Home / Companies / KRO Profile

KRO Profile

|

|

| Price: | $0.015 | Open Rec: | No |  |

| Market Cap: | $3,442,094 | WC % of Mkt Cap: | 6% |

| Working Cap: | $207,720 | As of: | 9/30/2023 |

| Issued: | 229,472,928 | Insider %: | 5.9% | | Diluted: | 291,034,260 | Story Type: | Resource: Discovery Exploration |

| Key People: | Mark Kolebaba (CEO), Mark T. Brown (CFO), Janice Davies (Sec), |

SV Rating: Bottom-Fish Spec Value - as of October 16, 2023: Adamera Minerals Corp has had Bottom-Fish Spec Value ratings assigned below $0.10 multiple times since late 2013 after Mark Kolebaba merged his two uranium and diamond companies and pivoted to gold exploration in northeastern Washington, a former mining region abandoned by juniors and majors alike. But the stock rarely made it above $0.10 and only briefly above $0.20 in 2017 because Adamera never pulled a clear cut discovery hole and there was always a wall of paper from clip and flippers who took a series of cheap unit private placements. The first exploration wave ran from 2013-2015 and focused on epithermal plays like Empire and Flag Hill on the western margin of the Republic Graben, and to a lesser extent on the eastern margin where a group of claims collectively known as Cooke Mountain had potential for skarn hosted gold deposits. The second wave ran from 2016-2019 and was focused on Cooke Mountain where Adamera had undertaken a regional Mag-EM survey to identify new targets premised on the model that the gold bearing sulphide deposits, which would be conductive, were associated with magnetite in the skarns formed in limestone near the gold mineralization. During 2020, a year when Adamera got no drilling done because of the covid pandemic, there were three important developments that became the basis for making Adamera a Bottom-Fish Spec Value rated 2021 Favorite at $0.10 effective April 1, 2021. These three developments are the arrival of Hochschild Mining as a farm-in partner for the Cooke Mountain project where drilling will begin in late April 2021, the assembly of the Buckhorn 2.0 property around the original Buckhorn Mine (1.3 million oz at 12 g/t gold) still owned by Kinross, and the arrival of a new audience linked to Crown Resources Corp (absorbed by Kinro...(see Profile for full Overview) SV Rating: Bottom-Fish Spec Value - as of October 16, 2023: Adamera Minerals Corp has had Bottom-Fish Spec Value ratings assigned below $0.10 multiple times since late 2013 after Mark Kolebaba merged his two uranium and diamond companies and pivoted to gold exploration in northeastern Washington, a former mining region abandoned by juniors and majors alike. But the stock rarely made it above $0.10 and only briefly above $0.20 in 2017 because Adamera never pulled a clear cut discovery hole and there was always a wall of paper from clip and flippers who took a series of cheap unit private placements. The first exploration wave ran from 2013-2015 and focused on epithermal plays like Empire and Flag Hill on the western margin of the Republic Graben, and to a lesser extent on the eastern margin where a group of claims collectively known as Cooke Mountain had potential for skarn hosted gold deposits. The second wave ran from 2016-2019 and was focused on Cooke Mountain where Adamera had undertaken a regional Mag-EM survey to identify new targets premised on the model that the gold bearing sulphide deposits, which would be conductive, were associated with magnetite in the skarns formed in limestone near the gold mineralization. During 2020, a year when Adamera got no drilling done because of the covid pandemic, there were three important developments that became the basis for making Adamera a Bottom-Fish Spec Value rated 2021 Favorite at $0.10 effective April 1, 2021. These three developments are the arrival of Hochschild Mining as a farm-in partner for the Cooke Mountain project where drilling will begin in late April 2021, the assembly of the Buckhorn 2.0 property around the original Buckhorn Mine (1.3 million oz at 12 g/t gold) still owned by Kinross, and the arrival of a new audience linked to Crown Resources Corp (absorbed by Kinro...(see Profile for full Overview) |

