| Kaiser Watch November 17, 2023: Is it a Peanut or a PMET? |

| Jim (0:00:00): What do you make of the Osisko group's plan to spin out its James Bay interests into a new company called Electric Element Mining Corp? |

On November 15, 2023 Osisko Development Corp and O3 Mining Inc put out a joint news release about having spun out all their James Bay interests into a new company called Electric Elements Mining Corp. Both companies are ultimately controlled by Osisko Gold Royalties which controls about 40% of Osisko Development (ODV), and about 9% of Osisko Mining Inc which in turn owns about 25% of O3 Mining. Osisko Mining is now in a 50:50 joint venture with Goldfields to develop the Windfall gold deposit near Lebel-sur-Quevillon in southern Quebec. O3 Mining was created to own a collection of orogenic gold deposits near Val D'Or straddling the Larder Lake-Cadillac Break of which Marban is the flagship. O3 had only one James Bay project called Eleonore-Opinaca located to the west of the Eleonore project now owned by Newmont. O3 indicated this summer that it would put boots on the ground to assess the lithium potential, though it is not clear if it was able to do so in light of the forest fire closures. O3 will receive 2.4 million shares of EEMC for this property which seems to be a little rich compared to ODV's James Bay assets.

Osisko Development's flagship is the Barkerville gold project in British Columbia but at some point Osisko Gold Royalties transferred into it all the James Bay properties it acquired when it took over Andre Gaumond's Virginia Mines in 2015. ODV will receive 9,599,999 shares of EEMC for all these assets which includes the Plex and Anatacau projects optioned out 90% to Brunswick Exploration Inc into which have been bundled the 8 claims within the Mirage project though Brunswick would net only 75% of those claims. ODV has also done 100% farmout deals to ASX-listed companies like Loyal Lithium Ltd (Trieste) and Cygnus Metals Ltd (Auclair) which still have potential milestone payments. EEMC has also raised $4,108,702 through seed financing of 8,217,405 shares at $0.50 of which ODV insiders bought 1,400,000 shares. This leaves 20,217,404 EEMC shares issued which at the $0.50 financing price implies a valuation of about $10 million for the James Bay portfolio. The financing paper will be restricted for 4 months from whenever EEMC becomes a reporting issuer.

What the press release did not make clear is how and when EEMC will go public. One path would be a dividend in specie whereby ODV issues its block to its shareholders, who would receive 1 EEMC for every 9 ODV shares or similar ratio. That would leave Osisko Gold as the largest shareholder. If O3 did a similar distribution the ratio would be 30:1 or worse, hardly worth the bother. An alternative approach which allows O3 and ODV to maintain their stakes in EEMC would be to do an RTO with a shell, though that would involve more dilution. Yet another approach would be to do a merger with an existing James Bay junior with interesting or strategic properties.

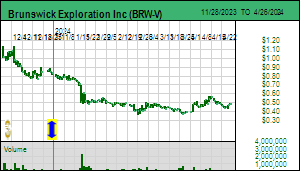

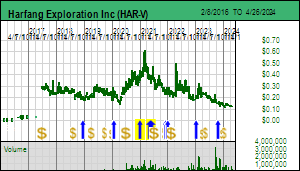

An example that comes to mind is Harfang Exploration Inc in which Osisko Gold owned 6,928,572 shares as of November 9, 2021 when it ceased to be an insider, possibly because its stake dropped below 10%. Two months later the Harfang-LaSalle merger was announced and completed on Apr 19, 2022 with a 2.1554 rollback for Harfang which would have reduced the Osisko position to 3,214,517 shares. At some point Osisko Gold transferred the Harfang position to ODV. Andre Gaumond himself did not cease to be an insider of Harfang until July 2023 though he stepped away from Osisko much earlier. His last insider report showed him owning just over 1 million shares.

Gaumond was the founder of Virginia Gold which Goldcorp bought out for the Eleonore gold discovery that is now a mine, and he remained the head of the spinout Virginia Mines which held all the other James Bay projects that were mainly focused on gold targets in greenstone belts. These included parts of the Corvette property of Patriot Battery Metals Corp which now hosts a world class lithium deposit much more valuable than Eleonore which has been an overall disappointment and contributed to the perception that James Bay is a lame gold frontier. While with Osisko Gold he became a backer of Harfang for which he recruited Francois Goulet as CEO until he resigned in late 2021. Goulet, who worked for Gaumond during the Virginia years, has resurfaced as an exploration geologist working for Brunswick on the Mirage project. He once told me that back in the Virginia years when lithium was a pathetic $200 million annual market his boss sternly forbade him and fellow workers from collecting any samples from those bush and mosquito free ridges because "those were worthless pegmatites". Bob Wares partly snagged him because of his physical familiarity with the James Bay region and those outcrops which back then were the place to have lunch. Now those that turn out to be lithium enriched are the lunch.

