| Kaiser Watch December 15, 2023: Are anti-mining people Putin Poodles? |

| Jim (0:00:00): Is Solitario any closer to getting a drill permit for its Golden Crest gold project? |

On December 12, 2023 Solitario Resources Corp announced that the US Forest Service has reported a Finding of No Significant Impact (FONSI) for a 25 drill site plan of operations application Solitario had submitted in early 2022. As explained in KW Episode May 12, 2023, Solitario's hope to have a drill permit by Q2 of 2023 to allow a summer drill program was derailed by an uproar created when a private group applied for a drill permit near the Pactola Reservoir in the southeastern part of the Black Hills region. This distracted the entire USFS staff which eventually dealt with the problem by creating a 8,329 ha mineral withdrawal around the reservoir. A draft environmental assessment by the USFS for Golden Crest was not completed until May 2023, but there was hope a final permit might be received by late August to allow a fall drill program. No such luck. The FONSI is an important milestone but it will be 4-5 months before Solitario has final approval to proceed with a drill program, assuming the anti-mining lobby does not file a lawsuit against the USFS.

The FONSI kicks off a 45 day public comment period which the USFS can extend for another 30 days and probably will because of the overlapping holiday season. Once the comment period has closed the USFS has 30 days to defend itself against all the complaints filed by the anti-mining crowd. The USFS can elect to extend its response period by another 30 days. It can then make a decision to grant a drill permit, which would be good timing because Solitario cannot mount a drill program until May. It is important to understand that Solitario's only role in any of this is to pay the cost of all the studies the USFS needed in order to make a competent and objective decision. The best case is 3 months for a decision, increasing to 4-5 months if all extensions are deployed.

However, once the USFS has approved a plan of operations there is a risk that one of the anti-mining entities will file litigation claiming that the USFS did not adequately address the objections. This may be the first drill permit the USFS would have granted in South Dakota in a long time (the drilling by Coeur and Dakota Gold in the northern part of the Black Hills is all on private land). The unknown question is how long would it take the courts to deal with such a lawsuit? At the state level South Dakota is entirely Republican and supportive of resource development, and since Golden Crest is only a low impact drill program, not a mining permit application, the courts might deal with a lawsuit quickly.

The stakes are very high, because Golden Crest continues to evolve as the hottest at surface gold prospect in the United States. Solitario has collected about 42,000 soil samples and about 10,000 bedrock samples during the past few years from about 75% of the property (the remaining 25% doesn't appear to be as interesting). CEO Chris Herald remains reluctant to publish a gold anomaly map because I suspect it would light up Golden Crest like a glorious Christmas tree. That, of course, raises the question, why was Golden Crest not discovered and turned into a mining district more than a century ago when the 90 million ounce Homestake district was discovered?

It turns out that even when Solitario has a carbonate rock sample that grades 100 g/t gold, no gold ever shows up when the sample is crushed and panned, the primary manner in which prospectors assessed the gold potential of interesting rocks. The gold grains apparently are micron sized, similar to the carbonate hosted Carlin type mineralization in Nevada. Unlike in the Homestake area, where the Precambrian banded iron formation rocks that host the former mine's 60 million ounces outcrop, the Golden Crest area is completely covered by carbonates that are even younger than in the Wharf area where Coeur is mining Tertiary aged carbonate hosted mineralization.

That may explain why earlier prospectors never dug any glory holes despite the abundance of altered structures at surface, but not why Homestake, which controlled the Black Hills district for a century, never paid any attention to the "other side of the mountain". Homestake drilled three 4,000 ft holes which confirmed the presence of Precambrian banded iron formation rocks with the same age as the Homestake deposit. Drill logs show the presence of alteration within the 1,200 ft sequence of carbonate cover rocks. None of the carbonates were assayed though presumably the BIF rocks were assayed for gold but came up blank. One of the holes still exists in a government storage unit but the bureaucrats have ignored all efforts by Solitario to gain access.

Historical research by Solitario has established that within Homestake there was a mindset that only Precambrian gold mattered, which is understandable in view of how rich the Homestake "ledges" were. The much younger Wharf mineralization in the carbonates at a tenth of the Homestake grade was apparently dismissed as inconsequential. This corporate culture quirk to which geologists are not immune may be the reason Solitario's Golden Crest project could turn into a multi-level monster gold discovery. Tracker Dec 20, 2022 explains how 3 different types and ages of deposits may be present.