| Last Corporate Change - Feb 19, 2013: 5:1 Name Change from Uranium North Resources Corp (UNR-V) |

| Last KRO Comment - Nov 22, 2023: KW Excerpt: Kaiser Watch November 22, 2023: Adamera Minerals Corp (ADZ-V) |

| Recent News - Apr 24, 2024: BLM Approval to Drill Multiple Targets on Buckhorn 2.0 Gold Project |

|

![]() |

|

|

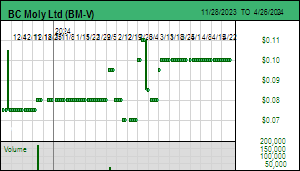

| Price: | $0.100 | Open Rec: | No |  |

| Market Cap: | $3,482,677 | WC % of Mkt Cap: | 19% |

| Working Cap: | $655,115 | As of: | 1/31/2024 |

| Issued: | 34,826,765 | Insider %: | 1.8% | | Diluted: | 40,887,371 | Story Type: | Resource: Feasibility Demonstration |

| Key People: | David D'Onofrio (CEO), Jerry Wang (CFO), Jimmy Mah (CFO), Richard Fischer (VP EX), |

SV Rating: Unrated SV Rating: Unrated |

| Last Corporate Change - Mar 7, 2023: Symbol Change |

| Recent News - Mar 9, 2023: Provides Update on Its Storie Molybdenum Deposit, Including 27% Increase in Measured & Indicated Resources for a Total of 241.6m lb Molybdenum, Inferred Resources of 23.4m lbs Molybdenum and |

|

![]() |

|

|

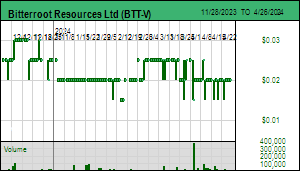

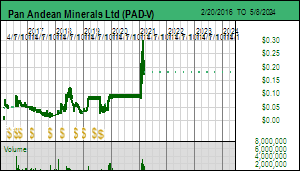

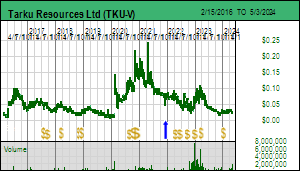

| Price: | $0.020 | Open Rec: | No |  |

| Market Cap: | $1,873,671 | WC % of Mkt Cap: | -19% |

| Working Cap: | ($346,740) | As of: | 1/31/2024 |

| Issued: | 93,683,556 | Insider %: | 27.2% | | Diluted: | 107,845,056 | Story Type: | Resource: Discovery Exploration |

| Key People: | Michael S. Carr (CEO), George W. Sanders (CFO), |

SV Rating: Unrated SV Rating: Unrated |

| Last Corporate Change - Sep 29, 2015: 10:1 Rollback with no Name Change |

| Last KRO Comment - Jul 13, 2015: Special Interest Comment: A Bitter End for the Root |

| Recent News - Sep 28, 2023: Management discussion and analysis |

|

![]() |

|

|

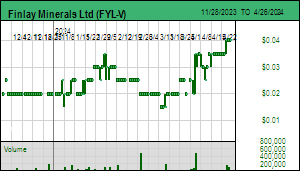

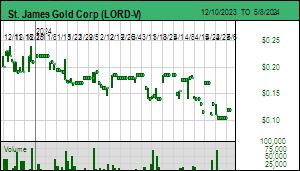

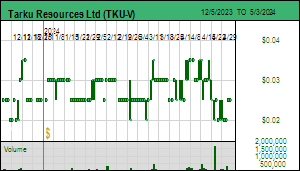

| Price: | $0.040 | Open Rec: | No |  |

| Market Cap: | $5,524,449 | WC % of Mkt Cap: | 11% |

| Working Cap: | $593,860 | As of: | 9/30/2023 |

| Issued: | 138,111,232 | Insider %: | 44.7% | | Diluted: | 169,326,281 | Story Type: | Resource: Discovery Exploration |

| Key People: | Robert F. Brown (CEO), Ilona B. Lindsay (CFO), Wade Barnes (VP EX), David A. Schwartz (Sec), |