Harfang has a decent James Bay portfolio of which the Serpent project has copper and lithium targets in the Mista area where a spodumene bearing outcrop was sampled this fall, with assays still pending. Harfang has initiated permitting for a winter drill program because the Mista copper target has a geophysical anomaly that needs to be tested whether or not the assays from the pegmatite outcrop justify drilling. The stock has come under inexplicable selling pressure since it published the outcrop news, trading 10.9 million shares since October 1, with Anonymous dumping 7.8 million while buying 3.1 million. The selling became ruthless during XPLOR week and CEO Ian Campbell has not been able to identify the seller and all the Quebec funds that he knows are long all seem mystified by the selling.

My own suspicion was that ODV was dumping its Harfang position though Ian thinks that is not the case. The likelier culprit is Monarch Mining Corp which bought $1.5 million at $0.55 (2,727,272 shares) when the Harfang-LaSalle merger closed in April 2022. Monarch's efforts to mine the Beaufor deposit have turned into a financial disaster and on November 3 one of its creditors moved to secure its $10 million loan. Monarch management will likely have known this was coming and would have accelerated selling Harfang during XPLOR week in order to make payroll. On November 14 Monarch filed for bankruptcy protection. What seemed like senseless and malicious selling, if done by Monarch, was a function of desperation and Monarch is now gone as a shareholder. The reason Anonymous has sold far more than Monarch had to sell would be because it was likely traders on the Anonymous buy side who are grinding out their positions for penny profits. Harfang has about $6 million working capital and about 61 million issued shares which translates into a cash breakup value of $0.10 with less than $3 million value implied for its James Bay portfolio. A merger with EEMC would thus be a good fit, though it would probably involve a rollback for Harfang shareholders which nobody would be overly keen about.

The reason, at least for now, why Harfang shareholders would sneer at a merger with EEMC is that the Osisko James Bay spinout news release offers no specific information about the resulting James Bay portfolio. ODV's web site section featuring its James Bay assets has not been updated for more than a year and still reflects what it looked like before Brunswick optioned Plex and Anatacau in November a year ago. The ODV James Bay map isn't even large enough to show the claims it has near Brunswick's Mirage and Winsome's Adina projects. This makes it hard to assess the lithium value potential of EEMC's James Bay portfolio, but we may soon see a very small component of it become quite valuable, namely those 8 small inlier claims that straddle part of the pegmatite corridor at Mirage.

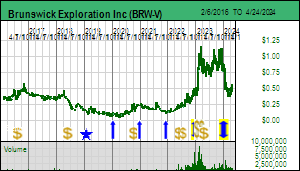

When this KW episode was recorded I was merely hopeful that Brunswick's prediction that its $5 million financing announced October 30 would close on November 17 would be confirmed Monday November 20. But on Friday at 5 minutes before midnight Toronto time a short news release popped up on Stockwatch confirming that it had indeed closed and been boosted to $5.7 million. It stated that the proceeds will be used for phase 2 drilling at Mirage (currently 2 drills turning) and to test advanced targets in Q1 of 2024 starting with the Arwen spodumene bearning outcrop on the Elrond project whose critical mineral potential has been optioned 85% from Midland Exploration Inc. The exemption used requires a four month hold. Next week CEO Killian Charles will be presenting at a conference in London and it might be convenient to use a newer presentation than the lame one on its web site from early October when Brunswick last provided a meaningful update about Mirage. Shareholders expected an update ahead of XPLOR and were disappointed to be given a 3 week blackout while the private placement closed and the company did one on one presentations at various conferences. Given the eleventh hour publishing of the financing news release on Friday, it is reasonable to expect a major update on Monday that shows us whether Mirage is a Peanut or a PMET.