America's anti-mining lobby, however, is formidable, and we saw this in action when Maine's Land Use Planning Commission held a hearing on December 13, 2023 during which LUPC staff were to present their analysis of the mine rezoning application of Wolfden Resources Corp. There are 9 commissioners who are not experts in the areas of environmental impact assessment, and this hearing was intended to allow the expert staff who processed Wolfden's application to present their findings and allow the commissioners to question the staff and eventually make an objective decision.

Pickett Mtn hosts a polymetallic VMS deposit in an area of northeastern Maine that is a large scale tree farm where stands of timber get cut down regularly. Maine has a new mining code which establishes the protocols for approving a mine and which forbids open-pit mining. In September 2020 Wolfden completed a PEA to support a 1,200 tpd underground mining operation (see Tracker Nov 27, 2023 for background). To begin the feasibility study and permitting stage Wolfden needed to have the Pickett Mtn mine site rezoned for industrial use. The Land Use Planning Commission rejected the application on October 13, 2021 on the grounds that it did not have the capacity to assess the proposal, even though that is the responsibility of the Department of Environmental Protection. What the LUPC was worried about was the presence of a mill and tailings storage facility, and somehow Wolfden got the idea that if it planned to build the mill and TSF simply on land within a nearby township, the rezoning would be approved. So Wolfden has spent the last 18 months scouting out the nearby townships and securing support for building the mill and TSF on land outside the LUPC jurisdiction.

The LUPC currently has only 8 commissioners, with the new ninth member not scheduled to be sworn in until early January. The commission chairperson was unable to attend, so only 7 commissioners were present. I've clipped the key segments from the "Guide for Commission Deliberations" where the staff has identified the pros and cons for mine development with regard to six considerations (Financial Practicability, Socioeconomics, Wildlife Resources/Habitats, Natural Character, Historical and Cultural/Relevant Tribal Impacts, and Water and Fish/Aquatic Habitats). The LUPC staff had highlighted those items it deemed relevant to decision making, and these were all on the "supports approval" side of consideration segment. So the job of the commissioners was to stress test these items to see if the staff did their job properly. As it turns out, three of the commissioners are anti-mining fundamentalists and effectively hijacked the session to create the impression for journalists that a mine in Maine is a very bad idea.

There is a false dichotomy that presents ideology as a linear spectrum from left to right, but a better way to present this spectrum is as a horseshoe whose ends nearly meet. Both ends are characterized by righteous certitude, the "left" with abstract moral truths and the "right" with sacred text based moral truths. The middle, which used to be called "liberal", represents individuals who understand that only tautologies qualify as truths, that scientific truths are ever evolving descriptions of how the universe works, and moral truths are goal oriented prescriptions of how human relations in a reality of physical scarcity ought to be organized which to qualify as "moral" must have universal applicability. What makes the left and right ends of the horseshoe very different from the middle of the horseshoe is that the certitude at each end of the horseshoe is the basis for oppressing others who do not share that certitude. The "liberal" middle has to live with the realization that in the moral realm the set of commonly accepted values is inconsistent and requires choices that always create winners and losers, denying the luxury of righteousness. For the middle pragmatism and negotiation becomes the guiding principle, something that is missing from the extreme ends of the horseshoe where it is all about coercing others.

The right end of the horseshoe makes no bones about being Putin Poodles, eager to see Ukraine thrown to Putin, and adoring the idea of a "strong leader" who seeks to exterminate the "enemies of the state" like vermin. The left end of the horseshoe where Xi Jinping sits, reaching across the aisle to shake hands with his buddy Putin and throwing individuals under the bus for the collective good,includes anti-mining fundamentalists who are unwitting Putin Poodles in their zeal to "protect" countries within the Global West from mining. Some, I suspect, are in fact self-aware Putin Poodles who adore strongmen like China's Xi Jinping and Russia's Vladimir Putin, and are de facto agents undermining democracy possibly funded by donations from unknown sources.