SV Rating: Bottom-Fish Spec Value - as of December 14, 2021 SV Rating: Bottom-Fish Spec Value - as of December 14, 2021 |

| Recent News - Apr 4, 2024: Issues a President's Letter |

|

![]() |

|

|

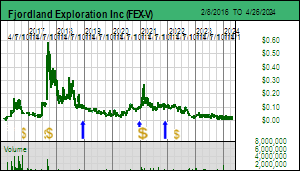

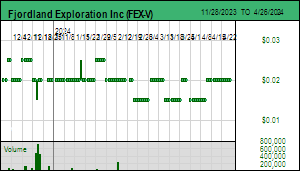

| Price: | $0.020 | Open Rec: | No |  |

| Market Cap: | $1,658,711 | WC % of Mkt Cap: | 32% |

| Working Cap: | $537,448 | As of: | 9/30/2023 |

| Issued: | 82,935,531 | Insider %: | 18.6% | | Diluted: | 101,560,531 | Story Type: | Resource: Discovery Exploration |

| Key People: | James R. Tuer (CEO), Mark T. Brown (CFO), |

SV Rating: Bottom-Fish Spec Value - as of November 24, 2021: Fjordland Exploration Inc has had a Bottom-Fish Spec Value rating since December 14, 2018 based largely on the South Voisey's Bay project optioned 65% to Robert Friedland's private Ivanhoe Electric Inc and was continued as such on November 24, 2021 for the KRO 2022 Watch List based on the arrival of Jamie Tuer in 2020 as the new CEO, completion of a $2.5 million financing and acquisition of the Renzy nickel project in 2021, and, Ivanhoe Electric's intention finally to drill the SVB project in 2022. Headed by Dick Atkinson since 1991, Fjordland started exploring Greenland for diamonds in 1996, shifted back to Canada in 2000 where it optioned the Woodjam copper-gold property in 2002 which delivered a discovery in 2004 that now sits inside Cons Woodjam Copper Corp after a spinout, recruited Tom Schroeter in 2007 to pursue regional exploration plays in British Columbia until his retirement in 2014, and pivoted to the South Voisey's Bay project in late 2014 which was optioned from another one of Atkinson's former companies that had decided to turn itself into a royalty company. SVB was the focus of intense exploration in 1995-1999 when there was hope that the Harp Lake complex hosted magmatic segregation style nickel-copper deposits similar to the Voisey's Bay system discovered in late 1995 by Friedland's Diamond Fields which Inco absorbed through a $4 billion transaction. Although narrow high grade mineralization was encountered here and there, the area play fizzled after 144 holes, and as claims gradually lapsed, Commander Resources Ltd, the successor to DA's Major General with an original land position in the area, consolidated them into the SVB package. The rationale was a 2012 academic study of the area which indicated that the Pants Lake intrusion north of the Harp Lak...(see Profile for full Overview) SV Rating: Bottom-Fish Spec Value - as of November 24, 2021: Fjordland Exploration Inc has had a Bottom-Fish Spec Value rating since December 14, 2018 based largely on the South Voisey's Bay project optioned 65% to Robert Friedland's private Ivanhoe Electric Inc and was continued as such on November 24, 2021 for the KRO 2022 Watch List based on the arrival of Jamie Tuer in 2020 as the new CEO, completion of a $2.5 million financing and acquisition of the Renzy nickel project in 2021, and, Ivanhoe Electric's intention finally to drill the SVB project in 2022. Headed by Dick Atkinson since 1991, Fjordland started exploring Greenland for diamonds in 1996, shifted back to Canada in 2000 where it optioned the Woodjam copper-gold property in 2002 which delivered a discovery in 2004 that now sits inside Cons Woodjam Copper Corp after a spinout, recruited Tom Schroeter in 2007 to pursue regional exploration plays in British Columbia until his retirement in 2014, and pivoted to the South Voisey's Bay project in late 2014 which was optioned from another one of Atkinson's former companies that had decided to turn itself into a royalty company. SVB was the focus of intense exploration in 1995-1999 when there was hope that the Harp Lake complex hosted magmatic segregation style nickel-copper deposits similar to the Voisey's Bay system discovered in late 1995 by Friedland's Diamond Fields which Inco absorbed through a $4 billion transaction. Although narrow high grade mineralization was encountered here and there, the area play fizzled after 144 holes, and as claims gradually lapsed, Commander Resources Ltd, the successor to DA's Major General with an original land position in the area, consolidated them into the SVB package. The rationale was a 2012 academic study of the area which indicated that the Pants Lake intrusion north of the Harp Lak...(see Profile for full Overview) |