Where did I get that expression from? Last week one of my Quebec contacts who seems to know one of the Mirage geologists called me up to tell me a geologist had told him Mirage is a Peanut. He was confused by my unhappy response so he repeated himself: Mirage is a PMET. He owns a lot more Brunswick than he should, so I hope he wasn't hearing what he wanted to hear, just as I was hearing what I had begun to fear. |

Osisko Development Corp (ODV-V)

Unrated Spec Value |

|

|

| Cariboo |

Canada - British Columbia |

4-Infill & Metallurgy |

Au |

O3 Mining Inc (OIII-V)

Unrated Spec Value |

|

|

| Marban |

Canada - Ontario |

7-Permitting & Feasibility |

Au |

Brunswick Exploration Inc (BRW-V)

Favorite

Fair Spec Value |

|

|

| Mirage |

Canada - Quebec |

2-Target Drilling |

Li |

Harfang Exploration Inc (HAR-V)

Bottom-Fish Spec Value |

|

|

| Serpent-Radisson |

Canada - Quebec |

2-Target Drilling |

Li Au Cu |

2022 Osisko Development Map of James Bay Holdings |

Is pre-bankrupt Monarch the source of recent Harfang selling? |

Harfang closeup map of Ameliane Li outcrop and Mista Cu targets |

Harfang Map showing K/Rb ratio progression away from batholith and location of Brunsiwck's Arwen outcrop at Elrond |

Photo of Harfang's Spodumene Outcrop at Serpent |

Maps for Brunswick's Mirage project and surrounding area |

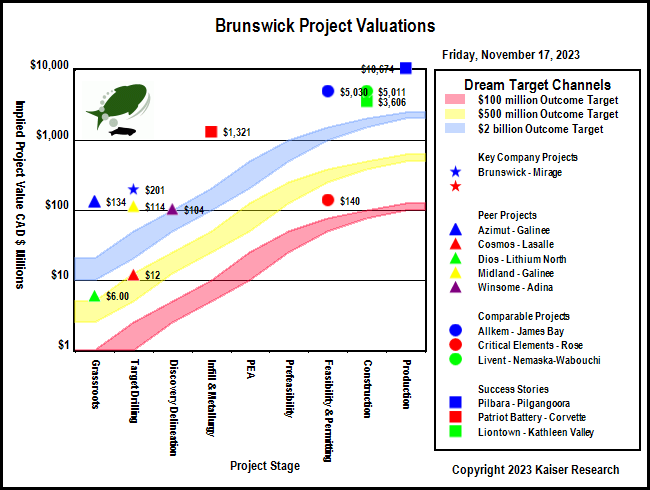

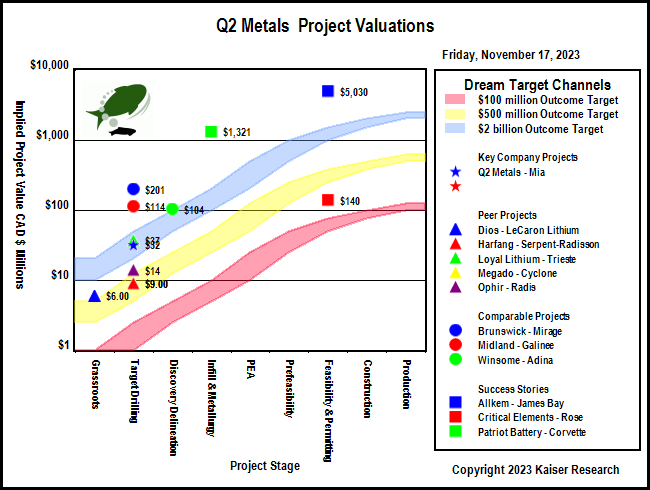

Implied Project Value Chart for Brunswick's Mirage project |

| Jim (0:13:35): Why did the market react so harshly to the Mia drilling update from Q2 Metals? |

On November 16, 2023 Q2 Metals Corp provided a drilling update for its Mia project in the James Bay region to which the market had a very negative reaction as if it was expecting a PMET but instead got a Peanut. This was a complete over-reaction but it built on an earlier development that spawned a breakdown in Q2's price. On November 2 Q2 announced it had reached a deal with Canadian Mining House (Tony Perron) to purchase the 2% NSR on which it only had a right of first refusal (ROFR.) When Q2 optioned Mia the vendor retained a 3% NSR of which Q2 only had the right to buy back 1% for $1 million which it has no reason to do any time soon unless the fine print includes deadline clauses. In addition some claims have an underlying 2% NSR owing to Franco-Nevada and some have a 2% NSR owing to Eastmain (Fury Gold). Q2 has no rights relative to these. The extra 2% held by CMH apparently covering the entire property was thus going to be a problem if Mia becomes a major lithium discovery and third parties hold a 4% NSR. One of the royalty companies may have approached CMH which triggered Q2's ROFR so it negotiated its purchase for $1,650,000 of which $883,333 is cash and $766,667 in cash or stock at Q2's option. The company did a poor job of explaining the rationale behind the deal, and the market, noting that although Q2 still has a healthy treasury of about $8 million, worried Q2 might prefer to issue stock. It also noted that CMH has received 13 million shares for the Mia sale and might think it a good idea to pound out some of this stock. Whether or not CMH was selling, others, fearing the worst form a drill program that started October 23, started to sell.