I have prepared a bar chart that everybody should familiarize themselves with so that they can figure out if they are witting or unwitting Putin Poodles. The IMF's October 2023 World Economic Outlook projects that the 2023 GDP will be $26.9 trillion, China's $17.7 trillion, and Russia's $1.9 (Canada is $2.1 trillion). The combined China-Russia GDP of $19.6 trillion is 73% of America's GDP. And yet China and Russia dominate the supply of raw materials, with the United States generally supplying less than 10% of most of them and often nothing at all. The blue bar represents America's share of raw material supply, and the labels represent what share of total global supply China and Russia represented in 2022. China and Russia are now allies in the Global East, both autocracies inflicting their horseshoe certitudes on their own people while endeavoring to assert them over others. When anti-mining people undermine the exploration and development of raw materials in Global West nations as a matter of "principle", not only do they parasitically support the victimization of downstream parties powerless to defend themselves in jurisdictions like China and Russia, but they are also boosting the raw material vulnerability of the Global West, exposing democracy to the future predations of autocracies. Anti-mining people are implicit Putin Poodles and they might as well join the Putin Poodle Party. |

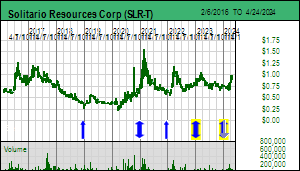

Solitario Resources Corp (SLR-T)

Favorite

Bottom-Fish Spec Value |

|

|

| Golden Crest |

United States - South Dakota |

2-Target Drilling |

Au |

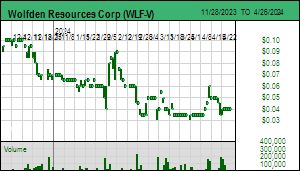

Wolfden Resources Corp (WLF-V)

Bottom-Fish Spec Value |

|

|

| Pickett Mountain |

United States - Maine |

7-Permitting & Feasibility |

Zn Pb Cu Ag Au |

US Vulnerability to China-Russia Raw Material Supply |

LUPC Guide for Deliberation Wolfden Pickett Mtn: Financial Practicability |

LUPC Guide for Deliberation Wolfden Pickett Mtn: Socioeconomics |

LUPC Guide for Deliberation Wolfden Pickett Mtn: Wildlife Resources/Habitats |

LUPC Guide for Deliberation Wolfden Pickett Mtn: Natural Character |

LUPC Guide for Deliberation Wolfden Pickett Mtn: Historical & Cultural Resources/Relevant Tribal Impacts |

LUPC Guide for Deliberation Wolfden Pickett Mtn: Water & Fish Resources/Aquatic Habitats |

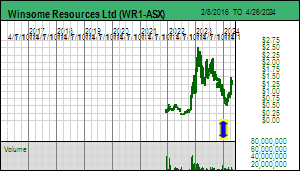

| Jim (0:14:03): What did you think of Winsome's maiden resource estimate at Adina? |

Winsome Resources Ltd published a maiden resource estimate on December 11, 2023 for its Adina lithium project in Quebec's James Bay region. Although the market initially had a positive response, trading Winsome as high as $1.25, by the end of the day the stock closed down a half penny at $1.04, and traded as low as $0.85 during the next couple days. The resource was estimated at 58.6 million tonnes of 1.12% Li2O based on 93 core holes (27,625 m) with 100 m spacing covering 1,340 m strike of the Main Zone (Jamar). Assays are pending for another 25,000 m drilled in 2023, with 5 rigs operating in December and another 50,000 m drilling planned for 2024. I thought it was an excellent maiden resource estimate and was puzzled by the negative market reaction.

One reason is the poor optics of a lithium carbonate price plunging as low as $6.30/lb during December amid hand-wringing media talk about how consumers are no longer lining up to buy an electric vehicle. That concern is irrelevant to resource juniors making lithium pegmatite discoveries today, because none of that lithium will be in production before 2030. You just need to look at the lithium price-grade rock value matrix to see that even a price in the $5-$10/lb lithium carbonate range makes most open-pittable gold deposits look pitiful.