| Last Corporate Change - Jun 21, 2017: 5:1 Rollback with no Name Change |

| Last KRO Comment - Nov 24, 2021: Tracker: Speculative Value Rating for Fjordland Exploration Inc |

| Recent News - Sep 14, 2023: Appoints Robert Cameron to its Board of Directors at AGM |

|

![]() |

|

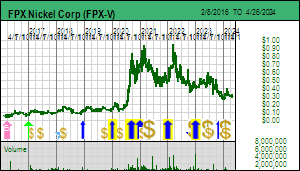

| Price: | $0.325 | Open Rec: | No |  |

| Market Cap: | $89,011,405 | WC % of Mkt Cap: | 35% |

| Working Cap: | $31,462,685 | As of: | 9/30/2023 |

| Issued: | 273,881,246 | Insider %: | 34.6% | | Diluted: | 292,626,246 | Story Type: | Resource: Feasibility Demonstration |

| Key People: | Martin Turenne (CEO), Peter M. D. Bradshaw (Chair), Felicia de la Paz (CFO), Tim Bekhuys (VPESG), |

SV Rating: Bottom-Fish Spec Value - as of December 29, 2023 SV Rating: Bottom-Fish Spec Value - as of December 29, 2023 |

| Last Corporate Change - Aug 25, 2017: 1:1 Name Change from First Point Minerals Corp (FPX-V) |

| Last KRO Comment - Feb 28, 2024: KW Excerpt: Kaiser Watch February 28, 2024: FPX Nickel Corp (FPX-V) |

| Recent News - Apr 18, 2024: Expansion to Generative Alliance with JOGMEC |

|

| |

Project |

Interest |

|

Country |

Region |

Stage |

IPV

($mm) |

Target |

Deposit

Model |

|

Decar |

100% WI |

|

Canada |

Central BC |

7-Permitting & Feasibility |

$95 |

Nickel |

Ultramafic Complex  |

|

Klow |

40% TC |

|

Canada |

Central BC |

3-Discovery Delineation |

$238 |

Nickel |

Ultramafic Complex  |

|

SAM |

100% WI |

|

Canada |

Central BC |

1-Grassroots |

$95 |

Magnesium |

Ultramafic Complex  |

|

Wale |

100% WI |

|

Canada |

Northern BC |

3-Discovery Delineation |

$95 |

Nickel |

Ultramafic Complex  |

|

Orca |

100% WI |

|

Canada |

British Columbia |

3-Discovery Delineation |

$95 |

Nickel |

Ultramafic Complex  |

|

Mich |

100% WI |

|

Canada |

Whitehorse |

2-Target Drilling |

$95 |

Nickel |

Ultramafic Complex  |

![]() |

|

|

| Price: | $0.350 | Open Rec: | No |  |

| Market Cap: | $90,282,058 | WC % of Mkt Cap: | 9% |

| Working Cap: | $7,952,373 | As of: | 9/30/2023 |

| Issued: | 257,948,737 | Insider %: | 0.9% | | Diluted: | 261,770,892 | Story Type: | Resource: Discovery Exploration |

| Key People: | Cynthia Le Sueur-Aquin (Pres), Tyler Dilney (CFO), Miles Nagamatsu (CFO), |