When the drilling update came out the market learned that Q2 had drilled 12 holes, 8 in the Mia area and 4 in the Carte area at the other end of a 9 km trend. Q2 reported spodumene bearing pegmatite intervals for the first 5 Mia holes which were drilled at different angles to help exploration VP Neil McCallum figure out the orientation of the pegmatite zones (dip, strike and thickness). Q2 confirmed that in the Mia area they are dealing with a series of stacked en echelon dykes similar to those at Allkem's world-class Galaxy-Cyr system. These dykes are oriented somewhat perpendicular to the strike of the shear structure, exploiting what in gold systems are called dilation zones or Ridel structures. At the other end of the trend where the Carte pegmatite outcrops the orientation seems to be parallel with the greenstone belt trend as is the case with CV5 at PMET's Corvette trend. Q2 drilled 2 vertical holes into Carte and 2 holes angled to the south. The company provided a table for all 12 drill holes listing lengths, angles and azimuth (compass direction). It provided plan maps so we can see their locations. In the case of the first 5 Mia holes it provided hole length intervals that were spodumene mineralized but did not provide sections for the holes. What the market saw was a list of short intervals of which only a few were longer than 10 metres. The longest interval was in hole 5 reported as 27.51 m starting at 187.74 m depth. The last interval was 14.78 m ending at 248.75 m.

What the company managed to accomplish might be called reverse grade smearing. The entire interval is 61.01 metres within which are 5 segments without visual spodumene that add up to 6.57 metres, representing just over 10% of unmineralized rock. In gold grade smearing unscrupulous companies take very short high grade intervals separated by wide spaces of barren or low grade rock and average out the gold content over a very long interval with a lower grade to create the illusion of a bulk tonnage system potentially containing millions of open-pittable ounces. KW Episode January 13, 2023 explains how this works. Visual reports of spodumene, of course, are not Li2O grades for which we will need assays. So it is still possible that Mia is a Peanut rather than a PMET. But the results as so far reported do not make it necessary that Mia is so far just a Peanut. But a market made nervous by the NSR buyout deal and the fact that PMET itself is languishing below $10 even though it just reported the longest ever spodumene interval got spooked by the preliminary results presentation method and knocked the stock below $0.30, enabling me to make Q2 Metals Corp a member of my 2024 Bottom-Fish Collection.

Ophir Gold Corp, which has $5 million working capital and is planning to drill its Radis property to the northeast of Mia in Q1 of 2024 where it has outcrops that look more parallel to the trend like Carte rather than sub-perpendicular like at Mia, suffered collateral damage in the market. Ophir Gold Corp was already a member of the 2024 Bottom-Fish Collection which helps remind me that unlike in 2022 when the bottom was bounced off in early December, this year we are suffering a large scale collective capitulation in the Canadian junior resource sector which will create bottom-fishing opportunities until the bitter end of the year. Canada's Globe & Mail, which has largely shunned the junior resource sector during the past decade, is running a series looking at the collapse of the resource junior eco-system. The latest installment, How Canada - and Bay Street - squandered the chance to finance the critical minerals revolution, does a pretty good analysis of some of the problems. |

Q2 Metals Corp (QTWO-V)

Bottom-Fish Spec Value |

|

|

| Mia |

Canada - Quebec |

2-Target Drilling |

Li |

Ophir Gold Corp (OPHR-V)

Bottom-Fish Spec Value |

|

|

| Radis |

Canada - Quebec |

2-Target Drilling |

Li |

Q2 Mia Map and spodumene interval tables for holes 1-5 |

Q2 Mia drill plan for Carte target |

Maps showing relationship of Q2's Mia and Ophir's Radis projects |

Implied Project Value chart for Q2's Mia project |

| Disclosure: JK owns shares of Brunswick, Brunswick is a Fair Spec Value rated Favorite; Harfang, Q2 Metals and Ophir Gold are Bottom-Fish Spec Value rated |