The main reason, however, for the negative reaction to Winsome's maiden Adina resource is the decision to choose 0.6% Li2O as the cutoff grade, chosen I suspect to meet the market's expectation of a resource with at least 50 million tonnes. The trade off was a lower grade than the 1.42% achieved by Patriot Battery Metals Corp for its maiden CV5 resource of 109.2 million tonnes. But Winsome did publish a table with different cutoff grades, and at 1.1% the Main Zone delivers a resource of 26.7 million tonnes of 1.44% Li2O. Following an October financing Winsome has about $60 million, so dilution to fund expansion of the Adina resource is not a problem for 2024.

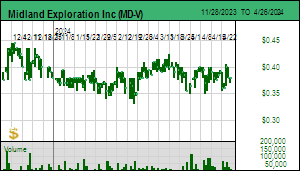

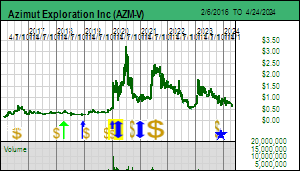

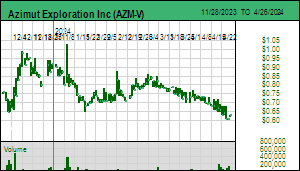

The Adina resource is good news for Comet Lithium Corp whose 100% owned Liberty property adjoins to the east of Adina and is on strike with Winsome's expansion drilling northeast of the Main Zone. Comet underwent a management change in November that brought on board the team behind Nomad Resources Partners Inc, including Vincent Metcalfe as the new chairman and Vincent Cardin-Tremblay as exploration VP. They were too late to influence a sampling program initiated by former management, but they did manage to get a gravity survey done in the western part of the property where the Trieste formation is present before it bends southeast onto the Galinee project Rio Tinto has optioned 70% from Midland Exploration Inc and plans to drill in Q1 of 2024. Azimut Exploration Inc, which is joint ventured 50% with SOQUEM on their own Galinee project to the south of Winsome and Midland, has drilled a dozen holes chasing the down dip projection of the Adina Main Zone and is awaiting assays. Azimut has not yet generated any LCT-type pegmatite targets elsewhere on its large Galinee project.

Silica rich pegmatite has a lower density than the country rock and Winsome has found gravity a useful tool for defining pegmatite drill targets where overburden obscures outcrop. Comet managed to secure drill permits for its pegmatite outcrops, so if they prove LCT-type (the sampling crew had no LIBS or XRF unit on hand to get a sneak preview), Comet may be drilling in early 2024. The key question for Comet's Liberty property is whether pegmatite emplacement was limited to the Trieste greenstone rocks, which gives Comet about 2.75 km strike potential, or also exploited a structural lineament that projects in a northeasterly direction for 6.5 km on the Liberty property. Comet is part of the 2024 Bottom-Fish Collection. Its Liberty project has an implied value of $12 million compared to Winsome's Adina implied value of $215 million, which itself is a fraction of PMET's $1.4 billion value. It will take some luck for Comet's Liberty to deliver a standalone resource, but there is a very good chance it has sufficient LCT-type pegmatite to deliver whatever shortfall Adina may deliver for Winsome. |

Winsome Resources Ltd (WR1-ASX)

Unrated Spec Value |

|

|

| Adina |

Canada - Quebec |

4-Infill & Metallurgy |

Li |

Comet Lithium Corp (CLIC-V)

Bottom-Fish Spec Value |

|

|

| Liberty |

Canada - Quebec |

2-Target Drilling |

Li |

Midland Exploration Inc (MD-V)

Bottom-Fish Spec Value |

|

|

| Galinee |

Canada - Quebec |

2-Target Drilling |

Li |

Azimut Exploration Inc (AZM-V)

Fair Spec Value |

|

|

| Galinee |

Canada - Quebec |

2-Target Drilling |

Li |

Lithium Grade-Price Rock Value Matrix |

Resource Estimate for Winsome's Adina Project |

Maps showing relative locations of Adina and Liberty Projects |

Maps shwoing relative locations of Galinee projects of Azimut and Midland |

| Disclosure: JK owns shares of Wolfden; Solitario is a Bottom-Fish Spec Value rated Favorite; Comet, Midland and Wolfden are Bottom-Fish Spec Value rated |