SV Rating: Unrated SV Rating: Unrated |

| Last Corporate Change - Nov 3, 2006: 1:1 Name Change from Laurion Gold Inc (LAG-V) |

| Recent News - Apr 22, 2024: Private Placement Non Brokered |

|

![]() |

|

|

| Price: | $0.290 | Open Rec: | No |  |

| Market Cap: | $14,649,230 | WC % of Mkt Cap: | 5% |

| Working Cap: | $677,769 | As of: | 11/30/2018 |

| Issued: | 50,514,585 | Insider %: | 4.6% | | Diluted: | 73,338,677 | Story Type: | Resource: Feasibility Demonstration |

| Key People: | J. William Morton (CEO), |

| Delisted: Lorraine Copper Corp began trading on April 17, 2008 as the holder of the former interests of Lysander Minerals Corp and Eastfield Resources Ltd in the Lorraine-Jajay mineral claims in the Fort St. George region of Northeast British Columbia, where Teck Cominco vested for 51% after spending $9 million by 2010. Lorraine-Jajay is an alkaline copper-gold system. A 43-101 resource estimate for 3 zones (Upper Main, Lower Main, Bishop) was published on May 30, 2012, for 6,419,000 t @ 0.61% Cu & 0.23 g/t Au indicated, and 28,823,000 t @9.45% Cu & 0.19 g/t Au inferred at a 0.2% Cu cutoff. In Dec 2015 Lorraine reached a deal to acquire Teck's 51% for $2 million in the form of 35.6 million shares, provided Lorraine could raise $2 million in equity. Lorraine undertook a 2:1 rollback on Feb 4, 2016. In May 2016 the deal was terminated, following which Bill Morton and Glen Garratt decided to turn Lorraine into a copper"optionality" junior and acquired Eastfield's 40% in the OK copper porphyry deposit near Powell River, BC. In June 2016 Lorraine secured a deal to acquire the Stardust (formerly Lustdust) project in BC's Quesnel Trough for 5.5 million shares from ALQ Gold Corp which had spent $11 million since the 1980s outlining a small gold-copper-silver carbonate replacement deposit. In June 2017 Lorraine optioned Stardust to Sun Metals Corp which can earn 100% by spending $6 million by 2021 and issuing 30% of issued stock on vesting to Lorraine. |

| Last Corporate Change - Apr 12, 2019: Plan of Arrangement at $0.29 |

| Last KRO Comment - Dec 28, 2018: Tracker: Spec Value Rating for Lorraine Copper Corp (LLC-V) |

| Recent News - Apr 8, 2019: Securityholders Approve Arrangement |

|

![]() |

|

|

| Price: | $0.030 | Open Rec: | No |  |

| Market Cap: | $1,706,750 | WC % of Mkt Cap: | -11% |

| Working Cap: | ($179,564) | As of: | 12/31/2023 |

| Issued: | 56,891,681 | Insider %: | 22.3% | | Diluted: | 64,626,681 | Story Type: | Resource: Discovery Exploration |

| Key People: | Andrew Thomson (CEO), Robert I. Valliant (Chair), Mark Santarossa (Pres), Brian Jennings (CFO), Steven Dawson (VP CD), |

