electric |

Canada - Quebec |

2-Target Drilling |

Li |

Harfang Exploration Inc (HAR-V)

Bottom-Fish Spec Value |

|

|

| Serpent-Radisson |

Canada - Quebec |

2-Target Drilling |

Li Au Cu |

James Bay Lithium Index |

Daily Performance of James Bay Lithium Index |

IPV CHart for Champrion Electric Metals |

XRF K-Nb Ratio Readings Map for Champion Electric |

Champion Electric Geology and Magnetic Survey Maps |

Harfang IPV Chart and Anonymous Big Dump Summary |

Harfang's Serpent-Radission Lithium Showing |

Harfang XRF K-Nb Ratio Readings at Serpent-Radisson |

| Disclosure: JK owns shares of Brunswick; Brunswick is a Fair Spec Value rated Favorite; Harfang is Bottom-Fish Spec Value rated |