SV Rating: Bottom-Fish Spec Value - as of December 31, 2021: Tri Origin Exploration Ltd, soon to be renamed NewOrigin Gold Corp, was made a Bottom-Fish Spec Value rated 2021 Favorite at $0.23 on December 31, 2020 based on an Andrew Thomson led management reorganization and Osisko backed financing in December 2020 that finally gives the Ontario project portfolio Bob Valliant built during the past decade a chance to deliver its exploration potential. After cleaning up debts Tri Origin has about $2 million working capital following a private placement completed early January consisting of 21,923,076 units at $0.125-$0.13 with a full 2 year warrant at $0.18. This was taken down by 67 placees including 12 brokers and insiders who took 2.2 million units. Osisko Mining Inc took down 3.2 million units and its spinout O3 Mining took 2.4 million units. Including the 2.7 million shares O3 will get for selling its Kinebik project to Tri Origin, the Osisko group will own 7.8 million shares plus warrants. Not included in this tally are Osisko related individuals who do not qualify as insiders for reporting purposes who may have participated in the financing. The hold period ends May 11, 2021. Tri Origin has 49.1 million issued and 72 million fully diluted, with the dilution from the 22 million warrants at $0.18 potentially adding nearly $4 million to working capital. The stock sagged in Q1 of 2021 because Covid issues prevented the company from getting a drill permit for a winter program at its Sky Lake project. They have contracted a driller to start in mid May and are optimistic the permit will arrive in time. The Bottom-Fish Spec Value rating reflects the 51% back-in rights on the Sky Lake and North Abitibi gold projects which need to be eliminated in order for rethink style exploration programs to attract the major financing they need. Tri...(see Profile for full Overview) SV Rating: Bottom-Fish Spec Value - as of December 31, 2021: Tri Origin Exploration Ltd, soon to be renamed NewOrigin Gold Corp, was made a Bottom-Fish Spec Value rated 2021 Favorite at $0.23 on December 31, 2020 based on an Andrew Thomson led management reorganization and Osisko backed financing in December 2020 that finally gives the Ontario project portfolio Bob Valliant built during the past decade a chance to deliver its exploration potential. After cleaning up debts Tri Origin has about $2 million working capital following a private placement completed early January consisting of 21,923,076 units at $0.125-$0.13 with a full 2 year warrant at $0.18. This was taken down by 67 placees including 12 brokers and insiders who took 2.2 million units. Osisko Mining Inc took down 3.2 million units and its spinout O3 Mining took 2.4 million units. Including the 2.7 million shares O3 will get for selling its Kinebik project to Tri Origin, the Osisko group will own 7.8 million shares plus warrants. Not included in this tally are Osisko related individuals who do not qualify as insiders for reporting purposes who may have participated in the financing. The hold period ends May 11, 2021. Tri Origin has 49.1 million issued and 72 million fully diluted, with the dilution from the 22 million warrants at $0.18 potentially adding nearly $4 million to working capital. The stock sagged in Q1 of 2021 because Covid issues prevented the company from getting a drill permit for a winter program at its Sky Lake project. They have contracted a driller to start in mid May and are optimistic the permit will arrive in time. The Bottom-Fish Spec Value rating reflects the 51% back-in rights on the Sky Lake and North Abitibi gold projects which need to be eliminated in order for rethink style exploration programs to attract the major financing they need. Tri...(see Profile for full Overview) |

| Last Corporate Change - Apr 28, 2021: 1:1 Name Change from Tri Origin Exploration Ltd (TOE-V) |

| Last KRO Comment - Apr 19, 2021: Tracker: What's Next for Tri Origin Exploration Ltd? |

| Recent News - Jan 25, 2022: Acquires Koval Property at its Sky Lake Gold Project |

|

![]() |

|

|

| Price: | $0.135 | Open Rec: | No |  |

| Market Cap: | $24,034,668 | WC % of Mkt Cap: | 7% |

| Working Cap: | $1,573,249 | As of: | 9/30/2023 |

| Issued: | 178,034,575 | Insider %: | 53.9% | | Diluted: | 248,074,304 | Story Type: | Resource: Feasibility Demonstration |

| Key People: | Tom M. MacNeill (CEO), Andrew Davidson (CFO), |

SV Rating: Unrated SV Rating: Unrated |

| Recent News - Feb 7, 2024: Intercepts 8 Meters of 25.41 g/m3 Placer Gold in Geotechnical Drilling from the Wingdam Underground Placer Gold Project |

|

![]() |

|

|

| Price: | $0.180 | Open Rec: | No |  |

| Market Cap: | $18,144,716 | WC % of Mkt Cap: | 9% |

| Working Cap: | $1,572,392 | As of: | 2/28/2023 |

| Issued: | 100,803,979 | Insider %: | 15.3% | | Diluted: | 114,442,314 | Story Type: | Resource: Discovery Exploration |

| Key People: | Sungbum Spencer Huh (CEO), Nancy Zhao (CFO), Gunmin Park (VP CD), Chris Chung (VP FI), |

SV Rating: Unrated SV Rating: Unrated |

| Last Corporate Change - Mar 7, 2018: 2:1 Rollback with no Name Change |

| Recent News - Apr 16, 2024: Appoints Renowned Battery Industry Pioneer Mr. Ricky Lee as Lead Managerial Advisor |

|

![]() |

|

|

| Price: | $0.130 | Open Rec: | No |  |

| Market Cap: | $3,855,078 | WC % of Mkt Cap: | -50% |

| Working Cap: | ($1,935,386) | As of: | 9/30/2023 |

| Issued: | 29,654,449 | Insider %: | 0.0% | | Diluted: | 39,062,179 | Story Type: | Resource: Feasibility Demonstration |

| Key People: | George Drazenovic (CEO), Jiang Yu (Chair), Jaisun Garcha (CFO), |

SV Rating: Unrated SV Rating: Unrated |

| Last Corporate Change - Oct 14, 2020: 1:1 Name Change from Bard Ventures Ltd (CBS-V) |

| Recent News - Dec 18, 2023: Completes Annual General Meeting and Re Elects Board of Directors |

|

![]() |

|

|

| Price: | $0.020 | Open Rec: | No |  |

| Market Cap: | $2,534,772 | WC % of Mkt Cap: | -16% |

| Working Cap: | ($401,813) | As of: | 12/31/2023 |

| Issued: | 126,738,588 | Insider %: | 15.9% | | Diluted: | 172,814,285 | Story Type: | Resource: Discovery Exploration |

| Key People: | Julien Davy (CEO), Bernard Lapointe (Chair), Kyle Appleby (CFO), |

SV Rating: Bottom-Fish Spec Value - as of December 7, 2021 SV Rating: Bottom-Fish Spec Value - as of December 7, 2021 |

| Last Corporate Change - Feb 7, 2020: 6.5:1 Rollback with no Name Change |

| Recent News - Mar 12, 2024: Acquires New Prospective land with Gold, and Base Metals Potential in the Abitibi Region |

|

![]() |

|

|

| Price: | $0.270 | Open Rec: | No |  |

| Market Cap: | $177,137,475 | WC % of Mkt Cap: | -34% |

| Working Cap: | ($59,575,595) | As of: | 9/30/2023 |

| Issued: | 656,064,724 | Insider %: | 25.0% | | Diluted: | 682,965,724 | Story Type: | Resource: Feasibility Demonstration |

| Key People: | Olusegun Lawson (CEO), Adrian J. G. Coates (Chair), Gareth Northam (COO), James Philip (VP CD), |

SV Rating: Unrated SV Rating: Unrated |

| Last Corporate Change - Sep 1, 2009: 2:1 Rollback with no Name Change |

| Recent News - Apr 18, 2024: Q1 2024 Operating Update |

|

![]() |

|

|

| Price: | $0.110 | Open Rec: | No |  |

| Market Cap: | $1,739,230 | WC % of Mkt Cap: | -8% |

| Working Cap: | ($143,228) | As of: | 9/30/2023 |

| Issued: | 15,811,179 | Insider %: | 43.6% | | Diluted: | 15,811,179 | Story Type: | Resource: Discovery Exploration |

| Key People: | Anish Sunderji (CEO), Aziz Shariff (CFO), |

SV Rating: Unrated SV Rating: Unrated |

| Last Corporate Change - Feb 21, 2023: Symbol Change |

|

![]() |

|